Beruflich Dokumente

Kultur Dokumente

Advanced Accounting Module 1: Partnership Accounting

Hochgeladen von

Delza DumadagOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Advanced Accounting Module 1: Partnership Accounting

Hochgeladen von

Delza DumadagCopyright:

Verfügbare Formate

1

ADVANCED ACCOUNTING

Module 1: Partnership Accounting

1.1 Partnership Formation

The MAIN CONCERN of accounting problems on PARTNERSHIP FORMATION is the COMPUTATION

OF THE NET CONTRIBUTION AND/OR CAPITAL CREDIT of a partner at the inception of the

partnership.

When a partnership is formed, the assets contributed by the partners and the liabilities assumed by the

partnership in behalf of the partners are all valued at agreed value, or in the absence of which, at fair

value. This means that the book value of the assets and liabilities in the separate books or records of the

prospective partners are adjusted. Adjustments are done directly to the capital account (i.e. no

nominal accounts will be debited or credited in the adjusting entries).

To wit, the net assets contributed by the partners at fair value constitutes the TOTAL BEGINNING

CAPITAL of the partnership:

TOTAL ASSETS CONTRIBUTED BY ALL PARNTERS

Less

TOTAL LIABILITIES ASSUMED BY THE PARTNERSHIP

=

TOTAL BEGINNING CAPITAL OF THE PARTNERSHIP

However, the INDIVIDUAL beginning capital of each partner may not necessarily be equal to the fair

value of the net assets each partner contributed. Their individual capital credits at the start of the

partnership will depend upon their agreement. The agreed capital (AC) of each partner is not

always equal to his/her Contributed capital (CC)

To illustrate, assume PARTNER A contributed P100,000 cash and PARTNER B contributed land with a

fair value of P200,000 to the partnership on January 1, 2015. However, their agreement is to have an

equal interest in the capital and profits of the partnership. The following journal entry will be made at

the start of the partnership:

1/1/15 Cash P100,000

Land 200,000

Partner A, Capital P150,000

Partner B, Capital 150,000

In the absence of any agreement, it is assumed that agreed capital is equal to contributed capital

(i.e. net investment method).

Looking at the journal entry, their agreement of having an equal interest favors Partner A over Partner

B. It is as if a “bonus” is given by Partner B to Partner A at the start of the partnership. Another way of

understanding this is by making a table similar to the one below:

CC AC Bonus from (to)

PARTNER A P100,000 P150,000 P50,000

PARTNER B 200,000 150,000 (50,000)

TOTAL P300,000 P300,000 -

There may be instances when an extra investment or immediate withdrawal is made by one or more

partners to equate their capital contributions to their percentage interest in the partnership. This is a

matter of applying simple algebra on the accounting equation.

ADVACC (Acctg 630) – MODULE 1: PARTNERSHIP ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

2

Practice Problems – Partnership Formation:

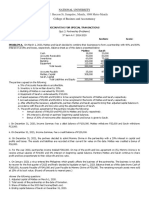

Problem 1: QR and ST decided to combine their businesses and form a partnership. Below are their

balance sheets before any adjustments:

QR ST

Cash P2,048,400 P1,098,360

Accounts receivable 1,031,960 2,498,716

Inventories 528,160 1,144,448

Property, plant & equipment (net) 613,380 852,224

Other assets ___8,800___ __15,840__

Total Assets P4,230,700 P5,609,588

Accounts payable P787,336 P1,072,060

Notes payable 1,000,000 -

Mortgage payable - 1,440,000

QR, Capital 2,443,364 -

ST, Capital ______________ __3,097,528

Total Liabilities & Equity P4,230,700 P5,609,588

The partners agreed that the property, plant and equipment of QR is under depreciated by P80,000 and

that of ST is over depreciated by P200,000. Accounts receivable of P 108,000 in QR’s book and P140,000 in

ST’s book are uncollectible. The partnership decided to assume the mortgage liability of ST. The

partnership agreement provides for a profit and loss ratio and capital interest of 60% to QR and 40% to ST.

ST is willing to invest or withdraw cash from the partnership to comply with the agreement.

Question 1: What are the capital balances of QR and ST right after the formation?

A. P6,896,292 ; P4,597,528 C. P2,255,364 ; P1,503,576

B. P6,896,292 ; P3,157,528 D. P2,255,364 ; P3,157,528

Question 2: What is the total assets of the partnership after formation?

A. P5,618,336 C. P6,618,336

B. P8,058,336 D. P9,840,288

Problem 2: On December 1, 2014, MG and AN are combining their separate businesses to form a

partnership. Cash and noncash assets are to be contributed. The noncash assets to be contributed and the

liabilities to be assumed are as follows:

MG AN

Book Value Fair Value Book Value Fair Value

Accounts Receivable 250,000 262,500 200,000 195,000

Inventory 400,000 450,000 200,000 207,500

PPE 1,000,000 912,500 862,500 822,500

Accounts Payable 150,000 150,000 112,500 112,500

MG and AN are to invest equal amounts of cash such that the contribution of MG would be 10% more than

the investment of AN.

What is the amount of cash presented on the partnership’s Statement of Financial Position on December 1,

2014.

A. P2,762,500

B. P2,512,500

C. P5,525,000

D. P5,025,000

ADVACC (Acctg 630) – MODULE 1: PARTNERSHIP ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

3

Problem 3: AK and BK decided to form a partnership on October 1, 2014. Their Statements of Financial

Position on this date were:

AK BK

Cash P65,625 P164,062.50

Accounts Receivable 1,487,500 896,875

Merchandise Inventory 875,000 885,937.50

Equipment 656,250 1,268,750

TOTAL 3,084,375 3,215,625

Accounts Payable 459,375 1,159,375

AK, Capital 2,625,000

BK, Capital 2,056,250

TOTAL 3,084,375 3,215,625

They agreed the following adjustments shall be made:

- Equipment of AK is under-depreciated by P87,500. BK’s is over-depreciated by P131,250.

- Allowance for bad debts is to be set up amounting to P297,500 for AK & P196,875 for BK.

- Inventories of P21,875 and P15,312.50 are worthless in the books of AK and BK respectively.

- The partnership agreement provides for profit and loss ratio of 70% to AK and 30% to BK.

Assuming the use of transfer of capital method, how much is the agreed capital of AK to bring the capital

balances proportionate to their profit and loss ratio.

A. P2,390,937.50

B. P2,935,406.25

C. P2,218,125.00

D. P1,024,687.50

Problem 4: MN and OP decided to form a partnership on June 1, 2015. The partnership will take over their

assets as well as assume their liabilities. As of June 1, 2015, the net assets of MN and OP are P220,000 and

P309,375 respectively. Liabilities of MN are 55% less than the value of its net assets while liabilities of OP

are 40% more than the value of its net assets. The partners agreed on a 25:75 profit and loss ratio.

Furthermore, the partners arrive on the following agreements: MN’s inventory is undervalued by P11,000.

An allowance for doubtful account is to be set up in the books of MN and OP at 10% of the accounts

receivable balances (MN, P27,500; OP, P41,250). Accrued salary of P20,250 was not recognized in OP’s

books.

How much cash should MN invest or withdraw so that their capital interest would be equal to their profit

and loss ratio?

A. P95,000 C. P133,250

B. P(133,250) D. P (95,000)

ADVACC (Acctg 630) – MODULE 1: PARTNERSHIP ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

4

1.2 Partnership Operations

The MAIN CONCERN of accounting problems on PARTNERSHIP OPERATIONS is the ALLOCATION

OF PARTNERSHIP PROFITS OR LOSSES TO THE PARTNERS.

Due to the nature of a partnership contract, partners may agree freely, subject to very few limitations, on

how they are to share the profits and losses of a partnership. Thus, it is virtually impossible to list down

all the possible ways of doing this. The following are the common allocation bases of sharing profits and

losses:

1. Equally – normally, but not generally, profits and losses are shared by all partners equally.

2. Using an arbitrary ratio or percentage – e.g. 50:30:20; 60% and 40%; 3:2:1

3. Using their capital ratios – when using capital ratios to allocate profits and losses, there are four (4)

capital ratios that may be used:

a. Original capital ratio – the ratio of the ORIGINAL capital credits of the partners at the

FORMATION of the partnership.

b. Beginning capital ratio – the capital ratio of the partners at the beginning of the CURRENT

ACCOUNTING PERIOD.

c. Ending capital ratio – the capital ratio of the partners at the end of the current accounting period

after investments and withdrawals but before profit allocation.

d. Average capital ratio – the ratio of the partners’ average capital balances from the start of the

current accounting period to the end of the same period. There are two (2) ways of computing the

average capitals of the partners:

o Simple average – the statistical mean of the beginning capital and ending capital of a partner

(i.e. [beginning capital + ending capital]/2)

o Peso-time average – a more accurate way of computing average capital by putting weights of

time on the moving balances of a partner’s capital due to his/her additional investments or

withdrawals during the accounting period (i.e. ∑ capital balances at points in time x weights of

time)

4. Salaries and interest on capital – partner salaries and interest on capital are NOT EXPENSE ITEMS

but rather a means of allocating profits and losses. Salaries are usually expressed as a fixed annual

amount while interest is usually expressed as an annual percentage of capital balances.

5. Bonuses – the amount of bonus is usually expressed as a percentage of profit (e.g. profit before or

after interest, bonuses and salaries).

6. Multiple allocations – the use of many allocation bases.

The following are the IMPORTANT RULES AND TRICKS you need to remember when solving problems

that involve the allocation of profits and losses to partners:

a. If the profit sharing ratio is not given, the following hierarchy shall apply:

i. Use the ORIGINAL capital ratio to allocate profits.

ii. In the absence of letter (a), use the BEGINNING capital ratio.

iii. In the absence of (a) and (b), allocate profits equally.

b. If the loss ratio is not given, then it is assumed to be equal to the profit sharing ratio.

c. Temporary, regular and year-end drawings should not be considered when computing for

average capital using the peso-time approach.

d. The profit or loss sharing ratio may not be equal to the percentage interests of the partners in the

partnership. However, when the problem is silent, the interest of a partner in the partnership

and his/her profit or loss ratio are equal.

e. Bonuses are not given when the partnership incurs a net loss. All other allocation bases may be

given even if there is a net loss or there is “negative allocation” due to insufficient profit.

f. When the profit or loss sharing agreement involves multiple allocations, profit or loss is allocated in

the order it is stated in the problem (e.g. salaries first, then interest, then bonuses, and so on…)

g. When the phrase “To the extent of the profit” or “as far as the profit is available” is used in the problem,

the allocation bases are used only to the extent of the profit (i.e. no negative allocation should occur).

This is most relevant when multiple allocation bases are used. For instance, if the profit or loss

agreement involves allocation of salaries and bonuses, but profit is only enough for salaries, then

bonus is no longer given.

ADVACC (Acctg 630) – MODULE 1: PARTNERSHIP ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

5

Practice Problems – Partnership Operations:

Problem 1: AB, QR and XY are manufacturers’ representative in the wholesale business. Their capital

accounts in the AQX Partnership for 2015 were as follows:

AB QR XY

January 1, Balances P135,000 P180,000 P75,000

March 1, withdrawal - 36,000 -

April 1, investment - - 30,000

May 1, investment 72,000 - -

June 1, investment - 27,000 -

August 1, withdrawal - - 9,000

October 1, withdrawal 54,000 - -

December 1, investment - 18,000 -

Required: Prepare an income distribution schedule for each of the following independent cases:

1. Interest is 10% of weighted average capital balances. Annual salaries are P480,000 to AB, P630,000

to QR and P510,000 to XY. QR receives a bonus of 25% of net income after deducting the bonus and

his salary. Any remainder is divided in a 2:3:4 ratio by AB, QR and XY, respectively. Net income was

P1,050,000 before any allocations.

2. Monthly salaries are P30,000 to AB, P50,000 to QR and P45,000 to XY. AB receives a bonus of 5% of

net income after deducting his bonus. Interest is 12% of ending capital balances. Any remainder is

divided by AB, QR and XY in a 25:40:35 ratio. The Income Summary account has a credit balance of

P2,835,000 before closing.

3. XY receives a bonus of 20% of net income after deducting the bonus and the salaries. Annual salaries

are P600,000 to AB, P540,000 to QR and P750,000 to XY. Interest is 15% of the ending capital in

excess of P140,000. Any remainder is to be divided by AB, QR and XY in the ratio of their beginning

capital balances. Net income was P1,740,000 before any allocations.

4. Monthly salaries are P32,000 to AB, P40,000 to QR and P42,000 to XY. QR receives a bonus of 10% of

net income after deducting his bonus. Interest is 25% on the excess of the ending capital balances

over the beginning capital balances. Any remainder is to be divided by AB, QR and XY in a 3:2:1 ratio.

The Income Summary account has a debit balance of P750,000 before closing.

5. Annual salaries of P450,000 to AB, P540,000 to QR and P810,000 to XY are allowed to the extent of

the earnings only. Any remainder is to be divided equally among the partners. Net income before

allocation is P960,000.

6. Annual salaries of P350,000, P400,000 and P500,000 are given to AB, QR and XY, respectively. Any

remainder is divided among the partners using a 5:3:2 ratio. Net income before allocation is

P850,000. Salaries given to partners were accounted as operating expenses during 2015.

Problem 2: CD partnership begins its first year of operations with the following capital balances: C, Capital,

P224,000 ; D, Capital, P112,000. The partnership agreement regarding allocation of profits and losses is as

follows:

C will be allowed a salary of P268,800 and P134,400 to D.

The partners will be allowed with interest equal to 10% of the beginning capital balance of the year.

C will be allowed a bonus of 10% of the net income after bonus.

The remainder will be divided on the basis of the beginning capital for the first year and equally for

the second year.

Each partner is allowed to withdraw up to P11,200 per year.

Assume that the income summary has a debit balance of P16,800 on the first year and a credit balance of

P61,600 on the second year. Assume further that each partner withdraws the maximum amount from the

business each period.

What is the balance of P’s capital account at the end of the second year?

A. P95,200 B. P39,480 C. P296,520 D. P201,600

ADVACC (Acctg 630) – MODULE 1: PARTNERSHIP ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

6

Problem 3: CC partnership began operations on June 1, 2014. On that date, CY and CR have capital credits

of P175,000 and P240,000, respectively. The partnership has the following profit-sharing plan:

- 10% interest on partners’ capital balances at the end of each year.

- P60,000 and P75,000 annual salaries for CY and CR, respectively.

- Remaining profit will be divided to CY and CR on a 3:2 ratio, respectively.

During the year, CY invested P150,000 worth of merchandise and withdrew P40,000 cash, while CR

invested P120,000 cash. The partnership earned a profit of P266,375 during the year.

How much is CY’s capital balance at the end of 2014?

A. P422,375

B. P444,825

C. P426,625

D. P413,625

Problem 4: AY and AN are partners who have the agreement to share profits and loss in the following

manner:

AY AN

Annual Salaries P261,000 P259,000

Interest on average balances 5% 10%

Bonus on net income after salaries and interest 10% -

Remainder 50% 50%

During the year ended December 31, 2014, the partnership generated a profit of P575,000 before any

deductions. AY’s and AN’s average capital balances for this year are P600,000 and P300,000 respectively.

Income is distributed to the partners only as far as it is available.

How much is the total share of AN in the net income for the year ended 2014?

A. P286,500

B. P287,500

C. P288,500

D. P295,665

Problem 5: Hans, Lance, Arthur and Sidd own a publishing company that they operate as a partnership.

Their agreement includes the following:

- Hans will receive a salary of P20,000 and a bonus of 3% of income after all the bonuses.

- Lance will receive a salary of P10,000 and a bonus of 2% of income after all the bonuses.

- All the partners are to receive the following: Hans – P5,000, Lance – P4,500, Arthur – P2,000 and Sidd –

P4,700, representing 10% interest on their average capital balances.

- Any remaining profits are to be divided equally among the partners.

- Partnership reports a profit of P40,000.

How much is Lance’s share in the profit if profit is distributed in the following order of priority: Interest

on capital, then bonuses, then salary, and then according to P/L ratio?

A. P12,560.00

B. P13,235.75

C. P12,433.00

D. P12,830.75

ADVACC (Acctg 630) – MODULE 1: PARTNERSHIP ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

7

1.3 Partnership Dissolution

The MAIN CONCERN of accounting problems on PARTNERSHIP DISSOLUTION is the

COMPUTATION OF THE CAPITAL BALANCE OF A PARTNER AFTER DISSOLUTION.

Partnership dissolution pertains to the CHANGE in the original partnership agreement or contract.

Dissolution occurs in each of the following instances.

1. Admission of a new partner 3. Death or incapacity of an existing

2. Retirement of an existing partner partner

4. Incorporation of a partnership

In Advanced Accounting, problems on partnership dissolution focus on admission or retirement.

1.3.1 Admission of a New Partner

When a new partner is admitted into the partnership, the transaction may be accounted for

either as a purchase of interest from other partners or as an investment of net assets into the

partnership. The accounting differences between the two are as follows:

1. Admission by PURCHASE (Key verbs: purchases, buys, pays, transfers) – this constitutes a

mere transfer of capital. The new partner has no net asset contributions to the partnership.

The capital balances of the old partners are simply debited and the capital balance of the new

partner is credited. Hence, the total capital of the partnership remains the same and any cash

settlement is considered to be a personal transaction among the partners.

However, there are instances where assets are required to be revalued prior to the transfer of

capital to the new partner. This is usually done to equate the personal cash settlement with

the capital credit of the new partner. The ff. computation is necessary:

Personal cash settlement of the new partner xxx

Divide: Interest of the new partner in the partnership _÷ %_

New total capital of the partnership xxx

Less: Old total capital of the partnership (prior to admission) _(xxx)_

Revaluation amount (to be allocated to OLD partners only) xxx

2. Admission by INVESTMENT (Key verbs: invests, contributes) – In this type of admission, there

is an actual investment of net assets on the partnership by the new partner. Consequently,

total capital of the partnership will definitely change upon the admission of the new partner.

Similar to what happens when forming a partnership, the capital credit of the new partner

upon his admission may not necessarily be equal to the fair value of his/her investment.

One way of solving accounting problems involving the admission of a new partner via

investment is through using the AC-CC table:

AC CC Bonus/Revaluation

Old partners XXXX XXXX XXX

New partner _XXXX_ _XXXX_ _____ XXX________

TOTAL XXXX XXXX XXX

The following shall be observed when using the table:

The CC of the OLD partners are simply equal to their capital balances prior to admission.

The CC of the NEW partner is simply equal to his/her net asset contributions (i.e. invested

capital).

The AC of the new partner depends on their agreement. Normally, it is computed in the

following manner: Total AC x % interest of new partner = AC of new partner

If AC-new partner > CC-new partner, the difference is BONUS to NEW partner.

If AC-new partner < CC-new partner, the difference is BONUS to OLD partners.

If AC-new partner = CC-new partner, there is NO BONUS.

If TOTAL AC > TOTAL CC, the difference is POSITIVE REVALUATION.

If TOTAL AC < TOTAL CC, the difference is NEGATIVE REVALUATION.

If TOTAL AC = TOTAL CC, the difference is NO REVALUATION.

Bonuses to old partners and revaluations are allocated to the OLD partners ONLY using their

original profit/loss sharing ratio.

If the problem is silent, the bonus method is used (TAC = TCC, but AC-new ≠ CC-new).

A bonus and revaluation can occur at the same time (TAC ≠ TCC, AC-new ≠ CC-new).

ADVACC (Acctg 630) – MODULE 1: PARTNERSHIP ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

8

1.3.1 Retirement/Withdrawal of an Existing Partner

When a partner of an existing partnership RETIRES or withdraws from the partnership, the

partnership settles his/her capital balance usually through payment of an agreed amount of

cash. The amount of the cash settlement and the retiring partner’s capital balance may not

necessarily be equal. The difference may be accounted for as a:

o Bonus to/from remaining partners – the difference between the cash settlement and the

capital balance of the retiring partner is considered as a bonus to/from the remaining

partners, as the case may be.

o Revaluation of assets – some of the partnership assets are revalued to equate the retiring

partner’s capital balance with his/her cash settlement. This can be done via:

Total revaluation – all the partners’ capital balances are adjusted for the revaluation. This

involves “grossing up” the difference of the retiring partner’s capital balance and his/her

cash settlement, then allocating such amount to the partners.

Capital balance of retiring partner xxx

Cash settlement _(xxx)_

Partial revaluation xxx

Divide: P/L ratio of retiring partner _÷ %_

Total asset revaluation to be allocated to ALL partners xxx

Partial revaluation – the retiring partner’s capital balance is equated with the cash

settlement by adjusting his/her capital ONLY and recognizing a corresponding asset

revaluation.

Other important things to remember when solving partnership dissolution problems:

1. Make sure to allocate net income and close drawings and additional investments to the capital

balances of the partners before effecting the dissolution.

2. When the problem is silent, the bonus method is used. Assets are only revalued when it is

explicitly stated in the problem.

3. The amount of the bonus and/or revaluation is allocated to the partners using the profit/loss

sharing agreement in effect BEFORE the dissolution occurs.

4. There are instances when the remaining partners will adjust their capital balances to comply

with their new interest ratios after the retirement.

Practice Problems – Partnership Dissolution:

Problem 1: On August 1, 2010, Marie and Paz formed a partnership. Marie contributed inventory of

P500,000 with a fair value of P300,000 while Paz contributed cash of P250,000 and a land valued

that cost her P900,000 with a carrying amount of P1,000,000 and a fair value of P1,250,000. The

partnership did not assume the mortgage attached to the property worth P250,000. The partners

agree to allocate profits and losses as follows:

1. Each partner shall receive 5% interest on the amount of his beginning capital.

2. Marie will receive a salary of P8,000 per month.

3. The remainder will be divided equally on the first year and 60:40 on subsequent years.

4. Marie and Paz are allowed to withdraw P5,000 per month. Any withdrawal is treated as a

direct reduction of capital.

In 2010, the partnership has a credit balance of income summary of P100,000. On July 1, 2011,

Ivonne was admitted in the partnership by investing P800,000 for a 25% interest. Asset revaluation

is to be recognized. After admission of Ivonne, the partners agreed to divide profits as follows:

1. Each partner shall receive 5% interest on the amount of his beginning capital.

2. All partners will receive a salary of P2,000 per month.

3. The balance to be divided 45% to Marie, 30% to Paz and 25% to Ivonne.

4. Each partner is allowed to withdraw P2,000 per month. Any withdrawal is treated as a

direct reduction of capital.

In 2011, the partnership earned a profit of P300,000 evenly throughout the year. How much is the

capital balance of Marie at the end of December 31, 2011.

ADVACC (Acctg 630) – MODULE 1: PARTNERSHIP ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

9

A. P707,623.44 B. P694,554.69 C. P670,652.97 D. P705,586.25

Problem 2: Vida, Vina and Vita, sharing profits and losses 5:3:2, have capital credit balances of

P400,000, P300,000 and P200,000 respectively. They decided to admit a new partner, Vera to a

30% interest in the partnership upon Vera’s investment of an amount equal to five-sixths of her

capital credit with no asset adjustment recognized. Immediately after the admission of Vera, the

capital credit balance of Vina will be:

A. P300,000 B. P330,000 C. P318,000 D. P282,000

Problem 3: PV, BK and TF were partners in Omaha Partnership. Their profit ratio is 50%, 30%,

20%, while their original capital interest ratio is 4:4:2. On July 1, 2014, JP was admitted by the

partnership for 20% interest in capital and 25% in profits by contributing P87,500 cash, and the

old partners agree to bring their interest to their original capital and profit interest sharing ratio.

JP is the recipient of the transfer of capital of P280,000 from the existing partners. The partnership

had net income of P210,000 before admission of JP and the partners agree to revalue its

overvalued equipment by P35,000. Capital balance of BK increased by P10,500 as a result of the

admission of JP, while the capital balance of TF at the start of the year is P700,000. The capital

balance of PV at the start of the year is:

A. P577,500 B. P350,000 C. P354,200 D. P441,000

Problem 4: SG, AP and TS are partners with capital balances of P784,000, P2,730,000 and

P1,190,000 respectively, sharing profits and losses in the ratio of 3:2:1. DJ is admitted as a new

partner bringing with him expertise and is to invest cash for a 25% interest in the partnership

which includes a credit of P735,000 for bonus upon his admission. How much cash should DJ

contribute?

A. P1,323,000 B. P1,575,000 C. P2,100,000 D. P588,000

Problem 5: On December 30, 2010, the balance sheet of Danger Co. has the following balances:

Total assets P450,000: Willie loan P25,000; Willie capital P103,750; Manny capital P96,250 and

Loren capital P225,000. The partners share profits and losses in the ratio of 25% to Willie, 25% to

Manny, and 50% to Loren. It was agreed among the partners that Willie retires from the

partnership and the partnership assets be adjusted to their fair values of P510,000 as of December

31, 2010. The partnership also suffered net loss of P150,000. The partnership would pay Willie

P108,500 cash for his total interest in the partnership.

What is the capital balance of the remaining partners after the retirement of Willie under the:

a. Bonus method?

b. Partial revaluation method?

c. Total revaluation method?

Problem 6: Ester, Judith and Martha were partners with capital balances on January 2, 2014 of

P70,000, P84,000 and P56,000, respectively. Their loss sharing ratio 3:5:2. On July 1, 2014, Ester

retires from the partnership. On the date of retirement the partnership net profit from operations

is P48,000. The partners agreed further to pay Ester P76,560 in settlement of her interest.

How much will be the capital of Judith after retirement of Ester?

A. P103,200 B. P114,743 C. P108,864 D. P107,904

Problem 7: On December 30, 2014, the Statement of Financial Position of DG Co. has the following

balances: Total assets of P2,250,000, VL loan P125,000, VL capital P518,750, MD capital P481,250

and LV capital P1,125,000. The partners share profits and losses in the ratio of 25% to VL, 25% to

MD and 50% to LV. It was agreed among the partners that VL retires from the partnership and the

partnership assets be adjusted to their fair value of P2,550,000 as of December 31, 2014. The

partnership also suffered net loss of P750,000. The partnership would pay VL the amount of

P542,500 cash for his total interest in the partnership.

What is the total capital of MD after retirement of VL?

ADVACC (Acctg 630) – MODULE 1: PARTNERSHIP ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

10

A. P383,750 B. P368,750 C. P365,000 D. P380,000

1.4 Partnership Liquidation

The MAIN CONCERN of accounting problems on PARTNERSHIP LIQUIDIATION is the CASH

SETTLEMENT TO PARTNERS at the end of the liquidation process.

As far as cash settlement is concerned, there are two ways to liquidate a partnership:

1. Lump-sum liquidation – settlement of capital balances through payment of cash is done

only after all the partnership assets are realized and all liabilities to creditors are settled,

i.e. one-time payment

2. Installment liquidation – cash payments to partners are done at different intervals of

the liquidation process when assets are partially realized and liabilities to outside

creditors can be settled in full.

When a partnership is liquidated through installment payments, the following may be used to

facilitate your computation:

o Schedule of safe payments (SSP) - the concept of the SSP is to compute the safest

installment payment to the partners assuming the ‘worst possible scenario’ after the

initial realization of assets. The worst possible scenario assumes the following:

a. All the remaining non-cash assets will no longer be realized (i.e. sold). This means

the book value of these assets are written-off as a loss.

b. Liabilities to external creditors are paid first before the partners.

c. Anticipated expenses are incurred.

b. All the partners are insolvent.

o Cash distribution program (CDP) – the CDP is somewhat similar to the SSP except that

it computes the loss absorption capacity (LAC) of each partner. The LAC is simply the

maximum loss a partner can absorb before his/her capital balance is reduced to zero.

Cash payments to partners are made first to the partner with the biggest LAC and so on.

Priority payments are computed by multiplying the partner’s P/L ratio with the

difference of his/her LAC and the next biggest LAC. Any cash in excess of the priority

cash payments are allocated using the P/L ratios.

When to use which? Using the SSP and CDP should yield the same results as far as

installment payments to partners are concerned. However, the SSP is more preferable if the

amount of unsold assets and liquidation expenses are given. The CDP is best used when only

the cash available for distribution is given or may be obtained.

THE SHORTCUT:

Since Advanced Accounting in the board examination usually involves problems that require you to

do a lot of ‘working back’, the following shortcut is proven to be useful to hasten your

computations:

*Breakdown of total loss:

Total interest of partner xxx* (1) Ga i n (l os s ) on rea l i za ti on of a s s ets

Cash settlement to partner __(xxx) (2) Book va l ue of uns ol d a s s ets

Loss (gain) on liquidation absorbed xxx (3) Li qui da ti on expens es

(4) Anti ci pated expens es (ca s h wi thhel d for

Divide: P/L Ratio of partner ÷ %__ a nti ci pa ted expens es )

Total loss on liquidation XXX (5) Ins ol vency of s ome pa rtners

*Total interest = capital balance +/- undistributed share in profits or losses +/- loan to (from) partners

Things to remember:

o When the problem is silent, all the partners are assumed to be insolvent.

o Due to the nature of the accounting equation, the cash available will ALWAYS equal the total

capital of the partnership after all non-cash assets are realized and all liabilities are settled.

o Gains and losses during the liquidation process is allocated to the capital balances of the

partners using their existing profit or loss agreement.

ADVACC (Acctg 630) – MODULE 1: PARTNERSHIP ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

11

o Remember that the final cash settlement is made at the final capital balances of the partners,

not using their profit or loss ratio.

Practice Problems – Partnership Liquidation:

Problem 1: SCA Partnership has the following account balances before liquidation:

Cash P350,000 Liabilities P1,125,000

Noncash assets 7,375,000 Loan from A 50,000

Loan to C 150,000 S, Capital (40%) 1,250,000

Receivable from S 20,000 C, Capital (40%) 1,900,000

Expenses 2,230,000 A, Capital (20%) 1,000,000

Revenues 4,800,000

During June, some noncash assets were sold that resulted to a loss of P46,125. Liquidation

expenses of P175,000 were paid and additional expenses amounting to P90,000 were expected to

be incurred through the following months of liquidation of the partnership. Liabilities to outsiders

amounting to P875,000 were paid. What is the book value of the noncash assets which were sold for

C to receive P555,550?

A. P2,375,000 B. P2,130,000 C. P2,328,875 D. P2,083,875

Problem 2: JFK partnership engaged in steel manufacturing business had the following condensed

financial position prior to liquidation:

ASSETS LIABILITIES AND CAPITAL

Cash P24,000 Liabilities P70,000

Noncash assets 360,000 Loan payable to J 30,000

J, Capital (50%) 90,000

F, Capital (30%) 140,000

____________ K, Capital (20%) __54,000__

Total P384,000 Total P384,000

Assuming assets with a book value of P140,000 were sold for P100,000 and that all available cash

was distributed. For what amount would the remaining assets have to be sold in order for partner F

to receive a total of P158,000 cash after liquidation?

A. P310,000 B. P300,000 C. P320,000 D. P330,000

Problem 3: After a long dispute, Chris, Ann and Nine decided to liquidate their partnership. Their

total interests as of January 1, 2014 are: Chris (25%) P375,000; Ann (40%) P450,000; Nine (35%)

P280,000. Partnership’s total assets on this date include P125,000 cash, a receivable from Chris

amounting to P25,000, and noncash assets of a certain amount. Total liabilities to outside creditors

are P320,000 and the partnership still owes Nine an amount of P20,000. At the end of the

liquidation, Ann received P75,000. How much were the noncash assets sold for?

A. P362,500 B. P312,500 C. P405,625 D. P410,625

Problem 4: Ebay, Amazon and Sulit divide profits and losses in a 2:3:4 ratio. Just prior to

liquidating their partnership, their respective account balances were P50,000, P96,000 and P74,000

as of April 1, 2009. Their total assets include cash of P5,000 and a loan to Ebay for P10,000, while

their total liabilities of P90,000, include a loan from Sulit for P30,000. The partners agreed to

distribute cash, as it becomes available, at month-end. Realization proceeds were P68,000 in April,

P56,000 in May and P63,000 in June. In the cash distribution on June 30, 2009, Sulit will receive:

A. P14,000 B. P28,000 C. P21,000 D. P35,000

Problem 5: Kevin, Paul and Rey have capital balances of P60,000, P100,000 and P36,000,

respectively and they share profits in the respective ratio of 4:2:1. Paul received P52,000 as a result

of the liquidation of the partnership. Loss on assets realization is:

ADVACC (Acctg 630) – MODULE 1: PARTNERSHIP ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

12

A. P118,000 B. P144,000 C. P132,000 D. P168,000

ADVACC (Acctg 630) – MODULE 1: PARTNERSHIP ACCOUNTING

Ateneo de Zamboanga University – School of Management and Accountancy

Das könnte Ihnen auch gefallen

- Prequalifying ExaminationDokument6 SeitenPrequalifying ExaminationVincent Villalino LabrintoNoch keine Bewertungen

- AFAR 0107. Partnership. CPARTC - StudentDokument8 SeitenAFAR 0107. Partnership. CPARTC - StudentApolinar Alvarez Jr.Noch keine Bewertungen

- Practical Accounting 2 - RMYCDokument10 SeitenPractical Accounting 2 - RMYCZadharie Abby Gail BurataNoch keine Bewertungen

- Advanced AccountingDokument4 SeitenAdvanced AccountingGennia Mae MartinezNoch keine Bewertungen

- Session 2 - Partnership Operations - Problems January 29, 2016Dokument10 SeitenSession 2 - Partnership Operations - Problems January 29, 2016Johnny CervantesNoch keine Bewertungen

- 1.4 Partnership Liquidation - 1Dokument4 Seiten1.4 Partnership Liquidation - 1Leane Marcoleta100% (2)

- Book 6Dokument4 SeitenBook 6Actg SolmanNoch keine Bewertungen

- AFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSDokument5 SeitenAFAR - FINAL EXAMINATION - 03.22.2019 Wo ANSWERSrain suansingNoch keine Bewertungen

- CH 07Dokument99 SeitenCH 07baldoewszxcNoch keine Bewertungen

- 8901 - Partnership FormationDokument3 Seiten8901 - Partnership FormationRica Jane Santos Marcelo100% (1)

- Partnership MyDokument13 SeitenPartnership MyHoneylyne PlazaNoch keine Bewertungen

- Chapter 1&2Dokument34 SeitenChapter 1&2iptrcrmlNoch keine Bewertungen

- Partnership HandoutsDokument4 SeitenPartnership Handoutsrose anne0% (1)

- 2018 Income Tax QDokument4 Seiten2018 Income Tax QlightNoch keine Bewertungen

- AdFAR.701 - Partnership Accounting - OnlineDokument6 SeitenAdFAR.701 - Partnership Accounting - OnlineMikaela Lapuz Salvador100% (2)

- Module 2 - Partnership Operation and Financial Reporting Module 2 - Partnership Operation and Financial ReportingDokument12 SeitenModule 2 - Partnership Operation and Financial Reporting Module 2 - Partnership Operation and Financial ReportingmsjoyceroxaneNoch keine Bewertungen

- BAFINAR - Midterm Draft (R) PDFDokument11 SeitenBAFINAR - Midterm Draft (R) PDFHazel Iris Caguingin100% (1)

- Partnership Exercises Answers and ExplanationsDokument25 SeitenPartnership Exercises Answers and Explanationsralphalonzo100% (1)

- Introduction To Partnership Accounting Partnership DefinedDokument33 SeitenIntroduction To Partnership Accounting Partnership DefinedMarcus MonocayNoch keine Bewertungen

- Partnership Additional ProbsDokument9 SeitenPartnership Additional ProbsJoy LagtoNoch keine Bewertungen

- PDF 1pdfsam01 Partnership Formation Amp Admission of A Partnerxx 1pdfDokument57 SeitenPDF 1pdfsam01 Partnership Formation Amp Admission of A Partnerxx 1pdflinkin soyNoch keine Bewertungen

- 123Dokument13 Seiten123Nicole Andrea TuazonNoch keine Bewertungen

- CH 009Dokument2 SeitenCH 009Joana TrinidadNoch keine Bewertungen

- Ac Far Quiz4Dokument5 SeitenAc Far Quiz4Kristine Joy CutillarNoch keine Bewertungen

- ExmDokument18 SeitenExmRoy Mitz Bautista0% (2)

- Finals Quiz Dissolution To LiquidationDokument6 SeitenFinals Quiz Dissolution To LiquidationJeane Mae Boo75% (4)

- B.) CC, P25,000: PP, P21,000 Aa, P38,000Dokument22 SeitenB.) CC, P25,000: PP, P21,000 Aa, P38,000Wendelyn TutorNoch keine Bewertungen

- Partnership MidtermDokument10 SeitenPartnership MidtermJoanna Caballero100% (1)

- Reviewer On Partnership Problems - Q2 PDFDokument3 SeitenReviewer On Partnership Problems - Q2 PDFAdrian Montemayor33% (3)

- AFAR-01 PartnershipDokument6 SeitenAFAR-01 PartnershipRamainne Ronquillo0% (1)

- Partnership Liquidation QuizDokument4 SeitenPartnership Liquidation QuizMark Francis Solante100% (1)

- Quiz - Quiz 2 Partnership Dissolution and Liquidation AnswersDokument15 SeitenQuiz - Quiz 2 Partnership Dissolution and Liquidation AnswersKent Zirkai CidroNoch keine Bewertungen

- Module 1.3 - Partnership Dissolution PDFDokument3 SeitenModule 1.3 - Partnership Dissolution PDFMila MercadoNoch keine Bewertungen

- Chapter 7Dokument18 SeitenChapter 7Yenelyn Apistar CambarijanNoch keine Bewertungen

- Chapter 3Dokument33 SeitenChapter 3Keith Joanne SantiagoNoch keine Bewertungen

- Partnership and CorpoDokument3 SeitenPartnership and CorpoKing MacunatNoch keine Bewertungen

- Adv Acc NADokument31 SeitenAdv Acc NAimianmoralesNoch keine Bewertungen

- Quiz 1 AFAR ReviewDokument7 SeitenQuiz 1 AFAR ReviewPrankyJellyNoch keine Bewertungen

- Partnership: Formation of A PartnershipDokument70 SeitenPartnership: Formation of A PartnershipWe WNoch keine Bewertungen

- P2 - AnswerKeyDokument9 SeitenP2 - AnswerKeyoizys131Noch keine Bewertungen

- Theories Chapter 1 - 5Dokument11 SeitenTheories Chapter 1 - 5u got no jamsNoch keine Bewertungen

- Lecture Notes: National University Ellery de Leon Advac 1-Partnerships 1 Semester SY 2016-2017Dokument10 SeitenLecture Notes: National University Ellery de Leon Advac 1-Partnerships 1 Semester SY 2016-2017sunflowerNoch keine Bewertungen

- Multiple Choice Partnership and CorporationDokument14 SeitenMultiple Choice Partnership and CorporationTrina Joy HomerezNoch keine Bewertungen

- P U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Dokument10 SeitenP U P College of Accountancy and Finance: First Evaluation Exams Practical Accounting 2Shaina AragonNoch keine Bewertungen

- Chap 10 PartnershipDokument24 SeitenChap 10 PartnershipIvhy Cruz Estrella100% (2)

- Balbin, Ma. Margarette P. Assignment #1Dokument7 SeitenBalbin, Ma. Margarette P. Assignment #1Margaveth P. BalbinNoch keine Bewertungen

- Name: Date: Subject: Section and Time:: Problem 1Dokument16 SeitenName: Date: Subject: Section and Time:: Problem 1Marie GarpiaNoch keine Bewertungen

- Quiz in PartnershipDokument13 SeitenQuiz in PartnershipDonalyn BannagaoNoch keine Bewertungen

- Afar QuestionsDokument16 SeitenAfar Questionspopsie tulalianNoch keine Bewertungen

- AFAR - Corp LiqDokument1 SeiteAFAR - Corp LiqJoanna Rose Deciar0% (1)

- P2Dokument20 SeitenP2Jemson YandugNoch keine Bewertungen

- Accounting 12Dokument4 SeitenAccounting 12Breathe ArielleNoch keine Bewertungen

- 1 - PDFsam - 01 Partnership - RetirementxxDokument9 Seiten1 - PDFsam - 01 Partnership - RetirementxxnashNoch keine Bewertungen

- Arts Cpa Review: BatchDokument8 SeitenArts Cpa Review: BatchKristel Sumabat0% (1)

- Handouts PartnershipDokument9 SeitenHandouts PartnershipCPANoch keine Bewertungen

- Reviewer From Prelim To FinalsDokument324 SeitenReviewer From Prelim To FinalsRina Mae Sismar Lawi-an100% (1)

- Reviewer From Prelim To FinalsDokument303 SeitenReviewer From Prelim To FinalsRina Mae Sismar Lawi-an67% (3)

- ACC102 Partnership ProblemsDokument13 SeitenACC102 Partnership ProblemsDana TajedarNoch keine Bewertungen

- Partnership Accounting Practical Accounting 2Dokument13 SeitenPartnership Accounting Practical Accounting 2random17341Noch keine Bewertungen

- RawDokument5 SeitenRawJenny MendozaNoch keine Bewertungen

- Great Depression of 1929Dokument21 SeitenGreat Depression of 1929Pradeep GuptaNoch keine Bewertungen

- Aldaman Aldahabi Gen - Tra.Co Inquiry 03.05.2020Dokument1 SeiteAldaman Aldahabi Gen - Tra.Co Inquiry 03.05.2020maxwell onyekachukwuNoch keine Bewertungen

- Market Performance of Cashew Nuts Among Marketers in North-Central Geo-Political Zone, NigeriaDokument13 SeitenMarket Performance of Cashew Nuts Among Marketers in North-Central Geo-Political Zone, NigeriaInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- For You And: Your EngineDokument6 SeitenFor You And: Your EngineMintomo IrawanNoch keine Bewertungen

- Good Shepherd International School, Ooty Mid Term Examination - September 2022Dokument8 SeitenGood Shepherd International School, Ooty Mid Term Examination - September 2022DANIYA GENERALNoch keine Bewertungen

- E Banking - HDFCDokument7 SeitenE Banking - HDFCmohammed khayyumNoch keine Bewertungen

- Online Shoping With ShopeeDokument7 SeitenOnline Shoping With ShopeeXII MM1Reiza Fauzan FirdausNoch keine Bewertungen

- Z KP DOSqafsxrsn 5 FDokument6 SeitenZ KP DOSqafsxrsn 5 FwelcommdzubairNoch keine Bewertungen

- Swot Analysis Question For PentamasterDokument2 SeitenSwot Analysis Question For PentamasterFatin Nur Aina Mohd RadziNoch keine Bewertungen

- International Management - UberDokument16 SeitenInternational Management - UberShazrina Sharuk100% (1)

- Lists of Authorized Banks in Bir Rdo 60Dokument1 SeiteLists of Authorized Banks in Bir Rdo 60Aljohn SebucNoch keine Bewertungen

- Emmanuel Olayinka Adeboye R2205D14535270: Governing International Oil and Gas (UEL-SG-7301-33314)Dokument13 SeitenEmmanuel Olayinka Adeboye R2205D14535270: Governing International Oil and Gas (UEL-SG-7301-33314)Emmanuel AdeboyeNoch keine Bewertungen

- View Current StatementDokument1 SeiteView Current StatementLochan MNoch keine Bewertungen

- Credit Facility Form (Grand)Dokument2 SeitenCredit Facility Form (Grand)cyed mansoorNoch keine Bewertungen

- Central Bank of Malta ActDokument29 SeitenCentral Bank of Malta ActcikkuNoch keine Bewertungen

- SoC Non ComfortDokument3 SeitenSoC Non ComfortShanmugam ThiyagarajanNoch keine Bewertungen

- Law On Obligations and Contracts Weeks 8 9Dokument64 SeitenLaw On Obligations and Contracts Weeks 8 9Moises The Way of Water TubigNoch keine Bewertungen

- Solutions For 50 Aptitude Questions On Profit and Loss QuestionsDokument16 SeitenSolutions For 50 Aptitude Questions On Profit and Loss QuestionsNaren Dran100% (1)

- Lone Pine - 4Q09 V 1Q10Dokument2 SeitenLone Pine - 4Q09 V 1Q10Glenn BuschNoch keine Bewertungen

- Selected Solutions Chap 6 8Dokument49 SeitenSelected Solutions Chap 6 8Arham SheikhNoch keine Bewertungen

- Vertical Analysis of Sopl For The Year 2020Dokument3 SeitenVertical Analysis of Sopl For The Year 2020Shubashini RajanNoch keine Bewertungen

- Agreement CashDokument13 SeitenAgreement Cashmgrace10090Noch keine Bewertungen

- Write 55g As A Percentage of 2.2kgDokument8 SeitenWrite 55g As A Percentage of 2.2kgKatrine Jaya AndrewNoch keine Bewertungen

- Doradiana,+a8 The+Effect 125+-+140Dokument16 SeitenDoradiana,+a8 The+Effect 125+-+140CheeweiLeeNoch keine Bewertungen

- Planning 1 - BrandingDokument21 SeitenPlanning 1 - BrandingAdityaNoch keine Bewertungen

- Economics Today 18th Edition Roger LeRoy Miller Test Bank DownloadDokument62 SeitenEconomics Today 18th Edition Roger LeRoy Miller Test Bank DownloadJeremy Jackson100% (19)

- The Importance of Leadership in A CompanyDokument7 SeitenThe Importance of Leadership in A Companyvasco baptistaNoch keine Bewertungen

- Cookie Creations Unit II BBA 2201 10-10Dokument6 SeitenCookie Creations Unit II BBA 2201 10-10Christy SnowNoch keine Bewertungen

- This Statement Should Be Read in Conjunction With The Accompanying NotesDokument6 SeitenThis Statement Should Be Read in Conjunction With The Accompanying NotesJoy AcostaNoch keine Bewertungen

- FIM - Group 10 Midterm ExamDokument14 SeitenFIM - Group 10 Midterm ExamSong Yi ChunNoch keine Bewertungen