Beruflich Dokumente

Kultur Dokumente

Auditing Problem 1

Hochgeladen von

jhobsCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Auditing Problem 1

Hochgeladen von

jhobsCopyright:

Verfügbare Formate

AUDITING PROBLEMS

PROBLEM NO. 1

You are engaged in the regular annual examination of the accounts and records of PRTC Manufacturing

Co. for the year ended December 31, 2012. To reduce the workload at year end, the company, upon

your recommendation, took its annual physical inventory on November 30, 2012. You observed the

taking of the inventory and made tests of the inventory count and the inventory records. The company’s

inventory account, which includes raw materials and work-in-process is on perpetual basis. Inventories

are valued at cost, first-in, first-out method. There is no finished goods inventory. The company’s

physical inventory revealed that the book inventory of P1,695,960 was understated by P84,000. To avoid

delay in completing its monthly financial statements, the company decided not to adjust the book

inventory until year-end except for obsolete inventory items. Your examination disclosed the following

information regarding the November 30 inventory: a. Pricing tests showed that the physical inventory

was overstated by P61,600. b. An understatement of the physical inventory by P4,200 due to errors in

footings and extensions. c. Direct labor included in the inventory amounted to P280,000. Overhead was

included at the rate of 200% of direct labor. You have ascertained that the amount of direct labor was

correct and that the overhead rate was proper. d. The physical inventory included obsolete materials

with a total cost of P7,000. During December, the obsolete materials were written off by a charge to cost

of sales.

Your audit also disclosed the following information about the December 31 inventory:

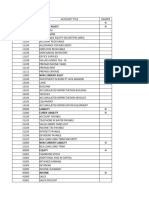

a. Total debits to the following accounts during December were:

Cost of sales P1,920,800

Direct labor 338,800

Purchases 691,600

b. The cost of sales of P1,920,800 included direct labor of P386,400.

QUESTIONS:

Based on the above and the result of your audit, determine the following:

1. Adjusted amount of physical inventory at November 30, 2012

a. P1,715,560 c. P1,845,760

b. P1,631,560 d. P1,722,560

2. Adjusted amount of inventory at December 31, 2012

a. P1,509,760 c. P1,502,760

b. P1,516,760 d. P1,425,760

3. Cost of materials on hand, and materials included in work in process as of December 31, 2012

a. P819,560 c. P728,560

b. P812,560 d. P942,760

4. The amount of direct labor included in work in process as of December 31, 2012

a. P618,800 c. P338,800

b. P232,400 d. P386,400

5. The amount of factory overhead included in work in process as of December 31, 2012

a. P 772,800 c. P464,800

b. P1,237,600 d. P777,600

Das könnte Ihnen auch gefallen

- Managing Successful Projects with PRINCE2 2009 EditionVon EverandManaging Successful Projects with PRINCE2 2009 EditionBewertung: 4 von 5 Sternen4/5 (3)

- Auditing Problem ReviewerDokument12 SeitenAuditing Problem ReviewerJan Amora Pueblo0% (4)

- Financial Statements: International Accounting (IFRS)Von EverandFinancial Statements: International Accounting (IFRS)Noch keine Bewertungen

- Ma Mod4 W08Dokument221 SeitenMa Mod4 W08Randy KuswantoNoch keine Bewertungen

- Auditing Problems With AnswersDokument12 SeitenAuditing Problems With Answersaerwinde79% (34)

- Audit of Inventory ProblemsDokument2 SeitenAudit of Inventory ProblemsZeeNoch keine Bewertungen

- Week 5 Normal Job Order CostingDokument8 SeitenWeek 5 Normal Job Order CostingRujean Salar AltejarNoch keine Bewertungen

- (Problems) - Audit of InventoriesDokument22 Seiten(Problems) - Audit of Inventoriesapatos40% (5)

- Inventories Problem No. 1Dokument4 SeitenInventories Problem No. 1Ren EyNoch keine Bewertungen

- Preweek Drill2Dokument7 SeitenPreweek Drill2Grave KnightNoch keine Bewertungen

- Audit Cash Reconciliation QuizDokument14 SeitenAudit Cash Reconciliation QuizJandave ApinoNoch keine Bewertungen

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionVon EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNoch keine Bewertungen

- Iso 9001 Audit Trail: A Practical Guide to Process Auditing Following an Audit TrailVon EverandIso 9001 Audit Trail: A Practical Guide to Process Auditing Following an Audit TrailBewertung: 5 von 5 Sternen5/5 (3)

- Answers and Solutions To Exercises PDFDokument22 SeitenAnswers and Solutions To Exercises PDFshaira aimee diolata100% (1)

- Aquatic Supplies Financial ProjectionsDokument11 SeitenAquatic Supplies Financial ProjectionsSrv VeenmanNoch keine Bewertungen

- Retail TerminologyDokument3 SeitenRetail Terminologylborrego_bacit100% (1)

- Inventory Valuation: A 5,000 P185 P230 P35 B 20,000 69 100 30 C 15,000 31 43 15 D 18,000 75 105 37Dokument3 SeitenInventory Valuation: A 5,000 P185 P230 P35 B 20,000 69 100 30 C 15,000 31 43 15 D 18,000 75 105 37ellaine villafaniaNoch keine Bewertungen

- PRTC Manufacturing Co.Dokument2 SeitenPRTC Manufacturing Co.hersheyNoch keine Bewertungen

- Auditing Problems With AnswersDokument13 SeitenAuditing Problems With AnswersVirgo Philip Wasil ButconNoch keine Bewertungen

- Audit Problems SolutionsDokument12 SeitenAudit Problems Solutionskim ryan besinanNoch keine Bewertungen

- Auditing ProblemsDokument53 SeitenAuditing ProblemsZerjo Cantalejo0% (1)

- ACCOUNTING 14-07 - APPLIED AUDITING Departmental With AnswerDokument9 SeitenACCOUNTING 14-07 - APPLIED AUDITING Departmental With AnswerkylacerroNoch keine Bewertungen

- Problem No.1: D. P147,000 C. P349,000 C. P639,000Dokument6 SeitenProblem No.1: D. P147,000 C. P349,000 C. P639,000debate ddNoch keine Bewertungen

- Ap 17 PDFDokument5 SeitenAp 17 PDFPdf FilesNoch keine Bewertungen

- AP 9206-1 InventoriesDokument5 SeitenAP 9206-1 InventoriesmiobratataNoch keine Bewertungen

- Audit of Inventory ProblemsDokument3 SeitenAudit of Inventory Problemsmarili ZarateNoch keine Bewertungen

- NAPOLEON COMPANY MARKETABLE SECURITIES AND INVESTMENT IN VOSP CORPORATIONDokument7 SeitenNAPOLEON COMPANY MARKETABLE SECURITIES AND INVESTMENT IN VOSP CORPORATIONJaylord PidoNoch keine Bewertungen

- Auditing Problem ReviewerDokument10 SeitenAuditing Problem ReviewerTina Llorca83% (6)

- Aud ProbDokument9 SeitenAud ProbKulet AkoNoch keine Bewertungen

- Auditing Problems Final ExamDokument10 SeitenAuditing Problems Final ExamVel JuneNoch keine Bewertungen

- Auditing Problems With AnswersDokument12 SeitenAuditing Problems With AnswersFlorie May HizoNoch keine Bewertungen

- BSA4A-Midterm Exam - Questions PDFDokument6 SeitenBSA4A-Midterm Exam - Questions PDFRochelleDianRaymundoNoch keine Bewertungen

- Following File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamDokument7 SeitenFollowing File Name: Family Name - First Name - Pre2 3A or 3B (As The Case May Be) - FinalexamAnna TaylorNoch keine Bewertungen

- (OH Is Overapplied) (Actual Activity) (ABC) : (Have A Difference)Dokument21 Seiten(OH Is Overapplied) (Actual Activity) (ABC) : (Have A Difference)Janna Mari FriasNoch keine Bewertungen

- AP03 Audit of Inventories QDokument6 SeitenAP03 Audit of Inventories Qbobo kaNoch keine Bewertungen

- MODAUD1 UNIT 4 - Audit of Inventories PDFDokument9 SeitenMODAUD1 UNIT 4 - Audit of Inventories PDFJake BundokNoch keine Bewertungen

- InventoriesDokument7 SeitenInventoriesShey INFTNoch keine Bewertungen

- Cel 1 Prac 1 Answer KeyDokument12 SeitenCel 1 Prac 1 Answer KeyLauren ObrienNoch keine Bewertungen

- 123Dokument11 Seiten123Jandave ApinoNoch keine Bewertungen

- Auditing Problems1Dokument45 SeitenAuditing Problems1Ronnel TagalogonNoch keine Bewertungen

- Auditing Problems1Dokument45 SeitenAuditing Problems1Ronnel TagalogonNoch keine Bewertungen

- 5th Year Exam APMIDTERMDokument11 Seiten5th Year Exam APMIDTERMMark Domingo MendozaNoch keine Bewertungen

- Auditing Problems and SolutionsDokument45 SeitenAuditing Problems and SolutionsRonnel TagalogonNoch keine Bewertungen

- AP 5905Q InventoriesDokument4 SeitenAP 5905Q Inventoriesxxxxxxxxx100% (1)

- Auditing Problems1Dokument45 SeitenAuditing Problems1Ronnel TagalogonNoch keine Bewertungen

- Problem 2Dokument1 SeiteProblem 2KATHRYN CLAUDETTE RESENTENoch keine Bewertungen

- AP.m 1401 Correction of ErrorsDokument12 SeitenAP.m 1401 Correction of ErrorsMark Lord Morales Bumagat75% (4)

- Audit Theory and ProblemDokument4 SeitenAudit Theory and ProblemRathew Cassey PencilNoch keine Bewertungen

- Week 09 - InventoryDokument4 SeitenWeek 09 - InventoryPj ManezNoch keine Bewertungen

- Quiz 5 InventoryDokument4 SeitenQuiz 5 InventoryCindy CrausNoch keine Bewertungen

- PU-P Advanced Financial Accounting and Reporting Cost ProblemsDokument6 SeitenPU-P Advanced Financial Accounting and Reporting Cost ProblemsJO SH UANoch keine Bewertungen

- COSTDokument6 SeitenCOSTJO SH UANoch keine Bewertungen

- COSTDokument6 SeitenCOSTJO SH UANoch keine Bewertungen

- INVENTORIESDokument5 SeitenINVENTORIESelsana philipNoch keine Bewertungen

- PRTC Cup 2017Dokument18 SeitenPRTC Cup 2017Sherrizah Ferrer MaribbayNoch keine Bewertungen

- Quizzers 9Dokument12 SeitenQuizzers 9Shanen Mendoza Young67% (6)

- Wrwftauditing Problems Watitiw: Page 1 of 7Dokument7 SeitenWrwftauditing Problems Watitiw: Page 1 of 7Ronnel TagalogonNoch keine Bewertungen

- Engineering Service Revenues World Summary: Market Values & Financials by CountryVon EverandEngineering Service Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Guide to Strategic Management Accounting for ManagerrsVon EverandGuide to Strategic Management Accounting for ManagerrsNoch keine Bewertungen

- Guide to Strategic Management Accounting for managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?Von EverandGuide to Strategic Management Accounting for managers: What is management accounting that can be used as an immediate force by connecting the management team and the operation field?Noch keine Bewertungen

- Pawn Shop Revenues World Summary: Market Values & Financials by CountryVon EverandPawn Shop Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Consumer Lending Revenues World Summary: Market Values & Financials by CountryVon EverandConsumer Lending Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- Interior Design Service Revenues World Summary: Market Values & Financials by CountryVon EverandInterior Design Service Revenues World Summary: Market Values & Financials by CountryNoch keine Bewertungen

- ACA Audit and Assurance Professional: Exam Preparation KitVon EverandACA Audit and Assurance Professional: Exam Preparation KitNoch keine Bewertungen

- Audit Risk Alert: Employee Benefit Plans Industry Developments, 2018Von EverandAudit Risk Alert: Employee Benefit Plans Industry Developments, 2018Noch keine Bewertungen

- PROBLEM NO. 4 - Rockets CompanyDokument1 SeitePROBLEM NO. 4 - Rockets CompanyjhobsNoch keine Bewertungen

- Period Covered Amount Percent: Computation of Amortization RateDokument3 SeitenPeriod Covered Amount Percent: Computation of Amortization RatejhobsNoch keine Bewertungen

- Ap Prob 11Dokument2 SeitenAp Prob 11jhobsNoch keine Bewertungen

- On July 1, 2020, Stony Company Purchased All of The Outstanding Stock of Argel For P4.0MDokument8 SeitenOn July 1, 2020, Stony Company Purchased All of The Outstanding Stock of Argel For P4.0MjhobsNoch keine Bewertungen

- Ap Prob 10Dokument1 SeiteAp Prob 10jhobsNoch keine Bewertungen

- Wizards Company Serial Bond AuditDokument1 SeiteWizards Company Serial Bond AuditjhobsNoch keine Bewertungen

- Heats Corporation Current and Noncurrent LiabilitiesDokument1 SeiteHeats Corporation Current and Noncurrent LiabilitiesjhobsNoch keine Bewertungen

- Ginebra Corporation liability audit for 2005Dokument2 SeitenGinebra Corporation liability audit for 2005jhobs100% (1)

- Ap Prob 3Dokument2 SeitenAp Prob 3jhobsNoch keine Bewertungen

- Ap Prob 8Dokument2 SeitenAp Prob 8jhobsNoch keine Bewertungen

- AP2 Quiz1 02112017Dokument3 SeitenAP2 Quiz1 02112017PatOcampoNoch keine Bewertungen

- Ap Prob 7Dokument3 SeitenAp Prob 7jhobsNoch keine Bewertungen

- Pistons Company adjusting entriesDokument2 SeitenPistons Company adjusting entriesjhobsNoch keine Bewertungen

- White Corporation Depreciation CalculationsDokument8 SeitenWhite Corporation Depreciation CalculationsAlbert Macapagal100% (2)

- AP 5902 LiabilitiesDokument11 SeitenAP 5902 LiabilitiesAnonymous Cd5GS3GM100% (1)

- PDFDokument28 SeitenPDFVinluan JeromeNoch keine Bewertungen

- Auditing Problem 3Dokument1 SeiteAuditing Problem 3jhobsNoch keine Bewertungen

- Convertible Bonds Problem No. 6 SEODokument2 SeitenConvertible Bonds Problem No. 6 SEOjhobsNoch keine Bewertungen

- Problem 5: Solution and ExplanationDokument3 SeitenProblem 5: Solution and ExplanationjhobsNoch keine Bewertungen

- Solution - Shareholders' EquityDokument14 SeitenSolution - Shareholders' EquityjhobsNoch keine Bewertungen

- Solutions - LiabilitiesDokument10 SeitenSolutions - LiabilitiesjhobsNoch keine Bewertungen

- Auditing Problem 2Dokument1 SeiteAuditing Problem 2jhobs100% (1)

- Auditing Problem 1Dokument1 SeiteAuditing Problem 1jhobsNoch keine Bewertungen

- Solution - IntangiblesDokument9 SeitenSolution - IntangiblesjhobsNoch keine Bewertungen

- Auditing Problem 4Dokument4 SeitenAuditing Problem 4jhobsNoch keine Bewertungen

- Theory QuestionsDokument5 SeitenTheory Questionsjhobs100% (1)

- Calculating Intangible Asset Values and ImpairmentDokument4 SeitenCalculating Intangible Asset Values and Impairmentjhobs100% (2)

- Auditing Problem 2Dokument1 SeiteAuditing Problem 2jhobs100% (1)

- Audit problems and solutionsDokument13 SeitenAudit problems and solutionsjhobsNoch keine Bewertungen

- The Trading Game InstructionsDokument12 SeitenThe Trading Game InstructionsJoeWaller0% (1)

- Cost Marathon NotesDokument85 SeitenCost Marathon NotessantoshNoch keine Bewertungen

- Exercise 1 Key PDF Cost of Goods Sold InvenDokument1 SeiteExercise 1 Key PDF Cost of Goods Sold InvenAl BertNoch keine Bewertungen

- A Perpetual System ToDokument16 SeitenA Perpetual System ToCharmine de la CruzNoch keine Bewertungen

- Advanced Financial Accounting 10th Edition Christensen Solutions Manual DownloadDokument50 SeitenAdvanced Financial Accounting 10th Edition Christensen Solutions Manual DownloadCecil Lombardo100% (17)

- MSQ-03 - Standard Costs and Variance AnalysisDokument13 SeitenMSQ-03 - Standard Costs and Variance AnalysisJenica SaludesNoch keine Bewertungen

- Module 1 Relevant CostingDokument6 SeitenModule 1 Relevant CostingJohn Rey Bantay RodriguezNoch keine Bewertungen

- Variable and Absorption Costing ReviewDokument6 SeitenVariable and Absorption Costing ReviewRj ArevadoNoch keine Bewertungen

- Standard Costing and The Balance ScorecardDokument76 SeitenStandard Costing and The Balance ScorecardSaifurKomolNoch keine Bewertungen

- Chapter 10Dokument5 SeitenChapter 10Ailene QuintoNoch keine Bewertungen

- Unit 7: Joint and By-Product Costing SystemDokument8 SeitenUnit 7: Joint and By-Product Costing SystemCielo PulmaNoch keine Bewertungen

- Income StatementDokument13 SeitenIncome StatementElleighn SaezNoch keine Bewertungen

- Comparing Merchandising and Manufakturing CompanyDokument3 SeitenComparing Merchandising and Manufakturing CompanyHermanNoch keine Bewertungen

- (Chp10-12) Pas 2 - Inventory, Inventory Valuation and Inventory EstimationDokument10 Seiten(Chp10-12) Pas 2 - Inventory, Inventory Valuation and Inventory Estimationbigbaek0% (3)

- A5 Activity 2 Capital Maintenance and Transaction Approach StudentsDokument17 SeitenA5 Activity 2 Capital Maintenance and Transaction Approach StudentsJOY MARIE RONATONoch keine Bewertungen

- Income Statement GuideDokument14 SeitenIncome Statement GuideReymark TalaveraNoch keine Bewertungen

- Attempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting PeriodDokument18 SeitenAttempt-1: The Company's Accountant Used A Denominator of Budgeted Machine Hours For The Current Accounting Periodpragadeeshwaran100% (2)

- Microsoft Office Excel: Exercise 1Dokument39 SeitenMicrosoft Office Excel: Exercise 1sunil khandelwalNoch keine Bewertungen

- Accounting Assessment Report - Hup Seng Berhad & Hwa Tai IndustriesDokument16 SeitenAccounting Assessment Report - Hup Seng Berhad & Hwa Tai IndustriesYoga ManiNoch keine Bewertungen

- Worksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Dokument7 SeitenWorksheet On Cost Analysis: Wollo University, Kombolcha Institute of Technology Plant Design and Economics (Cheg5193)Dinku Mamo100% (1)

- Cost Bookkeeping With AnswersDokument9 SeitenCost Bookkeeping With AnswersHafsa HayatNoch keine Bewertungen

- Daftar Akun PT Niko ElektronikDokument4 SeitenDaftar Akun PT Niko ElektronikYulitaNoch keine Bewertungen

- Midterm Mock Exam - SolutionsDokument12 SeitenMidterm Mock Exam - SolutionsNaisar ShahNoch keine Bewertungen

- Management Accounting (Hansen Mowen) CH02Dokument28 SeitenManagement Accounting (Hansen Mowen) CH02AvenGer100% (2)

- Answer Key Chapter 8 QuizDokument2 SeitenAnswer Key Chapter 8 QuizWesNoch keine Bewertungen