Beruflich Dokumente

Kultur Dokumente

Chapter 3 Review Quiz Solutions

Hochgeladen von

A. ZOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 3 Review Quiz Solutions

Hochgeladen von

A. ZCopyright:

Verfügbare Formate

Chapter 3 Investments and loans review quiz solutions

Question Solution

FV = PV (1+ r) n

= $18,000(1+ 0.049)5

1 = $22,863.88074...

» $22,863.88

Future value is $22 863.88

Lily I = Prn

= $50,000 ´ 0.03 ´ 4

= $6,000

Ryan A = P(1+ r)

n

0.03 4´12

= $50,000(1+ )

12

2

= $56,366.40105...

» $56,366.40

I = A- P

= $56,366 - $50,000

= $6,366

Ryan has earned an extra $366.

12

æ 0.08 ö

A = $1600 ´ ç 1+ ÷ I = $2029.19 - $1600

3 è 4 ø

= $429.19

= $2029.19

A = P(1+ r) n

= $3500(1+ 0.065)4

4a = $4502.632227...

= $4502.63

Blake has $4502.63 after 4 years.

I A P

4502.63 3500

4b

$1002.63

Blake earns $1002.63 in interest.

A = P(1+ r) n

1

æ 0.039 ö

= $35,000 ´ ç 1+

5a è 2 ÷ø

= $35,682.50

Balance after 6 months is $35,682.50

© G K Powers 2018 Published by Cambridge University Press 1

Chapter 3 Investments and loans review quiz solutions

A = P(1+ r) n

20

æ 0.039 ö

= $35,000 ´ ç 1+ » $51,500.642

è 2 ÷ø

5b

I = A- P

= $51,500.64 - $35,000 = $16,500.64

Interest earned after 10 years is $16,500.64.

FV = PV (1+ r) n

1.5´12

æ 0.048 ö

= $12,000 ´ ç 1+ ÷

6 è 12 ø

= $12,894.01219...

» $12,894

2018 to 2029 is 11 years

FV = PV (1+ r) n

= $695 ´ (1+ 0.08)11

7

= 1620.489103...

» $1620

Future value is $1620

Current value = 3000 ´ $2.25

8a

= $6,750

Annual dividend

Dividend yield = ´ 100%

Market price

$0.07

8b = ´ 100%

$2.25

= 3.111111... » 3%

Dividend yield is 3%

Dividend 1500 $0.24

9a $360

Daniel receives a dividend of $360.

0.24

Dividend yield = ´100%

1.80

9b

= 13.3333...% » 13.3%

Dividend yield is 13.3 %

S = V0 (1- r) n

= $35,000 ´ (1- 0.15) 4

10 = $18,270.21875

» $18,270.22

Salvage value of the ute is $18,270.22.

© G K Powers 2018 Published by Cambridge University Press 2

Chapter 3 Investments and loans review quiz solutions

S = V0 (1- r) n

= $83,700 ´ (1- 0.16)4

= $41,671.83

11 Depreciation = S - V0

= $83,700 - $41,671.83

= $42,028.17

Depreciation is $42 028.17

S = V0 (1- r) n

= $19,990(1- 0.18)3

12 = $11,021.84632...

» $11,022

Salvage value is $11 022

S = V0 (1- r) n

13

= $6200 ´ (1- 0.18)4

= $2803.15... » $2803

Salvage value is $2803

A = P(1+ r) n

24

æ 0.06 ö

= $4800 ç 1+

è 12 ÷ø

14

» $5410.37

Instalments = $5410.37 ¸ 24

» $225.43

Total paid = $485.38×36

15a = $17 473.68

Thomas is required to pay back $17 473.68

Total Interest = $17,473.68 - $14,000

= $3,473.68

$3473.68 ¸ 3

15b Interest rate = ´100

$14,000

= 8.2706666... » 8.27%

Flat rate of interest is 8.27%

Total paid = $2150×26×7

16a = $391 300

Levi is required to pay $391 300 for the loan.

© G K Powers 2018 Published by Cambridge University Press 3

Chapter 3 Investments and loans review quiz solutions

Interest = $391 300 − $246 000

16b = $145 300

Interest paid is $145 300

15.7%

Daily Interest Rate =

365

17a

= 0.04301369863...

» 0.0430%

Interest = $1240 ´ 0.0430% ´12 (12 days)

= $6.400438356... » $6.40

17b Total Paid = $1240 + $6.40

= $1246.40

Total amount paid is $1246.40

𝐹𝑉 = 𝑃(1 + 𝑟)𝑛

0.194 30

= $7895× (1 + )

18 365

= $8021.8624. . .

≈ $8021.86

Jayden owes $8021.86

𝐹𝑉 = 𝑃𝑉(1 + 𝑟)𝑛

0.07 15

= $4300× (1 + )

100

= $4345.3719. . .

19 ≈ $4345.37

𝐼 =𝐴−𝑃

= $4345.37 − $4300

= $45.37

Interest charged is $45.37

Costs = $37 + (12×$1.48) + (1×$14)

20 = $68.76

Zoe’s banking costs are $68.76

© G K Powers 2018 Published by Cambridge University Press 4

Das könnte Ihnen auch gefallen

- Chapter 4 Non-Right-Angled Trigonometry Review Quiz SolutionsDokument2 SeitenChapter 4 Non-Right-Angled Trigonometry Review Quiz SolutionsA. ZNoch keine Bewertungen

- Your College Budget AssignmentDokument8 SeitenYour College Budget Assignmentlatorrem6457100% (1)

- Physics - Annotated Exemplars Level 3 AS90774Dokument8 SeitenPhysics - Annotated Exemplars Level 3 AS90774Niharika MadaNoch keine Bewertungen

- Lab 06 - Homework - Conceptual Model For VoltageDokument4 SeitenLab 06 - Homework - Conceptual Model For VoltageYashvi SrivastavaNoch keine Bewertungen

- MTH 4130 Final ProjectDokument14 SeitenMTH 4130 Final ProjectJoseph RojasNoch keine Bewertungen

- Uli-Final Report Savannah Civic CTR RedevelopmentDokument43 SeitenUli-Final Report Savannah Civic CTR RedevelopmentWanda PeedeeNoch keine Bewertungen

- Chapter 2 ExercisesDokument8 SeitenChapter 2 ExercisesChoco PieNoch keine Bewertungen

- AEO - LBO Scenario #1a, Case 1 OverviewDokument4 SeitenAEO - LBO Scenario #1a, Case 1 Overviewmilken466Noch keine Bewertungen

- Adobe Font Folio: The Complete Type Solution For Design ProfessionalsDokument2 SeitenAdobe Font Folio: The Complete Type Solution For Design ProfessionalsJulio SanchezNoch keine Bewertungen

- Sim VentureDokument4 SeitenSim VenturejorjNoch keine Bewertungen

- (Guide) How To Change Your Battletag To Use The Asian/Korean Font and Look Super Cool! (PC Only)Dokument10 Seiten(Guide) How To Change Your Battletag To Use The Asian/Korean Font and Look Super Cool! (PC Only)Saverio SigurðrNoch keine Bewertungen

- Catalogo Trinity 2017Dokument24 SeitenCatalogo Trinity 2017Carlos Flores Gonzalez100% (1)

- Boundaries Between Staff, Volunteers & ClientsDokument4 SeitenBoundaries Between Staff, Volunteers & ClientsBree GrantNoch keine Bewertungen

- JeromeWorswick9e SSM CH04Dokument14 SeitenJeromeWorswick9e SSM CH04ivonneNoch keine Bewertungen

- Fin mgt-st-02 AssignmentDokument6 SeitenFin mgt-st-02 AssignmentSyed Sadaf AlamNoch keine Bewertungen

- Solution Manual For Cfin 6th by BesleyDokument12 SeitenSolution Manual For Cfin 6th by BesleyAmandaHarrissftia100% (90)

- Chapter 02 - How To Calculate Present ValuesDokument14 SeitenChapter 02 - How To Calculate Present Valuesdev4c-1Noch keine Bewertungen

- EE - Assignment Chapter 9-10 SolutionDokument11 SeitenEE - Assignment Chapter 9-10 SolutionXuân ThànhNoch keine Bewertungen

- Economics: Ordinary and Exact Simple InterestDokument5 SeitenEconomics: Ordinary and Exact Simple InterestLoiza Joi MulanoNoch keine Bewertungen

- Answer Keys - Time Value of MoneyDokument22 SeitenAnswer Keys - Time Value of MoneyrhlvajpayeeNoch keine Bewertungen

- CH - 05 SolutionDokument10 SeitenCH - 05 SolutionSaifur R. SabbirNoch keine Bewertungen

- Chapter 9 SolutionsDokument16 SeitenChapter 9 SolutionsIsah Ma. Zenaida Felisilda50% (2)

- 2019T2 FINS1613 Tutorial 03 FinMathII PDFDokument117 Seiten2019T2 FINS1613 Tutorial 03 FinMathII PDFBass MagicNoch keine Bewertungen

- Financial Management Assignment 2Dokument6 SeitenFinancial Management Assignment 2Sayaf ArbabNoch keine Bewertungen

- ASSIGNMENT 5 - Depreciation and Income TaxesDokument6 SeitenASSIGNMENT 5 - Depreciation and Income TaxesKhánh Đoan Lê ĐìnhNoch keine Bewertungen

- Syllabus Design For Reliability Engineering MECH 5740-061Dokument38 SeitenSyllabus Design For Reliability Engineering MECH 5740-061Brett MolhanNoch keine Bewertungen

- Unit 2 Time and Money DDokument5 SeitenUnit 2 Time and Money DCarmelo Janiza LavareyNoch keine Bewertungen

- Ass 3 Answer Key01Dokument2 SeitenAss 3 Answer Key01JAN ERWIN LACUESTANoch keine Bewertungen

- Jakia, Finance MathsDokument13 SeitenJakia, Finance MathsangelNoch keine Bewertungen

- Finance Chapter 5Dokument4 SeitenFinance Chapter 5ij017Noch keine Bewertungen

- Tla 9. Basic of Capital BudgetingDokument4 SeitenTla 9. Basic of Capital BudgetingNINIO B. MANIALAGNoch keine Bewertungen

- D E+ D X RD+ E D+ E X : Return Richard ExpectDokument5 SeitenD E+ D X RD+ E D+ E X : Return Richard ExpectSu Suan TanNoch keine Bewertungen

- 4 61 60603 MQGM Prel SM 3E 08Dokument11 Seiten4 61 60603 MQGM Prel SM 3E 08Zacariah SaadiehNoch keine Bewertungen

- Time Value of Money III - SolutionsDokument3 SeitenTime Value of Money III - SolutionsraymondNoch keine Bewertungen

- Homework 3 - StudentDokument6 SeitenHomework 3 - StudentMarket FarmersNoch keine Bewertungen

- Chapter 10 Bank DiscountDokument4 SeitenChapter 10 Bank DiscountYAHIA ADELNoch keine Bewertungen

- Chapter 2 PQ FMDokument5 SeitenChapter 2 PQ FMRohan SharmaNoch keine Bewertungen

- Ch6è Ç Ä È È È É¡ Ç ®Dokument7 SeitenCh6è Ç Ä È È È É¡ Ç ®fgknpqvfzcNoch keine Bewertungen

- Business Math - Chapter 1 Questions and SolutionsDokument3 SeitenBusiness Math - Chapter 1 Questions and Solutionsgrace paragasNoch keine Bewertungen

- Glasanay BF Q3W5Dokument3 SeitenGlasanay BF Q3W5Whyljyne Mary GlasanayNoch keine Bewertungen

- ACE 19HY09MAT SolnDokument5 SeitenACE 19HY09MAT SolnXianggui SuNoch keine Bewertungen

- Interest Formulas: Single PaymentsDokument38 SeitenInterest Formulas: Single PaymentsMark DimaunahanNoch keine Bewertungen

- PaybackDokument3 SeitenPaybackMd. Masudur Rahman MasumNoch keine Bewertungen

- Tugas Af Chapter 13Dokument5 SeitenTugas Af Chapter 13Nana NurhayatiNoch keine Bewertungen

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Dokument6 SeitenGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90salsabilla rpNoch keine Bewertungen

- Tugas GSLC Corp Finance Session 16Dokument6 SeitenTugas GSLC Corp Finance Session 16Javier Noel ClaudioNoch keine Bewertungen

- GSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Dokument6 SeitenGSLC Session 16: Javier Noel Claudio 2301949040 Accounting Technology Corporate Financial Management LB90Javier Noel ClaudioNoch keine Bewertungen

- CFIN 5th Edition Besley Solutions Manual DownloadDokument11 SeitenCFIN 5th Edition Besley Solutions Manual DownloadElizabeth Mcmullen100% (26)

- General MathematicsDokument23 SeitenGeneral MathematicsKLINTH JERALD PINLACNoch keine Bewertungen

- Fitzgeraldhyne Rappan - A031221038Dokument2 SeitenFitzgeraldhyne Rappan - A031221038Fitzgeraldhyne RappanNoch keine Bewertungen

- Topic 4 (FUTURE VALUE & PRESENT VALUE OF ANNUITY)Dokument4 SeitenTopic 4 (FUTURE VALUE & PRESENT VALUE OF ANNUITY)Sharmin Reula100% (2)

- 7 - Dec 13-20 - GM - Q2 - WEEK5 - Finding The Future Value and Present Value of Both Simple Annuities and General AnnuitiesDokument8 Seiten7 - Dec 13-20 - GM - Q2 - WEEK5 - Finding The Future Value and Present Value of Both Simple Annuities and General Annuitiesraymond galagNoch keine Bewertungen

- Final Exam Practice Papers SolutionsDokument31 SeitenFinal Exam Practice Papers Solutionssamuel ngNoch keine Bewertungen

- Mock Test SolutionsDokument11 SeitenMock Test SolutionsMyraNoch keine Bewertungen

- Solutions On Capital Budgeting AssignmentsDokument3 SeitenSolutions On Capital Budgeting AssignmentsjakezzionNoch keine Bewertungen

- MATH 109 Amortization: The Monthly PaymentDokument8 SeitenMATH 109 Amortization: The Monthly PaymentEarl Jan TampusNoch keine Bewertungen

- Kelompok Ii Tugas Kelompok Manajemen Keuangan Lanjutan No. P9-4Dokument9 SeitenKelompok Ii Tugas Kelompok Manajemen Keuangan Lanjutan No. P9-4RoyNoch keine Bewertungen

- Solutions To Problems: LG 1 BasicDokument13 SeitenSolutions To Problems: LG 1 BasicMuwadat Hussain67% (3)

- Group Activity 1 Group 2 Quarter2Dokument5 SeitenGroup Activity 1 Group 2 Quarter2Keith Justine AbabaoNoch keine Bewertungen

- According To Question,: Principal Borrowed ×R $ 100,000 × 0.09Dokument5 SeitenAccording To Question,: Principal Borrowed ×R $ 100,000 × 0.09NiharikaNoch keine Bewertungen

- 2021 Year 10 Assessment Task 3 Assessment NotificationDokument6 Seiten2021 Year 10 Assessment Task 3 Assessment NotificationA. ZNoch keine Bewertungen

- Year 11 Standard Task 1 NotificationDokument5 SeitenYear 11 Standard Task 1 NotificationA. ZNoch keine Bewertungen

- 2020 10MA 54 Assessment Notice Task 2Dokument6 Seiten2020 10MA 54 Assessment Notice Task 2A. ZNoch keine Bewertungen

- Assessment Task Notice - 2020 10 5.2 - 5.3 - 5.4 Term 2 Task 3Dokument6 SeitenAssessment Task Notice - 2020 10 5.2 - 5.3 - 5.4 Term 2 Task 3A. ZNoch keine Bewertungen

- 2021 10SC Task 4 NotificationDokument4 Seiten2021 10SC Task 4 NotificationA. ZNoch keine Bewertungen

- 2020 9SC Task 2 Major Project NotificationDokument8 Seiten2020 9SC Task 2 Major Project NotificationA. ZNoch keine Bewertungen

- 2020 9SC Task 3 NotificationDokument2 Seiten2020 9SC Task 3 NotificationA. ZNoch keine Bewertungen

- Information Report Plan: Title: Hints DraftDokument2 SeitenInformation Report Plan: Title: Hints DraftA. ZNoch keine Bewertungen

- 2020 9SC Task 4 NotificationDokument6 Seiten2020 9SC Task 4 NotificationA. ZNoch keine Bewertungen

- Food Chain and Food Web PDFDokument6 SeitenFood Chain and Food Web PDFA. ZNoch keine Bewertungen

- Circulatory System ActivityDokument2 SeitenCirculatory System ActivityA. ZNoch keine Bewertungen

- Extension Activity - TidesDokument1 SeiteExtension Activity - TidesA. ZNoch keine Bewertungen

- Chemical ObservationsDokument3 SeitenChemical ObservationsA. ZNoch keine Bewertungen

- Cell Organelle RiddlesDokument2 SeitenCell Organelle RiddlesA. ZNoch keine Bewertungen

- Plant System and Activity SheetDokument4 SeitenPlant System and Activity SheetA. ZNoch keine Bewertungen

- What Is Solar EnergyDokument1 SeiteWhat Is Solar EnergyA. ZNoch keine Bewertungen

- YR 7 Classification PBL RubricDokument4 SeitenYR 7 Classification PBL RubricA. ZNoch keine Bewertungen

- Year 7 Group Contract PBLDokument2 SeitenYear 7 Group Contract PBLA. ZNoch keine Bewertungen

- Benchmark 2 COMMUNICATIONclassification - Yr7Dokument1 SeiteBenchmark 2 COMMUNICATIONclassification - Yr7A. ZNoch keine Bewertungen

- Project Calendar - ClassificationDokument2 SeitenProject Calendar - ClassificationA. ZNoch keine Bewertungen

- Section 9F - Further Applications of Normal Distributions - 3 New Level 3 QuestionsDokument2 SeitenSection 9F - Further Applications of Normal Distributions - 3 New Level 3 QuestionsA. ZNoch keine Bewertungen

- Section 10E: Float Times and The Critical Path - 3 New Level 3 QuestionsDokument5 SeitenSection 10E: Float Times and The Critical Path - 3 New Level 3 QuestionsA. ZNoch keine Bewertungen

- Benchmark 3 CHARACTERISTICS OF VERTEBRATE CLASSES - Yr7Dokument1 SeiteBenchmark 3 CHARACTERISTICS OF VERTEBRATE CLASSES - Yr7A. ZNoch keine Bewertungen

- Entrance Event - ClassificationDokument2 SeitenEntrance Event - ClassificationA. ZNoch keine Bewertungen

- Benchmark 4 Classification LEVELS - Yr7Dokument3 SeitenBenchmark 4 Classification LEVELS - Yr7A. ZNoch keine Bewertungen

- Section 9E: Using Z-Scores To Compare Data - 4 New Level 3 QuestionsDokument2 SeitenSection 9E: Using Z-Scores To Compare Data - 4 New Level 3 QuestionsA. ZNoch keine Bewertungen

- Section 9D: Converting Z-Scores Into Actual Scores - 3 New Level 3 QuestionsDokument2 SeitenSection 9D: Converting Z-Scores Into Actual Scores - 3 New Level 3 QuestionsA. ZNoch keine Bewertungen

- Dhirubhai AmbaniDokument73 SeitenDhirubhai AmbaniVireksh PatelNoch keine Bewertungen

- Presentation Cost Function 1565423228 364760Dokument70 SeitenPresentation Cost Function 1565423228 364760udbhavana gjuNoch keine Bewertungen

- Birdflu 666Dokument934 SeitenBirdflu 666sligomcNoch keine Bewertungen

- Monetary Policy Guidelines For 2020 - 2022: MoscowDokument135 SeitenMonetary Policy Guidelines For 2020 - 2022: MoscowMary Femina KSNoch keine Bewertungen

- Hot Strip Mill Descale Nozzle UpgradeDokument8 SeitenHot Strip Mill Descale Nozzle UpgradeRakhee SinhaNoch keine Bewertungen

- Engg Eco Unit 2 D&SDokument129 SeitenEngg Eco Unit 2 D&SSindhu PNoch keine Bewertungen

- Moi Quiz With AnswersDokument6 SeitenMoi Quiz With AnswersLorraine TioNoch keine Bewertungen

- International Airport Part 1Dokument9 SeitenInternational Airport Part 1Raynier LigayaNoch keine Bewertungen

- I.s.en1010 1 2004+a1 2010Dokument9 SeitenI.s.en1010 1 2004+a1 2010uziNoch keine Bewertungen

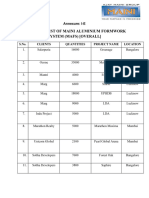

- Customer List of Maini Aluminium Formwork System - MafsDokument6 SeitenCustomer List of Maini Aluminium Formwork System - MafsgurushankarNoch keine Bewertungen

- Decorative Surfacing Products FSDokument85 SeitenDecorative Surfacing Products FSnnauthooNoch keine Bewertungen

- MICHEL BOUX, Ingénieur 4748 TomifobiaDokument2 SeitenMICHEL BOUX, Ingénieur 4748 Tomifobiaram sharanNoch keine Bewertungen

- Analysis of Export Market Structure For Acacia Wooden Furniture in VietnamDokument15 SeitenAnalysis of Export Market Structure For Acacia Wooden Furniture in Vietnamfeby febriantiNoch keine Bewertungen

- Wage Account November 2020M HN-1Dokument12 SeitenWage Account November 2020M HN-1Pavel ViktorNoch keine Bewertungen

- Loan Agreement TemplateDokument3 SeitenLoan Agreement TemplateGene AdionNoch keine Bewertungen

- PaymentReceipt 13522099Dokument1 SeitePaymentReceipt 13522099BhupenderNoch keine Bewertungen

- Project Report On Idbi BankDokument45 SeitenProject Report On Idbi BankShivkant SinghNoch keine Bewertungen

- Invoice 22639854990Dokument2 SeitenInvoice 22639854990Madhu SudhanNoch keine Bewertungen

- Analisis Laporan Keuangan SyariahDokument18 SeitenAnalisis Laporan Keuangan SyariahVia ManiezNoch keine Bewertungen

- FA2 CaseDokument3 SeitenFA2 CaseHamza Farooq KoraiNoch keine Bewertungen

- Solved For Each Player in The Following Games Find The DominantDokument1 SeiteSolved For Each Player in The Following Games Find The DominantM Bilal SaleemNoch keine Bewertungen

- Assignment 1: Dnyansagar Institute of Management & Research MBA-I/SEM-I/ASSIGNMENT (2016-17)Dokument1 SeiteAssignment 1: Dnyansagar Institute of Management & Research MBA-I/SEM-I/ASSIGNMENT (2016-17)ISLAMICLECTURESNoch keine Bewertungen

- Chương 4 EngDokument61 SeitenChương 4 EngVĩnh Tân TrầnNoch keine Bewertungen

- Test Bank For Macroeconomics Policy and Practice 2nd Edition Frederic S MishkinDokument25 SeitenTest Bank For Macroeconomics Policy and Practice 2nd Edition Frederic S MishkinSuzanne Washington100% (7)

- Charles Munger - Psychology Human MisjudgmentDokument21 SeitenCharles Munger - Psychology Human MisjudgmentEmily HunterNoch keine Bewertungen

- Gen. Math - 11 - Q2 - WK2Dokument8 SeitenGen. Math - 11 - Q2 - WK2Jehl T Duran50% (2)

- Viability of Coffee Farming As A Business: Lucy MuriithiDokument11 SeitenViability of Coffee Farming As A Business: Lucy MuriithiTrey NgugiNoch keine Bewertungen

- Diffusion Aceleration and Business Cycle Hickman 1959Dokument32 SeitenDiffusion Aceleration and Business Cycle Hickman 1959Eugenio MartinezNoch keine Bewertungen

- Brochure (Khadi Board) (10-2022) Green ColDokument4 SeitenBrochure (Khadi Board) (10-2022) Green ColRavindra SharmaNoch keine Bewertungen

- Chapter 1 Solutions PDFDokument11 SeitenChapter 1 Solutions PDFManas220398Noch keine Bewertungen