Beruflich Dokumente

Kultur Dokumente

ACC Q3CY10 Result Update

Hochgeladen von

Anshul RawatOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

ACC Q3CY10 Result Update

Hochgeladen von

Anshul RawatCopyright:

Verfügbare Formate

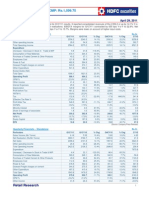

ACC

Result Update

Expect worst to be over- upgrade to ACCUMULATE

October 21, 2010

¾ APAT at Rs0.9bn (-79.3%yoy) sharply below estimates led by

Reco Previous Reco

lower realizations. Revenue decline of 16.9% yoy - volumes

Accumulate Hold

decline 3.6%yoy, realizations down 13.8%

CMP Target Price

Rs983 Rs1,035 ¾ Costs increases drag EBITDA to Rs 1.69bn by 74.6%yoy. RM

EPS change FY11E/12E (%) 8.0/5.9 cost/t up 16%yoy due to outside clinker purchases & increase

Target Price change (%) 18.3 in fly ash prices. EBITDA/t at Rs3512 (-73.6%yoy)

Nifty 6101

¾ Downgrade our earnings by 8% for CY10 & 5.9% for CY11.

Sensex 20261

With recent cement prices hikes and pick up in volumes, we

Price Performance expect the worst phase of profitability to be over for ACC

(%) 1M 3M 6M 12M

Absolute (5) 20 4 24 ¾ We upgrade our target price to Rs1050 by upgrading our

Rel. to Nifty (5) 7 (9) 6 valuation to EV/ton of USD 130 (earlier USD110/ton) and

Source: Bloomberg rolling over to CY11 nos. Upgrade to ACCUMULATE

Relative Price Chart Revenue decline of 16.9% yoy- realizations down 13.8%

1050 Rs % 30

980 22

Q3CY11 revenues at Rs16.37bn have declined by 16.9% yoy led by 3.6% yoy decline in

volumes (4.83 mt) and 13.8% yoy decline in realisations (Rs3390/t). Volumes declined

910 14

mainly due to a) Wadi II kiln shutdown for major part of Q3 for expansion hook-up b)

840 6

Chanda operations suffering monsoon & floods & c) North operations getting affected

770 -2 on account of flood & fly ash availability constraints.

700 -10

Oct-09 Dec-09 Feb-10 Mar-10 May-10 Jul-10 Aug-10

ACC (LHS) Rel to Nifty (RHS)

Increasing costs drag EBIDTA down by 74.6%

Source: Bloomberg Due to decline in realizations & significant increase in costs ACC’s EBIDTA at Rs 1.7bn

(our estimates Rs3.3 bn) fell sharply by 74.6%yoy and 69.3%qoq. RM costs at Rs516/t

Stock Details increased 16.6% yoy on account of higher purchase of clinker & increase in slag & fly

Sector Cement

ash prices. Power and fuel costs have increased by 4.3% yoy to Rs 749/t. These costs

Bloomberg ACC@IN could have been higher but lower clinker production volumes and captive power

Equity Capital (Rs mn) 1877 generation. Other expenses increased 13.8%yoy due to increase in royalty, provision for

Face Value(Rs) 10 inventory obsolescence. Total costs/t at Rs3038/t saw an increase of 16.9%yoy and

No of shares o/s (mn) 188 9.1%qoq.

52 Week H/L 1,049/686

Market Cap (Rs bn/USD mn) 182/4,101 EBIDTA/t at Rs352 down 74% yoy

Daily Avg Volume (No of sh) 501006 With sharp fall in realisation and higher costs, ACC’s EBITDA/t at Rs352 declined by

Daily Avg Turnover (US$mn) 10.5 73.6% yoy and 66.5% qoq with EBITDA margins contracting by 2354bps yoy to 10.4%.

These levels of profitability were last seen in CY2005 with EBIDTA/t of Rs368. However

Shareholding Pattern (%) with the recent price hikes (led by increasing producer discipline) we expect that the

J’10 M’10 D’09 worst to be behind as far as profitability is concerned.

Promoters 46.2 46.2 46.2

FII/NRI 15.4 13.2 13.0 Net profit at Rs0.9bn down 77% yoy

Institutions 18.1 20.1 19.8 Interest expenses for Q3CY10 increased by 19.3%yoy, while depreciation charges

Private Corp 4.8 4.7 5.0 increased 14.4%yoy taking ACC’s pre-exceptional net profit to Rs0.9bn, decline of

Public 15.4 15.9 16.0 79.3% yoy and 75%qoq. Reported profits at Rs1 bn include Rs100 mn as profit on sale

of business (Air pollution control activity)

Source: Capitaline

Consolidated Financial Snapshot Rs Mn

EPS EV/

(Rs mn) Net EBIDTA PAT EPS ROE PE EV/

Ajit Motwani growth Tonne

ajit.motwani@emkayglobal.com Y/E Dec) sales (Rs m) (%) (Rs m) (Rs) (%) (%) (x) EBIDTA (USD)

+91 22 6612 1255 CY08 72,829 17,332 23.8 11,639 64.6 -15.7 25.6 15.9 10.5 168.0

CY09 80,272 24,797 30.9 16,067 85.5 32.4 29.4 12.0 7.3 146.0

Chandan Asrani

CY10E 77,788 18,289 23.5 11,493 61.2 -28.5 18.0 16.8 9.8 123.4

chandan.asrani@emkayglobal.com

CY11E 86,424 21,527 24.9 13,386 71.2 16.5 18.7 14.4 7.7 113.8

+91 22 6612 1241

Emkay Global Financial Services Ltd 1

ACC Result Update

Result Table

Rs mn Q3CY09 Q4CY09 Q1CY10 Q2CY10 Q3CY10 YoY (%) QoQ (%) YTD CY10 YTD CY09 YoY (%)

Revenue 19,694 19,215 21,018 20,207 16,372 -16.9 -19.0 57,597 61,057 -5.7

Expenditure 13,015 14,315 14,796 14,677 14,673 12.7 0.0 44,146 40,561 8.8

as % of sales 66.1 74.5 70.4 72.6 89.6 76.6 66.4

Consumption of RM 2,219 2,354 2,481 2,829 2,493 12.4 -11.9 7,803 6,561 18.9

as % of sales 11.3 12.3 11.8 14.0 15.2 13.5 10.7

Stocks -347.9 -425.0 320.9 -483.3 560.6 -261.2 -216.0 398 138 189.4

as % of sales (1.8) (2.2) 1.5 (2.4) 3.4 0.7 0.2

Employee Cost 998 917 896 1063 1174 17.7 10.4 3,133 2,760 13.5

as % of sales 5.1 4.8 4.3 5.3 7.2 5.4 4.5

Power & Fuel 3,595 3,950 3,926 3,934 3,615 0.6 -8.1 11,474 11,447 0.2

as % of sales 18.3 20.6 18.7 19.5 22.1 19.9 18.7

Cost of traded cement 212 219 266 296 258 21.4 -12.8 819 712 15.0

as % of sales 1.1 1.1 1.3 1.5 1.6 1.4 1.2

Freight 2,548 2,672 2,753 2,700 2,255 -11.5 -16.5 7,708 7,872 -2.1

as % of sales 12.9 13.9 13.1 13.4 13.8 13.4 12.9

Other expenditure 3791 4628 4154 4339 4316 13.8 -0.5 12,810 11,070 15.7

as % of sales 19.3 24.1 19.8 21.5 26.4 22.2 18.1

EBITDA 6,679 4,900 6,222 5,530 1,699 -74.6 -69.3 13,451 20,497 -34.4

Depreciation 796 1052 935 962 911 14.4 -5.3 2,807 2,369 18.5

EBIT 5883 3848 5287 4568 789 -86.6 -82.7 10,644 18,128 -41.3

Other Income 509 833 609 597 709 39.4 18.7 1,915 1,580 21.2

Interest 136 180 127 141 162 19.3 15.3 431 439 -2.0

PBT 6256 4502 5769 5024 1335 -78.7 -73.4 12,128 19,268 -37.1

Total Tax 1900 1092 1717 1435 435 -77.1 -69.7 3,587 5,785 -38.0

Adjusted PAT 4355 3410 4051 3589 900 -79.3 -74.9 8,541 13,484 -36.7

(Profit)/loss from

JV's/Ass/MI

PAT after MI 4355 3410 4051 3589 900 -79.3 -74.9 8,541 13,484 -36.7

Extra ordinary items - - - - - - - - 224

Reported PAT 4355 2810 4051 3589 1000 -77.0 -72.1 8,641 13,260 -34.8

Reported EPS 23.2 18.2 21.6 19.1 4.8 -79.3 -74.9 45.5 71.9 -36.7

Margins (%) (bps) (bps) (bps)

EBIDTA 33.9 25.5 29.6 27.4 10.4 -2354 -1699 23.4 33.6 -1022

EBIT 29.9 20.0 25.2 22.6 4.8 -2506 -1779 18.5 29.7 -1121

EBT 31.8 23.4 27.4 24.9 8.2 -2361 -1671 21.1 31.6 -1050

PAT 22.1 17.7 19.3 17.8 5.5 -1662 -1226 14.8 22.1 -725

Effective Tax rate 30.4 24.3 29.8 28.6 32.6 219 400 29.6 30.0 -44

Per tonne analysis

Rs/t Q3CY09 Q4CY09 Q1CY10 Q2CY10 Q3CY10 YoY (%) QoQ (%) YTD CY10 YTD CY09 YoY (%)

Cement volumes 5.01 5.36 5.58 5.27 4.83 -3.6 -8.3 15.68 16.16 -3.0

Raw Material 443 439 445 537 516 16.6 -3.8 498 406 22.6

Stocks -69 -79 58 -92 116 -267.2 -226.6 25 9 198.2

Staff cost 199 171 161 202 243 22.1 20.5 200 171 17.0

Power & Fuel 718 737 703 746 748 4.3 0.3 732 708 3.3

Cost of traded cement 42 41 48 56 53 25.9 -4.8 52 44 18.5

Freight 509 498 493 512 467 -8.2 -8.9 492 487 0.9

Other expenses 757 863 745 823 894 18.1 8.5 817 685 19.3

Total Cost Per tonne 2598 2671 2652 2785 3038 16.9 9.1 2815 2510 12.2

EBIDTA/Ton 1333 914 1115 1049 352 -73.6 -66.5 858 1268 -32.4

Realization 3931 3585 3767 3834 3390 -13.8 -11.6 3673 3778 -2.8

Variable cost 1711 1715 1689 1852 1785 4.3 -3.6 1773 1646 7.8

Fixed cost 956 1035 905 1025 1137 18.9 10.9 1017 856 18.8

Emkay Research 21 October 2010 2

ACC Result Update

Capex plans update

Wadi II plant commissioned - Chanda expansion nearing completion

The Lighting up of Wadi II kiln was completed this quarter and it will ramp up as per plan.

The major expansion project at Chanda in the state of Maharashtra, which will add 3 mtpa

cement capacity is nearing completion and will be commissioned in the next quarter. Post

the completion of this project ACC will have a capacity of 30.4 mtpa. And the 25 MW

captive power plant at Chanda was commissioned in this quarter.

Downgrade Earnings

On account of lower than expected quarterly numbers we are downgrading our earnings

estimates for ACC by 8% for CY10 (EPS of R s61.2) and 5.9% for CY11 (EPS of Rs71.2).

CY10 earnings downgraded by 8%

CY10 CY11

Earlier Revised change Earlier Revised change

Sales 81084 77788 -4.1% 90406 86424 -4.4%

EBIDTA 19660 18289 -7.0% 22660 21527 -5.0%

EBIDTA (%) 24.2 23.5 25.1 24.9

Net Profit 12488 11493 -8.0% 14233 13386.3 -5.9%

EPS 66.4 61.2 -8.0% 75.7 71.2 -5.9%

Expect worst to be over for ACC…

As mentioned earlier ACC’s Q3CY10 EBIDTA/t of Rs352/t is lowest levels of profitability

since CY2005. However we believe that the worst is over as far as profitability is concerned.

Our view is based on following factors

1. Pace of capacity addition to recede– average quarterly additions to drop 50%

over next 6 quarter

Close to 65 mt of new capacity has been added over last 6 quarter (Q1FY10-Q2FY11),

i.e. an average addition of close to 11 mt every quarter. We estimate close to 33 mt of

new capacity additions over next 6 quarter, resulting in an average addition of 5.5 mt.

These average additions over next 6 quarters are 50% lower additions done in past 6

quarter.

2. Increasing pricing discipline - Recent cement price hike to restrict downgrade

With the sector profitability reaching levels of CY05 we have seen emergence of

producers understanding and pricing discipline. This is has to cement prices being

hiked by Rs15-35/bag across various regions. With recent price taken by cement

producer across country, we estimate average cement prices have reached ~Rs235-

237/bag. Our CY11E numbers for ACC (EPS of Rs71.3) are model at Rs241/bag.

Hence with further price hike of Rs5-6/bag, led by pick up in demand and receding

capacity additions, the cement prices can touch our estimates.

3. Landed International coal prices down ~ 10% from recent peaks

International coal prices (Richard bay South Africa) are currently ruling at USD88 down

6% from recent peaks. Adjusted for appreciation in INR against USD, the price are

down 10% from recent peaks. With this and pick in volumes (leverage fixed costs) we

expect cost pressure to recede.

Emkay Research 21 October 2010 3

ACC Result Update

… upgrade to ACCUMULATE

Driven by above mentioned factors we are upgrading our recommendation on ACC from

HOLD to ACCUMULATE and target price to Rs1035 as compared to Rs875. We have

valued ACC at an EV/ton of USD 130 (USD 120erlier) and PER of 13X (as compared to

12X earlier). The increase in our TP on ACC is driven by rollover of valuation to CY11

numbers and moderate increase in valuation multiples.

Valuation at EV/EBIDTA of 7.1X and EV/ton of 109 remain reasonable

considering ~25% RoCE

At current levels the stock is trading at PER of 13.6X (11.8X ex cash of Rs1131/share in

CY10) and EV/EBIDTA of 7.1X for CY11. On EV/ton basis the stock trades USD 109 for its

CY11 capacity. We believe these valuations; though not cheap are reasonable considering

that ACC’s would still generate CY11E RoCE of ~25% (close to 1.5X cost of capital).

Emkay Research 21 October 2010 4

ACC Result Update

Financials

Income Statement Balance Sheet

Y/E, Dec (Rs. mn) CY08 CY09 CY10E CY11E Y/E, Dec (Rs. mn) CY08 CY09 CY10E CY11E

Net Sales 72,829 80,272 77,788 86,424 Equity share capital 1,879 1,879 1,879 1,879

Growth (%) 4.2 10.2 (3.1) 11.1 Reserves & surplus 47,398 58,282 65,377 74,365

Total Expenditure 55,497 55,475 59,499 64,897 Shareholders Funds 49,277 60,161 67,256 76,245

Raw Materials Cost 7,991 8,915 9,317 10,879 Minority Interest

Employee expenses 4,163 3,677 4,008 4,249 Secured Loans 4,500 5,500 5,500 2,500

Power & Fuel cost 15,990 15,397 16,240 17,317 Unsecured Loans 320 169 400 400

Freight 11,786 12,241 12,978 14,295 Loan Funds 4,820 5,669 5,900 2,900

Others 15,567 15,246 16,956 18,157 Net Deferred Taxes 3,358 3,493 3,493 3,493

EBIDTA 17,332 24,797 18,289 21,527 Total Liabilities 57,455 69,323 76,649 82,637

Growth (%) (9.7) 43.1 (26.2) 17.7

EBIDTA % 23.8 30.9 23.5 24.9 Gross Block 58,357 68,263 83,763 89,763

Depreciation 2,942 3,421 3,801 4,338 Less: Acc Depreciation 23,660 26,680 30,480 34,819

EBIT 14,390 21,376 14,489 17,189 Net block 34,697 41,583 53,282 54,944

EBIT Margin (%) 19.8 26.6 18.6 19.9 Capital WIP 16,029 21,562 14,500 9,500

Other income 2,887 2,411 2,493 2,493 Investment 6,791 14,756 14,756 14,756

Interest 400 843 564 558 Current Assets 27,596 22,945 24,996 36,539

EBT 16,877 22,944 16,418 19,123 Inventories 7,933 7,790 7,549 8,387

Tax 5,238 6,877 4,925 5,737 Sundry Debtors 3,102 2,037 1,974 2,193

Effective tax rate (%) 31.0 30.0 30.0 30.0 Cash and Bank 9,842 7,464 9,929 20,415

Adjusted PAT 11,639 16,067 11,493 13,386 Loans and Advances 6,513 5,544 5,544 5,544

Growth (%) (5.0) 38.0 (28.5) 16.5 Other current assets 206.7 109.9 0 0

Net Margin (%) 16.0 20.0 14.8 15.5 Current Liab & Prov 27,657 31,522 30,885 33,101

(Profit)/loss from JV's/Ass/MI Current liabilities 18,018 20,603 19,966 22,182

Adjusted PAT After JVs/Ass/MI 11,639 16,067 11,493 13,386 Provisions 9,639 10,919 10,919 10,919

E/O items 489 0 0 0 Net current assets -61 -8,578 (5,889) 3,438

Reported PAT 12,128 16,067 11,493 13,386 Miscellaneous Exps 0 0 0 0

Growth (%) (15.7) 32.5 (28.5) 16.5 Total Assets 57,456 69,324 76,650 82,638

Cash Flow Key Ratios

Y/E, Dec (Rs. mn) CY08 CY09 CY10E CY11E Y/E, Dec CY08 CY09 CY10E CY11E

PBT (Ex-Other income) 13,990 20,533 13,925 16,630 Profitability (%)

Depreciation 2,942 3,421 3,801 4,338 EBITDA Margin 23.8 30.9 23.5 24.9

Interest Provided 400 843 564 558 Net Margin 16.0 20.0 14.8 15.5

Other Non-Cash items ROCE 32.8 37.5 23.3 24.7

Chg in working cap -672 4,859 -224 1,159 ROE 25.6 29.4 18.0 18.7

Tax paid 5,238 6,877 4,925 5,737 RoIC 57.2 84.9 46.0 45.6

Operating Cashflow 14,398 24,347 15,070 18,884 Per Share Data (Rs)

Capital expenditure -13,253 -15,440 -8,438 -1,000 EPS 64.6 85.5 61.2 71.2

Free Cash Flow 2,803 942 6,632 17,884 CEPS 80.2 103.7 81.4 94.3

Other income 2,887 2,411 2,493 2,493 BVPS 262.3 320.1 357.9 405.7

Investments 1,657 -7,966 0 0 DPS 20.0 23.0 20.0 20.0

Investing Cashflow -11,595 -23,405 -8,438 -1,000 Valuations (x)

Equity Capital Raised 0 0 0 0 PER 15.9 12.0 16.8 14.4

Loans Taken / (Repaid) 1,756 849 231 -3,000 P/CEPS 12.8 9.9 12.6 10.9

Interest Paid -400 -843 -564 -558 P/BV 3.9 3.2 2.9 2.5

Dividend paid (incl tax) -4,391 -5,051 -4,398 -4,398 EV / Sales 2.5 2.3 2.3 1.9

Income from investments EV / EBITDA 10.5 7.3 9.8 7.7

Others Dividend Yield (%) 1.9 2.2 1.9 1.9

Financing Cashflow -2,635 -4,203 -4,167 -7,398 Gearing Ratio (x)

Net chg in cash 168 -3,261 2,465 10,486 Net Debt/ Equity -0.2 -0.3 -0.3 -0.4

Opening cash position 7,435 9,842 7,464 9,929 Net Debt/EBIDTA -0.3 -0.1 -0.2 -0.8

Closing cash position 9,842 7,464 9,929 20,415 Working Cap Cycle (days) -35.0 -49.0 -49.0 -49.0

Emkay Research 21 October 2010 5

ACC Result Update

Recommendation History: ACC – ACC IN

Date Reports Reco CMP Target

22/07/2010 ACC Q2CY10 Result Update Hold 825 875

22/04/2010 ACC Q1CY2010 Result Update Reduce 919 875

05/02/2010 ACC Q4CY2009 Result Update Accumulate 882 930

28/10/2009 ACC Q3CY2009 Result Update Buy 758 930

Recent Research Reports

Date Reports Reco CMP Target

08/09/2010 Cement Sector Update

17/08/2010 Shree Cement Q1FY11 Result Update Accumulate 1,805 2,200

03/08/2010 Madras Cement Q1FY11 Result Update Reduce 100 101

02/08/2010 India cements Q1FY11 Result Update Sell 105 98

Emkay Global Financial Services Ltd.

Paragon Center, H -13 -16, 1st Floor, Pandurang Budhkar Marg, Worli, Mumbai – 400 013. Tel No. 6612 1212. Fax: 6624 2410

DISCLAIMER: This document is not for public distribution and has been furnished to you solely for your information and may not be reproduced or redistributed to any other person. The manner

of circulation and distribution of this document may be restricted by law or regulation in certain countries, including the United States. Persons into whose possession this document may come are

required to inform themselves of, and to observe, such restrictions. This material is for the personal information of the authorized recipient, and we are not soliciting any action based upon it. This

report is not to be construed as an offer to sell or the solicitation of an offer to buy any security in any jurisdiction where such an offer or solicitation would be illegal. No person associated with Emkay

Global Financial Services Ltd. is obligated to call or initiate contact with you for the purposes of elaborating or following up on the information contained in this document. The material is based upon

information that we consider reliable, but we do not represent that it is accurate or complete, and it should not be relied upon. Neither Emkay Global Financial Services Ltd., nor any person connected

with it, accepts any liability arising from the use of this document. The recipient of this material should rely on their own investigations and take their own professional advice. Opinions expressed are

our current opinions as of the date appearing on this material only. While we endeavor to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance,

or other reasons that prevent us from doing so. Prospective investors and others are cautioned that any forward-looking statements are not predictions and may be subject to change without notice.

We and our affiliates, officers, directors, and employees world wide, including persons involved in the preparation or issuance of this material may; (a) from time to time, have long or short positions in,

and buy or sell the securities thereof, of company (ies) mentioned herein or (b) be engaged in any other transaction involving such securities and earn brokerage or other compensation or act as a

market maker in the financial instruments of the company (ies) discussed herein or may perform or seek to perform investment banking services for such company(ies)or act as advisor or lender /

borrower to such company(ies) or have other potential conflict of interest with respect to any recommendation and related information and opinions. The same persons may have acted upon the

information contained here. No part of this material may be duplicated in any form and/or redistributed without Emkay Global Financial Services Ltd.'s prior written consent. No part of this document

may be distributed in Canada or used by private customers in the United Kingdom. In so far as this report includes current or historical information, it is believed to be reliable, although its accuracy and

completeness cannot be guaranteed.

Emkay Research 21 October 2010 www.emkayglobal.com

Das könnte Ihnen auch gefallen

- Murrey Math Lessons CompleteDokument57 SeitenMurrey Math Lessons Completefred100% (2)

- CPA BEC Financial RatiosDokument24 SeitenCPA BEC Financial Ratiospambia200050% (2)

- Reviewer Mas 2Dokument56 SeitenReviewer Mas 2Maria Priencess AcostaNoch keine Bewertungen

- Common Stocks As Long-Term Investments by Edgar Lawrence Smith NotesDokument12 SeitenCommon Stocks As Long-Term Investments by Edgar Lawrence Smith NotesTheodor Tonca50% (2)

- Analysis of Financial Statement Sample Assignment SolutionDokument23 SeitenAnalysis of Financial Statement Sample Assignment SolutionNaveed Saifi100% (5)

- Results in Line - Outlook Remain Cautious: Rs 825 Rs 875 Sensex 17,977Dokument5 SeitenResults in Line - Outlook Remain Cautious: Rs 825 Rs 875 Sensex 17,977Abhishek YadavNoch keine Bewertungen

- GAIL - 3QFY23 - 31-01-2023 - SystematixDokument9 SeitenGAIL - 3QFY23 - 31-01-2023 - SystematixvakilNoch keine Bewertungen

- AK Stockmart - ACC - Oct 22, 2010Dokument4 SeitenAK Stockmart - ACC - Oct 22, 2010bharshanNoch keine Bewertungen

- Ambuja Cement (ACEM IN) : Q3CY20 Result UpdateDokument6 SeitenAmbuja Cement (ACEM IN) : Q3CY20 Result Updatenani reddyNoch keine Bewertungen

- StarCement Q3FY24ResultReview8Feb24 ResearchDokument9 SeitenStarCement Q3FY24ResultReview8Feb24 Researchvarunkul2337Noch keine Bewertungen

- ACC-Limited 44 QuarterUpdateDokument6 SeitenACC-Limited 44 QuarterUpdateRohan RustagiNoch keine Bewertungen

- Ambuja Cement: Weak Despite The BeatDokument8 SeitenAmbuja Cement: Weak Despite The BeatDinesh ChoudharyNoch keine Bewertungen

- Acc (Acc In) - Q2cy21 Result Update - PL IndiaDokument6 SeitenAcc (Acc In) - Q2cy21 Result Update - PL IndiadarshanmaldeNoch keine Bewertungen

- JKLakshmi Cem Geojit 070218Dokument5 SeitenJKLakshmi Cem Geojit 070218suprabhattNoch keine Bewertungen

- Sanghvi Movers: Compelling ValuationsDokument9 SeitenSanghvi Movers: Compelling Valuationsarun_algoNoch keine Bewertungen

- Ultratech Cement (UTCEM IN) : Q1FY21 Result UpdateDokument6 SeitenUltratech Cement (UTCEM IN) : Q1FY21 Result UpdatewhitenagarNoch keine Bewertungen

- Sembcorp Marine LTD: Expecting Tardy RecoveryDokument6 SeitenSembcorp Marine LTD: Expecting Tardy RecoveryJohn TanNoch keine Bewertungen

- GE Shipping BUY: Result UpdateDokument9 SeitenGE Shipping BUY: Result UpdateAshokNoch keine Bewertungen

- GE Shipping BUY: Result UpdateDokument9 SeitenGE Shipping BUY: Result UpdateAshokNoch keine Bewertungen

- Grasim Industries: Results Above Estimates-Maintain ACCUMULATEDokument7 SeitenGrasim Industries: Results Above Estimates-Maintain ACCUMULATEcksharma68Noch keine Bewertungen

- Ciptadana - PT. Astra Agro Lestari TBK AALI - CPO Price Rally Boosts EarningsDokument7 SeitenCiptadana - PT. Astra Agro Lestari TBK AALI - CPO Price Rally Boosts EarningsWira AnindyagunaNoch keine Bewertungen

- Untr 20190725Dokument5 SeitenUntr 20190725endjoy_adjaNoch keine Bewertungen

- Apar IndustriesDokument6 SeitenApar IndustriesMONIL BARBHAYANoch keine Bewertungen

- Ciptadana Result Update 1H23 ADRO 24 Aug 2023 Maintain Buy LowerDokument7 SeitenCiptadana Result Update 1H23 ADRO 24 Aug 2023 Maintain Buy Lowerrajaliga.inggerisNoch keine Bewertungen

- InterGlobe Aviation 2QFY20 Result Reveiw 24-10-19Dokument7 SeitenInterGlobe Aviation 2QFY20 Result Reveiw 24-10-19Khush GosraniNoch keine Bewertungen

- Research On Apollo Tyres - 14-Aug-19Dokument5 SeitenResearch On Apollo Tyres - 14-Aug-19VIGNESH RKNoch keine Bewertungen

- JSW Steel (JSTL In) : Q4FY19 Result UpdateDokument6 SeitenJSW Steel (JSTL In) : Q4FY19 Result UpdatePraveen KumarNoch keine Bewertungen

- Bluedart Q3FY24 Result UpdateDokument8 SeitenBluedart Q3FY24 Result UpdatedarshanNoch keine Bewertungen

- Weak Balance Sheet Drags Profitability: Q3FY18 Result HighlightsDokument8 SeitenWeak Balance Sheet Drags Profitability: Q3FY18 Result Highlightsrishab agarwalNoch keine Bewertungen

- Ultratech Cement Limited: Outlook Remains ChallengingDokument5 SeitenUltratech Cement Limited: Outlook Remains ChallengingamitNoch keine Bewertungen

- Ipot DSNG q321Dokument6 SeitenIpot DSNG q321jijokojawaNoch keine Bewertungen

- Sanghi Industries - 2QFY18 - HDFC Sec-201711132133302229263Dokument9 SeitenSanghi Industries - 2QFY18 - HDFC Sec-201711132133302229263Anonymous y3hYf50mTNoch keine Bewertungen

- CEAT Annual Report 2019Dokument5 SeitenCEAT Annual Report 2019Roberto GrilliNoch keine Bewertungen

- Ramco Cements: Another Solid QuarterDokument8 SeitenRamco Cements: Another Solid QuarterumaganNoch keine Bewertungen

- Proof of Pudding: Highlights of The QuarterDokument9 SeitenProof of Pudding: Highlights of The QuarterAnonymous y3hYf50mTNoch keine Bewertungen

- 9M16 Earnings Beat Estimates As Coal Mining Outperforms: Share DataDokument4 Seiten9M16 Earnings Beat Estimates As Coal Mining Outperforms: Share DataJajahinaNoch keine Bewertungen

- Dishman Q3FY10 Result UpdateDokument4 SeitenDishman Q3FY10 Result UpdateshahavNoch keine Bewertungen

- Coal India (COAL IN) : Q4FY19 Result UpdateDokument6 SeitenCoal India (COAL IN) : Q4FY19 Result Updatesaran21Noch keine Bewertungen

- Tata Steel - Q2FY23 Result Update - 02112022 - 02-11-2022 - 12Dokument9 SeitenTata Steel - Q2FY23 Result Update - 02112022 - 02-11-2022 - 12AnirudhNoch keine Bewertungen

- Motherson Sumi LTD: Market PerformerDokument4 SeitenMotherson Sumi LTD: Market PerformerAnubhav GuptaNoch keine Bewertungen

- ICICIdirect BalrampurChini Q1SY10Dokument5 SeitenICICIdirect BalrampurChini Q1SY10Sunboy FarmingNoch keine Bewertungen

- Coal India - 2QFY18 - HDFC Sec-201711132155166709214Dokument10 SeitenCoal India - 2QFY18 - HDFC Sec-201711132155166709214Anonymous y3hYf50mTNoch keine Bewertungen

- Tata Chemicals LTD: 12-Feb-2008 Pioneer Intermediaries PVT LTD - Agarwalla, AshwaniDokument32 SeitenTata Chemicals LTD: 12-Feb-2008 Pioneer Intermediaries PVT LTD - Agarwalla, Ashwaniapi-3828752Noch keine Bewertungen

- Motilal Oswal - 2QFY20 - HDFC Sec-201910251913301814908Dokument15 SeitenMotilal Oswal - 2QFY20 - HDFC Sec-201910251913301814908Ajay SinghNoch keine Bewertungen

- Voltamp Transformers 26112019Dokument5 SeitenVoltamp Transformers 26112019anjugaduNoch keine Bewertungen

- ABG+Shipyard 11-6-08 PLDokument3 SeitenABG+Shipyard 11-6-08 PLapi-3862995Noch keine Bewertungen

- Wipro Q4FY09 Result UpdateDokument4 SeitenWipro Q4FY09 Result UpdateHardikNoch keine Bewertungen

- No Quick Turnaround Seen For The San Gabriel: First Gen CorporationDokument2 SeitenNo Quick Turnaround Seen For The San Gabriel: First Gen CorporationJohn Kyle LluzNoch keine Bewertungen

- Reliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Dokument18 SeitenReliance Industries: CMP: INR1,077 TP: INR1,057 (-2%)Abhiroop DasNoch keine Bewertungen

- Cochin PDFDokument8 SeitenCochin PDFdarshanmadeNoch keine Bewertungen

- Balrampur Chini 29092010Dokument2 SeitenBalrampur Chini 29092010Prina H DoshiNoch keine Bewertungen

- Birla-Corporation-Limited 204 QuarterUpdateDokument8 SeitenBirla-Corporation-Limited 204 QuarterUpdatearif420_999Noch keine Bewertungen

- Sbkuch 1Dokument8 SeitenSbkuch 1vishalpaul31Noch keine Bewertungen

- ACC 2QCY19 Result Update - 190719 - Antique ResearchDokument6 SeitenACC 2QCY19 Result Update - 190719 - Antique ResearchdarshanmadeNoch keine Bewertungen

- Greaves +angel+ +04+01+10Dokument6 SeitenGreaves +angel+ +04+01+10samaussieNoch keine Bewertungen

- Ki Adro 20190305Dokument6 SeitenKi Adro 20190305krisyanto krisyantoNoch keine Bewertungen

- Acc LTD (Acc) CMP: Rs.1,099.75: Q1CY11 Result Update April 29, 2011Dokument4 SeitenAcc LTD (Acc) CMP: Rs.1,099.75: Q1CY11 Result Update April 29, 2011Mohammed Asif ValsangkarNoch keine Bewertungen

- Screst 100930 RN2QFY11Dokument2 SeitenScrest 100930 RN2QFY11limml63Noch keine Bewertungen

- Sterlite Industries: Worst Seems To Be Priced inDokument3 SeitenSterlite Industries: Worst Seems To Be Priced inramanathanseshaNoch keine Bewertungen

- 1Q19 Earnings Beat Estimates On Lower-Than-Expected Opex: Cebu Air, IncDokument8 Seiten1Q19 Earnings Beat Estimates On Lower-Than-Expected Opex: Cebu Air, IncMaloxeNoch keine Bewertungen

- Kajaria Ceramics: Higher Trading Kept Growth IntactDokument4 SeitenKajaria Ceramics: Higher Trading Kept Growth IntactearnrockzNoch keine Bewertungen

- Buana Lintas Lautan: Equity ResearchDokument7 SeitenBuana Lintas Lautan: Equity ResearchSuma DyantariNoch keine Bewertungen

- Delivering Without Panandhro: Highlights of The QuarterDokument8 SeitenDelivering Without Panandhro: Highlights of The QuarterjaimaaganNoch keine Bewertungen

- Consolidated Construction Consortium LTD.: Dismal Quarter Expect Pick Up AheadDokument6 SeitenConsolidated Construction Consortium LTD.: Dismal Quarter Expect Pick Up AheadVivek AgarwalNoch keine Bewertungen

- Reaching Zero with Renewables: Biojet FuelsVon EverandReaching Zero with Renewables: Biojet FuelsNoch keine Bewertungen

- Osr FederalDokument11 SeitenOsr FederalAnshul RawatNoch keine Bewertungen

- All India Bank Officers' Confederation: For Circulation Among All Our Affiliates/State Units/MembersDokument2 SeitenAll India Bank Officers' Confederation: For Circulation Among All Our Affiliates/State Units/MembersAnshul RawatNoch keine Bewertungen

- LM Ooad It-701Dokument12 SeitenLM Ooad It-701Anshul RawatNoch keine Bewertungen

- Information TechnologyDokument22 SeitenInformation TechnologyAnshul RawatNoch keine Bewertungen

- Case - Thinning Diet Industry: Presented By: Abhishek Mehta - O4 Anshul Rawat - 11 Ashish Gutgutia - 19 Dhananjay Puri 28Dokument10 SeitenCase - Thinning Diet Industry: Presented By: Abhishek Mehta - O4 Anshul Rawat - 11 Ashish Gutgutia - 19 Dhananjay Puri 28Anshul RawatNoch keine Bewertungen

- Akshay Gopal 07 Amit Jain 08 Ankur Arora 09 Ankur Dave 10 Anshul Rawat 11Dokument17 SeitenAkshay Gopal 07 Amit Jain 08 Ankur Arora 09 Ankur Dave 10 Anshul Rawat 11Anshul RawatNoch keine Bewertungen

- Technical AnalysisDokument69 SeitenTechnical AnalysisNikhil KhandelwalNoch keine Bewertungen

- Derivativesmarket 111dfsaf006143752 Phpapp02Dokument17 SeitenDerivativesmarket 111dfsaf006143752 Phpapp02Aman TyagiNoch keine Bewertungen

- Britannia Industries LTDDokument12 SeitenBritannia Industries LTDStephen RajNoch keine Bewertungen

- C Boe Taxes and InvestingDokument27 SeitenC Boe Taxes and InvestingWillie DeVriesNoch keine Bewertungen

- Review of The Literature ProfitabilityDokument17 SeitenReview of The Literature Profitabilitysheleftme100% (3)

- Stock Market and Great Depression PresentationDokument29 SeitenStock Market and Great Depression PresentationRahulNoch keine Bewertungen

- Otcei by RohitDokument13 SeitenOtcei by RohitRohit PawarNoch keine Bewertungen

- Stempeutics Research PVT LTDDokument5 SeitenStempeutics Research PVT LTDIndia Business ReportsNoch keine Bewertungen

- Honeywell Question 1&2Dokument6 SeitenHoneywell Question 1&2anon_909027967Noch keine Bewertungen

- Extinguishing Financial Liabilities With Equity Instruments: IFRIC Interpretation 19Dokument8 SeitenExtinguishing Financial Liabilities With Equity Instruments: IFRIC Interpretation 19rosettejoy278Noch keine Bewertungen

- Planning and ForecastingDokument16 SeitenPlanning and ForecastingAinun Nisa NNoch keine Bewertungen

- Macroeconomic and Industry Analysis: InvestmentsDokument21 SeitenMacroeconomic and Industry Analysis: InvestmentsZainul KismanNoch keine Bewertungen

- Pset Capital Structure SolDokument6 SeitenPset Capital Structure SolDivyesh DixitNoch keine Bewertungen

- Overview of Accounting: EGR 403 Capital Allocation TheoryDokument18 SeitenOverview of Accounting: EGR 403 Capital Allocation TheoryBartholomew SzoldNoch keine Bewertungen

- 2000 PraceticeDokument24 Seiten2000 PraceticePom JungNoch keine Bewertungen

- Analysis of Mutual Funds in IndiaDokument78 SeitenAnalysis of Mutual Funds in Indiadpk1234Noch keine Bewertungen

- Stokes Merger With PackerDokument3 SeitenStokes Merger With Packersilverster_123Noch keine Bewertungen

- UB V KBDokument3 SeitenUB V KBJo-ana DesuyoNoch keine Bewertungen

- Boosting Returns - New Twists To Time-Tested Trading Techniques With Tom Gentile PDFDokument19 SeitenBoosting Returns - New Twists To Time-Tested Trading Techniques With Tom Gentile PDFpreshantNoch keine Bewertungen

- Mortgage and PledgeDokument158 SeitenMortgage and PledgeBeatrice TehNoch keine Bewertungen

- University of Mindanao Panabo CollegeDokument2 SeitenUniversity of Mindanao Panabo CollegeJessa Beloy100% (1)

- Mutual Fund Review: Equity MarketDokument15 SeitenMutual Fund Review: Equity MarketHariprasad ManchiNoch keine Bewertungen

- Excerpt From "When Wall Street Met Main Street" by Julia C. OttDokument2 SeitenExcerpt From "When Wall Street Met Main Street" by Julia C. OttOnPointRadioNoch keine Bewertungen

- Fama&MacBeth PresentationDokument16 SeitenFama&MacBeth PresentationAntonio J FernósNoch keine Bewertungen