Beruflich Dokumente

Kultur Dokumente

This Study Resource Was: Tugas Personal 2 Week 7/ Sesi 11

Hochgeladen von

Jimmi TambaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

This Study Resource Was: Tugas Personal 2 Week 7/ Sesi 11

Hochgeladen von

Jimmi TambaCopyright:

Verfügbare Formate

Tugas Personal 2

Week 7/ Sesi 11

m

e r as

co

eH w

o.

rs e

ou urc

o

aC s

Sarah Noerazizah Suherman

v i y re

2201847460

ed d

LMFA CLASS

ar stu

sh is

Th

https://www.coursehero.com/file/43195025/TP-2-Sarah-Noerazizah-Suherman-AkMenpdf/ ACCT6332-Managerial Accounting

Kasus 1

Gargamon Co. merupakan perusahaan yang bergerak dibidang pembuatan sepatu kulit.

Dibawah ini adalah data perusahaan selama 2 tahun :

Selling Price per unit $ 120

Manufacturing Cost

Variable cost:

Direct Materials $ 40

Direct Labor $ 5

Variable

Overhead $ 10

Fixed per Year $ 250,000

Selling and administrative cost

Variable per unit sold $ 10

m

e r as

Fixed per year $ 100,000

co

eH w

Year 1 Year 2

Units in beginning inventory - 1,000

o.

rs e

Units produced during the year 10,000 8,000

ou urc

Units sold during the year 9,000 9,000

Units in ending inventory 1,000 -

o

Ditanyakan:

aC s

1 Apabila perusahaan menggunakan absorption costing, tentukan:

v i y re

a. Unit Product Cost tiap tahun

b. Income Statement tiap tahun

2 Apabila perusahaan menggunakan variable costing, tentukan:

ed d

a. Unit Product Cost tiap tahun

b. Income Statement tiap tahun

ar stu

3 Rekonsiliasi laba absorption dan variable costing

sh is

Kasus 2

Th

Perusahaan pembuat laptop lokal, sedang berusaha membandingkan antara 2 seri best seller laptop

mereka. Data yang diperoleh adalah sebagai berikut:

234 YS Maharani

Harga 3,500,000 3,000,000

Unit Penjualan 500 700

Variable Cost 1,500,000 2,000,000

Fixed Manufacturing

Overhead 500,000,000 150,000,000

Fixed Selling and Adm perusahaan total 400,000,000

Buatlah variable costing format income statement yang disusun berdasarkan segmen lini produk

https://www.coursehero.com/file/43195025/TP-2-Sarah-Noerazizah-Suherman-AkMenpdf/ ACCT6332-Managerial Accounting

Kasus 1

1. Metode Absorption Costing :

a. Unit product cost tiap tahun :

Year 1 Year 2

Direct Materials $40 $40

Direct Labor $5 $5

Variable Overhead $10 $10

Fixed Overhead* $25 $31.25

Product Cost/Unit $80 $86.25

*Year 1 : 100,000 unit produced = $250,000/10,000

Year 2 : 8,000 unit produced = $250,000/8,000

b. Cost of goods sold absorption costing :

Year 1 Year 2

m

Product cost absorption $80 $86.25

e r as

Unit sold $9,000 $9,000

co

Cost of good sold absorption cost $720,000 $776,250

eH w

o.

Selling and administrative cost :

rs e Year 1 Year 2

ou urc

Variable per unit sold (@9,000) $90,000 $90,000

Fixed per year $100,000 $100,000

Selling and administrative cost Total $190,000 $190,000

o

aC s

Income Statement Absorption Costing :

v i y re

Year 1 Year 2

Sales (120 x @9,000) $1,080,000 $1,080,000

Cost of Goods Sold $720,000 $776,250

ed d

Gross Profit $360,000 $303,750

ar stu

Selling and administrative cost $190,000 $190,000

Net Income $170,000 $113,750

2. Metode Variable costing :

sh is

a. Unit product cost tiap tahun :

Th

Year 1 Year 2

Direct Materials $40 $40

Direct Labor $5 $5

Variable Overhead $10 $10

Product Cost/Unit $55 $55

b. Cost of goods sold variable costing :

Year 1 Year 2

Product cost variable $55 55

Unit sold 9,000 9,000

Cost of good sold variable cost $495,000 $495,000

https://www.coursehero.com/file/43195025/TP-2-Sarah-Noerazizah-Suherman-AkMenpdf/ ACCT6332-Managerial Accounting

Selling and administrative cost akan sama dengan metode Absorption Costing.

Income Statement Variable Costing :

Year 1 Year 2

Sales (120 x @9,000) $1,080,000 $1,080,000

Biaya Variable :

Cost of goods sold variable $495,000 $495,000

Selling and administrative cost $90,000 $90,000

Variable cost Total $585,000 $585,000

Contribution Margin $495,000 $495,000

Fixed Cost :

Fixed overhead cost $250,000 $250,000

Fixed selling and administrative cost $100,000 $100,000

Fixed cost Total $350,000 $350,000

Net Income $145,000 $145,000

m

e r as

co

3. Rekonsiliasi antara Absorption and Variable Costing :

eH w

Year 1 Year 2

o.

Fixed Overhead in Beginning Inventory (1,000 x $31.25)

rs e - $31,250

Fixed Overhead in Ending Inventory (1,000 x $25) $25,000 -

ou urc

Fixed Overhead Deferred in (release from) inventory $25,000 ($31,250)

Rekonsiliasi Laporan Laba Rugi Absorption and Variable Costing :

o

Year 1 Year 2

aC s

Variable costing net income $145,000 $145,000

v i y re

Add (deduct) fixed overhead deferred in (release from) $25,000 ($31,250)

inventoris

Absorption costing net income $170,000 ($113,750)

ed d

ar stu

Kasus 2

sh is

a. Unit product cost tiap tahun :

Th

234 YS Maharani

Variable Cost (direct material, direct labor and variable $1,500,000 $2,000,000

overhead)

Product Cost $1,500,000 $2,000,000

b. Cost of goods sold variable costing :

234 YS Maharani

Product cost variable $1,500,000 $2,000,000

Unit sold 500 700

Cost of good sold variable cost $750,000,000 $1,400,000,000

https://www.coursehero.com/file/43195025/TP-2-Sarah-Noerazizah-Suherman-AkMenpdf/ ACCT6332-Managerial Accounting

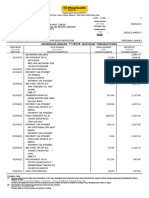

Income Statement Variable Costing :

234 YS Maharani

Sales $1,750,000,000 $2,100,000,000

Biaya Variable :

Cost of goods sold variable $750,000,000 $1,400,000,000

Variable cost Total $750,000,000 $1,400,000,000

Contribution Margin $1,000,000,000 $700,000,000

Fixed Cost :

Fixed overhead cost $500,000,000 $150,000,000

Fixed selling and administrative cost $400,000,000 $400,000,000

Fixed cost Total $900,000,000 $900,000,000

Net Income (Loss) $100,000,000 ($200,000,000)

m

e r as

co

eH w

o.

rs e

ou urc

o

aC s

v i y re

ed d

ar stu

sh is

Th

https://www.coursehero.com/file/43195025/TP-2-Sarah-Noerazizah-Suherman-AkMenpdf/ ACCT6332-Managerial Accounting

Powered by TCPDF (www.tcpdf.org)

Das könnte Ihnen auch gefallen

- Tugas Kelompok Ke-2 (Minggu 5)Dokument8 SeitenTugas Kelompok Ke-2 (Minggu 5)Savina SyachNoch keine Bewertungen

- Tugas ForumDokument4 SeitenTugas Forumarif budi hermansahNoch keine Bewertungen

- Tugas Chapter 13Dokument6 SeitenTugas Chapter 13irga ayudiasNoch keine Bewertungen

- Soal 1 (LO3 10%) : Tugas Personal Ke-2 Week 7Dokument16 SeitenSoal 1 (LO3 10%) : Tugas Personal Ke-2 Week 7Nadilla Nur100% (2)

- Tugas Kelompok Ke-3 (Minggu 7/ Sesi 13) : Weighted-Average Method - Periodic InventoryDokument10 SeitenTugas Kelompok Ke-3 (Minggu 7/ Sesi 13) : Weighted-Average Method - Periodic Inventoryliissylvia100% (2)

- Review CH 08Dokument7 SeitenReview CH 08Lalala100% (1)

- Firda Arfianti - 2301949596 - LA53 - ACCT7141 - Accounting Information System and Internal ControlDokument6 SeitenFirda Arfianti - 2301949596 - LA53 - ACCT7141 - Accounting Information System and Internal Controlfirda arfiantiNoch keine Bewertungen

- E7-39 Comparing ABC and Plantwide Overhead Cost Assigments: Setup Hours Oven HoursDokument3 SeitenE7-39 Comparing ABC and Plantwide Overhead Cost Assigments: Setup Hours Oven HoursDhiva Rianitha Manurung100% (1)

- Problem 21.3Dokument3 SeitenProblem 21.3Fayed Rahman MahendraNoch keine Bewertungen

- Tugas Personal Pertama AKDokument7 SeitenTugas Personal Pertama AKerni75% (4)

- Alpha BetaDokument13 SeitenAlpha BetaJoel Christian MascariñaNoch keine Bewertungen

- Tugas Personal Ke - (1) Minggu 2Dokument6 SeitenTugas Personal Ke - (1) Minggu 2Olim BariziNoch keine Bewertungen

- Sesi 9 & 10 Praktikum - SharedDokument9 SeitenSesi 9 & 10 Praktikum - SharedDian Permata SariNoch keine Bewertungen

- 2311 Acct6131039 Lhfa TK1-W3-S4-R2 Team8Dokument8 Seiten2311 Acct6131039 Lhfa TK1-W3-S4-R2 Team8Nadilla NurNoch keine Bewertungen

- Kumpulan Quiz UAS AkmenDokument23 SeitenKumpulan Quiz UAS AkmenPutri NabilahNoch keine Bewertungen

- Tgs Kelompok Ganda Kasus 3Dokument18 SeitenTgs Kelompok Ganda Kasus 3GARTMiawNoch keine Bewertungen

- Tugas Personal 1Dokument6 SeitenTugas Personal 1kopi klasikNoch keine Bewertungen

- Latihan PAK Pert 5Dokument3 SeitenLatihan PAK Pert 5Yudi HallimNoch keine Bewertungen

- Tugas Personal Ke-1 Week 2: Soal 1Dokument14 SeitenTugas Personal Ke-1 Week 2: Soal 1meifangNoch keine Bewertungen

- 11.3 Break Even in Units ($75,000/15,000 Units) - Fixed Cost Is $37,500Dokument14 Seiten11.3 Break Even in Units ($75,000/15,000 Units) - Fixed Cost Is $37,500Rizzah Nianiah100% (1)

- Personal Assignment 3 Week 7: RequirementsDokument8 SeitenPersonal Assignment 3 Week 7: RequirementsrizaNoch keine Bewertungen

- BINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Dokument5 SeitenBINUS University: Undergraduate / Master / Doctoral ) International/Regular/Smart Program/Global Class )Martha Wulan TumangkengNoch keine Bewertungen

- Modul Lab. Akuntansi Manajemen I 2019 - 2020 V1.1Dokument29 SeitenModul Lab. Akuntansi Manajemen I 2019 - 2020 V1.1Felix HarryyantoNoch keine Bewertungen

- Tugas Chapter 14Dokument7 SeitenTugas Chapter 14irga ayudiasNoch keine Bewertungen

- Ilovepdf MergedDokument9 SeitenIlovepdf MergedGARTMiawNoch keine Bewertungen

- Tug AsDokument5 SeitenTug Asihalalis5202100% (2)

- Proces CostingDokument14 SeitenProces CostingKenDedesNoch keine Bewertungen

- P5 4Dokument3 SeitenP5 4Monica HutagaolNoch keine Bewertungen

- Latihan Soal Akuntansi Untuk PensionDokument4 SeitenLatihan Soal Akuntansi Untuk PensionRini SusantyNoch keine Bewertungen

- ACY4001 Individual Assignment 2 SolutionsDokument7 SeitenACY4001 Individual Assignment 2 SolutionsMorris LoNoch keine Bewertungen

- Soal Bab 15Dokument5 SeitenSoal Bab 15suci monalia putriNoch keine Bewertungen

- Bab 6 Process CostingDokument23 SeitenBab 6 Process CostingVibbula Iswaradewi Anindyasari0% (1)

- Belinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To TheDokument1 SeiteBelinda 125150469 OY E7-14. On April 1, 2015, Prince Company Assigns $500,000 of Its Accounts Receivable To ThebelindaNoch keine Bewertungen

- Kelompok 4-SOAL STANDAR COSTINGDokument3 SeitenKelompok 4-SOAL STANDAR COSTINGAndriana Butera0% (1)

- Acctba3 E2-1, E2-2, E2-3Dokument13 SeitenAcctba3 E2-1, E2-2, E2-3DennyseOrlido100% (2)

- Soal Latihan Sewa - RahmaDokument3 SeitenSoal Latihan Sewa - RahmaAlya DRNoch keine Bewertungen

- IFA-I Assignment PDFDokument3 SeitenIFA-I Assignment PDFNatnael AsfawNoch keine Bewertungen

- Resume Kieso CHAPTER 17Dokument7 SeitenResume Kieso CHAPTER 17A RahmaNoch keine Bewertungen

- Asistensi Akmen Ch.8Dokument12 SeitenAsistensi Akmen Ch.8Irham SistiasyaNoch keine Bewertungen

- Contoh Dan Soal Cash FlowDokument9 SeitenContoh Dan Soal Cash FlowAltaf HauzanNoch keine Bewertungen

- AkkeuDokument6 SeitenAkkeuMedlin Yustisia RirringNoch keine Bewertungen

- AkuntansiDokument4 SeitenAkuntansiNadilla NurNoch keine Bewertungen

- Specimen For Qiuz & Assignment .........................................Dokument3 SeitenSpecimen For Qiuz & Assignment .........................................Umair AmirNoch keine Bewertungen

- Module 9 Problems - MrnakDokument9 SeitenModule 9 Problems - MrnakJenny MrnakNoch keine Bewertungen

- Akutansi Biaya 3Dokument2 SeitenAkutansi Biaya 3ulfania ekaNoch keine Bewertungen

- CH 22 - Lu Solution-Intermediate Acct - Acct ChangesDokument9 SeitenCH 22 - Lu Solution-Intermediate Acct - Acct Changesdaotam0% (1)

- CH 06Dokument50 SeitenCH 06Dr-Bahaaeddin Alareeni100% (1)

- Acc3 5Dokument4 SeitenAcc3 5dinda ardiyaniNoch keine Bewertungen

- Quiz - Inter 2 UTS - Wo AnsDokument3 SeitenQuiz - Inter 2 UTS - Wo AnsNike HannaNoch keine Bewertungen

- Exercises Chapter1Dokument4 SeitenExercises Chapter1Huyen Siu NhưnNoch keine Bewertungen

- KidsTravel Produces Car Seats For Children From Newborn To 2 Years OldDokument2 SeitenKidsTravel Produces Car Seats For Children From Newborn To 2 Years OldElliot Richard0% (1)

- Soal Ch. 15Dokument6 SeitenSoal Ch. 15Kyle KuroNoch keine Bewertungen

- Assignment Form ACCT7066 - Managerial AccountingDokument6 SeitenAssignment Form ACCT7066 - Managerial AccountingJulyaniNoch keine Bewertungen

- Tugas Mandiri Lab. Ak. Meng 1 - PersediaanDokument9 SeitenTugas Mandiri Lab. Ak. Meng 1 - PersediaanZachra MeirizaNoch keine Bewertungen

- Exercise CH 14: This Study Resource Was Shared ViaDokument9 SeitenExercise CH 14: This Study Resource Was Shared Vianaura syahdaNoch keine Bewertungen

- PensionDokument2 SeitenPensionRatna Sari100% (1)

- Soal Akm1Dokument2 SeitenSoal Akm1putri50% (2)

- 5-12 Cost Report Value-And Non-Value-Added Costs: AnswerDokument2 Seiten5-12 Cost Report Value-And Non-Value-Added Costs: AnswerLydia SamosirNoch keine Bewertungen

- Chapter 7 Problems PDFDokument18 SeitenChapter 7 Problems PDFArham Sheikh100% (1)

- This Study Resource WasDokument2 SeitenThis Study Resource WasReal Estate Golden TownNoch keine Bewertungen

- Finman Test BankDokument3 SeitenFinman Test BankATHALIAH LUNA MERCADEJASNoch keine Bewertungen

- Due Diligence QuestionnaireDokument5 SeitenDue Diligence QuestionnairetestnationNoch keine Bewertungen

- 4-Financial Requirements and Sources For ACTG6144Dokument6 Seiten4-Financial Requirements and Sources For ACTG6144RylleMatthanCorderoNoch keine Bewertungen

- State Bank of India (SBI) : Decent Performance in Q4Dokument5 SeitenState Bank of India (SBI) : Decent Performance in Q4deveshNoch keine Bewertungen

- HMPSA TALE (Tutoring and Learning Ease) : Accounting For Merchandising OperationsDokument53 SeitenHMPSA TALE (Tutoring and Learning Ease) : Accounting For Merchandising OperationsKevin Chandra100% (1)

- On October 1 2018 Jay Crowley Established Affordable Realty WhichDokument1 SeiteOn October 1 2018 Jay Crowley Established Affordable Realty WhichAmit Pandey0% (1)

- BBAW2103 Financial AccountingDokument336 SeitenBBAW2103 Financial AccountingJohn JamesNoch keine Bewertungen

- 74697bos60485 Inter p1 cp5 U3Dokument35 Seiten74697bos60485 Inter p1 cp5 U3aryanharsh2004Noch keine Bewertungen

- FIN202Dokument21 SeitenFIN202Thịnh Lưu Thiện HưngNoch keine Bewertungen

- 5.1. Debt Market Instrument CharacteristicsDokument15 Seiten5.1. Debt Market Instrument CharacteristicsMavis LunaNoch keine Bewertungen

- Dividend Policy ProposalDokument22 SeitenDividend Policy Proposalroman50% (4)

- Dokumen - Tips Wipro Ratio Analysis 55849d8e50235Dokument20 SeitenDokumen - Tips Wipro Ratio Analysis 55849d8e50235zomaan mirzaNoch keine Bewertungen

- Abbott 2004Dokument19 SeitenAbbott 2004Sahirr SahirNoch keine Bewertungen

- CA Final SFM Questions On Dividend Decision Prof Manish OW01JKS2Dokument47 SeitenCA Final SFM Questions On Dividend Decision Prof Manish OW01JKS2rahul100% (1)

- Direct Freight Express P/L: Credit RequestDokument35 SeitenDirect Freight Express P/L: Credit RequestMICK6166Noch keine Bewertungen

- Chart of Accounts (As of July 6,2018)Dokument382 SeitenChart of Accounts (As of July 6,2018)prince pacasumNoch keine Bewertungen

- FMCG Organisation Chart: Board of DirectorsDokument1 SeiteFMCG Organisation Chart: Board of DirectorsKumar Panchal0% (1)

- Access Bank PLCDokument13 SeitenAccess Bank PLCdaniel dennis encartaNoch keine Bewertungen

- Mid Term Small BisnesDokument6 SeitenMid Term Small BisnesNORIKHMAL BIN ABD HAMID BBAENoch keine Bewertungen

- Ch20 InvestmentAppraisalDokument32 SeitenCh20 InvestmentAppraisalsohail merchantNoch keine Bewertungen

- Ch. 4: Financial Forecasting, Planning, and BudgetingDokument41 SeitenCh. 4: Financial Forecasting, Planning, and BudgetingFahmia Winata8Noch keine Bewertungen

- The Takeover Controversy: Analysis and Evidence Lähde PDFDokument59 SeitenThe Takeover Controversy: Analysis and Evidence Lähde PDFNiklas NieminenNoch keine Bewertungen

- Accounting Cycle McqsDokument7 SeitenAccounting Cycle McqsasfandiyarNoch keine Bewertungen

- Maklumat PentingDokument136 SeitenMaklumat PentingFatin Nabilah IsmailNoch keine Bewertungen

- Solman Milan Special TransDokument158 SeitenSolman Milan Special TransPanda AsiaNoch keine Bewertungen

- Management Accountant Dec 2018Dokument124 SeitenManagement Accountant Dec 2018ABC 123Noch keine Bewertungen

- IDLC Finance Limited Internship ReportDokument36 SeitenIDLC Finance Limited Internship ReportZordanNoch keine Bewertungen

- Entrepreneurship Development (BM-302) : Assignment 1Dokument7 SeitenEntrepreneurship Development (BM-302) : Assignment 1AbhishekNoch keine Bewertungen

- Walter Mart Financial StatementDokument55 SeitenWalter Mart Financial StatementRIANNE MARIE REYNANTE RAMOSNoch keine Bewertungen

- Auditors Qualification 2.1Dokument39 SeitenAuditors Qualification 2.1Sayraj Siddiki AnikNoch keine Bewertungen