Beruflich Dokumente

Kultur Dokumente

How To Avoid Financial Risk From Increasing Online Grocery Shopping

Hochgeladen von

dreamer4077Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

How To Avoid Financial Risk From Increasing Online Grocery Shopping

Hochgeladen von

dreamer4077Copyright:

Verfügbare Formate

HONEY, I SHRUNK MY MARGINS

HOW TO AVOID FINANCIAL RISK FROM INCREASING ONLINE GROCERY SHOPPING

Ongoing social distancing measures made necessary by the COVID-19 pandemic have dramatically altered

consumer behavior. While most grocery stores remain open, many customers are preferring to stay home

and take advantage of home delivery and curbside pickup in unprecedented numbers. During the crisis

period, grocers have seen their digital sales more than double across click-and-collect and delivery

channels. This makes a deep dent in operating income, the extent of which we analyze below.

Based on history, we expect a significant portion of digital growth to stick and become permanent once the

restrictions are lifted. During the 2008-09 downturn, many shoppers were driven to discounters and a large

portion never fully returned to traditional grocers. The current crisis is similarly forcing customers to try

something new. Many will like it and will not snap back into past behaviors.

More than 40% of those who have bought groceries online in this period are new to this channel. Those

who aren’t new expect to increase their frequency of online purchases, according to the AlixPartners Surge

Demand Consumer Survey 1, with 39% indicating they were shopping online for groceries more than they

previously had.

Two myths about online grocery are being disproven by the current situation. First, there is now clear

evidence that grocery delivery is not simply a niche offering for dense, urban areas. Even before COVID-19,

some of the country’s largest operators were making rapid ecommerce progress in their core suburban

markets. Second, grocers must change their belief that low ecommerce margins are acceptable because

this is incremental business. Rather, grocers are fighting to keep their existing share as customers’

expectations change and baskets shift from traditional in-store trips to online.

Another long-held theory – that customers are unwilling to pay more for delivery and click-and-collect

options – will be tested in the medium term. Many customers have been willing to pay extra for services

they view as necessary from a safety standpoint in this time of crisis. However, this willingness may

decrease over time and even potentially disappear. Additionally, if even a handful of grocers start offering

these options for free to gain a competitive advantage, pricing power for everyone could evaporate quickly.

Irrespective of whether consumers are willing to pay extra, grocers urgently need to figure out how to get

more operationally efficient at digital channels and operations.

Over the next few months, the possible implications for the industry may include increased consolidation

and changes in pricing structures. Currently, grocery delivery is margin-neutral or even negative in some

cases, while click-and-collect options hold only slightly higher margins. This is, of course, because of these

channels’ implicit higher cost structure, which includes additional labor, third-party service fees, and capital

expenses that come with creating new warehouses and processes to cater to these options.

How big is the issue? All other factors being equal, our analysis suggests that a permanent overall online

penetration of between 7.5% and 20% would result in an individual retailer’s current operating income being

reduced by approximately 0.75 to 2.75 points if the retailer is unable to charge the customer extra fee for

the service. Pushing customers to click-and-collect options can deliver significantly better operating

income than a more delivery-heavy mix (Figure 1). This is the magnitude of the change grocers are going to

have to deal with.

HONEY, I SHRUNK MY MARGINS

Grocers need to take these immediate actions now to stay viable and avoid the margin impact depicted in

Figure 1 as the market evolves into its new normal:

Make bold capability decisions: Because circumstances have forced rapid ecommerce scaling, it is

imperative that digital capabilities be at full throttle now. Understandably, grocery retailers have

been busy weathering the current demand storm. But going forward, they must evaluate the how to

manage a longer-term shift. Does it make sense to use a third-party provider or build your own

platform? Consider the pros and cons of each and ensure that whichever option you choose still

allows you complete understanding of your customer. Outsourcing ecommerce is an easy solution

and can be a huge advantage when executive time and focus is in short supply. The right white-

label provider may offer both the right capabilities as well as control of the customer relationships

and trade funding. If your balance sheet allows for it, assess acquiring ecommerce capabilities. In

any case, evolving labor models to new shopping patterns will be essential.

Codify learnings from the current crush: While the last few weeks have been a true test rather than

a test run, there are valuable lessons to unpack. Track how the shift to digital channels affected

profit and loss while isolating the effects of the demand bump. As comparables return to normal,

model out financial and operational scenarios with a sustained, elevated level of ecommerce.

Determine what is incremental to your business and what has simply shifted online to the

detriment of in-store shopping.

HONEY, I SHRUNK MY MARGINS

Choose customer incentives carefully: Pay attention to how your channel mix and profitability

evolves as you settle into the new normal. Do not incentivize customers into actions unprofitable

for the business. If click-and-collect purchases structurally deliver higher profitability than delivery,

make them efficient and attractive for customers. This may require tactics such as offering pickup-

only assortments or increasing the availability and flexibility of pickup slots. Consider focusing

promotions on traditional shops to incentivize higher-margin and larger basket in-store purchases.

Feature private brands in digital channels and actively promote them using substitution logic when

branded products are out of stock.

Experiment with store real estate: Evaluate how your current real estate footprint can increase your

ability to fulfill delivery orders and use store space you already have to facilitate ecommerce

logistics. In locations where stores are too large, experiment with creating a mini-dark store by

separating an area for dedicated picking and packing. Identify lower-cost locations in your area and

snap them up to operate dark stores.

Partner with wholesalers: Wholesalers have a once-in-a-generation opportunity to help their

independent and regional customers by offering turnkey ecommerce solutions. They have the

required capital, balance sheet, and scale to make this work. The potential upside for wholesalers,

as they find success, is that they will help their smaller customers survive and may become more

relevant to larger multi-region grocers.

The current spike in home delivery and click-and-collect options will likely come to rest

significantly higher than where it was prior to COVID-19. This dynamic is forcing grocery retailers

to accelerate their digital channel development timeline by three to five years. Those that act now

and evolve their thinking and operations to scale digital channels quickly will be able to capitalize

on this momentum. Lessons from the last several weeks of shifting buying behaviors will help

grocers adapt faster and more effectively – delivering a better customer experience, mitigating

the risk of operating income losses, and taking share from competitors that don’t evolve as

quickly.

HONEY, I SHRUNK MY MARGINS

FOR A DEEPER DISCUSSION ABOUT THIS TOPIC, CONTACT:

John Bonno

Managing Director

jbonno@alixpartners.com

Matt Hamory

Managing Director

mhamory@alixpartners.com

Joel Rampoldt

Managing Director

jrampoldt@alixpartners.com

CONTACT THE AUTHORS:

Marco Di Marino

Director

mdimarino@alixpartners.com

Adam Goodliss

Director

agoodliss@alixpartners.com

ABOUT US

For nearly forty years, AlixPartners has helped businesses around the world respond quickly and decisively to their most critical challenges

– circumstances as diverse as urgent performance improvement, accelerated transformation, complex restructuring and risk mitigation.

These are the moments when everything is on the line – a sudden shift in the market, an unexpected performance decline, a time-

sensitive deal, a fork-in-the-road decision. But it’s not what we do that makes a difference, it’s how we do it.

Tackling situations when time is of the essence is part of our DNA – so we adopt an action-oriented approach at all times. We work

in small, highly qualified teams with specific industry and functional expertise, and we operate at pace, moving quickly from analysis

to implementation. We stand shoulder to shoulder with our clients until the job is done, and only measure our success in terms of

the results we deliver.

Our approach enables us to help our clients confront and overcome truly future-defining challenges. We partner with you to make

the right decisions and take the right actions. And we are right by your side. When it really matters.

The opinions expressed are those of the authors and do not necessarily reflect the views of AlixPartners, LLP, its affiliates, or any of

its or their respective other professionals or clients. This article regarding Honey, I shrunk my margins: how to avoid financial risk

from increasing online grocery shopping(“Article”) was prepared by AlixPartners, LLP (“AlixPartners”) for general information and

distribution on a strictly confidential and non-reliance basis. No one in possession of this Article may rely on any portion of this

Article. This Article may be based, in whole or in part, on projections or forecasts of future events. A forecast, by its nature, is

speculative and includes estimates and assumptions which may prove to be wrong. Actual results may, and frequently do, differ

from those projected or forecast. The information in this Article reflects conditions and our views as of this date, all of which are

subject to change. We undertake no obligation to update or provide any revisions to the Article. This article is the property of

AlixPartners, and neither the article nor any of its contents may be copied, used, or distributed to any third party without the prior

written consent of AlixPartners.

©2020 AlixPartners, LLP

1

Survey conducted from March 27 to 31, 2020 across 1,006 representative US households.

HONEY, I SHRUNK MY MARGINS

Das könnte Ihnen auch gefallen

- Building Omnichannel ExcellenceDokument11 SeitenBuilding Omnichannel ExcellenceContact AB12Noch keine Bewertungen

- Assignment - 3 (OPR-202) Supply Chain Management Avinash Singh (A22) (11806943)Dokument4 SeitenAssignment - 3 (OPR-202) Supply Chain Management Avinash Singh (A22) (11806943)avinasss1963_3707255Noch keine Bewertungen

- Industry Financials & Competitor ProfilingDokument5 SeitenIndustry Financials & Competitor ProfilingMaThew MarkoseNoch keine Bewertungen

- Customers Rule! (Review and Analysis of Blackwell and Stephan's Book)Von EverandCustomers Rule! (Review and Analysis of Blackwell and Stephan's Book)Noch keine Bewertungen

- Chapter 4Dokument13 SeitenChapter 4Cyra JimenezNoch keine Bewertungen

- Chapter - IX Managing Marketing RisksDokument40 SeitenChapter - IX Managing Marketing RiskskshitijsaxenaNoch keine Bewertungen

- Chapter - 5 Online RetailingDokument14 SeitenChapter - 5 Online RetailingKunal JainNoch keine Bewertungen

- ReSci - Retention Marketing & Predictive AnalyticsDokument27 SeitenReSci - Retention Marketing & Predictive AnalyticsYatin GargNoch keine Bewertungen

- Dropshipping: The Complete Guide For Beginners To Build A Profitable Ecommerce Business With Secret Money Making Strategies That Make Six Figures Per Month Passive Income By Selling Products OnlineVon EverandDropshipping: The Complete Guide For Beginners To Build A Profitable Ecommerce Business With Secret Money Making Strategies That Make Six Figures Per Month Passive Income By Selling Products OnlineNoch keine Bewertungen

- Assignment SCM (Dell Inc)Dokument5 SeitenAssignment SCM (Dell Inc)RrishavNoch keine Bewertungen

- Transforming Retail Marketing With Analytics: Driving Sales and Customer Loyalty With Personalized MarketingDokument12 SeitenTransforming Retail Marketing With Analytics: Driving Sales and Customer Loyalty With Personalized MarketingPhanniswer ChNoch keine Bewertungen

- 2 Building Customer Satisfaction, Value, and RetentionDokument9 Seiten2 Building Customer Satisfaction, Value, and RetentionAwol TunaNoch keine Bewertungen

- Case On: Building Customer Satisfaction, Value, and RetentionDokument23 SeitenCase On: Building Customer Satisfaction, Value, and RetentionShimekit LegeseNoch keine Bewertungen

- MCK Three Trends in Business To Business SalesDokument4 SeitenMCK Three Trends in Business To Business Salesmaks17281377Noch keine Bewertungen

- Jagran Lakecity Business School: Question & Answer (An Open Book Examination)Dokument11 SeitenJagran Lakecity Business School: Question & Answer (An Open Book Examination)Ashita PunjabiNoch keine Bewertungen

- 10 Tips For Running A Successful B2B Wholesale Distribution BusinessDokument2 Seiten10 Tips For Running A Successful B2B Wholesale Distribution BusinessHarsh ShrivastavaNoch keine Bewertungen

- PM04Dokument6 SeitenPM04Muhammad FaizanNoch keine Bewertungen

- I I IIII II II I I I I I I I II IIIII IIII I III II I I I IIII IIDokument4 SeitenI I IIII II II I I I I I I I II IIIII IIII I III II I I I IIII IImohdidreesNoch keine Bewertungen

- How To Weed Out The Garbage When Marketing Your ProductVon EverandHow To Weed Out The Garbage When Marketing Your ProductNoch keine Bewertungen

- BSS057-6 Corporate Innovation and Entrepreneurship Assignment 1 - Critical Evaluation of Selected VignettesDokument11 SeitenBSS057-6 Corporate Innovation and Entrepreneurship Assignment 1 - Critical Evaluation of Selected VignettesShubham AgarwalNoch keine Bewertungen

- BBM2102 Introduction To Purchasing and SuppliesDokument5 SeitenBBM2102 Introduction To Purchasing and Suppliescyrus100% (1)

- A new era of Value Selling: What customers really want and how to respondVon EverandA new era of Value Selling: What customers really want and how to respondNoch keine Bewertungen

- The Customer Revolution (Review and Analysis of Seybold's Book)Von EverandThe Customer Revolution (Review and Analysis of Seybold's Book)Noch keine Bewertungen

- Reverse Logistics The Way Forward Part 1 of 2 Codex986Dokument4 SeitenReverse Logistics The Way Forward Part 1 of 2 Codex986NikhilDehlanNoch keine Bewertungen

- Start Selling Without Inventory: Build Your Dropshipping EmpireVon EverandStart Selling Without Inventory: Build Your Dropshipping EmpireNoch keine Bewertungen

- Beyond e (Review and Analysis of Diorio's Book)Von EverandBeyond e (Review and Analysis of Diorio's Book)Noch keine Bewertungen

- Zaius CLTV WhitepaperDokument11 SeitenZaius CLTV WhitepapersoortyNoch keine Bewertungen

- PM04Dokument5 SeitenPM04Muhammad FaizanNoch keine Bewertungen

- Accenture Retail Customer ExperienceDokument7 SeitenAccenture Retail Customer ExperienceabhuttNoch keine Bewertungen

- The Three D's of Costumer ExperienceDokument7 SeitenThe Three D's of Costumer ExperienceJose Fernando Torres MesaNoch keine Bewertungen

- Dropshipping: Full Guide & How To Make A Business Step By StepVon EverandDropshipping: Full Guide & How To Make A Business Step By StepNoch keine Bewertungen

- 2012 Financial Services - Retail Banking Industry Perspective2012Dokument4 Seiten2012 Financial Services - Retail Banking Industry Perspective2012Brazil offshore jobsNoch keine Bewertungen

- BAIN BRIEF Is Complexity Killing Your Sales ModelDokument16 SeitenBAIN BRIEF Is Complexity Killing Your Sales ModelEdi Purwanto0% (1)

- Start An Online Grocery StoreDokument27 SeitenStart An Online Grocery StoreMuzically InspiredNoch keine Bewertungen

- Online GroceryDokument27 SeitenOnline GroceryMuzically InspiredNoch keine Bewertungen

- Building and Sustaining Relationships in RetailingDokument40 SeitenBuilding and Sustaining Relationships in Retailinghenry siyNoch keine Bewertungen

- Class 1 Activity 2 - Trends of E Business 2023-2024Dokument3 SeitenClass 1 Activity 2 - Trends of E Business 2023-2024Cristine Silva AguilarNoch keine Bewertungen

- Nor Maya Binti Salman 2009323773 Supply Chain and Distribution Management - MKT757 Test 1Dokument7 SeitenNor Maya Binti Salman 2009323773 Supply Chain and Distribution Management - MKT757 Test 1Maya SalmanNoch keine Bewertungen

- Dropshipping Income Genesis: The Secret Blueprint for Starting and Making Maximum Profits In e-commerce With Minimum RisksVon EverandDropshipping Income Genesis: The Secret Blueprint for Starting and Making Maximum Profits In e-commerce With Minimum RisksNoch keine Bewertungen

- Impact of Covid19 On Consumer BehaviourDokument5 SeitenImpact of Covid19 On Consumer BehaviourKuldeep Tomar100% (1)

- The Future of ShoppingDokument2 SeitenThe Future of ShoppingOlya ZherlitsinaNoch keine Bewertungen

- Um20Mb504: Principles of Marketing ManagementDokument6 SeitenUm20Mb504: Principles of Marketing ManagementPrajwalNoch keine Bewertungen

- Distinguishing Revenue, Profitability, and Risk MetricsDokument2 SeitenDistinguishing Revenue, Profitability, and Risk MetricsminhanhNoch keine Bewertungen

- Cost Accounting - Customer Profitability AnalysisDokument18 SeitenCost Accounting - Customer Profitability AnalysisNayeem AhmedNoch keine Bewertungen

- Marketbusters (Review and Analysis of Mcgrath and Macmillan's Book)Von EverandMarketbusters (Review and Analysis of Mcgrath and Macmillan's Book)Noch keine Bewertungen

- Electronic Shelf Labling: A Detailed ReportDokument9 SeitenElectronic Shelf Labling: A Detailed ReportManideep NuluNoch keine Bewertungen

- AfterpayDokument6 SeitenAfterpaykunwar showvhaNoch keine Bewertungen

- HBR's 10 Must Reads on Strategic Marketing (with featured article "Marketing Myopia," by Theodore Levitt)Von EverandHBR's 10 Must Reads on Strategic Marketing (with featured article "Marketing Myopia," by Theodore Levitt)Bewertung: 3.5 von 5 Sternen3.5/5 (10)

- Omni-Channel Retailing: Retail Management - Term PaperDokument11 SeitenOmni-Channel Retailing: Retail Management - Term Papernagadeep reddyNoch keine Bewertungen

- Store LoyaltyDokument7 SeitenStore LoyaltyBESTERWELL DKHARNoch keine Bewertungen

- Effects of Covid19 On Retailers and Strategy They Adopting To Keep Afloat-28032020-010125pm-28032020-022108pmDokument7 SeitenEffects of Covid19 On Retailers and Strategy They Adopting To Keep Afloat-28032020-010125pm-28032020-022108pmShahzeb MajeedNoch keine Bewertungen

- Model: Submitted by Subham Chakraborty 0191PGM002 PGDM SapDokument10 SeitenModel: Submitted by Subham Chakraborty 0191PGM002 PGDM SapSubham ChakrabortyNoch keine Bewertungen

- 7 Direct Mail Campaigns Every Digital Marketer Must TryDokument21 Seiten7 Direct Mail Campaigns Every Digital Marketer Must Trydreamer4077Noch keine Bewertungen

- Customer Cohorts Demystified: How To Segment Your Audience For Better Marketing ResultsDokument26 SeitenCustomer Cohorts Demystified: How To Segment Your Audience For Better Marketing Resultsdreamer4077Noch keine Bewertungen

- Your Business in The Cloud: Metrics Implementation GuideDokument47 SeitenYour Business in The Cloud: Metrics Implementation Guidedreamer4077Noch keine Bewertungen

- Class 4: Ideation Phase: Prototyping Overview of Ideation Phase: PrototypingDokument15 SeitenClass 4: Ideation Phase: Prototyping Overview of Ideation Phase: Prototypingdreamer4077Noch keine Bewertungen

- Class 5: Implementation Phase Overview of Implementation PhaseDokument13 SeitenClass 5: Implementation Phase Overview of Implementation Phasedreamer4077Noch keine Bewertungen

- Class 3: Workshop Guide Class Leader's GuideDokument11 SeitenClass 3: Workshop Guide Class Leader's Guidedreamer4077Noch keine Bewertungen

- Certified Analytics Professional: Examination Study GuideDokument141 SeitenCertified Analytics Professional: Examination Study Guidedreamer4077Noch keine Bewertungen

- Class 1: An Introduction To Human-Centered Design What Is Human-Centered Design?Dokument16 SeitenClass 1: An Introduction To Human-Centered Design What Is Human-Centered Design?dreamer4077Noch keine Bewertungen

- Class 4 - Worksheets - AccessibleDokument18 SeitenClass 4 - Worksheets - Accessibledreamer4077Noch keine Bewertungen

- Class 1: Workshop Guide: Let's Get Started!Dokument10 SeitenClass 1: Workshop Guide: Let's Get Started!dreamer4077Noch keine Bewertungen

- Rightsizing The Balance Sheet PDFDokument12 SeitenRightsizing The Balance Sheet PDFdreamer4077Noch keine Bewertungen

- Class 3 - Readings - AccessibleDokument8 SeitenClass 3 - Readings - Accessibledreamer4077Noch keine Bewertungen

- Class 5 - Worksheets - AccessibleDokument9 SeitenClass 5 - Worksheets - Accessibledreamer4077Noch keine Bewertungen

- Chapter - 1: Nature of Financial ManagementDokument16 SeitenChapter - 1: Nature of Financial Managementdreamer4077Noch keine Bewertungen

- 10 Question Checklist For Understanding The Behavior Your DataDokument2 Seiten10 Question Checklist For Understanding The Behavior Your Datadreamer4077Noch keine Bewertungen

- Questions To Help You Remember Your Accomplishments: January 2016Dokument1 SeiteQuestions To Help You Remember Your Accomplishments: January 2016dreamer4077Noch keine Bewertungen

- Your Roadmap: ENGAGE: Start Your Journey With Us!Dokument4 SeitenYour Roadmap: ENGAGE: Start Your Journey With Us!dreamer4077Noch keine Bewertungen

- Effective Conversations & Interview Cheat Sheet: Executive Career Upgrades As Seen inDokument9 SeitenEffective Conversations & Interview Cheat Sheet: Executive Career Upgrades As Seen indreamer4077Noch keine Bewertungen

- 2018 Book MarketSegmentationAnalysis PDFDokument332 Seiten2018 Book MarketSegmentationAnalysis PDFdreamer4077100% (1)

- How Much Is Custerom Experience WorthDokument16 SeitenHow Much Is Custerom Experience Worthdreamer4077Noch keine Bewertungen

- Making Websites Win - SampleDokument58 SeitenMaking Websites Win - Sampledreamer4077Noch keine Bewertungen

- 2019 Small Business Profiles USDokument4 Seiten2019 Small Business Profiles USdreamer4077Noch keine Bewertungen

- ACG Webinar Key TakeawaysPMDokument1 SeiteACG Webinar Key TakeawaysPMdreamer4077Noch keine Bewertungen

- Strategex PPT2Dokument46 SeitenStrategex PPT2dreamer4077Noch keine Bewertungen

- Mango Postharvest Management PDFDokument73 SeitenMango Postharvest Management PDFlulay1974100% (2)

- The Swatch GroupDokument35 SeitenThe Swatch GroupSusanna HartantoNoch keine Bewertungen

- Integration of Sales and Distribution Strategies Final 2003Dokument24 SeitenIntegration of Sales and Distribution Strategies Final 2003Sukesh Kumar50% (2)

- Class XI Business Studies PDFDokument3 SeitenClass XI Business Studies PDFआस्था वरूण सिंह पंवारNoch keine Bewertungen

- Marketing Plan For Nestle Kit KatDokument10 SeitenMarketing Plan For Nestle Kit KatKevin kyle CadavisNoch keine Bewertungen

- Sport Obermeyer CaseanswersDokument33 SeitenSport Obermeyer CaseanswersCansu Kapanşahin100% (1)

- Project Report On "Buying Behaviour: of Gold With Regards ToDokument77 SeitenProject Report On "Buying Behaviour: of Gold With Regards ToAbhishek MittalNoch keine Bewertungen

- Final ThesisDokument89 SeitenFinal ThesisHenok AsemahugnNoch keine Bewertungen

- Puregold Price ClubDokument14 SeitenPuregold Price Clubmercx0% (2)

- Apple Marketing ProjectDokument26 SeitenApple Marketing ProjectVidhya Malwade67% (6)

- Auto Spare Parts - PresentationDokument32 SeitenAuto Spare Parts - Presentationmimo11112222Noch keine Bewertungen

- KIscriptDokument50 SeitenKIscriptkrushekiNoch keine Bewertungen

- Safe E-Commerce in The Private Sector Enterprises in East EuropeDokument49 SeitenSafe E-Commerce in The Private Sector Enterprises in East EuropeXolani MpilaNoch keine Bewertungen

- Manual Part I Business SimDokument30 SeitenManual Part I Business SimJonasNoch keine Bewertungen

- ABFRL - JD - Assistant Store Manager (ASM)Dokument3 SeitenABFRL - JD - Assistant Store Manager (ASM)Akshat JainNoch keine Bewertungen

- Ikea-The Global Retailer Case StudyDokument2 SeitenIkea-The Global Retailer Case Studydoublek200175% (4)

- Swot Analysis of Pepsi With Other Soft DrinksDokument12 SeitenSwot Analysis of Pepsi With Other Soft DrinksMani SuperciliousNoch keine Bewertungen

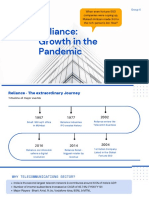

- G4 - D - Growth Strategy of RelianceDokument18 SeitenG4 - D - Growth Strategy of RelianceDeepansh GoyalNoch keine Bewertungen

- Convenience Stores AnalysisDokument8 SeitenConvenience Stores AnalysisPedro ViegasNoch keine Bewertungen

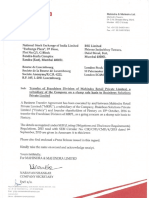

- Transfer of Franchisee Division of Mahindra Retail Private Limited, A Subsidiary of The Company On A Slump Sale Basis To Brainbees Solutions Private Limited (Company Update)Dokument6 SeitenTransfer of Franchisee Division of Mahindra Retail Private Limited, A Subsidiary of The Company On A Slump Sale Basis To Brainbees Solutions Private Limited (Company Update)Shyam SunderNoch keine Bewertungen

- MGT Group Case Study Report (Dunkin Donuts)Dokument18 SeitenMGT Group Case Study Report (Dunkin Donuts)Wasif100% (8)

- F Commerce List Bangladeshxlsxpdf PDF FreeDokument196 SeitenF Commerce List Bangladeshxlsxpdf PDF Freenaim777hNoch keine Bewertungen

- Marketing Planning Pineapple Drink Innovation of SDokument7 SeitenMarketing Planning Pineapple Drink Innovation of Snguyễn thủyNoch keine Bewertungen

- Bukky George KeyNote1 Africa Day Conference 2019Dokument40 SeitenBukky George KeyNote1 Africa Day Conference 2019Uche DuruNoch keine Bewertungen

- SYBBA Project Guidelines Retail ManagementDokument3 SeitenSYBBA Project Guidelines Retail ManagementganeshNoch keine Bewertungen

- Independent Study On Packaging Products MarketDokument204 SeitenIndependent Study On Packaging Products MarketJack FooNoch keine Bewertungen

- Lalit KumarDokument17 SeitenLalit KumarbuddysmbdNoch keine Bewertungen

- Running Head: The Container Store Case Study: Human Resource ManagementDokument5 SeitenRunning Head: The Container Store Case Study: Human Resource ManagementVictoria NjiiriNoch keine Bewertungen

- EMARKETER - Top 10 Trends 2022Dokument20 SeitenEMARKETER - Top 10 Trends 2022Зарина ЗангиеваNoch keine Bewertungen

- Marketing Aspect: (Shawarma Crave)Dokument26 SeitenMarketing Aspect: (Shawarma Crave)Joel BordeosNoch keine Bewertungen