Beruflich Dokumente

Kultur Dokumente

Name Wt. / Stock (%) : Primario Fund

Hochgeladen von

Rakshan ShahOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Name Wt. / Stock (%) : Primario Fund

Hochgeladen von

Rakshan ShahCopyright:

Verfügbare Formate

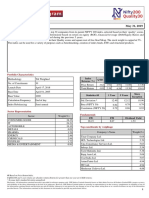

Nov 2019 TCG Advisory Services

Monthly Fact Sheet: TCG Funds Fund 2 – Primario Fund

Alternative Investment Fund (AIF) Cat III, Closed- End

MD: Chakri Lokapriya

Investment Information:

Portfolio Composition: Primario Fund

Equity 94.04

Primario Fund Debt / Liquid 5.96

Fund Launch Month Feb 2018

NAV (₹) 100.00

Portfolio (NAV) (₹)85.01 Select Holdings: Primario Fund

Min Investment (₹) 1 Crore Wt. / Stock

NAME (%)

Addl. Invst. (Multiples of) (₹) 1 Lakh

Fee Structure: Primario Fund HOUSING DEVELOPMENT FINANCE 3.48

IRCON INTERNATIONAL LTD 3.00

Contribution Management Performance Fee Hurdle JINDAL STEEL & POWER LTD 2.91

Amount Fee (p.a) Rate RBL BANK LTD 2.51

Option I 1 Cr to 3 Cr 2.25% 10% without catch up 10% RAIL VIKAS NIGAM LTD 2.31

Option II > 3 Cr to 5 Cr 2.00% 10% without catch up 10%

CHALET HOTELS LTD 2.10

Option III > 5 Cr to 15 Cr 1.75% 10% without catch up 10%

Option IV > 15 Cr 1.50% 10% without catch up 10%

ICICI LOMBARD GENERAL INSURA 2.03

Establishment Expenses-Up to 2.25% of aggregate capital contribution.

KEI INDUSTRIES LTD 1.88

EXIDE INDUSTRIES LTD 1.41

TATA STEEL LTD 1.10

Primario Fund Performance:

Fund/Index (%) Nov-19 YTD19 CY18 Launch*

Primario Fund (₹) 0.4 -0.8 -14.3 -15.0 Primario Fund: Multi-Cap, Multi Sector Fund:

Comp. Index (₹) 1.8 -6.7 -22.3 -20.0 Portfolio Mix Holding (%)

Large Cap 45.9

*Launched on Feb 23, 2018 Mid Cap 46.4

Small Cap 1.8

Sector Weights (%):

Portfolio Characteristics:

Primario Fund Index

FY20 FY21 1 yr. 2 yr.

Sector (%) (%)

EPS EPS Fwd. Fwd. ROE

Materials 12.00 8.07 Growth Growth PE PE

Utilities 1.04 3.01

Primario

Consumer Discretionary 10.08 8.16 Fund 20.1% 18.2% 17.9x 16.2x 16.0%

Industrials 19.88 6.95 Index 15.4% 13.7% 20.4x 18.0x 14.0%

Information Technology 1.66 10.65

Consumer Staples 1.39 8.66 Investment Objective: Primario Fund Invests in companies across

Health Care 1.08 4.40 sectors requiring growth capital or turnaround capital. Infusing equity

Financials 43.96 37.14 capital into such companies at major inflection points help

reinvigorate their financials, deleverage balance sheets, allowing

Energy 1.55 10.02

companies to expand their offerings or services translating into

Telecommunication Services - 2.18 higher profits and therefore higher investment returns. Primario fund

Real Estate 1.39 0.75 address the immediate need to capitalise India's listed & soon to be

Cash 5.96 - listed companies and help corporates break the viscous cycle of lack

Total 100.00 100.00 of capital impeding their growth or higher profits.

Fund Style: Primario Fund invests in institutional placements, anchor

capital to initial public offerings and soon to be listed companies, Multi-

cap. As an institutional investor the fund negotiates discounts, higher

allotments that UHNIs, portfolio management services, private equity

do not qualify for. Primario Fund aims for high absolute returns vs.

index with a 3 - 4-year investment horizon. The risk of investing,

includes capital loss, however diversification across sectors lowers

the risk to deliver risk adjusted returns.

For more information: Contact: +91-22-6747 9999 I customerservice@tcgamc.com I www.tcgamc.com

Nov 2019 TCG Advisory Services

Monthly Fact Sheet: TCG Funds Fund 2 – Primario Fund

Alternative Investment Fund (AIF) Cat III, Closed- End

Chakri Lokapriya, MD, Comments: Primario Fund

The Primario Fund has outperformed its index by +5.9% through YTD 2019 and delivered -0.8% vs. -6.7% Index. India’s key sectors

fell 5.8% YoY in Nov, the 3rd consecutive month of a fall in electricity production, with a similar pattern in diesel and gasoline demand,

indicating that a turnaround is a few quarters away. We expect RBI to continue to maintain an accommodative stance. Q2FY20 GDP

was the lowest since 2013. India is faced with a sharp fall in economic growth with nominal GDP of 6% which is below a 10 year

Government security yield. This implies that tax collection are likely to be well below target, and high leveraged companies would face

higher interest servicing costs, as financial institutions become choosy about who they led to, and what cost.

Taxes collection fell for the first time since 2009-2009, and will miss targets by 1.5-2%. We expect a gradual recovery with fiscal and

monetary support. With a nominal GDP of 6% which is below a 10 year Government security yield, would translate into below target

government revenue. Going into 2020, GDP prints may improve, as by 1QFY21 government spending would pick up.

Among portfolio holdings, PNC Infra, a leading infrastructure player, was up 14.6% on back of strong execution, revenue beat by 21%

on back of strong order book. We expect to see an earnings acceleration as the economy bottoms out. RBL Bank, was up 11.2% in

November, as the capital raising will lower the bank’s stressed assets and provide growth capital for next two years. ICICI Bank, was

up 10.7%. On resolution of Essar Steel, bank was one of the biggest beneficiaries as provided 100% on the exposure leading to write-

back of provision to the extent of 85%. Due to landmark judgment on Essar Steel by SC, ICICI Bank became well positioned to take

market share among the peers. Tata Global Beverages, was up 1.9% in November. It appears that the company has multiple levers,

and turning around certain divisions. Starbucks is expected to breakeven in FY20. Chalet Hotel, a hotel company, was up 9%. High

occupancy of 74%+ in core locations, bodes well in an up-trending industry cycle. Chalet is the largest partner for Marriott in India,

14% of Marriott India’s total Room Inventory and 25%+ of Marriott India’s revenue. Exide, India’s leading battery manufacturer was

up 1%. A rise of 6% in lead prices coupled with weak volume growth across the OEM’s resulted in Exide performance being subdued.

During the quarter EBITDA margin missed expectation by 30 bps as higher staff costs.

Ircon International, a leading turnkey construction company in public sector was down 2.7%, despite of strong Q2 execution. Clarity

on competitive bidding is required for govt. orders, which is expected in the coming months. SBI Life Insurance, was down 3.2%. For

the monthly growth numbers related to October’19. We believe this temporary. RVNL, an undertaking under Ministry of Railways, a

miniratna company, was down 1.2%. No major order book wins during Q2 coupled with sluggish government spending weighed on

the stock performance. So far Ministry of Railways has transferred 179 projects, out of which 174 projects are sanctioned for execution.

Out of these, 72 projects have been fully executed totalling to Rs206bn. Its order book as of 2QFY19 stood at Rs775bn (10x of FY18

revenue) for 102 ongoing projects. KEI, a leading player in Industrial cables segment was down by 12% MoM. Weakness in the stock

performance was largely owning to slow dealer sales, reflecting liquidity constraints and an overall lower demand. While KEI’s B2B

growth remains strong, a pickup in retail sales growth along are key triggers ahead.

Portfolio Outlook:

Against the backdrop of a yet to recover economy, we are positioning the fund across market capitalization where we see emerging

growth, and companies with recovering balance sheets, growing profits faster than their sector averages. The recent corporate tax

cut provides a buffer to falling profits. Inflation may tick up against this backdrop, though some of it one time in nature such as a 25-

40% increase in mobile per minute calling rates. RBI has room to cut a further 65bp and as the credit deposit ratio gap lessens, and

transmission of rates would help corporates breathe easier, we are likely to see a significant pick of private placement activity as the

pipeline of QIPS is robust at Rs. 82,768 crores.

Disclaimer: This document is being furnished to you on behalf of TCG Alternative Investment Fund (“Fund”) strictly on a confidential basis and only for informational purposes. The Fund is registered

with the Securities and Exchange Board of India (“SEBI”) as a Category III Alternative Investment Fund under the SEBI (Alternative Investment Funds) Regulations, 2012. This document is for

informational purposes only and should not be considered as an advice on the matter discussed herein. The information herein has been provided to its recipient upon the express understanding

that the information contained herein, or made available in connection with any further investigation, is strictly confidenti al and is intended for the exclusive use of its recipient. It shall not be

photocopied, reproduced or distributed to others at any time. This document is neither a prospectus nor an invitation to subscribe to the Fund and the information contained is entirely subject to the

Fund documents. Prospective investors should carefully review the underlying constituent documents of the Fund before making a decision to invest. In general, investment in the Fund will involve

significant risks. Nothing in this document is intended to constitute legal, tax, securities or investment advice, or opinion regarding the appropriateness of any investment, or a solicitation for any

product or service. The use of any information set out in this document is entirely at the recipient’s own risk. Interested persons are advised to seek independent professional advice to understand

all the risks attached with respect to making investments in the Fund. Also, persons interested in investing into the Fund should have the financial ability and willingness to accept the risks and lack

of liquidity, which are characteristics of the investments described herein. In making an investment decision, investors must rely on their own examination of the Fund documents and the terms of

the offering as set out in detail in such documents, including the merits and risks involved. In view of the particularized nature of tax consequences, each prospective investor is advised to consult

its own tax advisor with respect to specific tax consequences arising due to the investment in the Fund. SEBI Registration details IN/AIF3/17-18/0324

For more information: Contact: +91-22-6747 9999 I customerservice@tcgamc.com I www.tcgamc.com

Das könnte Ihnen auch gefallen

- Name Wt. / Stock (%) : Primario FundDokument2 SeitenName Wt. / Stock (%) : Primario FundRakshan ShahNoch keine Bewertungen

- Name Wt. / Stock (%) : Primario FundDokument2 SeitenName Wt. / Stock (%) : Primario FundRakshan ShahNoch keine Bewertungen

- Name Wt. / Stock (%) : Primario FundDokument2 SeitenName Wt. / Stock (%) : Primario FundRakshan ShahNoch keine Bewertungen

- Name Wt. / Stock (%) : Primario FundDokument2 SeitenName Wt. / Stock (%) : Primario FundRakshan ShahNoch keine Bewertungen

- Primario Mar20 Fact SheetDokument2 SeitenPrimario Mar20 Fact SheetRakshan ShahNoch keine Bewertungen

- Portfolio Holding Vs Performance (Since Inception) Sector - HoldingsDokument3 SeitenPortfolio Holding Vs Performance (Since Inception) Sector - HoldingsAshok MishraNoch keine Bewertungen

- MulticapDokument2 SeitenMulticapadithyaNoch keine Bewertungen

- Schroder Dana Prestasi Plus: Fund FactsheetDokument1 SeiteSchroder Dana Prestasi Plus: Fund FactsheetGiovanno HermawanNoch keine Bewertungen

- First State China A Shares Fund USD B FV en HK IE00B3LV6Z90Dokument1 SeiteFirst State China A Shares Fund USD B FV en HK IE00B3LV6Z90Jannaki PvNoch keine Bewertungen

- Ind Nifty 100Dokument2 SeitenInd Nifty 100Rajesh KumarNoch keine Bewertungen

- INF179K01CR2 - HDFC Midcap OpportunitiesDokument1 SeiteINF179K01CR2 - HDFC Midcap OpportunitiesKiran ChilukaNoch keine Bewertungen

- INF204K01HY3 - Reliance Smallcap FundDokument1 SeiteINF204K01HY3 - Reliance Smallcap FundKiran ChilukaNoch keine Bewertungen

- Nifty Low VolatilityDokument2 SeitenNifty Low VolatilityRajesh KumarNoch keine Bewertungen

- HDFC BlueChip FundDokument1 SeiteHDFC BlueChip FundKaran ShambharkarNoch keine Bewertungen

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDokument2 SeitenInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDeepak Singh PundirNoch keine Bewertungen

- Infrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundDokument2 SeitenInfrastructure Is Driving India's Growth. Buckle Up.: Invest in L&T Infrastructure FundGaurangNoch keine Bewertungen

- Ind Niftysmallcap100Dokument2 SeitenInd Niftysmallcap100Samriddh DhareshwarNoch keine Bewertungen

- Factsheet NIFTY Quality Low-Volatility 30Dokument2 SeitenFactsheet NIFTY Quality Low-Volatility 30Rajesh KumarNoch keine Bewertungen

- In123d Nifty50Dokument2 SeitenIn123d Nifty50praNoch keine Bewertungen

- INF090I01569 - Franklin India Smaller Cos FundDokument1 SeiteINF090I01569 - Franklin India Smaller Cos FundKiran ChilukaNoch keine Bewertungen

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Dokument2 SeitenPortfolio Characteristics: Since Inception 5 Years 1 Year QTD YTD Index Returns (%)Gita ThoughtsNoch keine Bewertungen

- Fundcard: Axis Treasury Advantage Fund - Direct PlanDokument4 SeitenFundcard: Axis Treasury Advantage Fund - Direct PlanYogi173Noch keine Bewertungen

- Ind Nifty50 PDFDokument2 SeitenInd Nifty50 PDFwartan solarNoch keine Bewertungen

- Ind Nifty50 PDFDokument2 SeitenInd Nifty50 PDFSantanu Mitra RayNoch keine Bewertungen

- Factsheet 1705132209349Dokument2 SeitenFactsheet 1705132209349umanarayanvaishnavNoch keine Bewertungen

- Ind Nifty 100Dokument2 SeitenInd Nifty 100Srisilpa KadiyalaNoch keine Bewertungen

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Dokument2 SeitenPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Rajesh KumarNoch keine Bewertungen

- Quant Tax Plan - Fact SheetDokument1 SeiteQuant Tax Plan - Fact Sheetsaransh saranshNoch keine Bewertungen

- Ind Nifty MidSmallcap 400Dokument2 SeitenInd Nifty MidSmallcap 400GovindarajanVaradachariNoch keine Bewertungen

- Ind Niftysmallcap 50Dokument2 SeitenInd Niftysmallcap 50Google finderNoch keine Bewertungen

- Ind Nifty50Dokument2 SeitenInd Nifty50topriyeshppNoch keine Bewertungen

- Equity Fund: % Top 10 Holding As On 31st March 2019Dokument1 SeiteEquity Fund: % Top 10 Holding As On 31st March 2019Sajith KumarNoch keine Bewertungen

- Ind Nifty India ConsumptionDokument2 SeitenInd Nifty India ConsumptionbhattjgNoch keine Bewertungen

- Ind Nifty 500Dokument2 SeitenInd Nifty 500Mihir DoshiNoch keine Bewertungen

- Inf200k01t28 - Sbi SmallcapDokument1 SeiteInf200k01t28 - Sbi SmallcapKiran ChilukaNoch keine Bewertungen

- Schroder Dana Andalan II: Fund FactsheetDokument1 SeiteSchroder Dana Andalan II: Fund Factsheetainun endarwatiNoch keine Bewertungen

- Portfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Dokument2 SeitenPortfolio Characteristics: Since Inception 5 Years 1 Year QTD Ytd Index Returns (%)Atul KaulNoch keine Bewertungen

- Factsheet NIFTY200 Quality30Dokument2 SeitenFactsheet NIFTY200 Quality30Rajesh KumarNoch keine Bewertungen

- Ind Nifty50Dokument2 SeitenInd Nifty50Prasad ChowdaryNoch keine Bewertungen

- ABSL Equity Hybrid '95 Fund Factsheet PDFDokument1 SeiteABSL Equity Hybrid '95 Fund Factsheet PDFKiranmayi UppalaNoch keine Bewertungen

- Nifty IndicesDokument19 SeitenNifty Indicesjitender8Noch keine Bewertungen

- Factsheet NiftyMidcapSelectDokument2 SeitenFactsheet NiftyMidcapSelectmohanchinnaiya7Noch keine Bewertungen

- Midcap FactsheetDokument2 SeitenMidcap FactsheetShubhashish SaxenaNoch keine Bewertungen

- BGF China Fund D2 USD: March 2019 FactsheetDokument2 SeitenBGF China Fund D2 USD: March 2019 FactsheetRicky ShooterNoch keine Bewertungen

- HDFC Diversified Equity FundDokument1 SeiteHDFC Diversified Equity FundMayank RajNoch keine Bewertungen

- 9 Factsheet - Nifty - Consumer - DurablesDokument2 Seiten9 Factsheet - Nifty - Consumer - DurablesKapilSahuNoch keine Bewertungen

- Portfolio X-Ray Report: 8500427624 : Asset Allocation % Top 10 Underlying Holdings Asset AllocationDokument6 SeitenPortfolio X-Ray Report: 8500427624 : Asset Allocation % Top 10 Underlying Holdings Asset AllocationTripat SinghNoch keine Bewertungen

- Bajaj Finserv Arbitrage Fund - One Pager-1Dokument2 SeitenBajaj Finserv Arbitrage Fund - One Pager-1padmaniaNoch keine Bewertungen

- Ind Nifty50Dokument2 SeitenInd Nifty50Devi Prasad BeheraNoch keine Bewertungen

- Nifty Top 50Dokument2 SeitenNifty Top 50BillionaireNoch keine Bewertungen

- AC Penetration Accross CountriesDokument21 SeitenAC Penetration Accross Countrieshh.deepakNoch keine Bewertungen

- Ind Nifty 500Dokument2 SeitenInd Nifty 500nagendraNoch keine Bewertungen

- NIFTY100 ESG Index FactsheetDokument2 SeitenNIFTY100 ESG Index FactsheetSanket SharmaNoch keine Bewertungen

- Factsheet 1705131940285Dokument2 SeitenFactsheet 1705131940285umanarayanvaishnavNoch keine Bewertungen

- Sbi Life Balanced Fund PerformanceDokument1 SeiteSbi Life Balanced Fund PerformanceVishal Vijay SoniNoch keine Bewertungen

- HDFC Large and Mid Cap Fund Regular PlanDokument1 SeiteHDFC Large and Mid Cap Fund Regular Plansuccessinvestment2005Noch keine Bewertungen

- Ind Nifty 500Dokument2 SeitenInd Nifty 500VIGNESH RKNoch keine Bewertungen

- Blue Chip JulyDokument1 SeiteBlue Chip JulyPiyushNoch keine Bewertungen

- Ind Nifty50 PDFDokument2 SeitenInd Nifty50 PDFAJAY KUMAR TALATHOTANoch keine Bewertungen

- Equity Valuation: Models from Leading Investment BanksVon EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNoch keine Bewertungen

- Starting A BusinessDokument10 SeitenStarting A BusinessManal Mernich BourdouiNoch keine Bewertungen

- Feasibility Study of Furfuryl Alcohol ProductionDokument3 SeitenFeasibility Study of Furfuryl Alcohol ProductionIntratec SolutionsNoch keine Bewertungen

- Foreign Direct Investment in Retail: February 23, 2004Dokument42 SeitenForeign Direct Investment in Retail: February 23, 2004Himanshu DwivediNoch keine Bewertungen

- Ic Exam Review: VariableDokument122 SeitenIc Exam Review: VariableJL RangelNoch keine Bewertungen

- 10K.Jala Mammadova&Aynura AliyevaDokument12 Seiten10K.Jala Mammadova&Aynura AliyevaAynura AliyevaNoch keine Bewertungen

- Indian Insurance Industry: Strategies Aimed at The Bottom of The PyramidDokument4 SeitenIndian Insurance Industry: Strategies Aimed at The Bottom of The PyramidSabby SinghNoch keine Bewertungen

- Quiz 1 Answer Key-2Dokument3 SeitenQuiz 1 Answer Key-2Allison LeNoch keine Bewertungen

- Stock Valuation: Div PP R PDokument7 SeitenStock Valuation: Div PP R PLeanne TehNoch keine Bewertungen

- 2003 White PaperDokument26 Seiten2003 White PaperShreeNoch keine Bewertungen

- Chapter 2 Literature ReviewDokument24 SeitenChapter 2 Literature Reviewcoolpeer91Noch keine Bewertungen

- DMX - Technologiies 3Q2009 - Profit Rises 18.01% To US$2.8M 091109Dokument3 SeitenDMX - Technologiies 3Q2009 - Profit Rises 18.01% To US$2.8M 091109WeR1 Consultants Pte LtdNoch keine Bewertungen

- Jack Welch - Two Decades at General ElectricDokument38 SeitenJack Welch - Two Decades at General ElectricJonathan Ong100% (1)

- Sbi Mitra SipDokument6 SeitenSbi Mitra SipYada GiriNoch keine Bewertungen

- Project Finance-Merger and AcquisitionDokument57 SeitenProject Finance-Merger and Acquisitionsandeepfox100% (1)

- Sa150-Notes 2018 PDFDokument15 SeitenSa150-Notes 2018 PDFNechifor Laurenţiu-CătălinNoch keine Bewertungen

- 644 - Corporate Finance SolutionDokument7 Seiten644 - Corporate Finance Solutionrayan.wydouwNoch keine Bewertungen

- Culture of Corruption in IndiaDokument229 SeitenCulture of Corruption in IndiaSatishchander Yadav100% (2)

- Financial Statements Analysis of VHCDokument20 SeitenFinancial Statements Analysis of VHCANoch keine Bewertungen

- Bacos, Romelito D. 201111820 Engr. Roslyn Peňa, Ce 20 January 2014Dokument6 SeitenBacos, Romelito D. 201111820 Engr. Roslyn Peňa, Ce 20 January 2014Rommell BacosNoch keine Bewertungen

- Motivation - Case StudyDokument4 SeitenMotivation - Case Studysunnysopal100% (1)

- 2011 Federal 1040Dokument2 Seiten2011 Federal 1040Swati SarangNoch keine Bewertungen

- Capital Market IntermediariesDokument17 SeitenCapital Market IntermediariesRaksha PathakNoch keine Bewertungen

- Premium Case DigestsDokument8 SeitenPremium Case DigestsGladysAnneMiqueNoch keine Bewertungen

- Alibaba Bond Dilemma Team 4 PDFDokument11 SeitenAlibaba Bond Dilemma Team 4 PDFKrish KadyanNoch keine Bewertungen

- HDFC ValuationDokument23 SeitenHDFC ValuationUdit UpretiNoch keine Bewertungen

- CHAPTER 1 FMDokument26 SeitenCHAPTER 1 FMZati TyNoch keine Bewertungen

- Boosting Efficiency at Matsushita: A Case Analysis Group 4Dokument31 SeitenBoosting Efficiency at Matsushita: A Case Analysis Group 4Claude Peña100% (1)

- Chapter 3 - NewDokument14 SeitenChapter 3 - NewNatasha GhazaliNoch keine Bewertungen

- Corporate Finance ProjectDokument13 SeitenCorporate Finance ProjectShailesh KumarNoch keine Bewertungen

- Human Resource Training EvaluationDokument8 SeitenHuman Resource Training EvaluationTunji OkiNoch keine Bewertungen