Beruflich Dokumente

Kultur Dokumente

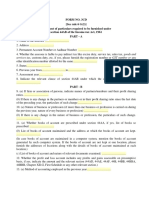

c36 Form PDF

Hochgeladen von

DavidOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

c36 Form PDF

Hochgeladen von

DavidCopyright:

Verfügbare Formate

C.

36

EAST AFRICAN COMMUNITY CUSTOMS

Regulation 197 (1), (2)

DECLARATION OF PARTICULARS RELATING TO CUSTOMS VALUE

1. Buyer For Official Use

2. Seller

3. Number and date of invoice

4. Number and date of contract 5. Terms of delivery (CIF, FOB, C&F, C&I)

6. Number and date of previous Customs decision covering boxes 7 to 8

7. (a) Is the buyer and seller related (as per paragraph 3 & 4 of the 4th Schedule to the Act)? If “NO” *YES/NO

go to box 8

(b) Did the relationship influence the price of the imported goods? *YES/NO

(c) Does the transaction value of the imported goods approximate to the customs value? If “YES?” give *YES/NO

details:

8. (a) Are there any restrictions as to the disposition or use of the goods by buyer, other than

Regulations which *YES/NO

- are imposed or required by law or by the public authorities in the Community

- limit the geographical areas in which the goods may be re-sold, or

- do not substantially affect the value of the goods?

(b) is the sale or price of goods subject to some condition or consideration for which a value *YES/NO

cannot be determined with respect to the goods being valued?

Specify the nature of the restrictions, conditions of considerations as appropriate (on a separate sheet)

If the value of conditions or considerations can be determined, indicate the amount in box 11(b)

9 (a) Have any ROYALITIES and LICENCE FEES on the imported goods been paid either directly or *YES/NO

indirectly by the buyer as a condition of the sale?

(b) Is the sale subject to an arrangement under which part of the proceeds of any subsequent RESALE *YES/NO

DISPOSAL or USE accrues directly or indirectly to the seller?

If “YES” to either of these questions, specify conditions (on a separate sheet) and if possible indicate the

amount in boxes 15 and 16.

10. I …………………………. …………………………………the undersigned, declare that all particulars given in this

document are true and complete.

Place: …………………………………. Date:………………………….

Signature:………………………………………………………………..

A: 11. (a) Net prices on the INVOICES

(Prices actually paid or payable for settlement)

Basis of

C.36

EAST AFRICAN COMMUNITY CUSTOMS

(b) Indirect payments – see Box 8 (b)

calculation

12. TOTAL A (in currency of invoice)

13. Cost incurred by the buyer:

(a) Commissions (Enter “X” as applicable:

B: Selling [ ] and /or buying [ ]

Adjustments of the (b) Brokerage

Price paid or Payabl e

(4th Schedule to the ( c) Costs for containers and packing

Act)

14. Goods and services supplied by the buyer free of charge or at reduced costs for use in

connection with the production and sale for export of the imported goods:

(N.B: the values shown represent an apportionment where appropriate)

(a) Materials, Components, Parts and similar items incorporated in the imported

goods.

(b) Tools, Dies, Moulds and similar items used in the production of the imported

goods.

(c) Materials consumed in the production of the imported goods.

(d) Engineering, development, art work, design work, plans and sketches

undertaken elsewhere other than in the country of the import and necessary for

the production of imported goods

15. Royalties and licences fees – see Box 9(a)

16. Proceeds of any subsequent resale, disposal or use accruing to the seller – see box

9(b)

17. Costs of delivery to the Community

(a) Transport/Freight

(b) Loading and handling charges

(c) Insurance

C: 18 18. TOTAL of “B” (in currency of invoice)

Post Landing

Expenses (may be 19. Cost of transport after arrival in the Community

included in “A”)

20. Charges of Construction, Maintenance and other related expenses after importation –

except installation costs

21. Other charges (specify)

22. Customs Duty and Taxes in the Community

23. TOTAL of “C” (in currency of invoice)

CUSTOMS VALUE 24. 23. Total Customs value (in currency of invoice)

(A+B) or (A+B-C) If

“C” is included in “A”

Das könnte Ihnen auch gefallen

- Zimbabwe Form 52 A Zimbabwe Revenue AuthorityDokument8 SeitenZimbabwe Form 52 A Zimbabwe Revenue AuthorityMandla Dube0% (1)

- Custom MCQ - 1 by VGDokument9 SeitenCustom MCQ - 1 by VGIS WING AP100% (1)

- Multiple Choice QuestionDokument6 SeitenMultiple Choice QuestionVikash KumarNoch keine Bewertungen

- Form1 North West Liquor License Application FormDokument5 SeitenForm1 North West Liquor License Application FormAmohelang C. Mofokeng100% (2)

- Engineering Procurement DirectorateDokument8 SeitenEngineering Procurement DirectorateFetene50% (2)

- Government and Not For Profit Organizations Quiz CH 5 Capital Assets KEY01Dokument2 SeitenGovernment and Not For Profit Organizations Quiz CH 5 Capital Assets KEY01Yijian ZhaoNoch keine Bewertungen

- R2207005 (Flex) CEJA Siegele Track A Opening TestimonyDokument37 SeitenR2207005 (Flex) CEJA Siegele Track A Opening TestimonyRob NikolewskiNoch keine Bewertungen

- 8 Value of Supply - TYBCOM FinalDokument13 Seiten8 Value of Supply - TYBCOM FinalNew AccountNoch keine Bewertungen

- PDFDokument18 SeitenPDFoneesxNoch keine Bewertungen

- FORM 24. Return of Allotment of Shares. (COMPANIES REGULATIONS, 1966 - P.U. 173 - 66)Dokument4 SeitenFORM 24. Return of Allotment of Shares. (COMPANIES REGULATIONS, 1966 - P.U. 173 - 66)auni fildzahNoch keine Bewertungen

- Odette ETI1Dokument44 SeitenOdette ETI1Helton MotaNoch keine Bewertungen

- MWG Notes - Miller.NDokument267 SeitenMWG Notes - Miller.NShariq AhmedNoch keine Bewertungen

- A Study On Drones Insights From PatentsDokument3 SeitenA Study On Drones Insights From PatentsInternational Journal of Innovative Science and Research TechnologyNoch keine Bewertungen

- Chart of Costing: Future CERAMIC CompanyDokument46 SeitenChart of Costing: Future CERAMIC CompanyCeramiatNoch keine Bewertungen

- CE Act, 1944 MCQsDokument35 SeitenCE Act, 1944 MCQs'Aakash Yadav'Noch keine Bewertungen

- Form No. 3Cd: Part ADokument8 SeitenForm No. 3Cd: Part ARavi BhartiaNoch keine Bewertungen

- Form No. 3Cd: Part ADokument8 SeitenForm No. 3Cd: Part Aravibhartia1978Noch keine Bewertungen

- Form No. 3Cd: Part ADokument8 SeitenForm No. 3Cd: Part Aravibhartia1978Noch keine Bewertungen

- Property - QuizDokument6 SeitenProperty - QuizAngelica manaoisNoch keine Bewertungen

- US Internal Revenue Service: f8873 - 2000Dokument2 SeitenUS Internal Revenue Service: f8873 - 2000IRSNoch keine Bewertungen

- Form Vat - IiiDokument4 SeitenForm Vat - IiihrsolutionNoch keine Bewertungen

- Mcq-Pgbp-Ito Exam-2020Dokument9 SeitenMcq-Pgbp-Ito Exam-2020Durgadevi BaskaranNoch keine Bewertungen

- Pre BoardDokument16 SeitenPre BoardPatrick WaltersNoch keine Bewertungen

- Form E.R.-4 Original / Duplicate: (See Rule 12 (2) (A) of The Central Excise Rules, 2002)Dokument9 SeitenForm E.R.-4 Original / Duplicate: (See Rule 12 (2) (A) of The Central Excise Rules, 2002)nallisubbuNoch keine Bewertungen

- 3 CDDokument13 Seiten3 CDchauhanhari1734Noch keine Bewertungen

- Real Estate Finance and Investments 14Th Edition Brueggeman Test Bank Full Chapter PDFDokument28 SeitenReal Estate Finance and Investments 14Th Edition Brueggeman Test Bank Full Chapter PDFMichaelHughesafdmb100% (4)

- ANSWER SHEET 26 FebDokument15 SeitenANSWER SHEET 26 FebImport Export ConsultancyNoch keine Bewertungen

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ADokument16 SeitenForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - AVidhi MiraniNoch keine Bewertungen

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ADokument16 SeitenForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - Ak.leela.kNoch keine Bewertungen

- ANSWER SHEET F CARD 19 FebDokument21 SeitenANSWER SHEET F CARD 19 FebImport Export ConsultancyNoch keine Bewertungen

- Financing Land Development Projects True/FalseDokument5 SeitenFinancing Land Development Projects True/FalseSiu RebeccaNoch keine Bewertungen

- Real Estate Finance and Investments 14th Edition Brueggeman Test BankDokument7 SeitenReal Estate Finance and Investments 14th Edition Brueggeman Test Bankmyalicenst100% (31)

- Price Schedule GoodsDokument6 SeitenPrice Schedule GoodsDangi DilleeRamNoch keine Bewertungen

- Deemed ExportDokument8 SeitenDeemed ExportSTNoch keine Bewertungen

- ADL 85 Export, Import Procedures and Documentation V2Dokument5 SeitenADL 85 Export, Import Procedures and Documentation V2solvedcare0% (1)

- CA 19ucc101 Financial AccountingDokument32 SeitenCA 19ucc101 Financial AccountingMuktha MathiNoch keine Bewertungen

- Cagayan - Batch 2Dokument22 SeitenCagayan - Batch 2Sarah BalisacanNoch keine Bewertungen

- Form No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ADokument16 SeitenForm No. 3Cd (See Rule 6 G (2) ) Statement of Particulars Required To Be Furnished Under Section 44AB of The Income-Tax Act, 1961 Part - ARaj PalNoch keine Bewertungen

- Taxation 2 NotesDokument166 SeitenTaxation 2 NotesmmsNoch keine Bewertungen

- Duty Drawback Application FormDokument2 SeitenDuty Drawback Application FormJusefNoch keine Bewertungen

- (C) Insurance Ordinance 2005Dokument2 Seiten(C) Insurance Ordinance 2005Farhan Ali ShahNoch keine Bewertungen

- (PAPER-I) CENTRAL EXCISE (Without Books)Dokument3 Seiten(PAPER-I) CENTRAL EXCISE (Without Books)Prajesh PrajapatiNoch keine Bewertungen

- Acca106 Midterm Exam 1st20212022 KeyDokument28 SeitenAcca106 Midterm Exam 1st20212022 KeyNicole Anne Santiago SibuloNoch keine Bewertungen

- Chapter 8: Revenue ReceiptsDokument6 SeitenChapter 8: Revenue ReceiptsVivek RatanNoch keine Bewertungen

- Mcq-Opt and Excise TaxesDokument3 SeitenMcq-Opt and Excise TaxesRandy ManzanoNoch keine Bewertungen

- Question PaperDokument3 SeitenQuestion PaperAida AmalNoch keine Bewertungen

- Eco Macro Worksheet 1Dokument2 SeitenEco Macro Worksheet 1virendrayogi2245Noch keine Bewertungen

- Paper 18Dokument19 SeitenPaper 18Aman jainNoch keine Bewertungen

- Form Jvat 409Dokument2 SeitenForm Jvat 409Suzanne BradyNoch keine Bewertungen

- Income Tax Audit ReportDokument7 SeitenIncome Tax Audit ReportMy NameNoch keine Bewertungen

- Ra 8181Dokument5 SeitenRa 8181Cons BaraguirNoch keine Bewertungen

- Supplemental Income and Loss: Schedule E (Form 1040) 13Dokument2 SeitenSupplemental Income and Loss: Schedule E (Form 1040) 13Ahmad GaberNoch keine Bewertungen

- AS 11 - Construction ContractsDokument8 SeitenAS 11 - Construction ContractsGesa StephenNoch keine Bewertungen

- INTERNATIONAL TRADE-Work SheetDokument9 SeitenINTERNATIONAL TRADE-Work SheetArun AroraNoch keine Bewertungen

- 2013811082624459UpdatedSRO655 (I) 2006june2013Dokument5 Seiten2013811082624459UpdatedSRO655 (I) 2006june2013asma_20786Noch keine Bewertungen

- Work Will Constitute An Infringement of BIMCO'sDokument17 SeitenWork Will Constitute An Infringement of BIMCO'sAyseColakNoch keine Bewertungen

- CBP's Side-by-Side Comparison of FTA'sDokument40 SeitenCBP's Side-by-Side Comparison of FTA'sYamilet TorresNoch keine Bewertungen

- Application For Permission To Post A Representative/ Establishoffice/branch Overseas InstructionsDokument7 SeitenApplication For Permission To Post A Representative/ Establishoffice/branch Overseas Instructionssanket shindeNoch keine Bewertungen

- TL MB 2018Dokument12 SeitenTL MB 2018Asnifah AlinorNoch keine Bewertungen

- Schedule ODokument2 SeitenSchedule Ovasudevbd08Noch keine Bewertungen

- Changes, Challenges & Solutions For Foundry Industry: The BeginningsDokument9 SeitenChanges, Challenges & Solutions For Foundry Industry: The BeginningskarthikkandaNoch keine Bewertungen

- B&D Case MMUGMDokument8 SeitenB&D Case MMUGMrobbyapr100% (4)

- Chapter 6 Dummy Variable AssignmentDokument4 SeitenChapter 6 Dummy Variable Assignmentharis100% (1)

- Problems With ROEDokument2 SeitenProblems With ROEwahab_pakistanNoch keine Bewertungen

- Export Duty DrawbackDokument22 SeitenExport Duty Drawbackdrishti21Noch keine Bewertungen

- By: Arma, Jeanevive L. Azores, Dennice E. Martin, Nicole M. Masongsong, Jayka C. Mayor, Jessica D. Salamanca, Danica Mae CDokument11 SeitenBy: Arma, Jeanevive L. Azores, Dennice E. Martin, Nicole M. Masongsong, Jayka C. Mayor, Jessica D. Salamanca, Danica Mae CJayka MasongsongNoch keine Bewertungen

- Module 1 Compensation N RewardDokument52 SeitenModule 1 Compensation N RewardAnshul PandeyNoch keine Bewertungen

- Part Two: Cost Accumulation For Inventory Valuation and Profit Measurement Chapter Five: Process CostingDokument28 SeitenPart Two: Cost Accumulation For Inventory Valuation and Profit Measurement Chapter Five: Process CostingCecilia Mfene SekubuwaneNoch keine Bewertungen

- Chapter 3 ShodhgangaDokument67 SeitenChapter 3 ShodhgangaPURVA BORKARNoch keine Bewertungen

- 03 - Markit Iboxx USD Liquid High Yield IndexDokument2 Seiten03 - Markit Iboxx USD Liquid High Yield IndexRoberto PerezNoch keine Bewertungen

- ROI (Return On Investment) Formula On Fashion ShowDokument4 SeitenROI (Return On Investment) Formula On Fashion Showsaravana maniNoch keine Bewertungen

- 2016 NAIC Instructions - IMRDokument13 Seiten2016 NAIC Instructions - IMRtiogang1256Noch keine Bewertungen

- Itc WaccDokument185 SeitenItc WaccvATSALANoch keine Bewertungen

- Group Project - Eco162Dokument30 SeitenGroup Project - Eco162robert100% (1)

- Monopoly ManualDokument4 SeitenMonopoly ManualRodlynMendoza100% (1)

- Cost Accounting and Control, Budget and Budgetary Control.Dokument45 SeitenCost Accounting and Control, Budget and Budgetary Control.Bala MechNoch keine Bewertungen

- Impact of Relative Price Changes and Asymmetric Adjustments On Aggregate InflationDokument4 SeitenImpact of Relative Price Changes and Asymmetric Adjustments On Aggregate InflationEizen LuisNoch keine Bewertungen

- Citation CJ4 - Operating Economics GuideDokument4 SeitenCitation CJ4 - Operating Economics Guidealbucur100% (1)

- Método Factorial Estimación de CostosDokument159 SeitenMétodo Factorial Estimación de CostosAle BernalNoch keine Bewertungen

- Prisma Celeste BLDGDokument30 SeitenPrisma Celeste BLDGLiz ValNoch keine Bewertungen

- Audit of Biological AssetsDokument5 SeitenAudit of Biological AssetsTrisha Mae RodillasNoch keine Bewertungen

- Collusive and Non-Collusive OligopolyDokument7 SeitenCollusive and Non-Collusive Oligopolymohanraokp2279Noch keine Bewertungen

- Master Siomai Uses ANKO Siomai Making Machines For Their 700 FranchisesDokument4 SeitenMaster Siomai Uses ANKO Siomai Making Machines For Their 700 Franchisesirum50% (2)

- Bollore Logistics CanadaDokument17 SeitenBollore Logistics Canadadeepakshi0% (1)

- L T and Grasim Merger Case AnalysisDokument16 SeitenL T and Grasim Merger Case AnalysisAshu KhandelwalNoch keine Bewertungen

- Reconciling The Total and Differential ApproachesDokument2 SeitenReconciling The Total and Differential ApproachesRonabelle NuezNoch keine Bewertungen

- Employee RemunerationDokument22 SeitenEmployee RemunerationJagruti Bhansali100% (3)

- Landscape With Invisible Hand by M.T. Anderson Chapter SamplerDokument26 SeitenLandscape With Invisible Hand by M.T. Anderson Chapter SamplerCandlewick PressNoch keine Bewertungen

- SWOT Analysis For HospitalDokument13 SeitenSWOT Analysis For HospitalkhinsumyinthlaingNoch keine Bewertungen

- Inco TermsDokument1 SeiteInco TermscharlesanNoch keine Bewertungen