Beruflich Dokumente

Kultur Dokumente

Optima Restore Rate Card Inclusive of Service Tax

Hochgeladen von

mksnake770 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

32 Ansichten2 SeitenOptima Restore Rate Card Inclusive of Service Tax

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenOptima Restore Rate Card Inclusive of Service Tax

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

32 Ansichten2 SeitenOptima Restore Rate Card Inclusive of Service Tax

Hochgeladen von

mksnake77Optima Restore Rate Card Inclusive of Service Tax

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Family Floater Health Insurance Plan Family Floater Health Insurance Plan

Plan 1 Plan 2 Plan 3 Plan 4 Plan 1 Plan 2 Plan 3 Plan 4

Sum Insured in INR 300,000 500,000 1,000,000 1,500,000 Sum Insured in INR 300,000 500,000 1,000,000 1,500,000

Age Group (Yrs) 1A + 2C 1A + 2C 1A + 2C 1A + 2C Age Group (Yrs) 2A + 1C 2A + 1C 2A + 1C 2A + 1C

18-35 7,600 10,320 13,023 15,854 18-35 8,436 11,149 13,835 16,834

36-45 8,344 10,893 14,229 17,308 36-45 9,816 12,270 16,020 19,475

46-50 12,117 17,281 20,766 25,280 46-50 17,484 21,856 29,132 35,535

51-55 16,091 20,114 27,636 33,655 51-55 21,944 27,430 36,134 43,993

56-60 18,285 22,856 31,292 38,093 56-60 26,151 32,687 42,850 52,136

61-65 36,081 41,778 51,633 53,858 61-65 48,422 56,192 69,559 72,571

66-70* 44,863 52,191 58,900 61,450 66-70* 63,941 74,599 84,325 87,966

71-75* 49,319 57,546 64,936 67,580 71-75* 75,635 88,554 100,136 104,260

76-80* 62,697 73,395 83,089 86,757 76-80* 97,175 114,047 129,336 135,128

> 80* 74,962 88,027 99,759 104,104 > 80* 116,921 137,584 156,150 163,050

Plan 1 Plan 2 Plan 3 Plan 4 Plan 1 Plan 2 Plan 3 Plan 4

Sum Insured in INR 300,000 500,000 1,000,000 1,500,000 Sum Insured in INR 300,000 500,000 1,000,000 1,500,000

Age Group (Yrs) 1A + 3C 1A + 3C 1A + 3C 1A + 3C Age Group (Yrs) 2A + 2C 2A + 2C 2A + 2C 2A + 2C

18-35 9,449 13,508 16,125 19,617 18-35 10,736 14,070 17,608 21,425

36-45 10,374 14,783 17,671 21,491 36-45 12,270 15,337 20,066 24,402

46-50 15,066 20,327 25,920 31,575 46-50 19,172 23,965 31,741 38,680

51-55 18,834 23,308 32,375 39,433 51-55 24,505 30,630 40,324 49,089

56-60 20,900 26,125 35,790 43,571 56-60 28,893 36,117 47,353 57,616

61-65 39,343 45,381 55,983 58,406 61-65 51,882 60,028 74,198 77,424

66-70* 48,124 55,795 62,865 65,594 66-70* 67,401 78,435 88,552 92,387

71-75* 52,581 61,151 68,900 71,725 71-75* 79,096 92,390 104,363 108,681

76-80* 65,959 76,998 87,053 90,901 76-80* 100,635 117,882 133,563 139,549

> 80* 78,223 91,631 103,722 108,249 > 80* 120,381 141,420 160,376 167,471

*Premium rates only for renewal

Where A–Adult and C–Child

Plan 1 Plan 2 Plan 3 Plan 4

• The premium mentioned is Annual Premium.

Sum Insured in INR 300,000 500,000 1,000,000 1,500,000

Age Group (Yrs) 2A 2A 2A 2A • Premium rates can be revised subject to approval from IRDA

18-35 6,847 8,637 11,352 13,836 • 7.5% Discount on premium if Insured Person is paying premium of 2 years in advance.

36-45 8,452 10,469 13,924 16,952

46-50 15,336 19,346 25,697 31,374 • The premium for the policy will remain the same for the policy period as mentioned in the policy schedule.

51-55 19,294 24,118 31,795 38,715 • Please note that your premium at renewal may change due to a change in your age or changes in the applicable tax rate.

56-60 23,773 29,716 39,010 47,477

For example:

61-65 44,915 52,302 64,853 67,649

66-70* 60,434 70,709 80,037 83,480 (1) Proposed Insured Age 33 years opting for 2 year policy with Basic Sum Insured of Rs 5 Lac.

71-75* 72,128 84,664 95,849 99,775 Calculation – 5,609 X 2 X 92.5% = Rs. 10,376.65/- plus taxes.

76-80* 93,668 110,157 125,049 130,642

(2) Proposed Insured Age 35 years opting for 2 year policy with Basic Sum Insured of Rs 5 Lac.

> 80* 113,414 133,694 151,862 158,565

Calculation – (5,609+6,395) X 92.5% = Rs. 11,103.7/- plus taxes.

Discounts: OptimaRESTORE

• Family Discount of 10% if 2 or more family members are covered in same policy under Individual Sum Insured Plan. The unbelievable health plan.

Annual Premium [Including Tax@ 12.36%]

Loadings: Individual Health Insurance Plan

• We may apply a risk loading on the premium payable (based upon the declarations made in the proposal form and the health

status of the persons proposed for insurance). The maximum risk loading applicable for an individual shall not exceed above Plan 1 Plan 2 Plan 3 Plan 4

100% per diagnosis / medical condition and an overall risk loading of over 150% per person. These loadings are applied Sum Insured in INR 3 Lac 5 Lac 10 Lac 15 Lac

from commencement date of the policy including subsequent renewal(s) with us or on the receipt of the request of increase Age Group (Yrs)

in Basic sum insured (for the increased Basicsum insured). 91D-17 4,601 5,327 7,190 8,628

• We will inform you about the applicable risk loading through a counter offer letter. You need to revert to us with consent and 18-35 5,042 6,302 8,993 11,021

additional premium (if any), within 15 days of the issuance of such counter offer letter. In case, you neither accept the counter 36-45 5,369 7,185 9,270 11,299

offer nor revert to us within 15 days, we shall cancel your application and refund the premium paid within next 7 days. 46-50 8,764 11,026 15,064 18,345

51-55 12,984 16,230 22,364 27,248

• We will not apply any additional loading on your policy premium at renewal based on claim experience. 56-60 16,545 19,909 28,609 34,888

• Please note that we will issue policy only after getting your consent. 61-65 31,560 36,864 4,5761 47,716

66-70* 40,341 47,278 53,551 55,854

71-75* 44,798 52,634 59,587 61,986

76-80* 58,176 68,482 77,740 81,161

> 80* 70,440 83,113 94,408 98,508

Family Floater Health Insurance Plan

Plan 1 Plan 2 Plan 3 Plan 4

Sum Insured in INR 300,000 500,000 1,000,000 1,500,000

Age Group (Yrs) 1A + 1C 1A + 1C 1A + 1C 1A + 1C

18-35 6,016 8,198 10,439 12,735

36-45 6,902 9,044 11,898 14,497

46-50 11,043 13,803 19,183 23,405

51-55 13,442 16,801 23,084 28,112

56-60 16,907 21,133 29,141 35,516

61-65 32,735 38,075 47,160 49,180

66-70* 41,517 48,489 54,825 57,188

71-75* 45,973 53,845 60,861 63,318

76-80* 59,351 69,694 79,014 82,495

> 80* 71,616 84,325 95,684 99,842

Let’s Uncomplicate.

AMHI/MA/H/0002/0063/112010/P

Toll Free Number: 1800-103-0555/ 1800-3010-2555 SMS: ‘restore’ to 56767 333

Buy online: apollomunichinsurance.com

Regd. Office: Apollo Hospitals Complex, Jubilee Hills, Hyderabad - 500 033, Andhra Pradesh.

Corp. Office: 10th Floor, Building No. 10, Tower B, DLF Cyber City, DLF City Phase II, Gurgaon - 122 002, Haryana.

Insurance is the subject matter of the solicitation.

Das könnte Ihnen auch gefallen

- Optima Restore Rate Card PDFDokument2 SeitenOptima Restore Rate Card PDFSrinivas GuvvaNoch keine Bewertungen

- ACA IHP Individual Rates Table 2015 (October 2015)Dokument6 SeitenACA IHP Individual Rates Table 2015 (October 2015)Lidya MandalasariNoch keine Bewertungen

- AMHI - Easy HealthDokument16 SeitenAMHI - Easy HealthRobin VermaNoch keine Bewertungen

- Or Rate Chart Excluding STDokument2 SeitenOr Rate Chart Excluding STRatzNoch keine Bewertungen

- SP - Bowtie Instructor Spreadsheet - To Author EditsDokument26 SeitenSP - Bowtie Instructor Spreadsheet - To Author EditsisabellelyyNoch keine Bewertungen

- FIRE CalculatorDokument6 SeitenFIRE CalculatorAbhijit BhowmickNoch keine Bewertungen

- BoeTie TermDokument32 SeitenBoeTie TermisabellelyyNoch keine Bewertungen

- Navi Health - Rate Chart TknybfnDokument20 SeitenNavi Health - Rate Chart Tknybfnzeshan aliNoch keine Bewertungen

- Office Premium - Pre-Tax Rates (In RS) : Plan Wise Premium TablesDokument21 SeitenOffice Premium - Pre-Tax Rates (In RS) : Plan Wise Premium TablesAnkit UjjwalNoch keine Bewertungen

- NMP Rate ChartDokument1 SeiteNMP Rate Chartmuruli dharNoch keine Bewertungen

- 972 Jeevan Umang Additional BIDokument4 Seiten972 Jeevan Umang Additional BIAmit GokhaleNoch keine Bewertungen

- Premium Chart New India Floater Mediclaim PolicyDokument1 SeitePremium Chart New India Floater Mediclaim PolicyDeepan ManojNoch keine Bewertungen

- HDFC Ergo Health Suraksha BrochureDokument10 SeitenHDFC Ergo Health Suraksha BrochureBaba KelaNoch keine Bewertungen

- NSCMP - Rate ChartDokument2 SeitenNSCMP - Rate ChartNeelam WaghNoch keine Bewertungen

- Money India ReformsDokument1 SeiteMoney India ReformsHarvinder SolankiNoch keine Bewertungen

- NSCMP - Rate Chart With GSTDokument2 SeitenNSCMP - Rate Chart With GSTNeelam WaghNoch keine Bewertungen

- Annexure - 2 Premium Chart - Family Health Optima Insurance Plan RevisedDokument18 SeitenAnnexure - 2 Premium Chart - Family Health Optima Insurance Plan Revisedkusal ghoshNoch keine Bewertungen

- Comprehensive Plan With GSTDokument40 SeitenComprehensive Plan With GSTDeepak ChoudhharyNoch keine Bewertungen

- Universal Sompo General Insurance Co LTD: Complete Healthcare Insurance UIN: UNIHLIP14003V011314Dokument10 SeitenUniversal Sompo General Insurance Co LTD: Complete Healthcare Insurance UIN: UNIHLIP14003V011314HarshaNoch keine Bewertungen

- PremiumChart CompleteHealthcareInsurance PDFDokument10 SeitenPremiumChart CompleteHealthcareInsurance PDFgrr.homeNoch keine Bewertungen

- How To Retire Before 30 - Ankur WarikooDokument23 SeitenHow To Retire Before 30 - Ankur WarikooSyed Mujeeb100% (1)

- Super Surplus PremiumDokument6 SeitenSuper Surplus PremiumshreyashahNoch keine Bewertungen

- NMP Rate Chart - 0Dokument1 SeiteNMP Rate Chart - 0abhishek basakNoch keine Bewertungen

- Certified Salary ScheduleFY2009Dokument1 SeiteCertified Salary ScheduleFY2009lhiltyNoch keine Bewertungen

- Star Women Care - Premium Chart (Including Tax - Two Year)Dokument2 SeitenStar Women Care - Premium Chart (Including Tax - Two Year)dharam singhNoch keine Bewertungen

- 4 Nstump Rate ChartDokument1 Seite4 Nstump Rate Chartmuruli dharNoch keine Bewertungen

- Assure PricingDokument6 SeitenAssure PricingdhdndnnNoch keine Bewertungen

- Universal Sompo General Insurance Co LTD: Complete Healthcare Insurance UIN: UNIHLIP21409V022021Dokument10 SeitenUniversal Sompo General Insurance Co LTD: Complete Healthcare Insurance UIN: UNIHLIP21409V022021Naveenraj SNoch keine Bewertungen

- Wealth BuilderDokument2 SeitenWealth BuilderDerrick ChangNoch keine Bewertungen

- National Insurance Company Limited: N A T I o N A L M e D I C L A I M P o L I C yDokument1 SeiteNational Insurance Company Limited: N A T I o N A L M e D I C L A I M P o L I C ySIMON DSOUZANoch keine Bewertungen

- How To Retire Before 30 - Ankur WarikooDokument7 SeitenHow To Retire Before 30 - Ankur WarikooJAYA BALDEV DasNoch keine Bewertungen

- Daftar Gaji Puskesmas MowilaDokument6 SeitenDaftar Gaji Puskesmas MowilaBinsarNoch keine Bewertungen

- Salary Scales 2019 PosterDokument1 SeiteSalary Scales 2019 PosterKevin FlynnNoch keine Bewertungen

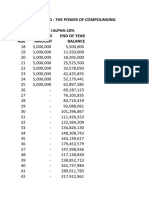

- Time Is Our Friend: The Power of Compounding Tabel Ialpha-10% Invested End of Year AGE Amount BalanceDokument8 SeitenTime Is Our Friend: The Power of Compounding Tabel Ialpha-10% Invested End of Year AGE Amount Balancebp3tki PontianakNoch keine Bewertungen

- New India Floater Mediclaim Policy Premium ChartDokument2 SeitenNew India Floater Mediclaim Policy Premium ChartSnehaAnilSurveNoch keine Bewertungen

- LIC's Jeevan Sangam, New Plan 831: Salient FeaturesDokument4 SeitenLIC's Jeevan Sangam, New Plan 831: Salient Featuresrahul BombayNoch keine Bewertungen

- NPMP Rate Chart With GSTDokument2 SeitenNPMP Rate Chart With GSTHIMANSHU SADANNoch keine Bewertungen

- Executive Order No. 201 Salary Standardization LawDokument9 SeitenExecutive Order No. 201 Salary Standardization LawDiosdado Cabo-Contiga AdolfoNoch keine Bewertungen

- Cost of Living Adjustment 1 April 2022 For Employees On Levels 1 To 12 and OsdsDokument127 SeitenCost of Living Adjustment 1 April 2022 For Employees On Levels 1 To 12 and Osdsxhanti classenNoch keine Bewertungen

- Soroban Exam 5cz5unDokument1 SeiteSoroban Exam 5cz5unHanonNoch keine Bewertungen

- Tedi Jan2014Dokument489 SeitenTedi Jan2014Angel Pérez SouffrontNoch keine Bewertungen

- Ilustrasi Cash Flow: Ke Dana Diputar Laba/ Rugi Saldo Hari Ke Potongan Harga BeliDokument15 SeitenIlustrasi Cash Flow: Ke Dana Diputar Laba/ Rugi Saldo Hari Ke Potongan Harga BeliJunoBwNoch keine Bewertungen

- Product BrochureDokument5 SeitenProduct Brochurevinay741147Noch keine Bewertungen

- 29 - Growth of Textile Industry in Pakistan Province WiseDokument2 Seiten29 - Growth of Textile Industry in Pakistan Province WiseIhtsham TariqNoch keine Bewertungen

- Description: Tags: HistoryDokument3 SeitenDescription: Tags: Historyanon-758127Noch keine Bewertungen

- Jadual Pembayaran Bulanan Pinjaman Peribadi Cash PlusDokument1 SeiteJadual Pembayaran Bulanan Pinjaman Peribadi Cash PlusNOR AZIMA BINTI SHAARI MoeNoch keine Bewertungen

- Salary Standardization LawDokument26 SeitenSalary Standardization LawJames Español NavasquezNoch keine Bewertungen

- Super Top-Up Medicare Policy Premium Chart - Including GSTDokument6 SeitenSuper Top-Up Medicare Policy Premium Chart - Including GSTvinay_814585077Noch keine Bewertungen

- CPP - Repayment Table FIR 7.88 EIR 13.93Dokument1 SeiteCPP - Repayment Table FIR 7.88 EIR 13.932rcrp8kzshNoch keine Bewertungen

- Energy Brochure OnlineDokument12 SeitenEnergy Brochure Onlinesanjay4u4allNoch keine Bewertungen

- Smart Wealth InsuredDokument2 SeitenSmart Wealth InsuredAshish RanjanNoch keine Bewertungen

- FIRE CalculatorDokument6 SeitenFIRE CalculatorharshahvNoch keine Bewertungen

- New India Mediclaim Policy Premium Chart-1Dokument2 SeitenNew India Mediclaim Policy Premium Chart-1saiNoch keine Bewertungen

- Shi Premium ChartDokument20 SeitenShi Premium Chartnadeem2510Noch keine Bewertungen

- AIA HealthShield Gold Max For ForeignersDokument11 SeitenAIA HealthShield Gold Max For Foreignersdaniel7tayNoch keine Bewertungen

- The Division Gear Attribute SheetDokument24 SeitenThe Division Gear Attribute SheetbrunoNoch keine Bewertungen

- Executive Order No. 201, S. 2016: February 19, 2016Dokument12 SeitenExecutive Order No. 201, S. 2016: February 19, 2016Jude MaiquezNoch keine Bewertungen

- 2017 APHG Population Pyramid AssignmentDokument6 Seiten2017 APHG Population Pyramid AssignmentJenniferNoch keine Bewertungen

- NOSIDokument2 SeitenNOSIJohn Josua GabalesNoch keine Bewertungen

- Subtracting Multi Digit Numbers Requires Thought | Children's Arithmetic BooksVon EverandSubtracting Multi Digit Numbers Requires Thought | Children's Arithmetic BooksNoch keine Bewertungen

- Complete Health Insurance BrochureDokument5 SeitenComplete Health Insurance BrochureRaghib ShakeelNoch keine Bewertungen

- Health Gain Brocher BrochureDokument2 SeitenHealth Gain Brocher Brochuremksnake77Noch keine Bewertungen

- Key Information Sheet: IhealthDokument18 SeitenKey Information Sheet: Ihealthmksnake77Noch keine Bewertungen

- Optima Restore ProspectusDokument7 SeitenOptima Restore Prospectusmksnake77Noch keine Bewertungen

- Aaai 13Dokument7 SeitenAaai 13mksnake77Noch keine Bewertungen

- Optima Restore BrochureDokument2 SeitenOptima Restore Brochurejsmanian79Noch keine Bewertungen

- Stories The Princess and The Dragon Transcript Final 2012-10-01Dokument2 SeitenStories The Princess and The Dragon Transcript Final 2012-10-01Smile Nadica100% (1)

- The Yellow Wall-PaperDokument10 SeitenThe Yellow Wall-PaperJuan Luis H GNoch keine Bewertungen

- Short Stories Jack and The Beanstalk TranscriptDokument1 SeiteShort Stories Jack and The Beanstalk TranscriptPaula PenaNoch keine Bewertungen

- MITFCU Incoming Wire Instructions - 1Dokument1 SeiteMITFCU Incoming Wire Instructions - 1mksnake77Noch keine Bewertungen

- Driving Today - Switzerland Traffic Regulations Driving HandbookDokument82 SeitenDriving Today - Switzerland Traffic Regulations Driving Handbookmksnake77100% (6)

- Aris A. Syntetos, Service Parts Management - Demand Forecasting and Inventory Control-Springer-Verlag London (2011)Dokument327 SeitenAris A. Syntetos, Service Parts Management - Demand Forecasting and Inventory Control-Springer-Verlag London (2011)Agung SudrajatNoch keine Bewertungen

- A Personal Selling Strategy: DevelopingDokument14 SeitenA Personal Selling Strategy: DevelopingAdeesh KakkarNoch keine Bewertungen

- Module 3 - Overhead Allocation and ApportionmentDokument55 SeitenModule 3 - Overhead Allocation and Apportionmentkaizen4apexNoch keine Bewertungen

- Curriculum Vitae of Hafiz Sikander 1Dokument7 SeitenCurriculum Vitae of Hafiz Sikander 1hafiz2422Noch keine Bewertungen

- Michigan Property Assessment FormDokument2 SeitenMichigan Property Assessment FormIsabelle PasciollaNoch keine Bewertungen

- Interview Experiences 2024Dokument3 SeitenInterview Experiences 2024Shourya PanchalNoch keine Bewertungen

- ACCA Membership To ICPAPDokument4 SeitenACCA Membership To ICPAPMian Muhammad Talha MehmoodNoch keine Bewertungen

- Creating Advertising Programe Message, Headlines, Copy, LogoDokument18 SeitenCreating Advertising Programe Message, Headlines, Copy, LogoHiren ShahNoch keine Bewertungen

- SS - 9 - Forfeiture of SharesDokument3 SeitenSS - 9 - Forfeiture of SharesMihir MehtaNoch keine Bewertungen

- AML Presentation & KYC Ver 1.9Dokument58 SeitenAML Presentation & KYC Ver 1.9nehal10100% (1)

- 10 - Chapter 3 Security in M CommerceDokument39 Seiten10 - Chapter 3 Security in M CommercehariharankalyanNoch keine Bewertungen

- TS-00019 5Dokument23 SeitenTS-00019 5Alfonso Mateo-sagastaNoch keine Bewertungen

- ALARP - Demonstration STD - AUSDokument24 SeitenALARP - Demonstration STD - AUSMahfoodh Al AsiNoch keine Bewertungen

- CHPT 1...... The Foundations of EntrepreneurshipDokument62 SeitenCHPT 1...... The Foundations of EntrepreneurshipHashim MalikNoch keine Bewertungen

- Nonprofit Org Chart: Board of Directors Board of DirectorsDokument1 SeiteNonprofit Org Chart: Board of Directors Board of DirectorssamNoch keine Bewertungen

- Solved in Consideration of 1 800 Paid To Him by Joyce HillDokument1 SeiteSolved in Consideration of 1 800 Paid To Him by Joyce HillAnbu jaromiaNoch keine Bewertungen

- BKash ProfileDokument10 SeitenBKash ProfileAshik Md Siam100% (1)

- IBU PPE StandardDokument17 SeitenIBU PPE StandardAndrianto BakriNoch keine Bewertungen

- Test Bank For Financial Management Principles and Applications 10th Edition by KeownDokument19 SeitenTest Bank For Financial Management Principles and Applications 10th Edition by KeownPria Aji PamungkasNoch keine Bewertungen

- Customer Persona and Value PropositionDokument24 SeitenCustomer Persona and Value PropositionVishnu KompellaNoch keine Bewertungen

- Bullying Behaviour in Corporate: What Is Workplace Bullying?Dokument5 SeitenBullying Behaviour in Corporate: What Is Workplace Bullying?prabhuhateNoch keine Bewertungen

- Chari Boru Bariso's Econ GuidsesDokument19 SeitenChari Boru Bariso's Econ GuidsesSabboona Gujii GirjaaNoch keine Bewertungen

- Measuring Innovation: A New PerspectiveDokument24 SeitenMeasuring Innovation: A New PerspectiveJoshua RitongaNoch keine Bewertungen

- Disruptive TechnologyDokument3 SeitenDisruptive TechnologyNeetu GoyalNoch keine Bewertungen

- Fin 254 Final ProjectDokument36 SeitenFin 254 Final ProjectDpn BzNoch keine Bewertungen

- Commissioner Vs Manning Case DigestDokument2 SeitenCommissioner Vs Manning Case DigestEKANGNoch keine Bewertungen

- Financial Reporting and Management Reporting Systems ReviewerDokument7 SeitenFinancial Reporting and Management Reporting Systems ReviewerSohfia Jesse Vergara100% (1)

- Evaluating Capacity and Expansion Opportunities at Tank Farm: A Decision Support System Using Discrete Event SimulationDokument7 SeitenEvaluating Capacity and Expansion Opportunities at Tank Farm: A Decision Support System Using Discrete Event SimulationKalai SelvanNoch keine Bewertungen

- Activity 1 Venn Diagram of Financial Market and Financial InstitutionsDokument1 SeiteActivity 1 Venn Diagram of Financial Market and Financial InstitutionsBea3Noch keine Bewertungen

- Inland Fish Farming URDUDokument17 SeitenInland Fish Farming URDUbaloch75100% (4)