Beruflich Dokumente

Kultur Dokumente

Paying For Education: How The World Bank and The International Monetary Fund Influence Education in Developing Countries

Hochgeladen von

Raju PatelOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Paying For Education: How The World Bank and The International Monetary Fund Influence Education in Developing Countries

Hochgeladen von

Raju PatelCopyright:

Verfügbare Formate

Paying for Education: How the World Bank and the International Monetary Fund Influence

Education in Developing Countries

Author(s): Nancy C. Alexander

Source: Peabody Journal of Education, Vol. 76, No. 3/4, Global Issues in Education (2001), pp.

285-338

Published by: Taylor & Francis, Ltd.

Stable URL: http://www.jstor.org/stable/1493253 .

Accessed: 20/06/2014 18:43

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at .

http://www.jstor.org/page/info/about/policies/terms.jsp

.

JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of

content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms

of scholarship. For more information about JSTOR, please contact support@jstor.org.

Taylor & Francis, Ltd. is collaborating with JSTOR to digitize, preserve and extend access to Peabody Journal

of Education.

http://www.jstor.org

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

PEABODY JOURNAL OF EDUCATION, 76(3&4), 285-338

Copyright ? 2001, Lawrence Erlbaum Associates, Inc.

Paying for Education:How the World

Bank and the InternationalMonetary

Fund Influence Education in

Developing Countries

Nancy C. Alexander

Citizens'Networkon EssentialServices,

A Projectof theTIDESCenter

The 1980s are sometimes described as a lost development decade.

School enrollments slumped. The tremendous progress made toward uni-

versal primary education in the 20 years from 1960 to 1980 was arrested or

reversed in many countries.

In 1990, the Education for All (EFA) Conference in Jomtien, Thailand,

made an urgent appeal to governments, donors, and creditors to address

the decline in basic education. Donor governments and creditors, includ-

ing the World Bank, made commitments to help developing countries

achieve education for all.

In June 1996, a conference was convened in Amman, Jordan, to assess

progress since the EFA Conference in Jomtien. The United Nations

This document was written for Oxfam America. Portions of it may be found in other publi-

cations by Nancy C. Alexander, including: "Accountability to Whom: The World Bank and Its

Strategic Allies," published in DerdeWereldin May 1998;various issues of "News & Notices for

World Bank Watchers"; "NGOs in the International Monetary and Financial System," (with

Charles Abugre) in InternationalMonetary and Financial Issues for the 1990s, published by

UNCTAD; and "Financing for Development," published by Friedrich Ebert Stiftung.

Requests for reprints should be sent to Nancy C. Alexander, Director of the Citizens' Net-

work on Essential Services, A Project of the TIDES Center, 7000B Carroll Avenue, Takoma

Park, MD 20912.

285

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

International Children's Emergency Fund (UNICEF, 1998) cites the find-

ings of the conference report:

Overall, primary enrolment was the brightest sign of progress by

mid-decade, with some 50 million more children in developing coun-

tries enrolled in primary school than in 1990. Discouragingly, howev-

er, this figure only managed to keep pace with the numbers of chil-

dren entering the 6- to 11-year old age group over the period. (p. 15)

Unsatisfactory progress was noted in some regions-South Asia and sub-

Saharan Africa. Progress in educating girls had also been disappointing.

During the five years following the conference, little gain was recorded

in the developing world in girls' primary enrollment as it rose only by

a fraction of a decimal point, from 45.4% in 1990 to 45.8% in 1995. The

gender gap in adult literacy actually widened over the same period.

(UNICEF, 1998, p. 15)

At the World Education Forum in April 2000, the international commu-

nity promised to launch a "global initiative" to mobilize resources to sup-

port national education efforts. However, since the Dakar, Senegal,

Forum, there has been no headway toward launching the initiative.

Educational progress is uphill. The world economic slump has hit

developing countries hard. Many are in recession or depression. Mean-

while, the donor and creditor community is increasingly tight-fisted.

However, as discussed later, more money for education is not necessarily

the answer. Even with vigorous education campaigns, there will be disap-

pointing progress unless creditors-especially the International Monetary

Fund (IMF) and the World Bank-begin to support homegrown, national

development strategies and education action plans. In addition, the insti-

tutions need to change their policy prescriptions for ailing economies, in

general, and for the education sector in particular.

This article provides an overview of the roles of the IMF and World

Bank from 1980 to the present. It distinguishes between two types of

impacts exerted by the IMF and World Bank in the education sector of

borrowing countries: (a) the World Bank's direct involvement in the edu-

cation sector of developing countries and countrywide economic reforms

and (b) Structural Adjustment Programs (SAPs) financed by the IMF as

well as the World Bank.

The first two sections of this article address the World Bank's direct

involvement in education through project investments (e.g., school con-

struction, curriculum development, or textbook publication) and reform

of the education sector (e.g., school privatization, cost recovery, decentral-

ization). The third section addresses SAPs financed by the IMF and World

286

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

Bank. Unlike the World Bank, the IMF does not make project investments

or reform education policies; it only engages in structural (and sectoral)

adjustment lending. The impacts of IMF- and World Bank-financed

adjustment programs ripple throughout a society, including households

and school systems.

Few independent analysts have attempted to evaluate the impact of

adjustment on education. This is unfortunate because adjustment policies

are a more powerful influence on the education sector than education

projects. As a result of the hiatus in research, we are significantly depen-

dent on the World Bank and IMF for their own evaluations of the impact

of adjustment on education.

This article finds that the operations of the institutions have had both

positive and negative impacts. The net influence of each institution has

been different in different countries, among different groups within coun-

tries, and in different time frames. Much of the literature about the impact

of the institutions addresses their track records in the 1980s, when even

according to their own admission, the institutions paid scant attention to

the impacts of their economic reform loans on vulnerable people.

This article underscores the World Bank's conclusion that, in many

countries, adjustment lending had a negative impact on primary educa-

tion in the 1980s. During the 1990s, there appears to be a weak, but posi-

tive, response to measures taken by the institutions and borrowing coun-

tries to modify SAPs. That is, in some circumstances, safety nets and

education investments have helped to stem school enrollment declines or

increase enrollments.

In 2002, the World Bank Group launched a Private Sector Development

(PSD) strategy that aims to expand the provision of educational services

by private firms and nongovernmental organizations (NGOs). In selected

instances, this approach may have merit. In general, however, the PSD

strategy endangers educational progress because it ignores the lessons of

experience. Among other things, it ignores the fact that when educational

services are provided at cost, they will not reach poor populations even

when subsidy schemes are used.

To analyze the influence on education of the IMF and World Bank oper-

ations, this article reviews the following issues:

* IMF and World Bank loans. Historically, the IMF and World Bank

provide loans1 at market rates as well as credits at concessional

1Technically, governments with active IMF programs are not "borrowers," although the

term is used in this article. They are actually "purchasers" of resources, some of which they

contribute to the IMF

287

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

rates (with interest rates below 1%). Shortly, the World Bank will

increase its levels of grant assistance.

* The volume of resources for education. Too often, the public sees

increasing amounts of resources for education as a good thing.

However, history shows that "aid" has sometimes been used to

dismantle education systems. Greater quantities of aid should be

used only to support good education policies.

* The types of loans: projects investments or adjustment loans. Over

time, adjustment loans generally have a stronger influence on edu-

cational outcomes than do investments in education projects.

* The purposes of reform. The purpose of many adjustment pro-

grams (e.g., cutting deficits and lowering per pupil costs) can com-

plement or conflict with educational goals.

* The impacts of reform. In many countries, the formulae used by

the Bank to reform the education sector have had more negative

than positive impacts. Furthermore, SAPs have often sabotaged

educational progress while weakening the state. Ultimately, the

state needs to be the guarantor of educational access, quality, and

progress.

IMF and World Bank Instruments: Grants and Loans

As a rule, bilateral donor governments and United Nations agencies

provide grant aid, whereas the World Bank and IMF provide loans and

credits. Hard currency debt obligations to the institutions must be repaid.

Grants are usually more valuable to countries than foreign loans;

"soft," or concessional, credits are more valuable than "hard," or market

rate, loans. Concessional loans have a significant grant component; they

have low interest rates and long grace periods.

The World Bank has facilities that offer both types of loans. The Inter-

national Bank for Reconstruction and Development (IBRD) extends so-

called "hard" or market rate loans. The International Development Asso-

ciation (IDA) extends concessional credits to poorer governments. IBRD

and IDA together constitute the World Bank.

The United States is exerting tremendous pressure on the IDA to pro-

vide an increasing amount of grant financing, especially for education.

Ordinarily, this would be good news. However, the United States wants

the World Bank to privatize education and use the grants to offset the

costs of providing education to poor populations. Experience demon-

strates that efforts to offset educational services through subsidy schemes

seldom work.

288

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

The Volumeof ResourcesforEducation

Grant assistance has declined over the last decade. In 1994-95, bilateral

donor governments provided less support for education (both in absolute

terms and as a percentage of total aid) than they did in 1989-1990 before

the 1990 EFA Conference in Jomtien. The good news is that the volume

and percentage of education aid devoted to basic education has tripled.2

World Bank lending for education has increased significantly since the

Jomtien conference. Overall lending for education doubled from the 1986

to 1990 period to the 1991 to 1998 period. Lending for primary education

has increased by 360%. In 1995, the volume of Bank loans ($3.1 billion)

represented 28% of all external finance for education.

Of the approximately $15 billion in education loan commitments made

by the World Bank from 1991 to 1998, two thirds were at market rates. One

third ($5.7 billion) was for poorer countries, which borrow from the IDA

and are concentrated in Africa. From the mid-1980s to the mid-1990s, the

share of education lending rose for two regions-South Asia and Latin

America and the Caribbean; the share of education lending fell for four

regions-sub-Saharan Africa, Middle East and North Africa, East Asia

and the Pacific, and Europe and Central Asia.

The volume of World Bank assistance to the education sector under-

states the institution's influence, because high levels of assistance provid-

ed by bilateral donors usually help finance World Bank-financed projects

and policies. Bank assistance (indeed, all external finance) represents a

tiny proportion (0.5% of 1%) of global spending for education. However,

in some times and places, it is significant in terms of volume of resources

for, and influence on, education. For instance, during the 1980s, Bank

resources constituted 16% of the resources available to African govern-

ments for education.

The Typesof Loans

Project lending is very different from adjustment lending. World

Bank-financed projects take 5 to 7 years for implementation. In contrast,

adjustment loans are quick disbursing.

Adjustment loans-SAPs and sector adjustment loans (SECALs)-

influence both the demand for and supply of educational services. Demand

2Germany,Japan, the United Kingdom, France, and The Netherlands shifted considerable

aid into basic education. Australia, Austria, Canada, Denmark, Finland, Switzerland, and

the United States made modest shifts. Belgium, Italy, and Norway decreased allocations to

basic education.

289

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

for educational services is elastic; that is, demand rises or falls as direct

and indirect costs of education rise or fall relative to a family's income

level. Families make choices and set priorities. Often, families place a

higher value on education of boys than girls.

The Purposesof Reform

In addition to influencing the incomes of households and the cost of

education, SAPs attempt to reduce the budget deficits of borrowing gov-

ernments. Because education budgets usually constitute a significant por-

tion of the federal budget, SAPs often change the level or composition of

education spending. Such changes affect many aspects of school systems,

such as school construction, administration and maintenance, teacher

salaries and benefits, and educational materials.

Generally, adjustment loans for the education sector or for an entire

economy are more powerful and influential than project loans. Hence, an

understanding of the net impact of the IMF and World Bank on educa-

tion relies heavily on an understanding of the impact of adjustment

loans.

Adjustment loans for the education sector may attempt to privatize

and decentralize education while recovering costs through user fees.

They also reorient spending from secondary and higher education to

basic education. These "recipes," or formulaic approaches to the educa-

tion sector (World Bank, 1979), have often retarded educational

progress. In addition, the goals of SAPs often conflict with the goals for

education.

From 1980 to 1993, there were more than 3,000 policy conditions

attached to World Bank SAPs, but only 50 related to education. Of these

50, only 6 explicitly called for increased spending on education.3 Now

social conditionality (requirements in a loan agreement in addition to the

terms of repayment) is the rule rather than the exception. However, social

conditions are often discretionary. The important binding conditions on

SAPs (e.g., "up-front conditions," which are imposed at negotiation,

preappraisal, and prior to release of loan installments, or tranches) may

have an adverse impact on the social sectors. Among other things, these

binding conditions usually induce governments to cut budget deficits,

which puts pressure on social sector spending.

3Figures derived from a list provided to the author by the Poverty Reduction & Economic

Management Network of the World Bank.

290

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

The World Bank Group's4 Approach to the

Education Sector

Volumeof Assistancefor Education

One can gauge the influence of a donor or creditor on the education

sector of a developing country by reviewing the volume of assistance and

its type, purpose, and impact. Too often, the volume of assistance provid-

ed by a financier is used as a proxy for effectiveness. This is misleading.

Forms of Assistance: Grants and Loans

Bilateral donor governments and United Nations agencies give grants

to developing country governments. Grant resources may seem more

valuable to developing country governments than loans, because grants

do not need to be repaid. However, the World Bank is considering extend-

ing grant assistance to subsidize privatization of education in borrowing

countries.

Declining GrantAidfor the EducationSector

In 1994 and 1995, bilateral donor governments provided less support

for education (both in absolute terms and as a percentage of total aid) than

they did in 1989 and 1990 before the 1990 EFA Conference in Jomtien.

However, the percentage of education grants devoted to basic education

tripled during this period.

In the early 1990s (1991-1994), the volume of Bank loans for education

($7.9 billion) represented 40% of all bilateral grants ($19.8 billion). This

percentage has increased. According to UNESCO's (1998) WorldEducation

Report, the World Bank's education commitments represented 46% of

bilateral assistance and 28% of all assistance in 1995 (Table 1).

4The World Bank refers to the institution's market rate window, the IBRD, as well as the

concessional window, the IDA. The IBRD is the facility for countries with per capita annual

incomes exceeding $925; IDA is the facility for poorer countries. IDA provides "soft," or con-

cessional, loans to the poorest countries, which are concentrated in sub-Saharan Africa and

South Asia. Affiliate members of the World Bank Group include the International Finance

Corporation (IFC) and the Multilateral Investment Guarantee Agency.

291

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

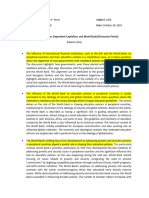

Table 1

1995 ExternalExpendituresforEducationin Millions of Current U.S. Dollars

Expenditure Amount

Bilateral assistance $4,450

All multilateral resources $2,717

World Bank ($2,057)

UN programs $278

UNESCO ($100)

Total $7,445

World Bank as % of total 28%

Note. From WorldEducationReport(p. 112), 1998, Paris:United Nations Educational, Scientific

and Cultural Organization. Copyright 1998 by UNESCO. Reprinted with permission. UN =

United Nations; UNESCO = United Nations Educational, Scientific and Cultural Organization.

TechnicalAssistance That Never ReachesDeveloping Countries

The Development Assistance Committee (DAC) of the Organization

for Economic Cooperation and Development (OECD) categorizes aid as

follows: investment projects, sector aid, technical cooperation, and other.

Importantly, 70% to 75% of all donor support since the mid-1980s has

focused on technical cooperation. Usually, most technical cooperation

monies and some project monies are spent in donor countries for purpos-

es such as training. Thus, it is calculated that 60% to 80% of all education

aid commitments are spent in donor countries (Bennell & Furlong, 1998).

Levelsand Typesof BankLending

Overall lending for education doubled from the 1986 to 1990 period to

the 1991 to 1998 period. During the 1990s, lending levels for basic educa-

tion have fluctuated wildly. In fiscal year (FY) 1998, the level of education

loan commitments-$3.1 billion-was three times the FY 1997 level. The

$3.1 billion level represents 36 loans to 28 countries, which is 9.1% of total

World Bank loan commitments of $28,594 billion. Commitments are dis-

bursed over a period of years. In FY 1998, education loan disbursements

totaled nearly $1.9 billion.

Basic EducationEmphasis

Bank lending for primary education increased by 360% from the 1986 to

1990 period to the 1991 to 1998 period. During the nine FYs 1990 to 1998,

the average annual level of lending for basic education was $809 million,

292

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

which is four times the annual average for the years 1986 to 1989. During

the 1990s, basic education constituted about one third to one half of Bank

education lending. Although basic education encompasses adult literacy

as well as primary education, adult literacy is not a Bank priority. In FY

1996, only two projects (in Ghana and in Indonesia) focused on this goal.

Prominenceof EducationOperationsin the Bank'sLoanPortfolio

The World Bank's medium-term plan for a borrowing country, the

Country Assistance Strategy (CAS), lays out the framework and rationale

for Bank investments in a country. A CAS is prepared every few years for

each borrowing country.5 The CAS describes plans for both kinds of lend-

ing operations: economic reforms, or SAPs, and project investments in

different sectors, such as agriculture, power, education, and health. The

World Bank's CASs identified education as a priority in 77% of all CASs

prepared during FY 1997 and the first half of FY 1998. Twenty percent of

the subject CASs proposed education loans; an additional 20% proposed

education research. Education loans represented 9% of all loans proposed

by the CASs, whereas education research represents 7% of all research

proposed by the CASs.

IBRD and IDA Lendingfor Education

International Bankfor Reconstructionand Development. In 1962, when

the Bank began education lending, there was controversy about whether

it was appropriate to use Bank finance (rather than grants) for education

purposes. The Board considered a proposal to use IBRD net profits for

education grants in IBRD countries. However, it was decided that net

profits should be channeled to low-income, IDA countries.

Of the approximately $15 billion in education commitments made

by the World Bank from 1991 to 1998, nearly two thirds were extended

by the hard loan window, the IBRD. The biggest borrowers for edu-

cation are IBRD or blend (both IBRD and IDA) countries: Mexico,

India, Brazil, Indonesia, China, Pakistan, Argentina, Korea, and the

Philippines.

5If country conditions change in the interim, the Bank updates the CAS by preparing a

new "short CAS" or a CAS "progress report."

293

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

International Development Association. During this time frame, over

one third ($5.7 billion) of the $15 billion in commitments represent credits

extended by the IDA. Most IDA countries are in Africa in which the ratio

of enrollments to the primary school-age population is declining. In FY

1998, 11 of 35 new education loan commitments were to IDA countries.

(Seven of the 11 were in sub-Saharan Africa.)

The World Bank's financing of education fell from an average of $2 bil-

lion per year in the 1990s to $1 billion per year for the last 2 years. These

levels continue to gyrate. Why? First, education is increasingly a priority

of powerful shareholder governments, such as the U.S. government.

Hence, the Bank is under pressure to "move money" for education. Sec-

ond, there are bottlenecks in the lending pipeline because many govern-

ments cannot or will not provide the local cost financing components of

education operations.

Implementation problems also stem from other factors, such as politi-

cal turmoil and weak institutions. Some Bank critics claim that SAPs,

which have downsized governments, are partly to blame for the inability

of governments to efficiently process and administer education loans.

International Finance Corporation.6 The power and authority of the

World Bank's private-sector affiliate, the IFC, is expanding.7 (The IFC has

a mandate to lend to, and take equity positions in, private ventures.8) The

IFC will increasingly team up with the Bank's soft loan arm, the IDA,

which lends to low-income governments. The Bank increased its budget

in FY 2002 to help finance expanded lending to low-income borrowers,9

which is expected to reach $7 billion in FYs 2002 to 2004.10Together, the

IFC and IDA are aggressively promoting the privatization of education.

The World Bank has an online service, EdInvest, which guides investors

to profitable ventures in the education sector.

6The IFC's approach to the education sector is described in Karmokolias and Maas (1997).

7The World Bank's (1995c) 1995 Annual Report referred to the institution's shift to sup-

porting private-sector investment (as opposed to direct lending to governments) as "a dra-

matic departure from what had been Bank policy for half a century."

8Forthe most part, the IFC would also take charge of the World Bank Group's on-lending

operations and policy risk guarantees. That is, if the market does not provide these services

to borrowing countries, the IFC/MIGA will provide them (or refer the borrower to the IBRD

and IDA).

90ne internal paper distributed within the Bank in March 2001 envisioned the Bank's

administrative budget growing from $1.2 billion in FY 2001 to about $1.3 billion in FY 2002.

It succeeds the Bank's FY 1998 to FY 2000 Strategic Compact.

l?IDA commitments increased to $6.8 billion for 134 projects in FY 2001, compared with

$4.4 billion for 126 projects in FY 2000.

294

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

The IFC's paper, IFC: Strategic Directions (World Bank, 2001), targets

five frontier areas for business expansion, including the social sectors,

infrastructure, small and medium-sized enterprises, domestic financial

institutions, and information technology and communications. Especially

in these areas, the IFC will increasingly take the lead in expanding private

provision of services,11 and IDA will work with governments to design

subsidy and other schemes to offset the costs of private provision to low-

income consumers.

Initiatives to privatize education are being taken without regard for the

needs and preferences of citizens in borrowing countries. Indeed, the IMF

and World Bank are suspending debt relief for several countries due to

their inadequate progress in privatization. Such coercive tactics subvert

efforts by citizens in borrowing countries to shape their own future

through national planning processes (e.g., the Poverty Reduction Strategy

Paper [PRSP] process; World Bank, 1992).

Regional patterns. From the mid-1980s to the mid-1990s, the share of

education lending rose for two regions-South Asia and Latin America

and the Caribbean; the share of education lending fell for four regions-

sub-Saharan Africa, Middle East and North Africa, East Asia and the

Pacific, and Europe and Central Asia. Of the six geographical regions,

Latin America and Caribbean and East Asia and the Pacific received the

most education resources-about 65%.

Demand for education loans. Governments prefer grant financing to

loan financing of education. Historically, demand for education loans has

been sluggish due to factors such as:

* The high level of sustained, recurrent costs (e.g., teacher salaries

and educational materials) required for effective education opera-

tions. Governments prefer to borrow for capital expenditures (e.g.,

construction of facilities).

* Education operations, like other operations, require that borrow-

ers provide counterpart funds. Borrowers provide almost 20% of

the total cost of education operations in counterpart funds. The

poorer governments have greater difficulty providing counterpart

funds.

"IFC investments increased four and a half times over in real terms between 1980 and

2000. The IFC's infrastructure department was created in 1992 and, by 2000, one fifth of IFC

lending went to private-sector infrastructure.

295

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

* Returns on education are realized in the long term. Education

operations do not usually generate a stream of revenues in the near

term. Nor do they directly contribute to the generation of foreign

exchange revenues, which can help to service foreign debts and

import goods and services.

Thus, although lending for education has been expanding since the late

1980s, demand by the poorest countries is much lower than demand by

lower middle-income and middle-income countries.

Many NGOs in developing countries oppose the government practice

of borrowing at market rates for social services, which they believe their

government should underwrite with their tax dollars. Some NGOs also

oppose greater World Bank provision of grants for education where

grants would subsidize the privatization of education.

Fungibility (the ability tofreely move moneyfrom one categoryof expenditure

to another). As described later, aid and credit are sometimes diverted for

other-than-intended purposes. Once assistance reaches a government's

treasury, it is fungible or transferable for any purpose. Education assis-

tance is especially fungible because governments are averse to providing

sustained levels of local cost financing for purposes such as teacher

salaries and educational materials. In addition, where there are IMF pro-

grams, governments may divert assistance to avoid violating IMF budget

deficit targets.

Staffing

The Bank has approximately 240 staff working in the education sector.

Of this total, about 20% have graduate exposure in the field of education.

The World Bank's 10,000 staff members are organized into thematic net-

works that provide services to country and regional departments.

The staff of the country and regional departments within the Bank hold

the reins of power in the Bank. A powerful country director, along with a

chief economist, staffs each Country Management Unit. In conjunction

with their client country or countries, these individuals coordinate the

design of CASs and determine the level and composition of lending,

including education lending.

The Country Management Units generate demand for the advice and

services of the Bank's thematic networks. The Human Development (HD)

Network supplies advice and services with respect to education, health,

296

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

and social protection operations to the country and regional departments.

The HD Network is relatively powerless compared with the thematic net-

works that focus on macroeconomic reform, private-sector engagement,

and infrastructure.

Lendingand Nonlending EducationServices

Lending Services

The principal loan instruments of the World Bank are (structural and

sectoral) adjustment loans and project investments.12 Adjustment loans

are popular with the World Bank and its borrowers because they are fast

disbursing and inexpensive to process. In contrast, project loans disburse

slowly over the course of 6 or more years.

As a rule, adjustment programs have a greater impact on the education

sector than do project investments. Thus, it is unfortunate that

researchers that seek to understand the influence of the World Bank on

the education sector tend to focus on education projects and overlook

adjustment programs. Hence, the public tends to have a distorted view of

the role of the World Bank and the IMF in education. Education sector

adjustment policies and structural adjustment programs are discussed in

the next sections.

StructuralAdjustment Programs

Adjustment loans, which aim to liberalize and privatize economies in

the context of strict budget discipline, are controversial and unpopular

for reasons described in the next sections. Hence, the IMF and World

Bank are gradually expunging the term adjustment from their lexicon. At

present, many World Bank adjustment loans to low-income countries are

now called Poverty Reduction Support Credits (PRSCs); IMF loans to

poor countries are called Poverty Reduction and Growth Facility

Arrangements. World Bank adjustment loans to middle-income countries

are being called Development Support Loans. These name games are cos-

metic; they are not accompanied by any change in the institutions' policy

prescriptions.

12Inaddition, the Bank and the IFC offer a variety of partial risk and partial credit guar-

antees to private investors. The IFC also takes equity positions in ventures.

297

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

SectorAdjustment Loans

Adjustment loans for the education sector often attempt to privatize

and decentralize education while recouping costs through various means,

including user fees.

Hybrid Loans

Adjustment provisions are also being packaged with project investment

loans. Hybrid loan instruments, including adaptable program loans (APLs)

and learning and innovation loans (LILs), combine adjustment and project

elements. The APL is a loan with a long-term development purpose and a

phased-in implementation process, which allows the borrower to pilot and

then scale up and replicate projects. Like the APL, the LIL allows a "grow-

as-you-go" approach to lending. However, it is smaller in scale. These new

instruments are especially well suited to education operations, which

involve a variety of governmental and nongovernmental stakeholders.

ProjectInvestments

In the early days of Bank project lending, nearly 80% of projects

involved civil works construction. The volume of construction has

declined steadily and now stands at about 23% of lending.

Most education expenditures are recurrent expenditures, such as

teacher salaries and benefits, textbooks, and other educational materials.

However, until the late 1980s, a Bank policy prohibited loans to support

recurrent expenditures. When this policy changed, the composition of

Bank lending changed. In 1995 to 1997, about 60% of operations supplied

equipment and textbooks or provided technical assistance.

Bank-financed projects focus on the supply side of education-that is,

provision of buildings, technology, and educational materials. Supply-

side financing works on the "field of dreams" theory that "if you build

the school, they (the students) will come."13 Providing a place in school

for every child is a demand-side as well as a supply-side challenge; fami-

lies must be able to afford the direct and indirect costs of educating their

children.

131n the 1989 movie Field of Dreams, a lover of baseball believed that if he built the perfect

ballpark, baseball players would rise from the dead to play.

298

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

Projects are only beginning to address issues relating to instructional

quality and "demand-side" barriers to education faced by certain popula-

tions. Barriers come in many varieties: language barriers, gender discrim-

ination,14 high direct and indirect costs, the opportunity cost of educa-

tion-that is, income foregone from children forsaking employment for

school, the location of schools in deprived rural settings, trade-offs

between investing in the education of different children within a family,

cultural and religious biases with respect to the value and type of appro-

priate education, and so on.

Nonlending Services

Training

In the late 1990s, six private foundations, 21 bilateral donors, and 20

multilateral development organizations funded activities of the Economic

Development Institute (EDI). During 1998 and 1999, EDI, which is the

Bank's training and education arm, had 21 core courses, one of which

focused on education reforms.

EDI's program on education reform is intended to "build capacity and

consensus for education reform in developing countries, focusing on

three areas, education financing, improved governance, and school and

teacher effectiveness." EDI also has a Girls Education Program, which is

part of the Partnership for Strategic Resource Planning, a multidonor col-

laboration with African countries led by African Women Educators

(World Bank, 1998a, p. 32).

In 1997, 11 companies gave substantial support for EDI's World Links

for Development, an electronic network for teachers and students on

development issues.15 This program reached 105 schools in 11 developing

countries in FY 1998.

EDI also has a program in Distance Education, Technology and Net-

works for Education, Health and Population, which "helps countries

use distance education, technology and networks to address problems

14Theaverage 6-year-old girl from a low- or middle-income country can expect to attend

school for 7.7 years; the average 6-year-old boy can expect 9.3 years of schooling (Patrinos &

Ariasingam, 1996).

15SunMicrosystems, URLabs, AMP, Cisco Systems, Advanced Network Services, Intel,

Apple, Lucent Technologies, Security Storage, Microsoft, and 3com.

299

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

of access and quality in their health and education sectors" (World

Bank, 1998a, p. 32).

Grant Giving

In late 2000, IDA began to provide a large volume of grants for educa-

tion in recipient countries. To date, however, IDA grant giving has been

limited to countries in conflict or projects funded by the Bank's Develop-

ment Grants Facility, which endorsed the first year of a multiyear program

to support UNICEF's education programs. In FY 1998, a $1.2 million grant

supported small-scale innovative programs at the community and local

levels to increase girls' enrollment rates. A partnership between the U.K.'s

Department for International Development, the Rockefeller Foundation,

and UNICEF (1998, p. 70) will study the implementation of girls' education

projects and initiative.

The Bank's Education Knowledge Management System is designed to

provide clients, partners, and staff of the Bank with the latest information

in the following areas: access and equity in basic education, effective

schools and teachers, education and technology, economics of education,

early childhood development, education system reform and manage-

ment, and postbasic education and training.

Research

Recent or forthcoming research reports include:

* Impact Evaluation of Education Projects: Decentralization and Pri-

vatization Issues

* Improving Primary Education in Kenya: A Randomized Evalua-

tion of Different Policy Options

* Child Labor and Schooling in Latin America

* When Learning Makes Reform More Productive: An Agenda for

Analysis

* El Salvador's School-Based Management Reforms

* Improving the Quality of Preschool Education in Kenya

* Evaluating the Impact of Supplementary Teachers in Nonformal

Education Centers

* The Impact of Colombia's Voucher Program: Using Randomization

Through a Lottery for Program Evaluation

* Economic Analysis in Education Projects

300

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

Monitoring and Evaluation

As of FY 1995, midterm reviews were conducted for only 12% of the

World Bank's education loans. As noted earlier, the Bank's (World Bank,

1997b) 1997 Annual Report,which concentrated on issues of development

effectiveness, states that the Bank's current systems for evaluating the

education sector are inadequate.

The Bank's monitoring and evaluation (M&E) system has been

plagued with difficulties. Borrowers sometimes resist using project

resources to collect data required for M&E. Moreover, until the 1990s,

M&E was seldom performed by client country constituencies, which have

the most intimate knowledge of the accomplishments of an operation.

In 1992, the Bank's Portfolio Management Task Force was disparaging

of Bank M&E. A 1994 Operations Evaluation Department (OED) study

found that Bank managers did not satisfactorily supervise projects or

report on their outcomes at completion. The study also found that track-

ing project indicators did not measurably contribute to project outcomes.

Historically, M&E has measured Bank inputs rather than outputs, or

results (e.g., schools built rather than children educated). Since 1992, the

Bank has concentrated on building results-based methodologies of M&E.

By 2002, the Bank was focusing on measuring results-based indicators

and seriously neglecting medium-term indicators. Hence, the Bank and

its borrowers are learning more about outcomes without understanding

what caused them.

Quality of Adjustment Lending

The Bank's OED provides misleading assessments of the performance

of adjustment programs. There are three types of adjustment perfor-

mance indicators: policy, intermediate, and outcome indicators. Policy

indicators reflect whether the government has complied with policy con-

ditions. Outcome indicators monitor progress toward growth and pover-

ty reduction goals. Intermediate indicators reflect progress toward

desired outcomes.

The OED relies heavily on policy indicators in claiming that 86% of FY

1999 and 2000 structural adjustment loans and 90% of SECALs performed

satisfactorily. (SECALs constitute roughly one third of all adjustment

lending by volume.) At the same time, OED finds that just 76% of adjust-

ment loans during these FYs were likely to sustain benefits over time. For

Africa, about half of its SECALS and 43% of its structural adjustment

loans were expected to sustain benefits.

301

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

A closer look at adjustment programs gives a gloomier view of their

performance. For instance, the Bank found that only 45% of FYs 1998 to

2000 adjustment operations addressed poverty issues adequately. Less

than 20% of a sample of adjustment loans linked adjustment policies with

efforts to reduce poverty; 22% of these loans made provisions for moni-

toring poverty and social indicators.

Another evaluation of adjustment loans found that:

The majority of [adjustment] loans do not address poverty directly, the

likely economic impact of proposed operations on the poor, or ways to

mitigate negative effects of reform. Even where traditional subsidy and

budgeting procedures are to be dismantled, the assumption is that

poverty alleviation is to be achieved through improvements in macro-

economic stability and in improvements in public administration, tar-

geting, efficiency, etc. ... Direct efforts to address short-term impact on

the poorest are rarely considered. (Environmentally and Socially Sus-

tainable Development Network, 1999)

Quality of ProjectInvestment Loans

The Bank's OED has generally measured project success relative to

three criteria: achievement of objectives, sustainability, and institutional

development.

Achievementof objectives. The OED found that for a cohort of projects

completed in the 1973 to 1993 time frame, over 82% achieved their stated

objectives, such as manpower development, skills training, access to and

quality of education, and institutional development.

Sustainability. An evaluation of 111 education projects supported by

the Bank since 1989, 62% were judged as likely to sustain their gains. Dis-

aggregated by region, we see that sustainability is exceptionally low in

African countries (56%) and Latin American and Caribbean countries

(50%),but higher in East Asian countries (85%).

Evaluation data show that project success is inversely correlated with

the number of years the Bank has been involved in the education sector.

(The longer the Bank is involved in the education sector, the less chance of

project success.)

302

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

The Bank is increasingly providing support for education, health,

water, and other basic services through social funds (SFs), which operate

in parallel to activities of borrowing governments. SF projects allow local

stakeholders to determine investment decisions through subproject pro-

posals, which they themselves prepare. In 2001-2002, the Bank is evaluat-

ing the relevance, efficiency, sustainability, and institutional development

impacts of SFs. This evaluation trivializes the extent to which SFs subvert

the authority and effectiveness of governments, because the SF operations

are usually carried out in parallel with federal and state programs-

almost like another line ministry. To make a sustainable, lasting contribu-

tion to social well-being, SF activities will need to be integrated with

mainstream social programs offered at the federal, state, and local levels.

World Bank Recipes for Educational Reform

Overview

The level of Bank support for education generally varies depending on

a borrowing government's willingness to undertake reforms recommend-

ed by the Bank. In principle, this makes sense. As a lender with fiduciary

responsibility, the Bank has a right to ensure that borrowers do not waste

or misuse resources. However, the Bank's recipes for reform are often

standardized and simplistic: privatize, decentralize, recover costs, and

transfer resources from higher to primary education. Because these

recipes are viewed as "goods," then it is often assumed that there is a lin-

ear relationship between the recipe and the outcome (e.g., if some decen-

tralization is good, then more must be better).

In and of themselves, these recipes are neither good nor bad. Their effica-

cy depends on the circumstances. In general, the analytical basis for Bank-

proposed reforms was developed in the industrial North. For instance, the

rationale for the Bank's 1990 primary education policy draws largely on

developed country experience as the basis for its policy recommendations.

There is a conspicuous lack of research and analysis of the impact of reforms

based on information and experience in developing countries.

Still, the application of simple, standardized recipes has revolutionized

the Bank's education portfolio. According to Jones (1992), a comparison of

loans approved in 1990 with loans approved in 1980 shows that (a) the

percentage of projects with increased privatization and cost-sharing rose

from 33% to 100%, (b) projects aimed at reducing recurrent costs rose from

33% to 78%, and (c) projects to expand secondary and tertiary education

declined from 50% to 11%. In 1990, 70% of projects called for increases in

303

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

primary schooling, 67% of projects reduced subsidies for secondary and

tertiary students, 56% raised tuition fees, 67% enlisted communities in

school construction, and 56% contained covenants encouraging govern-

ments to support private education (ones, 1992, pp. 177-178). Impacts of

the Bank's formulaic approach to fiscal adjustment and education reform

resulted in the widespread imposition of user fees, which in turn,

deprived generations of poor children of an education. As many studies

demonstrate, charges for basic services impose a tax on human develop-

ment (Oxfam International, 2001).

In October 2000, the U.S. government enacted a law requiring U.S. rep-

resentatives to international financial institutions to oppose any loan

operation that would impose user fees for primary education and basic

health care. Subsequently, the Bank beat a fast retreat from its past policies

of encouraging and even requiring user fees.

As of September 2001, the Bank's policy on user fees was ambiguous

(Adams & Hartnett, 1996; Bray, 1996a; Patrinos & Ariasingam, 1996; van

der Gaag, 1995; World Bank, 1996b). Although the Bank states principled

opposition to user fees for primary education, it often assumes that states

will continue to impose such fees. Hence, the Bank sees a role for itself in

carefully designing user fee policies so that poor people will not be hurt.

There is broad agreement among communities of educators and econo-

mists about the importance of certain economic and social values.

Although many policymakers agree on educational values, such as quali-

ty and equity, differences arise when such values are consistently subordi-

nated to economic values. In addressing the qualifications of teachers,

United Nations Educational, Scientific and Cultural Organization's

(UNESCO) 1998 World Education Report cites the International Labor

Organization's 1996 report, Impactof StructuralAdjustment on the Employ-

ment and Trainingof Teachers:

... No other aspect of structural adjustment programmes [than teacher

compensation] has demonstrated so clearly the increasing tendency of

national development policies to subject education to the same cost-

cutting logic of market forces that is applied to the overall system of

production: if qualified people are willing to teach for less pay than the

standard rates, then why not hire them? (UNESCO, 1998, p. 36)

UNESCO claims that the same logic is often applied to the issue of class-

room size. That is, in seeking economic efficiency one can continue

decreasing the teacher-pupil ratio, much as a factory manager would

attempt to increase output while cutting costs. Cost containment is an

important value when considered in tandem with the requisites of a quali-

ty education. Too often, the focus on efficiency eclipses educational needs.

304

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

Measures of internal efficiency may relate to (a) staff efficiency-

student-teacher ratio, multigrade teaching, multiple shifts, and length-

ened school week and school year (in general, the Bank emphasizes the

benefits of a lower teacher-student ratio [fewer teachers per class] and

shifting expenses from salaries to training and educational materials);

(b) reducing repetition and dropout rates; (c) efficiency of facility use-

percentage of time (day/week/month/year) facilities are occupied; and

(d) construction costs-simplify designs, use appropriate materials and

community labor while upholding safety and building standards. In con-

trast, external efficiency focuses on how education translates into jobs, pro-

motes productivity gains, reduces poverty, and increases social mobility.

Because staff with advanced degrees in education are in such short

supply in the Bank, staff deployed to the Bank's education unit often look

for simple, standardized solutions. Especially for weaker borrowers, the

provision of simple, standard answers to complex needs can be unhelpful.

This is worrisome because governments must be able to monitor and

evaluate the policies and practices of a burgeoning number of actors in

the education sector. If such actors lack accountability to governments,

the government will be unable to facilitate achievement of education

goals, such as universal primary education. If institutions in borrower

countries are challenged to design solutions to their unique circum-

stances, their capacity grows.

It is possible that, if the Bank's analysis had greater depth, the Depart-

ments of Education would seek out Bank experts in Western countries.

However, the Bank does not receive contracts from countries in the OECD.

Recipes

As noted earlier, the Bank has five major policy prescriptions for the

educational challenges of borrowing countries.

* Privatize.

* Recover costs through user fees.

* Implement demand-side financing.

* Decentralize.

* Transfer subsidies from higher education to basic education.

The Bank packages such products in adjustment or project loans. Here

are two typical Bank policy packages:

1. Increase the private costs of higher education; reduce public

financing of vocational education; finance loans for low-income

305

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

students; and transfer public resources from higher education to

basic education.

2. To improve resource utilization, the borrowing government should:

decentralize by establishing school-based management; offer fami-

lies a choice of schools; involve the private sector in financing and

service delivery; increase class size; provide incentives for teacher

achievement; and monitor educational outcomes and achievement.

Each policy prescription is defined and described in the following section.

Privatize

To some, privatization connotes transfer of ownership of education

facilities from government to private or nongovernmental entities. Here,

the term is intended to encompass all aspects of private-sector and non-

governmental involvement in education. Privatization can involve the

transfer from public to private hands of:

* Ownership of education facilities and other assets.

* Financing.

* Management.

* Delivery of education services.

Some estimate that private investment accounts for one third of educa-

tion spending globally, whereas public investment accounts for two thirds

of spending. In fact, there are insufficient data to know this with any

degree of certainty.

WorldBank GroupStrategies

The World Bank Group (including the private-sector affiliate, the IFC)16

emphasizes three options for public-private collaboration in education:

1. Private schools subsidized by public money.

2. Public schools that are privately managed.

3. Parental choice, which often involves providing parents with

vouchers that permit them to choose their children's schools.

16TheIFC committed to seven education projects in FY 1998, five of which are located in

West Africa.

306

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

The Shareof Private-SectorInvestment

The proportion of total spending from private sources ranges widely:

Haiti-80%, Hungary-6.9%, India-11%, Kenya-38%, Uganda-57%,

and Venezuela-27%. However, 90% of primary school students are

enrolled in public education systems (World Bank, 1995a, pp. 53-55).

Some governments, such as India's, have systems for supplanting pri-

vate financing with public financing. In India's Maharashtra State, the

government will absorb costs of funding schools after they have scored

high on key capacity-building areas.

Boosting Privatizationof EducationThrough

Output-BasedAid Schemes

Increasingly, education systems will be administered through output-

based aid (OBA) schemes, in which the government delegates service pro-

vision to private (or nonprofit) providers and compensates providers only

after services are delivered (e.g., after students pass standardized tests).

OBA focuses on achieving measurable results. In education systems in

the United States and elsewhere, student achievement, as measured by

success on standardized tests, is considered an "output" or a "result." But

in the United States, student achievement has not been improved after

almost a decade of obsessive focus on standardized testing. Even when

school districts use performance contracting to hire and pay private firms

to produce a single output (e.g., higher test scores), firms do no better

than public schools. Hence, the growing, large-scale resistance to the

emphasis on standardized testing by parents and educators. What is sur-

prising at first is that outputs-massive levels of standardized testing-

have not redirected funding within education systems in any significant

way. The sector has been beset with confusion about what criteria to use

to award funding increases to high-performing or low-performing

schools.

The chances of poor people receiving services through output-based

schemes are poor for a host of reasons, including the following:

* The difficulty of targeting subsidies and leakage, or capture, of

subsidies by well-to-do groups. For instance, the bureaucratic

apparatus needed to conduct means testing to target subsidies and

exemptions has, in some cases, been shown to cost more than sub-

sidies themselves.

* The incentives for private providers to pocket subsidies or inflate

losses (e.g., provide low-quality or no service).

307

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

* The lack of regulatory mechanisms, which can oversee and enforce

OBA contracts and ensure that services are delivered in acceptable

ways.

* The lack of judicial mechanisms that permit poor users to appeal or

seek recourse when a contractor fails to deliver services in the spec-

ified manner. It is unrealistic for the PSD Strategy to assume that an

arm's-length relationship will exist between borrowing govern-

ments and service providers

* The fiscal liabilities assumed by the public sector when OBA

schemes fail.

* Resistance to foreign service providers. Increasingly, contractors in

OBA schemes will be international or foreign service providers,

which will exacerbate cultural conflicts, access, affordability and

accountability problems. Usually, domestic service providers will

lack the "deep pockets" for up-front financing for health, educa-

tion, or water services, as required by OBA schemes.

Social Funds

One way of devolving government responsibility for education is the

SF. As noted earlier, SFs channel monies to local communities for small-

scale projects to reduce poverty by, among other things, delivering social

services and creating jobs. SFs were originally designed to accompany

adjustment programs in Latin America. Because the SFs bypass govern-

ment bureaucracies, they sometimes offer speedy services. However, SF

programs fail to coordinate their activities with those of government min-

istries. They can also cater to special interests.

SFs have become widespread. The Bank has helped to establish SFs in

22 countries, including Bolivia, Cameroon, Ethiopia, Honduras, Senegal,

Uganda, and Zambia. Funds generally pool resources from multiple

donors and creditors.

Examples

Chile. Beginning in 1980, the government provided incentives for pri-

vate schools to compete with public schools by providing vouchers for

both. The percentage of subsidized private primary school enrollment has

doubled and stands at one third (33%).

Colombia. British Petroleum, in partnership with the government and

in association with a World Bank-financed project, is setting up pilot proj-

308

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

ects in municipalities to establish integrated family care centers. British

Petroleum is involved in large-scale oil exploitation in various parts of

Colombia. Colombia has also initiated a Bank-supported program to pro-

vide vouchers (financed by the central and municipal governments),

which students can use to attend private schools.

Pros

* Like private education, public education is often biased against the

poor. In the case of public or private provision, access to education for dis-

advantaged groups can require subsidies.

* Unlike public systems that can run deficits, private systems must

exercise financial discipline and still remain competitive.

* Teachers' unions can sometimes protect the employment and wage

interests of public teachers at the expense of other interests (e.g., recurrent

expenses, such as materials and training).

* In some countries, the public-sector provision of education is highly

inefficient and poor in quality. These deficiencies reduce demand for edu-

cation.

Cons

* The responsibility of federal, state, and municipal governments for

oversight and supervision of the education sector can diminish when edu-

cation functions are transferred to the private sector. OBA schemes and SFs

often circumvent and undercut the government. In turn, this can undercut

achievement of education goals, such as universal primary education.

* Fewer and fewer Bank loans by the end of the 1980s were free of the

obligations imposed by loan conditionality to promote the privatization

of education through the building up of systems of private institutions

and the expansion of user charges in the public sector. Bank-promoted

subsidization of private schools increased to questionable levels when it

was in clear danger of jeopardizing public commitments to educational

quality, in both public and private institutions.

* In theory, private school systems can foster greater financial account-

ability. However, where private schools are subsidized with public

money, financial discipline can be compromised. Thus, World Bank sup-

port for private school subsidies has been controversial.

* Private-sector actors, which the Bank's affiliate, the IFC, calls

"edupreneurs," and NGOs are not always properly equipped to provide

309

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

high-quality formal educational services on a large scale with financial

accountability. Their niche is usually in small-scale innovation.

* Private school systems can increase social stratification and

rural-urban divisions. Children of low-income and racial or ethnic minor-

ity families are often "ghettoized" in public school systems that underper-

form their private-sector counterparts.

* Sometimes poorly functioning systems, which are intended to subsi-

dize the direct or indirect fees for private (or public) education via vouch-

ers or other means, impede access to education (Lennock, 1994).

* Private teachers are usually not able to protect their interests

through collective bargaining.

* To succeed, SFs require strong project selection criteria, effective

monitoring and supervision, and integration with government-provided

services. Currently, they constitute a parallel delivery system. SF innova-

tions, principles, and technologies should be mainstreamed into public-

sector programs. SFs should also address the capacity-building needs of

local organizations.

RecoverCosts

The term cost recoveryrefers to the following:

* The cost of constructing educational buildings and facilities. It is

now common practice for such communities to absorb the cost of con-

structing school facilities. In fact, this is the main kind of cost recovery at

the primary education level still officially sanctioned or advocated by the

World Bank. The contributions of foreign aid to the capital costs of con-

struction are widely criticized. Aid is blamed for excessive costs for facili-

ties that are often inappropriate to the needs of communities.

* Textbook fees and the topping off of teachers' salaries are common-

place. Formal tuition fees are uncommon at the primary school level.

* The less visible costs to families involve: the costs of travel to and

lodging in proximity to schools and the costs of food and uniforms, or

clothing.

* There are also opportunity costs-namely work that children cannot

perform at home when they are at school. In general, girls contribute

more significantly to work around the home than do boys. There is also

the cash income foregone by children obtaining an education rather than

working for pay. It is significant to note that families need to make trade-

offs with respect to the education of their children. Increasingly, sec-

ondary schools impose more significant fees on families than do primary

schools. Consequently, parents who decide to pay the bill for one or more

310

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

secondary school students may find the direct or indirect costs of educat-

ing a primary school student less affordable.

Examples

Nicaragua. In the Bank-financed project that decentralized school

management (see following section, "Decentralize"), parents equated

decentralization, or participation, with the imposition of fees (cuotas)

on impoverished rural families. The system became highly controver-

sial and altered social relations inside the school. Parents said: "It is like

the institution is privatizing itself. They now say education is no longer

free. You have to pay for everything." Oxfam International (2001) pro-

vides additional examples of how education charges constitute a tax on

human development in Tanzania, Zambia, and Ghana.

Pros

* In theory, cost-recovery schemes can waive fees for primary school

and low-income children.

* In theory, recovery of costs can help ensure efficient and effective

spending.

Cons

* In practice, waiver and exemption systems often fail. Thus, for

low-income families, fees can be a barrier to school enrollment and

completion.

* Using both cost-recovery and demand-side financing mechanisms

may be inefficient when a majority of the students in the locale or

country are poor.

* Many countries have limited capacity to administer cost-recovery

and demand-side financing mechanisms.

ImplementDemand-SideAnalysis and Financing

Descriptionof the Issue

In the 1990s, Bank-financed projects still emphasized the supply side of

education-provision of buildings, materials, and technology. However,

increasingly, the Bank is conducting demand-side analysis (e.g., beneficiary

311

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

or social assessment) to identify problems that impede school attendance

of girls, low-income students, and other marginalized or disadvantaged

groups.

With the benefit of such analysis, education loans can be designed in

ways that increase school attendance. For instance, in Turkey, a number of

measures were taken to induce girls to attend school, including:

* Construction, extension, and rehabilitation of facilities, especially

those that can induce attendance of girls (e.g., secure boundary

walls, lavatories, and female teacher housing).

* Provision of secure transportation to and from schools in areas

where school closings have led to consolidation.

* Introduction of flexible school schedules, child care policies allow-

ing siblings to accompany students, and provision of double shifts

that make it easier for parents to forego girls' help at home.

* Incentives to increase the number of female teachers in rural areas

through provision of scholarships, housing, and hardship pay.

The Bank has also undertaken strategies to compensate families for the

cost of their children's education. Such strategies may involve stipends

(cash payments), community financing (through monetary or nonmone-

tary contributions), targeted bursaries (cash payments that go directly

to schools, municipalities, or provinces), vouchers (usually publicly

financed cash payments), and scholarships.

In 1995, school dropout rates in Brasilia were dramatically reduced when

Governor Buarque established an innovative scholarship program. The

program provided a stipend (or bolsa)equivalent to a minimum wage ($128

per month per family, regardless of the size of the family or the number of

children in the family) to every low-income family with children aged 7 to

14. Eligible families were in the lowest quintile of the income distribution

(with an income level less than $50 per month per family member) and

employed or searching for employment. A school savings program provid-

ed a deposit of approximately $90 into a savings account for each child of a

participating family who successfully completed a school year.

Enrollment statistics often mask demand-side problems. During the

late 1980s, enrollments were declining for poor populations in Cote

d'Ivoire, despite the fact that net enrollments and education expenditures

were increasing. In other words, increases in enrollments of nonpoor chil-

dren exceeded the decline among enrollments of poor children. The gap

in enrollment and in educational progress widened between the nonpoor

and the poor, between urban and rural areas, and between various socio-

economic groups (Grootaert, 1994, p. 131).

312

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

Payingfor Education

To achieve universal primary education, it is essential to boost the

demand by poor families for education by protecting and increasing

incomes and, at the same time, boosting the supply of education services

to disadvantaged regions and groups. Even after the significant declines

in primary enrollments in the 1980s, the Bank is hesitant about embracing

demand-side solutions. A recent Bank publication, "School Enrollment

Decline in Sub-Saharan Africa: Beyond the Supply Constraint," notes that

between 1981 and 1991, primary enrollment declined in at least 14 of 27

African countries surveyed. It concludes that declining incomes and

employment opportunities may affect household decisions and, therefore,

the Bank should not assume inelastic demand for education (Bredie &

Beeharry, 1998). It is puzzling that the Bank is so tentative about this con-

clusion, given the evidence about how declining income and employment

opportunities influence the decisions, including education decisions, of

poor families.

Demand-side solutions might include ensuring that IMF and World

Bank adjustment policies do not jeopardize livelihoods and diminish

incomes, user fees are eliminated, and indirect costs of schooling are cov-

ered by stipends and scholarships. Until recently, the Bank only consid-

ered strategies to offset the indirect costs of schooling. To that end, it ana-

lyzed the effectiveness of funding student subsidy schemes to increase

enrollment among the rural poor in several countries, including

Bangladesh, Brazil, Pakistan, and Tanzania.

Examples

The World Bank has instituted a variety of demand-side financing

schemes in Bangladesh (stipends for girls), Chad (community financing),

China (targeted bursary for poor and minority children and free text-

books), Colombia (targeted bursary, voucher system), Jamaica (student

loans), Mexico (targeted bursary for poor and indigenous populations),

and Pakistan (subsidies to private schools servicing low-income, rural girl

students).

Pros

* Demand-side financing can reduce or eliminate family costs for

schooling and raise enrollment rates.

* Where targeting of low-income children or girls is effective,

demand-side financing can enhance equity.

313

This content downloaded from 195.78.108.37 on Fri, 20 Jun 2014 18:43:39 PM

All use subject to JSTOR Terms and Conditions

N. C. Alexander

Cons

* The costs of applying for a waiver may be prohibitive. In Zimbab-

we, families were required to travel long distances to apply for

exemptions to fees. Furthermore, there were often long time lags

(6-9 months) in benefit payments.

* Financing may only compensate a family for partial costs of

schooling. Indirect costs of schools (e.g., transportation, clothing,

foregone income) may be prohibitive.

* Stipends may be misused or siphoned off.

* A social stigma may be attached to children in the populations tar-

geted for assistance.

* Systems may be difficult to administer.

Decentralize

Decentralization entails devolving the responsibility and the opera-

tions of the educational system from the federal government to subsidiary

levels of government, such as states and municipalities. In some countries

and regions, such as Latin America, centralized control over school fund-

ing, curricula, and personnel issues is seen as a remnant of colonialism.

Examples