Beruflich Dokumente

Kultur Dokumente

CIR V ROYAL TRADERS

Hochgeladen von

Horeb Felix VillaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CIR V ROYAL TRADERS

Hochgeladen von

Horeb Felix VillaCopyright:

Verfügbare Formate

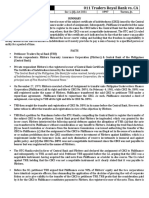

CIR v. Traders Royal Bank, G.R. No.

167134, March 18, 2015

Facts:

BIR issued an assessment against Traders Royal Bank (TRB) for deficiency of Document Stamp Tax (DST) for 1996 and 1997.

The deficiency was found to be on its declaration, among others, on its Trust Indenture Agreements. TRB opines that such Trust

Indenture Agreements are not subject to documentary stamp tax for the reason that the relationship established between parties is

that of the trustor and trustee, wherein the funds and/or properties of the trustor are given to the Trustee Bank not as a deposit but

under a Common Trust Fund maintained and to be managed by the Trustee.

CIR denied the protest of TRB on the ground that the Trust Indenture Agreements were but a form of deposit, hence subject to

DST.

The CTA Division, however, concurred with TRB that the Trust Indenture Agreements were different from a certificate of

deposit. It reasoned that the basic characteristic of trust, other fiduciary and investment management relationship is the absolute

non-existence of debtor-creditor relationship.

CTA en banc affirmed the cancellation of the assessments against TRB for DST on its Trust Indenture Agreements. Hence, this

present case.

Issue: Whether or not Trust Indenture Agreements constituted a deposit thereby subject to Documentary Stamp Tax?

Ruling:

SC is of the opinion that the conduct of the banks of trusts and other fiduciary business can only be determined through a

scrutiny of the terms and conditions embodied in the said agreements.

However, TRB was not able to present a Trust Indenture Agreements. Failing to dispose of such burden is fatal to TRB as the

agreements were not only in its possession, but more importantly, because its protest against the DST assessments was entirely

grounded on the allegation that the Agreements were trusts. Without the actual Trust Indenture Agreements, there would be no

factual basis for concluding that the same were trusts, as such not subject to DST.

For failing to present Trust Indenture Agreements and present proof of error in the tax assessments of the BIR, the SC affirmed

the assessments of the BIR. It disposed of the case as to wit:

“WHEREFORE, premises considered, the instant Petition for Review on Certiorari is GRANTED. The assailed Decision dated

February 14, 2005 of the CTA e n b a n c in C.T.A. EB No. 32, arming the Decision dated April 28, 2004 and Resolution dated

September 10, 2004 of the CTA Division in C.T.A. Case No. 6392, is REVERSED and SET ASIDE. Respondent Traders Royal

Bank is ORDERED to pay the deficiency Documentary Stamp Taxes on its Trust Indenture Agreements for the taxable years

1996 and 1997, in the amounts of P1,064,064.38 and P104,595.00, respectively, plus 20% delinquency interest from February

14, 2002 until full payment thereof.”

Das könnte Ihnen auch gefallen

- Understanding Named, Automatic and Additional Insureds in the CGL PolicyVon EverandUnderstanding Named, Automatic and Additional Insureds in the CGL PolicyNoch keine Bewertungen

- Compiled Tax Digests 1Dokument15 SeitenCompiled Tax Digests 1Dominique PobeNoch keine Bewertungen

- Taxation-2-Finals-Compilation (EDER) PDFDokument113 SeitenTaxation-2-Finals-Compilation (EDER) PDFEder EpiNoch keine Bewertungen

- University of The Philippines College of LawDokument3 SeitenUniversity of The Philippines College of LawGLORILYN MONTEJONoch keine Bewertungen

- CIR V Traders Royal Bank, GR No. 167134, Mar 18, 2015Dokument3 SeitenCIR V Traders Royal Bank, GR No. 167134, Mar 18, 2015SophiaFrancescaEspinosaNoch keine Bewertungen

- Cir VS Traders Royal BankDokument4 SeitenCir VS Traders Royal BankGLORILYN MONTEJONoch keine Bewertungen

- 011 Traders Royal Bank vs. CA PDFDokument2 Seiten011 Traders Royal Bank vs. CA PDFLoren Bea TulalianNoch keine Bewertungen

- PDF Tax Case Digest Gen Principles - CompressDokument3 SeitenPDF Tax Case Digest Gen Principles - CompressGarp BarrocaNoch keine Bewertungen

- Corpo DigestDokument8 SeitenCorpo DigestJillandroNoch keine Bewertungen

- G.R. No. 121171 December 29, 1998 Asset Privatization Trust vs. Court of AppealsDokument2 SeitenG.R. No. 121171 December 29, 1998 Asset Privatization Trust vs. Court of AppealsOrlando DatangelNoch keine Bewertungen

- 51 Bank of Commerce Vs RPNDokument5 Seiten51 Bank of Commerce Vs RPNDavid Antonio A. EscuetaNoch keine Bewertungen

- 1 CIR v. Traders Royal Bank GR No. 167134 Nov. 18, 2015Dokument16 Seiten1 CIR v. Traders Royal Bank GR No. 167134 Nov. 18, 2015AlexandraSoledadNoch keine Bewertungen

- Traders Royal Bank Vs Court of AppealsDokument2 SeitenTraders Royal Bank Vs Court of AppealsRostum AgapitoNoch keine Bewertungen

- Lee VS CaDokument3 SeitenLee VS CaVebsie D. MolavinNoch keine Bewertungen

- TRDokument21 SeitenTRanailabuca100% (1)

- Bangayan vs. RCBC DigestDokument2 SeitenBangayan vs. RCBC DigestCfc-sfc Naic Chapter100% (1)

- Bdo V Equitable BankingDokument2 SeitenBdo V Equitable Bankingבנדר-עלי אימאם טינגאו בתולהNoch keine Bewertungen

- Bank of Commerce v. Radio Philippines Network, Inc. - 2014Dokument56 SeitenBank of Commerce v. Radio Philippines Network, Inc. - 2014Eugene RoxasNoch keine Bewertungen

- (C 01) DBP vs. Sima Wei, 219 SCRA 736, March 9, 1993Dokument8 Seiten(C 01) DBP vs. Sima Wei, 219 SCRA 736, March 9, 1993JJNoch keine Bewertungen

- 192 Lee Vs CA 375 SCRA 579 (2002)Dokument3 Seiten192 Lee Vs CA 375 SCRA 579 (2002)Alan GultiaNoch keine Bewertungen

- Bank of Commerce V. Radio Philippines NetworkDokument4 SeitenBank of Commerce V. Radio Philippines NetworkGenesis LealNoch keine Bewertungen

- GR 146717Dokument2 SeitenGR 146717Maryanne UnoNoch keine Bewertungen

- Nego Compiled Case DigestsDokument26 SeitenNego Compiled Case DigestsGertrude PillenaNoch keine Bewertungen

- Bank of Commerce v. RPN DIGESTDokument3 SeitenBank of Commerce v. RPN DIGESTkathrynmaydeveza100% (1)

- Statcon Case Digest 2Dokument14 SeitenStatcon Case Digest 2Jui Aquino ProvidoNoch keine Bewertungen

- E B ' O Verdict: Accept: Ditorial Oard S BservationsDokument5 SeitenE B ' O Verdict: Accept: Ditorial Oard S BservationsRichik DadhichNoch keine Bewertungen

- Busuego Vs Case DigestDokument2 SeitenBusuego Vs Case DigestEricson MabaoNoch keine Bewertungen

- Icon Development Vs National Life InsuranceDokument4 SeitenIcon Development Vs National Life InsuranceParis ValenciaNoch keine Bewertungen

- Bank of Commerce Vs RPNDokument6 SeitenBank of Commerce Vs RPNGeorginaNoch keine Bewertungen

- Divina Nego OutlineDokument16 SeitenDivina Nego OutlineSamantha KingNoch keine Bewertungen

- Topic Digested By: Title of Case Case No. & Date of Promulgation Ponente Court Plaintiff/Appellant Defendant/Appellee Doctrine (Syllabus) FactsDokument2 SeitenTopic Digested By: Title of Case Case No. & Date of Promulgation Ponente Court Plaintiff/Appellant Defendant/Appellee Doctrine (Syllabus) FactsCali AustriaNoch keine Bewertungen

- Memorandum in Support of The Motion To DissmissDokument8 SeitenMemorandum in Support of The Motion To Dissmissval_guralnikNoch keine Bewertungen

- BDO V Equitable BankDokument1 SeiteBDO V Equitable BankArmand Jerome CaradaNoch keine Bewertungen

- Bank of Commerce, PetitionerDokument14 SeitenBank of Commerce, PetitionerEstela BenegildoNoch keine Bewertungen

- Nov. Monthly UpdatesDokument19 SeitenNov. Monthly UpdatesIshitaNoch keine Bewertungen

- G.R. No. 195615 - Bank of Commerce VDokument49 SeitenG.R. No. 195615 - Bank of Commerce VLien PatrickNoch keine Bewertungen

- 123 Charles Lee, Et Al Vs CA Phil Bank of Communications, GR 117913, Feb 1, 2002Dokument2 Seiten123 Charles Lee, Et Al Vs CA Phil Bank of Communications, GR 117913, Feb 1, 2002Alan GultiaNoch keine Bewertungen

- Credit TransactionsDokument13 SeitenCredit TransactionsClarinda MerleNoch keine Bewertungen

- Lee V Court of Appeals G.R. NO. 117913. February 1, 2002Dokument37 SeitenLee V Court of Appeals G.R. NO. 117913. February 1, 2002Mailah AwingNoch keine Bewertungen

- Compilation of Case DigestsDokument22 SeitenCompilation of Case DigestsMarietta Alquiza MagallonNoch keine Bewertungen

- Cir v. Traders Royal BankDokument17 SeitenCir v. Traders Royal BankPauline100% (1)

- EVALUATE THE ASSIGNMENTS SAYS THE SUPREME COURT - Carl Piazza v. Citimortgage - Supreme Court "Mediation, Directs Dist. Ct. To Evaluate AssignmentsDokument4 SeitenEVALUATE THE ASSIGNMENTS SAYS THE SUPREME COURT - Carl Piazza v. Citimortgage - Supreme Court "Mediation, Directs Dist. Ct. To Evaluate Assignments83jjmackNoch keine Bewertungen

- Banking Security V RCBCDokument6 SeitenBanking Security V RCBCReb CustodioNoch keine Bewertungen

- CIR v. PBCOMDokument7 SeitenCIR v. PBCOMcdacasidsidNoch keine Bewertungen

- 07 Bank of Commerce Vs Serrano (Flordeliza)Dokument2 Seiten07 Bank of Commerce Vs Serrano (Flordeliza)Rad IsnaniNoch keine Bewertungen

- CIR vs. First Express PawnshopDokument1 SeiteCIR vs. First Express PawnshopTogz Mape100% (1)

- Bpi VS Carlito Lee GR No. 190144Dokument2 SeitenBpi VS Carlito Lee GR No. 190144JC Hilario100% (1)

- 19 Chugani Vs PDICDokument2 Seiten19 Chugani Vs PDICJoshua Erik MadriaNoch keine Bewertungen

- Development Bank of Rizal Vs SIMA WEIDokument2 SeitenDevelopment Bank of Rizal Vs SIMA WEIhash_tntNoch keine Bewertungen

- Gateway v. Asianbank & Equitable v. RCBCDokument4 SeitenGateway v. Asianbank & Equitable v. RCBCAika MontecilloNoch keine Bewertungen

- Pvt. Ltd. in This Case The Tribunal Stated That The Existence of Dispute Signifies That A Suit or AnDokument3 SeitenPvt. Ltd. in This Case The Tribunal Stated That The Existence of Dispute Signifies That A Suit or AnRajeev SutrakarNoch keine Bewertungen

- Traders Royal Bank vs. CADokument2 SeitenTraders Royal Bank vs. CAMariaFaithFloresFelisarta100% (1)

- Income Taxation DigestDokument17 SeitenIncome Taxation DigestSitty MangNoch keine Bewertungen

- Letter of Credit Bar Q and A 1990-2017Dokument7 SeitenLetter of Credit Bar Q and A 1990-2017Ira Francia Alcazar100% (1)

- Digest in InsuranceDokument2 SeitenDigest in InsuranceFaith Imee RobleNoch keine Bewertungen

- NotesDokument8 SeitenNotesRegielyn RabocarsalNoch keine Bewertungen

- Security Bank Corporation vs. Great Wall Commercial Press Company (G.R. No. 219345) DigestDokument2 SeitenSecurity Bank Corporation vs. Great Wall Commercial Press Company (G.R. No. 219345) DigestCourtney TirolNoch keine Bewertungen

- 609 Letter Templates: The Ultimate Guide to Repair Your Credit Score. Learn How to Use Credit Report Disputes, Improve Your Personal Finance and Raise Your Score to 100+.Von Everand609 Letter Templates: The Ultimate Guide to Repair Your Credit Score. Learn How to Use Credit Report Disputes, Improve Your Personal Finance and Raise Your Score to 100+.Noch keine Bewertungen

- An Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersVon EverandAn Overview of Compulsory Strata Management Law in NSW: Michael Pobi, Pobi LawyersNoch keine Bewertungen

- Anonymous Complaint Against Atty. Cresencio P. Co Untian Jr. (Legal Ethics)Dokument2 SeitenAnonymous Complaint Against Atty. Cresencio P. Co Untian Jr. (Legal Ethics)Horeb Felix VillaNoch keine Bewertungen

- Anonymous Complaint Against Atty. Cresencio P. Co Untian Jr. (Legal Ethics)Dokument2 SeitenAnonymous Complaint Against Atty. Cresencio P. Co Untian Jr. (Legal Ethics)Horeb Felix VillaNoch keine Bewertungen

- Austria v. Crystal ShippingDokument1 SeiteAustria v. Crystal ShippingHoreb Felix VillaNoch keine Bewertungen

- 02 Herma Shipyard Inc. v. Oliveros Et Al GR No.208936, April 17, 2017, Citing Alu-Tucp, Del Castillo J.Dokument14 Seiten02 Herma Shipyard Inc. v. Oliveros Et Al GR No.208936, April 17, 2017, Citing Alu-Tucp, Del Castillo J.Horeb Felix VillaNoch keine Bewertungen

- Estate of The Late Juliana Diez Vda de Gabiel v. CIRDokument1 SeiteEstate of The Late Juliana Diez Vda de Gabiel v. CIRHoreb Felix VillaNoch keine Bewertungen

- ESCASINAS Vs SHANGRILADokument2 SeitenESCASINAS Vs SHANGRILAHoreb Felix VillaNoch keine Bewertungen

- ROGELIO NOGALES Vs CMCDokument2 SeitenROGELIO NOGALES Vs CMCHoreb Felix VillaNoch keine Bewertungen

- ANGELINA FRANCISCO Vs NLRCDokument2 SeitenANGELINA FRANCISCO Vs NLRCHoreb Felix Villa100% (1)

- LAZARO Vs SSCDokument1 SeiteLAZARO Vs SSCHoreb Felix Villa100% (1)

- PHILIPPINE GLOBAL COMMUNICATIONS V DE VERADokument1 SeitePHILIPPINE GLOBAL COMMUNICATIONS V DE VERAHoreb Felix VillaNoch keine Bewertungen

- Motion For Substitution of CounselDokument5 SeitenMotion For Substitution of CounselHoreb Felix Villa100% (1)

- CALAMBA MEDICAL CENTER Vs NLRCDokument2 SeitenCALAMBA MEDICAL CENTER Vs NLRCHoreb Felix VillaNoch keine Bewertungen

- Fort Bonifacio Development Corporation V CIRDokument1 SeiteFort Bonifacio Development Corporation V CIRHoreb Felix VillaNoch keine Bewertungen

- CIR Vs INSULAR LIFEDokument2 SeitenCIR Vs INSULAR LIFEHoreb Felix VillaNoch keine Bewertungen

- Tambunting VS CirDokument1 SeiteTambunting VS CirHoreb Felix VillaNoch keine Bewertungen

- In Re Sereno (2018)Dokument4 SeitenIn Re Sereno (2018)Horeb Felix VillaNoch keine Bewertungen

- Fianza v. PeopleDokument2 SeitenFianza v. PeopleHoreb Felix VillaNoch keine Bewertungen

- ARNEL CALAHI vs. PEOPLE OF THE PHILIPPINESDokument1 SeiteARNEL CALAHI vs. PEOPLE OF THE PHILIPPINESHoreb Felix VillaNoch keine Bewertungen

- Legal Forms - Request For AdmissionDokument5 SeitenLegal Forms - Request For AdmissionHoreb Felix Villa100% (1)

- CHILD LEARNING CENTER v. TAGARIODokument1 SeiteCHILD LEARNING CENTER v. TAGARIOHoreb Felix VillaNoch keine Bewertungen

- Cayao-Lasam v. RamoleteDokument1 SeiteCayao-Lasam v. RamoleteHoreb Felix VillaNoch keine Bewertungen

- M-I Drilling Fluids UK v. Dynamic Air Et. Al.Dokument23 SeitenM-I Drilling Fluids UK v. Dynamic Air Et. Al.Patent LitigationNoch keine Bewertungen

- Nomination FormDokument1 SeiteNomination FormSanthosh KumarNoch keine Bewertungen

- Re-Appointment Letter PDFDokument2 SeitenRe-Appointment Letter PDFShanto ChowdhuryNoch keine Bewertungen

- D D Basu Art. 19Dokument22 SeitenD D Basu Art. 19Kirti VyasNoch keine Bewertungen

- Abundo V Comelec GR No 201716 Jan 8, 2013Dokument11 SeitenAbundo V Comelec GR No 201716 Jan 8, 2013Chev CheliosNoch keine Bewertungen

- Summary of Authentication of Documentary EvidenceDokument2 SeitenSummary of Authentication of Documentary Evidencejuvpilapil100% (2)

- Foreign JudgementDokument7 SeitenForeign JudgementDerrick Ombura NazleyNoch keine Bewertungen

- Department of Labor: POWERS COLEEN L V PINNACLE AIRLINES ET 2005SOX00065 (JUL 19 2005) 144106 ORDER SDDokument16 SeitenDepartment of Labor: POWERS COLEEN L V PINNACLE AIRLINES ET 2005SOX00065 (JUL 19 2005) 144106 ORDER SDUSA_DepartmentOfLaborNoch keine Bewertungen

- AXA GUIDE - Distributor Agreement PDFDokument16 SeitenAXA GUIDE - Distributor Agreement PDFunfriendly.gy22680% (1)

- PIL - FormatDokument9 SeitenPIL - FormatSaket BisaniNoch keine Bewertungen

- Amjad Khan Vs The State On 20 MarchDokument6 SeitenAmjad Khan Vs The State On 20 MarchArpan KamalNoch keine Bewertungen

- Answers in LaborDokument14 SeitenAnswers in LaborMerabSalio-anNoch keine Bewertungen

- United States Court of Appeals, Tenth CircuitDokument12 SeitenUnited States Court of Appeals, Tenth CircuitScribd Government DocsNoch keine Bewertungen

- UNCW Policy: Verification of CredentialsDokument4 SeitenUNCW Policy: Verification of CredentialsBrandon WissbaumNoch keine Bewertungen

- Affidavit of Service: by Registered Mail and Private Courier ToDokument1 SeiteAffidavit of Service: by Registered Mail and Private Courier ToKrstn LiuNoch keine Bewertungen

- Criteria For Right of WayDokument2 SeitenCriteria For Right of WayAE KONoch keine Bewertungen

- Patent InfringementDokument7 SeitenPatent InfringementAzeem Rasic Nabi100% (1)

- Sec of Educ V Heirs of Dulay DigestDokument3 SeitenSec of Educ V Heirs of Dulay DigestPaolo QuilalaNoch keine Bewertungen

- Imprisonment: Violation PD 442Dokument4 SeitenImprisonment: Violation PD 442Kimberly RamosNoch keine Bewertungen

- Plebprocedure 2016Dokument51 SeitenPlebprocedure 2016makatiplebNoch keine Bewertungen

- 1624 1637Dokument5 Seiten1624 1637cris50% (2)

- Dy v. Bibat-PalamosDokument3 SeitenDy v. Bibat-PalamosTon RiveraNoch keine Bewertungen

- Section 10. Contestant To File Ground of Contest.: Rule 76 SECTIONS 10-13Dokument2 SeitenSection 10. Contestant To File Ground of Contest.: Rule 76 SECTIONS 10-13Bfp Siniloan FS LagunaNoch keine Bewertungen

- Preamble of The Constitution of IndiaDokument23 SeitenPreamble of The Constitution of IndiaBhanu100% (1)

- United States v. Robert A. Contestabile, Randelle Thornburgh, 989 F.2d 463, 11th Cir. (1993)Dokument4 SeitenUnited States v. Robert A. Contestabile, Randelle Thornburgh, 989 F.2d 463, 11th Cir. (1993)Scribd Government DocsNoch keine Bewertungen

- Notarial Practice Law - Lingan Vs CalubaquibDokument2 SeitenNotarial Practice Law - Lingan Vs Calubaquibhigh protector75% (4)

- International Commercial Arbitration - in PDFDokument14 SeitenInternational Commercial Arbitration - in PDFadvikaNoch keine Bewertungen

- Construction Contract VariationsDokument24 SeitenConstruction Contract Variationserrajeshkumar100% (2)

- ScriptDokument6 SeitenScriptMiguel CastilloNoch keine Bewertungen

- Rules of Legal ReasoningDokument31 SeitenRules of Legal ReasoningLEIGH100% (1)