Beruflich Dokumente

Kultur Dokumente

Impact of Governmental Policies On Foreign Direct Investment: A Case of Zimbabwe

Hochgeladen von

itaimadzivanyikaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Impact of Governmental Policies On Foreign Direct Investment: A Case of Zimbabwe

Hochgeladen von

itaimadzivanyikaCopyright:

Verfügbare Formate

Business Research Methods University of South Wales

Impact of governmental policies on Foreign Direct Investment: A Case of Zimbabwe

By Itai Madzivanyika

Madzivanyika Itai BS414 A1 Business Research methods

Abstract

While FDI has been a welcome development in Sub Saharan Africa in bridging the gap on

investment capital the story has been an indifferent one in Zimbabwe because the gains

realised by other neighbouring countries have not produced the same spill over effects to the

Zimbabwean economy. The purpose of this paper is to outline the role of political institution

and relevant policies determinants on FDI. This research explores the impact of government

policy on foreign direct investment in post independent Zimbabwe (1980-2015). The

research aims to use political risk rating indices as a measure of institutional policy

effectiveness. While there has been more research on non-institutional determinants of FDI

there has be less on the role played by institutional determinants such as observance of

property rights and legal systems which FDI. Priori there is a positive correlation between

high property rights index and the inward flow of FDI. Other macroeconomic, non-

institutional determinants of FDI such are the population size, human capital development,

capital intensity, and external debt to GDP ratio, infrastructural development such as road,

rail, and communication network.

Key words: Foreign Direct Investment (FDI), Political risk rating , Institutional factors, macro-

economic factors

Madzivanyika Itai BS414 A1 Business Research methods

Background Introduction

At independence in 1980 Zimbabwe inherited a highly regulated but successful economy.

The new government continued with the same path but introduced redistributive policies to

address the marginalisation of the black populace that had happened during the colonial era.

Muzurura (2015, p. 2) as cited from UNICTAD (2014) assets that the was marked growth in

the economy averaging 10.2 per cent driven by rising world metal prices, opening of trade to

export markets due to lifting of trade embargo which had previously been imposed on the

colonial regime. While there was growth there had been low inflow of FDI dating pre-

independence from Unilateral Declaration of Independence (UDI) in 1965. According to

Zwizwai, Kambudzi and Mauwa (2014) incipient droughts coupled by abortive economic

policies and highly social oriented public spending resulted in low GDP and a rising external

depth. This later resulted in Economic Structural Adjustment Programme (ESAP) in 1991 to

reverse this trend at the behest of the World Bank. The goal of ESAP was to shift from a

command economy to a market driven economy, liberalisation of foreign trade, exchange

control, pricing, monetary system and foster economic growth. Additionally the government

of the day introduced market driven interest rates, tax, tariffs and exports rebates. To

mobilise and improve the easy of attracting FDI the Zimbabwe investment Centre (ZIC) was

born. Despite all these conceited efforts ESAP was not able to address the structural deficits

in the economy instead it resulted in a rebound effect just like all other preceding economic

blueprints. The was increase in economic stability because due to market liberalisation the

economy which had aging machinery inherited from the colonial period was exposed to

competition resulting in local companies dwindling fortunes. Muzurura (2014, p.2) as cited

from WB (2012) asserts that there was also perception from the general populace that the

ESAP programme was a donor influenced package. The ZIC shifted from the original

intention of being a one stop shop but became a government tool for filtering investors who

were incongruent to the governmental policies. According to Gwenhamo (2009, p.5)

Cheaper imports from neighbouring South Africa, Botswana and increase of Chinese

investment resulted in the downward spiral of the economy. The government of the day

reverted to the interventionist approach witnessed from its early rule. Willing buyer willing

seller policy on land acquisition agreed during the Lancaster House constitution was

abandoned fast track land expropriation which resulted in disastrous consequences.

Agricultural production declined to all time low, increased money supply fuelled inflation, low

lines of credit resulted in budget deficits and decline in the provision of basic services such

as education, health care and availability of food staffs. The external debt increased to 6

Billion in 2011 with inflation rising to 231 million percent by 2008 resulting in the ditching of

local currency in favour of dollarisation in February 2009 as cited by Muzurura(2015, p.3)

Madzivanyika Itai BS414 A1 Business Research methods

from WB(2012). Against this background the study of institutional determinants of FDI in

Zimbabwe presents an interesting topic, there has been policy inconsistency as witnessed

by abortive policies and interventionist approach to redress ill implemented and advised

policies.

Overview of FDI inflow in Zimbabwe Post Independence era

FDI has always been the capital of choice in many developing nations in Sub Saharan Africa

(SSA). Despite neighbouring countries benefitting from this capital injection Zimbabwe’s

story is alarming considering it has natural resource endowments, low cost labour force,

highly trained human resources. According to UNICTAD (2015) there has been an upsurge

in FDI to Southern Africa, with neighbouring South Africa Zambia, Botswana and

Mozambique racking 51.84 billion, 14.05billion, 5.09 billion and 26.99billion respectively over

the past decade (2005-2015). Zimbabwe has only managed to attract 2.54 billion for the past

decade a pale shadow considering the higher human capital resource compared

neighbouring Mozambique for a country which is not at war like Libya, Central African

Republic and Burundi.

The government of the day has always been trying to put measures in place but never

getting the real deal. After the lapse of the 10 year period of independence Zimbabwe had to

adjust its economic blueprint to curtail the downward spiral due to social spending and

improve investment inflows. Economic structural Adjustment Programme (ESAP) was

introduced in 1990 on advice from the World Bank. Inflows reached an all-time high of 444

million since independence. However the trend has not been sustained on the upturn of the

new century. Inflows declined to a low of 3.8million in 2001 and 2003 steadily rising from

2009 to date as deduced from UNICTAD (2017). Zimbabwe’s ranking on the world rankings

of the Ease to do Business has been appalling ranked 161 out of 190 countries as

articulated on Doing business 2017. The Financial Express (2015) wrote that the Vice

President admitting that Zimbabwe has to improve on the Ease of doing Business if she was

to realise the boon that comes from FDIs.

Madzivanyika Itai BS414 A1 Business Research methods

FDI INFLOWS

600

500

400

MILLIONS US$

300

200

100

0

80 82 84 86 88 90 92 94 96 98 00 02 04 06 08 10 12 14

1 9 19 1 9 19 1 9 19 1 9 19 19 19 20 2 0 20 2 0 20 2 0 20 2 0

Figure 1 Source: Own Computation

Since the past decade (2006 to 2015), investment has averaged only 17% of GDP

whereas an investment rate of at least 30% of GDP is needed for economic growth

according to statistics from UNICTAD (2015). FDI decision are based on natural

resource endowments, infrastructural development, population and therefore potential

market size, human capital development, banking system, institutional policies like as

measured by political stability, ability to repatriate profits, ease of doing business.

According to Muzurura (2015, p.4) and Sikwila (2014, p.2) the low FDI attraction

performances in Zimbabwe are not consistent with the country’s potential, human capital

development and its vast natural resource endowments which are mature for exploitation

by resource-seeking investors.

This paper seeks to explore if institutional factors as identified using the Political

Resource Survey Group are contributory to the low FDIs inflows over and above the

macroeconomic factors that have usually been explored form previous studies by

Gwenhamo (2008), Anyanwu (2011) Sikwila (2015), Frimpong and Oteng-Abyie (2006);

Chinyere and Ugochukwu (2013) Ahiawodzi and Tsorhe (2013), Manda (2014), Busse

and Hekener (2005)

The study seeks answers to the following questions: What is the impact government

policy on FDI inflows into Zimbabwe? What policy factors matter most in boosting FDI

inflows to Zimbabwe? The study is significant given Zimbabwe’s low FDI inflows

compared to regional neighbours, low share of world trade, unpredictable foreign aid

inflows and erratic economic performance. FDI inflows offer the only tangible channel to

stimulate economic growth and improve Zimbabwe living standards given its ability to

Madzivanyika Itai BS414 A1 Business Research methods

bridge the gap on development budgetary deficits, reduce technological gap, and

improve productivity, employment creation, improving the GDP hence living standards

as supported by Busse and Hefeker (2005) and Dao (2013, p. 709). FDI also plays the

pivotal roles of filling in domestic savings, foreign exchange, export returns, and tax

revenue gaps as postulated by Busee and Hefeker (2005) and Muzurura (2014, p.5).

Whilst most studies on FDI in Africa concentrate on macroeconomic determinants of FDI

(see Sikwila, 2015 and Muzurura 2015) this study focuses only institutional determinants

of FDI inflows into Zimbabwe. The article is made up of five sections: section one is the

introduction on FDI in Zimbabwe. Section two covers theoretical consideration and

empirical literature; Section three presents the methodological framework. Section four is

for findings and discussions whilst section five is concerned with the conclusions and

recommendation.

Madzivanyika Itai BS414 A1 Business Research methods

Literature Review:

Studies on FDI inflows in developing countries have been determined by pull and push

factors as concurred by Busse and Hefeker (2005), Bénassy‐Quéré, Coupet and Mayer

(2005), Gwenhamo (2009), and Muzurura (2015). The quality of institutions have been

attributed to the mixed blessings from FDI. Most of the pull factors are endogenous to the

Multinational Company (MNC) investor such as firm size, external competiveness, low

interest rate in the host country and favourable political environment. Similar research on

FDI worldwide by Wei (2000), Walsh and Yu (2010) have showed that FDI inflow has a

positive correlation economic growth as measured by gross national income per capita

(GNI), negative correlation with inflation, positive correlation with population size and

negative correlation with political instability which has been affirmed by most research work

on FDI as deduced from Gwenhamo (2009) and Busse and Hekener (2005). They all agree

that lack of policy fundamentals cannot be replaced by government incentives such as tax

rebates, tax holidays and subsidies on imports of capital goods with the OECD checklist on

FDI(2003) also affirming that these are supplementary to the economic and political

fundamentals principles needed for creating an enabling environment for business growth.

Whilst most governance issues have been known to many African governments there has

been lack of political will to implement measures that are beneficial to the populace which

the institutions operate, resultantly the role of political fundamentals in attracting FDI cannot

be underestimated. Verwey (2007) “The political environment act like a cushion in which the

economy swim”

Madzivanyika Itai BS414 A1 Business Research methods

Methodology

Data over the post independent period in Zimbabwe was downloaded from the United

Nations Cooperation (UNICTAD 2015) for trade and development website. Property rights

indices and time series data extracted for the purpose of this exploratory study. This

research is there to explain the impact of government policy on inward Foreign Direct

Investment (FDI) flow using the case of Zimbabwe. For this topic I hope to use secondary

qualitative and quantitative data available from government’s statistical information, World

Bank statistics, Organisation for Economic Co-operation and Development (OECD)

information, professional as well academic data. Secondary validated data will come in

handy and relevant to my research. It is readily available and accessible electronically on

internet resources so is easy to compare from a wealthy of resources.

The analysis comprises the period 1980 to 2015 on GNI and political risk rating from 1996 to

2015 with the data from 1996 being collected on 2 yearly intervals and the yearly from

2000.on Zimbabwe. Data is also collected from Doing Business for comparison of Zimbabwe

with its neighbours of which the linkage between political institutions and FDI is of particular

concern (see Appendix C Doing business ranking and indices).

Information on political risk and institutions are taken from the International Country Risk

Guide (ICRG), provided by the Political Risk Services (PRS) Group. Publicly available data

on the summarised data from the World Bank website is used for the analysis. The

summarised country risk rating indicators as defined by the PRS Group the indicators do not

only rate political risk, but also various components of political institutions. They are defined

as follows according to World Bank (2015). The PRS prefix on each code referring to the

Political and Risk Services Group who pioneered the study in 1984.

• Political Stability and Absence of Violence is the combined effect of Government

stability, internal and external conflict and the effects of ethnic tensions. The

combined effect has a code PRSPV. Government stability measures the

government’s adherence to carry out its policies and to stay in power.

• SOCIO measures socio-economic pressures arising in society that restrain

government action or raises social disgruntlement that destabilises the political

regime. Incorporated in the combined effect PRSPV

• INVEST coded PRSRQ stands for the risks on an investment profile such as

inability to repatriate profits, expropriation delays in payments which are not

covered by the risk financing or offset through an economic means.

• ICONFL stands for internal conflict, measuring political violence within the

country which can take the form of civil war, terrorism, political violence or civil

Madzivanyika Itai BS414 A1 Business Research methods

disorder and its actual or potential impact on governance. Denoted by combined

effect PRSPV.

• ECONFL weighs external conflict, namely the risk to the incumbent government

from foreign action, ranging from non-violent external pressure, such as

diplomatic pressures, withholding aid or trade sanctions, to violent external

pressures, ranging from cross border conflicts to all-out war. Denoted by

combined effect PRSPV.

• The effect of ETHNIC tensions is incorporated in combined code PRS PV

assesses the degree of tensions among ethnic groups attributable to racial,

nationality or language divisions, common in Africa because of fragmented

minority groups in the same nation or area.

• RELIG measures religious tensions, stemming from the domination of society

and/or governance by a single religious group seeking, for instance, to replace

civil by religious law or to exclude other religions from the political and social

process. Common amongst radicalised religions. Coded as PRSPV.

• CORR assesses the level of corruption. Denoted by code PRSCC.

• MILIT represents the influence of the military in politics, which could signal that

then government is unable to function effectively and that the country might have

an unfavourable environment for business. Coded on combined code as PRSVA.

• LAW Coded as PRSRL. Measures the rule of law and presence of order, i.e., the

ability to prosecute and unbiased the legal system.

• DEMOC relates to the democratic accountability of the government, that is, the

ability of the government to perform the mandate they were elected for by the

citizens but also to fundamental civil freedom and political rights. It is denoted on

the summarised table by PRSVA in this case denoting the combined effect of

military in politics and democratic accountability of the government to the

citizenry.

• BUR stands for the institutional strength and quality of the bureaucracy, which

might act as a shock absorber tending to reduce policy revisions if governments

change. PRSGE measuring the bureaucracy quality of the government.

Each indicator is assessed on a scale from 0 to 12, with higher values indicating less political

risk and better institutions. The World Bank data (2015) uses rating data with scale 1 to 6. As

depicted on appendix C. According to Busse and Hekener (2005), these indicators are

widely recognised as high-quality measures of political risk and institutions. From World

Bank (2005) analysis on the combined formulated data all the summarised political risk

factors are mostly positively related to each other as they all assess political risk and

Madzivanyika Itai BS414 A1 Business Research methods

institutions from different points of view. For instance the combined effect of government

stability, internal conflict and external effect as denoted by PRSVA is partially correlated to

regulatory quality (PRSRQ) and rule of law (PRSRL) with partial correlations 0.54 and 0.37

respectively. Similarly control of crime and corruption is positively correlated to regulatory

environment quality by a correlation of 0.75. Moreover most of the political risk factors are

strongly positively correlated to Gross National Income per capita. Contradictory results on

coming from rule of law and political stability and absence of violence which can be ignored

since studies form large samples of country data in Sub Saharan Africa have shown positive

correlations as asserted by WTO (2014) and Chakrabrati (2001)

Table 1 Correlation Matrix logGNI and Political risk indicators

log GNI PRSVA PRSPV PRSGE PRSRQ PRSRL PRSCC

log GNI 1

PRSVA 0.520104 1

PRSPV -0.02533 0.354355 1

PRSGE 0.574546 0.714035 0.198743 1

PRSRQ 0.7424 0.537988 0.22255 0.49552 1

PRSRL -0.09844 0.367475 0.72036 -0.00964 0.28691 1

PRSCC 0.664126 0.702784 0.513617 0.632183 0.746924 0.511788 1

In many of the previous exploratory studies on FDI by Sikwila (2015), Muzururura (2015),

Dao (2013); Akwaowo 2013), Walsh and Jianyang (2010), Gwenhamo (2009), Busse and

Hekener (2005) Chakrabarti (2001) and Wei (2000) population size, political risk indicators,

Gross Domestic Product or Gross national income, Inflation, trade are mostly the factors

used to explain the impact of FDI. Using per capita figures takes into account population

size. Regarding the independent variables of foreign investment, a standard procedure

would be to use a common theoretical model for the determinants of FDI flows, integrate

political risk indicators and then estimate the effects. A statistical regression model can be

used to infer the behaviour of FDI due to varying macro-economic and political institution

indicators.

Market size, economic performance measured as Gross Domestic Product (GDP) or Gross

National Income (GNI) per capita, is probably the most important factor in explaining foreign

investment according to Busse and Hekener (2005). Market size plays a big role for

horizontal FDI (market seeking investment). According to Carkovic and Levine, (2002) high

Madzivanyika Itai BS414 A1 Business Research methods

(GDP or GNI) growth rates indicate the purchasing power in the market which may signal

high investment returns which are attractive to MNC. However endogeneity may arise since

high incomes may be boosted by FDI inflows (Gwenhamo et al 2009).

Openness to trade is another determinant of FDI. It is usually measured by the ratio of

imports and exports to GDP. This ratio is quantifies trade restrictions. In general, the impact

of openness to trade is linked to the type of foreign investment (Asiedu, 2002). Horizontal

FDI may be attracted by highly regulated market since they protect the MNC from

competitors while open market favour vertically expanding MNC which reduce trade barriers

since trade barriers increase cost of production, are an indicator of market imperfections

such as exchange controls which limit the ability to repatriate profits.

X

The empirical linkages between political risk, institutions, Growth, inflation and GNI can be

deducted from the following equation on FDI flows.

log FDIi = ß0 + ß1 log GNIi + ß2 GROWTHi + ß3 log TRADEi + ß4 log INFLATIONi

+ ß5 POLITICALi + ei (i)

Where ßj are the estimated parameters coefficients and the parameters stand for

1. GNIi, -Gross National Income per Capita current international in USD

2. GROWTHi- for market growth and potential

3. TRADEi- to control the openness of trade

4. INFLATIONi as a proxy for macroeconomic distortions

5. POLITICALi stands for indicators for political risk and institutions,

6. ei is an error term.

Gross National income, market growth and Trade are expected to be positively correlated to

Foreign Direct Investment inflows whereas for INFLATION we would assume a negative

linkage as asserted by Busse and Hekener (2005). Favourable policies would have a

positive linkage to FDI

Madzivanyika Itai BS414 A1 Business Research methods

Data analysis

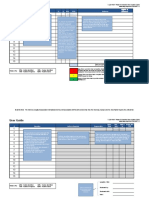

Table 2 Regression Analysis Log GNI as Proxy for FDI

Regression Statistics

Multiple R 0.897770877

R Square 0.805992547

Adjusted R Square 0.689588075

Standard Error 0.041590697

Observations 17

ANOVA

df SS MS F Significance F

Regression 6 0.071862943 0.011977157 6.92406859 0.004060688

Residual 10 0.01729786 0.001729786

Total 16 0.089160804

Coefficients Standard Error t Stat P-value Lower 95% Upper 95%

Intercept 3.283882792 0.140265538 23.41190029 4.5787E-10 2.971351697 3.596413887

0.42238437

PRSVA 0.194258809 0.232213544 0.83655245 4 -0.323145211 0.71166283

0.72467153

PRSPV -0.086535856 0.238855202 -0.362294206 4 -0.618738413 0.445666701

0.48978407

PRSGE -0.13953708 0.194613307 -0.716996604 9 -0.573162551 0.294088391

0.09180569

PRSRQ 0.234966073 0.126008277 1.864687604 9 -0.045797866 0.515730012

0.04701111

PRSRL -0.271730694 0.119998084 -2.264458615 7 -0.539103086 -0.004358302

0.05423270

PRSCC 0.357113385 0.163803005 2.180139394 9 -0.007862456 0.722089225

From the regression analysis there is a positive correlation between political risk indicators

and Gross national income (GNI) which in this case is being used as a proxy for FDI. This

implies the political institutions have a big role to play as far as creating a conducive

environment for enabling business growth. As highlighted from OECD (2003) policy

measures cannot be substituted incentives on Foreign Direct Investment as has been the

order of the day in Zimbabwe. Economic blueprints have been overridden for political

expediency as concurred by Zwizwai, Kambudzi and Mauwa (2014). Government

institutions have a role of crafting policies that are lure the investor. Not only are the policies

internally acceptable but follow the world leading practices. From statistics from the Doing

Business 2017 the Zimbabwean score and ranking has been appalling while the powers that

be accept that there need for alignment the political will has been lacking as historically

witnessed from abortive politics and interventionist policies which result in capital flight

Madzivanyika Itai BS414 A1 Business Research methods

From the table 3 below there is an issue of multi-collinearity between FDI and GNI since the

correlation between the 2 variables is greater than 0.8, 0.92 in this case. This implies the

regression model need to be improved upon if it is used as a predictive tool

Table 3: Correlation Matrix log FDI and FDI explanatory Variables

Log FDI log GNI Growth log Inflation Political Log Trade

Log FDI 1

log GNI 0.917690002 1

Growth -0.30182439 -0.58906006 1

log Inflation -0.84886564 -0.82735996 0.35679 1

Political 0.513728898 0.660520567 -0.78245 -0.579769804 1

Log Trade 0.182051799 -0.184893937 0.81656 -0.111776281 -0.541850837 1

Madzivanyika Itai BS414 A1 Business Research methods

Conclusion

Foreign Direct Investments are desirable for economic growth since they have spill over

effects such as bringing in foreign exchange, technology transfer, human capital

development through skills transfer and development, provide taxes to host countries, they

are less susceptible to crises and sudden stops. While these benefits can be realised to host

countries it is the business environment which have a pull effect on Multi-National

Companies (MNCs). Despite the Multinational Companies being able to influence policy

change the host governments have to create have a bigger role to play it creating a

conducive policy framework which have a pull effect on the MNCs However it is political risk

which is a source of concern which is deterrent to the investor as pointed out through this

min explanatory study. Time series data available from 1996 to 2015 derived from World

Bank summary data displayed that political risk plays a crucial role in attracting FDI.

Inference using a simple statistically model pointed out the effect of the rule of the law

respect of property rights, observance of civil and political rights, absence of internal and

external conflict, absence of radicalism emanating from religious groups are pivotal to

attracting FDI. Macroeconomic issues such as the GDP or GNI ratio, inflation and trade

openness play a pivotal role in enhancing a host country’s competitiveness as an invest

destination. This therefore calls for the political leadership to be aligned with the universally

recognised policy fundamentals impacting FDI. The government of Zimbabwe have to

display maturity to end the cyclic process which has been displayed since independence

which has been a turn off to MNC.

Madzivanyika Itai BS414 A1 Business Research methods

References:

1. Ahiawodzi, K. A. and Tsorhe, K. D. (2013). ‘Taxation and Private Investment in Ghana: An

Empirical Study’. British Journal of Economics, Finance and Management Sciences. 7(1)

2. Akwaowo, E (2013) ‘Exploring Foreign Direct Investments in Developing African Countries:

Their Effects on the Economic Growth in Cameroon (2006-2011)’, iBusiness, 5, pp.18-35,

[Online]. Available at: http://dx.doi.org/10.4236/ib.2013.51003 (Accessed: 30 March 2017)

3. Asiedu, E. (2002), On the Determinants of Foreign Direct Investment to Developing

Countries: Is Africa Different? World Development, Vol. 30, No. 1, pp. 107-119.

4. Bénassy‐Quéré, A., Coupet, M. and Mayer, T., 2007. ‘Institutional determinants of foreign

direct investment.’ The World Economy, 30(5), pp.764-782.[Online] Available at:

https://www.researchgate.net/publication/227700380 ( Accessed 15 may 2017)

5. BS4S14V1 Lecture Notes Philosophy of Research Notes 0215AZ [Online] Available at:

http://vle.southwales-online.com/mod/forum/view.php?id=22269 (Accessed: 10 April 2017).

6. Busse, M and Hefeker, C (2015) ‘Political Risk, Institutions and Foreign Direct Investment’

Hamburg Institute of International Economics Neuer Jungfernstieg 21 – 20347 Hamburg,

Germany

7. Cameron, S. and Price, B. (2014) Business Research Methods: A practical approach

McGraw- Hill Education

8. Carkovic, M.V. and Levine, R., 2002. ‘Does foreign direct investment accelerate economic

growth?’[Online] Available at: https://poseidon01.ssrn.com/delivery.php?

ID=174093090115102070027066088091102027020072023065091036126126064072084123

12103010305504909703006608811210610608101002306308608507009102112212000209

602407410508608505602011108211100610312008511606606411800607207002802707900

8011005006112025100124&EXT=pdf (Accessed 15 May 2017)

9. Chakrabarti, A., 2001. ‘The determinants of foreign direct investments: Sensitivity analyses of

cross‐country regressions. Kyklos’, 54(1), pp.89-114.[Online ] Available at :

http://onlinelibrary.wiley.com/doi/10.1111/1467-6435.00142/full (Accessed 10 May 2017)

10. Dao, M. Q (2013) ‘The Role of Policy Fundamentals in Fostering Economic Growth in

Developing Countries’ 4, pp.706-711 Modern Economy [Online] Available at:

http://dx.doi.org/10.4236/me.2013.411076 (Accessed: 30 March 2017)

11. Daude, C and Enersto, E. (2001)The Quality of Institutions and Foreign Direct Investment

http://econweb.umd.edu/~daude/research_files/institutions.pdf( Accessed 10 may 2017)

12. De Clercq, D., Hessels, J. and Van Stel A., (2008) ‘Knowledge Spillovers and New Ventures’

Export Orientation,’ Small Business Economics, 31(3), pp. 283-303.[Online] Available at:

doi:10.1007/s11187-008-9132-z (Accessed: 30 March 2017)

13. Dupasquier, C. and Osakwe, P.N., (2006). ‘Foreign direct investment in Africa: Performance,

challenges, and responsibilities.’ Journal of Asian Economics, 17(2), pp.241-260. Ebook

[ Online] Available at : https://books.google.co.zw/books ( Accessed: 18 may 2017)

14. Ezeoha, A.E. and Cattaneo, N., (2012) ‘FDI flows to sub-Saharan Africa: The impact of

finance, institutions, and natural resource endowment. Comparative Economic

Studies, 54(3), pp.597-632.’ [Online] Available at doi:10.1057/ces.2012.18 (Accessed on:15

May 2017)

15. Financial Express (2015) ‘Zimbabwe’s FDI Inflows Drop 23% In 2015: UNCTAD ‘ [Online]

Available at :http://fxzim.co.zw/2016/07/13/zimbabwes-fdi-inflows-drop-23-in-2015-unctad/

(Accessed 18 May, 2017)

16. Frimpong, J. and Oteng-Abayie, E. (2006). ‘Bivariate Causality Analysis between PFDI

inflows and Economic Growth in Ghana,’ MPRA Paper no 351

http://unctadstat.unctad.org/wds/TableViewer/downloadPrompt.aspx. (Accessed 18 May

2017)

17. Louw, L. and Venter, P. (2013). ‘Strategic Management. Developing Sustainability in

Southern Africa. New York: Oxford University Press.’

18. Manda, S. (2014). ‘Capital Flows and Current Account Dynamics in Zimbabwe.’ Journal of

Economics and International Business Management, Vol. 2(4) pp. 82-99 [Online] Available

at:http://sciencewebpublishing.net/jeibm/archive/2014/4/pdf/Manda.pdf ( Accessed 15 May

2015)

19. OCED 2006 ‘Policy Framework for Investment’[Online] Available at;

http://www.oecd.org/investment/investment-policy/36671400.pdf . (Accessed 10 May 2017)

20. OECD 2003 ‘Checklist for Foreign Direct Investment Incentive Policies.’ [Online ] Available

at :http://www.oecd.org/daf/inv/investment-policy/2506900.pdf (Accessed on 10 May 2017)

Madzivanyika Itai BS414 A1 Business Research methods

21. Schneider, F. and Bruno, F. (1985). ‘Economic and Political Determinants of Foreign Direct

Investment, World Development,’ Vol. 13, No. 2, pp. 161-175.

22. Ugochukwu, U.S and Chinyere, U.P (2013). ‘The Impact of Capital Formation on the Growth

of Nigerian Economy.’ Research Journal of Finance and Accounting Vol, (9) pp 36-42

23. Ugochukwu, U.S and Chinyere, U.P (2013). ‘The Impact of Capital Formation on the Growth

of Nigerian Economy’. Research Journal of Finance and Accounting Vol, (9) pp 36-42

24. UNCTAD (2010). Online, FDI/TNC database (www.unctad-org/fdistatistics).

25. UNCTAD (2014). ‘Foreign direct investments in Africa. United Nations: New York and

Geneva’

26. UNICTAD (2017) ‘Foreign direct investment: Inward and outward flows and stock, annual,

1970-2015’ [Online] Available at

http://unctadstat.unctad.org/CountryProfile/GeneralProfile/enGB/716/GeneralProfile16.pdf

(Accessed 10 May 2017)

27. Verwey, I. 2007. ‘Success Factors of Women Entrepreneurs in Construction. Development

Bank of Southern Africa.’ [Online]. Available at: <http://www.irbnet.de/>. (Accessed 21 Jan

2017)

28. Walsh, J. P. and Jiangyan,Y (2010) ‘Determinants of Foreign Direct Investment: A Sectoral

and Institutional Approach’ [Online] Available at

:https://www.imf.org/external/pubs/ft/wp/2010/wp10187.pdf( Accessed 17 May 2017)

29. Wei, Shang-Jin (2000), How Taxing is Corruption on International Investors?, Review of

Economics and Statistics, Vol. 82, No. 1, pp. 1-11. [Online] Available at

:https://www.google.co.zw/?

gws_rd=cr&ei=ZpgdWYWfOMTWwAKCvrHgDA#q=international+country+risk+guide

(Accessed 18 may 2017)

30. World Bank (2014). ‘The World Development Indicators 2014’[Online] Available

at:https://openknowledge.worldbank.org/bitstream/handle/10986/.../9780821399859.pdf

(Accessed 20 May 2017)

31. Zwizwai, B. , Kambudzi, A and Mauwa B.(2014) ‘Zimbabwe: Economic Policy-Making and

Implementation: A Study of Strategic Trade and Selective Industrial Policies’

Madzivanyika Itai BS414 A1 Business Research methods

Table 4: Description of Critical terms

Variable Definition Source

FDI Foreign direct investment per capita, net inflows in current in US World Bank (2017)

dollars

GNI Gross National Income per capita, PPP current international World Bank (2017)

US dollars

GROWTH Real growth of Gross National Income per capita in per World Bank (2017)

cent

TRADE Total imports and exports divided by Gross Domestic World Bank (2017)

Product

INFLATION Change in GDP Deflator in per cent World Bank (2017)

GOVST Government stability World Bank (2017)

SOCIO Socio-economic conditions World Bank (2017)

INVEST Investment profile World Bank (2017)

CONFL I Internal conflict World Bank (2017)

ECONFL External conflict World Bank (2017)

CORR Level of corruption World Bank (2017)

MILIT Influence of military in politics World Bank (2017)

RELIG Tensions among religious groups World Bank (2017)

LAW Law and order World Bank (2017)

ETHNIC Tensions among ethnic groups World Bank (2017)

DEMOC Democratic accountability of the government World Bank (2017)

BUR Institutional strength and quality of the bureaucracy World Bank (2017)

Figure 2 How Zimbabwe and comparator economies rank on the ease of doing business

Source: Doing Business 2017

Table 5 : Sample Data

log GNI PRSVA PRSPV PRSGE PRSRQ PRSRL PRSCC

Madzivanyika Itai BS414 A1 Business Research methods

3.271842 0.58 0.78 0.75 0.27 0.67 0.50

3.283301 0.50 0.64 0.50 0.45 0.67 0.33

3.276462 0.50 0.53 0.50 0.09 0.33 0.17

3.257679 0.33 0.44 0.50 0.14 0.08 0.00

3.184691 0.33 0.61 0.50 0.05 0.08 0.00

3.161368 0.33 0.63 0.50 0.05 0.50 0.00

3.146128 0.42 0.68 0.38 0.05 0.50 0.00

3.136721 0.42 0.67 0.38 0.00 0.50 0.00

3.120574 0.38 0.60 0.38 0.00 0.50 0.00

3.021189 0.33 0.61 0.38 0.00 0.50 0.00

3.075547 0.33 0.62 0.38 0.00 0.50 0.00

3.10721 0.33 0.61 0.38 0.00 0.50 0.08

3.146128 0.33 0.63 0.38 0.00 0.50 0.08

3.190332 0.33 0.63 0.38 0.00 0.50 0.17

3.206826 0.33 0.68 0.38 0.14 0.50 0.17

3.220108 0.33 0.64 0.38 0.14 0.50 0.17

3.232996 0.33 0.66 0.38 0.27 0.50 0.17

Source: UNICTAD 2017

Madzivanyika Itai BS414 A1 Business Research methods

Political Risk Services International Country Risk Guide (PRS)

Data Provider Political Risk Services

Description Commercial business information p rovider headquartered in Sy racuse, United States

Website www.p rsgroup .com

Data S ource International Country Risk Guide

Type Exp ert assessments subject to p eer review at the topic and regional levels

Respondents Political Risk Services staff

Frequency M onthly since 1984

Coverage Global samp le of countries

Public Access Full dataset is commercially available. Averages of sub-indicators are p ublicly available in

this sp readsheet.

Description The International Country Risk Guide includes a Political Risk Index, which in turn consists of 12 comp onents measuring various dimensions of the p olitical and business environment facing firms op erating in a

country . We use data from December rep orts of each y ear.

2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2000 1998 1996

Voice and Accountability

Military in politics X X X X X X X X X X X X X X X X X

Democratic accountability X X X X X X X X X X X X X X X X X

Political Stability and Absence of Violence

Government stability X X X X X X X X X X X X X X X X X

Internal conflict X X X X X X X X X X X X X X X X X

External conf lict X X X X X X X X X X X X X X X X X

Ethnic tensions X X X X X X X X X X X X X X X X X

Government Effectiveness

Bureaucratic quality X X X X X X X X X X X X X X X X X

Regulatory Quality

Investment prof ile X X X X X X X X X X X X X X X X X

Rule of Law

Law and order X X X X X X X X X X X X X X X X X

Control of Corruption

Corruption X X X X X X X X X X X X X X X X X

Country Coverage 140 140 140 140 140 140 140 140 140 140 140 140 140 140 140 140 129

Year of publication 2015 2014 2013 2012 2011 2010 2009 2008 2007 2006 2005 2004 2003 2002 2000 1998 1996

Source: World Bank 201

Madzivanyika Itai BS414 A1 Business Research methods

Das könnte Ihnen auch gefallen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Determining The Requirements of A Mobile B2B ApplicationDokument23 SeitenDetermining The Requirements of A Mobile B2B Applicationitaimadzivanyika50% (4)

- Critically Analysing The Role of The Customer Focus in Developing Marketing Strategy Using The Case Study of AmazonDokument19 SeitenCritically Analysing The Role of The Customer Focus in Developing Marketing Strategy Using The Case Study of AmazonitaimadzivanyikaNoch keine Bewertungen

- Strategic Operations Management SkillsDokument23 SeitenStrategic Operations Management Skillsitaimadzivanyika67% (3)

- Critical Personal Reflection On Strategic Marketing Module Using The Case of AmazonDokument7 SeitenCritical Personal Reflection On Strategic Marketing Module Using The Case of AmazonitaimadzivanyikaNoch keine Bewertungen

- Application of Leadership and Management Theories in Contemporary OrganisationDokument30 SeitenApplication of Leadership and Management Theories in Contemporary Organisationitaimadzivanyika100% (1)

- Assignment 1 Leadership and Management TheoriesDokument30 SeitenAssignment 1 Leadership and Management TheoriesitaimadzivanyikaNoch keine Bewertungen

- Critical Strategic Analysis of GE Power Business Unit in General Electric CompanyDokument16 SeitenCritical Strategic Analysis of GE Power Business Unit in General Electric Companyitaimadzivanyika0% (1)

- Strategic Systems ThinkingDokument12 SeitenStrategic Systems ThinkingitaimadzivanyikaNoch keine Bewertungen

- Strategic System Thinking ReviewDokument19 SeitenStrategic System Thinking ReviewitaimadzivanyikaNoch keine Bewertungen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Methods of Research and Thesis Writing by Calmorin PDFDokument5 SeitenMethods of Research and Thesis Writing by Calmorin PDFMarce Mangaoang0% (1)

- Effectiveness of Collaborative LearningDokument16 SeitenEffectiveness of Collaborative LearningGreg MedinaNoch keine Bewertungen

- The First Industrial RevolutionDokument28 SeitenThe First Industrial RevolutionArturo SolórzanoNoch keine Bewertungen

- Taxpayers' $3 BILLIONS WASTED by National Science FoundationDokument73 SeitenTaxpayers' $3 BILLIONS WASTED by National Science FoundationLevitatorNoch keine Bewertungen

- Mapeh 10Dokument4 SeitenMapeh 10RAC REOPTANoch keine Bewertungen

- User Guide: # Y N N/A RYG EvidenceDokument10 SeitenUser Guide: # Y N N/A RYG EvidencealdiNoch keine Bewertungen

- Boko Haram: Origin, Tactics and StrategyDokument7 SeitenBoko Haram: Origin, Tactics and StrategyHumble MartinsNoch keine Bewertungen

- History of RetailingDokument3 SeitenHistory of RetailingANKIT SINGHNoch keine Bewertungen

- Converting Leads Into SalesDokument3 SeitenConverting Leads Into SalesFrank Finn100% (2)

- IMC Objective 1Dokument9 SeitenIMC Objective 1Malik Muhammad AliNoch keine Bewertungen

- C01.00-Introduction - Key PDFDokument17 SeitenC01.00-Introduction - Key PDFRawan Abu ShamalaNoch keine Bewertungen

- Imperial College Business School - MSC Brochure PDFDokument50 SeitenImperial College Business School - MSC Brochure PDFAntónio PedrosaNoch keine Bewertungen

- Performance Evaluation For SalesPersonDokument33 SeitenPerformance Evaluation For SalesPersonRaman KulkarniNoch keine Bewertungen

- BLUM vs. Zamora Case DigestDokument1 SeiteBLUM vs. Zamora Case Digestunbeatable38Noch keine Bewertungen

- Corp Governance Assignment 1 For W.JOSEPHDokument22 SeitenCorp Governance Assignment 1 For W.JOSEPHWellington JosephNoch keine Bewertungen

- Advantages of Marketing HumorDokument2 SeitenAdvantages of Marketing HumorJanae Cruxette RamosNoch keine Bewertungen

- Great Hyderabad Adventure Club GHAC Newsletter Aug 10Dokument18 SeitenGreat Hyderabad Adventure Club GHAC Newsletter Aug 10Diyanat AliNoch keine Bewertungen

- Software Architecture For Developers, Volu - Simon BrownDokument200 SeitenSoftware Architecture For Developers, Volu - Simon BrownFlorgle FloopNoch keine Bewertungen

- SG COwen AnalysisDokument18 SeitenSG COwen AnalysisTauseefAhmadNoch keine Bewertungen

- Yakuza: (Criminal Gangs) in Japan: Characteristics and Management in PrisonDokument14 SeitenYakuza: (Criminal Gangs) in Japan: Characteristics and Management in PrisontareghNoch keine Bewertungen

- Music Licensing Representation AgreementDokument7 SeitenMusic Licensing Representation AgreementDigital Music News100% (8)

- Public Goods & Common ResourcesDokument15 SeitenPublic Goods & Common ResourcestanzaNoch keine Bewertungen

- Demo TiklosDokument7 SeitenDemo Tiklosdado dermsNoch keine Bewertungen

- Reading PlanDokument3 SeitenReading PlanMark Andrew FernandezNoch keine Bewertungen

- LP - Graphic OrganizersDokument10 SeitenLP - Graphic Organizersleigh arenilloNoch keine Bewertungen

- Angelenin Conce: Work ExperienceDokument2 SeitenAngelenin Conce: Work ExperienceAngelenin ConceNoch keine Bewertungen

- Sebi2 PDFDokument5 SeitenSebi2 PDFNAGARAJU MOTUPALLINoch keine Bewertungen

- SCIENCE-DRRR - Q1 - W1 - Mod2 PDFDokument18 SeitenSCIENCE-DRRR - Q1 - W1 - Mod2 PDFjohn_mateo80% (5)

- CIA Wants To Convert India To ChristianityDokument1 SeiteCIA Wants To Convert India To Christianityripest100% (1)

- 2.3 Movie Time: Antonia TasconDokument2 Seiten2.3 Movie Time: Antonia TasconAntonia Tascon Z.100% (1)