Beruflich Dokumente

Kultur Dokumente

10 Coca-Cola-Philippines-vs-CIR

Hochgeladen von

higoremso giensdks0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

124 Ansichten1 SeiteCopyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

124 Ansichten1 Seite10 Coca-Cola-Philippines-vs-CIR

Hochgeladen von

higoremso giensdksCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

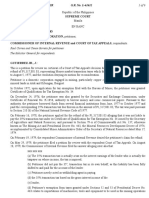

Coca- Cola Bottler’s Philippines, Inc.

, vs Commission in Mirant, Section 229 should "apply only to instances of

of Internal Revenue erroneous payment or illegal collection of internal revenue

taxes." Erroneous or wrongful payment includes excessive

G.R. No. 222428, February 19, 2018 payment because they all refer to payment of taxes not legally

FACTS: due. Under the VAT System, there is no claim or issue that the

"excess" input VAT is "excessively or in any manner wrongfully

On April 24, 2008, petitioner Coca-Cola Bottlers collected." In fact, if the "excess" input VAT is an "excessively"

Philippines, Inc., a Value-Added Tax (VAT)-registered, collected tax under Section 229, then the taxpayer claiming to

domestic corporation filed its Quarterly VAT Return for the apply such "excessively" collected input VAT to offset his

period of January 1, 2008 to March 31, 2008 and amended the output VAT may have no legal basis to make such offsetting.

same a few times thereafter. The person legally liable to pay the input VAT can claim a

On April 20, 2010, petitioner filed with the BIR's Large refund or credit for such "excessively" collected tax, and thus

Taxpayers Service an administrative claim for refund or tax there will no longer be any "excess" input VAT. This will upend

credit of its alleged over/erroneous payment of VAT for the the present VAT System as we know it.28

quarter ended March 31, 2008 in the total amount of P123, It is clear, based on the foregoing, that neither the law

459,647.70.6. Three (3) days thereafter, petitioner filed with nor jurisprudence authorize petitioner's claim for refund or

the CTA a judicial claim for refund or issuance of tax credit issuance of tax credit. In asserting its alleged right to said

certificate presenting petitioner's input and output VAT claim, petitioner unfortunately failed to convince the Court

through its computerized accounting system.7 that it is entitled to the refund or credit of input VAT in the

The CTA Division denied petitioner's claim for lack of amount of P123,459,647.70 it inadvertently failed to include in

merit. Subsequently, the CTA En Banc affirmed the ruling of its VAT Return. This is because as shown above, petitioner's

the CTA. claim is not governed by Section 229 as an ordinary refund or

credit outside of the VAT System as the same does not involve

ISSUE: a tax that is "erroneously, illegally, excessively, or in any

manner wrongfully collected." Neither is said claim authorized

Whether or not the petitioner’s claim for refund falls

under Sections 110(B) and 112(A) as the same does not seek to

within the purview of section 229.

refund or credit input tax due or paid attributable to zero-rated

RULING: The petition is devoid of merit. or effectively zero-rated sales.

From the plain text of Section 229, it is clear that what

can be refunded or credited is a tax that is "erroneously, xxx

illegally, xxx excessively or in any manner wrongfully

collected." In short, there must be a wrongful payment because

what is paid, or part of it, is not legally due. As the Court held

Das könnte Ihnen auch gefallen

- Revised Makati Revenue CodeDokument162 SeitenRevised Makati Revenue CodeHelena Herrera100% (2)

- San Juan vs. CastroDokument2 SeitenSan Juan vs. CastroMyla RodrigoNoch keine Bewertungen

- Heng Tong Textiles Co., Inc. v. CIR (1968) Case DigestDokument2 SeitenHeng Tong Textiles Co., Inc. v. CIR (1968) Case DigestShandrei GuevarraNoch keine Bewertungen

- Donor - Christian and Missionary Alliance Donee - Petitioner Both Are Religious CorporationsDokument3 SeitenDonor - Christian and Missionary Alliance Donee - Petitioner Both Are Religious CorporationsRobelle RizonNoch keine Bewertungen

- 28 Municipality of Cainta Vs City of PasigDokument2 Seiten28 Municipality of Cainta Vs City of Pasighigoremso giensdks100% (3)

- Flipkart Labels 22 Dec 2015 01 52 PDFDokument6 SeitenFlipkart Labels 22 Dec 2015 01 52 PDFshireenNoch keine Bewertungen

- Memo To Suppliers - Invoicing Requirements - 2019Dokument5 SeitenMemo To Suppliers - Invoicing Requirements - 2019Mark MagallanesNoch keine Bewertungen

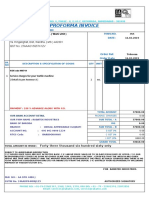

- Proforma Invoice: M/S Gimatex Industries Pvt. Ltd. (Wani Unit)Dokument1 SeiteProforma Invoice: M/S Gimatex Industries Pvt. Ltd. (Wani Unit)Vikram ShahNoch keine Bewertungen

- Basilan Estates vs. CirDokument1 SeiteBasilan Estates vs. CirLizzy WayNoch keine Bewertungen

- Taxation Law 1 Selected JurisprudenceDokument7 SeitenTaxation Law 1 Selected JurisprudenceStradivariumNoch keine Bewertungen

- BPI V Trinidad DigestDokument2 SeitenBPI V Trinidad DigestTon Ton CananeaNoch keine Bewertungen

- Conwi v. Court of Tax Appeals, G.R. No. 48532, August 31, 1992Dokument6 SeitenConwi v. Court of Tax Appeals, G.R. No. 48532, August 31, 1992zac100% (1)

- Cir V Itogon-Suyoc MinESDokument2 SeitenCir V Itogon-Suyoc MinESkeloNoch keine Bewertungen

- Sec of Finance v. LazatinDokument10 SeitenSec of Finance v. Lazatinana abayaNoch keine Bewertungen

- Phil. Home Assurance Corp vs. CADokument1 SeitePhil. Home Assurance Corp vs. CACaroline A. LegaspinoNoch keine Bewertungen

- Tax - Procter & Gamble VS Municipality of JagnaDokument2 SeitenTax - Procter & Gamble VS Municipality of JagnaKath LimNoch keine Bewertungen

- Mambulao Lumber Company vs. RepublicDokument5 SeitenMambulao Lumber Company vs. RepublicJoseLuisBunaganGuatelaraNoch keine Bewertungen

- Calasanz Vs CommDokument4 SeitenCalasanz Vs CommEANoch keine Bewertungen

- G.R. No. 190506 Coral Bay Nickel Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Bersamin, J.Dokument3 SeitenG.R. No. 190506 Coral Bay Nickel Corporation, Petitioner, Commissioner of Internal Revenue, Respondent. Decision Bersamin, J.carlo_tabangcuraNoch keine Bewertungen

- Procter and Gamble Phils. (204 SCRA 377)Dokument3 SeitenProcter and Gamble Phils. (204 SCRA 377)Karl MinglanaNoch keine Bewertungen

- 208 - Jardine v. Aliposa - de LunaDokument1 Seite208 - Jardine v. Aliposa - de LunaVon Lee De LunaNoch keine Bewertungen

- Bertillo - Phil. Guaranty Co. Inc. Vs CIR and CTADokument2 SeitenBertillo - Phil. Guaranty Co. Inc. Vs CIR and CTAStella BertilloNoch keine Bewertungen

- Digest RR 14-2001 PDFDokument1 SeiteDigest RR 14-2001 PDFCliff DaquioagNoch keine Bewertungen

- Facts:: Philippine Petroleum Corporation Vs Municipality of Pililla, Rizal, GR 90776 (June 03, 1991)Dokument2 SeitenFacts:: Philippine Petroleum Corporation Vs Municipality of Pililla, Rizal, GR 90776 (June 03, 1991)pnp bantayNoch keine Bewertungen

- 67 CIR V Procter GambleDokument2 Seiten67 CIR V Procter GambleNaomi QuimpoNoch keine Bewertungen

- Chevron Vs CIRDokument2 SeitenChevron Vs CIRKim Lorenzo CalatravaNoch keine Bewertungen

- 3.G.R. No. 103092Dokument5 Seiten3.G.R. No. 103092Lord AumarNoch keine Bewertungen

- Plaridel Surety & Ins Co v. CIR 21 SCRA 1187Dokument1 SeitePlaridel Surety & Ins Co v. CIR 21 SCRA 1187Kyle DionisioNoch keine Bewertungen

- CIR v. Vda de PrietoDokument3 SeitenCIR v. Vda de Prietoevelyn b t.Noch keine Bewertungen

- United Cadiz Sugar Farmers Association Multi-Purpose Cooperative v. CommissionerDokument6 SeitenUnited Cadiz Sugar Farmers Association Multi-Purpose Cooperative v. CommissionerEryl YuNoch keine Bewertungen

- 35 Metro Pacific Corp Vs CIR (CTA Case)Dokument3 Seiten35 Metro Pacific Corp Vs CIR (CTA Case)Yaneeza MacapadoNoch keine Bewertungen

- Cir v. GoodrichDokument7 SeitenCir v. GoodrichClaudine Ann ManaloNoch keine Bewertungen

- Commissioner of Internal Revenue v. Manila Jockey Club, 108 Phil 281Dokument2 SeitenCommissioner of Internal Revenue v. Manila Jockey Club, 108 Phil 281Charles Roger Raya100% (1)

- CIR Vs Phil Aluminum WheelsDokument6 SeitenCIR Vs Phil Aluminum WheelsCherry Jean RomanoNoch keine Bewertungen

- Microsoft Vs CIRDokument1 SeiteMicrosoft Vs CIRKaren Mae ServanNoch keine Bewertungen

- CIR v. PALDokument18 SeitenCIR v. PALmceline19Noch keine Bewertungen

- 1 Conwi vs. Commissioner, 213 SCRA 83Dokument7 Seiten1 Conwi vs. Commissioner, 213 SCRA 83Anne Marieline BuenaventuraNoch keine Bewertungen

- Javier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesDokument7 SeitenJavier vs. Commissioner Ancheta: CTA CASE NO 3393 JULY 27, 1983 Rean GonzalesRean Raphaelle GonzalesNoch keine Bewertungen

- Conwi v. Cir, 213 Scra 83Dokument4 SeitenConwi v. Cir, 213 Scra 83Anonymous iOYkz0wNoch keine Bewertungen

- Tax - Vat GuidenotesDokument13 SeitenTax - Vat GuidenotesNardz AndananNoch keine Bewertungen

- 143-Western Minolco Corp. v. CIR, Et. Al. 124 SCRA 121Dokument6 Seiten143-Western Minolco Corp. v. CIR, Et. Al. 124 SCRA 121Jopan SJNoch keine Bewertungen

- Corre vs. Tan CorreDokument3 SeitenCorre vs. Tan CorreRachel AlmadinNoch keine Bewertungen

- Borja Vs GellaDokument4 SeitenBorja Vs Gelladwight yuNoch keine Bewertungen

- CIR vs. Burroghs, G.R. No. 66653, June 19, 1986Dokument1 SeiteCIR vs. Burroghs, G.R. No. 66653, June 19, 1986Oro ChamberNoch keine Bewertungen

- CIR V Castaneda DigestDokument1 SeiteCIR V Castaneda DigestKTNoch keine Bewertungen

- Javier v. AnchetaDokument1 SeiteJavier v. AnchetaGSSNoch keine Bewertungen

- Cases On TaxationDokument13 SeitenCases On TaxationPeanutButter 'n JellyNoch keine Bewertungen

- C. Bloomberry Resorts and Hotels Inc. vs. Bureau of Internal RevenueDokument2 SeitenC. Bloomberry Resorts and Hotels Inc. vs. Bureau of Internal RevenueJoieNoch keine Bewertungen

- Tax2 - Midterms DigestsDokument95 SeitenTax2 - Midterms DigestsValerie TioNoch keine Bewertungen

- Bir V. Ca: GR. No. 197590, Nov. 24, 2014Dokument2 SeitenBir V. Ca: GR. No. 197590, Nov. 24, 2014Jezreel Y. ChanNoch keine Bewertungen

- COMMISSIONER OF INTERNAL REVENUE, Petitioner, vs. CITYTRUST INVESTMENT PHILS., INC., Respondent.Dokument1 SeiteCOMMISSIONER OF INTERNAL REVENUE, Petitioner, vs. CITYTRUST INVESTMENT PHILS., INC., Respondent.Charles Roger Raya100% (1)

- CIR V JAMIRDokument1 SeiteCIR V JAMIRShelvin EchoNoch keine Bewertungen

- Bantillo - CIR Vs PNBDokument3 SeitenBantillo - CIR Vs PNBAto TejaNoch keine Bewertungen

- Samar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Dokument18 SeitenSamar-I Electric Cooperative, Petitioner, vs. Commissioner of Internal Revenue, Respondent.Maria Nicole Vaneetee100% (1)

- Tax Remedies - Mcle LectureDokument150 SeitenTax Remedies - Mcle LectureKiko BautistaNoch keine Bewertungen

- 6 Income TaxationDokument13 Seiten6 Income TaxationAnne Marieline BuenaventuraNoch keine Bewertungen

- GROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanDokument4 SeitenGROUP 7 CASE DIGESTGenovis Ferrer Orbita SultanJoatham GenovisNoch keine Bewertungen

- BILOTLOTDokument5 SeitenBILOTLOTCamille LescanoNoch keine Bewertungen

- 13-Fisher v. Trinidad G.R. No. L-17518 October 30, 1922Dokument13 Seiten13-Fisher v. Trinidad G.R. No. L-17518 October 30, 1922Jopan SJNoch keine Bewertungen

- 17 Republic Vs de La RamaDokument3 Seiten17 Republic Vs de La RamaLara YuloNoch keine Bewertungen

- Taxation: SEC 1-83 p347Dokument347 SeitenTaxation: SEC 1-83 p347ArtLayeseNoch keine Bewertungen

- Basilan Estates Inc. v. CIR and CTADokument2 SeitenBasilan Estates Inc. v. CIR and CTATon Ton CananeaNoch keine Bewertungen

- Coca Cola vs. CIRDokument1 SeiteCoca Cola vs. CIRmenlyn100% (4)

- FEBRUARY - 2018 - COCACOLA Vs CIR (Tolentino) PDFDokument2 SeitenFEBRUARY - 2018 - COCACOLA Vs CIR (Tolentino) PDFIVY TOLENTINONoch keine Bewertungen

- Coca-Cola Bottlers v. Cir DigestDokument4 SeitenCoca-Cola Bottlers v. Cir DigestkathrynmaydevezaNoch keine Bewertungen

- 30 Herarc-Realty-Corporation-vs-the-Provincial-Treasurer-of-Batangas-DigestDokument1 Seite30 Herarc-Realty-Corporation-vs-the-Provincial-Treasurer-of-Batangas-Digesthigoremso giensdksNoch keine Bewertungen

- AALA Etal Vs UY EtalDokument3 SeitenAALA Etal Vs UY Etalhigoremso giensdksNoch keine Bewertungen

- First, Section 7 of RA No. 9282 Explicitly Enumerates The Scope of The CTA's Jurisdiction OverDokument2 SeitenFirst, Section 7 of RA No. 9282 Explicitly Enumerates The Scope of The CTA's Jurisdiction Overhigoremso giensdksNoch keine Bewertungen

- 29 - NPC Vs TenorioDokument2 Seiten29 - NPC Vs Tenoriohigoremso giensdksNoch keine Bewertungen

- 31 Alliance-of-Quezon-City-Homeowners-Association-Inc-vs-the-Quezon-City-Government-DigestDokument2 Seiten31 Alliance-of-Quezon-City-Homeowners-Association-Inc-vs-the-Quezon-City-Government-Digesthigoremso giensdksNoch keine Bewertungen

- Commissioner Of-Wps OfficeDokument3 SeitenCommissioner Of-Wps OfficeEller-Jed Manalac MendozaNoch keine Bewertungen

- Spouses Pacquiao Vs Cta and Cir: G.R. No. 213394, April 06, 2016Dokument2 SeitenSpouses Pacquiao Vs Cta and Cir: G.R. No. 213394, April 06, 2016higoremso giensdksNoch keine Bewertungen

- Bureau of Customs vs. Devanadera G.R. No. 193253 - September 8, 2015 RulingDokument2 SeitenBureau of Customs vs. Devanadera G.R. No. 193253 - September 8, 2015 Rulinghigoremso giensdksNoch keine Bewertungen

- City of Manila Vs Cosmos Bottling CorpDokument1 SeiteCity of Manila Vs Cosmos Bottling Corpmaria100% (3)

- 27 City-of-Pasig-v-Manila-Electric-CompanyDokument2 Seiten27 City-of-Pasig-v-Manila-Electric-Companyhigoremso giensdks100% (1)

- Allied Banking Corp Vs CIRDokument1 SeiteAllied Banking Corp Vs CIRhigoremso giensdksNoch keine Bewertungen

- Mitsubishi V Bureau of CustomsDokument1 SeiteMitsubishi V Bureau of CustomsmariaNoch keine Bewertungen

- Philippine American Life and General Insurance Company vs. Secretary of Finance and Commissioner On Internal RevenueDokument1 SeitePhilippine American Life and General Insurance Company vs. Secretary of Finance and Commissioner On Internal Revenuehigoremso giensdksNoch keine Bewertungen

- Commisioner of Costum Vs Oilink International CorporationDokument1 SeiteCommisioner of Costum Vs Oilink International Corporationhigoremso giensdksNoch keine Bewertungen

- Rhombus Energy, Inc. vs. Commissioner of Internal Revenue DigestDokument2 SeitenRhombus Energy, Inc. vs. Commissioner of Internal Revenue DigestEmir MendozaNoch keine Bewertungen

- CIR V GJM La ChicaDokument3 SeitenCIR V GJM La ChicaJason BuenaNoch keine Bewertungen

- Medicard Phil Inc. vs. CIRDokument2 SeitenMedicard Phil Inc. vs. CIRhigoremso giensdksNoch keine Bewertungen

- Idt Notes June Dec 22Dokument232 SeitenIdt Notes June Dec 22Sam SamNoch keine Bewertungen

- Article Enjeux de Gestion Et Audit de La Fiscalité Locale Au Maroc (Chegri)Dokument20 SeitenArticle Enjeux de Gestion Et Audit de La Fiscalité Locale Au Maroc (Chegri)ndt100% (1)

- False 6. The Final Withholding VAT Is 12% of The Contract Price of Purchased Services From WithinDokument2 SeitenFalse 6. The Final Withholding VAT Is 12% of The Contract Price of Purchased Services From WithinLazy LeathNoch keine Bewertungen

- PDF ResizeDokument14 SeitenPDF ResizeJonny DomalaonNoch keine Bewertungen

- Crc-Ace Review School: TAXATION (1-70)Dokument10 SeitenCrc-Ace Review School: TAXATION (1-70)LuisitoNoch keine Bewertungen

- For Local Sales Only In-House and Bank Price List Meridian Place General Trias, CaviteDokument1 SeiteFor Local Sales Only In-House and Bank Price List Meridian Place General Trias, CaviteMary FranceNoch keine Bewertungen

- Tax Ation San Beda College of LAW - ALABANGDokument52 SeitenTax Ation San Beda College of LAW - ALABANGKenneth Abarca SisonNoch keine Bewertungen

- Nonprofit Law in KenyaDokument23 SeitenNonprofit Law in KenyaHillary KabillahNoch keine Bewertungen

- PWC Vat in Africa 2022Dokument280 SeitenPWC Vat in Africa 2022Andrey Pavlovskiy100% (1)

- City Assessor of Cebu VSDokument6 SeitenCity Assessor of Cebu VSLaw StudentNoch keine Bewertungen

- 121 Bip ReportsDokument617 Seiten121 Bip ReportsMuhammad NadeemNoch keine Bewertungen

- Presentation On RCMDokument13 SeitenPresentation On RCMCA Nakul GuptaNoch keine Bewertungen

- MATH6 - Q2 - Week 4 Finally Approved For PrintingDokument11 SeitenMATH6 - Q2 - Week 4 Finally Approved For PrintingMariel SalazarNoch keine Bewertungen

- Rental CopierDokument4 SeitenRental CopierRajesh RajputNoch keine Bewertungen

- Bus Admin New Feeschedule 2020 2021Dokument3 SeitenBus Admin New Feeschedule 2020 2021Ajith PNoch keine Bewertungen

- 2019 Bar Examinations TAXATION LAWDokument10 Seiten2019 Bar Examinations TAXATION LAWEric RamilNoch keine Bewertungen

- Business Taxation-2Dokument33 SeitenBusiness Taxation-2Pranjal pandeyNoch keine Bewertungen

- Auditing The Finance and Accounting FunctionsDokument19 SeitenAuditing The Finance and Accounting FunctionsMark Angelo BustosNoch keine Bewertungen

- TAX-5.0 - Individual Income TaxDokument65 SeitenTAX-5.0 - Individual Income TaxCharmaine RosalesNoch keine Bewertungen

- SITXGLC001 - Written AssessmentDokument10 SeitenSITXGLC001 - Written AssessmentRohan ShresthaNoch keine Bewertungen

- Byfkj5: SanremoDokument3 SeitenByfkj5: SanremoRustam TadeevNoch keine Bewertungen

- 2307 BirDokument3 Seiten2307 BirPFMPC SecretaryNoch keine Bewertungen

- 2018 6 1Dokument1 Seite2018 6 1HaseebPirachaNoch keine Bewertungen

- Latihan Soal PT CahayaDokument20 SeitenLatihan Soal PT CahayaAisyah Sakinah PutriNoch keine Bewertungen

- Mock Fundamentals For PrintingDokument17 SeitenMock Fundamentals For PrintingBRENDA BRADECINANoch keine Bewertungen

- Avon CaseDokument23 SeitenAvon CaseGladys Bustria OrlinoNoch keine Bewertungen