Beruflich Dokumente

Kultur Dokumente

Ejercicios ICAPM 30.11.19.

Hochgeladen von

fransheska Gallegos0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten2 SeitenCopyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

21 Ansichten2 SeitenEjercicios ICAPM 30.11.19.

Hochgeladen von

fransheska GallegosCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

1.

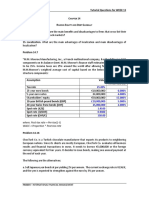

URP CORP ICAPM

URP CORP has globalized its own business activities, and has operations in 3 different

countries (London, New York, Brazil), having several investments in the United States.

Also the investor base that owns URP CORP shares has also globally diversified. URP CORP

shares are now listed London, Sao Paulo and New York, in addition to their home listing on

the Mila Exchange. The year that started 1.1.2019 is closing in a few days on 31.12.2019.

Using the ICAPM, URP CORP beta, when calculated against a larger global equity market

index, which includes these foreign markets and their investors, is a lower 0.90. The

expected world market return for a larger globally integrated equity market is 8.00% and

the Risk free rate is 4.00%. Using the following information calculate URP CORP ICAPM

London New York Brazil

S0 = Sol 4.30/ GBP S0 = Sol 3.37/ USD S0 = Sol 0.87/ BRL

S1 = Sol 4.40/GBP S1 = Sol 3.40/USD S1 = Sol 0.80/BRL

F = Sol 4.35/ GBP F = Sol 3.35/USD F = Sol 0.83/BRL

Gamma´S For Income

ΓLondon = 0.74

ΓNewYork = 0.81

ΓBrazil = 0.59

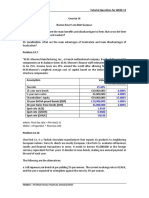

2. ANG CORP ICAPM

ANG CORP, CFO Juan Perez Quispe, has expander even more its business activities, and

now has operations in 5 different countries (Paris, Berlin, Bogota, Tokyo, India), having

several investments in the France and Locally. The year that started 1.1.2025 is closing in

a few days on 31.12.2025. Using the ICAPM, ANG CORP beta, 0.85. The expected world

market return for a larger globally integrated equity market is 9.00% and the Risk free rate

is 5.50%. Using the following information calculate ANG CORP International Capital Asset

Pricing Model.

Paris Berlin Bogota

S0 = Sol 3.89/ EUR S0 = Sol 3.89/ EUR S0 = Sol 0.0010/ COP

S1 = Sol 3.75/EUR S1 = Sol 3.75/EUR S1 = Sol 0.00097/COP

F = Sol 3.80/EUR F = Sol 3.80/EUR F = Sol 0.00093/ COP

Tokyo New Delhi

S0 = Sol 0.031/ JPY S0 = Sol 0.048/ INR

S1 = Sol 0.032/ JPY S1 = Sol 0.047/INR

F = Sol 0.030/ JPY F = Sol 0.0475/ INR

Gamma´S For Income

ΓParis = 0.54

ΓBerlin = 0.90

ΓBogota = 0.09

ΓTokyo = 0.70

ΓN.Delhi = 0.28

3. URP Corp Perú borrowed EUR 2,500,000 for one year at a 4% interest. During the year the

EURO appreciates from an initial EUR 0.39/SOL to EUR 0.27/ SOL .

a. What is the Sol cost of debt?

b. After one year URP Corp must pay how much? In Soles?

c. What is the total cost of borrowing?

d. What is the after tax cost EURO debt, when Peru´s income tax rate is 29%.

Das könnte Ihnen auch gefallen

- FINA3020 Assignment3Dokument5 SeitenFINA3020 Assignment3younes.louafiiizNoch keine Bewertungen

- Exchange Rate Determination and PPP ConceptsDokument6 SeitenExchange Rate Determination and PPP ConceptsHương Lan TrịnhNoch keine Bewertungen

- If NumericalsDokument13 SeitenIf NumericalsArindam Chatterjee0% (1)

- Ps3 AnswerDokument10 SeitenPs3 AnswerChan Kong Yan AnnieNoch keine Bewertungen

- Homework Topic 3 - To SendDokument4 SeitenHomework Topic 3 - To SendThùy NguyễnNoch keine Bewertungen

- Tutorial Forex Spot MarketDokument2 SeitenTutorial Forex Spot Marketkacem_hzNoch keine Bewertungen

- Forex Problems1Dokument4 SeitenForex Problems1skalidasNoch keine Bewertungen

- Microsoft Word - Module 1Dokument4 SeitenMicrosoft Word - Module 1sshreyasNoch keine Bewertungen

- Forex Good PDFDokument80 SeitenForex Good PDFsudheeraryaNoch keine Bewertungen

- ECB3IFMIB Regular Tutorials ExercisesDokument13 SeitenECB3IFMIB Regular Tutorials ExercisesjuanpablooriolNoch keine Bewertungen

- Techcombank Exchange Rates AssignmentDokument28 SeitenTechcombank Exchange Rates AssignmentOanh TruongNoch keine Bewertungen

- MF Tutorial 6Dokument29 SeitenMF Tutorial 6Hueg Hsien0% (1)

- Forex PDFDokument76 SeitenForex PDFjeet bagdaiNoch keine Bewertungen

- Sample Quiz - SolDokument2 SeitenSample Quiz - SolRahul GhadageNoch keine Bewertungen

- 1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisDokument3 Seiten1) Answer: Interest Expense 0 Solution:: Financial Statement AnalysisGA ZinNoch keine Bewertungen

- FRA and SWAPSDokument49 SeitenFRA and SWAPSBluesinhaNoch keine Bewertungen

- 06 Notes - Loan Amortization PDFDokument4 Seiten06 Notes - Loan Amortization PDFAlberto ElquetedejoNoch keine Bewertungen

- Amortization Methods ExplainedDokument4 SeitenAmortization Methods ExplainedAlberto ElquetedejoNoch keine Bewertungen

- Summary:! 2 Details:! 6: Group 7Dokument17 SeitenSummary:! 2 Details:! 6: Group 7Morgan KalifaNoch keine Bewertungen

- MF 6Dokument29 SeitenMF 6Hueg HsienNoch keine Bewertungen

- Home Assignment 2 - Iftm: International Finance and Treasury ManagementDokument3 SeitenHome Assignment 2 - Iftm: International Finance and Treasury Managementcool_cyrusNoch keine Bewertungen

- New Heritage Doll Case - Compute Cash Flows and Terminal ValueDokument2 SeitenNew Heritage Doll Case - Compute Cash Flows and Terminal ValuejjjjjNoch keine Bewertungen

- C14 - Tutorial Ques PDFDokument2 SeitenC14 - Tutorial Ques PDFJilynn SeahNoch keine Bewertungen

- Illustrations For Practice Q&ADokument5 SeitenIllustrations For Practice Q&ADhruvi AgarwalNoch keine Bewertungen

- C14 - Tutorial Ques PDFDokument2 SeitenC14 - Tutorial Ques PDFJilynn SeahNoch keine Bewertungen

- C14 - Tutorial Ques PDFDokument2 SeitenC14 - Tutorial Ques PDFJilynn SeahNoch keine Bewertungen

- Chapter 06 International PaDokument59 SeitenChapter 06 International PaLiaNoch keine Bewertungen

- Solutions Exercises 2 10Dokument4 SeitenSolutions Exercises 2 10jason.sevin02Noch keine Bewertungen

- Carrefour S.A. Case: USD Debt FinancingDokument9 SeitenCarrefour S.A. Case: USD Debt FinancingIzzaNoch keine Bewertungen

- SM Ch3-6Dokument14 SeitenSM Ch3-6Danka PredolacNoch keine Bewertungen

- Assignment Questions For Neopost 4Dokument2 SeitenAssignment Questions For Neopost 4ogrjkvdjNoch keine Bewertungen

- INTERNATIONAL FINANCE FORUMULASDokument17 SeitenINTERNATIONAL FINANCE FORUMULASMileth Xiomara Ramirez GomezNoch keine Bewertungen

- Triangular Arbitrage: Actual Cross Rate and What The Cross Rate Ought To BeDokument8 SeitenTriangular Arbitrage: Actual Cross Rate and What The Cross Rate Ought To BeIndeevar SarkarNoch keine Bewertungen

- Financial Mathematics: TopicDokument12 SeitenFinancial Mathematics: TopiceibsourceNoch keine Bewertungen

- Paper LBO Model Example - Street of WallsDokument6 SeitenPaper LBO Model Example - Street of WallsAndrewNoch keine Bewertungen

- Problem Set Session 3 Exchange RatesDokument8 SeitenProblem Set Session 3 Exchange RatesPauline CavéNoch keine Bewertungen

- Mis Group AssignmentDokument14 SeitenMis Group Assignmentmeraschuo23Noch keine Bewertungen

- Accounting 201 SlidesDokument166 SeitenAccounting 201 Slidessteevms100% (3)

- Laporan Bing NyaDokument6 SeitenLaporan Bing NyaHanifRNoch keine Bewertungen

- Activities FXDokument5 SeitenActivities FXWaqar KhalidNoch keine Bewertungen

- Q&P Ch7 20080411Dokument36 SeitenQ&P Ch7 20080411EZEKIELNoch keine Bewertungen

- Foreign Exchange Arithmetic WorksheetDokument4 SeitenForeign Exchange Arithmetic WorksheetViresh YadavNoch keine Bewertungen

- 1-Activities EcoDokument6 Seiten1-Activities EcombondoNoch keine Bewertungen

- 3Dokument1 Seite3Nhanh LêNoch keine Bewertungen

- Techniques For Managing ExposureDokument26 SeitenTechniques For Managing Exposureprasanthgeni22100% (1)

- Note On The Accounting Treatment of Promissory NotesDokument2 SeitenNote On The Accounting Treatment of Promissory NotesirishpoliticsNoch keine Bewertungen

- ForexDokument9 SeitenForexemmaNoch keine Bewertungen

- Chapter 5Dokument1 SeiteChapter 5abcNoch keine Bewertungen

- Lecture 03Dokument13 SeitenLecture 03simraNoch keine Bewertungen

- Illustrations For PracticeDokument3 SeitenIllustrations For PracticeDhruvi AgarwalNoch keine Bewertungen

- Fin Man HW1Dokument3 SeitenFin Man HW1Carl Dhaniel Garcia SalenNoch keine Bewertungen

- Fin Man HW1Dokument3 SeitenFin Man HW1KingkongNoch keine Bewertungen

- LBO TrainingDokument18 SeitenLBO TrainingCharles Levent100% (3)

- Ch4-EDokument51 SeitenCh4-Ehuy anh leNoch keine Bewertungen

- Wolfx Signals ®Dokument9 SeitenWolfx Signals ®Fale MensNoch keine Bewertungen

- Spot Exchange Markets. Quiz QuestionsDokument14 SeitenSpot Exchange Markets. Quiz Questionsym5c2324100% (1)

- Embracing Portugal: A Step-by-Step Guide to Relocating and Thriving in the Land of Sun and HistoryVon EverandEmbracing Portugal: A Step-by-Step Guide to Relocating and Thriving in the Land of Sun and HistoryNoch keine Bewertungen

- Img 20200702 0001Dokument1 SeiteImg 20200702 0001fransheska GallegosNoch keine Bewertungen

- Sara Is Asparagus FarmerDokument1 SeiteSara Is Asparagus Farmerfransheska GallegosNoch keine Bewertungen

- $ ,) X/LT,:M) Ü: Eycüv Jo RvnsDokument1 Seite$ ,) X/LT,:M) Ü: Eycüv Jo Rvnsfransheska GallegosNoch keine Bewertungen

- Final Proyectos EJEMPLODokument21 SeitenFinal Proyectos EJEMPLOfransheska GallegosNoch keine Bewertungen

- Equilibrium Interest Rates and Exchage Rates Ses 16Dokument15 SeitenEquilibrium Interest Rates and Exchage Rates Ses 16fransheska GallegosNoch keine Bewertungen

- Efta PerúDokument10 SeitenEfta Perúfransheska GallegosNoch keine Bewertungen

- Sara Is Asparagus FarmerDokument1 SeiteSara Is Asparagus Farmerfransheska GallegosNoch keine Bewertungen

- Average Est. Desv Adj Close Date Netflix Return Promedio Des. EstDokument29 SeitenAverage Est. Desv Adj Close Date Netflix Return Promedio Des. Estfransheska GallegosNoch keine Bewertungen

- The BRICS Bank: An Acronym With CapitalDokument2 SeitenThe BRICS Bank: An Acronym With Capitalfransheska GallegosNoch keine Bewertungen

- Writing Practice 1Dokument1 SeiteWriting Practice 1fransheska GallegosNoch keine Bewertungen

- Homework - Tomas Delgado JaureguiDokument2 SeitenHomework - Tomas Delgado Jaureguifransheska GallegosNoch keine Bewertungen

- FinanzasDokument23 SeitenFinanzasfransheska GallegosNoch keine Bewertungen

- Class Exercise Covered Interest ArbitrageDokument3 SeitenClass Exercise Covered Interest Arbitragefransheska GallegosNoch keine Bewertungen

- Efta - TratadosDokument17 SeitenEfta - Tratadosfransheska GallegosNoch keine Bewertungen

- Efta - TratadosDokument17 SeitenEfta - Tratadosfransheska GallegosNoch keine Bewertungen

- Class Exercises - BondsDokument1 SeiteClass Exercises - Bondsfransheska GallegosNoch keine Bewertungen

- Trabajo 2-SismoDokument9 SeitenTrabajo 2-Sismofransheska GallegosNoch keine Bewertungen

- ShakiraDokument2 SeitenShakirafransheska GallegosNoch keine Bewertungen

- Trabajo 2pc-SismoDokument6 SeitenTrabajo 2pc-Sismofransheska GallegosNoch keine Bewertungen

- Nombrado, Sean Lester CBET - 01 - 303A Review Questions Concept Review Questions Test QuestionsDokument5 SeitenNombrado, Sean Lester CBET - 01 - 303A Review Questions Concept Review Questions Test QuestionsSean Lester S. NombradoNoch keine Bewertungen

- I. Personal InformationDokument18 SeitenI. Personal Informationm95237240Noch keine Bewertungen

- List of 2013 Young Global Leaders Honourees: East AsiaDokument9 SeitenList of 2013 Young Global Leaders Honourees: East AsiaHaki NgowiNoch keine Bewertungen

- Dividend Discount Model (DDM) : A Study Based On Select Companies From IndiaDokument11 SeitenDividend Discount Model (DDM) : A Study Based On Select Companies From IndiaRaihan RamadhaniNoch keine Bewertungen

- 12 Entrep 6 Developing A Business PlanDokument21 Seiten12 Entrep 6 Developing A Business PlanRochelle Acala Del RosarioNoch keine Bewertungen

- Home Assignment Ch.1Dokument6 SeitenHome Assignment Ch.1Sausan SaniaNoch keine Bewertungen

- Procter Gamble AnalysisDokument37 SeitenProcter Gamble Analysisapi-115328034100% (2)

- CSE Awareness On Savings and Investment For The StudentsDokument33 SeitenCSE Awareness On Savings and Investment For The StudentsAlexander FloresNoch keine Bewertungen

- Breadtalk Group LTD: Singapore Company GuideDokument11 SeitenBreadtalk Group LTD: Singapore Company GuideBrandon TanNoch keine Bewertungen

- Financial Position Statement AnalysisDokument5 SeitenFinancial Position Statement AnalysisElaine Fiona Villafuerte100% (2)

- Comparing Top Equity Mutual FundsDokument62 SeitenComparing Top Equity Mutual FundsAbhishek singhNoch keine Bewertungen

- CRISIL Unit Linked Insurance Plan (ULIP) Ranking: As On March 2021Dokument45 SeitenCRISIL Unit Linked Insurance Plan (ULIP) Ranking: As On March 2021chriscolmanNoch keine Bewertungen

- Kc2 Practice Revision KitDokument7 SeitenKc2 Practice Revision KitVinthuja MurukesNoch keine Bewertungen

- University of Cambridge International Examinations General Certificate of Education Ordinary LevelDokument12 SeitenUniversity of Cambridge International Examinations General Certificate of Education Ordinary LevelDhoni KhanNoch keine Bewertungen

- Demystifying yPAXG - A Defi Token Backed by GoldDokument28 SeitenDemystifying yPAXG - A Defi Token Backed by GoldTilak Rana MagarNoch keine Bewertungen

- AF208 Group AssignmentDokument18 SeitenAF208 Group AssignmentNavin N Meenakshi ChandraNoch keine Bewertungen

- CFA Level 1 SyllabusDokument3 SeitenCFA Level 1 SyllabusSanjay MehrotraNoch keine Bewertungen

- Investment Management NotesDokument75 SeitenInvestment Management NotesArjun Nayak100% (2)

- Accounting Chapter 2Dokument25 SeitenAccounting Chapter 2Maisha UddinNoch keine Bewertungen

- Multi-Dimensions of Unit Linked Insurance Plan Among Various Investment AvenuesDokument8 SeitenMulti-Dimensions of Unit Linked Insurance Plan Among Various Investment AvenuesRahul TangadiNoch keine Bewertungen

- SME IPO Due Diligence Process v1Dokument34 SeitenSME IPO Due Diligence Process v1Jatin SharmaNoch keine Bewertungen

- CIMB Islamic Sukuk Fund: Fund Objective Investment VolatilityDokument2 SeitenCIMB Islamic Sukuk Fund: Fund Objective Investment VolatilityMaria haneffNoch keine Bewertungen

- Flirting With RiskDokument17 SeitenFlirting With RiskIvan Jay EsminoNoch keine Bewertungen

- Module in Fundamentals of Accountancy 2Dokument8 SeitenModule in Fundamentals of Accountancy 2RoseAnnGatuzNicolas100% (1)

- Introduction To Accounting 1. Definition Accounting Standardcouncil (Asc)Dokument14 SeitenIntroduction To Accounting 1. Definition Accounting Standardcouncil (Asc)Simon Marquis LUMBERANoch keine Bewertungen

- Business ValuationDokument5 SeitenBusiness ValuationPulkitAgrawalNoch keine Bewertungen

- FRM 2018 Mock ExamDokument27 SeitenFRM 2018 Mock ExamPaul Antonio Rios MurrugarraNoch keine Bewertungen

- Report On Performance Analysis of SEBLDokument53 SeitenReport On Performance Analysis of SEBLShanu Uddin Rubel80% (10)

- PakinvestbondsDokument33 SeitenPakinvestbondsali bilalNoch keine Bewertungen

- Derpo Class 1& 2Dokument5 SeitenDerpo Class 1& 2laale dijaanNoch keine Bewertungen