Beruflich Dokumente

Kultur Dokumente

Shalby Limited BSE 540797 Financials Balance Sheet

Hochgeladen von

akumar4uCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Shalby Limited BSE 540797 Financials Balance Sheet

Hochgeladen von

akumar4uCopyright:

Verfügbare Formate

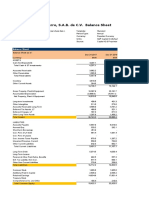

Shalby Limited (BSE:540797) > Financials > Balance Sheet

Balance Sheet

Balance Sheet as of: Restated Restated Restated Press Release

Mar-31-2015 Mar-31-2016 Mar-31-2017 Mar-31-2018 Mar-31-2019 Dec-31-2019

Currency INR Million INR Million INR Million INR Million INR Million INR

ASSETS

Cash And Equivalents 310.0 160.7 117.0 116.7 53.1 -

Short Term Investments 0.4 0.7 - - 107.8 -

Total Cash & ST Investments 310.4 161.4 117.0 116.7 160.8 982.0

Accounts Receivable 241.6 339.2 336.3 566.9 866.4 -

Other Receivables 9.2 9.2 133.3 118.0 64.7 -

Notes Receivable 4.9 41.9 56.2 - - -

Total Receivables 255.6 390.2 525.8 684.9 931.1 -

Inventory 58.2 74.9 76.5 120.5 128.1 -

Prepaid Exp. 1.9 3.4 6.2 6.6 6.2 -

Other Current Assets 0.0 11.7 164.7 1,191.7 799.6 -

Total Current Assets 626.2 641.6 890.1 2,120.4 2,025.9 -

Gross Property, Plant & Equipment 3,433.2 5,067.2 5,588.4 7,270.2 7,567.3 -

Accumulated Depreciation (940.5) (1,067.5) (172.5) (407.4) (736.2) -

Net Property, Plant & Equipment 2,492.7 3,999.7 5,415.9 6,862.8 6,831.1 -

Goodwill 161.7 11.3 19.6 101.6 101.6 -

Other Intangibles 4.6 4.8 5.0 7.9 20.7 -

Deferred Tax Assets, LT - - 71.7 113.4 20.3 -

Other Long-Term Assets 228.3 381.7 382.9 408.3 392.1 -

Total Assets 3,513.4 5,039.1 6,785.1 9,614.2 9,391.6 -

LIABILITIES

Accounts Payable 614.2 467.8 392.3 491.7 562.7 -

Accrued Exp. 33.8 77.2 72.5 60.9 45.2 -

Short-term Borrowings 75.3 93.2 263.8 157.2 - -

Curr. Port. of LT Debt 141.8 103.8 164.4 225.5 139.2 -

Curr. Income Taxes Payable - - 3.7 5.0 - -

Unearned Revenue, Current 2.1 5.7 5.6 8.7 9.3 -

Other Current Liabilities 36.7 169.3 394.5 198.8 127.7 -

Total Current Liabilities 903.8 917.0 1,296.8 1,147.8 884.0 -

Long-Term Debt 737.3 2,010.7 2,854.0 754.4 569.1 -

Unearned Revenue, Non-Current - - 88.8 128.4 118.8 -

Pension & Other Post-Retire. Benefits 1.4 2.0 0.8 0.2 0.2 -

Def. Tax Liability, Non-Curr. 111.7 20.8 0.0 - - -

Other Non-Current Liabilities 51.6 34.7 36.9 68.3 21.1 -

Total Liabilities 1,805.8 2,985.2 4,277.3 2,099.1 1,593.2 -

Pref. Stock, Convertible 4.3 5.3 - - - -

Total Pref. Equity 4.3 5.3 - - - -

Common Stock 349.4 873.6 874.1 1,080.1 1,080.1 -

Additional Paid In Capital 46.5 - 3.2 4,524.1 4,490.1 -

Retained Earnings 1,284.1 1,171.4 1,619.5 1,895.8 2,213.2 -

Treasury Stock - - - - - -

Comprehensive Inc. and Other - - 17.2 14.5 14.5 -

Total Common Equity 1,680.0 2,044.9 2,514.1 7,514.6 7,797.9 8,082.9

Minority Interest 23.3 3.7 (6.2) 0.6 0.5 -

Total Equity 1,707.6 2,053.9 2,507.8 7,515.1 7,798.4 8,083.4

Total Liabilities And Equity 3,513.4 5,039.1 6,785.1 9,614.2 9,391.6 -

Supplemental Items

Total Shares Out. on Filing Date 87.4 87.4 87.4 108.0 108.0 108.7

Total Shares Out. on Balance Sheet Date 87.4 87.4 87.4 108.0 108.0 108.7

Book Value/Share 19.23 23.41 28.76 69.57 72.2 75.1

Tangible Book Value 1,513.7 2,028.8 2,489.4 7,405.1 7,675.7 7,945.8

Tangible Book Value/Share 17.33 23.22 28.48 68.56 71.06 73.83

Total Debt 954.4 2,207.8 3,282.2 1,137.1 708.2 547.2

Net Debt 644.0 2,046.3 3,165.3 1,020.4 547.4 (434.8)

Debt Equiv. of Unfunded Proj. Benefit Obligation 3.9 10.4 22.7 19.8 21.7 NA

Debt Equivalent Oper. Leases NA NA 7.5 11.6 106.9 NA

Total Minority Interest 23.3 3.7 (6.2) 0.6 0.5 0.5

Inventory Method NA FIFO NA Avg Cost Avg Cost NA

Raw Materials Inventory 39.9 42.6 35.3 87.6 91.5 NA

Finished Goods Inventory 11.6 24.1 33.8 23.2 29.5 NA

Other Inventory Accounts 6.8 8.1 7.4 9.8 7.1 NA

Land 541.9 936.9 887.1 1,133.0 1,239.9 NA

Buildings 534.3 1,279.7 1,172.2 2,577.8 2,903.1 NA

Machinery 1,449.9 2,028.8 1,322.1 3,095.3 3,407.0 NA

Construction in Progress 907.1 821.9 2,207.0 464.0 17.4 -

Full Time Employees NA NA 1,772 2,576 2,448 NA

Part-Time Employees NA NA NA 33 NA NA

Accum. Allowance for Doubtful Accts 13.5 13.2 21.5 6.4 20.9 NA

Filing Date Nov-30-2017 Nov-30-2017 Aug-22-2018 Aug-01-2019 Aug-01-2019 NA

Restatement Type NC RS RS RS O NV

Calculation Type REP REP REP REP REP FWD

Currency INR INR INR INR INR INR

Exchange Rate 1.0 1.0 1.0 1.0 1.0 1.0

Conversion Method H H H H H H

Note: For multiple class companies, total share counts are primary class equivalent, and for foreign companies listed as primary ADRs, total share counts are ADR-equivalent.

Das könnte Ihnen auch gefallen

- Securities Operations: A Guide to Trade and Position ManagementVon EverandSecurities Operations: A Guide to Trade and Position ManagementBewertung: 4 von 5 Sternen4/5 (3)

- Narayana Hrudayalaya Limited NSEI NH Financials Balance SheetDokument2 SeitenNarayana Hrudayalaya Limited NSEI NH Financials Balance Sheetakumar4uNoch keine Bewertungen

- Max Healthcare Institute Limited BSE 539981 Financials Balance SheetDokument3 SeitenMax Healthcare Institute Limited BSE 539981 Financials Balance Sheetakumar4uNoch keine Bewertungen

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financials Balance SheetDokument3 SeitenApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financials Balance Sheetakumar4uNoch keine Bewertungen

- Efrs 2014-2018 Amsa. Ratios-Final-2Dokument60 SeitenEfrs 2014-2018 Amsa. Ratios-Final-2Nicolás Bórquez MonsalveNoch keine Bewertungen

- BDODokument6 SeitenBDOVince Raphael MirandaNoch keine Bewertungen

- Promit Singh Rathore - 20PGPM111Dokument14 SeitenPromit Singh Rathore - 20PGPM111mahiyuvi mahiyuviNoch keine Bewertungen

- Pidilite IndustriesDokument5 SeitenPidilite IndustriesPrena JoshiNoch keine Bewertungen

- Slides Week 8 No AnswerDokument38 SeitenSlides Week 8 No Answerchingwen731Noch keine Bewertungen

- Pakistan State Oil Company Limited (Pso)Dokument6 SeitenPakistan State Oil Company Limited (Pso)Maaz HanifNoch keine Bewertungen

- Mac Balance SheetDokument5 SeitenMac Balance Sheetshalinikn1507Noch keine Bewertungen

- 14-10 Years HighlightsDokument1 Seite14-10 Years HighlightsJigar PatelNoch keine Bewertungen

- Group AssignmentDokument4 SeitenGroup Assignment1954032027cucNoch keine Bewertungen

- Financial Statements For Jollibee Foods CorporationDokument4 SeitenFinancial Statements For Jollibee Foods CorporationKevin CeladaNoch keine Bewertungen

- Caso HertzDokument32 SeitenCaso HertzJORGE PUENTESNoch keine Bewertungen

- Actividad 3.1Dokument27 SeitenActividad 3.1David RiosNoch keine Bewertungen

- Financial Statements For Jollibee Foods CorporationDokument8 SeitenFinancial Statements For Jollibee Foods CorporationJ U D YNoch keine Bewertungen

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDokument12 SeitenBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNoch keine Bewertungen

- Adv EnzDokument4 SeitenAdv EnzSafwan BhikhaNoch keine Bewertungen

- Beijing Tongrentang Co LTD (600085 CH) - As ReportedDokument6 SeitenBeijing Tongrentang Co LTD (600085 CH) - As ReportedWen Yau LeeNoch keine Bewertungen

- Financial Statements-Kingsley AkinolaDokument4 SeitenFinancial Statements-Kingsley AkinolaKingsley AkinolaNoch keine Bewertungen

- Cash Flows:: Currency in Millions of U.S. DollarsDokument3 SeitenCash Flows:: Currency in Millions of U.S. DollarscutooteddyNoch keine Bewertungen

- Standalone Balance Sheet - Lupin LTD.: ParticularsDokument26 SeitenStandalone Balance Sheet - Lupin LTD.: ParticularsshubhNoch keine Bewertungen

- BEMLDokument7 SeitenBEMLdurgesh varunNoch keine Bewertungen

- CASE Exhibits - HertzDokument15 SeitenCASE Exhibits - HertzSeemaNoch keine Bewertungen

- PVR LTD (PVRL IN) - StandardizedDokument18 SeitenPVR LTD (PVRL IN) - StandardizedSrinidhi SrinathNoch keine Bewertungen

- ROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements2 - BloombergDokument2 SeitenROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements2 - BloombergImmanuel Billie AllenNoch keine Bewertungen

- Wassim Zhani Starbucks Valuation 2007-2011Dokument13 SeitenWassim Zhani Starbucks Valuation 2007-2011wassim zhaniNoch keine Bewertungen

- General Govt DataDokument10 SeitenGeneral Govt DataEdgar MugaruraNoch keine Bewertungen

- Komatsu LTD (6301 JT) - StandardizedDokument36 SeitenKomatsu LTD (6301 JT) - StandardizedIan RiceNoch keine Bewertungen

- Acc FCFFDokument25 SeitenAcc FCFFArchit PateriaNoch keine Bewertungen

- Traveller Balance SheetDokument4 SeitenTraveller Balance SheetMathi Mahi JayanthNoch keine Bewertungen

- Balance Sheet of Colgate Palmolive & Hindustan Unilever LTDDokument5 SeitenBalance Sheet of Colgate Palmolive & Hindustan Unilever LTDAmit SanglikarNoch keine Bewertungen

- Housing Development Finance Corp LTD (HDFC IN) - StandardizedDokument4 SeitenHousing Development Finance Corp LTD (HDFC IN) - StandardizedAswini Kumar BhuyanNoch keine Bewertungen

- Final Project Financial ManagementDokument10 SeitenFinal Project Financial ManagementMaryam SaeedNoch keine Bewertungen

- Ceat LTD (CEAT IN) - As ReportedDokument24 SeitenCeat LTD (CEAT IN) - As ReportedAman SareenNoch keine Bewertungen

- Financial AnalysisDokument6 SeitenFinancial AnalysisRinceNoch keine Bewertungen

- Financial Statements Fin202 STDokument17 SeitenFinancial Statements Fin202 SThannlqs180026Noch keine Bewertungen

- Strategic Management AssignmentDokument12 SeitenStrategic Management AssignmentTuvshinjargal BaatarchuluunNoch keine Bewertungen

- HCL Technologies LTD (HCLT IN) - StandardizedDokument6 SeitenHCL Technologies LTD (HCLT IN) - StandardizedAswini Kumar BhuyanNoch keine Bewertungen

- Nissan Motor Co LTDDokument11 SeitenNissan Motor Co LTDShamsa AkbarNoch keine Bewertungen

- Tiffany & Co's Analysis: Student Name Institutional Affiliation Course Name Instructor Name DateDokument6 SeitenTiffany & Co's Analysis: Student Name Institutional Affiliation Course Name Instructor Name DateOmer KhanNoch keine Bewertungen

- Assignment No. 1Dokument2 SeitenAssignment No. 1AMegoz 25Noch keine Bewertungen

- Assignment Financial Analysis SolvedDokument2 SeitenAssignment Financial Analysis SolvedShaimaa MuradNoch keine Bewertungen

- Grupo Lala S A B de C V BMV LALA B Financials Cash FlowDokument4 SeitenGrupo Lala S A B de C V BMV LALA B Financials Cash FlowElda AlemanNoch keine Bewertungen

- Model No 1 Utkarsh (FFM)Dokument3 SeitenModel No 1 Utkarsh (FFM)Utkarsh UtkarshNoch keine Bewertungen

- Tallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Dokument109 SeitenTallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Shovon MustaryNoch keine Bewertungen

- Toyota Balance SheetDokument3 SeitenToyota Balance SheetqwertuipbkjhggfgfddNoch keine Bewertungen

- Bharat Forge LTD (BHFC IN) - AdjustedDokument4 SeitenBharat Forge LTD (BHFC IN) - AdjustedAswini Kumar BhuyanNoch keine Bewertungen

- Asian PaintsDokument38 SeitenAsian PaintsKartikai MehtaNoch keine Bewertungen

- LDG - Financial TemplateDokument20 SeitenLDG - Financial TemplateQuan LeNoch keine Bewertungen

- CiplaDokument5 SeitenCiplaSantosh AgarwalNoch keine Bewertungen

- Beta Exhibit 03 - 91 Day Tresury BillDokument1 SeiteBeta Exhibit 03 - 91 Day Tresury BillAnonymous tvA58EWlRgNoch keine Bewertungen

- 5T A165c3af PDFDokument1 Seite5T A165c3af PDFSumit GargNoch keine Bewertungen

- 5T A165c3afDokument1 Seite5T A165c3afSumit GargNoch keine Bewertungen

- Balance Sheet of Tata MotorsDokument6 SeitenBalance Sheet of Tata Motorsnehanayaka25Noch keine Bewertungen

- XLS EngDokument26 SeitenXLS EngcellgadizNoch keine Bewertungen

- CF P&L Excel GodrejDokument4 SeitenCF P&L Excel GodrejPraksh chandra Rajeek kumarNoch keine Bewertungen

- EquityDokument3 SeitenEquityyasrab abbasNoch keine Bewertungen

- Beyond Meat Inc NasdaqGS BYND FinancialsDokument6 SeitenBeyond Meat Inc NasdaqGS BYND FinancialsFabricio Arturo Olalde MacedoNoch keine Bewertungen

- Notice of 27th AgmDokument14 SeitenNotice of 27th Agmakumar4uNoch keine Bewertungen

- Lead PM JioMart JDDokument2 SeitenLead PM JioMart JDakumar4uNoch keine Bewertungen

- A Study of Employee Attrition Rate in Hospital SectorDokument8 SeitenA Study of Employee Attrition Rate in Hospital Sectorakumar4uNoch keine Bewertungen

- System DesignDokument122 SeitenSystem Designmukul_manglaNoch keine Bewertungen

- Design Thinking EbookDokument850 SeitenDesign Thinking Ebookakumar4uNoch keine Bewertungen

- Delta Corp Annual Report FY 2021-22Dokument241 SeitenDelta Corp Annual Report FY 2021-22akumar4uNoch keine Bewertungen

- Annual Report 2017 2018Dokument220 SeitenAnnual Report 2017 2018akumar4uNoch keine Bewertungen

- Market Roundup - Online Learning Platforms in India: Edition - 1Dokument24 SeitenMarket Roundup - Online Learning Platforms in India: Edition - 1akumar4uNoch keine Bewertungen

- PitchDokument11 SeitenPitchakumar4uNoch keine Bewertungen

- Value Chain by SlidesgoDokument34 SeitenValue Chain by SlidesgoCarlos ChacónNoch keine Bewertungen

- The Startup's Guide To Google CloudDokument18 SeitenThe Startup's Guide To Google Cloudakumar4uNoch keine Bewertungen

- Consulting Proposal: Lorem Ipsum Dolor Sit AmetDokument20 SeitenConsulting Proposal: Lorem Ipsum Dolor Sit AmetAnonymous AgBoRO9100% (2)

- How To (Actually) Calculate CAC - Interactive SpreadsheetsDokument8 SeitenHow To (Actually) Calculate CAC - Interactive Spreadsheetsakumar4uNoch keine Bewertungen

- Zscaler Inc - Form 10-K (Sep-18-2019)Dokument164 SeitenZscaler Inc - Form 10-K (Sep-18-2019)akumar4uNoch keine Bewertungen

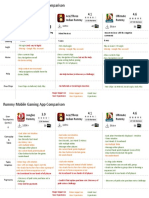

- Rummy Mobile Gaming ComparisonDokument2 SeitenRummy Mobile Gaming Comparisonakumar4uNoch keine Bewertungen

- ZScaler FY 2020 - Annual ReportDokument236 SeitenZScaler FY 2020 - Annual Reportakumar4uNoch keine Bewertungen

- 1bcf4f2c 17cc 4759 9081 Dcc0f5beeb6Dokument158 Seiten1bcf4f2c 17cc 4759 9081 Dcc0f5beeb6divya mNoch keine Bewertungen

- Indian IT and ITeS Industry Report 170708Dokument32 SeitenIndian IT and ITeS Industry Report 170708workosaurNoch keine Bewertungen

- VALUE MIGRATION MOSL-20170106-SU-PG100 mOST PDFDokument100 SeitenVALUE MIGRATION MOSL-20170106-SU-PG100 mOST PDFanurag70Noch keine Bewertungen

- Zscaler Inc - Form 10-K (Sep-17-2020)Dokument186 SeitenZscaler Inc - Form 10-K (Sep-17-2020)akumar4uNoch keine Bewertungen

- IBEF IT-and-BPM-January-2021Dokument34 SeitenIBEF IT-and-BPM-January-2021akumar4u100% (1)

- IBEF Healthcare-March-2021Dokument39 SeitenIBEF Healthcare-March-2021akumar4uNoch keine Bewertungen

- IBEF Report Mobile GamingDokument5 SeitenIBEF Report Mobile Gamingakumar4uNoch keine Bewertungen

- GICS Sector Classification HandbookDokument26 SeitenGICS Sector Classification HandbookAndrewNoch keine Bewertungen

- Kovai Medical Center and Hospital Limited BSE 523323 FinancialsDokument39 SeitenKovai Medical Center and Hospital Limited BSE 523323 Financialsakumar4uNoch keine Bewertungen

- Fortis Healthcare Limited BSE 532843 FinancialsDokument44 SeitenFortis Healthcare Limited BSE 532843 Financialsakumar4uNoch keine Bewertungen

- IBEF Healthcare-March-2021Dokument39 SeitenIBEF Healthcare-March-2021akumar4uNoch keine Bewertungen

- Rummy Mobile Gaming ComparisonDokument2 SeitenRummy Mobile Gaming Comparisonakumar4uNoch keine Bewertungen

- KMC Speciality Hospitals India Limited BSE 524520 FinancialsDokument38 SeitenKMC Speciality Hospitals India Limited BSE 524520 Financialsakumar4uNoch keine Bewertungen

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP FinancialsDokument40 SeitenApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financialsakumar4uNoch keine Bewertungen

- ASC - Accounting Standard CouncilDokument12 SeitenASC - Accounting Standard CouncilAlyna JNoch keine Bewertungen

- CDO Sked - Weekend MAY. 2023bATCHDokument2 SeitenCDO Sked - Weekend MAY. 2023bATCHAnna FaqingerNoch keine Bewertungen

- Governement Accounting - Journal Entries-2Dokument16 SeitenGovernement Accounting - Journal Entries-2LorraineMartin100% (1)

- Cash Flow Statement AnalysisDokument19 SeitenCash Flow Statement AnalysisKNOWLEDGE CREATORS90% (10)

- Inventories Time Stamped & Los StampedDokument30 SeitenInventories Time Stamped & Los StampedRajnish RajNoch keine Bewertungen

- MTDrill 2Dokument17 SeitenMTDrill 2Cedric Legaspi TagalaNoch keine Bewertungen

- Eva Mva Study Pack 40Dokument2 SeitenEva Mva Study Pack 40vishalbansal6675Noch keine Bewertungen

- Book 123Dokument3 SeitenBook 123Andres WijayaNoch keine Bewertungen

- Indirect Method Statement of Cash FlowsDokument62 SeitenIndirect Method Statement of Cash FlowsArun Girish100% (1)

- Practise Chapter 1+3+4 (For Quiz 1)Dokument16 SeitenPractise Chapter 1+3+4 (For Quiz 1)Phạm Hồng Trang Alice -Noch keine Bewertungen

- POF Assignment 2Dokument6 SeitenPOF Assignment 2Kai Shuen33% (3)

- Financial Reporting and AnalysisDokument50 SeitenFinancial Reporting and AnalysisGeorge Shevtsov83% (6)

- Doddy Bicara InvestasiDokument34 SeitenDoddy Bicara InvestasiAmri RijalNoch keine Bewertungen

- Tools and Techniques of Financial Statement AnalysisDokument10 SeitenTools and Techniques of Financial Statement AnalysisVignesh VijayanNoch keine Bewertungen

- Partnership AppDokument22 SeitenPartnership AppPeter AkramNoch keine Bewertungen

- Liabilities: B-ACTG214 SY2019-2020 de La Salle University - DasmariñasDokument158 SeitenLiabilities: B-ACTG214 SY2019-2020 de La Salle University - DasmariñasErika Mae LegaspiNoch keine Bewertungen

- Chapter 4 - Completing The ADokument153 SeitenChapter 4 - Completing The APatricia Pantin100% (2)

- Go Digit General Insurance Limited Financials Income StatementDokument3 SeitenGo Digit General Insurance Limited Financials Income StatementShuchita AgarwalNoch keine Bewertungen

- CBRMDokument14 SeitenCBRMSurajSinghalNoch keine Bewertungen

- 7110 w14 Ms 21Dokument11 Seiten7110 w14 Ms 21Muhammad Umair100% (1)

- Sales Less: Operating Expenses Opg Variable Expenses Opg Fixed Expenses Pbit Interest Fin Fixed Exp PBT TAX PAT EPSDokument102 SeitenSales Less: Operating Expenses Opg Variable Expenses Opg Fixed Expenses Pbit Interest Fin Fixed Exp PBT TAX PAT EPSAksh KhandelwalNoch keine Bewertungen

- Quiz IntAccDokument12 SeitenQuiz IntAccTrixie HicaldeNoch keine Bewertungen

- Ias 19 Book Example With TransactionDokument20 SeitenIas 19 Book Example With Transactionasmaaabdelaziz373Noch keine Bewertungen

- Basic Accountingch3 1 1Dokument64 SeitenBasic Accountingch3 1 1Renmar CruzNoch keine Bewertungen

- CFR Sample QuestionsDokument10 SeitenCFR Sample Questionsisgigles157Noch keine Bewertungen

- Valuation Lecture I: WACC vs. APV and Capital Structure DecisionsDokument14 SeitenValuation Lecture I: WACC vs. APV and Capital Structure DecisionsJuan Manuel VeronNoch keine Bewertungen

- The Behavior of Costs: Changes From The Eleventh EditionDokument14 SeitenThe Behavior of Costs: Changes From The Eleventh EditionAlka NarayanNoch keine Bewertungen

- 3rd ActivityDokument2 Seiten3rd Activitydar •Noch keine Bewertungen

- Financial Management Part 1Dokument44 SeitenFinancial Management Part 1Dante Arcigal JrNoch keine Bewertungen

- PRELEC1 Final ExamDokument4 SeitenPRELEC1 Final ExamAramina Cabigting BocNoch keine Bewertungen