Beruflich Dokumente

Kultur Dokumente

Narayana Hrudayalaya Limited NSEI NH Financials Balance Sheet

Hochgeladen von

akumar4uCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Narayana Hrudayalaya Limited NSEI NH Financials Balance Sheet

Hochgeladen von

akumar4uCopyright:

Verfügbare Formate

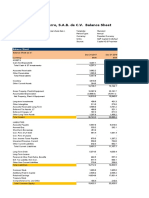

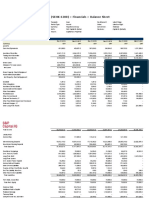

Narayana Hrudayalaya Limited (NSEI:NH) > Financials > Balance Sheet

Balance Sheet

Balance Sheet as of: Restated Restated Restated Reclassified Press Release

Mar-31-2015 Mar-31-2016 Mar-31-2017 Mar-31-2018 Mar-31-2019 Dec-31-2019

Currency INR Million INR Million INR Million INR Million INR Million INR Million

ASSETS

Cash And Equivalents 295.2 137.7 262.4 333.3 964.9 -

Short Term Investments 0.4 - - 0.0 12.2 -

Total Cash & ST Investments 295.6 137.7 262.4 333.3 977.1 1,599.7

Accounts Receivable 1,535.8 1,648.6 1,696.3 3,010.6 2,905.1 -

Other Receivables 32.5 47.2 47.0 12.3 7.6 -

Notes Receivable 94.8 104.7 251.6 82.3 33.1 -

Total Receivables 1,663.1 1,800.5 1,994.9 3,105.1 2,945.7 -

Inventory 512.2 497.5 523.6 836.2 831.9 -

Prepaid Exp. 39.6 90.7 96.2 320.8 311.6 -

Other Current Assets 94.0 333.1 138.7 197.5 207.5 -

Total Current Assets 2,604.5 2,859.5 3,015.8 4,792.9 5,273.7 -

Gross Property, Plant & Equipment 11,606.3 13,542.8 14,969.9 22,512.5 23,773.7 -

Accumulated Depreciation (2,944.0) (3,478.2) (4,230.0) (5,127.2) (6,288.1) -

Net Property, Plant & Equipment 8,662.3 10,064.6 10,739.8 17,385.4 17,485.6 -

Long-term Investments 532.4 873.9 962.2 88.9 178.1 -

Goodwill 642.2 590.2 581.5 660.5 660.5 -

Other Intangibles 31.7 28.3 26.9 932.1 911.3 -

Loans Receivable Long-Term - 169.0 202.6 424.9 350.7 -

Deferred Tax Assets, LT - - - 80.4 40.6 -

Other Long-Term Assets 1,228.7 978.4 939.2 990.9 1,470.0 -

Total Assets 13,701.7 15,563.8 16,467.9 25,356.0 26,370.5 -

LIABILITIES

Accounts Payable 1,358.4 1,610.3 2,065.8 3,049.9 3,335.3 -

Accrued Exp. 295.6 402.9 227.9 417.4 402.6 -

Short-term Borrowings 986.3 450.6 90.2 375.8 115.4 -

Curr. Port. of LT Debt 569.2 253.8 278.9 676.3 766.2 -

Curr. Income Taxes Payable 6.2 3.6 0.4 - - -

Unearned Revenue, Current 85.1 176.4 146.7 179.4 227.2 -

Other Current Liabilities 133.6 250.0 415.7 404.8 256.9 -

Total Current Liabilities 3,434.4 3,147.6 3,225.6 5,103.5 5,103.5 -

Long-Term Debt 2,065.8 1,875.7 1,798.0 6,979.8 7,325.6 -

Unearned Revenue, Non-Current 20.8 1,355.2 1,316.5 1,288.2 1,319.4 -

Pension & Other Post-Retire. Benefits 106.3 129.2 151.9 138.6 158.0 -

Def. Tax Liability, Non-Curr. 358.3 231.6 248.0 395.7 478.7 -

Other Non-Current Liabilities 25.4 62.0 94.8 1,089.8 1,169.9 -

Total Liabilities 6,011.0 6,801.3 6,834.8 14,995.6 15,555.1 -

Common Stock 2,000.0 2,043.6 2,043.6 2,043.6 2,043.6 -

Additional Paid In Capital 3,889.4 4,901.2 4,901.2 4,901.2 5,002.1 -

Retained Earnings 1,344.5 1,705.2 2,535.3 3,041.8 3,633.4 -

Treasury Stock - (20.4) (20.1) (19.5) (15.6) -

Comprehensive Inc. and Other 450.0 130.2 170.8 390.4 147.8 -

Total Common Equity 7,683.9 8,759.8 9,630.8 10,357.5 10,811.4 11,107.7

Minority Interest 6.8 2.7 2.4 2.9 4.0 -

Total Equity 7,690.7 8,762.5 9,633.2 10,360.4 10,815.4 11,112.3

Total Liabilities And Equity 13,701.7 15,563.8 16,467.9 25,356.0 26,370.5 -

Supplemental Items

Total Shares Out. on Filing Date 200.0 202.3 202.4 202.4 202.8 202.5

Total Shares Out. on Balance Sheet Date 200.0 202.3 202.4 202.4 202.8 202.5

Book Value/Share 38.42 43.3 47.59 51.17 53.31 54.65

Tangible Book Value 7,010.1 8,141.3 9,022.4 8,764.9 9,239.6 9,656.1

Tangible Book Value/Share 35.05 40.24 44.59 43.3 45.56 47.51

Total Debt 3,621.3 2,580.1 2,167.1 8,031.9 8,207.1 9,517.7

Net Debt 3,325.7 2,442.4 1,904.7 7,698.6 7,230.0 7,918.0

Debt Equiv. of Unfunded Proj. Benefit Obligation 109.3 135.3 157.0 200.0 228.9 NA

Debt Equivalent Oper. Leases 2,058.8 4,530.9 4,469.8 5,548.4 6,368.2 NA

Total Minority Interest 6.8 2.7 2.4 2.9 4.0 4.6

Equity Method Investments NA 871.5 931.3 37.5 29.4 NA

Inventory Method FIFO FIFO FIFO FIFO FIFO NA

Raw Materials Inventory 522.4 505.3 531.6 849.5 906.1 NA

Land 937.9 2,085.2 2,082.2 2,409.4 2,418.7 NA

Buildings 3,455.0 3,737.1 3,850.7 7,734.3 8,033.2 NA

Machinery 6,846.4 7,418.8 8,323.6 11,869.4 12,714.9 NA

Construction in Progress 204.1 138.0 530.4 268.7 361.7 -

Leasehold Improvements 163.0 163.7 183.0 230.7 245.3 -

Full Time Employees NA 13,557 14,330 NA NA NA

Accum. Allowance for Doubtful Accts 191.4 186.7 127.7 302.0 415.6 NA

Filing Date Jul-06-2016 Aug-09-2017 May-29-2018 Jul-12-2019 Jul-12-2019 NA

Restatement Type RS RS RS RD O NV

Calculation Type REP REP REP REP REP FWD

Currency INR INR INR INR INR INR

Exchange Rate 1.0 1.0 1.0 1.0 1.0 1.0

Conversion Method H H H H H H

Note: For multiple class companies, total share counts are primary class equivalent, and for foreign companies listed as primary ADRs, total share counts are ADR-equivalent.

Das könnte Ihnen auch gefallen

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyVon EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyNoch keine Bewertungen

- Trustee Investment Strategy for Endowments and FoundationsVon EverandTrustee Investment Strategy for Endowments and FoundationsNoch keine Bewertungen

- Shalby Limited BSE 540797 Financials Balance SheetDokument3 SeitenShalby Limited BSE 540797 Financials Balance Sheetakumar4uNoch keine Bewertungen

- Max Healthcare Institute Limited BSE 539981 Financials Balance SheetDokument3 SeitenMax Healthcare Institute Limited BSE 539981 Financials Balance Sheetakumar4uNoch keine Bewertungen

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financials Balance SheetDokument3 SeitenApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financials Balance Sheetakumar4uNoch keine Bewertungen

- Slides Week 8 No AnswerDokument38 SeitenSlides Week 8 No Answerchingwen731Noch keine Bewertungen

- Efrs 2014-2018 Amsa. Ratios-Final-2Dokument60 SeitenEfrs 2014-2018 Amsa. Ratios-Final-2Nicolás Bórquez MonsalveNoch keine Bewertungen

- Pidilite IndustriesDokument5 SeitenPidilite IndustriesPrena JoshiNoch keine Bewertungen

- Toyota Balance SheetDokument3 SeitenToyota Balance SheetqwertuipbkjhggfgfddNoch keine Bewertungen

- Housing Development Finance Corp LTD (HDFC IN) - StandardizedDokument4 SeitenHousing Development Finance Corp LTD (HDFC IN) - StandardizedAswini Kumar BhuyanNoch keine Bewertungen

- BDODokument6 SeitenBDOVince Raphael MirandaNoch keine Bewertungen

- Komatsu LTD (6301 JT) - StandardizedDokument36 SeitenKomatsu LTD (6301 JT) - StandardizedIan RiceNoch keine Bewertungen

- Adv EnzDokument4 SeitenAdv EnzSafwan BhikhaNoch keine Bewertungen

- Pakistan State Oil Company Limited (Pso)Dokument6 SeitenPakistan State Oil Company Limited (Pso)Maaz HanifNoch keine Bewertungen

- Nissan Motor Co LTDDokument11 SeitenNissan Motor Co LTDShamsa AkbarNoch keine Bewertungen

- Promit Singh Rathore - 20PGPM111Dokument14 SeitenPromit Singh Rathore - 20PGPM111mahiyuvi mahiyuviNoch keine Bewertungen

- Wassim Zhani Starbucks Valuation 2007-2011Dokument13 SeitenWassim Zhani Starbucks Valuation 2007-2011wassim zhaniNoch keine Bewertungen

- General Govt DataDokument10 SeitenGeneral Govt DataEdgar MugaruraNoch keine Bewertungen

- Financial Statements For Jollibee Foods CorporationDokument4 SeitenFinancial Statements For Jollibee Foods CorporationKevin CeladaNoch keine Bewertungen

- Cash Flows:: Currency in Millions of U.S. DollarsDokument3 SeitenCash Flows:: Currency in Millions of U.S. DollarscutooteddyNoch keine Bewertungen

- ICICI Bank LTD (ICICIBC IN) - StandardizedDokument51 SeitenICICI Bank LTD (ICICIBC IN) - StandardizedSasidharan RavikumarNoch keine Bewertungen

- Balance Sheet of Tata MotorsDokument6 SeitenBalance Sheet of Tata Motorsnehanayaka25Noch keine Bewertungen

- Group AssignmentDokument4 SeitenGroup Assignment1954032027cucNoch keine Bewertungen

- Standalone Balance Sheet - Lupin LTD.: ParticularsDokument26 SeitenStandalone Balance Sheet - Lupin LTD.: ParticularsshubhNoch keine Bewertungen

- Acc FCFFDokument25 SeitenAcc FCFFArchit PateriaNoch keine Bewertungen

- HCL Technologies LTD (HCLT IN) - StandardizedDokument6 SeitenHCL Technologies LTD (HCLT IN) - StandardizedAswini Kumar BhuyanNoch keine Bewertungen

- PVR LTD (PVRL IN) - StandardizedDokument18 SeitenPVR LTD (PVRL IN) - StandardizedSrinidhi SrinathNoch keine Bewertungen

- Strategic Management AssignmentDokument12 SeitenStrategic Management AssignmentTuvshinjargal BaatarchuluunNoch keine Bewertungen

- Financial Statements For Jollibee Foods CorporationDokument8 SeitenFinancial Statements For Jollibee Foods CorporationJ U D YNoch keine Bewertungen

- Caso HertzDokument32 SeitenCaso HertzJORGE PUENTESNoch keine Bewertungen

- Assignment No. 1Dokument2 SeitenAssignment No. 1AMegoz 25Noch keine Bewertungen

- Traveller Balance SheetDokument4 SeitenTraveller Balance SheetMathi Mahi JayanthNoch keine Bewertungen

- Bidding For Hertz Leveraged Buyout, Spreadsheet SupplementDokument12 SeitenBidding For Hertz Leveraged Buyout, Spreadsheet SupplementAmit AdmuneNoch keine Bewertungen

- LDG - Financial TemplateDokument20 SeitenLDG - Financial TemplateQuan LeNoch keine Bewertungen

- Model No 1 Utkarsh (FFM)Dokument3 SeitenModel No 1 Utkarsh (FFM)Utkarsh UtkarshNoch keine Bewertungen

- Asian PaintsDokument38 SeitenAsian PaintsKartikai MehtaNoch keine Bewertungen

- Công Ty Cổ Phần Vĩnh Hoàn VHC 7.52.36 AmDokument37 SeitenCông Ty Cổ Phần Vĩnh Hoàn VHC 7.52.36 AmTammy DaoNoch keine Bewertungen

- Mac Balance SheetDokument5 SeitenMac Balance Sheetshalinikn1507Noch keine Bewertungen

- Financial Statements-Kingsley AkinolaDokument4 SeitenFinancial Statements-Kingsley AkinolaKingsley AkinolaNoch keine Bewertungen

- CASE Exhibits - HertzDokument15 SeitenCASE Exhibits - HertzSeemaNoch keine Bewertungen

- Hindalco Balance SheetDokument2 SeitenHindalco Balance Sheetakhilesh718Noch keine Bewertungen

- Actividad 3.1Dokument27 SeitenActividad 3.1David RiosNoch keine Bewertungen

- Financial AnalysisDokument6 SeitenFinancial AnalysisRinceNoch keine Bewertungen

- ROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements2 - BloombergDokument2 SeitenROADS NIGERIA PLC (ROADS - Lagos) - Financial Statements2 - BloombergImmanuel Billie AllenNoch keine Bewertungen

- CiplaDokument29 SeitenCiplaShalom M.ANoch keine Bewertungen

- Beta Exhibit 03 - 91 Day Tresury BillDokument1 SeiteBeta Exhibit 03 - 91 Day Tresury BillAnonymous tvA58EWlRgNoch keine Bewertungen

- JohnsonDokument12 SeitenJohnsonJannah Victoria AmoraNoch keine Bewertungen

- Tallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Dokument109 SeitenTallu Spinning Mills: Particulars 2009 2010 2011 2012 2013Shovon MustaryNoch keine Bewertungen

- 14-10 Years HighlightsDokument1 Seite14-10 Years HighlightsJigar PatelNoch keine Bewertungen

- 5T A165c3af PDFDokument1 Seite5T A165c3af PDFSumit GargNoch keine Bewertungen

- 5T A165c3afDokument1 Seite5T A165c3afSumit GargNoch keine Bewertungen

- Bhushan Steel LTD (BHUS IN) - Balance SheetDokument4 SeitenBhushan Steel LTD (BHUS IN) - Balance SheetVamsi GunturuNoch keine Bewertungen

- Tiffany & Co's Analysis: Student Name Institutional Affiliation Course Name Instructor Name DateDokument6 SeitenTiffany & Co's Analysis: Student Name Institutional Affiliation Course Name Instructor Name DateOmer KhanNoch keine Bewertungen

- Ratio Analysis of TATA MOTORSDokument8 SeitenRatio Analysis of TATA MOTORSmr_anderson47100% (8)

- SHREE Moneycontrol - Com - Company Info - Print FinancialsDokument2 SeitenSHREE Moneycontrol - Com - Company Info - Print FinancialsMohammad DishanNoch keine Bewertungen

- Agricultural Bank of China Limited SEHK 1288 Financials Balance SheetDokument3 SeitenAgricultural Bank of China Limited SEHK 1288 Financials Balance SheetJaime Vara De ReyNoch keine Bewertungen

- TVS Motor Co LTD (TVSL IN) - StandardizedDokument34 SeitenTVS Motor Co LTD (TVSL IN) - StandardizedAswini Kumar BhuyanNoch keine Bewertungen

- Bharat Forge BSDokument6 SeitenBharat Forge BSAswini Kumar BhuyanNoch keine Bewertungen

- CF P&L Excel GodrejDokument4 SeitenCF P&L Excel GodrejPraksh chandra Rajeek kumarNoch keine Bewertungen

- Securities Operations: A Guide to Trade and Position ManagementVon EverandSecurities Operations: A Guide to Trade and Position ManagementBewertung: 4 von 5 Sternen4/5 (3)

- Notice of 27th AgmDokument14 SeitenNotice of 27th Agmakumar4uNoch keine Bewertungen

- Delta Corp Annual Report FY 2021-22Dokument241 SeitenDelta Corp Annual Report FY 2021-22akumar4uNoch keine Bewertungen

- Annual Report 2017 2018Dokument220 SeitenAnnual Report 2017 2018akumar4uNoch keine Bewertungen

- Zscaler Inc - Form 10-K (Sep-18-2019)Dokument164 SeitenZscaler Inc - Form 10-K (Sep-18-2019)akumar4uNoch keine Bewertungen

- Design Thinking EbookDokument850 SeitenDesign Thinking Ebookakumar4uNoch keine Bewertungen

- Zscaler Inc - Form 10-K (Sep-17-2020)Dokument186 SeitenZscaler Inc - Form 10-K (Sep-17-2020)akumar4uNoch keine Bewertungen

- The Startup's Guide To Google CloudDokument18 SeitenThe Startup's Guide To Google Cloudakumar4uNoch keine Bewertungen

- Kovai Medical Center and Hospital Limited BSE 523323 FinancialsDokument39 SeitenKovai Medical Center and Hospital Limited BSE 523323 Financialsakumar4uNoch keine Bewertungen

- IBEF Healthcare-March-2021Dokument39 SeitenIBEF Healthcare-March-2021akumar4uNoch keine Bewertungen

- IBEF IT-and-BPM-January-2021Dokument34 SeitenIBEF IT-and-BPM-January-2021akumar4u100% (1)

- Rummy Mobile Gaming ComparisonDokument2 SeitenRummy Mobile Gaming Comparisonakumar4uNoch keine Bewertungen

- KMC Speciality Hospitals India Limited BSE 524520 FinancialsDokument38 SeitenKMC Speciality Hospitals India Limited BSE 524520 Financialsakumar4uNoch keine Bewertungen

- Healthcare: Ind AS 116: Impact Analysis On Healthcare CompaniesDokument7 SeitenHealthcare: Ind AS 116: Impact Analysis On Healthcare Companiesakumar4uNoch keine Bewertungen

- Expansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal GopiDokument13 SeitenExpansion Done and Consolidation On Re-Rating Ahead?: Nitin Agarwal Nirmal Gopiakumar4uNoch keine Bewertungen

- Fortis Healthcare Limited BSE 532843 FinancialsDokument44 SeitenFortis Healthcare Limited BSE 532843 Financialsakumar4uNoch keine Bewertungen

- Apollo Hospitals Enterprise Limited NSEI APOLLOHOSP FinancialsDokument40 SeitenApollo Hospitals Enterprise Limited NSEI APOLLOHOSP Financialsakumar4uNoch keine Bewertungen

- India - Healthcare: NCR Healthcare Visit: Tales From DelhiDokument5 SeitenIndia - Healthcare: NCR Healthcare Visit: Tales From Delhiakumar4uNoch keine Bewertungen

- Healthcare: Resilient Growth in A Seasonally Weak QuarterDokument9 SeitenHealthcare: Resilient Growth in A Seasonally Weak Quarterakumar4uNoch keine Bewertungen

- Indian HospitalsDokument8 SeitenIndian Hospitalsakumar4uNoch keine Bewertungen

- A Study of India's Healthcare Sector Including Union Budget 2020Dokument15 SeitenA Study of India's Healthcare Sector Including Union Budget 2020akumar4uNoch keine Bewertungen

- Mobile App Performance Assessement - FINALDokument16 SeitenMobile App Performance Assessement - FINALredejavoeNoch keine Bewertungen

- ActionPlan8D ModifiedDokument23 SeitenActionPlan8D ModifiedwilkesgillinghamNoch keine Bewertungen

- Akd 73673805038Dokument1 SeiteAkd 73673805038Rishaan RanjanNoch keine Bewertungen

- Brochure 2023Dokument3 SeitenBrochure 2023Sandeep SNoch keine Bewertungen

- Iog Solution AssignmentDokument2 SeitenIog Solution Assignmentpoonam4927Noch keine Bewertungen

- Introduction To Operations Management: True / False QuestionsDokument20 SeitenIntroduction To Operations Management: True / False QuestionsRecel Benhel100% (1)

- Implementation of Lean Principles: Towards Augmenting Productivity in Construction Industry - A Literature ReviewDokument3 SeitenImplementation of Lean Principles: Towards Augmenting Productivity in Construction Industry - A Literature ReviewAce NovoNoch keine Bewertungen

- Revised Read Me 0-C FirstDokument3 SeitenRevised Read Me 0-C Firstabubakr jimohNoch keine Bewertungen

- Vision 2021 Science Tech PDFNOTES - CODokument165 SeitenVision 2021 Science Tech PDFNOTES - COAASTHA SHARMANoch keine Bewertungen

- Ebook PDF Contemporary Canadian Business Law 12th Edition PDFDokument41 SeitenEbook PDF Contemporary Canadian Business Law 12th Edition PDFlori.parker237100% (35)

- Full Download Issues in Economics Today 7th Edition Guell Test BankDokument35 SeitenFull Download Issues in Economics Today 7th Edition Guell Test Bankelizebethwebbs100% (36)

- Chapter 1Dokument73 SeitenChapter 1Rashmi AroraNoch keine Bewertungen

- Feasibility Study For A Residential Construction Project: A Case StudyDokument7 SeitenFeasibility Study For A Residential Construction Project: A Case Studyaashritha lNoch keine Bewertungen

- Deed of Sale of Motor VehicleDokument1 SeiteDeed of Sale of Motor VehicleRalph AnitoNoch keine Bewertungen

- Quantitative Analysis Lecture - 1-Introduction: Associate Professor, Anwar Mahmoud Mohamed, PHD, Mba, PMPDokument41 SeitenQuantitative Analysis Lecture - 1-Introduction: Associate Professor, Anwar Mahmoud Mohamed, PHD, Mba, PMPEngMohamedReyadHelesyNoch keine Bewertungen

- 1406 and 1550 - Law of Corporate Finance ProjectDokument25 Seiten1406 and 1550 - Law of Corporate Finance ProjectIsha Sen100% (1)

- Database Assignment 1 Mohammed Shalabi 201810028Dokument5 SeitenDatabase Assignment 1 Mohammed Shalabi 201810028Mohammed ShalabiNoch keine Bewertungen

- Chapter-2 Regime of Patent in India and Its Global ScenarioDokument19 SeitenChapter-2 Regime of Patent in India and Its Global Scenariochongtham rajeshNoch keine Bewertungen

- Corruption in International BusinessDokument20 SeitenCorruption in International BusinessZawad ZawadNoch keine Bewertungen

- Add Users To Office 365 With Windows PowerShellDokument3 SeitenAdd Users To Office 365 With Windows PowerShelladminakNoch keine Bewertungen

- DR 202221919Dokument40 SeitenDR 202221919Lassaad Ben MahjoubNoch keine Bewertungen

- 11-1 - Assessment of Entrepreneurial OpportunitiesDokument24 Seiten11-1 - Assessment of Entrepreneurial OpportunitiesMuhammad Obaid ElahiNoch keine Bewertungen

- CM20 Topic 1 Revenue Recognition 2022 (BB Students)Dokument72 SeitenCM20 Topic 1 Revenue Recognition 2022 (BB Students)victor.hamelleNoch keine Bewertungen

- Pre-Course Work - Miralles, Ana FelnaDokument5 SeitenPre-Course Work - Miralles, Ana FelnaAna Felna R. MirallesNoch keine Bewertungen

- AS BookDokument18 SeitenAS BookMaanav VasantNoch keine Bewertungen

- Case Ball Point PenDokument16 SeitenCase Ball Point Penankur2wazzNoch keine Bewertungen

- The External Assessment: Chapter ThreeDokument46 SeitenThe External Assessment: Chapter Threeملک طیبNoch keine Bewertungen

- 20880-Article Text-66052-1-10-20180826Dokument9 Seiten20880-Article Text-66052-1-10-20180826shubham moonNoch keine Bewertungen

- Democratizing Instant Fulfillment For Indonesian E-Commerce & SmesDokument25 SeitenDemocratizing Instant Fulfillment For Indonesian E-Commerce & SmesIdam Idhamkhalik100% (1)

- Literature Review On Employee Performance EvaluationDokument5 SeitenLiterature Review On Employee Performance EvaluationaflsvwoeuNoch keine Bewertungen