Beruflich Dokumente

Kultur Dokumente

Ucsi University Faculty of Business and Information Science (Fobis) Course Outline Cum Teaching Plan

Hochgeladen von

Hamza Iftekhar0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

89 Ansichten3 Seiten1. This document outlines the course plan for AS303 Statistical Simulation for Financial Modelling, which is a 3 credit hour course offered in the May 2020 semester.

2. The course objectives are to develop practical skills in designing, implementing, and analyzing discrete-event simulation systems to enable a critical understanding of simulation output in financial environments.

3. Assessment will be based on coursework including labs, tests, and a final examination.

Originalbeschreibung:

Originaltitel

AS303TeachingPlanMay2020 (1)

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden1. This document outlines the course plan for AS303 Statistical Simulation for Financial Modelling, which is a 3 credit hour course offered in the May 2020 semester.

2. The course objectives are to develop practical skills in designing, implementing, and analyzing discrete-event simulation systems to enable a critical understanding of simulation output in financial environments.

3. Assessment will be based on coursework including labs, tests, and a final examination.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

89 Ansichten3 SeitenUcsi University Faculty of Business and Information Science (Fobis) Course Outline Cum Teaching Plan

Hochgeladen von

Hamza Iftekhar1. This document outlines the course plan for AS303 Statistical Simulation for Financial Modelling, which is a 3 credit hour course offered in the May 2020 semester.

2. The course objectives are to develop practical skills in designing, implementing, and analyzing discrete-event simulation systems to enable a critical understanding of simulation output in financial environments.

3. Assessment will be based on coursework including labs, tests, and a final examination.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

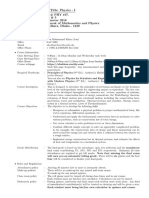

UCSI UNIVERSITY

FACULTY OF BUSINESS AND INFORMATION SCIENCE (FoBIS)

Course Outline cum Teaching Plan

1. Course Code & Title : AS303 Statistical Simulation for Financial Modelling

2. Programme : Bachelor of Science (Hons) Actuarial Science

Bachelor of Science (Hons) Actuarial Science & Finance

3. Semester and Year : May 2020

4. Credit Hour & : 3 credit hours

Contact Hours Lecture : 1.5 hours

Tutorial : 1.5 hours

Lab : 1.5 hours

5. Lecturer : Prof Kuru Ratnavelu

6. Tutor : Same as above

7. Mode of Delivery : Lecture, Tutorial and lab session

8. Objective : To develop the practical skills necessary to design, implement and

analyse discrete-event simulation systems, and to cover the basic

theory underlying discrete-event simulation methodologies in order

to enable a critical understanding of simulation output in financial

environments.

9. Learning Outcomes : After completing this unit, students will be able to: -

1. apply the principle of Monte Carlo simulation approach to

problem solving.

2. simulate both discrete and continuous random variables using

the inversion method, Acceptance-Rejection and polar

transformation, or other variance reduction techniques.

3. undertake Monte Carlo simulation of stochastic processes.

4. approximate simulation of diffusion via discretization

methods.

5. apply and evaluate the results using Monte Carlo simulation

methods in the solution of problems arising in finance and

insurance

10. Reading List : Main Text:

1. McLeish, D.L. (2005). Monte Carlo Simulation and Finance.

New Jersey: Wiley-Interscience.

Additional Text:

1. Paul Glasserman (2003). Monte Carlo Methods in Financial

Engineering. New York: Springer Verlag.

2. Chan, N.H.& Wong, H.Y. (2006). Simulation Techniques in

Financial Risk Management. New Jersey: Wiley-Interscience.

3. McDonald, R.L. (2012). Derivative Markets, 3rd Ed, Pearson

Addison Wesley.

4. Klugman, S.A., H H. Panjer, G E. Willmot. (2012). Loss

Models: From Data to Decision, 4th Ed, New Jersey: Wiley-

Interscience

11. Method of :

Assessment No. Method of Assessment Total

1. Coursework

(a) Lab 10% 50%

(b) Test 1 20%

(c) Test 2 20%

2. Final Examination 50%

GRAND TOTAL 100%

12. Remark : -

Lecture, Tutorial and Assessment Plan

Session Lecture Topic Tutorial Topic Assessment Reference

Wk 1 - 2 Philosophy of the Monte Tutorial 1 - 2 Klugman, etc.

Carlo Approach • Basic Monte Carlo (Chapter 21)

• Principles of Monte Carlo simulation procedure

• Example: Problem solved • Estimation of sample

using Monte Carlo simulation size

• Efficiency of simulation

estimators

Wk 3 - 7 Random Number Generation Tutorial 3-6 Test 1 in McLeish

• Linear congruential generator • Inverse transformation Week 7 (Chapter 3) &

• General sampling methods method Chan (Chapter

• Inverse transform method • Acceptance-Rejection 4)

• Acceptance-Rejection method method

• Normal Random Variables • Normal variate

and Vectors generation

• Generating Univariate Normal • Cholesky

• Generating Multivariate decomposition

Normal

Wk 8-9 Application of Simulation in Tutorial 7 – 8 Klugman, etc.

Statistics • Bootstrap and loss (Chapter 21)

• Bootstrap method for simulation

estimation of MSE

• Loss models

Wk 10-12 Simulation of Stochastic Tutorial 9 – 10 Test 2 in

Processes • Simulation of Week 12

• Introduction to continuous- Brownian Motion and

time stochastic processes, Lognormal process

Brownian Motion, Geometric with jumps

Brownian Motion

• Computer implementation of

Brownian Motion

• Processes with Jumps

• Financial Management

• Disability Insurance

Wk 11 - 13 Approximate Simulation of Tutorial 11 – 12 McLeish

Diffusion Using Discretization • Simulation of (Chapter 3)

Methods diffusion process

• The Euler Scheme

• Second order methods

Wk 13 - 14 Variance Reduction Tutorial 13 – 14 McLeish

Techniques • Variance reduction (Chapter 4)

• Control Variates techniques Chan (Chapter

• Antithetic Variates 6)

• Stratified Sampling

• Importance Sampling

Information on Lab Practical Session

Week Activities Session (1.5 hours)

1–2 Generating non-uniform random variates I: Using Excel 3

built-in functions (2 weeks)

• Familiarization with Excel programming using Excel

• Generate non-uniform random variates using Excel built-

in functions

• Inversion method

• Test of randomness and uncorrelatedness

3–5 Introduction to VBA (3 weeks) 4.5

• Writing, editing and debugging VBA program

• Data types and declaration of data in VBA

• Sub and Function procedures

• User defined functions

6 Assignment (5%) 1.5

7-8 Generating non-uniform random variates II: Using VBA 3

functions (2 weeks)

• Box-Muller method

• Acceptance-Rejection method

• Cholesky decomposition

9 – 10 Diffusion processes (2 weeks) 3

• Brownian Motion

• Simulation on stock prices and interest rate

11 Lab Test 2 (5%) 1.5

Content from week 5 to week 9

12-14 Application of Simulation I (3 weeks) 4.5

• Pricing of options and related portfolio

• Estimate probability of ruin for an insurance business

This teaching plan is:

Prepared by: Moderated by: Approved by:

(Name: Prof Kuru Ratnavelu) (Name: Dr. Loh Yue Fang) (Name: Prof Ong Seng Huat)

Lecturer Moderator Head of School/Department

Date: 3rd May 2020 Date: Date:

Das könnte Ihnen auch gefallen

- Mathematical Techniques of Applied Probability: Discrete Time Models: Basic TheoryVon EverandMathematical Techniques of Applied Probability: Discrete Time Models: Basic TheoryBewertung: 5 von 5 Sternen5/5 (1)

- Introduction to Dynamic Programming: International Series in Modern Applied Mathematics and Computer Science, Volume 1Von EverandIntroduction to Dynamic Programming: International Series in Modern Applied Mathematics and Computer Science, Volume 1Noch keine Bewertungen

- Institute of Technology: Course PolicyDokument8 SeitenInstitute of Technology: Course PolicySamriddha Das GuptaNoch keine Bewertungen

- ES815 Stochastic ProcessesDokument2 SeitenES815 Stochastic ProcessesJkarlos TlNoch keine Bewertungen

- Jaipuria Institute of Management, Noida PGDM (G-SM-M) TRIMESTER IV AY 2020-21 Batch 2019-21Dokument10 SeitenJaipuria Institute of Management, Noida PGDM (G-SM-M) TRIMESTER IV AY 2020-21 Batch 2019-21vaibhav chaurasiaNoch keine Bewertungen

- Savage & Williams) Hal 4. Dan 35. 1990 PDFDokument224 SeitenSavage & Williams) Hal 4. Dan 35. 1990 PDFgiyono100% (1)

- ISE3004Dokument3 SeitenISE3004Farhan NewazNoch keine Bewertungen

- Statistics For Engineers (MAT2001) - SyllabusDokument3 SeitenStatistics For Engineers (MAT2001) - SyllabusDiyali67% (3)

- Statistics For Engineers (MAT2001) - SyllabusDokument3 SeitenStatistics For Engineers (MAT2001) - Syllabusmanjeet kumarNoch keine Bewertungen

- Kuw 315193Dokument135 SeitenKuw 315193yqqpn7nkd5Noch keine Bewertungen

- Course PlanDokument6 SeitenCourse Planzohaib akhtarNoch keine Bewertungen

- MATH 111 Calculus 1 4Dokument4 SeitenMATH 111 Calculus 1 4j.roziboyevNoch keine Bewertungen

- Course 9 Applied Data Analytics Second VersionDokument16 SeitenCourse 9 Applied Data Analytics Second Versionjin0935Noch keine Bewertungen

- A) Course Overview and Description: Use of Mathematical Tools For The Analysis of Chemical Engineering OperationsDokument2 SeitenA) Course Overview and Description: Use of Mathematical Tools For The Analysis of Chemical Engineering OperationsnelsonNoch keine Bewertungen

- Learning OutcomesDokument13 SeitenLearning OutcomesWan2wantNoch keine Bewertungen

- Eco No Metrics Course OutlineDokument6 SeitenEco No Metrics Course OutlineAli FarooqNoch keine Bewertungen

- Bmat202l Probability-And-Statistics TH 1.0 65 Bmat202lDokument3 SeitenBmat202l Probability-And-Statistics TH 1.0 65 Bmat202lManav IsraniNoch keine Bewertungen

- Kirkup Experimental Methods PDFDokument240 SeitenKirkup Experimental Methods PDFPeterParker1983100% (2)

- Bahan Ajar Minggu 12 SimsisDokument10 SeitenBahan Ajar Minggu 12 SimsisjovankaNoch keine Bewertungen

- ORDokument2 SeitenORungabungaNoch keine Bewertungen

- Course Outline Probability MethodsDokument5 SeitenCourse Outline Probability MethodsgmujtabaNoch keine Bewertungen

- Nonuniform Sampling - The Theory and PraticeDokument56 SeitenNonuniform Sampling - The Theory and PraticeSamba TraoreNoch keine Bewertungen

- Physics I 1 3 0 2 4 6 No English Compulsory Bachelor Lecture, Question and Answer, ApplicationDokument4 SeitenPhysics I 1 3 0 2 4 6 No English Compulsory Bachelor Lecture, Question and Answer, ApplicationmelihNoch keine Bewertungen

- Module Lab Bistat LanjutanDokument121 SeitenModule Lab Bistat LanjutanElleana YauriNoch keine Bewertungen

- ECE 511 Summer Intro Ver 2Dokument2 SeitenECE 511 Summer Intro Ver 2Simon LeeNoch keine Bewertungen

- QF204 - Tee Chyng Wen - AY15-16 T1Dokument3 SeitenQF204 - Tee Chyng Wen - AY15-16 T1Hohoho134Noch keine Bewertungen

- Structural Theory 2 - First Second Third ModulesDokument120 SeitenStructural Theory 2 - First Second Third ModulesNj Concepcion RobeniolNoch keine Bewertungen

- SVKM's NMIMS ASMSOC - Course Outline: Business Analytics and VisualizationDokument4 SeitenSVKM's NMIMS ASMSOC - Course Outline: Business Analytics and VisualizationVivek GulatiNoch keine Bewertungen

- Econometrics Theory and Applications ECO501 - ComsatsDokument5 SeitenEconometrics Theory and Applications ECO501 - ComsatsAhmed ArifNoch keine Bewertungen

- Chapter 1Dokument19 SeitenChapter 1Ahmed AbdelhamidNoch keine Bewertungen

- CQF Learning Pathway January 2016 V2Dokument12 SeitenCQF Learning Pathway January 2016 V2Shravan VenkataramanNoch keine Bewertungen

- Or HDokument136 SeitenOr HIsha IssahNoch keine Bewertungen

- Power Distribution and Utilization: 1. Course CodeDokument3 SeitenPower Distribution and Utilization: 1. Course CodeSakhawat AliNoch keine Bewertungen

- Semester & Branch: I Me - : Course Plan 2012-2013Dokument6 SeitenSemester & Branch: I Me - : Course Plan 2012-2013Babitha DhanaNoch keine Bewertungen

- STA 112 Outline - 021843Dokument5 SeitenSTA 112 Outline - 021843monyeidavid13Noch keine Bewertungen

- ME2021-Module Outline (UGC)Dokument3 SeitenME2021-Module Outline (UGC)nipunamfdoNoch keine Bewertungen

- 4yr MechanicsDokument3 Seiten4yr Mechanicscatotheophilus18Noch keine Bewertungen

- Lecture 5: Simulation Technology and Manufacturing System SimulationDokument50 SeitenLecture 5: Simulation Technology and Manufacturing System Simulationbilash mehediNoch keine Bewertungen

- Bioprocess Principle - UNIT IV - CompiledDokument89 SeitenBioprocess Principle - UNIT IV - CompiledsravyapadavalaaNoch keine Bewertungen

- SessionPlans - b256cCG Course ProfileDokument8 SeitenSessionPlans - b256cCG Course ProfileNitya KushwahNoch keine Bewertungen

- MENG331 Course Outline FALL 2022-2023Dokument3 SeitenMENG331 Course Outline FALL 2022-2023Moboy11 hazardNoch keine Bewertungen

- Machine Learning (6CS4-02) Unit-1 NotesDokument34 SeitenMachine Learning (6CS4-02) Unit-1 NotesRajat MalikNoch keine Bewertungen

- Calclus Maths Course OutlineDokument2 SeitenCalclus Maths Course OutlineMburu KaranjaNoch keine Bewertungen

- ML Unit-2Dokument34 SeitenML Unit-2Rajat Malik100% (1)

- PHY41M1: This Course Will Be Presented OnlineDokument5 SeitenPHY41M1: This Course Will Be Presented OnlinePhomediNoch keine Bewertungen

- Maths SylabusDokument4 SeitenMaths SylabusBhagubhai MafatlalNoch keine Bewertungen

- 2 3 One 2 One N Inverse FunctionsDokument23 Seiten2 3 One 2 One N Inverse Functionstarek mahmoudNoch keine Bewertungen

- Syst Analys and Decision Supp Methods in Computer ScienceDokument6 SeitenSyst Analys and Decision Supp Methods in Computer ScienceA.Selçuk TunçerNoch keine Bewertungen

- Mat 1001Dokument3 SeitenMat 1001Taran MamidalaNoch keine Bewertungen

- Statistics and Probability Primer SY 2022-2023 STEM - Q1Dokument10 SeitenStatistics and Probability Primer SY 2022-2023 STEM - Q1abigail.angpingNoch keine Bewertungen

- CQF CurriculumDokument21 SeitenCQF Curriculumernesto123_53Noch keine Bewertungen

- DSC3215-ZHQ (I, 1718)Dokument2 SeitenDSC3215-ZHQ (I, 1718)caspersoongNoch keine Bewertungen

- Course Outline DJJ40163 Sesi 2 2023 - 2024Dokument4 SeitenCourse Outline DJJ40163 Sesi 2 2023 - 2024Mohd Shahrom IsmailNoch keine Bewertungen

- IEE 6300: Advanced Simulation Modeling and AnalysisDokument7 SeitenIEE 6300: Advanced Simulation Modeling and AnalysisTsega GetnetNoch keine Bewertungen

- Modeling and Simulation: ME 635/IPD 611 Kishore PochirajuDokument48 SeitenModeling and Simulation: ME 635/IPD 611 Kishore PochirajuFredNoch keine Bewertungen

- Machine Learning (6CS4-02) Unit-3 NotesDokument21 SeitenMachine Learning (6CS4-02) Unit-3 NotesRajat MalikNoch keine Bewertungen

- Phy 107Dokument2 SeitenPhy 107fahadNoch keine Bewertungen

- Calculus PDFDokument6 SeitenCalculus PDFNoel AdsuaraNoch keine Bewertungen

- Syllabus of 14.130X Taught in MITDokument6 SeitenSyllabus of 14.130X Taught in MITBhargav DindukurthiNoch keine Bewertungen

- ML Unit-5Dokument25 SeitenML Unit-5Rajat MalikNoch keine Bewertungen

- Tutorial 5 & 6 - SolutionDokument6 SeitenTutorial 5 & 6 - SolutionHamza IftekharNoch keine Bewertungen

- Consultation Hours (Jan-2020)Dokument2 SeitenConsultation Hours (Jan-2020)Hamza IftekharNoch keine Bewertungen

- Osamaamir Ar253 FaDokument8 SeitenOsamaamir Ar253 FaHamza IftekharNoch keine Bewertungen

- IP1 Guidelines V3Dokument7 SeitenIP1 Guidelines V3Hamza IftekharNoch keine Bewertungen

- Ali Izaan - 1001748265Dokument1 SeiteAli Izaan - 1001748265Hamza IftekharNoch keine Bewertungen

- Tutorial (Assigned Number) PDFDokument1 SeiteTutorial (Assigned Number) PDFHamza IftekharNoch keine Bewertungen

- Student Academic Performance Form Student Meeting RecordDokument1 SeiteStudent Academic Performance Form Student Meeting RecordHamza IftekharNoch keine Bewertungen

- AS202 Assignment Cover Page 201901Dokument1 SeiteAS202 Assignment Cover Page 201901Hamza IftekharNoch keine Bewertungen

- 2019-2020 Final Exam-ProbabilityDokument2 Seiten2019-2020 Final Exam-ProbabilityHamza IftekharNoch keine Bewertungen

- 5d907d0c5a64d - KAD3011 Assignment (Sep2019)Dokument4 Seiten5d907d0c5a64d - KAD3011 Assignment (Sep2019)Hamza IftekharNoch keine Bewertungen

- MIT18 05S14 Class3 Slides PDFDokument28 SeitenMIT18 05S14 Class3 Slides PDFMoMoNoch keine Bewertungen

- 1.AIS - Discrete and Binomial ProbabilityDokument12 Seiten1.AIS - Discrete and Binomial ProbabilityPaolo Niel ArenasNoch keine Bewertungen

- Convergence of Random VariablesDokument7 SeitenConvergence of Random Variablesdaniel656Noch keine Bewertungen

- 28-2021 PSABE Board Exam Review Lecture FinalDokument129 Seiten28-2021 PSABE Board Exam Review Lecture FinalFrances PasanaNoch keine Bewertungen

- STAT2006 Assignment 3: N 2 A 2 N 2 B 2Dokument2 SeitenSTAT2006 Assignment 3: N 2 A 2 N 2 B 2Joe HoNoch keine Bewertungen

- NT Rand 2Dokument44 SeitenNT Rand 2narelemilioNoch keine Bewertungen

- Probabilistic Methods For Durability DesignDokument92 SeitenProbabilistic Methods For Durability Designjhonny salozziNoch keine Bewertungen

- Probability and Statistics 2019 June QBDokument16 SeitenProbability and Statistics 2019 June QBsravaniNoch keine Bewertungen

- Lecture-4 - Random Variables and Probability DistributionsDokument42 SeitenLecture-4 - Random Variables and Probability DistributionsAayushi Tomar67% (3)

- Fundamental Probability: A Computational ApproachDokument19 SeitenFundamental Probability: A Computational Approachquant3Noch keine Bewertungen

- Probability and Statistics For Engineers - Richard L. Scheaffer, Madhuri S. Mulekar, James T. McClaveDokument159 SeitenProbability and Statistics For Engineers - Richard L. Scheaffer, Madhuri S. Mulekar, James T. McClaveAmish SharmaNoch keine Bewertungen

- Wiener Processes and Itô's LemmaDokument31 SeitenWiener Processes and Itô's LemmaMukesh KumarNoch keine Bewertungen

- Test 8. ProbabilityDokument7 SeitenTest 8. Probability台大人家教中心Noch keine Bewertungen

- Chapter 12Dokument51 SeitenChapter 12Juan Manuel Lima RivasNoch keine Bewertungen

- Online Calibrated Regression For Adversarially Robust ForecastingDokument22 SeitenOnline Calibrated Regression For Adversarially Robust ForecastingVetal YeshorNoch keine Bewertungen

- Statistic and ProbabilityDokument21 SeitenStatistic and ProbabilityChris Paris100% (4)

- محاضرات الدكتور نوري فرحان المياحي في العمليات التصادفية ر354Dokument46 Seitenمحاضرات الدكتور نوري فرحان المياحي في العمليات التصادفية ر354Olla Abdo100% (1)

- UT Dallas Syllabus For cs3341.501.09s Taught by Michael Baron (Mbaron)Dokument2 SeitenUT Dallas Syllabus For cs3341.501.09s Taught by Michael Baron (Mbaron)UT Dallas Provost's Technology GroupNoch keine Bewertungen

- In Statistics, How Do T and Z - Normal Distributions Differ - QuoraDokument3 SeitenIn Statistics, How Do T and Z - Normal Distributions Differ - QuoraBruno SaturnNoch keine Bewertungen

- Chapter 08 PowerPointDokument18 SeitenChapter 08 PowerPointBondzanNoch keine Bewertungen

- Chapter 3. Decision Theory: ObjectiveDokument26 SeitenChapter 3. Decision Theory: ObjectiveThien TranNoch keine Bewertungen

- Lesson4 1515Dokument14 SeitenLesson4 1515gm hashNoch keine Bewertungen

- Measure of Central TendencyDokument24 SeitenMeasure of Central Tendencymariell quitorianoNoch keine Bewertungen

- Department of Electrical:Electronic Engineering - Details of SyllabusDokument13 SeitenDepartment of Electrical:Electronic Engineering - Details of Syllabusdamilolaa_xNoch keine Bewertungen

- Chapter - 10 - Queuing Theory SirDokument27 SeitenChapter - 10 - Queuing Theory Sirdisharawat3923Noch keine Bewertungen

- Lim Xin YongDokument5 SeitenLim Xin YongYong LimNoch keine Bewertungen

- Using The Binomial Distribution PDFDokument6 SeitenUsing The Binomial Distribution PDFwolfretonmathsNoch keine Bewertungen

- Probability & Stochastic Processes (EL-GY 6303) Hw11 SolutionDokument8 SeitenProbability & Stochastic Processes (EL-GY 6303) Hw11 Solutionalamali88Noch keine Bewertungen

- ASSIGNMENT 2 SIM 3251 (DUE DATE: 22/5/2020) Chapter 3, 4 & 5Dokument3 SeitenASSIGNMENT 2 SIM 3251 (DUE DATE: 22/5/2020) Chapter 3, 4 & 5syah howNoch keine Bewertungen

- It Involves The Analysis of The Frequency of Past Events It Refers To Data Continuos, Fraction Not Countable Discrete CountableDokument3 SeitenIt Involves The Analysis of The Frequency of Past Events It Refers To Data Continuos, Fraction Not Countable Discrete CountablecolNoch keine Bewertungen