Beruflich Dokumente

Kultur Dokumente

Consolidated Statements of Income: Dollars in Millions Except Per Share Amounts

Hochgeladen von

Tran Van HaiOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Consolidated Statements of Income: Dollars in Millions Except Per Share Amounts

Hochgeladen von

Tran Van HaiCopyright:

Verfügbare Formate

Dollars in Millions Except Per Share Amounts

Consolidated Statements of Income

For the years ended December 31,

2019 2018 2017

Net sales $ 15,693 $ 15,544 $ 15,454

Cost of sales 6,368 6,313 6,174

Gross profit 9,325 9,231 9,280

Selling, general and administrative expenses 5,575 5,389 5,400

Other (income) expense, net 196 148 173

Operating profit 3,554 3,694 3,707

Non-service related postretirement costs 108 87 118

Interest (income) expense, net 145 143 102

Income before income taxes 3,301 3,464 3,487

Provision for income taxes 774 906 1,313

Net income including noncontrolling interests 2,527 2,558 2,174

Less: Net income attributable to noncontrolling interests 160 158 150

Net income attributable to Colgate-Palmolive Company $ 2,367 $ 2,400 $ 2,024

Earnings per common share, basic $ 2.76 $ 2.76 $ 2.30

Earnings per common share, diluted $ 2.75 $ 2.75 $ 2.28

See Notes to Consolidated Financial Statements.

Dollars in Millions

Consolidated Statements of Comprehensive Income

2019 2018 2017

Net income including noncontrolling interests $ 2,527 $ 2,558 $ 2,174

Other comprehensive income (loss), net of tax:

Cumulative translation adjustments 25 (237) 302

Retirement plan and other retiree benefit adjustments (100) 38 54

Gains (losses) on cash flow hedges (12) 10 (14)

Total Other comprehensive income (loss), net of tax (87) (189) 342

Total Comprehensive income including noncontrolling interests 2,440 2,369 2,516

Less: Net income attributable to noncontrolling interests 160 158 150

Less: Cumulative translation adjustments attributable to

noncontrolling interests (2) (19) 17

Total Comprehensive income attributable to noncontrolling

interests 158 139 167

Total Comprehensive income attributable to Colgate-Palmolive

Company $ 2,282 $ 2,230 $ 2,349

Dollars in Millions Except Share and Per Share Amounts

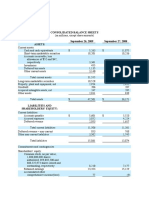

Consolidated Balance Sheets

As of December 31,

2019 2018

Assets

Current Assets

Cash and cash equivalents $ 883 $ 726

Receivables (net of allowances of $82 and $77,

respectively) 1,440 1,400

Inventories 1,400 1,250

Other current assets 456 417

Total current assets 4,179 3,793

Property, plant and equipment, net 3,750 3,881

Goodwill 3,508 2,530

Other intangible assets, net 2,667 1,637

Deferred income taxes 177 152

Other assets 753 168

Total assets $ 15,034 $ 12,161

Liabilities and Shareholders’ Equity

Current Liabilities

Notes and loans payable $ 260 $ 12

Current portion of long-term debt 254 -

Accounts payable 1,237 1,222

Accrued income taxes 370 411

Other accruals 1,917 1,696

Total current liabilities 4,038 3,341

Long-term debt 7,333 6,354

Deferred income taxes 507 235

Other liabilities 2,598 2,034

Total liabilities 14,476 11,964

Commitments and contingent liabilities - -

Shareholders’ Equity

Common stock, $1 par value

(2,000,000,000 shares authorized, 1,465,706,360 shares issued) 1,466 1,466

Additional paid-in capital 2,488 2,204

Retained earnings 22,501 21,615

Accumulated other comprehensive income (loss) (4,273) (4,188)

Unearned compensation (2) (3)

Treasury stock, at cost (22,063) (21,196)

Total Colgate-Palmolive Company shareholders’ 117 (102)

equityinterests

Noncontrolling 441 299

Total equity 558 197

Total liabilities and equity $ 15,034 $ 12,161

See Notes to Consolidated Financial Statements.

Dollars in Millions

Consolidated Statements of Changes in Shareholders' Equity

Colgate-Palmolive Company Shareholders' Equity

Additional Accumulated Other

Common Paid-In Unearned Treasury Retained Comprehensive Noncontrolling

Stock Capital Compensation Stock Earnings Income (Loss) Interests

Balance, January 1, 2017 $ 1,466 $ 1,691 $ (7) $ (19,135) $ 19,922 $ (4,180) $ 260

Net income 2,024 150

Other comprehensive income (loss), net of tax 325 17

Dividends (1,405) (124)

Stock-based compensation expense 127

Shares issued for stock options 197 313

Shares issued for restricted stock awards (34) 34

Treasury stock acquired (1,399)

Other 3 2 6 (10)

Balance, December 31, 2017 $ 1,466 $ 1,984 $ (5) $ (20,181) $ 20,531 $ (3,855) $ 303

Net income 2,400 158

Other comprehensive income (loss), net of tax (170) (19)

Dividends (1,448) (143)

Stock-based compensation expense 109

Shares issued for stock options 137 190

Shares issued for restricted stock awards (31) 31

Treasury stock acquired (1,238)

Other 5 2 2 132 (163)

Balance, December 31, 2018 $ 1,466 $ 2,204 $ (3) $ (21,196) $ 21,615 $ (4,188) $ 299

Net income 2,367 160

Other comprehensive income (loss), net of tax (85) (2)

Dividends (1,472) (141)

Stock-based compensation expense 100

Shares issued for stock options 210 305

Shares issued for restricted stock awards (29) 29

Noncontrolling interests assumed through

acquisition 125

Treasury stock acquired (1,202)

Other 3 1 1 (9)

Balance, December 31, 2019 $ 1,466 $ 2,488 $ (2) $ (22,063) $ 22,501 $ (4,273) $ 441

See Notes to Consolidated Financial Statements.

Dollars in Millions

Consolidated Statements of Cash Flow

For the years ended December 31,

2019 2018 2017

Operating Activities

Net income including noncontrolling interests $ 2,527 $ 2,558 $ 2,174

Adjustments to reconcile net income including noncontrolling interests

to net cash provided by operations:

Depreciation and amortization 519 511 475

Restructuring and termination benefits, net of cash 18 (7) 91

Stock-based compensation expense 100 109 127

Charge for U.S tax reform - 80 275

Deferred income taxes 17 27 108

Voluntary benefit plan contributions (113) (67) (81)

Cash effects of changes in:

Receivables 19 (79) (15)

Inventories (77) (58) (8)

Accounts payable and other accruals 36 18 (96)

Other non-current assets and liabilities 87 (36) 4

Net cash provided by operations 3,133 3,056 3,054

Investing Activities

Capital expenditures (335) (436) (553)

Sale of property and non-core product lines 1 1 44

Purchases of marketable securities and investments (184) (169) (347)

Proceeds from sale of marketable securities and investments 131 156 391

Payment for acquisitions, net of cash acquired (1,711) (728) 0

Other (1) 6 (6)

Net cash used in investing activities (2,099) (1,170) (471)

Financing Activities

Principal payments on debt (6,611) (7,355) (4,808)

Proceeds from issuance of debt 8,059 7,176 4,779

Dividends paid (1,614) (1,591) (1,529)

Purchases of treasury shares (1,202) (1,238) (1,399)

Proceeds from exercise of stock options 498 329 507

Net cash used in financing activities (870) (2,679) (2,450)

Effect of exchange rate changes on Cash and cash equivalents (7) (16) 87

Net increase (decrease) in Cash and cash equivalents 157 (809) 220

Cash and cash equivalents at beginning of year 726 1,535 1,315

Cash and cash equivalents at end of year $ 883 $ 726 $ 1,535

Supplemental Cash Flow Information

Income taxes paid $ 803 $ 847 $ 1,037

Interest paid $ 185 $ 194 $ 150

See Notes to Consolidated Financial Statements.

Dollars in Millions Except Per Share Amounts

Historical Financial Summary

For the years ended December 31,

(Unaudited)

2019 2018 2017 2016 2015 2014 2013 2012 2011 2010

Continuing Operations

Net sales $ 15,693 $ 15,544 $ 15,454 $ 15,195 $ 16,034 $ 17,277 $ 17,420 $ 17,085 $ 16,734 $ 15,564

Results of operations:

Net income attributable to Colgate-Palmolive Company 2,367 (1) 2,400 (2) 2,024 (3) 2,441 (4) 1,384 (5) 2,180 (6) 2,241 (7) 2,472 (8) 2,431 (9) 2,203 (10)

Per commom share, basic 2.76 (1) 2.76 (2) 2.30 (3) 2.74 (4) 1.53 (5) 2.38 (6) 2.41 (7) 2.60 (8) 2.49 (9) 2.22 (10)

Per commom share, diluted 2.75 (1) 2.75 (2) 2.28 (3) 2.72 (4) 1.52 (5) 2.36 (6) 2.38 (7) 2.57 (8) 2.47 (9) 2.16 (10)

Depreciation and amortization expense 519 511 475 443 449 442 439 425 421 376

Financial Position

Current ratio 1.0 1.1 1.4 1.3 1.2 1.2 1.1 1.2 1.2 1.0

Property, plant and equipment, net 3,750 3,881 4,072 3,840 3,796 4,080 4,083 3,842 3,668 3,693

Capital expenditures 335 436 553 593 691 757 670 565 537 550

Total assets 15,034 12,161 12,676 12,123 11,935 13,440 13,968 13,379 12,711 11,163

Long-term debt 7,333 6,354 6,566 6,520 6,246 5,625 4,732 4,911 4,417 2,806

Colgate-Palmolive Company shareholders' equity 117 (102) (60) (243) (299) 1,145 2,305 2,189 2,375 2,675

Share and Other

Book value per common share 0.66 0.23 0.28 0.03 (0.04) 1.55 2.79 2.60 2.71 2.95

Cash dividends declared and paid per common share 1.71 1.66 1.59 1.55 1.50 1.42 1.33 1.22 1.14 1.02

Closing price 68.84 59.52 75.45 65.44 66.62 69.19 65.21 52.27 46.20 40.19

Number of common shares outstanding (in millions) 854.7 862.9 874.7 883.1 892.7 906.7 919.9 935.8 960.0 989.8

Number of common shareholders of record 20,556 21,900 22,700 23,600 24,400 25,400 26,900 27,600 28,900 29,900

Number of employees 34,300 33,600 35,900 36,700 37,900 37,700 37,400 37,700 38,600 39,200

Note: All per share amounts and numbers of shares outstanding were adjusted for the two-for-one stock split of the Company's common stock in 2013.

1 Net income attributable to Colgate-Palmolive Company and Earnings per common share in 2019 includes $102 of aftertax charges related to the Global Growth and Efficiency Program, a $20 aftertax charge for acquisition-related costs, a

$20 aftertax benefit related to a value-added tax matter in Brazil and a $29 tax benefit related to Swiss income tax reform.

2 Net income attributable to Colgate-Palmolive Company and earnings per common share in 2018 include $125 of aftertax charges related to the Global Growth and Efficiency Program, a $15 benefit from a foreign tax matter, and an $80

charge related to U.S. tax reform.

3

Net income attributable to Colgate-Palmolive Company and earnings per common share in 2017 include $246 of aftertax charges related to the Global Growth and Efficiency Program and a $275 charge related to U.S. tax reform

4 Net income attributable to Colgate-Palmolive Company and earnings per common share in 2016 include $168 of aftertax charges related to the Global Growth and Efficiency Program, a $63 aftertax gain on the sale of land in Mexico, $11 of

aftertax charges for a litigation matter and $35 of benefits from tax matters.

5 Net income (loss) attributable to Colgate-Palmolive Company and earnings (loss) per common share in 2015 include a $1,058 aftertax charge related to the change in accounting for the Company’s Venezuelan operations, $183 of aftertax

charges related to the Global Growth and Efficiency Program, $22 of aftertax charges related to the remeasurement of CP Venezuela’s local currency-denominated net monetary assets as a result of effective devaluations, $120 aftertax

gain on the sale of the South Pacific laundry detergent business, a $14 aftertax charge for a litigation matter and a $15 charge for a tax matter.

6 Net income attributable to Colgate-Palmolive Company and earnings per common share in 2014 include $208 of aftertax charges related to the Global Growth and Efficiency Program, $214 of aftertax charges related to the remeasurement

of CP Venezuela’s local currency-denominated net monetary assets as a result of effective devaluations, $41 of charges for litigation matters, $3 of aftertax costs related to the sale of land in Mexico and a $66 charge for a tax matter.

7 Net income attributable to Colgate-Palmolive Company and earnings per common share in 2013 include $278 of aftertax charges related to the Global Growth and Efficiency Program, a $111 aftertax charge related to the remeasurement of

CP Venezuela’s local currency-denominated net monetary assets as a result of a devaluation, a $23 charge for a litigation matter and $12 of aftertax costs related to the sale of land in Mexico.

8 Net income attributable to Colgate-Palmolive Company and earnings per common share in 2012 include $70 of aftertax charges related to the Global Growth and Efficiency Program, $18 of aftertax costs related to the sale of land in Mexico

and $14 of aftertax costs associated with various business realignment and other cost-saving initiatives.

9 Net income attributable to Colgate-Palmolive Company and earnings per common share in 2011 include an aftertax gain of $135 on the sale of the non-core laundry detergent business in Colombia, offset by $147 of aftertax costs

associated with various business realignment and other cost-saving initiatives, $9 of aftertax costs related to the sale of land in Mexico and a $21 charge for a litigation matter.

10 Net income attributable to Colgate-Palmolive Company and earnings per common share in 2010 include a $271 one-time charge related to the transition to hyperinflationary accounting in Venezuela, $61 of aftertax charges for termination

benefits related to overhead reduction initiatives, a $30 aftertax gain on sales of non-core product lines and a $31 benefit related to the reorganization of an overseas subsidiary.

Das könnte Ihnen auch gefallen

- Colgate 2020 AR Excel Financials For AR Web Site HSDokument6 SeitenColgate 2020 AR Excel Financials For AR Web Site HSMohammad ameen Ur rahmanNoch keine Bewertungen

- Colgate 2021 AR Excel Financials For AR Web Site FR FINALDokument5 SeitenColgate 2021 AR Excel Financials For AR Web Site FR FINALPavithra SankolNoch keine Bewertungen

- 2014 AR Excel Financials For AR Web Site FINALDokument6 Seiten2014 AR Excel Financials For AR Web Site FINALPranjal SharmaNoch keine Bewertungen

- Espresso Software Financial Statements and Supplementary DataDokument38 SeitenEspresso Software Financial Statements and Supplementary DataAnwar AshrafNoch keine Bewertungen

- Star ReportsDokument38 SeitenStar ReportsAnnisa DewiNoch keine Bewertungen

- Financial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016Dokument5 SeitenFinancial Statements and Supplementary Data: (In Millions, Except Per Share Amounts) Year Ended June 30, 2018 2017 2016SSDNoch keine Bewertungen

- A3 6Dokument3 SeitenA3 6David Rolando García OpazoNoch keine Bewertungen

- 5.6 Excel of Financial Statement AnalysisDokument6 Seiten5.6 Excel of Financial Statement AnalysisTRan TrinhNoch keine Bewertungen

- Consolidated Statements of Income: Dollars in Millions Except Per Share AmountsDokument6 SeitenConsolidated Statements of Income: Dollars in Millions Except Per Share AmountsoraywattNoch keine Bewertungen

- Nike, Inc. Consolidated Statements of Income Year Ended December 31 (In Millions) 2019 2018Dokument3 SeitenNike, Inc. Consolidated Statements of Income Year Ended December 31 (In Millions) 2019 2018David Rolando García OpazoNoch keine Bewertungen

- Analysis and Interpretation of Profitability: Operating ExpensesDokument2 SeitenAnalysis and Interpretation of Profitability: Operating ExpensesDavid Rolando García OpazoNoch keine Bewertungen

- Aritzia Inc. Q1 2021 FSDokument25 SeitenAritzia Inc. Q1 2021 FSKevin GitauNoch keine Bewertungen

- TZero 2018 10-KDokument20 SeitenTZero 2018 10-KgaryrweissNoch keine Bewertungen

- Adani Ports & Special Economic Zone Ltd. (India) : SourceDokument9 SeitenAdani Ports & Special Economic Zone Ltd. (India) : SourceDivyagarapatiNoch keine Bewertungen

- Bharat Petroleum Corporation Ltd. (India) : SourceDokument6 SeitenBharat Petroleum Corporation Ltd. (India) : SourceDivyagarapatiNoch keine Bewertungen

- Optiva Inc. Q2 2022 Financial Statements FinalDokument19 SeitenOptiva Inc. Q2 2022 Financial Statements FinaldivyaNoch keine Bewertungen

- Marsh MC Lennan 2021-79-83Dokument5 SeitenMarsh MC Lennan 2021-79-83socialsim07Noch keine Bewertungen

- Marsh MC Lennan 2021-79-83-1-4Dokument4 SeitenMarsh MC Lennan 2021-79-83-1-4socialsim07Noch keine Bewertungen

- Balance Sheets and Income Statements For Costco Wholesale Corporation FollowDokument2 SeitenBalance Sheets and Income Statements For Costco Wholesale Corporation FollowDavid Rolando García OpazoNoch keine Bewertungen

- Titan Company Ltd. (India) : SourceDokument6 SeitenTitan Company Ltd. (India) : SourceDivyagarapatiNoch keine Bewertungen

- Poll 3 - SolutionDokument19 SeitenPoll 3 - Solutionakshita bansalNoch keine Bewertungen

- Practice Set 2 Pfizer HM SolvedDokument17 SeitenPractice Set 2 Pfizer HM SolvedNISHA BANSALNoch keine Bewertungen

- Tutorial 5 Part 1 Ratio CalculationsDokument14 SeitenTutorial 5 Part 1 Ratio CalculationsNISHA BANSALNoch keine Bewertungen

- Bajaj Finserv Ltd. (India) : SourceDokument5 SeitenBajaj Finserv Ltd. (India) : SourceDivyagarapatiNoch keine Bewertungen

- Five Below 2018 Financial StatementsDokument4 SeitenFive Below 2018 Financial StatementsElie GergesNoch keine Bewertungen

- MOD Technical Proposal 1.0Dokument23 SeitenMOD Technical Proposal 1.0Scott TigerNoch keine Bewertungen

- Home Depot OriDokument21 SeitenHome Depot OriBrayan PerezNoch keine Bewertungen

- Cipla Ltd. (India) : SourceDokument6 SeitenCipla Ltd. (India) : SourceDivyagarapatiNoch keine Bewertungen

- Att-Ar-2012-Financials Cut PDFDokument5 SeitenAtt-Ar-2012-Financials Cut PDFDevandro MahendraNoch keine Bewertungen

- Ultratech Cement Ltd. (India) : SourceDokument6 SeitenUltratech Cement Ltd. (India) : SourceDivyagarapatiNoch keine Bewertungen

- Ratio Analysis ExcerciseDokument12 SeitenRatio Analysis Excercisegaurav makhijaniNoch keine Bewertungen

- Jeronimo Martins Colombia S.A.S. (Colombia)Dokument6 SeitenJeronimo Martins Colombia S.A.S. (Colombia)LAURA VALENTINA PEREZ RODRIGUEZNoch keine Bewertungen

- Video 2.5-DogamerDokument18 SeitenVideo 2.5-DogamerutamiNoch keine Bewertungen

- Group Work Number 2Dokument10 SeitenGroup Work Number 2Enizel MontrondNoch keine Bewertungen

- Consolidated Statements of Operations - USD ($) Shares in Millions, $ in MillionsDokument20 SeitenConsolidated Statements of Operations - USD ($) Shares in Millions, $ in MillionsLuka KhmaladzeNoch keine Bewertungen

- Audi Aulia S (1814190008) - Tugas P5 Akuntansi InternasionalDokument17 SeitenAudi Aulia S (1814190008) - Tugas P5 Akuntansi InternasionalAuliaNoch keine Bewertungen

- Assets: PAYNET, Inc. Consolidated Balance SheetsDokument3 SeitenAssets: PAYNET, Inc. Consolidated Balance Sheetschemicalchouhan9303Noch keine Bewertungen

- Appendix: 2019 Balance Sheet and Supplemental InformationDokument2 SeitenAppendix: 2019 Balance Sheet and Supplemental Informationminh daoNoch keine Bewertungen

- Colgate Financial Model UnsolvedDokument27 SeitenColgate Financial Model Unsolvedrsfgfgn fhhsdzfgv100% (1)

- Financial Model - Colgate Palmolive (Unsolved Template) : Prepared by Dheeraj Vaidya, CFA, FRMDokument27 SeitenFinancial Model - Colgate Palmolive (Unsolved Template) : Prepared by Dheeraj Vaidya, CFA, FRMMehmet Isbilen100% (1)

- Tugas (TM.5) Manajemen KeuanganDokument12 SeitenTugas (TM.5) Manajemen KeuanganFranklyn DavidNoch keine Bewertungen

- Farag HWCH 3Dokument8 SeitenFarag HWCH 3drenghalaNoch keine Bewertungen

- Balance SheetDokument25 SeitenBalance SheetImran AhmedNoch keine Bewertungen

- Unaudited Condensed Consolidated Financial ReportsDokument33 SeitenUnaudited Condensed Consolidated Financial ReportsinforumdocsNoch keine Bewertungen

- Financials 1219051-21.09.20Dokument6 SeitenFinancials 1219051-21.09.20Eduardo FélixNoch keine Bewertungen

- Final Exam AccountingDokument7 SeitenFinal Exam Accountingshirley franciscoNoch keine Bewertungen

- PG 2021 Financial StatementsDokument6 SeitenPG 2021 Financial StatementsCamille E. CamtuganNoch keine Bewertungen

- 3M - 2019 Annual Report ExcerptDokument7 Seiten3M - 2019 Annual Report ExcerptKumar AbhishekNoch keine Bewertungen

- Pepsico Inc 2019 Annual ReportDokument1 SeitePepsico Inc 2019 Annual ReportToodley DooNoch keine Bewertungen

- 3 - CokeDokument30 Seiten3 - CokePranali SanasNoch keine Bewertungen

- Divi's Laboratories Ltd. (India) : SourceDokument5 SeitenDivi's Laboratories Ltd. (India) : SourceDivyagarapatiNoch keine Bewertungen

- Asian PaintsDokument6 SeitenAsian PaintsDivyagarapatiNoch keine Bewertungen

- Asian Paints Ltd. (India) : SourceDokument6 SeitenAsian Paints Ltd. (India) : SourceDivyagarapatiNoch keine Bewertungen

- Projected Income Statement of Ayala Land IncorporationDokument2 SeitenProjected Income Statement of Ayala Land IncorporationErika May RamirezNoch keine Bewertungen

- ALI Financial Statements (2021)Dokument26 SeitenALI Financial Statements (2021)Lorey Joy IdongNoch keine Bewertungen

- Dr. Reddy's Laboratories Ltd. (India) : SourceDokument6 SeitenDr. Reddy's Laboratories Ltd. (India) : SourceDivyagarapatiNoch keine Bewertungen

- Consolidated Balance Sheet Metapower International, IncDokument12 SeitenConsolidated Balance Sheet Metapower International, IncJha YaNoch keine Bewertungen

- UPL Ltd. (India) : SourceDokument6 SeitenUPL Ltd. (India) : SourceDivyagarapatiNoch keine Bewertungen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Corporate Actions: A Guide to Securities Event ManagementVon EverandCorporate Actions: A Guide to Securities Event ManagementNoch keine Bewertungen

- Question:-: Solution:-Computation of The Classified Year End Balance SheetDokument4 SeitenQuestion:-: Solution:-Computation of The Classified Year End Balance SheetShadowmaster LegendNoch keine Bewertungen

- AUC Settlement in Asset Accounting - Your Finance BookDokument3 SeitenAUC Settlement in Asset Accounting - Your Finance BookTamal BiswasNoch keine Bewertungen

- Krispy Kreme-Case Study Solution FinanceDokument32 SeitenKrispy Kreme-Case Study Solution FinanceHayat Omer Malik100% (3)

- Horizontal+Vertical+Common Size AnalysisDokument15 SeitenHorizontal+Vertical+Common Size AnalysisAwalludin FajarNoch keine Bewertungen

- AC1025 2012-Principles of Accounting Main EQP and Commentaries AC1025 2012-Principles of Accounting Main EQP and CommentariesDokument69 SeitenAC1025 2012-Principles of Accounting Main EQP and Commentaries AC1025 2012-Principles of Accounting Main EQP and Commentaries전민건Noch keine Bewertungen

- CIMA F2 Workbook Q PDFDokument79 SeitenCIMA F2 Workbook Q PDFshehaniNoch keine Bewertungen

- Audit of The Financing and Investing Cycle ReportDokument20 SeitenAudit of The Financing and Investing Cycle ReportCyrell S. SaligNoch keine Bewertungen

- Business Finance - 5 - 24 - 23Dokument8 SeitenBusiness Finance - 5 - 24 - 23Angel LopezNoch keine Bewertungen

- OSIM International Annual Reoprt 2009Dokument198 SeitenOSIM International Annual Reoprt 2009Ho Lun Tang0% (1)

- #1-Illustrative ProblemDokument19 Seiten#1-Illustrative ProblemNisharie AbanNoch keine Bewertungen

- Consolidated Financials Q4FY24Dokument10 SeitenConsolidated Financials Q4FY24Akash KushwahaNoch keine Bewertungen

- Auditing Problem 2Dokument1 SeiteAuditing Problem 2jhobs100% (1)

- UNIT V: Working Capital Management and Contemporary Issues in FinanceDokument56 SeitenUNIT V: Working Capital Management and Contemporary Issues in FinanceSantosh DhakalNoch keine Bewertungen

- NAS 1: Presentation of Financial Statements: Prepared By: CA Anish GyawaliDokument22 SeitenNAS 1: Presentation of Financial Statements: Prepared By: CA Anish GyawaliSujit DasNoch keine Bewertungen

- QP Accountancy XIIDokument9 SeitenQP Accountancy XIITûshar ThakúrNoch keine Bewertungen

- Ratio Analysis Ibrahim Fibres LTDDokument4 SeitenRatio Analysis Ibrahim Fibres LTDanon_607941Noch keine Bewertungen

- Commonwealth Bank Financial AnalysisDokument11 SeitenCommonwealth Bank Financial AnalysisMuhammad MubeenNoch keine Bewertungen

- Financial Statements Year Ended December 31, 20X5: ABC CompanyDokument11 SeitenFinancial Statements Year Ended December 31, 20X5: ABC CompanysaraNoch keine Bewertungen

- Accountancy QP Set-3Dokument11 SeitenAccountancy QP Set-3ABDUL RAHMAN 11BNoch keine Bewertungen

- Fixed Asset Accounting Project ReportDokument80 SeitenFixed Asset Accounting Project ReportRobinn Tigga0% (1)

- Activity No. 1. Accounting PracticesDokument3 SeitenActivity No. 1. Accounting PracticesNalin SNoch keine Bewertungen

- 7-11 Franchising Paper PROPOSAL ONLYDokument42 Seiten7-11 Franchising Paper PROPOSAL ONLYYara AB100% (1)

- V-Mart: Annual Report FY18: Improvement Across Key ParametersDokument14 SeitenV-Mart: Annual Report FY18: Improvement Across Key ParametersRanjan KumarNoch keine Bewertungen

- FAR270 JULY 2022 SolutionDokument8 SeitenFAR270 JULY 2022 SolutionNur Fatin Amirah100% (1)

- Chapter 1 Accounting ConceptsDokument6 SeitenChapter 1 Accounting ConceptsJamEs Luna MaTudioNoch keine Bewertungen

- Names of Team Members Roll No Criteria For Selection of Main CompanyDokument31 SeitenNames of Team Members Roll No Criteria For Selection of Main CompanyGaurav SharmaNoch keine Bewertungen

- GCE O Level Principles of Accounts GlossaryDokument6 SeitenGCE O Level Principles of Accounts Glossaryebookfish0% (1)

- MCQ Accounting StandardDokument13 SeitenMCQ Accounting StandardNgân GiangNoch keine Bewertungen

- DepreciationDokument58 SeitenDepreciationGilang RamadhanNoch keine Bewertungen

- Feasibility Report On Dairy Farm (200 Animal)Dokument32 SeitenFeasibility Report On Dairy Farm (200 Animal)Jawad Jamil89% (9)