Beruflich Dokumente

Kultur Dokumente

C14 - Tutorial Ques PDF

Hochgeladen von

Jilynn SeahOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

C14 - Tutorial Ques PDF

Hochgeladen von

Jilynn SeahCopyright:

Verfügbare Formate

Tutorial Questions for WEEK 13

CHAPTER 14

RAISING EQUITY AND DEBT GLOBALLY

13. Cross-Listing. What are the main benefits and disadvantages to firms that cross-list their

shares on multiple stock markets?

15. Localization. What are the main advantages of localization and main disadvantages of

localization?

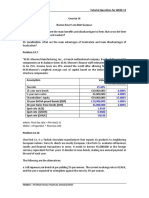

Problem 14.7

"M.M. Monroe Manufacturing, Inc., a French multinational company, has the following debt

components on its balance sheet. M.M. Monroe’s finance staff estimates their cost of equity

to be 15%. Income taxes are 25% around the world after allowing for credits. Calculate

M.M.Monroe’s weighted average cost of capital based on the below mentioned capital

structure components:

Assumption Value (Given)

Pre-tax Cost (%)

Tax rate 25.00%

25-year euro bonds €10,000,000 6.000%

5-year euro notes €4,000,000 4.000%

Shareholders' equity €50,000,000 15.000%

10-year British pound bonds (GBP) £10,000,000 5.000%

20-year Swiss franc bonds (CHF) 25,000,000 2.000%

Spot rate (€/£) 1.4100

Spot rate (¥/CHF) 0.9600

Spot rate (CHF/€) 138.00

where, Post-tax rate = Pre-tax(1-t)

WACC = Proportion * Post-tax rate

Problem 14.16

ChocTurk Co. is a Turkish chocolate manufacturer that exports its products to neighboring

European nations. Since its clients are mostly European, ChocTurk Co. evaluates all business

results and financial transactions in euros. It needs to borrow €5,000,000 or the foreign

currency equivalent for four years. It decides to issue bonds, making one annual payment at

the end of each year.

The following are the alternatives:

a. Sell Japanese yen bonds at par yielding 2% per annum. The current exchange rate is ¥136/€,

and the yen is expected to strengthen against the euro by 3% per annum.

FIN3034 – INTERNATIONAL FINANCIAL MANAGEMENT

Tutorial Questions for WEEK 13

b. Sell Sterling-denominated bonds at par yielding 5% per annum. The current exchange rate

is €0.7350/£, and the pound is expected to weaken against the euro by 4% per annum.

c. Sell euro bonds at par yielding 4% per annum.

Which course of action do you recommend Choco Turk Co. take and why?

You are requested to manually calculate the IRR for this problem usually a range of +/- 1%

will be an acceptable answer.

Japanese Sterling Euro

Alternatives yen bonds pound bonds

bonds

Coupon rate 2.000% 5.000% 4.000%

Current cross rate 0.7350

136.00

Expected change in the value of the foreign 3.000% -4.000% 0.000%

currency

Principal needed by ChocoTurk Co. €5,000,000

Refer to Formulae Table for Appreciation and Depreciation Formulae

Reference to the exchange rate for Sterling pound-denominated bonds €0.7350/£, and the

pound is expected to weaken against the euro by 4% per annum.

0.735 0.7067 0.7362 0.7669 0.7988 (EURO/POUND)

1.361 1.415 1.471 1.530 1.592 (POUND/EURO)

FIN3034 – INTERNATIONAL FINANCIAL MANAGEMENT

Das könnte Ihnen auch gefallen

- Method Statement of Static Equipment ErectionDokument20 SeitenMethod Statement of Static Equipment Erectionsarsan nedumkuzhi mani100% (4)

- Lesson 3 - Materials That Undergo DecayDokument14 SeitenLesson 3 - Materials That Undergo DecayFUMIKO SOPHIA67% (6)

- Carrefour S.A. Case: USD Debt FinancingDokument9 SeitenCarrefour S.A. Case: USD Debt FinancingIzzaNoch keine Bewertungen

- Sample Exam Part IDokument3 SeitenSample Exam Part ISw00per100% (1)

- Global Finance Exam - 2 Fall 2012Dokument6 SeitenGlobal Finance Exam - 2 Fall 2012mauricio0327Noch keine Bewertungen

- Carrefour SA International Business Finance 13013Dokument14 SeitenCarrefour SA International Business Finance 13013nadiafloreaNoch keine Bewertungen

- Exchange Rate Determination and PPP ConceptsDokument6 SeitenExchange Rate Determination and PPP ConceptsHương Lan TrịnhNoch keine Bewertungen

- Chap 5-MCQ Parity Without Key-1Dokument6 SeitenChap 5-MCQ Parity Without Key-1magical_life96Noch keine Bewertungen

- International Finance PDFDokument5 SeitenInternational Finance PDFDivakara ReddyNoch keine Bewertungen

- NVH Analysis in AutomobilesDokument30 SeitenNVH Analysis in AutomobilesTrishti RastogiNoch keine Bewertungen

- 2016 04 1420161336unit3Dokument8 Seiten2016 04 1420161336unit3Matías E. PhilippNoch keine Bewertungen

- Anthony Flagg's Complaint Against Eddie LongDokument23 SeitenAnthony Flagg's Complaint Against Eddie LongRod McCullom100% (1)

- C14 - Tutorial Ques PDFDokument2 SeitenC14 - Tutorial Ques PDFJilynn SeahNoch keine Bewertungen

- C14 - Tutorial Ques PDFDokument2 SeitenC14 - Tutorial Ques PDFJilynn SeahNoch keine Bewertungen

- C14 - Tutorial Answer PDFDokument5 SeitenC14 - Tutorial Answer PDFJilynn SeahNoch keine Bewertungen

- Chapter 9 - Economic ExposureDokument23 SeitenChapter 9 - Economic ExposurealdoNoch keine Bewertungen

- MBF14e Chap04 Governance PbmsDokument16 SeitenMBF14e Chap04 Governance PbmsKarl60% (5)

- Heriot-Watt University Finance - June 2013 Section II Case StudiesDokument9 SeitenHeriot-Watt University Finance - June 2013 Section II Case StudiesakilNoch keine Bewertungen

- MF Tutorial 6Dokument29 SeitenMF Tutorial 6Hueg Hsien0% (1)

- Forex Problems1Dokument4 SeitenForex Problems1skalidasNoch keine Bewertungen

- Application of Concepts 5. Swaps: Fixed Rate Floating Rate Company X 8.0% Libor Company Y 8.8% LiborDokument8 SeitenApplication of Concepts 5. Swaps: Fixed Rate Floating Rate Company X 8.0% Libor Company Y 8.8% LiborAgastya SoodNoch keine Bewertungen

- MF 6Dokument29 SeitenMF 6Hueg HsienNoch keine Bewertungen

- 8 Management of Transaction ExposureDokument57 Seiten8 Management of Transaction Exposureamamodia_1Noch keine Bewertungen

- FNE306 Assignment 6 AnsDokument9 SeitenFNE306 Assignment 6 AnsCharles MK ChanNoch keine Bewertungen

- Futures and Swaps Arbitrage OpportunitiesDokument6 SeitenFutures and Swaps Arbitrage Opportunitiesnoname19753Noch keine Bewertungen

- FINA3020 Assignment3Dokument5 SeitenFINA3020 Assignment3younes.louafiiizNoch keine Bewertungen

- Note On The Accounting Treatment of Promissory NotesDokument2 SeitenNote On The Accounting Treatment of Promissory NotesirishpoliticsNoch keine Bewertungen

- PROBLEM SET 5 Part 2.: SwapsDokument8 SeitenPROBLEM SET 5 Part 2.: SwapsSumit GuptaNoch keine Bewertungen

- Finanzas Internacionales - Ejercicios de la tarea 3 Preguntas 1 y 6, problema 4Dokument8 SeitenFinanzas Internacionales - Ejercicios de la tarea 3 Preguntas 1 y 6, problema 4gerardoNoch keine Bewertungen

- International Corporate Finance March 22, 2011: Managing Operating Exposure Suggested Exercises: 1, 4, 6Dokument54 SeitenInternational Corporate Finance March 22, 2011: Managing Operating Exposure Suggested Exercises: 1, 4, 6faycal626Noch keine Bewertungen

- Week 6 Solutions To ExercisesDokument6 SeitenWeek 6 Solutions To ExercisesBerend van RoozendaalNoch keine Bewertungen

- Ch17 Show-ReviseDokument49 SeitenCh17 Show-ReviseAsdelina RNoch keine Bewertungen

- Sample QuestionDokument9 SeitenSample QuestionYussone Sir'YussNoch keine Bewertungen

- The economics of hedging: Reducing risk and increasing valueDokument29 SeitenThe economics of hedging: Reducing risk and increasing valueRoman RoscaNoch keine Bewertungen

- PL FM J15 Exam PaperDokument7 SeitenPL FM J15 Exam PaperIsavic AlsinaNoch keine Bewertungen

- Exercises Yield To MaturityDokument2 SeitenExercises Yield To MaturityJohnNoch keine Bewertungen

- Agency Problems and International Opportunities in MNC TutorialDokument5 SeitenAgency Problems and International Opportunities in MNC TutorialVaibhav Anand RastogiNoch keine Bewertungen

- S07 Desfelurs V3Dokument2 SeitenS07 Desfelurs V3Khushi singhalNoch keine Bewertungen

- International Corporate Finance: © 2019 Pearson Education LTDDokument8 SeitenInternational Corporate Finance: © 2019 Pearson Education LTDLeanne TehNoch keine Bewertungen

- PS7 Primera ParteDokument5 SeitenPS7 Primera PartethomasNoch keine Bewertungen

- Techniques For Managing ExposureDokument26 SeitenTechniques For Managing Exposureprasanthgeni22100% (1)

- 1-Activities EcoDokument6 Seiten1-Activities EcombondoNoch keine Bewertungen

- Final Assignment Sept 2023 BBF30803Dokument4 SeitenFinal Assignment Sept 2023 BBF30803karthiyainni gunasegarNoch keine Bewertungen

- Foreign currency risk factorsDokument16 SeitenForeign currency risk factorsHastings KapalaNoch keine Bewertungen

- 683sol01 PDFDokument46 Seiten683sol01 PDFUzma KhanNoch keine Bewertungen

- Econ 406 Final Exam Main 2017Dokument5 SeitenEcon 406 Final Exam Main 2017Shihab HasanNoch keine Bewertungen

- Respuestas de Paridad InternacionalDokument15 SeitenRespuestas de Paridad InternacionalDavid BoteroNoch keine Bewertungen

- Managing Transaction Exposure HedgingDokument56 SeitenManaging Transaction Exposure HedgingkoolgalpoorniNoch keine Bewertungen

- Activities FXDokument5 SeitenActivities FXWaqar KhalidNoch keine Bewertungen

- Operating Exposure (Or Chapter 9)Dokument19 SeitenOperating Exposure (Or Chapter 9)sindhupallavigundaNoch keine Bewertungen

- Solution - Problems and Solutions Chap 8Dokument8 SeitenSolution - Problems and Solutions Chap 8Sabeeh100% (1)

- FINA3020 Question Bank Solutions PDFDokument27 SeitenFINA3020 Question Bank Solutions PDFTrinh Phan Thị NgọcNoch keine Bewertungen

- Chapter 06 International PaDokument59 SeitenChapter 06 International PaLiaNoch keine Bewertungen

- Homework Topic 3 - To SendDokument4 SeitenHomework Topic 3 - To SendThùy NguyễnNoch keine Bewertungen

- A Swap Dealer Quotes A Euro Midrate of 3 8175 PercentDokument1 SeiteA Swap Dealer Quotes A Euro Midrate of 3 8175 Percenttrilocksp SinghNoch keine Bewertungen

- 683sol04 PDFDokument46 Seiten683sol04 PDFJonah MoyoNoch keine Bewertungen

- Asset Swap GuideDokument11 SeitenAsset Swap Guideemerging11Noch keine Bewertungen

- Mid-Term I Review QuestionsDokument7 SeitenMid-Term I Review Questionsbigbadbear3100% (1)

- MCQ Parity KeyDokument6 SeitenMCQ Parity Key21070653Noch keine Bewertungen

- Solutions Nss NC 19Dokument8 SeitenSolutions Nss NC 19lethiphuongdanNoch keine Bewertungen

- 2015 CommentaryDokument43 Seiten2015 Commentaryduong duongNoch keine Bewertungen

- Interest Rate Derivatives Explained: Volume 1: Products and MarketsVon EverandInterest Rate Derivatives Explained: Volume 1: Products and MarketsNoch keine Bewertungen

- The Incomplete Currency: The Future of the Euro and Solutions for the EurozoneVon EverandThe Incomplete Currency: The Future of the Euro and Solutions for the EurozoneNoch keine Bewertungen

- Trading Economics: A Guide to Economic Statistics for Practitioners and StudentsVon EverandTrading Economics: A Guide to Economic Statistics for Practitioners and StudentsNoch keine Bewertungen

- Chapter 11 - Text Book ReferenceDokument22 SeitenChapter 11 - Text Book ReferenceJilynn SeahNoch keine Bewertungen

- Chapter 12 - Text BookDokument26 SeitenChapter 12 - Text BookJilynn SeahNoch keine Bewertungen

- Chapter 13 - Class Notes PDFDokument33 SeitenChapter 13 - Class Notes PDFJilynn SeahNoch keine Bewertungen

- Chapter 13 - Text BookDokument30 SeitenChapter 13 - Text BookJilynn SeahNoch keine Bewertungen

- Scenemaster3 ManualDokument79 SeitenScenemaster3 ManualSeba Gomez LNoch keine Bewertungen

- Machine Design - LESSON 4. DESIGN FOR COMBINED LOADING & THEORIES OF FAILUREDokument5 SeitenMachine Design - LESSON 4. DESIGN FOR COMBINED LOADING & THEORIES OF FAILURE9965399367Noch keine Bewertungen

- Admission Checklist (Pre-) Master September 2021Dokument7 SeitenAdmission Checklist (Pre-) Master September 2021Máté HirschNoch keine Bewertungen

- Presentation of The LordDokument1 SeitePresentation of The LordSarah JonesNoch keine Bewertungen

- Responsibility Centres: Nature of Responsibility CentersDokument13 SeitenResponsibility Centres: Nature of Responsibility Centersmahesh19689Noch keine Bewertungen

- Brightline Guiding PrinciplesDokument16 SeitenBrightline Guiding PrinciplesdjozinNoch keine Bewertungen

- Business PlanDokument9 SeitenBusiness PlanRico DejesusNoch keine Bewertungen

- Accident Causation Theories and ConceptDokument4 SeitenAccident Causation Theories and ConceptShayne Aira AnggongNoch keine Bewertungen

- Letter of Recommendation For Nicolas Hallett From Big Ten Network's Casey Peterson.Dokument1 SeiteLetter of Recommendation For Nicolas Hallett From Big Ten Network's Casey Peterson.Nic HallettNoch keine Bewertungen

- NH School Employee Criminal Record Check FormDokument2 SeitenNH School Employee Criminal Record Check FormEmily LescatreNoch keine Bewertungen

- Mechanical PropertiesDokument30 SeitenMechanical PropertiesChristopher Traifalgar CainglesNoch keine Bewertungen

- M Series CylindersDokument61 SeitenM Series CylindersAndres SantanaNoch keine Bewertungen

- Maths Lit 2014 ExamplarDokument17 SeitenMaths Lit 2014 ExamplarAnymore Ndlovu0% (1)

- 3000W InverterDokument2 Seiten3000W InverterSeda Armand AllaNoch keine Bewertungen

- Embedded Systems: Martin Schoeberl Mschoebe@mail - Tuwien.ac - atDokument27 SeitenEmbedded Systems: Martin Schoeberl Mschoebe@mail - Tuwien.ac - atDhirenKumarGoleyNoch keine Bewertungen

- Library Management System (Final)Dokument88 SeitenLibrary Management System (Final)Ariunbat Togtohjargal90% (30)

- MSDS Metafuron 20 WPDokument10 SeitenMSDS Metafuron 20 WPAndi DarmawanNoch keine Bewertungen

- Fleck 3150 Downflow: Service ManualDokument40 SeitenFleck 3150 Downflow: Service ManualLund2016Noch keine Bewertungen

- WSM 0000410 01Dokument64 SeitenWSM 0000410 01Viktor Sebastian Morales CabreraNoch keine Bewertungen

- C J L F S: Vinod TiwariDokument21 SeitenC J L F S: Vinod TiwariVinod TiwariNoch keine Bewertungen

- Research Grants Final/Terminal/Exit Progress Report: Instructions and Reporting FormDokument13 SeitenResearch Grants Final/Terminal/Exit Progress Report: Instructions and Reporting FormBikaZee100% (1)

- Afar Partnerships Ms. Ellery D. de Leon: True or FalseDokument6 SeitenAfar Partnerships Ms. Ellery D. de Leon: True or FalsePat DrezaNoch keine Bewertungen

- Hilti X-HVB SpecsDokument4 SeitenHilti X-HVB SpecsvjekosimNoch keine Bewertungen

- (Lesson 10-1) - Quality Assurance, Hemocytometry, Thoma PipetsDokument22 Seiten(Lesson 10-1) - Quality Assurance, Hemocytometry, Thoma PipetselleNoch keine Bewertungen

- Tutorial Manual Safi PDFDokument53 SeitenTutorial Manual Safi PDFrustamriyadiNoch keine Bewertungen