Beruflich Dokumente

Kultur Dokumente

Activity 1: Economic Security Refers To A Feeling of Freedom and Safety. The People of

Hochgeladen von

Alexis KingOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Activity 1: Economic Security Refers To A Feeling of Freedom and Safety. The People of

Hochgeladen von

Alexis KingCopyright:

Verfügbare Formate

KING, ALEXIS O.

BSA 2C

TF 10:30-12:00

ACTIVITY 1

Recall the eight goals of economics, which among these goals are made for

economic policies? Explain your answer?

Economic security refers to a feeling of freedom and safety. The people of

a country feel themselves safe no matter wherever they are in their homeland. It

is the responsibility of the government of a country to provide security of life and

belongings of their people. That is why government establishes defense including

police for the protection and security of the natives. Economic security or

financial security is the condition of having stable income or other resources to

support a standard of living now and in the foreseeable future. It includes

probable continued solvency, predictability of the future cash flow of a person or

other economic entity, such as a country and employment security or job

security. Financial security more often refers to individual and family money

management and savings. Economic security tends to include the broader effect

of a society's production levels and monetary support for non-working citizens.

For me it is the economic security that is made for economic policies.

Because economic security refers to a feeling of freedom and safety. The people

of a country feel themselves safe no matter wherever they are in their homeland.

And a good economic policy should be people-oriented. The welfare of the

people is always the primary consideration. Some former poor nations became

progressive because their policies have been focused on the improvement of the

quality of life of the masses.

ACTIVITY 2

Explain the nature of the economic policies.

Economic policy is based on economic theory or principle. It is the

applications of a theory or principle. Are formulated to attain specific objectives or

solve certain problems. Many policy makers are politicians or top government

officials who have been elected by the people.

Economic policies are as good as their makers. If the policy makers are

only after about their own personal interest, then their policies will have adverse

effects on the sector of the economy.

Comment on our own economic policies.

In our country which is the Philippines, the main program of the

government is to improve the quality of life of the people. In fact Dr. Placido

Mapa, Jr., former Minister of economic planning said:

“Man has always been the focus of all development efforts hence, the

ultimate goal of all development activities is to improve the people’s quality of life.

This brings us to a point that of haring the fruits of development. And this goal

can only be achieved by pursuing national development policies for various

regions, through with the government hopes to redress income disparities

caused by growth imbalances ”

But it is not always what you said that matters. It is the output or result.

Some economic policies are not given that high level of priority. Our economic

growth has a lot to be improved. And the policy makers must focus on the

‘people-oriented’ policy. Since all of those policies are concerned primarily by the

people.

Give some features of a good economic policies. Explain one.

One of the features of a good economic policy is that it must be long

range, but flexible to a certain degree. An economic policy must be long range; it

means that it must have a wider scope in order for it to be effective. But it must

also be flexible to a certain degree. It only means that a good economic policy

can be revised or improved if ever a certain situation occur. All in all, a good

economic policy must be adaptable and its main goal should always be for the

betterment of all.

Define Monetary policy. What are the monetary goals of the Bangko Sentral na

Pilipinas?

Monetary policy is an instruments used by the BSP to ease and tighten

credit in the economy thus promote price stability and increase or reduce liquidity

in the financial system.

The primary objective of BSP’s monetary policy is to promote a low and

stable inflation conductive to a balanced and sustainable economic growth. The

adoption of inflation targeting framework for monetary policy in January 2002 is

aimed at achieving this objective.

Explain the nature of fiscal policy?

Fiscal policy is commonly looked upon as comprising those variations in

government tax and expenditure programs which are undertaken with the

express purpose of securing the goals of macro-economic policy. It is therefore

but one aspect of the system of public finance and does not include measures

which are undertaken for reasons of allocative efficiency or which reflect a

concern with the distribution of income. Since changes in tax and expenditure

policies often imply a change in the size of the national debt, variations in debt

policy are often included under the general heading of fiscal policy. Whilst we

refer briefly to the choice between taxation and debt in the financing of any given

expenditure programs, we consider debt management policy — by which we

mean changes in the composition of a given debt — to be an entirely separate

and distinct policy question and one beyond the scope of our current concern.

The debt referred to above should be understood in its commonly accepted

sense as consisting of bonds and securities issued by the government.

State the effects of fiscal policy in the economy, how are these related to

economic development?

2. economic development?

The effect of fiscal policy depends on the current state of the economy of a

specific country. Whenever the economy seems to be overheating or growing too

fast, the government may decrease spending. This will result to the decrease in the

overall demand in the economy.

Fiscal policy involves taxes. The decreasing tax tends to stimulate economic

growth. If people will pay less tax, they will have more money on hand which they

can either spend or save. If there is an increase in spending there is also an

increase in demand and so the production should also increase.

Explain how the categories of the supply-side policy may improve the inflation

rate, employment rate, economic growth and the balanced of payment of the

country.

Supply-side policy designed to increase LONG-RUN AGGREGATE

SUPPLY (LRAS), also known as the full employment level of output. It will focus

on improving the structural long term performance/competitiveness of an

economy and improve the production potential/capacity. The aims of the policies

are to positively affect the production side of the economy by improving the

institutional framework and the capacity to produce.

Employment rate Supply-side policies can contribute to reducing

structural, frictional and real wage unemployment and therefore help reduce the

natural rate of unemployment.

Economic growth Supply-side policies will increase the sustainable rate

of economic growth by increasing Long Run aggregating supply (LRAS); this

enables a higher rate of economic growth without causing inflation.

Balance of payment By making firms more productive and competitive,

they will be able to export more. This is important in light of the increased

competition from an increasingly globalised marketplace.

Das könnte Ihnen auch gefallen

- Business Economics: Business Strategy & Competitive AdvantageVon EverandBusiness Economics: Business Strategy & Competitive AdvantageNoch keine Bewertungen

- Fiscal PolicyDokument21 SeitenFiscal PolicyDilpreet Singh MendirattaNoch keine Bewertungen

- Fiscal PolicyDokument20 SeitenFiscal PolicyPranav VaidNoch keine Bewertungen

- Monetary and Fiscal ReportDokument14 SeitenMonetary and Fiscal ReportShoaib AbbasNoch keine Bewertungen

- Project Report On: Economics of Global TradeDokument37 SeitenProject Report On: Economics of Global TradePallavi RanjanNoch keine Bewertungen

- IEBE Matrial Part2Dokument58 SeitenIEBE Matrial Part2parveenNoch keine Bewertungen

- Monetary Policy and Fiscal PolicyDokument23 SeitenMonetary Policy and Fiscal PolicyIam hackerNoch keine Bewertungen

- Paper:: 11, Managerial Economics 35, Fiscal PolicyDokument13 SeitenPaper:: 11, Managerial Economics 35, Fiscal PolicyShelly SinghNoch keine Bewertungen

- Macro EconomicsDokument14 SeitenMacro EconomicsMarwah YaseenNoch keine Bewertungen

- Definition of Fiscal PolicyDokument27 SeitenDefinition of Fiscal PolicySana IsmailNoch keine Bewertungen

- L8B Introduction To MacroeconomicsDokument19 SeitenL8B Introduction To Macroeconomicskurumitokisaki967Noch keine Bewertungen

- Presentation 23261111 PDFDokument12 SeitenPresentation 23261111 PDFShaswat BhattacharyaNoch keine Bewertungen

- StabilizationDokument21 SeitenStabilizationSherali SoodNoch keine Bewertungen

- Fiscal Policy V UNIT-1Dokument10 SeitenFiscal Policy V UNIT-1madhumithaNoch keine Bewertungen

- Chapter 8Dokument54 SeitenChapter 8Tegegne AlemayehuNoch keine Bewertungen

- Topic: Economic Policies: I. Learning ObjectivesDokument11 SeitenTopic: Economic Policies: I. Learning ObjectivesAlexis KingNoch keine Bewertungen

- Last Be AssignmentDokument3 SeitenLast Be Assignmenttaeng makes me question myself so muchNoch keine Bewertungen

- Assaigment of Fiscal Policy 1Dokument6 SeitenAssaigment of Fiscal Policy 1yulinda rahma sariNoch keine Bewertungen

- Public Finance IIDokument8 SeitenPublic Finance IIBimo Danu PriambudiNoch keine Bewertungen

- Subject EconomicsDokument10 SeitenSubject EconomicsMubashirNoch keine Bewertungen

- Monetary & Fiscal PolicyDokument10 SeitenMonetary & Fiscal Policyaruna koliNoch keine Bewertungen

- All Print Macro Nad MicroDokument15 SeitenAll Print Macro Nad MicrosmitaNoch keine Bewertungen

- MacroDokument34 SeitenMacroPratik LawanaNoch keine Bewertungen

- Wahid Rasool Imran Ali Jawad Ul Hassan Haseeb Azam: Ms. Maheen KhanDokument24 SeitenWahid Rasool Imran Ali Jawad Ul Hassan Haseeb Azam: Ms. Maheen KhanWahid RasoolNoch keine Bewertungen

- Fiscal and Monetary Policy and Other PoliciesDokument5 SeitenFiscal and Monetary Policy and Other PoliciesNathaniel GampolNoch keine Bewertungen

- Impact of Fiscal Policy On Economic Growth in NigeriaDokument20 SeitenImpact of Fiscal Policy On Economic Growth in NigeriaHenry MichealNoch keine Bewertungen

- Monetary Policy & Fiscal Policy (2) DDDDDDokument10 SeitenMonetary Policy & Fiscal Policy (2) DDDDDepic gamesNoch keine Bewertungen

- Monetary Policy NewDokument12 SeitenMonetary Policy NewAbdul Kader MandolNoch keine Bewertungen

- Fiscal PolicyDokument23 SeitenFiscal Policyapi-376184490% (10)

- Unit 4-Fiscal PolicyDokument55 SeitenUnit 4-Fiscal Policyironman73500Noch keine Bewertungen

- Macroeconomics CIA 3 2nd SemesterDokument33 SeitenMacroeconomics CIA 3 2nd SemesterMeghansh AgarwalNoch keine Bewertungen

- Answer To The Questions No - 6: A) Write Short Note - Monetary Policy and Fiscal Policy. 'Monetary Policy'Dokument5 SeitenAnswer To The Questions No - 6: A) Write Short Note - Monetary Policy and Fiscal Policy. 'Monetary Policy'obydursharifNoch keine Bewertungen

- Economic Policy AnalysisDokument16 SeitenEconomic Policy AnalysisBidulaNoch keine Bewertungen

- Fiscal PolicyDokument10 SeitenFiscal Policyshaliniagarwal2777Noch keine Bewertungen

- Macro-Economics ProjectDokument63 SeitenMacro-Economics ProjectarpanmajumderNoch keine Bewertungen

- Monetary and Fiscal Policy: Faridullah HamdardDokument7 SeitenMonetary and Fiscal Policy: Faridullah HamdardFaridullahNoch keine Bewertungen

- What Is Fiscal Policy?: TaxationDokument7 SeitenWhat Is Fiscal Policy?: TaxationNathaniel GampolNoch keine Bewertungen

- Business EnviromentDokument19 SeitenBusiness EnviromentHarshit YNoch keine Bewertungen

- What Is Fiscal PolicyDokument12 SeitenWhat Is Fiscal PolicyNasir LatifNoch keine Bewertungen

- Fiscal Policy (ECONOMICS)Dokument20 SeitenFiscal Policy (ECONOMICS)Rajneesh DeshmukhNoch keine Bewertungen

- Mohd Ebad Askari Unit 3 EEDokument4 SeitenMohd Ebad Askari Unit 3 EEEyaminNoch keine Bewertungen

- Fiscal and Monetary PolicyDokument11 SeitenFiscal and Monetary PolicyNahidul IslamNoch keine Bewertungen

- Fiscal and Monetary Policy PDFDokument2 SeitenFiscal and Monetary Policy PDFAbbas KazmiNoch keine Bewertungen

- Fiscal and Monetary Policies of IndiaDokument13 SeitenFiscal and Monetary Policies of IndiaRidhika GuptaNoch keine Bewertungen

- Fiscal PolicyDokument9 SeitenFiscal PolicyEnrique IglesiasNoch keine Bewertungen

- Research Questions 3. Objectives 4. Research Methodology 5. Analysis and Interpretation 6. Conclusion 7. ReferencesDokument22 SeitenResearch Questions 3. Objectives 4. Research Methodology 5. Analysis and Interpretation 6. Conclusion 7. ReferencesAnubhav VermaNoch keine Bewertungen

- Economy Topic 2Dokument20 SeitenEconomy Topic 2Ikra MalikNoch keine Bewertungen

- A Role of Fiscal Policy Impact On Indian Economy: A Overview With Case StudyDokument14 SeitenA Role of Fiscal Policy Impact On Indian Economy: A Overview With Case Studyowais zargarNoch keine Bewertungen

- Fiscal Policy - 1Dokument6 SeitenFiscal Policy - 1Prashant SinghNoch keine Bewertungen

- Assignment On Monetary Policy in BangladeshDokument6 SeitenAssignment On Monetary Policy in BangladeshAhmed ImtiazNoch keine Bewertungen

- Be-Unit - IiiDokument30 SeitenBe-Unit - IiimaddaliaravindNoch keine Bewertungen

- Fiscal PolicyDokument10 SeitenFiscal PolicygyytgvyNoch keine Bewertungen

- Fiscal PolicyDokument11 SeitenFiscal PolicyVenkata RamanaNoch keine Bewertungen

- Dagyaw 2023Dokument1 SeiteDagyaw 2023Mikay SungaNoch keine Bewertungen

- Impact of Fiscal Policy and Monetary Policy On The Economic Growth of Nigeria (1980 - 2016)Dokument22 SeitenImpact of Fiscal Policy and Monetary Policy On The Economic Growth of Nigeria (1980 - 2016)AJHSSR JournalNoch keine Bewertungen

- Fiscal Policy and Monetary WorldDokument13 SeitenFiscal Policy and Monetary WorldSatyam KanwarNoch keine Bewertungen

- Fiscal Policies LinksDokument3 SeitenFiscal Policies LinksAmol MoryeNoch keine Bewertungen

- Fiscal Policy & Monetary PolicyDokument8 SeitenFiscal Policy & Monetary PolicyFaisal AwanNoch keine Bewertungen

- Fiscal PolicyDokument29 SeitenFiscal Policyjay100% (1)

- Qa edexcel6EC02Dokument7 SeitenQa edexcel6EC02SaChibvuri JeremiahNoch keine Bewertungen

- MEMORANDUMDokument2 SeitenMEMORANDUMAlexis KingNoch keine Bewertungen

- Correlation KING Alexis O.Dokument1 SeiteCorrelation KING Alexis O.Alexis KingNoch keine Bewertungen

- Revenue CycleDokument2 SeitenRevenue CycleAlexis KingNoch keine Bewertungen

- Name: KING, Alexis O. Course and Year: BSA 3CDokument2 SeitenName: KING, Alexis O. Course and Year: BSA 3CAlexis KingNoch keine Bewertungen

- Final Examination Lit KINGDokument1 SeiteFinal Examination Lit KINGAlexis KingNoch keine Bewertungen

- Accounting For Shareholders Equity KINGDokument11 SeitenAccounting For Shareholders Equity KINGAlexis KingNoch keine Bewertungen

- ERP Core Applications: By: Alexis O. KingDokument7 SeitenERP Core Applications: By: Alexis O. KingAlexis KingNoch keine Bewertungen

- Proponents of Archetypal CriticismDokument1 SeiteProponents of Archetypal CriticismAlexis KingNoch keine Bewertungen

- School of Education, Arts and Sciences: LiteratureDokument2 SeitenSchool of Education, Arts and Sciences: LiteratureAlexis KingNoch keine Bewertungen

- Activity 4.2 KINGDokument6 SeitenActivity 4.2 KINGAlexis KingNoch keine Bewertungen

- DepletionDokument2 SeitenDepletionFria Mae Aycardo AbellanoNoch keine Bewertungen

- Increase in Global Competition-Due To An Increase in Global Competition LeadDokument4 SeitenIncrease in Global Competition-Due To An Increase in Global Competition LeadAlexis KingNoch keine Bewertungen

- Accounting For Shareholders Equity KINGDokument11 SeitenAccounting For Shareholders Equity KINGAlexis KingNoch keine Bewertungen

- Critical Analysis and Discussion QuestionsDokument2 SeitenCritical Analysis and Discussion QuestionsAlexis KingNoch keine Bewertungen

- Problem 2.4.1: Name: Jolina C. Pasahol Block: B Time: 03:00 - 04:30 MT A. Cost ModelDokument2 SeitenProblem 2.4.1: Name: Jolina C. Pasahol Block: B Time: 03:00 - 04:30 MT A. Cost ModelAlexis KingNoch keine Bewertungen

- Problem-2 3 1Dokument6 SeitenProblem-2 3 1Alexis KingNoch keine Bewertungen

- Group 3Dokument12 SeitenGroup 3Alexis KingNoch keine Bewertungen

- Topic: Economic Policies: I. Learning ObjectivesDokument11 SeitenTopic: Economic Policies: I. Learning ObjectivesAlexis KingNoch keine Bewertungen

- Problem-2 3 2Dokument4 SeitenProblem-2 3 2Alexis KingNoch keine Bewertungen

- Relevant Costing Exercises - KingDokument7 SeitenRelevant Costing Exercises - KingAlexis KingNoch keine Bewertungen

- Capital Budgeting Exercises 2 NUNEZ PDFDokument3 SeitenCapital Budgeting Exercises 2 NUNEZ PDFAlexis KingNoch keine Bewertungen

- Critical Analysis and Discussion QuestionsDokument2 SeitenCritical Analysis and Discussion QuestionsAlexis KingNoch keine Bewertungen

- AuditingDokument4 SeitenAuditingAlexis KingNoch keine Bewertungen

- Entrepreneurial MindDokument2 SeitenEntrepreneurial MindAlexis KingNoch keine Bewertungen

- Activity 1: Economic Security Refers To A Feeling of Freedom and Safety. The People ofDokument4 SeitenActivity 1: Economic Security Refers To A Feeling of Freedom and Safety. The People ofAlexis KingNoch keine Bewertungen

- Week 1 Output-KingDokument4 SeitenWeek 1 Output-KingAlexis KingNoch keine Bewertungen

- Key Ws - Chapter Ix-Assembling Your Opportunity Portfolio: King, Alexis O. Bsa 2CDokument1 SeiteKey Ws - Chapter Ix-Assembling Your Opportunity Portfolio: King, Alexis O. Bsa 2CAlexis KingNoch keine Bewertungen

- NAME: Alexis O. King Course and Year: Bsa 2C Negotiable InstrumentsDokument5 SeitenNAME: Alexis O. King Course and Year: Bsa 2C Negotiable InstrumentsAlexis KingNoch keine Bewertungen

- Finals KingDokument1 SeiteFinals KingAlexis KingNoch keine Bewertungen

- Capital BudgetingDokument2 SeitenCapital BudgetingAlexis KingNoch keine Bewertungen

- Essay On FamilyDokument2 SeitenEssay On Familyapi-277963081Noch keine Bewertungen

- LAZ PAPER Ethics Ethical Conduct Challenges and Opportunities in Modern PracticeDokument15 SeitenLAZ PAPER Ethics Ethical Conduct Challenges and Opportunities in Modern PracticenkwetoNoch keine Bewertungen

- Security System Owner's Manual: Interactive Technologies Inc. 2266 North 2nd Street North St. Paul, MN 55109Dokument61 SeitenSecurity System Owner's Manual: Interactive Technologies Inc. 2266 North 2nd Street North St. Paul, MN 55109Carlos Enrique Huertas FigueroaNoch keine Bewertungen

- Financial Management Summary and FormulasDokument30 SeitenFinancial Management Summary and FormulasRheu ReyesNoch keine Bewertungen

- SAARC and Pakistan, Challenges, ProspectDokument10 SeitenSAARC and Pakistan, Challenges, ProspectRiaz kingNoch keine Bewertungen

- Were The Peace Treaties of 1919-23 FairDokument74 SeitenWere The Peace Treaties of 1919-23 FairAris Cahyono100% (1)

- Nittscher vs. NittscherDokument4 SeitenNittscher vs. NittscherKeej DalonosNoch keine Bewertungen

- Big Enabler Solutions ProfileDokument6 SeitenBig Enabler Solutions ProfileTecbind UniversityNoch keine Bewertungen

- Problem 1246 Dan 1247Dokument2 SeitenProblem 1246 Dan 1247Gilang Anwar HakimNoch keine Bewertungen

- Pengantar Ilmu PolitikDokument12 SeitenPengantar Ilmu PolitikAmandaTabraniNoch keine Bewertungen

- People vs. Patulot - Case DigestDokument5 SeitenPeople vs. Patulot - Case DigestGendale Am-isNoch keine Bewertungen

- 6 Habits of True Strategic ThinkersDokument64 Seiten6 Habits of True Strategic ThinkersPraveen Kumar JhaNoch keine Bewertungen

- The Hidden Opportunity in Container Shipping: Travel, Transport & LogisticsDokument8 SeitenThe Hidden Opportunity in Container Shipping: Travel, Transport & LogisticseyaoNoch keine Bewertungen

- Meritor DownloadDokument68 SeitenMeritor DownloadShubham BhatiaNoch keine Bewertungen

- RrlmatirxDokument4 SeitenRrlmatirxJohn Linard AninggaNoch keine Bewertungen

- Statistik API Development - 080117 AHiADokument6 SeitenStatistik API Development - 080117 AHiAApdev OptionNoch keine Bewertungen

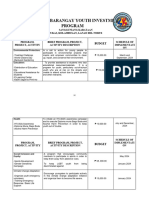

- Annual Barangay Youth Investment ProgramDokument4 SeitenAnnual Barangay Youth Investment ProgramBarangay MukasNoch keine Bewertungen

- 30 Iconic Filipino SongsDokument9 Seiten30 Iconic Filipino SongsAlwynBaloCruzNoch keine Bewertungen

- Chap 2 Tanner - The Sales Function & Multi Sales Channels 280516Dokument17 SeitenChap 2 Tanner - The Sales Function & Multi Sales Channels 280516Shahzain RafiqNoch keine Bewertungen

- Literature - Short Stories Test 2Dokument22 SeitenLiterature - Short Stories Test 2cosme.fulanitaNoch keine Bewertungen

- Ramesh and GargiDokument14 SeitenRamesh and GargiAlok AhirwarNoch keine Bewertungen

- HSEMS PresentationDokument21 SeitenHSEMS PresentationVeera RagavanNoch keine Bewertungen

- Difference Between Reptiles and Amphibians????Dokument2 SeitenDifference Between Reptiles and Amphibians????vijaybansalfetNoch keine Bewertungen

- Lesson 2 - BasicDokument7 SeitenLesson 2 - BasicMichael MccormickNoch keine Bewertungen

- View of Hebrews Ethan SmithDokument295 SeitenView of Hebrews Ethan SmithOlvin Steve Rosales MenjivarNoch keine Bewertungen

- Nature of Vat RefundDokument7 SeitenNature of Vat RefundRoselyn NaronNoch keine Bewertungen

- Xeridt2n cbn9637661Dokument7 SeitenXeridt2n cbn9637661Naila AshrafNoch keine Bewertungen

- Letter of Appeal Pacheck Kay Tita ConnieDokument2 SeitenLetter of Appeal Pacheck Kay Tita ConnieNikko Avila IgdalinoNoch keine Bewertungen

- Comparative Analysis On Renaissance and 20th Century Modern ArchitectureDokument2 SeitenComparative Analysis On Renaissance and 20th Century Modern ArchitectureJeriel CandidatoNoch keine Bewertungen

- Ashok Leyland - Industry Visit ReportDokument7 SeitenAshok Leyland - Industry Visit Reportabikrishna1989Noch keine Bewertungen