Beruflich Dokumente

Kultur Dokumente

CA Intermediate - Financial Management: Swapnil Patni's Classes

Hochgeladen von

Aniket PatelOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

CA Intermediate - Financial Management: Swapnil Patni's Classes

Hochgeladen von

Aniket PatelCopyright:

Verfügbare Formate

[1]

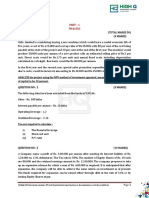

Total No. of Questions – 6 No. of Printed Pages – 3

Time Allowed – 90 Mins Maximum Marks – 50

Answers to questions to be given only in English. Answers in Hindi will not be valued.

Candidates are also required to answer any Five questions from the remaining Six questions.

CA Intermediate – Financial Management

Q 1)

(A) ABC Ltd adopts constant - WACC approach, and believes that its cost of Debt and overall

cost of capital is at 9% and 12% respectively. If the ratio of the market value of debt to the market

value of equity is 0.8, what rate of return do equity shareholders earn? Assume that there are no

taxes.

(5 Marks)

(B) Following Information relate to a Concern

Debtors Velocity 3 Months Gross Profit Ratio 25%

Gross Profit ₹ 4,00,000 Stock Turnover Ratio 1.5

Closing Stock of the period is ₹ 10,000 above the opening stock. You are required to

compute-

a) Sales

b) Costs of Goods sold

c) Sundry Debtors

(5 Marks)

d) Closing Stock

Q 2)

(A) The following information pertains to M/s XY Ltd.

Earnings of the Company ₹ 5,00,000

Dividend Payout ratio 60%

No. of shares outstanding 1,00,000

Equity capitalization rate 12%

Rate of return on investment 15%

i) What would be the market value per share as per Walter’s model?

ii) What is the optimum dividend payout ratio according to Walter’s model and the market value

of Company’s share at that payout ratio?

(5 Marks)

(B) The total sales (all credit) of a firm are ₹ 6,40,000. It has a gross profit margin of 15 per cent

and a current ratio of 2.5. The firm’s current liabilities are ₹ 96,000; inventories ₹ 48,000 and cash ₹

16,000.

a) Determine the average inventory to be carried by the firm, if an inventory turnover of 5 times is

expected? (Assume a 360 day year).

b) Determine the average collection period if the opening balance of debtors is intended to be of ₹

80,000? (Assume a 360 day year).

(5 Marks)

Swapnil Patni’s Classes

[2]

Q 3)

(A) The following information is collected from the annual reports of J Ltd:

Profit before tax ₹ 2.50 crore

Tax rate 40 percent

Retention ratio 40 percent

Number of outstanding shares 50,00,000

Equity capitalization rate 12 percent

Rate of return on investment 15 percent

What should be the market price per share according to Gordon's model of dividend policy?

(B) The following data relates to four Firms – (5 Marks)

Firm A B C D

EBIT ₹ 2,00,000 ₹ 3,00,000 ₹ 5,00,000 ₹ 6,00,000

Interest ₹ 20,000 ₹ 60,000 ₹ 2,00,000 ₹ 2,40,000

Equity 12% 16% 15% 18%

Capitalization

Rate

Assuming that there are no taxes and Interest rate on debt is 10%, Determine the value and WACC of each

firm using the Net Income Approach.

(5 Marks)

Q 4)

(A) X Ltd. is considering the following two alternative financing plans:

Particulars Plan – I (₹) Plan – II (₹)

Equity shares of ₹ 10 4,00,000 4,00,000

each 12% Debentures 2,00,000 -

2,00,000

Preference Shares of ₹ 100

each 6,00,000 6,00,000

The Indifference point between the plans is ₹ 2,40,000. Corporate tax rate is 30%.

Calculate the rate of dividend on preference shares. (5 Marks)

(B) The following information regarding the equity shares of M ltd. is given:

Market price ₹ 58.33

Dividend per share ₹5

Multiplier 7

According to the Graham & Dodd approach to the dividend policy, compute the EPS.

(5 Marks)

Swapnil Patni’s Classes

[3]

Q 5)

ABC Ltd. has 50,000 outstanding shares. The current market price per share is ₹ 100 each. It hopes

to make a net income of ₹ 5,00,000 at the end of current year. The Company’s Board is considering

a dividend of ₹ 5 per share at the end of current financial year. The company needs to raise ₹

10,00,000 for an approved investment expenditure. The company belongs to a risk class for

which the capitalization rate is 10%. Show, how the M-M approach affects the value of firm if the

dividends are paid or not paid.

(10 Marks)

Q 6)

From the following Information, prepare Balance sheet of a Firm:

Stock Turnover Ratio (based On 7 Times Liquidity Ratio 1.25

cost of goods sold

Rate of Gross Profit to Sales (All 25% Net Working Capital ₹ 8,00,000

sales are on credit basis.)

Sales to Fixed Assets 2 times Net Worth to Fixed Assets 0.9 times

Average Debt Collection Period 1.5 months Reserves and Surplus 0.25 Times

Current Ratio 2 Long Term Debts Nil

(10 Marks)

Swapnil Patni’s Classes

Das könnte Ihnen auch gefallen

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Von EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- 71888bos57845 Inter p8qDokument6 Seiten71888bos57845 Inter p8qMayank RajputNoch keine Bewertungen

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDokument6 SeitenCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNoch keine Bewertungen

- Model Questions BBS 3rd Year Fundamental of Financial Management PDFDokument9 SeitenModel Questions BBS 3rd Year Fundamental of Financial Management PDFShah SujitNoch keine Bewertungen

- Rajdhani College FM Assignment FinalDokument6 SeitenRajdhani College FM Assignment Finalayushkorea52629Noch keine Bewertungen

- FMECO M.test EM 30.03.2021 QuestionDokument6 SeitenFMECO M.test EM 30.03.2021 Questionsujalrathi04Noch keine Bewertungen

- Board of Studies Academic Capital Structure Questions 1649402823Dokument6 SeitenBoard of Studies Academic Capital Structure Questions 1649402823Arundhathi MNoch keine Bewertungen

- Financial Decision MakingDokument4 SeitenFinancial Decision MakingHarsh DedhiaNoch keine Bewertungen

- Question Paper Problems 2008-2012Dokument9 SeitenQuestion Paper Problems 2008-2012sujith1978Noch keine Bewertungen

- 6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Dokument15 Seiten6th Sem-FM - Model QP by Srijita Datta and Arunangsu Das Sarma-26Apr2020Kashish GroverNoch keine Bewertungen

- Commando Test On FM (COC, CSP, DP) : Ranker's ClassesDokument3 SeitenCommando Test On FM (COC, CSP, DP) : Ranker's ClassesmuskanNoch keine Bewertungen

- Ca Inter May 2023 ImpDokument23 SeitenCa Inter May 2023 ImpAlok TiwariNoch keine Bewertungen

- DBE Sem-2 Question PapersDokument16 SeitenDBE Sem-2 Question PapersTanmay AroraNoch keine Bewertungen

- Sessional Examination: Master of Business Administration (MBA) Semester: IIIDokument4 SeitenSessional Examination: Master of Business Administration (MBA) Semester: IIINishaTripathiNoch keine Bewertungen

- SFM New Sums AddedDokument78 SeitenSFM New Sums AddedRohit KhatriNoch keine Bewertungen

- FM & Eco - Test 1Dokument3 SeitenFM & Eco - Test 1Ritam chaturvediNoch keine Bewertungen

- 73153bos58999 p8Dokument27 Seiten73153bos58999 p8Sagar GuptaNoch keine Bewertungen

- Chapter 5Dokument2 SeitenChapter 5pavkarsp14Noch keine Bewertungen

- Financial Management-1Dokument6 SeitenFinancial Management-1chelseaNoch keine Bewertungen

- Previous Year Question Paper (F.M)Dokument10 SeitenPrevious Year Question Paper (F.M)Alisha Shaw0% (1)

- MTP Oct. 2018 FM and Eco QuestionDokument6 SeitenMTP Oct. 2018 FM and Eco QuestionAisha MalhotraNoch keine Bewertungen

- B7AF100 - 2021 - OMD1 - First Sitting Exam PaperDokument12 SeitenB7AF100 - 2021 - OMD1 - First Sitting Exam PaperAZLEA BINTI SYED HUSSIN (BG)Noch keine Bewertungen

- FM & Eco Grand Test 2Dokument8 SeitenFM & Eco Grand Test 2moniNoch keine Bewertungen

- Paper 8 Financial Management & Economics For Finance PDFDokument5 SeitenPaper 8 Financial Management & Economics For Finance PDFShivam MittalNoch keine Bewertungen

- FM MTP MergedDokument330 SeitenFM MTP MergedAritra BanerjeeNoch keine Bewertungen

- 7 Corporate Finance - Prof. Gagan SharmaDokument4 Seiten7 Corporate Finance - Prof. Gagan SharmaVampireNoch keine Bewertungen

- Adhish Sir'S Classes 1: Chapter - Cost of CapitalDokument8 SeitenAdhish Sir'S Classes 1: Chapter - Cost of CapitaladhishcaNoch keine Bewertungen

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerDokument17 SeitenQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The Remaining Six Questions. Working Notes Should Form Part of The AnswerMajidNoch keine Bewertungen

- RM 3Dokument6 SeitenRM 3Harsh KumarNoch keine Bewertungen

- Gujarat Technological UniversityDokument3 SeitenGujarat Technological UniversityAmul PatelNoch keine Bewertungen

- 01 LeveragesDokument11 Seiten01 LeveragesZerefNoch keine Bewertungen

- Gujarat Technological UniversityDokument3 SeitenGujarat Technological UniversityAmul PatelNoch keine Bewertungen

- Paper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementDokument27 SeitenPaper - 8: Financial Management and Economics For Finance Section - A: Financial ManagementSakshi KhandelwalNoch keine Bewertungen

- Cost of CapitalDokument3 SeitenCost of CapitalkimjethaNoch keine Bewertungen

- SFM QuesDokument5 SeitenSFM QuesAstha GoplaniNoch keine Bewertungen

- Sep23 Ques-1Dokument5 SeitenSep23 Ques-1absankey770Noch keine Bewertungen

- Swapnil Patni's Classes: CA Intermediate - Financial Management Total Marks - 60Dokument3 SeitenSwapnil Patni's Classes: CA Intermediate - Financial Management Total Marks - 60Aniket PatelNoch keine Bewertungen

- MTP 19 53 Questions 1713430127Dokument12 SeitenMTP 19 53 Questions 1713430127Murugesh MuruNoch keine Bewertungen

- FFTFMDokument5 SeitenFFTFMKaran NewatiaNoch keine Bewertungen

- An Autonomous Institution, Affiliated To Anna University, ChennaiDokument7 SeitenAn Autonomous Institution, Affiliated To Anna University, Chennaisibi chandanNoch keine Bewertungen

- Part 1 - FM & ECO - 27145216 PDFDokument3 SeitenPart 1 - FM & ECO - 27145216 PDFMaharajan GomuNoch keine Bewertungen

- MTP 17 53 Questions 1710507531Dokument9 SeitenMTP 17 53 Questions 1710507531janasenalogNoch keine Bewertungen

- J8. CAPII - RTP - June - 2023 - Group-IIDokument162 SeitenJ8. CAPII - RTP - June - 2023 - Group-IIBharat KhanalNoch keine Bewertungen

- New ProjectDokument10 SeitenNew Projectvishal soniNoch keine Bewertungen

- Leverage Problems SRDokument2 SeitenLeverage Problems SRRamsha SadafNoch keine Bewertungen

- Copfin 1B August Block 2018Dokument4 SeitenCopfin 1B August Block 2018tawandaNoch keine Bewertungen

- FM Eco 100 Marks Test 1Dokument6 SeitenFM Eco 100 Marks Test 1AnuragNoch keine Bewertungen

- Test Paper: Chapter-1: Cost of CapitalDokument13 SeitenTest Paper: Chapter-1: Cost of Capitalcofinab795Noch keine Bewertungen

- Dividend DecisionsDokument3 SeitenDividend DecisionstoabhishekpalNoch keine Bewertungen

- Financial Management - Honours: Eighth Paper (A-34-A) (Accounting and Finance Group) Full Marks: 100Dokument3 SeitenFinancial Management - Honours: Eighth Paper (A-34-A) (Accounting and Finance Group) Full Marks: 100Suraj GuptaNoch keine Bewertungen

- Bangalore University Previous Year Question Paper AFM 2020Dokument3 SeitenBangalore University Previous Year Question Paper AFM 2020Ramakrishna NagarajaNoch keine Bewertungen

- Management Accounting - 1Dokument4 SeitenManagement Accounting - 1amaljacobjogilinkedinNoch keine Bewertungen

- Dividend DecisionsDokument3 SeitenDividend Decisionsjdon50% (2)

- 44956mtpbosicai Final QP p2Dokument7 Seiten44956mtpbosicai Final QP p2Shubham SurekaNoch keine Bewertungen

- Dividend DecisionDokument2 SeitenDividend Decisionbharatipaul42Noch keine Bewertungen

- 01 Leverages FTDokument7 Seiten01 Leverages FT1038 Kareena SoodNoch keine Bewertungen

- WACC puOgaACHywDokument3 SeitenWACC puOgaACHywAravNoch keine Bewertungen

- BSF 1102 - Principles of Finance - November 2022Dokument6 SeitenBSF 1102 - Principles of Finance - November 2022JulianNoch keine Bewertungen

- Capital StructureDokument7 SeitenCapital StructureKhushi RaniNoch keine Bewertungen

- Cost of CapitalDokument10 SeitenCost of CapitalYasin Misvari T MNoch keine Bewertungen

- Guidelines For Mock Test - 903018Dokument4 SeitenGuidelines For Mock Test - 903018chemical_alltimeNoch keine Bewertungen

- Ethical and Security Issues PDFDokument26 SeitenEthical and Security Issues PDFMrinal MishraNoch keine Bewertungen

- Data Analytics Financial ServicesDokument4 SeitenData Analytics Financial ServiceskasfurNoch keine Bewertungen

- Case QuestionsDokument1 SeiteCase QuestionsAniket PatelNoch keine Bewertungen

- Gujarat Technological University: Subject Name: Time: 10:30 AM To 01:30 PM Total Marks: 70Dokument2 SeitenGujarat Technological University: Subject Name: Time: 10:30 AM To 01:30 PM Total Marks: 70Aniket PatelNoch keine Bewertungen

- EMBA 2011 Fayaz KhakiDokument135 SeitenEMBA 2011 Fayaz KhakiAniket PatelNoch keine Bewertungen

- FInal - Circular - MIV Marks Entry - SU20 - Pharmacy (1) - 182375Dokument2 SeitenFInal - Circular - MIV Marks Entry - SU20 - Pharmacy (1) - 182375Aniket PatelNoch keine Bewertungen

- 6 Things To Do Before Joining An MBADokument19 Seiten6 Things To Do Before Joining An MBAAniket PatelNoch keine Bewertungen

- Sub: Rating Downgrade by Icra of Ncds of PNB Housing Finance Limited ("The Company")Dokument10 SeitenSub: Rating Downgrade by Icra of Ncds of PNB Housing Finance Limited ("The Company")Aniket PatelNoch keine Bewertungen

- Advt MBA-MCA PDFDokument1 SeiteAdvt MBA-MCA PDFSuresh RajaniNoch keine Bewertungen

- Bank Holidays GujaratDokument1 SeiteBank Holidays GujaratRenuka SharmaNoch keine Bewertungen

- Balance Sheet AnalysisDokument25 SeitenBalance Sheet Analysissinger0% (1)

- Excel MCQ LinksDokument1 SeiteExcel MCQ LinksAniket PatelNoch keine Bewertungen

- Swapnil Patni's Classes: CA Intermediate - Financial Management Total Marks - 60Dokument3 SeitenSwapnil Patni's Classes: CA Intermediate - Financial Management Total Marks - 60Aniket PatelNoch keine Bewertungen

- Gujarat Technological UniversityDokument3 SeitenGujarat Technological UniversityAniket PatelNoch keine Bewertungen

- Swapnil Patni's Classes: CA Intermediate - Financial Management Total Marks - 60Dokument3 SeitenSwapnil Patni's Classes: CA Intermediate - Financial Management Total Marks - 60Aniket PatelNoch keine Bewertungen

- Gujarat Technological University: Master of Business AdministrationDokument3 SeitenGujarat Technological University: Master of Business AdministrationRajan GorasiaNoch keine Bewertungen

- Gujarat Technological University: Master of Business AdministrationDokument3 SeitenGujarat Technological University: Master of Business Administrationharold_gravity9885Noch keine Bewertungen

- CalculusDokument3 SeitenCalculusYashPatelNoch keine Bewertungen

- Gujarat Technological University: Master of Business AdministrationDokument3 SeitenGujarat Technological University: Master of Business AdministrationRajan GorasiaNoch keine Bewertungen

- 3529202Dokument4 Seiten3529202HarishNoch keine Bewertungen

- Gujarat Technological UniversityDokument4 SeitenGujarat Technological UniversityAniket PatelNoch keine Bewertungen

- Gujarat Technological UniversityDokument3 SeitenGujarat Technological UniversityAniket PatelNoch keine Bewertungen

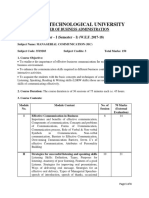

- Gujarat Technological University: Master of Business Administration Year - I (Semester - I) (W.E.F. 2017-18)Dokument4 SeitenGujarat Technological University: Master of Business Administration Year - I (Semester - I) (W.E.F. 2017-18)Aniket PatelNoch keine Bewertungen

- Concept of Ethic in Business 303 1bDokument19 SeitenConcept of Ethic in Business 303 1bMohammad Tariqul IslamNoch keine Bewertungen

- MisDokument1 SeiteMisAniket PatelNoch keine Bewertungen

- Gujarat Technological University: Master of Business Administration Year - I (Semester - I) (W.E.F. 2017-18)Dokument4 SeitenGujarat Technological University: Master of Business Administration Year - I (Semester - I) (W.E.F. 2017-18)Aniket PatelNoch keine Bewertungen

- Gujarat Technological University: Master of Business AdministrationDokument5 SeitenGujarat Technological University: Master of Business AdministrationAniket PatelNoch keine Bewertungen

- PDFDokument2 SeitenPDFDeepak ThakurNoch keine Bewertungen

- Capturing Project Requirements and KnowledgeDokument8 SeitenCapturing Project Requirements and KnowledgeefiolNoch keine Bewertungen

- Small Business ProjectDokument2 SeitenSmall Business ProjectYousef ManasraNoch keine Bewertungen

- Turnaround StrategyDokument2 SeitenTurnaround Strategyamittripathy084783Noch keine Bewertungen

- Wagini X Digitea PresentationDokument23 SeitenWagini X Digitea PresentationRAM CHANDRANoch keine Bewertungen

- Tybms Sem5 CRM Apr19Dokument2 SeitenTybms Sem5 CRM Apr19chirag guptaNoch keine Bewertungen

- International Trade Finance - Nov 2009Dokument8 SeitenInternational Trade Finance - Nov 2009Basilio MaliwangaNoch keine Bewertungen

- Nepal Investment Bank Limited-BackgroundDokument3 SeitenNepal Investment Bank Limited-BackgroundPrabin Bikram Shahi ThakuriNoch keine Bewertungen

- Lagos State Government: Request For Proposal RFP No: /S/C/SS/003/21Dokument76 SeitenLagos State Government: Request For Proposal RFP No: /S/C/SS/003/21olumidewilliams0207Noch keine Bewertungen

- Assignment 1 Islamic Vs Conventional Banks Performance AnalysisDokument8 SeitenAssignment 1 Islamic Vs Conventional Banks Performance AnalysisWali AfridiNoch keine Bewertungen

- Chevron OEDokument9 SeitenChevron OESundar Kumar Vasantha GovindarajuluNoch keine Bewertungen

- Assignment: National College Business AdministrationDokument4 SeitenAssignment: National College Business AdministrationZubair Afzal Khan0% (1)

- nayanMB0025Model Question PapersSikkim Manipal UniversityDokument11 SeitennayanMB0025Model Question PapersSikkim Manipal UniversityYash koradiaNoch keine Bewertungen

- Material Master Data CleansingDokument11 SeitenMaterial Master Data CleansingmsukuNoch keine Bewertungen

- Business Analyst Resume SampleDokument1 SeiteBusiness Analyst Resume SampleHoney Nhassie Marie GonzagaNoch keine Bewertungen

- Listening Comprehension SectionDokument41 SeitenListening Comprehension SectionKhoirul AnasNoch keine Bewertungen

- Real Estate PortfolioDokument17 SeitenReal Estate Portfolioapi-283375993Noch keine Bewertungen

- Advantages and Disadvantages of Shareholders or StakeholdersDokument1 SeiteAdvantages and Disadvantages of Shareholders or StakeholdersЭнхлэн АриунбилэгNoch keine Bewertungen

- Introduction To Management by Stephen P. Robbins Chapter.7Dokument16 SeitenIntroduction To Management by Stephen P. Robbins Chapter.7Murtaza Moiz0% (1)

- Chapter No. 1: ContentDokument101 SeitenChapter No. 1: ContentVipul AdateNoch keine Bewertungen

- CHP 15 Fin 13Dokument14 SeitenCHP 15 Fin 13Player OneNoch keine Bewertungen

- BP Texas City Case NotesDokument2 SeitenBP Texas City Case Notesmohamed eliwaNoch keine Bewertungen

- Chapter 7Dokument22 SeitenChapter 7anis abdNoch keine Bewertungen

- Employee Retention Internship ReportDokument25 SeitenEmployee Retention Internship ReportAakansha DhadaseNoch keine Bewertungen

- International Economics 16th Edition Thomas Pugel Test BankDokument24 SeitenInternational Economics 16th Edition Thomas Pugel Test Bankkhucly5cst100% (25)

- Oracle ASCP: How To Configure High Speed Manufacturing Routings in Oracle Applications For ASCPDokument7 SeitenOracle ASCP: How To Configure High Speed Manufacturing Routings in Oracle Applications For ASCPAvinash RoutrayNoch keine Bewertungen

- Triana Saleh CVDokument4 SeitenTriana Saleh CVtriana saIehNoch keine Bewertungen

- The Impacts of Road Infrastructure On Economic DevelopmentDokument5 SeitenThe Impacts of Road Infrastructure On Economic DevelopmentFarai T MapurangaNoch keine Bewertungen

- 1 Basic Concepts Quiz-MergedDokument50 Seiten1 Basic Concepts Quiz-MergedsukeshNoch keine Bewertungen

- Abridged Letter of Offer Equity 01102021Dokument12 SeitenAbridged Letter of Offer Equity 01102021Nitesh BairagiNoch keine Bewertungen

- History of E-CommerceDokument10 SeitenHistory of E-CommerceTanushNoch keine Bewertungen