Beruflich Dokumente

Kultur Dokumente

Sun Limitedabridgedsept2016v4 PDF

Hochgeladen von

Yash HardowarOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sun Limitedabridgedsept2016v4 PDF

Hochgeladen von

Yash HardowarCopyright:

Verfügbare Formate

(File No.

3886) — Business Registration No : C06003886 - Incorporated in the Republic of Mauritius

SUN LIMITED Abridged Financial Statements for the year ended 30 June 2016

THE GROUP THE GROUP

Consolidated Statement of Profit or Audited Unaudited Audited Audited Unaudited Audited

Consolidated Geographical and

Loss and other Comprehensive Income Restated Restated

Segmental Information

(Abridged) 18 months 18 months

Year ended 30 June ended 30 June Year ended 30 June ended 30 June

2016 2015 2015

Rs’000 Rs’000 Rs’000 2016 2015 2015

Revenue 4,989,237 4,205,829 6,174,276 Rs’000 Rs’000 Rs’000

Other operating income 63,930 95,411 129,804 Geographical revenue:

Mauritius 4,599,135 3,267,977 4,708,594

Total revenue 5,053,167 4,301,240 6,304,080 Maldives 31,545 527,545 860,594

Earnings before interests, taxation, depreciation and Others 422,487 505,718 734,892

amortisation (EBITDA) 777,789 742,287 952,864

Total revenue including other operating income 5,053,167 4,301,240 6,304,080

Depreciation and amortisation (356,894) (323,658) (490,663)

Geographical results:

Operating profit 420,895 418,629 462,201

Finance costs (457,453) (297,884) (462,998) Mauritius (160,061) 483,161 337,346

Finance income 10,527 8,182 11,227 Maldives (209,449) 17,174 75,457

Share of results of associates (6,799) 27,948 27,948 Others 49 3,715 (7,551)

(Loss)/Profit before tax and exceptional items (32,830) 156,875 38,378

(Loss)/Profit for the period (369,461) 504,050 405,252

Fair value gain on business combination - 604,500 604,500 Segment revenue:

Closure,marketing launch,restructuring,

branding and transaction costs (534,208) (265,249) (265,249) Hotel operations - External sales 4,621,400 3,770,375 5,518,196

(Loss)/Profit before tax (567,038) 496,126 377,629 Hotel operations - Inter-segment sales 290,764 360,314 520,372

Income tax credit 197,577 7,924 27,623 4,912,164 4,130,689 6,038,568

(Loss)/Profit for the year / period (369,461) 504,050 405,252 Real estate 9,280 25,147 50,992

Other comprehensive income for the year / period net of tax 11,267 1,186,062 1,170,607 Others - External sales 422,487 505,718 734,892

Elimination of inter-segment sales (290,764) (360,314) (520,372)

Total comprehensive income for the year / period (358,194) 1,690,112 1,575,859

Total revenue including other operating income 5,053,167 4,301,240 6,304,080

(Loss)/Profit attributable to: Segment results:

Owners of the Company (300,353) 514,872 416,044

Hotel operations (372,092) 493,875 399,340

Non-controlling interests (69,108) (10,822) (10,792)

Real estate 2,582 6,460 13,463

(369,461) 504,050 405,252 Others 49 3,715 (7,551)

Total comprehensive income attributable to: (Loss)/Profit for the period (369,461) 504,050 405,252

Owners of the Company (293,016) 1,695,398 1,581,115

Non-controlling interests (65,178) (5,286) (5,256) THE GROUP

Audited

(358,194) 1,690,112 1,575,859

Consolidated Statement of Audited Unaudited Restated

Basic (Loss) / Earnings per share (Rs) (2.37) 4.71 3.93

Cash Flows (Abridged) 18 months

Year ended 30 June ended 30 June

Consolidated Statement of Changes in Equity (Abridged) 2016 2015 2015

Rs’000 Rs’000 Rs’000

THE GROUP Operating profit before working capital changes 385,825 560,183 780,216

Attibutable Non Change in working capital (653,157) 96,515 96,089

to owners of the Treasury controlling Total Cash (used in)/generated from operations (267,332) 656,698 876,305

Company shares interests equity

Income taxes paid (5,707) (8,575) (20,153)

Rs’000 Rs’000 Rs’000 Rs’000

Net cash flows (used in) / from operating activities (273,039) 648,123 856,152

At 1 July 2014 6,800,215 (1,422,238) 1,773 5,379,750

Net cash flows (used in) investing activities (1,634,086) (1,819,122) (2,663,290)

Issue of shares to non-controlling interest - - 865,150 865,150

Net cash flows from financing activities 1,511,606 982,160 1,764,751

Purchase of Treasury Shares - (9,792) - (9,792)

Net decrease in cash and cash equivalents (395,519) (188,839) (42,387)

Rights Issue 1,193,319 - - 1,193,319

Cash and cash equivalents at 1 July / 1 January (281,506) (92,667) (239,119)

Total comprehensive income for the period 1,581,115 - (5,256) 1,575,859

Net cash and cash equivalents at 30 June (677,025) (281,506) (281,506)

At 30 June 2015 9,574,649 (1,432,030) 861,667 9,004,286

Notes to the above:

At 1 July 2015 THE GROUP

- as previously reported 9,484,787 (1,432,030) 861,667 8,914,424

1. The abridged financial statements of the Group are

audited by Messrs BDO & Co., Chartered Accountants,

Consolidated Statement Audited Audited

- prior year adjustment 89,862 - - 89,862

and have been prepared using the same accounting

policies as the audited Statements for the eighteen

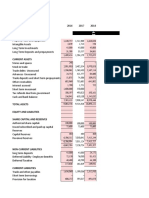

of Financial Position Restated

- as restated 9,574,649 (1,432,030) 861,667 9,004,286 month period ended 30 June 2015, except for the (Abridged) 30 June 30 June

adoption of amendments to published standards and 2016 2015

Total comprehensive income for the year (293,016) - (65,178) (358,194) interpretations issued which are now effective.

At 30 June 2016 9,281,633 (1,432,030) 796,489 8,646,092 These financial statements are issued pursuant to

Listing Rule 12.14 and the Security Act 2005 ASSETS Rs’000 Rs’000

2. The 18 months ended 30 June 2015 has been Non-current assets

Comments on the results restated due to adjustment on the final consideration

for the acquisition of the remaining 50% shareholding

Property, plant and equipment 15,883,066 14,805,789

Sun Limited reports total revenue of Rs 5.05 billion for the year, up by 17.5% compared to the unaudited twelve months period ended in Anahita Hotel Limited. In accordance with “IFRS 3: Operating equipment 100,099 104,568

30 June 2015. Business Combinations”, Sun Limited has retrospectively

adjusted for the provisional amounts recognised at

Intangible assets 2,050,820 1,991,801

The Group occupancy improved from 76.3% to 78.6% during the period under review. the acquisition date of Anahita Hotel Limited, that Investments in associates 808,293 815,092

is, 30 June 2015, to reflect the final consideration. The

Despite a significant portion of our inventory being closed during the year, the Group was able to achieve a 26% increase in Revenue retrospective adjustments were made by restating the

Other investments 5,550 5,550

per Available Room (RevPAR) to Rs 5,030, whilst our Average Daily Rate (ADR) increased by 22% to Rs 6,400. comparative amounts for prior period. Leasehold rights and land prepayments 396,471 408,097

As a reminder, in March 2014, Sun Limited, formerly Sun

The Group EBITDA grew by 5% to Rs778 million. Operating profit remained however stable at Rs 421 million. The finance costs and the Resorts Limited, changed its financial year-end from 31

Other financial assets 90,011 129,702

exceptional items linked mainly to closure and re-launch costs rose to Rs 457 million and Rs 534 million respectively. The increase in December to 30 June. Therefore, the statutory results

19,334,310 18,260,599

of the 12 months ended 30 June 2016 (1 July 2015 to 30

the financial costs are linked to the acquisition of an additional 50% stake in the Four Seasons and a 30% in the Ambre Hotel property June 2016) are not directly comparable to the previous Current assets 1,692,885 1,153,339

company, the major renovation projects undertaken at Shangri-La’s Le Touessrok, Kanuhura Hotel and the Four Seasons as well as eighteen-month financial year from 1 January 2014

the consolidation of the latter’s debt. to 30 June 2015 as approved by SRL shareholders. Total assets 21,027,195 19,413,938

To facilitate a better understanding of underlying

Sun posted a net loss of Rs 369.5 million for the financial year after taking into account a positive deferred tax impact. business performance, pro forma financial statements EQUITY AND LIABILITIES

for the twelve-month period ended 30 June 2015 have

also been prepared. Shareholders' equity 7,849,603 8,142,619

Non-controlling interests 796,489 861,667

Outlook

By Order of the Board Total equity 8,646,092 9,004,286

Sun has now well progressed in the implementation of its 2014-2019 plan. In the coming year, renovation and closure costs will CIEL Corporate Services Ltd

Company Secretary

progressively decrease, while net finance costs will remain high. Borrowings 3,792,914 4,344,350

28 September 2016

Deferred tax liability 655,566 865,518

These factors should be offset by renewed sales momentum as the Group’s renovated assets drive revenue up; all of the Group’s This announcement is issued pursuant to Listing Rule 12.14 and

resorts will be fully operational in December 2016 for the first time in two years. Moreover, it is anticipated that Shangri-La’s Le the Securities Act 2005. The Board of Directors of Sun Limited Employee benefit liability 264,592 190,056

accepts full responsibility for the accuracy of the information

Touessrok will start contributing positively, supporting the already high performing Four Seasons hotel in our luxury segment. Forward- contained in this report. The statement of direct and indirect Non-current liabilities 4,713,072 5,399,924

interests of officers of the Company required under rule 8(2)(m) of

bookings are indicating encouraging room rate growth, thus endorsing the Group’s new rate positioning which will come into effect in the Securities (Disclosure Obligations of Reporting Issuers) Rules Current liabilities 7,668,031 5,009,728

November 2016, as part of its yield optimization strategy. 2007 is available upon request from the Secretary, free of charge

at CIEL Corporate Services Ltd, Ebène Skies, Ebène, Mauritius. Total liabilities 12,381,103 10,409,652

Copies of this report are available to the public, free of charge, at

Sun Limited continues its focus on reaching excellence in operations across all its clusters and is confident that it will progressively the Registered Office of the Company.

return to sustainable profit growth.

Registered Office

Total equity and liabilities 21,027,195 19,413,938

5th floor, Ebène Skies

To support this strategy, the Group is well advanced in the restructuring of its indebtedness to ensure that it matches future cash flows Rue de L’institut, Ebène

Total net interest-bearing loans and

as well as bringing down the average cost of debt. borrowings 9,270,941 6,918,364

Transfer Office

MCB Registry & Securities Ltd. Sir William Newton Street, Port Louis Gearing 51.7% 43.4%

Das könnte Ihnen auch gefallen

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineVon EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNoch keine Bewertungen

- Sun Limited Abridged Financial Statements: The Group's Audited Results For The Year Ended 30 June 2017 Are As FollowsDokument1 SeiteSun Limited Abridged Financial Statements: The Group's Audited Results For The Year Ended 30 June 2017 Are As FollowsYash HardowarNoch keine Bewertungen

- Corp First Quarterly Report 2015Dokument21 SeitenCorp First Quarterly Report 2015Iqra JawedNoch keine Bewertungen

- CAL BankDokument2 SeitenCAL BankFuaad DodooNoch keine Bewertungen

- Unga Group Financial Report Year Ended June 2018Dokument1 SeiteUnga Group Financial Report Year Ended June 2018Ian MutukuNoch keine Bewertungen

- 4412 Boohoo Ar 2019Dokument27 Seiten4412 Boohoo Ar 2019harutotsukassaNoch keine Bewertungen

- (Final) Financial Statement For Tax Return (03.03.2018)Dokument24 Seiten(Final) Financial Statement For Tax Return (03.03.2018)Engineering EntertainmentNoch keine Bewertungen

- Announcement of Interim Results For The Six Months Ended 30 June 2020Dokument45 SeitenAnnouncement of Interim Results For The Six Months Ended 30 June 2020in resNoch keine Bewertungen

- Bsheet 04Dokument3 SeitenBsheet 04pranav6201Noch keine Bewertungen

- Half Year Financials 2018 - Kenya WebDokument1 SeiteHalf Year Financials 2018 - Kenya WebdouglasNoch keine Bewertungen

- en PDFDokument49 Seitenen PDFJ. BangjakNoch keine Bewertungen

- Mq-18-Results-In-Excel - tcm1255-522302 - enDokument5 SeitenMq-18-Results-In-Excel - tcm1255-522302 - enbhavanaNoch keine Bewertungen

- Lakh Datta Flour MillsDokument14 SeitenLakh Datta Flour MillsjimmuNoch keine Bewertungen

- Draft FS Tax Purpose 01.03.2018Dokument25 SeitenDraft FS Tax Purpose 01.03.2018Engineering EntertainmentNoch keine Bewertungen

- Historical Data Dec19Dokument9 SeitenHistorical Data Dec19WilsonNoch keine Bewertungen

- Income Statement and Balance SheetDokument8 SeitenIncome Statement and Balance SheetMyustafizzNoch keine Bewertungen

- EWM Results - 3Q 2019Dokument24 SeitenEWM Results - 3Q 2019kimNoch keine Bewertungen

- Antler Fabric Printers (PVT) LTD 2016Dokument37 SeitenAntler Fabric Printers (PVT) LTD 2016IsuruNoch keine Bewertungen

- Profit & Loss Account of Infosys - in Rs. Cr.Dokument2 SeitenProfit & Loss Account of Infosys - in Rs. Cr.Samta Sukhdeve100% (1)

- Ecobank Ghana Limited: Un-Audited Financial Statements For The Three-Month Period Ended 31 March 2022Dokument8 SeitenEcobank Ghana Limited: Un-Audited Financial Statements For The Three-Month Period Ended 31 March 2022Fuaad DodooNoch keine Bewertungen

- Hindustan Unilever: PrintDokument2 SeitenHindustan Unilever: PrintUTSAVNoch keine Bewertungen

- Hindustan Unilever: PrintDokument2 SeitenHindustan Unilever: PrintAbhay Kumar SinghNoch keine Bewertungen

- Jamna Auto Industries LimitedDokument1 SeiteJamna Auto Industries LimitedpoloNoch keine Bewertungen

- Jtiasa 4Q 30 June 2016 ResultsDokument12 SeitenJtiasa 4Q 30 June 2016 ResultskimNoch keine Bewertungen

- Consolidated Statement of Profit and LossDokument1 SeiteConsolidated Statement of Profit and LossSukhmanNoch keine Bewertungen

- Extracted Pages From Walton Hi-Tech Industries Limited Red-Herring Prospectus Dt. 02.01.2020 - Updated - 2Dokument1 SeiteExtracted Pages From Walton Hi-Tech Industries Limited Red-Herring Prospectus Dt. 02.01.2020 - Updated - 2Aslam HossainNoch keine Bewertungen

- 8167-W 2017 PPB IsDokument3 Seiten8167-W 2017 PPB IsVijay KumarNoch keine Bewertungen

- Cscstel 202206 Q2Dokument13 SeitenCscstel 202206 Q2Al TanNoch keine Bewertungen

- ACCT2006 AssignmentDokument17 SeitenACCT2006 Assignmentalgiak94Noch keine Bewertungen

- Profit and Loss Account For The Year Ended 31 March, 2009: ST STDokument2 SeitenProfit and Loss Account For The Year Ended 31 March, 2009: ST STRanjan DasguptaNoch keine Bewertungen

- Kpi Q3 Fy24Dokument12 SeitenKpi Q3 Fy24tapas.patel1Noch keine Bewertungen

- 2016 08 04 BWG Q22016 Results Ann v7Dokument19 Seiten2016 08 04 BWG Q22016 Results Ann v7knightridNoch keine Bewertungen

- Beg A Cheese 2016Dokument4 SeitenBeg A Cheese 2016杨子偏Noch keine Bewertungen

- Bangladesh q1 Report 2016 Tcm244 547768 enDokument5 SeitenBangladesh q1 Report 2016 Tcm244 547768 entdebnath_3Noch keine Bewertungen

- 2016 Nestle ExtratedDokument7 Seiten2016 Nestle ExtratednesanNoch keine Bewertungen

- Bangladesh q1 Report 2020 Tcm244 553014 enDokument7 SeitenBangladesh q1 Report 2020 Tcm244 553014 entdebnath_3Noch keine Bewertungen

- KPI Q1 FY24 June2023Dokument12 SeitenKPI Q1 FY24 June2023tapas.patel1Noch keine Bewertungen

- PSO StatementDokument1 SeitePSO StatementNaseeb Ullah TareenNoch keine Bewertungen

- Quarterly Report 20180331Dokument15 SeitenQuarterly Report 20180331Ang SHNoch keine Bewertungen

- Apollo Ar19Dokument72 SeitenApollo Ar19Wen Xin GanNoch keine Bewertungen

- KPIs Bharti Airtel 04022020Dokument13 SeitenKPIs Bharti Airtel 04022020laksikaNoch keine Bewertungen

- Audited Consolidated-Statements - PAL 2022Dokument10 SeitenAudited Consolidated-Statements - PAL 2022P patelNoch keine Bewertungen

- These Financial Statements Should Be Read in Conjunction With The Annexed NotesDokument10 SeitenThese Financial Statements Should Be Read in Conjunction With The Annexed NotesSK. Al Mamun MamunNoch keine Bewertungen

- Thal Limited Result 12-09-2023Dokument3 SeitenThal Limited Result 12-09-2023zaid khanNoch keine Bewertungen

- A04 Blsj73ol5xk6x7wb.1Dokument28 SeitenA04 Blsj73ol5xk6x7wb.1Paul BluemnerNoch keine Bewertungen

- q1 Results FinalDokument1 Seiteq1 Results Finalmixedbag100% (1)

- 4920-D 2018 2018 Annual CFDokument4 Seiten4920-D 2018 2018 Annual CFVijay KumarNoch keine Bewertungen

- Ar 2016Dokument247 SeitenAr 2016Gain GainNoch keine Bewertungen

- Renuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021Dokument11 SeitenRenuka Foods PLC: Interim Financial Statements - For The Period Ended 31 December 2021hvalolaNoch keine Bewertungen

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokument3 SeitenStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNoch keine Bewertungen

- Acc AssignmentDokument25 SeitenAcc AssignmentMyustafizzNoch keine Bewertungen

- Valoracion EcopetrolDokument66 SeitenValoracion EcopetrolNicolas SarmientoNoch keine Bewertungen

- 31 March 2020Dokument8 Seiten31 March 2020lojanbabunNoch keine Bewertungen

- Q3 Interim Condensed Consolidated FS 2019Dokument8 SeitenQ3 Interim Condensed Consolidated FS 2019FaizanSulNoch keine Bewertungen

- 3rd Quarter 2021Dokument19 Seiten3rd Quarter 2021sakib9949Noch keine Bewertungen

- Assignment FSADokument15 SeitenAssignment FSAJaveria KhanNoch keine Bewertungen

- Quarterly Report 20200930Dokument18 SeitenQuarterly Report 20200930Ang SHNoch keine Bewertungen

- Interim Financial Statement - 3rd Quarter: Aitken Spence Hotel Holdings PLCDokument16 SeitenInterim Financial Statement - 3rd Quarter: Aitken Spence Hotel Holdings PLCnowfazNoch keine Bewertungen

- Answer 1 Joyce TilyenjiDokument4 SeitenAnswer 1 Joyce TilyenjiANDREW MAZIMBANoch keine Bewertungen

- Financial Statement ACIFL 31 March 2015 ConsolidatedDokument16 SeitenFinancial Statement ACIFL 31 March 2015 ConsolidatedNurhan JaigirdarNoch keine Bewertungen

- Construction and Building MaterialsDokument11 SeitenConstruction and Building MaterialsYash HardowarNoch keine Bewertungen

- ABKID LTD (ST Regis)Dokument5 SeitenABKID LTD (ST Regis)Yash HardowarNoch keine Bewertungen

- Sun Resorts AR 2015 P1Dokument30 SeitenSun Resorts AR 2015 P1Yash HardowarNoch keine Bewertungen

- MCI Eng PDFDokument7 SeitenMCI Eng PDFYash HardowarNoch keine Bewertungen

- Bridges LLC ProposalDokument4 SeitenBridges LLC ProposalYash HardowarNoch keine Bewertungen

- Profit Maximization Vs Stockholders' Wealth MaximizationDokument10 SeitenProfit Maximization Vs Stockholders' Wealth MaximizationMarienell YuNoch keine Bewertungen

- TAX Ch03Dokument13 SeitenTAX Ch03GabriellaNoch keine Bewertungen

- Cost AccountingDokument3 SeitenCost AccountingXen XeonNoch keine Bewertungen

- Annexure B To Directors' Report Report On Corporate GovernanceDokument10 SeitenAnnexure B To Directors' Report Report On Corporate GovernancePritam BhadadeNoch keine Bewertungen

- Using The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisDokument2 SeitenUsing The Gordon Dividend Model. Compare The Cost of Equity Computed On The BasisONASHI DEVNANI BBANoch keine Bewertungen

- Understanding Financial Statements PowerpointDokument18 SeitenUnderstanding Financial Statements PowerpointVergel MartinezNoch keine Bewertungen

- Acc 1 - Financial Accounting and Reporting QUIZ NO. 17 - Partnership Formation (Application)Dokument1 SeiteAcc 1 - Financial Accounting and Reporting QUIZ NO. 17 - Partnership Formation (Application)nicole bancoroNoch keine Bewertungen

- Chapter 6 Satatement of Cash FlowsDokument28 SeitenChapter 6 Satatement of Cash FlowsCabdiraxmaan GeeldoonNoch keine Bewertungen

- List of Hedge Funds From OdpDokument5 SeitenList of Hedge Funds From OdpChris AbbottNoch keine Bewertungen

- Pagcor Vs BirDokument5 SeitenPagcor Vs BirClarisse Ann MirandaNoch keine Bewertungen

- Corporate Reporting Homework (Day 1)Dokument9 SeitenCorporate Reporting Homework (Day 1)Sara MirchevskaNoch keine Bewertungen

- Chapter Two Principles & Basis of Accounting For Government & NFP EntitiesDokument10 SeitenChapter Two Principles & Basis of Accounting For Government & NFP Entitiesmeron fitsum100% (1)

- Business Finance-Module 1Dokument15 SeitenBusiness Finance-Module 1Alex PrioloNoch keine Bewertungen

- Types of AcquisitionDokument16 SeitenTypes of AcquisitionSonali SinghNoch keine Bewertungen

- Mutual Fund Industry Decade of Growth 2010 2020 ReportDokument36 SeitenMutual Fund Industry Decade of Growth 2010 2020 ReportHarshit SinghNoch keine Bewertungen

- D.G.khan Cement Company Limited 2011-12 Annual ReportDokument135 SeitenD.G.khan Cement Company Limited 2011-12 Annual ReportSaleem KhanNoch keine Bewertungen

- Financial Statements ExercicesDokument7 SeitenFinancial Statements Exercicesluliga.loulouNoch keine Bewertungen

- Types of Dividend PoliciesDokument3 SeitenTypes of Dividend PoliciesAlphaNoch keine Bewertungen

- Introduction - Joint Stock CompanyDokument5 SeitenIntroduction - Joint Stock Companyiisjaffer100% (3)

- Unit 7: Investment in Associates & Joint Ventures: Financial ReportingDokument11 SeitenUnit 7: Investment in Associates & Joint Ventures: Financial ReportingSiva DineshNoch keine Bewertungen

- 2Q 2019 PEHA Phapros+TbkDokument91 Seiten2Q 2019 PEHA Phapros+TbkHiji DuaNoch keine Bewertungen

- aaNDIC QUARTERLY VOL 33 NO 3 4 Article CAPITAL STRUCTURE AND PERFORMANCE OF DEPOSIT MONEY BANKS IN NIGERIA 2 PDFDokument31 SeitenaaNDIC QUARTERLY VOL 33 NO 3 4 Article CAPITAL STRUCTURE AND PERFORMANCE OF DEPOSIT MONEY BANKS IN NIGERIA 2 PDFYemi AdetayoNoch keine Bewertungen

- One Person Company by Sabarnee ChatterjeeDokument11 SeitenOne Person Company by Sabarnee ChatterjeeSabarnee Chatterjee50% (2)

- The Steel War - Mittal Vs ArcelorDokument25 SeitenThe Steel War - Mittal Vs ArcelorAsiri PrasadNoch keine Bewertungen

- Income Tax Payment Challan: PSID #: 21114984Dokument1 SeiteIncome Tax Payment Challan: PSID #: 21114984Zia Sultan AwanNoch keine Bewertungen

- Chap 9 SolutionsDokument10 SeitenChap 9 SolutionsAalo M ChakrabortyNoch keine Bewertungen

- Chapter 10Dokument40 SeitenChapter 10joyabyss100% (1)

- CFAS ExercisesDokument10 SeitenCFAS ExercisesDhea MaligayaNoch keine Bewertungen

- Analysis of Financial StatementDokument4 SeitenAnalysis of Financial StatementhhaiderNoch keine Bewertungen

- Lopez Holdings Corporation - LPZDokument2 SeitenLopez Holdings Corporation - LPZJC CalaycayNoch keine Bewertungen