Beruflich Dokumente

Kultur Dokumente

Importance of International Financial Management

Hochgeladen von

Olga Sîrbu0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten2 SeitenOriginaltitel

importance of international financial management

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten2 SeitenImportance of International Financial Management

Hochgeladen von

Olga SîrbuCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

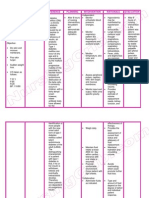

CHAPTER 1

1. Importance of International Financial Management

It is important to study financial management since we are living in a globalized and

integrated world economy. American consumers, for example, routinely purchase oil imported

from Saudi Arabia and Nigeria, TV sets from Korea, automobiles from Germany and Japan,

garments from China, shoes from Indonesia, handbags from Italy, and wine from France.

Owing to the continuous liberalization of international trade and investment, and rapid

advances in telecommunications and transportation technologies, the world economy will

become even more integrated.

2. International financial management vs domestic financial management

The major dimensions are:

a) foreign exchange and political risks (sovereign government have the right to regulate the

movement of goods, capital and people across their borders. This laws sometimes can exchange

in unexpected ways).

b) market imperfections ( legal restrictions on the movement of goods, people and money;

transactions cost, shipping cost).

c) and expanded opportunity set

3. Major trends in international business

A major economic trend of the recent decades is the rapid pace with which former state-

owned businesses bare being privatized. With the fall of communism, many eastern bloc

countries began stripping themselves of inefficient business operations formerly run by the

state. Privatization has placed a new demand on international capital markets to finance the

purchase of the former state enterprises, and it has also brought about a demand for new

managers with international business skills.

4. Country economic well-being enhanced through free international trade in goods

and services

It is mutually beneficial for two countries to specialize in the production of the goods for which

they have comparative advantages and then trade those goods. By doing so, the two countries

can increase their combined production, which allows both countries to consume more of both

goods. This argument remains valid even if a country can produce both goods more efficiently

than the other country. International trade is not a zero-sum game, but is instead, could be an

increasing-sum game at which all players become winners.

5. Considerations which limit the extent of theory of comparative advantage as

realistic

The theory of comparative advantage claims that economic well-being is enhanced if each

country's citizens produce what they have a comparative advantage in producing relative to the

citizens of other countries, and then trade products. Underlying the theory are the assumptions of

free trade between nations and that the factors of production (land, buildings, labor, technology,

and capital) are relatively immobile. To the extent that these assumptions do not hold, the theory

of comparative advantage will not realistically describe international trade.

6. Multinational corporations (MNCs) and economic role

A multinational corporations (MNC) is a firm that has been incorporated in one country and has

productions and sales operations in another countries.

There are about 60.000 MNCs in the world

Many MNCs obtain raw materials from one nations, financial capital from another, produce

goods with labor and capital equipment in a third country, and sell their output in various other

national markets

Das könnte Ihnen auch gefallen

- Profit of The CompanyDokument2 SeitenProfit of The CompanyOlga SîrbuNoch keine Bewertungen

- Securities of The CompanyDokument2 SeitenSecurities of The CompanyOlga SîrbuNoch keine Bewertungen

- Authenticated Authenticated: Registration Article 37. Registration of The Company and Its AssetsDokument2 SeitenAuthenticated Authenticated: Registration Article 37. Registration of The Company and Its AssetsOlga SîrbuNoch keine Bewertungen

- General Sharehoders MeetingDokument5 SeitenGeneral Sharehoders MeetingOlga SîrbuNoch keine Bewertungen

- Classes of SharesDokument2 SeitenClasses of SharesOlga SîrbuNoch keine Bewertungen

- Rights and Duties of ShareholdersDokument3 SeitenRights and Duties of ShareholdersOlga SîrbuNoch keine Bewertungen

- Security of The CompanyDokument3 SeitenSecurity of The CompanyOlga SîrbuNoch keine Bewertungen

- 1.1. Definition and Qualification of The Distribution Contract Under Russian LawDokument3 Seiten1.1. Definition and Qualification of The Distribution Contract Under Russian LawOlga SîrbuNoch keine Bewertungen

- AMERICAN TYPE of ContractDokument4 SeitenAMERICAN TYPE of ContractOlga SîrbuNoch keine Bewertungen

- Article 8. Branch Offices and Representative Offices of The CompanyDokument2 SeitenArticle 8. Branch Offices and Representative Offices of The CompanyOlga SîrbuNoch keine Bewertungen

- IL, European PartDokument12 SeitenIL, European PartOlga SîrbuNoch keine Bewertungen

- Article16. Bonds: Due DateDokument2 SeitenArticle16. Bonds: Due DateOlga SîrbuNoch keine Bewertungen

- Joint Stock CompanyDokument2 SeitenJoint Stock CompanyOlga SîrbuNoch keine Bewertungen

- Arbitrary Allocations-Not Significant Determinants of The CostDokument2 SeitenArbitrary Allocations-Not Significant Determinants of The CostOlga SîrbuNoch keine Bewertungen

- Cost Accumulation SystemDokument2 SeitenCost Accumulation SystemOlga SîrbuNoch keine Bewertungen

- International ConventionDokument3 SeitenInternational ConventionOlga SîrbuNoch keine Bewertungen

- Sixth Council DirectiveDokument1 SeiteSixth Council DirectiveOlga SîrbuNoch keine Bewertungen

- Integrated Cost Accounting SystemDokument2 SeitenIntegrated Cost Accounting SystemOlga SîrbuNoch keine Bewertungen

- Management Accounting:: Major Differences: Legal Requirements, Focus On, Bodies, Time Dimension, Report FrequencyDokument2 SeitenManagement Accounting:: Major Differences: Legal Requirements, Focus On, Bodies, Time Dimension, Report FrequencyOlga SîrbuNoch keine Bewertungen

- Spain: Population (July 2017) - 46,468, 102 (30) Density - 92/ (238.3/sq Mi.)Dokument17 SeitenSpain: Population (July 2017) - 46,468, 102 (30) Density - 92/ (238.3/sq Mi.)Olga SîrbuNoch keine Bewertungen

- Reforms For Inclusive Growth: 2017 Oecd Economic Survey of SpainDokument35 SeitenReforms For Inclusive Growth: 2017 Oecd Economic Survey of SpainOlga SîrbuNoch keine Bewertungen

- International Investment Law: Salini TestDokument2 SeitenInternational Investment Law: Salini TestOlga SîrbuNoch keine Bewertungen

- UkraineDokument19 SeitenUkraineOlga SîrbuNoch keine Bewertungen

- Universita Degli Studi Di Verona Sede Di Vicenza Corso Di Laurea Magistrale in International Economics and Business ManagementDokument15 SeitenUniversita Degli Studi Di Verona Sede Di Vicenza Corso Di Laurea Magistrale in International Economics and Business ManagementOlga SîrbuNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Umihara Et Al-2017-Chemistry - A European JournalDokument3 SeitenUmihara Et Al-2017-Chemistry - A European JournalNathalia MojicaNoch keine Bewertungen

- Think Feel DoDokument3 SeitenThink Feel DoHardik MehtaNoch keine Bewertungen

- Ancient India: Book Recommendation: Indian Feudalism Urban Decay in India - RS SharmaDokument5 SeitenAncient India: Book Recommendation: Indian Feudalism Urban Decay in India - RS SharmaShraddha 7Noch keine Bewertungen

- Inner DriveDokument51 SeitenInner DriveShaurya VajhulaNoch keine Bewertungen

- Edagogy of Anguages: VerviewDokument54 SeitenEdagogy of Anguages: VerviewMukesh MalviyaNoch keine Bewertungen

- ENG11H Realism 6-Outcasts of Poker FlatDokument3 SeitenENG11H Realism 6-Outcasts of Poker FlatJosh Cauhorn100% (1)

- Paper 19 AugustDokument552 SeitenPaper 19 AugustUma Sankar Pradhan100% (1)

- Sabre V8Dokument16 SeitenSabre V8stefan.vince536Noch keine Bewertungen

- Nursing Care Plan Diabetes Mellitus Type 1Dokument2 SeitenNursing Care Plan Diabetes Mellitus Type 1deric85% (46)

- Resume Pet A Sol LanderDokument3 SeitenResume Pet A Sol LanderdreyesfinuliarNoch keine Bewertungen

- Infoblatt Skischulen Trends Port eDokument18 SeitenInfoblatt Skischulen Trends Port eAustrian National Tourism BoardNoch keine Bewertungen

- Transformational and Charismatic Leadership: The Road Ahead 10th Anniversary EditionDokument32 SeitenTransformational and Charismatic Leadership: The Road Ahead 10th Anniversary Editionfisaac333085Noch keine Bewertungen

- Modern Steel ConstructionDokument70 SeitenModern Steel ConstructionohundperNoch keine Bewertungen

- Acute Conditions of The NewbornDokument46 SeitenAcute Conditions of The NewbornCamille Joy BaliliNoch keine Bewertungen

- FinancialAccountingTally PDFDokument1 SeiteFinancialAccountingTally PDFGurjot Singh RihalNoch keine Bewertungen

- Sequence Analytical and Vector Geometry at Teaching of Solid Geometry at Secondary SchoolDokument10 SeitenSequence Analytical and Vector Geometry at Teaching of Solid Geometry at Secondary SchoolJuan S. PalmaNoch keine Bewertungen

- 67 9268Dokument34 Seiten67 9268Salvador ReyesNoch keine Bewertungen

- A3 Report Template Checklist - SafetyCultureDokument4 SeitenA3 Report Template Checklist - SafetyCulturewarriorninNoch keine Bewertungen

- FORM 2 Enrolment Form CTU SF 2 v.4 1Dokument1 SeiteFORM 2 Enrolment Form CTU SF 2 v.4 1Ivy Mie HerdaNoch keine Bewertungen

- Micromine TutorialDokument5 SeitenMicromine TutorialFerdinand Siahaan100% (1)

- DIFFERENCE BETWEEN Intrior Design and DecorationDokument13 SeitenDIFFERENCE BETWEEN Intrior Design and DecorationSadaf khanNoch keine Bewertungen

- New Arrivals 17 - 08 - 2021Dokument16 SeitenNew Arrivals 17 - 08 - 2021polar necksonNoch keine Bewertungen

- Ap Reg W# 5-Scaffold For Transfer TemplateDokument2 SeitenAp Reg W# 5-Scaffold For Transfer TemplateJunafel Boiser Garcia100% (2)

- Mechanical Energy Storage: Created by Nick StroudDokument24 SeitenMechanical Energy Storage: Created by Nick StroudAli ShazanNoch keine Bewertungen

- Siemens 6SL31622AA000AA0 CatalogDokument20 SeitenSiemens 6SL31622AA000AA0 CatalogIrfan NurdiansyahNoch keine Bewertungen

- An1914 PDFDokument56 SeitenAn1914 PDFUpama Das100% (1)

- A A ADokument5 SeitenA A ASalvador__DaliNoch keine Bewertungen

- Test Bank For Macroeconomics 8th Canadian Edition Andrew AbelDokument16 SeitenTest Bank For Macroeconomics 8th Canadian Edition Andrew AbelstebinrothNoch keine Bewertungen

- 热虹吸管相变传热行为CFD模拟 王啸远Dokument7 Seiten热虹吸管相变传热行为CFD模拟 王啸远小黄包Noch keine Bewertungen

- Vallen AE AccesoriesDokument11 SeitenVallen AE AccesoriesSebastian RozoNoch keine Bewertungen