Beruflich Dokumente

Kultur Dokumente

ACF5950 - Assignment # 7 Semester 2 2015: The Business Has The Following Opening Balances: Additional Information

Hochgeladen von

kiet0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

53 Ansichten2 SeitenOriginaltitel

docx (4)

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

53 Ansichten2 SeitenACF5950 - Assignment # 7 Semester 2 2015: The Business Has The Following Opening Balances: Additional Information

Hochgeladen von

kietCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

ACF5950 - Assignment # 7 Semester 2 2015

Name: WANG, LUYAO (26357682)

Email: lwan351@student.monash.edu

Proprietor

Dr. F. Urball

:

Name: Best Friends Vet Clinic

Description

Veterenarian Clinic

:

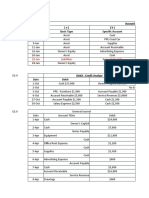

The business has the following Additional Information:

opening balances:

Medical Supplies $1,747

Office Supplies $619Closing stock of medical 1,534

Medical Equipment $35,448supplies on 30/6 ($)

Bank Loan (due 2016) $29,287Closing stock of office 599

Account Payable $8,523supplies on 30/6 ($)

Motor Vehicle $35,042Medical equipment scrap 3,876

Account Receivable $21,737value ($)

Cash At Bank $11,807Medical equipment useful 4

life (years)

Rent paid for (months) 4

Insurance paid for (months) 4

Motor vehicle scrap value

4,670

($)

Motor vehicle useful life

5

(years)

Bank loan interest rates (%

9

per year)

Transactions:

A

m

o Descriptio

Date Description Date Amount

u n

n

t

1- Paid General Motor Vehicle

$2,335 2-Jun $200

Jun Insurance Expenses

2- Vaccination - Rent of Business

$713 3-Jun $4,287

Jun Account Premises

3- Vaccination - Purchase office

$1,066 4-Jun $462

Jun Account supplies - Account

6- Sundry Cash Withdrawals by

$238 6-Jun $530

Jun Expenses Owner

Advertising

7-

Expense - $633 8-Jun Staff Wages $1,227

Jun

Account

Advertising

9- Pet consultation -

Expense - $621 9-Jun $1,552

Jun Cash

Account

11- Sundry Advertising Expense -

$143 11-Jun $349

Jun Expenses Cash

13- Desexing - Pet consultation -

$2,605 14-Jun $1,138

Jun Cash Account

14- Advertising $372 15-Jun Receive Payment $1,130

Jun Expense - Cash from Account

Customers

15- Purchase medical

Staff Wages $1,227 17-Jun $698

Jun supplies - Account

Cash

18- Payment to Account

Withdrawals by $419 19-Jun $665

Jun Payable

Owner

19- Pet consultation

$2,094 20-Jun Vaccination - Cash $1,011

Jun - Cash

Payment to

21-

Account $722 21-Jun Desexing - Cash $2,173

Jun

Payable

Receive Payment

22-

Staff Wages $1,227 23-Jun from Account $1,222

Jun

Customers

Purchase office

23- Motor Vehicle

supplies - $395 23-Jun $194

Jun Expenses

Account

24- Pet consultation Purchase medical

$1,175 24-Jun $337

Jun - Account supplies - Cash

Additional cash

24-

contributed by $2,678 29-Jun Vaccination - Cash $1,097

Jun

owner

29-

Staff Wages $1,227

Jun

Comments:

This business was purchased on 1 June.

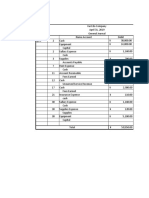

You are required to prepare a general journal entry to incorporate the

opening balances into the current period, including the balancing

capital figure.

You will need to refer to the Additional Information section for your

adjusting entries.

The rent and insurance period start on 1 June.

Show three types of revenue, namely pet consultation, vaccination and

desexing fees. All revenues received were for the month of June.

Unless otherwise indicated, all transactions are on a cash basis. Use one

general Account Receivable for all debtors and one general Account

Payable for all creditors.

Your Balance Sheet should show assets and liabilities divided into

current and non-current.

Staff work a 7-day week and are paid on the 8th day.

Das könnte Ihnen auch gefallen

- Sovereign Gold Bond - by AdarshDokument21 SeitenSovereign Gold Bond - by AdarshAadarsh ChaudharyNoch keine Bewertungen

- V Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetDokument3 SeitenV Krishna Anaparthi Phdpt-02 Accounting Assignment - 2 Maynard Company - A Balance SheetV_Krishna_AnaparthiNoch keine Bewertungen

- Tugas Pengantar Akuntansi-1Dokument23 SeitenTugas Pengantar Akuntansi-1Wiedya fitrianaNoch keine Bewertungen

- Case 3.1Dokument2 SeitenCase 3.1Sandeep Agrawal100% (6)

- Bimbel PADokument31 SeitenBimbel PAHalle TeferiNoch keine Bewertungen

- Theories ExerciseDokument1 SeiteTheories ExerciseZeneah MangaliagNoch keine Bewertungen

- ACF5950-Assignment-2801656-kaidi ZhangDokument13 SeitenACF5950-Assignment-2801656-kaidi ZhangkietNoch keine Bewertungen

- ACF5950-Assignment-2801656-kaidi ZhangDokument13 SeitenACF5950-Assignment-2801656-kaidi ZhangkietNoch keine Bewertungen

- Tutorial Work With SolutionsDokument73 SeitenTutorial Work With SolutionsAlison Mokla100% (1)

- Tax Saving GuideDokument36 SeitenTax Saving GuideSamantha JNoch keine Bewertungen

- Treatment ProcessesDokument28 SeitenTreatment ProcesseskietNoch keine Bewertungen

- Liabilities: Problem 1Dokument8 SeitenLiabilities: Problem 1Frederick AbellaNoch keine Bewertungen

- 2492493Dokument7 Seiten2492493mohitgaba19100% (1)

- Department of Accounting: ACF5950 - Assignment # 350 Semester 1 2015Dokument2 SeitenDepartment of Accounting: ACF5950 - Assignment # 350 Semester 1 2015kietNoch keine Bewertungen

- ACF5950 - Assignment # 109 Semester 2 2014: The Business Has The Following Opening Balances: Additional InformationDokument2 SeitenACF5950 - Assignment # 109 Semester 2 2014: The Business Has The Following Opening Balances: Additional InformationkietNoch keine Bewertungen

- ACC/ACF1100: Assignment #: 711Dokument1 SeiteACC/ACF1100: Assignment #: 711Alireza KafaeiNoch keine Bewertungen

- Alpha Graphics CompanyDokument2 SeitenAlpha Graphics CompanyMira FebriasariNoch keine Bewertungen

- Requirements: Application Assignment-Coaching Session 5 The Following Are His Activities For The Month of December 2019Dokument29 SeitenRequirements: Application Assignment-Coaching Session 5 The Following Are His Activities For The Month of December 2019Edrianne Dela RamaNoch keine Bewertungen

- Latihan Laporan KeuanganDokument7 SeitenLatihan Laporan KeuanganAldy HidayatNoch keine Bewertungen

- BSBFIA412 AssessmentDokument10 SeitenBSBFIA412 AssessmentXavar Xan100% (4)

- ACTY 2100 Mid Exam Questions 2022Dokument6 SeitenACTY 2100 Mid Exam Questions 2022Adel WesiaNoch keine Bewertungen

- TP 1Dokument3 SeitenTP 1Raka FajarNoch keine Bewertungen

- Book 1Dokument45 SeitenBook 1ZULFA SYAMNoch keine Bewertungen

- P 1548 2Dokument7 SeitenP 1548 2Jalaj GuptaNoch keine Bewertungen

- 4281554Dokument6 Seiten4281554mohitgaba19Noch keine Bewertungen

- Kimmel, Weygandt, Kieso: Tools For Business Decision Making, 3rd EdDokument50 SeitenKimmel, Weygandt, Kieso: Tools For Business Decision Making, 3rd Edujjval10Noch keine Bewertungen

- Cheg - 22 Jan 2024 at 11.14Dokument1 SeiteCheg - 22 Jan 2024 at 11.14fayyasin99Noch keine Bewertungen

- Week 5 - ACCY111 NotesDokument5 SeitenWeek 5 - ACCY111 NotesDarcieNoch keine Bewertungen

- MGMT 026 Chapter 09 HW PDFDokument16 SeitenMGMT 026 Chapter 09 HW PDFJm SevallaNoch keine Bewertungen

- Exercises AccountingTransactionsDokument4 SeitenExercises AccountingTransactionsRuneet Kaur AroraBD21036Noch keine Bewertungen

- M Arkan Hafidz - 2602297301 - Assignment Week 2Dokument6 SeitenM Arkan Hafidz - 2602297301 - Assignment Week 2Arkan HafidzNoch keine Bewertungen

- Problem 1. Prepare AJE From The Books of Silent As of Consider The FF InformationDokument10 SeitenProblem 1. Prepare AJE From The Books of Silent As of Consider The FF InformationYuan LoganNoch keine Bewertungen

- ACCT1101 Wk3 Tutorial 2 SolutionsDokument7 SeitenACCT1101 Wk3 Tutorial 2 SolutionskyleNoch keine Bewertungen

- Financial & Managerial Accounting - JunXianDokument5 SeitenFinancial & Managerial Accounting - JunXianhashtagjxNoch keine Bewertungen

- Exercise 6: Double Entry Bookkeeping (Level Advanced)Dokument2 SeitenExercise 6: Double Entry Bookkeeping (Level Advanced)Lerry AnnNoch keine Bewertungen

- Student's Name: Professor's Name: DateDokument5 SeitenStudent's Name: Professor's Name: DateAnonymous pvVCR5XLpNoch keine Bewertungen

- Slowhand Services General Journal For The Month Ended of May, 2011 Date Explanation Ref DR CRDokument19 SeitenSlowhand Services General Journal For The Month Ended of May, 2011 Date Explanation Ref DR CRAnna Altahea ArthicNoch keine Bewertungen

- Statement: Google AdsDokument2 SeitenStatement: Google Adsmyhostinger94Noch keine Bewertungen

- K174091078 - Nguyễn Hoàng Thanh Uyên - ACR4.1Dokument35 SeitenK174091078 - Nguyễn Hoàng Thanh Uyên - ACR4.1Uyên Nguyễn Hoàng Thanh100% (1)

- Wealth Project Report FinalDokument32 SeitenWealth Project Report FinalJasneet SinghNoch keine Bewertungen

- Week 7 Tutorial HomeworkDokument17 SeitenWeek 7 Tutorial HomeworkTanya ShaikNoch keine Bewertungen

- Start-Up Expenses Year 1 (Starting Balance Sheet) : Fixed Assets Amount Notes Depreciation (Years)Dokument1 SeiteStart-Up Expenses Year 1 (Starting Balance Sheet) : Fixed Assets Amount Notes Depreciation (Years)Anthony Burson-ThomasNoch keine Bewertungen

- Financial Accounting Assignment - 1Dokument17 SeitenFinancial Accounting Assignment - 1Yosef MitikuNoch keine Bewertungen

- Module 3 and 4 - Cash To Accrual Basis, Single Entry and Correction of Errors - PP PDFDokument13 SeitenModule 3 and 4 - Cash To Accrual Basis, Single Entry and Correction of Errors - PP PDFJesievelle Villafuerte NapaoNoch keine Bewertungen

- Personal Financial Report Of: Rajesh Sharma & FamilyDokument13 SeitenPersonal Financial Report Of: Rajesh Sharma & FamilyMit MakwanaNoch keine Bewertungen

- Training Financial AccountingDokument23 SeitenTraining Financial AccountingSara PiccioliNoch keine Bewertungen

- Quiz Akuntansi OlgazfDokument18 SeitenQuiz Akuntansi OlgazfOlga Zulmaniar FadjrinNoch keine Bewertungen

- Accounting Homework 2-12-2024 FINALDokument6 SeitenAccounting Homework 2-12-2024 FINALsamiramellaneoNoch keine Bewertungen

- Lesson 6 - JournalizingDokument23 SeitenLesson 6 - JournalizingJudie Mae BelonioNoch keine Bewertungen

- Trial Balance WorksheetDokument11 SeitenTrial Balance WorksheetMike StevenNoch keine Bewertungen

- Client Name: Petra and Sean Alexander Financial Advisor: Ashish Rawat DATE: 29 Januray'21Dokument5 SeitenClient Name: Petra and Sean Alexander Financial Advisor: Ashish Rawat DATE: 29 Januray'21Srushti RajNoch keine Bewertungen

- Account Debited (A) (B) Date Basic Type Specific AccountDokument12 SeitenAccount Debited (A) (B) Date Basic Type Specific AccountVALENCIA TORENTHANoch keine Bewertungen

- Mid Term 2022 (Bsa1)Dokument4 SeitenMid Term 2022 (Bsa1)An KhanhNoch keine Bewertungen

- Solution Manual For Horngrens Financial and Managerial Accounting The Financial Chapters 4Th Edition Nobles Mattison Matsumura 970133255577 0133255573 Full Chapter PDFDokument36 SeitenSolution Manual For Horngrens Financial and Managerial Accounting The Financial Chapters 4Th Edition Nobles Mattison Matsumura 970133255577 0133255573 Full Chapter PDFnorman.washington378100% (11)

- Fundamentals of Financial AccountingDokument9 SeitenFundamentals of Financial AccountingEmon EftakarNoch keine Bewertungen

- Roshita Desthi Nurimah - A20 - Tugas BAB 3Dokument12 SeitenRoshita Desthi Nurimah - A20 - Tugas BAB 3Roshita Desthi NurimahNoch keine Bewertungen

- Accounts SamplepaperDokument29 SeitenAccounts SamplepaperPawni JadhavNoch keine Bewertungen

- ACCT 2211 Assignment 2Dokument17 SeitenACCT 2211 Assignment 2Tannaz SNoch keine Bewertungen

- Quiz (Dicky Irawan - C1i017051)Dokument3 SeitenQuiz (Dicky Irawan - C1i017051)DICKY IRAWAN 1Noch keine Bewertungen

- BX2011 Topic01 Workshop Qns & Sols 2021Dokument9 SeitenBX2011 Topic01 Workshop Qns & Sols 2021Shi Pyeit Sone KyawNoch keine Bewertungen

- Audit First Take 2Dokument23 SeitenAudit First Take 2Pau CaisipNoch keine Bewertungen

- Financial Accounting and Reporting: Exercise 1Dokument6 SeitenFinancial Accounting and Reporting: Exercise 1Lenneth MonesNoch keine Bewertungen

- Tugas 3 (Revisi) - Proses Posting-Ricky Andrian K. RumereDokument23 SeitenTugas 3 (Revisi) - Proses Posting-Ricky Andrian K. RumererickyNoch keine Bewertungen

- Accounting LessonsDokument2 SeitenAccounting Lessonsmaryam nabaNoch keine Bewertungen

- Jawaban Latihan SoalDokument31 SeitenJawaban Latihan SoalRizalMawardiNoch keine Bewertungen

- Accounting LessonsDokument2 SeitenAccounting Lessonsmaryam nabaNoch keine Bewertungen

- SummaryDokument3 SeitenSummarykietNoch keine Bewertungen

- Water Pinch2aDokument16 SeitenWater Pinch2akietNoch keine Bewertungen

- Assignment 3Dokument4 SeitenAssignment 3kietNoch keine Bewertungen

- Characterization OverallDokument14 SeitenCharacterization OverallkietNoch keine Bewertungen

- AssignmentsDokument2 SeitenAssignmentskietNoch keine Bewertungen

- Assignment 2 and 3Dokument8 SeitenAssignment 2 and 3kietNoch keine Bewertungen

- L3 - Intro To Kemp Pinch SoftwareDokument2 SeitenL3 - Intro To Kemp Pinch SoftwarekietNoch keine Bewertungen

- Cost EstimationDokument2 SeitenCost EstimationkietNoch keine Bewertungen

- PinchDokument4 SeitenPinchkietNoch keine Bewertungen

- Chapter 5 Accrual Accounting Adjustments: Discussion QuestionsDokument7 SeitenChapter 5 Accrual Accounting Adjustments: Discussion QuestionskietNoch keine Bewertungen

- Request For Information: AttnDokument1 SeiteRequest For Information: AttnkietNoch keine Bewertungen

- OPM4003 Marking Rubric: Assessment 4 - Individual Research PaperDokument1 SeiteOPM4003 Marking Rubric: Assessment 4 - Individual Research PaperkietNoch keine Bewertungen

- Day 2Dokument36 SeitenDay 2kietNoch keine Bewertungen

- Delivering Projects: DR Sajad Fayezi Monash Business SchoolDokument16 SeitenDelivering Projects: DR Sajad Fayezi Monash Business SchoolkietNoch keine Bewertungen

- Delivering Projects: DR Sajad Fayezi Monash Business SchoolDokument27 SeitenDelivering Projects: DR Sajad Fayezi Monash Business SchoolkietNoch keine Bewertungen

- Q1 Here Is The Post-Adjustment Trial Balance of Status Cymbal LTD at 30 June 2019Dokument3 SeitenQ1 Here Is The Post-Adjustment Trial Balance of Status Cymbal LTD at 30 June 2019kietNoch keine Bewertungen

- Topic 1: Introduction To Financial AccountingDokument1 SeiteTopic 1: Introduction To Financial AccountingkietNoch keine Bewertungen

- Chapter 8 Accounts Receivable and Further Record-Keeping: Discussion QuestionsDokument3 SeitenChapter 8 Accounts Receivable and Further Record-Keeping: Discussion Questionskiet100% (1)

- Set 6 AnsDokument6 SeitenSet 6 AnskietNoch keine Bewertungen

- Chapter 10 Noncurrent Assets: Discussion QuestionsDokument6 SeitenChapter 10 Noncurrent Assets: Discussion QuestionskietNoch keine Bewertungen

- Chapter 1 Introduction To Financial Accounting: Discussion QuestionsDokument7 SeitenChapter 1 Introduction To Financial Accounting: Discussion QuestionskietNoch keine Bewertungen

- Chapter 3 The Double-Entry System: Discussion QuestionsDokument16 SeitenChapter 3 The Double-Entry System: Discussion QuestionskietNoch keine Bewertungen

- PC&I Assignment 4 (2016) Due 311016Dokument4 SeitenPC&I Assignment 4 (2016) Due 311016kietNoch keine Bewertungen

- Modeling and Design of Heat Exchangers in A Solar-Multi Effect Distillation PlantDokument6 SeitenModeling and Design of Heat Exchangers in A Solar-Multi Effect Distillation Plantkiet100% (1)

- Preworkshop PDFDokument2 SeitenPreworkshop PDFkietNoch keine Bewertungen

- Nelson Mckee Has Been Filing Agent For 908 Registrants Such As Jpmac, Deutsche, PHH, Lehman, Thornburg, HarborviewDokument23 SeitenNelson Mckee Has Been Filing Agent For 908 Registrants Such As Jpmac, Deutsche, PHH, Lehman, Thornburg, Harborview83jjmackNoch keine Bewertungen

- Assignment No. 5 Hoba Franchising Joint ArrangementsDokument4 SeitenAssignment No. 5 Hoba Franchising Joint ArrangementsJean TatsadoNoch keine Bewertungen

- Invoice Flomih & Vio Bussines SRL: CX Ref: 18911926 Invoice No.: 151140-838 Invoice Date: 29 Nov 2019Dokument1 SeiteInvoice Flomih & Vio Bussines SRL: CX Ref: 18911926 Invoice No.: 151140-838 Invoice Date: 29 Nov 2019calinmusceleanuNoch keine Bewertungen

- Idea Builder: Meaning of BSPDokument1 SeiteIdea Builder: Meaning of BSPDong RoselloNoch keine Bewertungen

- Lesson 21 - Closing Entries, Post-Closing, Trial Balance and Reversing EntriesDokument8 SeitenLesson 21 - Closing Entries, Post-Closing, Trial Balance and Reversing EntriesMayeng MonayNoch keine Bewertungen

- Enclosure 1. Teacher-Made Learner's Home Task (Week 9) : The Nature of A Service BusinessDokument7 SeitenEnclosure 1. Teacher-Made Learner's Home Task (Week 9) : The Nature of A Service BusinessKim FloresNoch keine Bewertungen

- Mutual Fund: Advnatages and Disadvantages To InvestorsDokument11 SeitenMutual Fund: Advnatages and Disadvantages To InvestorsSnehi GuptaNoch keine Bewertungen

- Business Finance: JollibeeDokument25 SeitenBusiness Finance: JollibeespaghettiNoch keine Bewertungen

- Solution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray HiltonDokument35 SeitenSolution Manual For Modern Advanced Accounting in Canada 9th Edition Darrell Herauf Murray Hiltoncravingcoarctdbw6wNoch keine Bewertungen

- Accounting Policies and Procedures Manual (Draft)Dokument30 SeitenAccounting Policies and Procedures Manual (Draft)Malaking Pulo Multi-Purpose CooperativeNoch keine Bewertungen

- Fraud Risk Assessment: An Empirical AnalysisDokument11 SeitenFraud Risk Assessment: An Empirical AnalysisGDPNoch keine Bewertungen

- Imran Ul Haq ACMA CGMA MBADokument2 SeitenImran Ul Haq ACMA CGMA MBASheza FarooqNoch keine Bewertungen

- E-Banking Consumer BehaviourDokument116 SeitenE-Banking Consumer Behaviourahmadksath88% (24)

- Principles of Financial AccountingDokument7 SeitenPrinciples of Financial Accountinghnoor94Noch keine Bewertungen

- Idx 3rd Quarter Statistic 2021 List IPODokument1 SeiteIdx 3rd Quarter Statistic 2021 List IPOandree elnusaNoch keine Bewertungen

- Study of Mutual Funds in IndiaDokument41 SeitenStudy of Mutual Funds in IndiaUnnati GuptaNoch keine Bewertungen

- 022 1.1.3 B.com BC404 2018-19Dokument1 Seite022 1.1.3 B.com BC404 2018-19AankuNoch keine Bewertungen

- BOBDokument39 SeitenBOBpayal22octNoch keine Bewertungen

- Loan Function of BanksDokument2 SeitenLoan Function of BanksKarlo OfracioNoch keine Bewertungen

- Fa2 Tut 5Dokument5 SeitenFa2 Tut 5Truong Thi Ha Trang 1KT-19Noch keine Bewertungen

- Kwitansi Receipt: Pola TeknikDokument1 SeiteKwitansi Receipt: Pola Teknikꓰꓡ ꓖꓴꓮꓣꓣꓳꓟꓮꓠꓔꓲꓚꓳꓳNoch keine Bewertungen

- Chapter 9: Declration of DividendDokument4 SeitenChapter 9: Declration of DividendKalyan Singh ChauhanNoch keine Bewertungen

- Irshad CV 2Dokument2 SeitenIrshad CV 2Asad MehmoodNoch keine Bewertungen

- Modarabah and Deposit ManagementDokument34 SeitenModarabah and Deposit ManagementaleenaaaNoch keine Bewertungen

- Acctg Lab 7Dokument8 SeitenAcctg Lab 7AngieNoch keine Bewertungen

- SOA - LAI-00061947 - Wed Mar 31 10 - 51 - 22 UTC 2021Dokument4 SeitenSOA - LAI-00061947 - Wed Mar 31 10 - 51 - 22 UTC 2021shreeji metalNoch keine Bewertungen