Beruflich Dokumente

Kultur Dokumente

CFA Level 1 - 2020 Curriculum Changes (300hours) PDF

Hochgeladen von

Alberto Toressi0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

232 Ansichten1 SeiteOriginaltitel

CFA Level 1 - 2020 Curriculum Changes (300Hours).pdf

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

232 Ansichten1 SeiteCFA Level 1 - 2020 Curriculum Changes (300hours) PDF

Hochgeladen von

Alberto ToressiCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

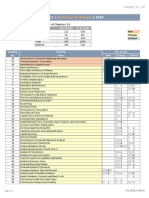

CFA Level 1: 2020 Curriculum Changes (vs.

2019)

Summary: - 2020 L1 has 57 readings: 1 reading removed, none added. New Updated

- 14 readings updated: Mostly small changes, except FRA. Removed Moved

- Overall, lots of small updates, no major content changes.

Topic Reading # Reading Name Comments

1 Ethics and Trust in the Investment Profession Minor changes: 2 LOS added

2 Code of Ethics and Standards of Professional Conduct

Ethics 3 Guidance for Standards I-VII

4 Introduction to the Global Investment Performance Standards (GIPS)

5 Global Investment Performance Standards

6 The Time Value of Money

7 Discounted Cash Flow Applications

87 Statistical Concepts & Market Returns

98 Probability Concepts

Quantitative Methods (QM)

10 9 Common Probability Distributions

11 10 Sampling & Estimation

12 11 Hypothesis Testing Minor changes: 1 LOS added

13 Technical Analysis Moved to Portfolio Management

14 12 Topics in Demand & Supply Analysis

15 13 The Firm & Market Structures

16 14 Aggregate Output, Prices and Economic Growth

Economics 17 15 Understanding Business Cycles

18 16 Monetary & Fiscal Policy

19 17 International Trade and Capital Flows

20 18 Currency Exchange Rates

21 19 Introduction to Financial Statement Analysis

22 20 Financial Reporting Standards Major revision: 9 LOS removed, 5 added

23 21 Understanding Income Statement Minor changes: 1 LOS updated

24 22 Understanding Balance Sheet

25 23 Understanding Cashflow Statement

Financial Reporting & 26 24 Financial Analysis Techniques

Analysis (FRA) 27 25 Inventories

28 26 Long Lived Assets Minor changes: 2 LOS removed

29 27 Income Taxes

30 28 Non-Current (Long-Term) Liabilities Minor changes: 3 LOS merged into 2

31 29 Financial Reporting Quality

32 30 Applications of Financial Statement Analysis

33 31 Introduction to Corporate Governance & Other ESG Considerations

34 32 Capital Budgeting Minor changes: 1 LOS added

Corporate Finance 35 33 Cost of Capital

36 34 Measures of Leverage

37 35 Working Capital Management

44 36 Market Organization & Structure

45 37 Security Market Indices

46 38 Market Efficiency

Equity

47 39 Overview of Equity Securities

48 40 Introduction to Industry & Company Analysis

49 41 Equity Valuation: Concepts & Basic Tools

50 42 Fixed-Income Securities: Defining Elements

51 43 Fixed-Income Markets: Issuance, Trading, Funding

52 44 Introduction to Fixed-Income Valuation Minor changes: 1 LOS added

Fixed Income

53 45 Introduction to Asset-Backed Securities

54 46 Understanding Fixed-Income Risk and Return

55 47 Fundamentals of Credit Analysis

56 48 Derivative Markets & Instruments Minor changes: 1 LOS added

Derivatives

57 49 Basics of Derivative Pricing & Valuation Minor changes: 1 LOS added, 1 removed

Alternative Investments 58 50 Introduction to Alternative Investments Minor changes: 1 LOS removed

38 51 Portfolio Management: An Overview Minor changes: 1 LOS added

39 52 Portfolio Risk & Return: Part I Minor changes: 1 LOS added

40 53 Portfolio Risk & Return: Part II

Portfolio Management

41 54 Basics of Portfolio Planning & Construction Minor changes: 1 LOS added

(PM)

42 55 Introduction to Risk Management

13 56 Technical Analysis Moved from Quantitative Methods

43 57 Fintech in Investment Management

www.300Hours.com

Das könnte Ihnen auch gefallen

- International Accounting Standards: from UK standards to IAS, an accelerated route to understanding the key principles of international accounting rulesVon EverandInternational Accounting Standards: from UK standards to IAS, an accelerated route to understanding the key principles of international accounting rulesBewertung: 3.5 von 5 Sternen3.5/5 (2)

- CFA Level 1 Curriculum Changes 2021 (300hours)Dokument1 SeiteCFA Level 1 Curriculum Changes 2021 (300hours)Sumalya BhattaacharyaaNoch keine Bewertungen

- 2022 CFA Level 1 Curriculum Changes Summary (300hours)Dokument1 Seite2022 CFA Level 1 Curriculum Changes Summary (300hours)jkklnklnNoch keine Bewertungen

- Regulatory Assessment Toolkit: A Practical Methodology For Assessing Regulation on Trade and Investment in ServicesVon EverandRegulatory Assessment Toolkit: A Practical Methodology For Assessing Regulation on Trade and Investment in ServicesNoch keine Bewertungen

- 300hours - CFA Level 1 Curriculum Changes 2024 SummaryDokument2 Seiten300hours - CFA Level 1 Curriculum Changes 2024 Summaryphan hàNoch keine Bewertungen

- 2022 CFA Level 2 Curriculum Changes Summary (300hours)Dokument1 Seite2022 CFA Level 2 Curriculum Changes Summary (300hours)mawais263Noch keine Bewertungen

- The Power of Public Investment Management: Transforming Resources Into Assets for GrowthVon EverandThe Power of Public Investment Management: Transforming Resources Into Assets for GrowthNoch keine Bewertungen

- CFA Level 2 Curriculum Changes 2021 (300hours)Dokument1 SeiteCFA Level 2 Curriculum Changes 2021 (300hours)rashedghanimNoch keine Bewertungen

- CFA Level 2 - 2020 Curriculum Changes (300hours) PDFDokument1 SeiteCFA Level 2 - 2020 Curriculum Changes (300hours) PDFJOAONoch keine Bewertungen

- 2022 CFA Level 3 Curriculum Changes Summary (300hours)Dokument1 Seite2022 CFA Level 3 Curriculum Changes Summary (300hours)Tran HongNoch keine Bewertungen

- 2023 CFA Level 2 Curriculum Changes Summary (300hours)Dokument1 Seite2023 CFA Level 2 Curriculum Changes Summary (300hours)Arfan RamadhanNoch keine Bewertungen

- 300hours - CFA Level 2 Curriculum Changes 2024 SummaryDokument1 Seite300hours - CFA Level 2 Curriculum Changes 2024 SummaryClareNoch keine Bewertungen

- CFA Level 1 - Changes Outline 2024Dokument27 SeitenCFA Level 1 - Changes Outline 2024esha100% (1)

- CFA Level I 2021 - 2022 Curriculum Changes: Subjects 2021 Reading No Reading NameDokument20 SeitenCFA Level I 2021 - 2022 Curriculum Changes: Subjects 2021 Reading No Reading NameKushagri MangalNoch keine Bewertungen

- 2023 CFA Level 3 Curriculum Changes Summary (300hours)Dokument1 Seite2023 CFA Level 3 Curriculum Changes Summary (300hours)Victor MendesNoch keine Bewertungen

- 300hours - CFA Level 3 Curriculum Changes 2024 SummaryDokument1 Seite300hours - CFA Level 3 Curriculum Changes 2024 SummaryBullcapitalNoch keine Bewertungen

- 2019 20 CFA Level I Curriculum ChangesDokument20 Seiten2019 20 CFA Level I Curriculum ChangesNadia JNoch keine Bewertungen

- CFA Level 1 - Changes 2024 - Aswini BajajDokument8 SeitenCFA Level 1 - Changes 2024 - Aswini BajajShaitan Ladka100% (1)

- CFA Level I 2019 - 2020 Curriculum Changes: Subjects 2019 Reading No Reading NameDokument20 SeitenCFA Level I 2019 - 2020 Curriculum Changes: Subjects 2019 Reading No Reading NameVaibhav SarinNoch keine Bewertungen

- CFA Level II 2016-2017 Program ChangesDokument2 SeitenCFA Level II 2016-2017 Program ChangesMohsin Ul Amin KhanNoch keine Bewertungen

- 2023 CFA Level 1 Curriculum Changes Summary (300hours)Dokument2 Seiten2023 CFA Level 1 Curriculum Changes Summary (300hours)johnNoch keine Bewertungen

- CFA Level II 2019-2020 Program ChangesDokument1 SeiteCFA Level II 2019-2020 Program ChangesMohsin Ul Amin KhanNoch keine Bewertungen

- C0 ContentsDokument13 SeitenC0 ContentsTori TomNoch keine Bewertungen

- CFA Program Curriculum Changes Level 1Dokument3 SeitenCFA Program Curriculum Changes Level 1Zain RehmanNoch keine Bewertungen

- Cfa L2 - 2020: Order of Study (Video)Dokument2 SeitenCfa L2 - 2020: Order of Study (Video)Chulbul PandeyNoch keine Bewertungen

- CFA Level 3: 2020 Curriculum Changes SummaryDokument1 SeiteCFA Level 3: 2020 Curriculum Changes SummaryabcdeNoch keine Bewertungen

- CFA Level 3 - 2020 Curriculum Changes (300hours)Dokument1 SeiteCFA Level 3 - 2020 Curriculum Changes (300hours)duc anhNoch keine Bewertungen

- CFA Level I 2019 2020 Program ChangesDokument2 SeitenCFA Level I 2019 2020 Program Changesweeliyen5754Noch keine Bewertungen

- Level I 2018 2019 Program Changes PDFDokument2 SeitenLevel I 2018 2019 Program Changes PDFMuhammad BurairNoch keine Bewertungen

- Personal Financial Planning - Theory and PracticeDokument415 SeitenPersonal Financial Planning - Theory and PracticeFabian Dimas100% (2)

- Fintree CFA LI 2018 Curriculum ChangesDokument2 SeitenFintree CFA LI 2018 Curriculum ChangesMohamed GamalNoch keine Bewertungen

- IFT 2016 2017 All Levels CFA Program Changes PDFDokument5 SeitenIFT 2016 2017 All Levels CFA Program Changes PDFTrisha SharmaNoch keine Bewertungen

- Annual Report and Accounts 2011: 3i Infrastructure PLCDokument80 SeitenAnnual Report and Accounts 2011: 3i Infrastructure PLCgaja babaNoch keine Bewertungen

- Study Planner L1 2023Dokument9 SeitenStudy Planner L1 2023learningdemo211Noch keine Bewertungen

- TMB 20230223xex99d1Dokument232 SeitenTMB 20230223xex99d1Safeer khanNoch keine Bewertungen

- CFA Level I 2018 - 2019 Curriculum ChangesDokument3 SeitenCFA Level I 2018 - 2019 Curriculum ChangesRanganNoch keine Bewertungen

- Interloop Limited embracing digitalization to strengthen supply chainsDokument304 SeitenInterloop Limited embracing digitalization to strengthen supply chainsusama juttNoch keine Bewertungen

- Ific 2018Dokument324 SeitenIfic 2018FarihaHaqueLikhi 1060100% (1)

- 2015 Financial StatementsDokument83 Seiten2015 Financial StatementsSaurav Kumar100% (1)

- DGKC Annual Report 2020Dokument270 SeitenDGKC Annual Report 2020rahee saleenNoch keine Bewertungen

- Brief Contents: Strategy Evaluation 284Dokument8 SeitenBrief Contents: Strategy Evaluation 284Abigail RodriguezNoch keine Bewertungen

- L2 CFA Schedule - Jun 2011Dokument28 SeitenL2 CFA Schedule - Jun 2011mengcheeNoch keine Bewertungen

- Investment Project Design - 2011 - Kurowski - Front MatterDokument13 SeitenInvestment Project Design - 2011 - Kurowski - Front MatterFrancis LewahNoch keine Bewertungen

- Ir Bfin 2022 - EngDokument444 SeitenIr Bfin 2022 - Engk26hansaNoch keine Bewertungen

- Brief Contents: Preface Introduction To Financial ManagementDokument12 SeitenBrief Contents: Preface Introduction To Financial ManagementDarlynple MenorNoch keine Bewertungen

- Nippon Active Value Fund plc Annual Report Highlights Strong PerformanceDokument78 SeitenNippon Active Value Fund plc Annual Report Highlights Strong Performancecena1987Noch keine Bewertungen

- 01 FM New RAVI KISHOR PDFDokument21 Seiten01 FM New RAVI KISHOR PDFAKSHAT ARORA0% (2)

- Intl Ifstmts 12 012 Gafs Illst DisclDokument210 SeitenIntl Ifstmts 12 012 Gafs Illst DisclMaximo Gutierrez100% (1)

- Illustrative Disclosures: Guide To Annual Financial StatementsDokument210 SeitenIllustrative Disclosures: Guide To Annual Financial StatementsAnge100% (1)

- Valuation and Depreciation Public Sector PDFDokument186 SeitenValuation and Depreciation Public Sector PDFcorneliu100% (1)

- Corporate Finance - GBV PDFDokument12 SeitenCorporate Finance - GBV PDFHesty SaniaNoch keine Bewertungen

- Ifr MiningDokument38 SeitenIfr MiningRolando MontalicoNoch keine Bewertungen

- Integrated Report 2019 PDFDokument172 SeitenIntegrated Report 2019 PDFAhmed AwanNoch keine Bewertungen

- DG Cement Annual Report 2016 PDFDokument261 SeitenDG Cement Annual Report 2016 PDFSamsam RaufNoch keine Bewertungen

- DGK 2015-16 - FDokument261 SeitenDGK 2015-16 - FMuhammad Abbas SandhuNoch keine Bewertungen

- Lse Aemc 2021Dokument94 SeitenLse Aemc 2021Bijoy AhmedNoch keine Bewertungen

- NWG Annual Report and AccountsDokument221 SeitenNWG Annual Report and Accountssanthosh.24Noch keine Bewertungen

- Finanical ManagementDokument589 SeitenFinanical Managementsnarramneni81% (21)

- Financial IntermediaryDokument4 SeitenFinancial IntermediaryValerie Mae AbuyenNoch keine Bewertungen

- Reaction Paper (Chapter 13)Dokument5 SeitenReaction Paper (Chapter 13)Arsenio RojoNoch keine Bewertungen

- BST CH 10Dokument21 SeitenBST CH 10Dilip KumarNoch keine Bewertungen

- 1Dokument39 Seiten1Professor XNoch keine Bewertungen

- RSM230 Chapter NotesDokument15 SeitenRSM230 Chapter NotesJoey LinNoch keine Bewertungen

- Analyze Financial Health with Ratio AnalysisDokument16 SeitenAnalyze Financial Health with Ratio AnalysisApurva JhaNoch keine Bewertungen

- Conceptual Framework for Financial ReportingDokument14 SeitenConceptual Framework for Financial ReportingCorin Ahmed CorinNoch keine Bewertungen

- Important Questions For CBSE Class 12 Business Studies Chapter 9Dokument12 SeitenImportant Questions For CBSE Class 12 Business Studies Chapter 9Smita SrivastavaNoch keine Bewertungen

- Compiled Questions For PracticeDokument32 SeitenCompiled Questions For PracticeojasbiNoch keine Bewertungen

- TEST 2 - 2021 - Attempt ReviewDokument22 SeitenTEST 2 - 2021 - Attempt Reviewpretty jesayaNoch keine Bewertungen

- Unit-4 Issues and Challenges PDFDokument13 SeitenUnit-4 Issues and Challenges PDFNavdeep SinghNoch keine Bewertungen

- CeCOC Low PDFDokument8 SeitenCeCOC Low PDFkripanshNoch keine Bewertungen

- Financial Instruments Definition and TypesDokument9 SeitenFinancial Instruments Definition and TypesShreeamar SinghNoch keine Bewertungen

- "Study of Working Capital Management": A Project Report OnDokument58 Seiten"Study of Working Capital Management": A Project Report Onvishalsalve33Noch keine Bewertungen

- Unit 05Dokument98 SeitenUnit 05Shah Maqsumul Masrur TanviNoch keine Bewertungen

- Merchant BankingDokument25 SeitenMerchant Bankingsshishirkumar50% (2)

- Reasons Banks Require Liquidity and Capital AdequacyDokument21 SeitenReasons Banks Require Liquidity and Capital AdequacyThanhTuyenNguyenNoch keine Bewertungen

- Optimize Working Capital & Short-Term Finance with Strategic PlanningDokument28 SeitenOptimize Working Capital & Short-Term Finance with Strategic PlanninganggibekNoch keine Bewertungen

- Chap 5Dokument23 SeitenChap 5selva0% (1)

- Formula - Ratio AnalysisDokument2 SeitenFormula - Ratio Analysiszakirno19248100% (2)

- Financial Institutions, Markets, and Money, 8 Edition: Power Point Slides ForDokument39 SeitenFinancial Institutions, Markets, and Money, 8 Edition: Power Point Slides ForMahmoud AbdullahNoch keine Bewertungen

- Nism Series II B Registrar To An Issue Mutual Funds Workbook in PDFDokument184 SeitenNism Series II B Registrar To An Issue Mutual Funds Workbook in PDFLingamplly Shravan KumarNoch keine Bewertungen

- Simplified Cost Accounting Part Ii: Solutions ManualDokument58 SeitenSimplified Cost Accounting Part Ii: Solutions ManualAnthony Koko CarlobosNoch keine Bewertungen

- MB20202 Corporate Finance Unit III Study MaterialsDokument24 SeitenMB20202 Corporate Finance Unit III Study MaterialsSarath kumar CNoch keine Bewertungen

- Standing Instruction and Indemnity Form 2023Dokument4 SeitenStanding Instruction and Indemnity Form 2023Clint AnthonyNoch keine Bewertungen

- aaNDIC QUARTERLY VOL 33 NO 3 4 Article CAPITAL STRUCTURE AND PERFORMANCE OF DEPOSIT MONEY BANKS IN NIGERIA 2 PDFDokument31 SeitenaaNDIC QUARTERLY VOL 33 NO 3 4 Article CAPITAL STRUCTURE AND PERFORMANCE OF DEPOSIT MONEY BANKS IN NIGERIA 2 PDFYemi AdetayoNoch keine Bewertungen

- Cost of Capital: Powerpoint Presentation Prepared by Michel Paquet, SaitDokument54 SeitenCost of Capital: Powerpoint Presentation Prepared by Michel Paquet, SaitArundhati SinhaNoch keine Bewertungen

- Dwnload Full Corporate Finance Canadian 7th Edition Jaffe Solutions Manual PDFDokument35 SeitenDwnload Full Corporate Finance Canadian 7th Edition Jaffe Solutions Manual PDFgoblinerentageb0rls7100% (13)

- Xparcoac Midterms ReviewerDokument11 SeitenXparcoac Midterms ReviewerKristine dela CruzNoch keine Bewertungen

- TB 17Dokument15 SeitenTB 17Gvanca Gigauri100% (4)