Beruflich Dokumente

Kultur Dokumente

Latest Income Tax Slabs - Fundfolio by Sharique Samsudheen

Hochgeladen von

salmanOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Latest Income Tax Slabs - Fundfolio by Sharique Samsudheen

Hochgeladen von

salmanCopyright:

Verfügbare Formate

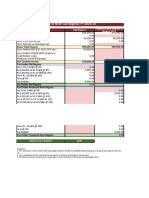

Please copy the data into a different sheet for changing values and your own calculations

Gross Income (₹) 1,500,000 Net Taxable Income (₹) Old Rate Tax Amount New Rate Tax Amount

Upto ₹ 2.5 Lakhs 0 0 0 0

Low Medium High

Deductions Deductions Deductions ₹ 2.5 Lakhs - ₹ 5 Lakhs 0 0 0 0

₹ 2.5 Lakhs - ₹ 5 Lakhs 5% 12,500 5% 12,500

Gross Income 1,500,000 1,500,000 1,500,000 ₹ 5 Lakhs - ₹ 7.5 Lakhs 20% 50,000 10% 25,000

HRA Exemption 360,000 ₹ 7.5 Lakhs - ₹ 10 Lakhs 20% 50,000 15% 37,500

Standard Deduction 50,000 50,000 50,000 ₹ 10 Lakhs - ₹ 12.5 Lakhs 30% 75,000 20% 50,000

₹ 12.5 Lakhs - ₹ 15 Lakhs 30% 75,000 25% 62,500

Gross Total Income 1,450,000 1,450,000 1,090,000 > ₹ 15 Lakhs 30% 30%

Deductions under Sec. 80C 150,000 150,000

Deductions under Sec. 80D Exemptions & Deductions YES NO

Net Taxable Income 1,450,000 1,300,000 940,000

Tax @ Old Slabs 257,400 210,600 104,520

Tax @ New Slabs 195,000 195,000 195,000 When to Choose Old Tax Structure

Difference under New Slabs 62,400 15,600 -90,480 Gross Income Deductions

7,50,000 >1,25,000

10,00,000 >1,87,000

12,50,000 >2,08,000

>=15,00,000 >2,50,000

Das könnte Ihnen auch gefallen

- Tax Slabs FY 2020-21 - by AssetYogiDokument2 SeitenTax Slabs FY 2020-21 - by AssetYogiSACHIN REVEKARNoch keine Bewertungen

- Tax Slabs FY 2020-21 - by AssetYogiDokument2 SeitenTax Slabs FY 2020-21 - by AssetYogiMohan ChoudharyNoch keine Bewertungen

- Tax Slabs FY 2020-21 - by AssetYogiDokument2 SeitenTax Slabs FY 2020-21 - by AssetYogiAnubhav KumarNoch keine Bewertungen

- Compare Old and New Income Tax Slabs for FY 2020-21 in IndiaDokument2 SeitenCompare Old and New Income Tax Slabs for FY 2020-21 in IndiaSarang AgrawalNoch keine Bewertungen

- Tax Slabs FY 2020-21 - by AssetYogiDokument2 SeitenTax Slabs FY 2020-21 - by AssetYogiMohan ChoudharyNoch keine Bewertungen

- Tax Slabs FY 2020-21 - by AssetYogiDokument2 SeitenTax Slabs FY 2020-21 - by AssetYogiVishalNoch keine Bewertungen

- Tax Slabs FY 2020-21 - by AssetYogiDokument2 SeitenTax Slabs FY 2020-21 - by AssetYogiNirav TailorNoch keine Bewertungen

- Tax CalculatorDokument3 SeitenTax CalculatorAbhi RamachandranNoch keine Bewertungen

- Only Fill Yellow Cells: WorkingsDokument2 SeitenOnly Fill Yellow Cells: WorkingsvikrammoolchandaniNoch keine Bewertungen

- How To Pay Zero Income Tax On 20 Lakhs SalaryDokument9 SeitenHow To Pay Zero Income Tax On 20 Lakhs SalaryvijaytechskillupgradeNoch keine Bewertungen

- New-Tax-Regime-vs-Old-Calculator by Juned ShaikhDokument4 SeitenNew-Tax-Regime-vs-Old-Calculator by Juned ShaikhJunedNoch keine Bewertungen

- WorkingDokument4 SeitenWorkingHaresh RajputNoch keine Bewertungen

- Practical Practice QuestionsDokument17 SeitenPractical Practice QuestionsGungun SharmaNoch keine Bewertungen

- Income-Tax Rates Under The New Tax Regime V/s The Old Tax RegimeDokument2 SeitenIncome-Tax Rates Under The New Tax Regime V/s The Old Tax Regimeharish vNoch keine Bewertungen

- Old vs New Tax Regimes Comparison for FY 2023-24Dokument7 SeitenOld vs New Tax Regimes Comparison for FY 2023-24Gajendra HoleNoch keine Bewertungen

- Tax Slabs: Ca. Dipayan DasDokument4 SeitenTax Slabs: Ca. Dipayan DasNoob GamerNoch keine Bewertungen

- New Tax Regime Vs Old Calculator by AssetYogiDokument4 SeitenNew Tax Regime Vs Old Calculator by AssetYogijohnNoch keine Bewertungen

- Financial Planning: Alqaab Arshad Amish Bhalla ShawezDokument6 SeitenFinancial Planning: Alqaab Arshad Amish Bhalla ShawezAlqaab ArshadNoch keine Bewertungen

- Income Current Deductions: STAY: Old Tax Regime Is Better by Rs. 62400Dokument8 SeitenIncome Current Deductions: STAY: Old Tax Regime Is Better by Rs. 62400Sahil SNoch keine Bewertungen

- MGAC2 ForecastingDokument22 SeitenMGAC2 ForecastingJoana TrinidadNoch keine Bewertungen

- CS Executive Tax Laws Amendments by Vipul ShahDokument41 SeitenCS Executive Tax Laws Amendments by Vipul ShahCloxan India Pvt LtdNoch keine Bewertungen

- New Tax Regime Vs Old Calculator by AssetYogiDokument3 SeitenNew Tax Regime Vs Old Calculator by AssetYogiSukanta MondalNoch keine Bewertungen

- Task-1 Master Budget With Profit ProjectionsDokument5 SeitenTask-1 Master Budget With Profit ProjectionsbabluanandNoch keine Bewertungen

- Practice Problems Chapter 12 Corporate Cash Flow and Project AnalysisDokument57 SeitenPractice Problems Chapter 12 Corporate Cash Flow and Project AnalysiszoeyNoch keine Bewertungen

- Tax CalculatorDokument3 SeitenTax CalculatorumaNoch keine Bewertungen

- CAPITAL STRUCTURE Sums OnlinePGDMDokument6 SeitenCAPITAL STRUCTURE Sums OnlinePGDMSoumendra RoyNoch keine Bewertungen

- Compare Taxes Under Old and New Tax RegimesDokument2 SeitenCompare Taxes Under Old and New Tax Regimesda MNoch keine Bewertungen

- Tea Villa CafeDokument8 SeitenTea Villa CafeHarsh BaidNoch keine Bewertungen

- Income Tax Amendment FA 2017 - Key Highlights of Individual TaxationDokument14 SeitenIncome Tax Amendment FA 2017 - Key Highlights of Individual TaxationrakeshNoch keine Bewertungen

- Quikchex 2020 Tax Comparison CalculatorDokument1 SeiteQuikchex 2020 Tax Comparison CalculatorSankar rajNoch keine Bewertungen

- Financial Plan: Important AssumptionsDokument15 SeitenFinancial Plan: Important AssumptionsjehooniesunshineNoch keine Bewertungen

- How To Save Tax For Salary Above 20 LakhsDokument12 SeitenHow To Save Tax For Salary Above 20 LakhsvijaytechskillupgradeNoch keine Bewertungen

- Choose Your Tax RegimeDokument3 SeitenChoose Your Tax Regimejanesh singhNoch keine Bewertungen

- Start-File-Capital-Budgeting_v3Dokument5 SeitenStart-File-Capital-Budgeting_v3milanomenganNoch keine Bewertungen

- Provided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDokument5 SeitenProvided Tax Tables: These Tax Tables Are Provided in The Exam Booklets For The March 2011 CFP Certification ExaminationDebolina DasNoch keine Bewertungen

- Tax Sace 1Dokument13 SeitenTax Sace 1kumar kartikeyaNoch keine Bewertungen

- AF Ch. 4 - Analysis FS - ExcelDokument9 SeitenAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinNoch keine Bewertungen

- Sunrise Bakery NPV AnalysisDokument4 SeitenSunrise Bakery NPV Analysisrutvik55% (11)

- Unlock Your Business Potential with 4 Keys to Profit GrowthDokument28 SeitenUnlock Your Business Potential with 4 Keys to Profit GrowthPratiiek Mor100% (6)

- Via BIR Form 1706Dokument1 SeiteVia BIR Form 1706YnnaNoch keine Bewertungen

- Ratio Analysis Numericals Including Reverse RatiosDokument6 SeitenRatio Analysis Numericals Including Reverse RatiosFunny ManNoch keine Bewertungen

- Yadnya-Income Tax Regime CalculatorDokument16 SeitenYadnya-Income Tax Regime CalculatorRaghavendra DeshpandeNoch keine Bewertungen

- Fidelity's Guide To ELSS: Drashti InvestmentsDokument15 SeitenFidelity's Guide To ELSS: Drashti InvestmentsDrashti InvestmentsNoch keine Bewertungen

- Q1.a) "Find Out The Taxes Paid by Both Mr. Sarthak and Mr. Bhavesh For The A.Y. 2021-22."Dokument11 SeitenQ1.a) "Find Out The Taxes Paid by Both Mr. Sarthak and Mr. Bhavesh For The A.Y. 2021-22."kumar kartikeyaNoch keine Bewertungen

- Lt2 - Iev - Ecsy ColaDokument11 SeitenLt2 - Iev - Ecsy ColaMarcus McWile Morningstar100% (1)

- Tax Slabs - Exemptions - Ay 2022-23Dokument19 SeitenTax Slabs - Exemptions - Ay 2022-23RatnaPrasadNalamNoch keine Bewertungen

- Initial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsDokument5 SeitenInitial Investment Fixed Cost Variable Cost Particulars Amount (RS.) Particulars Amount (RS.) ParticularsPrince JoshiNoch keine Bewertungen

- Afm Long - Term Financing - LeveragesDokument8 SeitenAfm Long - Term Financing - LeveragesDaniel HaileNoch keine Bewertungen

- Solution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadDokument7 SeitenSolution Manual For Managerial Economics Applications Strategies and Tactics 13th Edition DownloadStephenWolfpdiz100% (45)

- Hax To Save Tax Income Tax Calculator by Labour Law AdvisorDokument15 SeitenHax To Save Tax Income Tax Calculator by Labour Law AdvisorponmaniNoch keine Bewertungen

- AFM IBSB Leverages WordDokument16 SeitenAFM IBSB Leverages WordSangeetha K SNoch keine Bewertungen

- Capital BudgetingDokument20 SeitenCapital BudgetingAngelo VilladoresNoch keine Bewertungen

- Sols-Dr RajniDokument5 SeitenSols-Dr Rajnialex breymannNoch keine Bewertungen

- Capital Budgeting MathDokument3 SeitenCapital Budgeting MathMD.TARIQUL ISLAM CHOWDHURYNoch keine Bewertungen

- Tax 2023Dokument2 SeitenTax 2023riyaza_2Noch keine Bewertungen

- Budget Summary Report1Dokument4 SeitenBudget Summary Report1Evans mwenzeNoch keine Bewertungen

- Budget Summary Report Highlights Revenue GrowthDokument4 SeitenBudget Summary Report Highlights Revenue GrowthEvans mwenzeNoch keine Bewertungen

- CF Assignment 1 Group 9Dokument51 SeitenCF Assignment 1 Group 9rishabh tyagiNoch keine Bewertungen

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsVon EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNoch keine Bewertungen

- Fast-Track Tax Reform: Lessons from the MaldivesVon EverandFast-Track Tax Reform: Lessons from the MaldivesNoch keine Bewertungen

- Mcqs For Hardness of Water Competitive Exams: Answer: CDokument9 SeitenMcqs For Hardness of Water Competitive Exams: Answer: Csalman100% (3)

- Geography General Studies-I Mains Previous Year QuestionsDokument5 SeitenGeography General Studies-I Mains Previous Year QuestionssalmanNoch keine Bewertungen

- Countable vs. Uncountable Nouns: English Grammar RulesDokument3 SeitenCountable vs. Uncountable Nouns: English Grammar RulessalmanNoch keine Bewertungen

- RATIO AND PROPORTION PROBLEMSDokument23 SeitenRATIO AND PROPORTION PROBLEMSsalmanNoch keine Bewertungen

- Earthing System BasicsDokument62 SeitenEarthing System BasicssalmanNoch keine Bewertungen

- Mcqs For Hardness of Water Competitive Exams: Answer: CDokument9 SeitenMcqs For Hardness of Water Competitive Exams: Answer: Csalman100% (3)

- PSC exam guide by Bibi MohananDokument13 SeitenPSC exam guide by Bibi MohanansalmanNoch keine Bewertungen

- (Online Educator, Blogger-My Notebook)Dokument13 Seiten(Online Educator, Blogger-My Notebook)salmanNoch keine Bewertungen

- Option Trading StrategiesDokument5 SeitenOption Trading StrategiesNeeraj SharmaNoch keine Bewertungen

- PDFDokument15 SeitenPDFanba_88anbuNoch keine Bewertungen

- RATIO AND PROPORTION PROBLEMSDokument23 SeitenRATIO AND PROPORTION PROBLEMSsalmanNoch keine Bewertungen

- EESL Recruitment Advertisement of Middle and Junior Level Positions PDFDokument15 SeitenEESL Recruitment Advertisement of Middle and Junior Level Positions PDFfake fNoch keine Bewertungen

- CPWD DGSetsFinal2013Dokument0 SeitenCPWD DGSetsFinal2013vinaygvmNoch keine Bewertungen

- EESLSCHEMEWWWALLEXAMREVIEWDokument15 SeitenEESLSCHEMEWWWALLEXAMREVIEWpaheNoch keine Bewertungen

- 1113616593150526592292Dokument2 Seiten1113616593150526592292Rajashekar rajNoch keine Bewertungen

- Apprentice NotificationDokument3 SeitenApprentice NotificationCRAZY MINDNoch keine Bewertungen

- SynonymsDokument3 SeitenSynonymssalmanNoch keine Bewertungen

- 4 5940597574674155178Dokument5 Seiten4 5940597574674155178salmanNoch keine Bewertungen

- MSME Tech Centre Bhiwadi RecruitmentDokument3 SeitenMSME Tech Centre Bhiwadi RecruitmentsalmanNoch keine Bewertungen

- Wire Size SpecificationsDokument2 SeitenWire Size SpecificationsJun HuatNoch keine Bewertungen

- Capacitors Manufacturing Business-411179 PDFDokument39 SeitenCapacitors Manufacturing Business-411179 PDFsalmanNoch keine Bewertungen

- Noti Keam EngDokument1 SeiteNoti Keam EngsalmanNoch keine Bewertungen

- Training BrochureDokument2 SeitenTraining BrochuresalmanNoch keine Bewertungen

- Corrigendum DMRC Asst Manager JR Engineer OtherDokument1 SeiteCorrigendum DMRC Asst Manager JR Engineer OthersalmanNoch keine Bewertungen

- Tneb Power Engineers HandbookDokument2 SeitenTneb Power Engineers Handbooksalman50% (4)

- Power Engineers HandbookDokument6 SeitenPower Engineers HandbookAnonymous YWDRaCkSNoch keine Bewertungen

- Job Description LinkDokument21 SeitenJob Description LinksalmanNoch keine Bewertungen

- Smart Wiring for Electrical Panel Design and ManufacturingDokument18 SeitenSmart Wiring for Electrical Panel Design and ManufacturingsalmanNoch keine Bewertungen

- Walk in Interview For Well Engineer Drilling Engineer Geophysicist and Chemist On ContractDokument6 SeitenWalk in Interview For Well Engineer Drilling Engineer Geophysicist and Chemist On ContractsalmanNoch keine Bewertungen

- Entrepreneurship Assignment YUSUFDokument15 SeitenEntrepreneurship Assignment YUSUFShaxle Shiiraar shaxleNoch keine Bewertungen

- Fishbone DiagramDokument1 SeiteFishbone DiagramAsri Marwa UmniatiNoch keine Bewertungen

- Questions With SolutionsDokument4 SeitenQuestions With SolutionsArshad UllahNoch keine Bewertungen

- For The Families of Some Debtors, Death Offers No RespiteDokument5 SeitenFor The Families of Some Debtors, Death Offers No RespiteSimply Debt SolutionsNoch keine Bewertungen

- Assignment of Management Assignment of ManagementDokument7 SeitenAssignment of Management Assignment of ManagementNguyen Anh Vu100% (1)

- Barriers To Environmental Management in Hotels in Kwazulu - Natal, South AfricaDokument13 SeitenBarriers To Environmental Management in Hotels in Kwazulu - Natal, South AfricaGlobal Research and Development ServicesNoch keine Bewertungen

- Plastic PolutionDokument147 SeitenPlastic Polutionluis100% (1)

- Prayer Before Study: Saint Thomas AquinasDokument98 SeitenPrayer Before Study: Saint Thomas AquinasGea MarieNoch keine Bewertungen

- For A New Coffe 2 6Dokument2 SeitenFor A New Coffe 2 6Chanyn PajamutanNoch keine Bewertungen

- CFAS - Prelims Exam With AnsDokument12 SeitenCFAS - Prelims Exam With AnsAbarilles, Sherinah Mae P.Noch keine Bewertungen

- Unit 2 Financial PlanningDokument10 SeitenUnit 2 Financial PlanningMalde KhuntiNoch keine Bewertungen

- Tugas Uts Mata Kuliah Manajemen Pemasaran Dosen Pembimbing: Muchsin Saggaf. Shihab, MBA, PH, DDokument19 SeitenTugas Uts Mata Kuliah Manajemen Pemasaran Dosen Pembimbing: Muchsin Saggaf. Shihab, MBA, PH, Dbizantium greatNoch keine Bewertungen

- Chapter 13Dokument5 SeitenChapter 13Marvin StrongNoch keine Bewertungen

- Yu Chen-2023Dokument8 SeitenYu Chen-2023jennyNoch keine Bewertungen

- Applied Economics: January 2020Dokument18 SeitenApplied Economics: January 2020Jowjie TVNoch keine Bewertungen

- HUMAN RESOURCE MANAGEMENT FUNCTIONS OBJECTIVES CHALLENGESDokument71 SeitenHUMAN RESOURCE MANAGEMENT FUNCTIONS OBJECTIVES CHALLENGESviper9930950% (2)

- Case - FMC - 02Dokument5 SeitenCase - FMC - 02serigalagurunNoch keine Bewertungen

- Rental Quotation (Template)Dokument2 SeitenRental Quotation (Template)I CNoch keine Bewertungen

- Carta de La Junta Sobre La AEEDokument3 SeitenCarta de La Junta Sobre La AEEEl Nuevo DíaNoch keine Bewertungen

- Market Research in TCILDokument26 SeitenMarket Research in TCILRohIt SeNanNoch keine Bewertungen

- Hutchison Whampoa Capital Structure DecisionDokument11 SeitenHutchison Whampoa Capital Structure DecisionUtsav DubeyNoch keine Bewertungen

- ch18 ANALYZING FINANCIAL STATEMENTSDokument67 Seitench18 ANALYZING FINANCIAL STATEMENTSUpal MahmudNoch keine Bewertungen

- OilGas DCF NAV ModelDokument21 SeitenOilGas DCF NAV ModelbankiesoleNoch keine Bewertungen

- Marketing Research: Methodological Foundations, 9e: by Churchill and IacobucciDokument21 SeitenMarketing Research: Methodological Foundations, 9e: by Churchill and IacobucciYazan GhanemNoch keine Bewertungen

- Expansion and Financial RestructuringDokument50 SeitenExpansion and Financial Restructuringvikasgaur86100% (5)

- Judgement-Tat No. 86 of 2019 - Ruaraka Diversified Investments Limited-Vs-commissioner of Domestic TaxesDokument20 SeitenJudgement-Tat No. 86 of 2019 - Ruaraka Diversified Investments Limited-Vs-commissioner of Domestic TaxesPhilip MwangiNoch keine Bewertungen

- Land Use Patterns in CitiesDokument46 SeitenLand Use Patterns in Citiesarnav saikiaNoch keine Bewertungen

- 1597165857AFE 202 ASSIGNMENT Aransiola Grace Oluwadunsin Business PlanDokument16 Seiten1597165857AFE 202 ASSIGNMENT Aransiola Grace Oluwadunsin Business PlanMBI TABENoch keine Bewertungen

- Meenachi RKDokument7 SeitenMeenachi RKmeenachiNoch keine Bewertungen

- Bluescope Steel 2016Dokument48 SeitenBluescope Steel 2016Romulo AlvesNoch keine Bewertungen