Beruflich Dokumente

Kultur Dokumente

BIR Form 1702-RT

Hochgeladen von

Gil DelenaCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

BIR Form 1702-RT

Hochgeladen von

Gil DelenaCopyright:

Verfügbare Formate

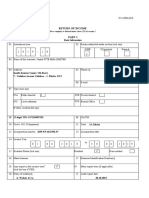

BIR Form 1702-RT https://efps.bir.gov.ph/faces/EFPSWeb_war/forms2013Version/1702RT/...

BIR Form No.

Page 2 June 2013 1702-RT06/13P2

Taxpayer Identification Number (TIN) Registered Name

403 - 698 - 252 - 000 GREAT PRIME TRADING CORPORATION

Part IV - Computation of Tax (Do NOT enter Centavos)

30 Net Sales/Revenues/Receipts/Fees (From Schedule 1 Item 6) 14,833,233

31 Less: Cost of Sales/Services (From Schedule 2 Item 27) 11,242,328

32 Gross Income from Operation (Item 30 Less Item 31) 3,590,905

33 Add: Other Taxable Income Not Subjected to Final Tax (From Schedule 3 Item 4) 0

34 Total Gross Income (Sum of Items 32 & 33) 3,590,905

Less: Deductions Allowable under Existing Law

35 Ordinary Allowable Itemized Deductions (From Schedule

1,987,305

4 Item 40)

36 Special Allowable Itemized Deductions (From Schedule

0

5 Item 5)

37 NOLCO (only for those taxable under Sec. 27(A to C);

Sec. 28(A)(1) & (A)(6)(b) of the tax Code) (From Schedule 0

6A Item 8D)

38 Total Itemized Deductions (Sum of Items 35 to 37) 1,987,305

OR [in case taxable under Sec 27(A) & 28(A)(1)]

39 Optional Standard Deduction (40% of Item 34) 0

40 Net Taxable Income (Item 34 Less Item 38 OR 39) 1,603,600

41 Income Tax Rate 30.0%

42 Income Tax Due other than MCIT (Item 40 x Item 41) 481,080

43 Minimum Corporate Income Tax (MCIT) (2% of Gross Income in Item 34) 71,818

44 Total Income Tax Due (Normal Income Tax in Item 42 or MCIT in Item 43, whichever is higher)

481,080

(To part II Item 16)

45 Less: Total Tax Credits/Payments (From Schedule 7 Item 12) (To Part II Item 17) 396,977

46 Net Tax Payable (Overpayment) (Item 44 Less Item 45) (To Part II Item 18) 84,103

Add Penalties

47 Surcharge 0

48 Interest 0

49 Compromise 0

50 Total Penalties (Sum of Items 47 to 49) (To part II Item 19) 0

51 Total Amount Payable (Overpayment) (Sum Item 46 & 50) (To Part II Item 20) 84,103

Part V - Tax Relief Availment (Do NOT enter Centavos)

52 Special Allowable Itemized Deductions (30% of Item 36) 0

53 Add: Special Tax Credits (From Schedule 7 Item 9) 0

54 Total Tax Relief Availment (Sum of Items 52 & 53) 0

Part VI - Information - External Auditor/Accredited Tax Agent

55 Name of External Auditor/Accredited Tax Agent

MARINO D. SAGUN

56 TIN 114 - 885 - 963 - 000

57 Name of Signing Partner (If External Auditor is a Partnership)

58 TIN - - -

59 BIR Accreditation No. 60 Issue Date (MM/DD/YYYY) 61 Expiry Date (MM/DD/YYYY)

01 - 004135 - 001 - 2016 01/31/2016 01/31/2019

2 of 8 17/03/2017 4:59 PM

Das könnte Ihnen auch gefallen

- Your Legal Disability RightsDokument8 SeitenYour Legal Disability Rightsapi-518553751Noch keine Bewertungen

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDokument1 Seite1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsjoel razNoch keine Bewertungen

- Vat Relief Bir Transmittal Form Annex A 1Dokument1 SeiteVat Relief Bir Transmittal Form Annex A 1Gil DelenaNoch keine Bewertungen

- The Wanta ChroniclesDokument17 SeitenThe Wanta ChroniclespfoxworthNoch keine Bewertungen

- UCSP Quarter Examination (2nd Quarter)Dokument9 SeitenUCSP Quarter Examination (2nd Quarter)GIO JASMINNoch keine Bewertungen

- The UN Security Council and The Question of Humanitarian InterventionDokument18 SeitenThe UN Security Council and The Question of Humanitarian InterventionJanet PhamNoch keine Bewertungen

- Acebedo V CADokument2 SeitenAcebedo V CACecille Mangaser100% (1)

- Philippines New Annual Income Tax Return Form 01 IAF JUNE 2013Dokument12 SeitenPhilippines New Annual Income Tax Return Form 01 IAF JUNE 2013Danilla Navarro VelasquezNoch keine Bewertungen

- de Braganza Vs Villa Abrille 105 Phil 456 DigestDokument2 Seitende Braganza Vs Villa Abrille 105 Phil 456 DigestJERROM ABAINZA100% (1)

- People v. AnguacDokument2 SeitenPeople v. Anguacjjj100% (1)

- Cold Call Script: (If Seller Asks, "How Did You Get My Number??" Respond With "Rebuttals/Extras" Listed On Page 3.)Dokument3 SeitenCold Call Script: (If Seller Asks, "How Did You Get My Number??" Respond With "Rebuttals/Extras" Listed On Page 3.)Gil DelenaNoch keine Bewertungen

- Heirs of Franco v. Spouses Gonzales Garcia CLR II G01 DLSUDokument1 SeiteHeirs of Franco v. Spouses Gonzales Garcia CLR II G01 DLSUMark Evan GarciaNoch keine Bewertungen

- Astradigital Inc BIRForm 1702RT-page 2Dokument1 SeiteAstradigital Inc BIRForm 1702RT-page 2MARIA CRISTINA DE PAZNoch keine Bewertungen

- 2pg Itr SMIIDokument1 Seite2pg Itr SMIIRic Dela CruzNoch keine Bewertungen

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDokument3 Seiten1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsLLYOD FRANCIS LAYLAYNoch keine Bewertungen

- BIR Form Page 2Dokument1 SeiteBIR Form Page 2Mark De JesusNoch keine Bewertungen

- EXIS INC - Financial Report 2022Dokument25 SeitenEXIS INC - Financial Report 2022JohnfreNoch keine Bewertungen

- 1701Q-2nd FINALDokument1 Seite1701Q-2nd FINALLoufelleJoiceCaseñasNoch keine Bewertungen

- 1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsDokument1 Seite1701Q Quarterly Income Tax Return: For Individuals, Estates and TrustsAshly MateoNoch keine Bewertungen

- 1701Q Page 2Dokument1 Seite1701Q Page 2John ApeladoNoch keine Bewertungen

- 02D. QTRLY ITR (8%) Pg2Dokument1 Seite02D. QTRLY ITR (8%) Pg2marivel c divinoNoch keine Bewertungen

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersDokument2 SeitenQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxNoch keine Bewertungen

- 1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Dokument2 Seiten1702-MX Annual Income Tax Return: (From Part IV-Schedule 2 Item 15B)Vince Alvin DaquizNoch keine Bewertungen

- 1701a - Page 2Dokument1 Seite1701a - Page 2Sygee BotantanNoch keine Bewertungen

- Quarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersDokument2 SeitenQuarterly Income Tax Return For Corporations, Partnerships and Other Non-Individual TaxpayersRegs AccountingTaxNoch keine Bewertungen

- Tax Returns 2nd QTR 2023Dokument2 SeitenTax Returns 2nd QTR 2023Anita De GuzmanNoch keine Bewertungen

- 1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationDokument2 Seiten1601-C Monthly Remittance Return: of Income Taxes Withheld On CompensationJa'maine ManguerraNoch keine Bewertungen

- 1701A Annual Income Tax Return: (Add More... )Dokument1 Seite1701A Annual Income Tax Return: (Add More... )Karen Faye TorrecampoNoch keine Bewertungen

- eFPS Home - Efiling and Payment System PDFDokument2 SeiteneFPS Home - Efiling and Payment System PDFRegs AccountingTaxNoch keine Bewertungen

- 1601C JanuaryDokument3 Seiten1601C JanuaryJoshua Honra0% (1)

- 82276BIR Form 1702-EXDokument7 Seiten82276BIR Form 1702-EXJessicaWeinNoch keine Bewertungen

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDokument1 Seite1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and Trustsmelanie vistalNoch keine Bewertungen

- 19blwph6736c1zo - 112022 - GSTR-3B MDokument4 Seiten19blwph6736c1zo - 112022 - GSTR-3B MSheksNoch keine Bewertungen

- Return of Income: Basic InformationDokument11 SeitenReturn of Income: Basic InformationShuvro PaulNoch keine Bewertungen

- Return of Income: For An Individual AssesseeDokument44 SeitenReturn of Income: For An Individual AssesseeSammyNoch keine Bewertungen

- VAT Form202Dokument2 SeitenVAT Form202ncgohil78Noch keine Bewertungen

- Tax Returns 3rd QTR 2023Dokument2 SeitenTax Returns 3rd QTR 2023Anita De GuzmanNoch keine Bewertungen

- Form 1622072023 022228Dokument2 SeitenForm 1622072023 022228Kajal RandiveNoch keine Bewertungen

- 1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsDokument2 Seiten1701 Annual Income Tax Return: Individuals (Including MIXED Income Earner), Estates and TrustsJohn Lesther PabiloniaNoch keine Bewertungen

- ARAS AGRO Ltd.2022-2023Dokument9 SeitenARAS AGRO Ltd.2022-2023Friends Law ChamberNoch keine Bewertungen

- 19blwph6736c1zo - 032023 - GSTR-3B MDokument4 Seiten19blwph6736c1zo - 032023 - GSTR-3B MSheksNoch keine Bewertungen

- Draft ReportDokument8 SeitenDraft Report0264192238Noch keine Bewertungen

- 19blwph6736c1zo - 092022 - GSTR-3B MDokument4 Seiten19blwph6736c1zo - 092022 - GSTR-3B MSheksNoch keine Bewertungen

- 2021-2022 Shrikant Jadhav Form 16-Part B PDFDokument6 Seiten2021-2022 Shrikant Jadhav Form 16-Part B PDFVidya JadhavNoch keine Bewertungen

- Form GSTR-3B (See Rule 61 (5) )Dokument6 SeitenForm GSTR-3B (See Rule 61 (5) )Asma KhanNoch keine Bewertungen

- 1601-C July For ApprovalDokument1 Seite1601-C July For ApprovalJa'maine ManguerraNoch keine Bewertungen

- 23bch021 (Dilkhush Kumar) GSTR-3BDokument2 Seiten23bch021 (Dilkhush Kumar) GSTR-3Bpr91127810Noch keine Bewertungen

- Form 1607062022 182100Dokument2 SeitenForm 1607062022 182100Manveer Rori AlaNoch keine Bewertungen

- 19blwph6736c1zo - 072023 - GSTR-3B MDokument4 Seiten19blwph6736c1zo - 072023 - GSTR-3B MSheksNoch keine Bewertungen

- © The Institute of Chartered Accountants of IndiaDokument15 Seiten© The Institute of Chartered Accountants of IndiaRobinxyNoch keine Bewertungen

- Mushak-9.1 VAT Return On 14.MAR.2022Dokument18 SeitenMushak-9.1 VAT Return On 14.MAR.2022Kazi MahbubNoch keine Bewertungen

- 1601C 082019 ItemsiDokument1 Seite1601C 082019 Itemsi___wenaNoch keine Bewertungen

- Standalone Profit LossDokument1 SeiteStandalone Profit LossrahulNoch keine Bewertungen

- Mat Adjustments Table (Ay 2021-22)Dokument4 SeitenMat Adjustments Table (Ay 2021-22)priyal shahNoch keine Bewertungen

- 1601C Sept 2019Dokument2 Seiten1601C Sept 2019Virnadette Lopez0% (1)

- Form 1619042024 085917Dokument3 SeitenForm 1619042024 085917SODHI SINGHNoch keine Bewertungen

- Zaini Zain (BAF2009012) Taxation UpdatedDokument15 SeitenZaini Zain (BAF2009012) Taxation UpdatedZaini ZainNoch keine Bewertungen

- Mushak-9.1 VAT Return On 17.DEC.2023Dokument7 SeitenMushak-9.1 VAT Return On 17.DEC.2023Md. Abu NaserNoch keine Bewertungen

- 19blwph6736c1zo - 062023 - GSTR-3B MDokument4 Seiten19blwph6736c1zo - 062023 - GSTR-3B MSheksNoch keine Bewertungen

- © The Institute of Chartered Accountants of IndiaDokument15 Seiten© The Institute of Chartered Accountants of IndiaAnkitaNoch keine Bewertungen

- 19jdaps4566m1zn - 082023 - GSTR-3B MDokument4 Seiten19jdaps4566m1zn - 082023 - GSTR-3B MSheksNoch keine Bewertungen

- Mushak-9.1 VAT Return On 14.JUN.2022Dokument13 SeitenMushak-9.1 VAT Return On 14.JUN.2022Kazi MahbubNoch keine Bewertungen

- 19kxcps4738e1zy - 032023 - GSTR-3B MDokument4 Seiten19kxcps4738e1zy - 032023 - GSTR-3B MSheksNoch keine Bewertungen

- Sunrise GST Calculation For Mar-21Dokument1 SeiteSunrise GST Calculation For Mar-21Gaurav RawatNoch keine Bewertungen

- Mushak-9.1 VAT Return On 14.JAN.2022Dokument8 SeitenMushak-9.1 VAT Return On 14.JAN.2022Md. Abu NaserNoch keine Bewertungen

- Mushak-9.1 VAT Return On 16.JUN.2022Dokument6 SeitenMushak-9.1 VAT Return On 16.JUN.2022Noor TriftoNoch keine Bewertungen

- Quarterly Income Tax Return: Schedule 1Dokument3 SeitenQuarterly Income Tax Return: Schedule 1Ja'maine ManguerraNoch keine Bewertungen

- 19blwph6736c1zo - 012023 - GSTR-3B MDokument4 Seiten19blwph6736c1zo - 012023 - GSTR-3B MSheksNoch keine Bewertungen

- Alphalist of Regular Suppliers Top 20,000Dokument12 SeitenAlphalist of Regular Suppliers Top 20,000Gil DelenaNoch keine Bewertungen

- Annual Income Tax Return: Reset FormDokument4 SeitenAnnual Income Tax Return: Reset FormGil DelenaNoch keine Bewertungen

- Law SyllabusDokument157 SeitenLaw SyllabusjiaorrahmanNoch keine Bewertungen

- SOS Security Coverage For The PGS Conferment Ceremony of PRO13Dokument5 SeitenSOS Security Coverage For The PGS Conferment Ceremony of PRO13Kim MoritNoch keine Bewertungen

- Oxfam Codes of ConductDokument2 SeitenOxfam Codes of ConductGISCAR MINJANoch keine Bewertungen

- Legal Aspects of Business - Satyam ScandalDokument12 SeitenLegal Aspects of Business - Satyam ScandalVishesh NarwariaNoch keine Bewertungen

- 20bs Javellana V LedesmaDokument2 Seiten20bs Javellana V Ledesmacrisanto m. perezNoch keine Bewertungen

- UCPB Vs Spouses BelusoDokument9 SeitenUCPB Vs Spouses BelusoOke HarunoNoch keine Bewertungen

- AbdBorhan Bin HJ Daud & Ors V Abd Malek Bin Hussin Malek (CA)Dokument20 SeitenAbdBorhan Bin HJ Daud & Ors V Abd Malek Bin Hussin Malek (CA)Safia NazNoch keine Bewertungen

- #76 Macasiano Vs DioknoDokument6 Seiten#76 Macasiano Vs DioknoRose Ann LascuñaNoch keine Bewertungen

- M.P.warehousng & Logistics Policy 2012 Rules - EnglishDokument6 SeitenM.P.warehousng & Logistics Policy 2012 Rules - EnglishSantoshh MishhNoch keine Bewertungen

- Actus ReusDokument3 SeitenActus ReusDonna MarieNoch keine Bewertungen

- Untittled Sheet3 LastDokument2 SeitenUntittled Sheet3 Lastprit100% (1)

- Writ of Continuing Mandamus (FIL)Dokument33 SeitenWrit of Continuing Mandamus (FIL)Ronnie RimandoNoch keine Bewertungen

- Re-Enrolment Application Form 2018Dokument6 SeitenRe-Enrolment Application Form 2018Timmy JamesNoch keine Bewertungen

- In The Supreme Court of India,: Appellate JurisdictionDokument26 SeitenIn The Supreme Court of India,: Appellate JurisdictionShivendu PandeyNoch keine Bewertungen

- Proclamation No. 635 S. 1995 - Official Gazette of The Republic of The PhilippinesDokument6 SeitenProclamation No. 635 S. 1995 - Official Gazette of The Republic of The PhilippinesEric NagumNoch keine Bewertungen

- Areola Vs CADokument2 SeitenAreola Vs CAEarlcen MinorcaNoch keine Bewertungen

- P L D 1991 KARACHI (Different Cases)Dokument11 SeitenP L D 1991 KARACHI (Different Cases)Anonymous 16w0dovNoch keine Bewertungen

- Sample Quiz 4 On ObliconDokument4 SeitenSample Quiz 4 On ObliconRegina MuellerNoch keine Bewertungen

- TeresaZhou (US Tax Resume 06.01. 2015) CADokument3 SeitenTeresaZhou (US Tax Resume 06.01. 2015) CALin ZhouNoch keine Bewertungen

- Evidence Cases April 8Dokument39 SeitenEvidence Cases April 8Charisse Ayra C. ClamosaNoch keine Bewertungen

- ArmisVSrecho ApplicantDokument25 SeitenArmisVSrecho ApplicantNorman Kenneth SantosNoch keine Bewertungen

- Denr Application For Agricultural Free PatentDokument3 SeitenDenr Application For Agricultural Free PatentAngelica DulceNoch keine Bewertungen