Beruflich Dokumente

Kultur Dokumente

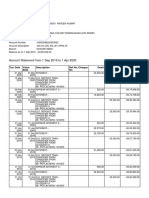

National Bank of Kenya Financial Results 30 September 2010

Hochgeladen von

xpretty0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

25 Ansichten1 SeiteThe National Bank of Kenya Limited announced unaudited results for the third quarter of 2010. Net interest income increased to 3.18 billion shillings from 2.25 billion in the previous quarter. Non-interest income also rose to 1.98 billion shillings from 984.4 million. Total assets grew to 67.4 billion shillings as of September 30, 2010 compared to 59.4 billion at the end of the previous quarter.

Originalbeschreibung:

Originaltitel

National_Bank_of_Kenya_Financial_results_30_September_2010

Copyright

© Attribution Non-Commercial (BY-NC)

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe National Bank of Kenya Limited announced unaudited results for the third quarter of 2010. Net interest income increased to 3.18 billion shillings from 2.25 billion in the previous quarter. Non-interest income also rose to 1.98 billion shillings from 984.4 million. Total assets grew to 67.4 billion shillings as of September 30, 2010 compared to 59.4 billion at the end of the previous quarter.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

25 Ansichten1 SeiteNational Bank of Kenya Financial Results 30 September 2010

Hochgeladen von

xprettyThe National Bank of Kenya Limited announced unaudited results for the third quarter of 2010. Net interest income increased to 3.18 billion shillings from 2.25 billion in the previous quarter. Non-interest income also rose to 1.98 billion shillings from 984.4 million. Total assets grew to 67.4 billion shillings as of September 30, 2010 compared to 59.4 billion at the end of the previous quarter.

Copyright:

Attribution Non-Commercial (BY-NC)

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

The Board of Directors of National Bank of Kenya Limited hereby announce the un-audited results of the Bank for

the third quarter ended 30 September

2010

PROFIT AND LOSS ACCOUNT 30 S

30-Sep-10

10 30 J

30-Jun-10

10 31 M 10

31-Mar-10 31-Dec-09

31 D 09 30 S

30-Sep-0909 BALANCE SHEET 30 S

30-Sep-10

10 30 J

30-Jun-10

10 31 M 10

31-Mar-10 31-Dec-09

31 D 09 30 S

30-Sep-09

09

for the third quarter ended 30 September 2010 Shs'000 Shs'000 Shs'000 Shs'000 Shs'000 as at 30 September 2010 Shs'000 Shs'000 Shs'000 Shs'000 Shs'000

Un-audited Un-audited Un-audited Audited Un-audited Un-audited Un-audited Un-audited Audited Un-audited

1 Interest Income A Assets

1.1 Loans and advances 1,619,694 1,030,212 492,567 1,621,114 1,169,582 1 Cash (both local and foreign) 1,688,639 1,591,965 1,493,710 1,470,378 1,308,812

1.2 Government securities 2,424,721 1,858,557 747,105 2,814,100 2,071,701 2 Balances due from Central Bank Of Kenya 8,797,206 4,530,623 4,589,811 6,418,485 7,300,232

1.3 Deposits and placements with banking institutions 20,329 16,989 5,531 49,795 36,699 3 Kenya Government securities 21,129,305 25,307,179 28,722,237 26,609,661 26,314,742

1.4 Other Interest Income - - - - - 4 Foreign Currency Treasury bills and bonds - - - - -

1.5 Total interest income 4,064,744 2,905,758 1,245,203 4,485,009 3,277,982 5 Deposits and balances due from local banking institutions 1,495,529 500,297 2,181,539 166,677 3,490,469

6 Deposits and balances due from banking institutions abroad 1,219,431 1,226,662 1,252,513 987,594 1,051,517

2 Interest Expense 7 Government and other securities held for dealing purposes 11,178,180 6,668,684 - - -

2.1 Customer deposits 879,998 656,310 330,541 1,132,065 766,010 8 Tax recoverable - - - -

2.2 Deposits and placements from banking institutions 8,059 235 33 20,551 23,629 9 Loans and advances to customers (net) 17,334,825 15,490,676 14,577,058 13,156,455 12,025,066

2.3 Other - - - - - 10 Investment securities 52,509 52,509 52,509 52,509 36,716

2.4 Total Interest Expenses 888,057 656,545 330,574 1,152,616 789,639 11 Balances due from group companies - - - - -

12 Investment in associates - - - - -

3 Net Interest Income 3,176,687 2,249,213 914,629 3,332,393 2,488,343 13 Investment in subsidiary companies 19,963 19,963 19,963 19,963 19,963

14 Investment in joint ventures - - - - -

4 Non-Interest Income 15 Investment in properties - - - - -

4.1 Fees and commissions on loans and advances 172,865 103,810 50,811 224,646 106,283 16 Property and equipment 2,259,492 2,136,904 2,113,272 2,071,001 1,886,189

4.2 Other fees and commissions 823,961 535,554 270,134 1,128,803 882,412 17 Prepaid lease rentals 11,812 11,837 11,874 11,911 11,948

4.3 Foreign exchange trading income (loss) 208,818 146,875 59,700 297,384 229,465 18 Intangible assets 56,784 49,947 53,702 57,078 49,281

4.4 Dividend Income - - - - - 19 Deferred tax asset - - - - -

4.5 Other Income 775,037 198,168 183,039 753,412 378,590 20 Retirement benefit asset - - - - -

4.6 Total Non-Interest Income 1,980,681 984,407 563,684 2,404,245 1,596,750 21 Other assets 2,161,004 1,803,729 1,298,289 382,696 1,746,014

22 Total Assets 67,404,679 59,390,975 56,366,477 51,404,408 55,240,949

5 Total Operating Income 5,157,368 3,233,620 1,478,313 5,736,638 4,085,093

B Liabilities

6 Other Operating Expenses 23 Balances due to Central Bank of Kenya - - - - -

6.1 Loan loss provision 220,580 150,002 100,001 143,520 113,708 24 Customer deposits 53,794,244 46,380,597 45,265,094 41,995,446 41,438,209

6.2 Staff costs 1,782,848 1,160,567 569,950 1,986,720 1,528,091 25 Deposits and balances due to local banking institutions 2,265 2,798 26,441 50,290 64,768

6.3 Directors' emoluments 28,200 23,865 11,485 49,708 34,263 26 Deposits and balances due to foreign banking institutions - - - - -

6.4 Rental charges 65,677 53,104 20,116 78,377 60,786 27 Other money market deposits - - - - -

6.5 Depreciation charge on property and equipment 194,314 102,480 51,480 203,854 127,462 28 Borrowed funds - - - - -

6.6 Amortisation charges 21,751 14,191 7,095 28,529 23,172 29 Balances due to group companies 21,976 21,976 21,976 21,976 21,976

6.7 Other operating expenses 857,115 528,905 232,017 1,086,489 766,915 30 Tax payable 73,149 8,860 270,519 114,944 26,947

6.8 Total Operating Expenses 3,170,485 2,033,114 992,144 3,577,197 2,654,397 31 Dividends payable 10,517 10,518 10,521 10,524 108,961

32 Deferred tax liability 198,124 198,124 198,124 198,124 89,458

7 Profit before tax and exceptional items 1,986,883 1,200,506 486,169 2,159,441 1,430,696 33 Retirement benefit liability - - - - -

8 Exceptional items - - - - - 34 Other liabilities 4,045,634 4,044,068 2,335,517 1,105,412 6,309,912

9 Profit after exceptional items 1,986,883 1,200,506 486,169 2,159,441 1,430,696 35 Total Liabilities 58,145,909 50,666,941 48,128,192 43,496,716 48,060,231

10 Current tax (635,803) (384,162) (155,574) (680,560) (457,823)

11 Deferred tax - - - (15,926) - C Shareholders' Funds

12 Profit after tax and exceptional items 1,351,080 816,344 330,595 1,462,955 972,873 36 Paid Up/Assigned Capital 7,075,000 7,075,000 6,675,000 6,675,000 6,675,000

37 Share Premium/(discount)

( ) - - 370,585

, 370,585

, 370,585

,

38 Revaluation reserve 682,639 682,639 682,639 682,641 454,679

OTHER DISCLOSURES 30-Sep-10 30-Jun-10 31-Mar-10 31-Dec-09 30-Sep-09 39 Retained Earnings/(Accumulated losses) 1,332,032 840,492 384,158 53,563 (401,157)

Shs'000 Shs'000 Shs'000 Shs'000 Shs'000 40 Statutory Loan Loss Reserve 169,099 125,903 125,903 125,903 81,611

Un-audited Un-audited Un-audited Audited Un-audited 41 Proposed Dividends - - - - -

1 Non-performing loans and advances 42 Capital grants - - - - -

a Gross non-performing loans and advances 1,061,560 1,323,904 1,325,277 1,301,757 1,245,891 43 Total Shareholders' Funds 9,258,770 8,724,034 8,238,285 7,907,692 7,180,718

Less: 44 Total Liabilities & Shareholders' Funds 67,404,679 59,390,975 56,366,477 51,404,408 55,240,949

b Interest in suspense 29,892 34,824 35,509 33,651 31,080

c Total Non-performing loans and advances (a-b) 1,031,668 1,289,080 1,289,768 1,268,106 1,214,811 CONSOLIDATION

Less:

d Loan loss Provisions 755,111 1,043,028 989,397 888,577 837,294 Consolidated financial statements have not been prepared as the subsidiary companies are dormant and the amounts involved are not

e Net NPLs exposure (c-d) 276,557 246,052 300,371 379,529 377,517 material.

f Discounted Value of Securities 276,557 246,052 300,371 379,529 377,517 The directors do not recommend the payment of an interim dividend.

g Net NPLs exposure (e-f) - - - - - The un-audited financial statements are extracts of the financial statements and records of the Bank which were approved by the Board of

Directors on 26 October 2010.

2 Insider loans and Advances

a Shareholders and associates - - - - - BOARD OF DIRECTORS

b Directors 12,704 4,157 4,808 4,418 4,900

c Employees 2,206,437 1,981,789 1,835,944 1,778,718 1,696,388 M.E.G.Muhindi National Social Security Fund

d Total insider loans, advances and other facilities 2,219,141 1,985,946 1,840,752 1,783,136 1,701,288

A.C.Juma Dr J.N.Riria

3 Off-Balance sheet items

a Letters of credit, guarantees and acceptances 4,300,403 3,899,915 4,145,435 3,286,329 2,632,681 R.M.Marambii F.L.Atwoli

b Other contingent liabilities - - - - 10,184

c Total contingent liabilities 4,300,403 3,899,915 4,145,435 3,286,329 2,642,865 P.S.Treasury P.W.Ngumi

4 Capital Strength I.M.Mworia L.G.Kamweti - Company Secretary

a Core capital 7,731,492 7,507,320 7,264,446 7,099,149 6,157,992

b Minimum Statutory Capital 350 000

350,000 350 000

350,000 350 000

350,000 350 000

350,000 250 000

250,000 A N Ismail

A.N.Ismail

c Excess/(Deficiency) (a-b) 7,381,492 7,157,320 6,914,446 6,749,149 5,907,992

d Supplementary capital 339,759 296,563 296,563 296,563 195,281 REGISTERED OFFICE

e Total capital (a+d) 8,071,251 7,803,883 7,561,009 7,395,712 6,353,273 National Bank Building,

f Total risk weighted assets 23,366,249 20,987,728 20,238,799 17,376,921 17,463,905

g Core capital/total deposit liabilities 14% 16% 16% 17% 15% 18 Harambee Avenue, Nairobi.

h Minimum Statutory Ratio 8% 8% 8% 8% 8%

I Excess/(Deficiency) (g-h) 6% 8% 8% 9% 7% P.O. BOX 72866, 00200, Nairobi.

j Core capital/total risk weighted assets 33% 36% 36% 41% 35%

k Minimum Statutory Ratio 8% 8% 8% 8% 8% Telephone 2828000, 0711038000, 0732018000 Fax 311444.

l Excess/(Deficiency) (j-k) 25% 28% 28% 33% 27%

m Total capital/total risk weighted assets 35% 37% 37% 43% 36% E-Mail : info@nationalbank.co.ke

n Minimum Statutory Ratio 12% 12% 12% 12% 12%

o Excess/(Deficiency)(m-n) 23% 25% 25% 31% 24% Website : www.nationalbank.co.ke

5 Liquidity

a Liquidity

i idi R Ratio

i 52% 50% 38% 35% 43%

b Minimum Statutory Ratio 20% 20% 20% 20% 20%

c Excess/(Deficiency)(a-b) 32% 30% 18% 15% 23%

www.nationalbank.co.ke

Das könnte Ihnen auch gefallen

- Data For The Year 2009: Close - End Mutual FundDokument32 SeitenData For The Year 2009: Close - End Mutual FundRana Sajid OmerNoch keine Bewertungen

- History Payment-PrintDokument1 SeiteHistory Payment-Printmualifatul hasanahNoch keine Bewertungen

- SCH Aries Oct 22-23Dokument4 SeitenSCH Aries Oct 22-23onlyhitmanNoch keine Bewertungen

- Geo Magnet Extensometer: Trees RemovedDokument2 SeitenGeo Magnet Extensometer: Trees RemovedSajid IqbalNoch keine Bewertungen

- It Calculator 2010 11 01042010Dokument1 SeiteIt Calculator 2010 11 01042010bonika08Noch keine Bewertungen

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument2 SeitenAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancesumandeepNoch keine Bewertungen

- Sbi Loan1Dokument1 SeiteSbi Loan1gangadhar_payyavulaNoch keine Bewertungen

- Newtom - WWW - Newtom.It - This Document May Not Be in 1:1 Scale 0.1220710224840461.335 Page 1 of 1 SW Ver. 10.1Dokument1 SeiteNewtom - WWW - Newtom.It - This Document May Not Be in 1:1 Scale 0.1220710224840461.335 Page 1 of 1 SW Ver. 10.1mj shahmoradiNoch keine Bewertungen

- Capital Buildup Summary 30 June 2020 2020 PDFDokument4 SeitenCapital Buildup Summary 30 June 2020 2020 PDFvinitNoch keine Bewertungen

- Tanggal: Jadwal Kerja Lir Ilir Periode: 16 JAN Sampai 16 FEB 2022 Name Position DayDokument10 SeitenTanggal: Jadwal Kerja Lir Ilir Periode: 16 JAN Sampai 16 FEB 2022 Name Position DayDapoer HintNoch keine Bewertungen

- 20171012first Term Final Exam AnswersDokument4 Seiten20171012first Term Final Exam AnswersSaad Shehryar0% (1)

- SN - Progress Update As of 09-Sep-2020 (Week No. 057) - 4WLADokument11 SeitenSN - Progress Update As of 09-Sep-2020 (Week No. 057) - 4WLALee BañezNoch keine Bewertungen

- RPG To TPMDokument1 SeiteRPG To TPMruben EdwardNoch keine Bewertungen

- EHG Citizens SalariesDokument1 SeiteEHG Citizens SalariesThembi MudongoNoch keine Bewertungen

- Solutions To Problems Chapter 3Dokument31 SeitenSolutions To Problems Chapter 3Mutiara MahuletteNoch keine Bewertungen

- November 2020 PayslipDokument3 SeitenNovember 2020 PayslipRose hillsNoch keine Bewertungen

- 2010 08 21 - 142723 - P11 2aDokument3 Seiten2010 08 21 - 142723 - P11 2aJessica DragonIvyNoch keine Bewertungen

- AN-32 RE Flight Manual Part-IIDokument491 SeitenAN-32 RE Flight Manual Part-IIRizwan KhanNoch keine Bewertungen

- Industrial PageDokument1 SeiteIndustrial PageEdAchadoNoch keine Bewertungen

- Data For The Year 2017: 1 Close-End Mutual FundDokument14 SeitenData For The Year 2017: 1 Close-End Mutual FundAbdul Moiz YousfaniNoch keine Bewertungen

- Astra Otoparts Tbk. (S) : Company Report: January 2017 As of 31 January 2017Dokument3 SeitenAstra Otoparts Tbk. (S) : Company Report: January 2017 As of 31 January 2017Nyoman ShantiyasaNoch keine Bewertungen

- 2009-2010 School Calendar Premier High School of Beaumont: Educating The Individual, Not The ClassDokument1 Seite2009-2010 School Calendar Premier High School of Beaumont: Educating The Individual, Not The ClassResponsiveEdNoch keine Bewertungen

- HARIAN Benjeng MetatuaDokument300 SeitenHARIAN Benjeng Metatuamuhammadfarid hdNoch keine Bewertungen

- Mutual Funds & Assets Under ManagementDokument3 SeitenMutual Funds & Assets Under ManagementSunil SahuNoch keine Bewertungen

- Huntsville - PremierDokument1 SeiteHuntsville - PremierResponsiveEdNoch keine Bewertungen

- Legal Disclaimer: Read and Accept Before Accessing The Tutorial WorkbookDokument15 SeitenLegal Disclaimer: Read and Accept Before Accessing The Tutorial WorkbooksubhashbuddanaNoch keine Bewertungen

- Repayment ModelDokument18 SeitenRepayment ModelUmair GardeziNoch keine Bewertungen

- Target Bulan Depan Rate Target AtasDokument3 SeitenTarget Bulan Depan Rate Target Atasanto donlotNoch keine Bewertungen

- CBE - AC.STMT - RP.PDF Meseret MeseleDokument31 SeitenCBE - AC.STMT - RP.PDF Meseret MeseleLeulNoch keine Bewertungen

- Account Statement From 1 Sep 2019 To 1 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument2 SeitenAccount Statement From 1 Sep 2019 To 1 Apr 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceP NAVEEN KUMARNoch keine Bewertungen

- Asssingment MBA FFA Nov2020 1Dokument3 SeitenAsssingment MBA FFA Nov2020 1Samit DasNoch keine Bewertungen

- Bank Central Asia TBK.: January 2014Dokument4 SeitenBank Central Asia TBK.: January 2014yohannestampubolonNoch keine Bewertungen

- Lembar Penilaian Juri Latte ArtDokument4 SeitenLembar Penilaian Juri Latte ArtBima RifandyNoch keine Bewertungen

- Trading MNC ModifiedDokument34 SeitenTrading MNC Modifiedmas agung chandraNoch keine Bewertungen

- LapKeu Bank BCA PDFDokument4 SeitenLapKeu Bank BCA PDFWearWinoNoch keine Bewertungen

- Huntsville - VistaDokument1 SeiteHuntsville - VistaResponsiveEdNoch keine Bewertungen

- Linia/Route 420: Bod Colonie 16.09.2019 Bod Colonie - RulmentulDokument35 SeitenLinia/Route 420: Bod Colonie 16.09.2019 Bod Colonie - RulmentulS6 edge Samsung GalaxyNoch keine Bewertungen

- SecindiDokument1 SeiteSecindischizitNoch keine Bewertungen

- G EJy BNK IXYJry 9 W VDokument1 SeiteG EJy BNK IXYJry 9 W Vdurga workspotNoch keine Bewertungen

- Nro EppsDokument1 SeiteNro EppsGabriela ApazaNoch keine Bewertungen

- Effective Date Cost Center CC Description Account Account Description Supplier Reference Number Amount Line DescriptionDokument2 SeitenEffective Date Cost Center CC Description Account Account Description Supplier Reference Number Amount Line DescriptionRene ChuaNoch keine Bewertungen

- Bcic PDFDokument3 SeitenBcic PDFyohannestampubolonNoch keine Bewertungen

- Tanque Cap&xisto 2002Dokument5 SeitenTanque Cap&xisto 2002Loreni de OliveiraNoch keine Bewertungen

- A CD Cal 2010Dokument3 SeitenA CD Cal 2010deepak111yadavNoch keine Bewertungen

- VSXTK Nni 5 Z FXBC CsDokument1 SeiteVSXTK Nni 5 Z FXBC CssumandeepNoch keine Bewertungen

- Snap Statement: Pt. Bank Rakyat Indonesia (Persero), TBKDokument1 SeiteSnap Statement: Pt. Bank Rakyat Indonesia (Persero), TBKners fatmaNoch keine Bewertungen

- 2009-2010 School Calendar Premier High School of Austin: Educating The Individual, Not The ClassDokument1 Seite2009-2010 School Calendar Premier High School of Austin: Educating The Individual, Not The ClassResponsiveEdNoch keine Bewertungen

- 20181027Mid-Term Exam AnswerDokument4 Seiten20181027Mid-Term Exam AnswershifazubairNoch keine Bewertungen

- 20181027Mid-Term Exam AnswerDokument4 Seiten20181027Mid-Term Exam AnswershifazubairNoch keine Bewertungen

- 20181027Mid-Term Exam AnswerDokument4 Seiten20181027Mid-Term Exam AnswershifazubairNoch keine Bewertungen

- 05 May ForecastDokument18 Seiten05 May ForecastEvelyn Agustin BlonesNoch keine Bewertungen

- NY - Osc.master - Copy List of Single and Sole Source ContractsDokument1.525 SeitenNY - Osc.master - Copy List of Single and Sole Source ContractsGovernmentricoNoch keine Bewertungen

- WB066M Master DRG List As 0n 15 05 10Dokument62 SeitenWB066M Master DRG List As 0n 15 05 10Prakash WarrierNoch keine Bewertungen

- Interest Bearing Non Interest Bearing Notes HandoutsDokument4 SeitenInterest Bearing Non Interest Bearing Notes HandoutsAliezaNoch keine Bewertungen

- Olga Lucia Ortiz Cruz Y O 03 CL 38 # 4E-09 16-03-1130-00-00-000 MagisterioDokument1 SeiteOlga Lucia Ortiz Cruz Y O 03 CL 38 # 4E-09 16-03-1130-00-00-000 Magisteriosandra milena tique cruzNoch keine Bewertungen

- Account Statement From 1 Apr 2021 To 8 Jan 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument2 SeitenAccount Statement From 1 Apr 2021 To 8 Jan 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceTanveer PinjariNoch keine Bewertungen

- 7 16 10TheWrongDebateDokument3 Seiten7 16 10TheWrongDebaterichardck30Noch keine Bewertungen

- Melissa ISD School Calendar 2009-2010Dokument1 SeiteMelissa ISD School Calendar 2009-2010ironstampNoch keine Bewertungen

- Waumini by LawsDokument31 SeitenWaumini by LawsxprettyNoch keine Bewertungen

- DR Ouko FactfileDokument61 SeitenDR Ouko FactfilexprettyNoch keine Bewertungen

- The Akikuyu of British East AfricaDokument626 SeitenThe Akikuyu of British East Africaxpretty100% (2)

- Gospel Bearers, Gender BarriersDokument12 SeitenGospel Bearers, Gender BarriersxprettyNoch keine Bewertungen

- Gospel Bearers, Gender BarriersDokument12 SeitenGospel Bearers, Gender BarriersxprettyNoch keine Bewertungen

- Kenya Weekly Commentary 6 November 2009Dokument11 SeitenKenya Weekly Commentary 6 November 2009xprettyNoch keine Bewertungen

- State Bank of India Strategy AnalysisDokument25 SeitenState Bank of India Strategy AnalysisVineet Raj Goel85% (20)

- RBA APU PPT - OJK 16 April 2018Dokument46 SeitenRBA APU PPT - OJK 16 April 2018BunnyNoch keine Bewertungen

- Assignment - Journal, Ledger - Trial BalanceDokument2 SeitenAssignment - Journal, Ledger - Trial BalanceishitaNoch keine Bewertungen

- 10 Myths About Financial DerivativesDokument6 Seiten10 Myths About Financial DerivativesArshad FahoumNoch keine Bewertungen

- Asiatrust Vs TubleDokument5 SeitenAsiatrust Vs Tubleecinue guirreisaNoch keine Bewertungen

- Frauds in Micro FinanceDokument6 SeitenFrauds in Micro FinanceSyed MohammedNoch keine Bewertungen

- Expo Exhi 2008Dokument72 SeitenExpo Exhi 2008Engr Umar Iqbal100% (1)

- SHOCKER: Internal Emails Reveal Florida Legislative Staff Asked Payday Industry For Approval of Changes To New Lending BillDokument9 SeitenSHOCKER: Internal Emails Reveal Florida Legislative Staff Asked Payday Industry For Approval of Changes To New Lending BillAllied ProgressNoch keine Bewertungen

- New Valley Bank & Trust Public Co. FileDokument91 SeitenNew Valley Bank & Trust Public Co. FileJim KinneyNoch keine Bewertungen

- AchformDokument2 SeitenAchformhancockmedicalsolutionsllcNoch keine Bewertungen

- Jose C. Tupaz Iv and Petronila C. Tupaz vs. Ca and BpiDokument7 SeitenJose C. Tupaz Iv and Petronila C. Tupaz vs. Ca and BpiTrem GallenteNoch keine Bewertungen

- Deed of GiftDokument16 SeitenDeed of GiftSukirti Shikha100% (2)

- Receipt: Transfer OverviewDokument3 SeitenReceipt: Transfer Overviewdargo75% (4)

- Cardholder Change Account Form: Citibank Government Travel Card ProgramDokument4 SeitenCardholder Change Account Form: Citibank Government Travel Card ProgramcskjainNoch keine Bewertungen

- EUR Statement: Account SummaryDokument2 SeitenEUR Statement: Account SummarySW ProjectNoch keine Bewertungen

- Thailand Package - Mr. VinayDokument6 SeitenThailand Package - Mr. Vinayganiguruprasad1_2582Noch keine Bewertungen

- GR 9 June Exam 2023Dokument11 SeitenGR 9 June Exam 2023Rolandi ViljoenNoch keine Bewertungen

- Saving AccountDokument9 SeitenSaving AccountpalkhinNoch keine Bewertungen

- MFM Project Guidelines From Christ University FFFFFDokument6 SeitenMFM Project Guidelines From Christ University FFFFFakash08agarwal_18589Noch keine Bewertungen

- BTS Accounting Firm Trial Balance December 31, 2014Dokument4 SeitenBTS Accounting Firm Trial Balance December 31, 2014Trisha AlaNoch keine Bewertungen

- Engineering Economy Umak: Time Value of MoneyDokument26 SeitenEngineering Economy Umak: Time Value of MoneyTangina DenNoch keine Bewertungen

- Agreement: Golden Hills Subdivision, Herein Represented By: Liza R. Molinar, ofDokument3 SeitenAgreement: Golden Hills Subdivision, Herein Represented By: Liza R. Molinar, ofJoyceCollantesNoch keine Bewertungen

- HSE Lesson17Dokument20 SeitenHSE Lesson17SteeeeeeeephNoch keine Bewertungen

- Internal Factor Evaluation (Ife) of Kotak Mahindra: Key Success Factors Weight Rate ScoreDokument9 SeitenInternal Factor Evaluation (Ife) of Kotak Mahindra: Key Success Factors Weight Rate Scoresimran punjabiNoch keine Bewertungen

- Performance Analysis of Mobile Financial Industries A Comparative Analysis Between Bkash Limited and Dutch Bangla Bank RocketDokument83 SeitenPerformance Analysis of Mobile Financial Industries A Comparative Analysis Between Bkash Limited and Dutch Bangla Bank RocketWahidul Haque Khan SanielNoch keine Bewertungen

- Accounting Entries in ModulesDokument88 SeitenAccounting Entries in ModulesSuresh Joshi100% (2)

- SRS Internet Banking SystemDokument44 SeitenSRS Internet Banking SystemRahul Khanchandani83% (6)

- CurrenciesDokument32 SeitenCurrenciesGenelyn RodriguezNoch keine Bewertungen

- Cipla-I 4/4/2018 13:45 565.55 NEUTRAL 567.34 Cnxit-I 4/4/2018 12:30 12620 SELL MODE 12634.93Dokument8 SeitenCipla-I 4/4/2018 13:45 565.55 NEUTRAL 567.34 Cnxit-I 4/4/2018 12:30 12620 SELL MODE 12634.93dewanibipinNoch keine Bewertungen

- Session Readings (Euro Issues)Dokument8 SeitenSession Readings (Euro Issues)Arathi SundarramNoch keine Bewertungen