Beruflich Dokumente

Kultur Dokumente

04 Long Term Construction Contracts PDF

Hochgeladen von

Kyla Valencia Ngo0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

59 Ansichten2 SeitenOriginaltitel

04-Long-term-Construction-Contracts.pdf

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

59 Ansichten2 Seiten04 Long Term Construction Contracts PDF

Hochgeladen von

Kyla Valencia NgoCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

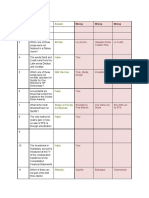

Kind of costs EXCLUDED Note: TCITD is cumulative.

Directly • Selling costs →

attributable expense • Is the outcome profit or loss?

Indirectly • General and o POC

attributable administrative costs ▪ If profit, use POC

• Depreciation of idle ▪ If loss, use 100%

assets o Zero-profit

• R&D costs → ▪ Profit = 0

expense ▪ Loss = 100%

• Advances to • Data: per year or as of?

Reimbursable subcontracted → o Income statement -> nominal -> cost

receivable incurred each year

• Materials delivered o Balance sheet -> real -> cost incurred to

but not yet utilized date

except specialized

materials BALANCE SHEET APPROACH

FORMULAS Construction in Progress

• Percentage of completion Costs incurred to Cumulative RGL

o Costs incurred to date / total costs date (CI) (L)

▪ Costs incurred to date will be reduced by Cumulative RGP

gain on disposal of excess and scrap (P)

materials Ending balance

(CIP)

METHODS OF REVENUE RECOGNITION

• Cost recovery (zero-profit) Progress Billings

o No profit is recognized until construction Beginning

contract is completed Additional billings

o Outcome cannot be estimated reliably Ending balance

o Revenue is recognized only to the extent of

contract costs that are probable (If POC is Accounts Receivable

not yet 100%, CR = CC → RGP = 0) Progress billings to Collections

o Contract costs are recognized as an date

expense in the period in which they are Ending balance

incurred

▪ Very similar to the recognition of COGS CIP XX

Progress billings (XX)

• Percentage of completion Net XX

o Used when the problem is silent • Net is positive -> current asset (due from

o Used when the outcome can be estimated customer)

reliably • Net is negative -> current liability (due to

Difference Formulas customer)

Input Cost to cost TCITD / ETCC

Output Engineering or

estimate TCITD / (TCITD

+ ETCC)

JOURNAL ENTRIES • Does not have an income element

o Ignore this when solving for RGP and net

1.1. Incurrence of cost income. See, no effect on net income

Raw materials XX • Think of it as contractors’ protection

Salaries XX

Utilities XX JOURNAL ENTRIES

Cash XX

Cash XX

1.2. Transfer to WIP or CIP Contract retention XX

Construction in progress XX Accounts receivable XX

Raw materials XX

Salaries XX Cash XX

Utilities XX Contract retention XX

But hassle ‘yan, so— MOBILIZATION FEE

1. Incurrence of cost • Liability

Construction in progress XX • Deducted from bills of contractors in equal

Cash XX installment covering the project period

o Just check whatever’s given in the problem

2. Progress billings • Does not have an income element, so ignore

Accounts receivable XX again when solving for RGP and NI

Progress billings XX • Does not affect progress billing, but affects

accounts receivable

3. Collection on progress billings

Cash If profit If loss

Accounts receivable Construction Always (CIP > (CIP <

CI) CI)

4. Profit recognition – POC method CIP + (1

CIP (profit) XX Revenue POC x

CIP – POC) x

Construction costs (bal) XX (as of) TCR

loss

CR XX

CR – CI + (1 –

Cost to

Cost (as of) RGP to POC) x

Construction costs (bal) XX date

date loss

CR XX

CIP (loss) XX

PERCENTAGE OF COMPLETION

5. Settlement

COST-TO-COST METHOD

Building XX

Contract price XX

CIP XX

Total estimated costs

Progress billings XX Costs incurred to date XX

CIP XX Estimated costs to complete XX XX

Total estimated gross profit (A XX

Note: CIP in the year of completion = 0 to D)

Multiply by: POC %

CONSTRUCTION REVENUE USING (R)Gross profit to date XX

PERCENTAGE OF COMPLETION METHOD (R)GP – previous year (XX)

(R)GP – current year XX

• First year • Contract price is affected by

o CR = contract price x POC + escalation clause (increase in certain costs)

• Second/subsequent years - de-escalation clause (opposite)

o CR = contract price x change in POC - penalty clause

- incentive payment

+/- modifications or variations or adjustments

CONTRACT RETENTION Add if: increase in cost

• May be part of billing, but not paid to contractor Deduct if: decrease in cost

Das könnte Ihnen auch gefallen

- LTCC Work BookDokument49 SeitenLTCC Work BookHannah NolongNoch keine Bewertungen

- HO LTCC-StudentsDokument4 SeitenHO LTCC-StudentsYasminNoch keine Bewertungen

- LTCCDokument2 SeitenLTCCN JoNoch keine Bewertungen

- Capital BudgetingDokument27 SeitenCapital BudgetingDilu - SNoch keine Bewertungen

- 6 - Budgect CashflowDokument12 Seiten6 - Budgect CashflowH. DaasNoch keine Bewertungen

- International Capital Budgeting and Cost of CapitalDokument50 SeitenInternational Capital Budgeting and Cost of CapitalGaurav Kumar100% (2)

- Long Term Construction ContractsDokument2 SeitenLong Term Construction ContractsRes GosanNoch keine Bewertungen

- IAS 11 - Construction ContractsDokument2 SeitenIAS 11 - Construction ContractsPatricia Ann TamposNoch keine Bewertungen

- Net Present Value (NPV)Dokument28 SeitenNet Present Value (NPV)Subhan UllahNoch keine Bewertungen

- Acctg For LTCC - IllustrationsDokument13 SeitenAcctg For LTCC - IllustrationsGalang, Princess T.Noch keine Bewertungen

- Finance T3 2017 - w8Dokument39 SeitenFinance T3 2017 - w8aabubNoch keine Bewertungen

- Revenue RecognitionDokument8 SeitenRevenue RecognitionSedrick ChiongNoch keine Bewertungen

- Capital Budgeting - Evaluation TechniquesDokument42 SeitenCapital Budgeting - Evaluation TechniquesShubham KhuranaNoch keine Bewertungen

- Capital Project Evaluation: - Overview and "Vocabulary" - MethodsDokument30 SeitenCapital Project Evaluation: - Overview and "Vocabulary" - Methodsmarco961Noch keine Bewertungen

- Costs or Cash OutflowsDokument4 SeitenCosts or Cash OutflowsLau RencéNoch keine Bewertungen

- Notes For L3Dokument11 SeitenNotes For L3yuyin.gohyyNoch keine Bewertungen

- Revenue Recognition: Long Term ConstructionDokument3 SeitenRevenue Recognition: Long Term ConstructionLee SuarezNoch keine Bewertungen

- Statement of Profitloss OciDokument1 SeiteStatement of Profitloss Ocigummydummy5678Noch keine Bewertungen

- Long-Term Construction Contracts & FranchiseDokument6 SeitenLong-Term Construction Contracts & FranchiseBryan ReyesNoch keine Bewertungen

- Revenue Recognition: Long Term ConstructionDokument3 SeitenRevenue Recognition: Long Term ConstructionLee SuarezNoch keine Bewertungen

- CIVE629 Chapter+02Dokument106 SeitenCIVE629 Chapter+02Jimmy hkNoch keine Bewertungen

- CF FormulaesDokument30 SeitenCF FormulaesKALAI ARASANNoch keine Bewertungen

- BA 2 Short NotesDokument20 SeitenBA 2 Short NotesNivneth PeirisNoch keine Bewertungen

- 3 Capital BudgetingDokument6 Seiten3 Capital BudgetingAshNor RandyNoch keine Bewertungen

- Chapter 6 Capital Allowance Industrial Building AllowanceDokument57 SeitenChapter 6 Capital Allowance Industrial Building AllowancePatricia TangNoch keine Bewertungen

- Accounting Standards AS 7, 9 and 3: DTRTI LucknowDokument44 SeitenAccounting Standards AS 7, 9 and 3: DTRTI LucknowvivekNoch keine Bewertungen

- Capital Budgeting: Kavishe W.FDokument39 SeitenCapital Budgeting: Kavishe W.FThomasaquinos Gerald Msigala Jr.Noch keine Bewertungen

- Chapter Three Project ManagementDokument67 SeitenChapter Three Project ManagementIsuu JobsNoch keine Bewertungen

- Unit 3 Long Term Construction ContractDokument20 SeitenUnit 3 Long Term Construction ContractTrixie Hicalde0% (1)

- FA2 - Sem04 ImpairmentDokument5 SeitenFA2 - Sem04 Impairmenttitu patriciuNoch keine Bewertungen

- Capital BudgetingDokument26 SeitenCapital BudgetingGowryshankar SumatharanNoch keine Bewertungen

- Vsa Taxation Incometaxation Part4.2Dokument14 SeitenVsa Taxation Incometaxation Part4.2lopa.palis.uiNoch keine Bewertungen

- Metalanguage: Utilize The Various Techniques in Evaluating Capital InvestmentsDokument16 SeitenMetalanguage: Utilize The Various Techniques in Evaluating Capital InvestmentsGrowing BiznizNoch keine Bewertungen

- Chapter 7 - Construction ContractsDokument17 SeitenChapter 7 - Construction ContractsMikael James VillanuevaNoch keine Bewertungen

- CAPBUDGETINGfinalDokument68 SeitenCAPBUDGETINGfinalmeowgiduthegreatNoch keine Bewertungen

- Reviewer Financial ManagementDokument39 SeitenReviewer Financial ManagementDerek Dale Vizconde NuñezNoch keine Bewertungen

- Chapter 6 Capital AllowanceDokument59 SeitenChapter 6 Capital AllowanceKailing KhowNoch keine Bewertungen

- P2 Construction Contract - GuerreroDokument22 SeitenP2 Construction Contract - GuerreroCelen OchocoNoch keine Bewertungen

- Lecture 8 Construction Contracts Ias 11 Revision Notes PDFDokument6 SeitenLecture 8 Construction Contracts Ias 11 Revision Notes PDFKim Nicole ReyesNoch keine Bewertungen

- Depreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Dokument3 SeitenDepreciable Amount (Total) Depreciation Rate (Per Year) Depreciation Expense (Per Year)Charles Kevin Mina100% (1)

- CF AfterMT UpdatedDokument116 SeitenCF AfterMT UpdatednitinNoch keine Bewertungen

- CH 7-11Dokument319 SeitenCH 7-11anynameNoch keine Bewertungen

- L11 Mmi Bma 19 Financing and ValuationDokument28 SeitenL11 Mmi Bma 19 Financing and ValuationchooisinNoch keine Bewertungen

- Cash Flows StatementsDokument4 SeitenCash Flows StatementsMae-shane SagayoNoch keine Bewertungen

- Investment NotesDokument12 SeitenInvestment NotesNtege SimonNoch keine Bewertungen

- Petroleum EconomicsDokument11 SeitenPetroleum EconomicsDivine Oghosa BazuayeNoch keine Bewertungen

- Pak Taufikur CH 11 Financial Management BrighamDokument69 SeitenPak Taufikur CH 11 Financial Management BrighamRidhoVerianNoch keine Bewertungen

- CF EstimationDokument97 SeitenCF Estimationdanish khanNoch keine Bewertungen

- 15.401 Recitation 15.401 Recitation: 8: Capital BudgetingDokument17 Seiten15.401 Recitation 15.401 Recitation: 8: Capital BudgetingJohnNoch keine Bewertungen

- CF Lecture 23 3Dokument68 SeitenCF Lecture 23 3jrwang429Noch keine Bewertungen

- Cost and Revenue Analysis Chapter 2 Unit 4Dokument51 SeitenCost and Revenue Analysis Chapter 2 Unit 4desiredmalehereNoch keine Bewertungen

- 2021CFA二级公司金融 基础班 PDFDokument228 Seiten2021CFA二级公司金融 基础班 PDFCHAN StephenieNoch keine Bewertungen

- Session 7 Financial Analysis - Upto P & LDokument10 SeitenSession 7 Financial Analysis - Upto P & LVismay WadiwalaNoch keine Bewertungen

- Longterm Investment DecisionDokument4 SeitenLongterm Investment DecisionDijheyNavarraNoch keine Bewertungen

- L03 - Real Sector Accounts, Analysis and ForecastingDokument29 SeitenL03 - Real Sector Accounts, Analysis and ForecastingDekon MakroNoch keine Bewertungen

- FAR NotesDokument3 SeitenFAR NotesMay Grethel Joy PeranteNoch keine Bewertungen

- Capital Asset Investment: Strategy, Tactics and ToolsVon EverandCapital Asset Investment: Strategy, Tactics and ToolsBewertung: 1 von 5 Sternen1/5 (1)

- Equity Valuation: Models from Leading Investment BanksVon EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNoch keine Bewertungen

- BVPS and Eps Exercises PDFDokument9 SeitenBVPS and Eps Exercises PDFKyla Valencia NgoNoch keine Bewertungen

- Pledge and Mortgage PDFDokument43 SeitenPledge and Mortgage PDFKyla Valencia NgoNoch keine Bewertungen

- Revenue From Contracts With Customers: Ifrs 15Dokument64 SeitenRevenue From Contracts With Customers: Ifrs 15Kyla Valencia NgoNoch keine Bewertungen

- Adv2 KahootDokument3 SeitenAdv2 KahootKyla Valencia NgoNoch keine Bewertungen

- Answer: Wrong Wrong WrongDokument2 SeitenAnswer: Wrong Wrong WrongKyla Valencia NgoNoch keine Bewertungen

- Guaranty, Loan, DepositDokument15 SeitenGuaranty, Loan, DepositKyla Valencia Ngo100% (1)

- Auditing MCQs Multiple Choice Questions and Answers 2023 - Auditing MCQs For B.Com, CA, CS and CMA ExamsDokument38 SeitenAuditing MCQs Multiple Choice Questions and Answers 2023 - Auditing MCQs For B.Com, CA, CS and CMA Examsvenakata3722Noch keine Bewertungen

- LifeInsRetirementValuation M05 LifeValuation 181205Dokument83 SeitenLifeInsRetirementValuation M05 LifeValuation 181205Jeff JonesNoch keine Bewertungen

- Modern BankingDokument15 SeitenModern BankingRavi ChavdaNoch keine Bewertungen

- IFRS 15 vs. IAS 18: Huge Change Is Here!: Ifrs Accounting Most Popular Revenue Recognition 305Dokument10 SeitenIFRS 15 vs. IAS 18: Huge Change Is Here!: Ifrs Accounting Most Popular Revenue Recognition 305sharifNoch keine Bewertungen

- Startup Accelerator Rankings Methodology & Companion Report - Kellogg School of Management NorthwesternDokument4 SeitenStartup Accelerator Rankings Methodology & Companion Report - Kellogg School of Management NorthwesternFrank Gruber50% (2)

- Contract of AntichresisDokument2 SeitenContract of Antichresisjoshboracay100% (9)

- Islami Bank Bangladesh Limited: Dhanmondi BranchDokument1 SeiteIslami Bank Bangladesh Limited: Dhanmondi BranchMonirul IslamNoch keine Bewertungen

- Summer Traning Report of Working Capital Manegment (CCBL)Dokument62 SeitenSummer Traning Report of Working Capital Manegment (CCBL)PrabhatNoch keine Bewertungen

- Golf Course Business Plan - Union College 2009Dokument48 SeitenGolf Course Business Plan - Union College 2009flippinamsterdam100% (2)

- You Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalDokument28 SeitenYou Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalSamima KhatunNoch keine Bewertungen

- Itr1 PreviewDokument7 SeitenItr1 Previewsanthoush sankarNoch keine Bewertungen

- Jurnal Bahasa InggrisDokument15 SeitenJurnal Bahasa InggrisYasinta JebautNoch keine Bewertungen

- Transactions History: Account HolderDokument3 SeitenTransactions History: Account Holder13KARATNoch keine Bewertungen

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Dokument1 SeiteTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)raviNoch keine Bewertungen

- 2012a Buyback NoticeDokument4 Seiten2012a Buyback Noticekv chandrasekerNoch keine Bewertungen

- KAMM Notes Taxation Bar 2021Dokument115 SeitenKAMM Notes Taxation Bar 2021Bai MonadinNoch keine Bewertungen

- Notice To Loan RepaymentDokument2 SeitenNotice To Loan RepaymentDebasish NathNoch keine Bewertungen

- Galgotias University Vishwajeet Singh S/O Kuldeep SinghDokument1 SeiteGalgotias University Vishwajeet Singh S/O Kuldeep SinghAashika SinghNoch keine Bewertungen

- Gap Thesis and The Survival of Informal Financial Sector in NigeriaDokument6 SeitenGap Thesis and The Survival of Informal Financial Sector in NigeriaMadiha MunirNoch keine Bewertungen

- Suppose The Government Borrows 20 Billion More Next Year ThanDokument2 SeitenSuppose The Government Borrows 20 Billion More Next Year ThanMiroslav GegoskiNoch keine Bewertungen

- Comprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Dokument4 SeitenComprehensive Quiz No. 007-Hyperinflation Current Cost Acctg - GROUP-3Jericho VillalonNoch keine Bewertungen

- PG - M.com - Commerce (English) - 31031 Investment Analysis and Portfolio ManagementDokument166 SeitenPG - M.com - Commerce (English) - 31031 Investment Analysis and Portfolio ManagementDeeNoch keine Bewertungen

- Solution 1-5 1Dokument4 SeitenSolution 1-5 1Dan Edison RamosNoch keine Bewertungen

- Chapter 05 MCQsDokument7 SeitenChapter 05 MCQsElena WangNoch keine Bewertungen

- I-Byte Business Services July 2021Dokument64 SeitenI-Byte Business Services July 2021IT ShadesNoch keine Bewertungen

- Beepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023Dokument39 SeitenBeepedia Weekly Current Affairs (Beepedia) 16th-22nd December 2023BRAJ MOHAN KUIRYNoch keine Bewertungen

- 3rd LectureDokument4 Seiten3rd LectureHarpal Singh HansNoch keine Bewertungen

- Dispute FormDokument1 SeiteDispute Formuzair muhdNoch keine Bewertungen

- Annuity DueDokument2 SeitenAnnuity DueJsbebe jskdbsj50% (2)

- BEEX - One-The First Fully Transparent Integrated Crypto ExchangeDokument2 SeitenBEEX - One-The First Fully Transparent Integrated Crypto ExchangeRendy NeoubuxNoch keine Bewertungen