Beruflich Dokumente

Kultur Dokumente

0452 w17 Ms 21 PDF

Hochgeladen von

NyarlathotepOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

0452 w17 Ms 21 PDF

Hochgeladen von

NyarlathotepCopyright:

Verfügbare Formate

Cambridge Assessment International Education

Cambridge International General Certificate of Secondary Education

ACCOUNTING 0452/21

Paper 2 October/November 2017

MARK SCHEME

Maximum Mark: 120

Published

This mark scheme is published as an aid to teachers and candidates, to indicate the requirements of the

examination. It shows the basis on which Examiners were instructed to award marks. It does not indicate the

details of the discussions that took place at an Examiners’ meeting before marking began, which would have

considered the acceptability of alternative answers.

Mark schemes should be read in conjunction with the question paper and the Principal Examiner Report for

Teachers.

Cambridge International will not enter into discussions about these mark schemes.

Cambridge International is publishing the mark schemes for the October/November 2017 series for most

Cambridge IGCSE®, Cambridge International A and AS Level components and some Cambridge O Level

components.

® IGCSE is a registered trademark.

This document consists of 9 printed pages.

© UCLES 2017 [Turn over

0452/21 Cambridge IGCSE – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

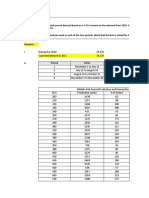

1(a) Brian account 15

$ $

2016 2017

Aug 1 Balance b/d 1 000 July 31 Cash 720 (1)

Bad debts 280 (1)

1 000 1 000

Bad debts account

$ $

2017 2017

July 31 Total to date 990 July 31 Income

Brian 280 (1) Statement 1 270 (1)OF

1 270 1 270

Bad debts recovered account

$ $

2017 2017

July 31 Income July 31 Bank

Statement* 118 (1) (AL Stores) 118 (1)

118 118

* Alternately accept transfer to bad debts account and net transfer from bad

debts to income statement

Rent account

$ $

2017 2017

July 31 Total paid 5 200 July 31 Balance c/d 400

Drawings 1 200 (1)

Income Statement 3 600 (1)OF

5 200 5 200

2017

Aug 1 Balance b/d 400 (1)

Drawings account

$ $

2017 2017

July 31 Total to date 9 650 July 31 Capital 10 850 (1)OF

Rent 1 200 (1)OF

10 850 10 850

Commission receivable account

$ $

2017 2017

July 31 Income July 31 Total to date 890

Statement 1 040 (1) Balance c/d 150

1 040 1 040

2017

Aug 1 Balance b/d 150 (1)

© UCLES 2017 Page 2 of 9

0452/21 Cambridge IGCSE – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

1(a) Provision for depreciation of office fixtures account

$ $

2017 2016

July 31 Balance c/d 15 435 Aug 1 Balance b/d 11 100

2017

July 31 Income 4 335 (1)

Statement

15 435 15 435

2017

Aug 1 Balance b/d 15 435 (1)OF

1(b) An estimate (1) of the amount which a business will lose/be unable to collect 2

in a financial year because of bad debts (1)

1(c) Percentage of the total amount owing by credit customers 1

Estimating which individual credit customers will not pay their accounts

Considering the length of time the debts have been outstanding

Estimate, based on experience, of amount lost each year from bad debts

Any 1 point (1)

1(d) debit credit 2

Income statement (1) Provision for doubtful debts (1)

1(e) The profit for the year is not overstated (1) 2

The trade receivables (current assets) are not overstated/shown at more

realistic value (1)

1(f) The sales for which a business is unlikely to be paid (1) are regarded as 2

an expense of the year in which those sales are made (1)

1(g) Reduce credit sales/sell on a cash basis 2

Obtain references from new credit customers

Fix a credit limit for each customer

Improve credit control

Issue invoices and monthly statements promptly

Refuse further supplies until outstanding balance is paid

Allow cash discount for prompt payment

Charge interest on overdue accounts

Any 2 points (1) each

© UCLES 2017 Page 3 of 9

0452/21 Cambridge IGCSE – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

2(a) 9

debit credit no entry

opening balance owed by credit customers 9(1)

credit sales 9(1)

cash sales 9(1)

provision for doubtful debts 9(1)

bad debts written off 9(1)

cash discount allowed to credit customers 9(1)

trade discount allowed to credit customers 9(1)

contra between sales and purchases ledger 9(1)

cash received from credit customers 9(1)

2(b) book of prime (original) entry 4

returns to credit suppliers purchases returns journal (1)

discount received cash book (1)

interest charged by credit supplier journal (1)

contra entry to sales ledger control journal (1)

account

2(c)(i) An entry which appears on the debit side of the purchases ledger control 1

account and the credit of the sales ledger control account (1)

2(c)(ii) It is made when a sales ledger account is set off against a purchases ledger 1

account of the same person/business (1)

2(d) Overpayment of the amount owing 2

Failure to deduct cash discount due

Goods returned after account settled

Payment made in advance

Any 2 reasons (1) each

2(e)(i) Trade receivables 365 1

× } whole formula (1)

Credit sales 1

2(e)(ii) 20 520 365 2

× } whole formula (1)

186 700 1

= 40.11 = 41 days (1)

2(f) Offer cash discount for prompt payment 2

Charge interest on overdue accounts

Improve credit control/send invoices or statements promptly

Refuse further supplies until outstanding balance paid

Invoice discounting and debt factoring

Any 2 points (1) each

© UCLES 2017 Page 4 of 9

0452/21 Cambridge IGCSE – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

2(g) Trade payables 365 1

× } whole formula (1)

Credit purchases 1

2(h) Will not be pleased 2

May refuse further supplies

May charge interest

May issue stern reminders/threaten legal action

Or other suitable comment

Any 2 comments (1) each

Question Answer Marks

3(a) 5

$ $

Subscriptions received 12 540 (1)

Add Subscriptions outstanding at year end 240 (1)

12 780

Less Subscriptions prepaid at year end 180 (1)

Subscriptions outstanding at start of year 600 (1) 780

Subscriptions for the year 12 000 (1)

Accept alternative presentation

3(b) AS Sports Club 9

Income and Expenditure Account for the year ended 30 September 2017

$ $ $

Income

Subscriptions 12 000 (1)OF

Profit on shop – revenue 3 510

– less purchases 2 410 1 100 (1)

13 100

Expenditure

Rates and insurance

(1500 (1) + 60 (1)) 1 560

Open day – expenses 5 250

less receipts 4 180 1 070 (1)

Rent 1 800 }(1)

General expenses 2 640 }

Loan interest (5% × 7 000) 350 (1)

Depreciation of Equipment

((22 000 + 8 000) × 20%) 6 000 (1) 13 420

Deficit 320 (1)OF

© UCLES 2017 Page 5 of 9

0452/21 Cambridge IGCSE – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

3(c) AS Sports Club 9

Statement of Financial Position at 30 September 2017

$ $ $

Assets

Non-current assets Cost Accumulated Book

depreciation value

Equipment 30 000 10 400 (1)OF 19 600 (1)OF

Current assets

Other receivables

(Subscriptions) 240 (1)

Total assets 19 840

Liabilities

Accumulated fund

Opening balance 11 870 (1)

Less Deficit 320 (1)OF

11 550

Non-current liabilities

Bank loan

(repayable 2020) 7 000 (1)

Current liabilities

Other payables 350 (1)OF

(loan interest)

Subscriptions prepaid 180 (1)

Bank 760 (1)

1 290

Total liabilities 19 840

3(d) Loan interest is an expense account/any accrued interest is a current 2

liability (1)

The loan is a non-current liability (1)

Accept other valid points

Question Answer Marks

4(a) (87 500 + 56 200 + 100) : (81 500 + 17 100) 2

= 143 800 : 98 600 (1) whole formula

= 1.46 : 1 (1)

4(b) Current assets only approximately 1½ times the current liabilities 2

Lower than the “benchmark” of 2:1

Can meet the current liabilities from the current assets

Do not have a lot of surplus current assets available after paying current

liabilities

Seems to be a little inadequate (depending on the type of business)

Comments to be based on answer to (a)

Any 2 comments (1) each

© UCLES 2017 Page 6 of 9

0452/21 Cambridge IGCSE – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

4(c) (56 200 + 100) : (81 500 + 17 100) 2

= 56 300 : 98 600 (1) whole formula

= 0.57 : 1 (1)

4(d) Increased expenditure on inventory 2

Increase in bank overdraft/change from positive bank balance to overdraft

Purchase of non-current assets

Repayment of long-term loan

Increase in current liabilities/increase in trade payables

Decrease in trade receivables

Decrease in cash

Increase in drawings

Any 2 reasons (1) each

4(e) Unable to pay debts when they fall due 2

Unable to take advantage of cash discounts

Unable to take advantage of business opportunities when they arise

May have difficulty in obtaining further supplies

May not be able to take drawings

Any 2 points (1) each

4(f) current ratio quick ratio 4

no no

increase decrease effect increase decrease effect

introduce 9 9

$20 000

additional

capital

obtain short- 9(1) 9(1)

term bank loan

of $10 000

sell half the 9(1) 9(1)

inventory at

cost price

4(g) Cost of sales 1

Average inventory

4(h) 765 990 765 990 2

Or

(87 500 + 72000) ÷ 2 87 500 − (15 500 ÷ 2)

765 990

= } (1)

79 750

= 9.60 times (1)

4(i) Higher inventory levels 2

Lower sales activity

Or other suitable reason

Any 2 reasons (1) each

© UCLES 2017 Page 7 of 9

0452/21 Cambridge IGCSE – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

5(a) 43 000 3

(500 000 + 11 000 + 14 000 + 75 000

43 000 (1) 100

= ×

600 000 (1) 1

= 7.17% (1)

5(b) 25 000 100 1

×

500 000 1

= 5%

5(c) 15 000 + 30 000 100 3

×

500 000 + 100 000 1

45 000 (1)

=

600 000 (1)

= 7.5% (1)

5(d) 71 000 – (3% × 75 000) (1) 2

= 71 000 – 2250

= 68 750 (1)

5(e) CP Limited 7

Statement of Changes in Equity for the year ended 30 September 2017

Ordinary General Retained Total

share reserve earnings

capital

$ $ $ $

On 1 October 2016 500 000 11 000 14 000 525 000 (1)

Share issue 100 000 100 000 (1)

Profit for the year 68 750 68 750 (1)OF

Dividend paid (25 000) (25 000) (1)

(for year ended 30

September 2016)

Dividend paid (15 000) (15 000) (1)

(for year ended 30

September 2017)

Transfer to general 5 000 (5 000) (1)

reserve

On 30 September 600 000 16 000 37 750 653 750 (1)

2017

© UCLES 2017 Page 8 of 9

0452/21 Cambridge IGCSE – Mark Scheme October/November

PUBLISHED 2017

Question Answer Marks

5(f) Long term loans 2

Debenture holders are not members of the company

Do not carry voting rights

Carry a fixed rate of interest

Interest is not dependent on the company's profit

Are often secured on the assets of the company's

Debenture holders are repaid before the shareholders in a winding-up

Any 2 features (1) each

5(g) Carry a fixed rate of dividend 2

Dividend may not be paid if there is not enough profit

Dividend is paid before ordinary share dividend

Preference shareholders are members of the company

Do not usually carry voting rights

Capital is repaid before ordinary share capital in a winding-up

Are not secured on the assets of the company

Any 2 features (1) each

5(h) increase decrease no 5

$ $ effect

effect on current assets 300 000

effect on non-current liabilities 300 000

(1)

effect on profit for the year 9 000

(2)*

effect on profit available for ordinary 9 000

shareholders (1)OF

effect on equity 9(1)

* (1) position + (1) amount

© UCLES 2017 Page 9 of 9

Das könnte Ihnen auch gefallen

- 0452 s17 Ms 23Dokument12 Seiten0452 s17 Ms 23Vyakt MehtaNoch keine Bewertungen

- Cambridge International Examinations: Principles of Accounts 7110/22 May/June 2017Dokument13 SeitenCambridge International Examinations: Principles of Accounts 7110/22 May/June 2017Phiri AgnesNoch keine Bewertungen

- Cambridge Assessment International Education: Principles of Accounts 7110/22 October/November 2017Dokument13 SeitenCambridge Assessment International Education: Principles of Accounts 7110/22 October/November 2017Makanaka MutandariNoch keine Bewertungen

- Cambridge International Examinations: Accounting 0452/22 March 2017Dokument13 SeitenCambridge International Examinations: Accounting 0452/22 March 2017Mike ChindaNoch keine Bewertungen

- Cambridge Assessment International Education: Accounting 0452/22 October/November 2017Dokument12 SeitenCambridge Assessment International Education: Accounting 0452/22 October/November 2017pyaaraasingh716Noch keine Bewertungen

- 0452 m17 Ms 22Dokument13 Seiten0452 m17 Ms 22Mohammed MaGdyNoch keine Bewertungen

- Cambridge International Examinations: Principles of Accounts 7110/21 May/June 2017Dokument9 SeitenCambridge International Examinations: Principles of Accounts 7110/21 May/June 2017Taha AhmedNoch keine Bewertungen

- Accrual & PrepaymentsDokument4 SeitenAccrual & PrepaymentsronstarcaristaNoch keine Bewertungen

- Zodeq Vision - Accounting LedgersDokument24 SeitenZodeq Vision - Accounting LedgerskeemorodriquezNoch keine Bewertungen

- Rent 2017 - 2018Dokument9 SeitenRent 2017 - 2018Muhammad SamiNoch keine Bewertungen

- Cambridge Assessment International Education: Accounting 9706/23 October/November 2017Dokument8 SeitenCambridge Assessment International Education: Accounting 9706/23 October/November 2017ASHITA AGARWAL-01841Noch keine Bewertungen

- Accruals Q1 AnswerDokument2 SeitenAccruals Q1 AnswerRiyu RimmyNoch keine Bewertungen

- 2017 BGSS 4E5N Prelim P2Dokument10 Seiten2017 BGSS 4E5N Prelim P2Damien SeowNoch keine Bewertungen

- May 2018 Professional Examinations Financial Accounting (Paper 1.1) Chief Examiner'S Report, Questions and Marking SchemeDokument28 SeitenMay 2018 Professional Examinations Financial Accounting (Paper 1.1) Chief Examiner'S Report, Questions and Marking SchemeJoseph PhaustineNoch keine Bewertungen

- Cambridge International Advanced Subsidiary and Advanced LevelDokument12 SeitenCambridge International Advanced Subsidiary and Advanced LevelTatenda NdlovuNoch keine Bewertungen

- AY1718 Finals (Actual) Sem 1 SolutionsDokument33 SeitenAY1718 Finals (Actual) Sem 1 SolutionsshermaineNoch keine Bewertungen

- In Class Activity Solution 4.1Dokument17 SeitenIn Class Activity Solution 4.1Jeanelle ColaireNoch keine Bewertungen

- Pakpattan Campus Admin BlockDokument5 SeitenPakpattan Campus Admin Blockpisourie25Noch keine Bewertungen

- Accounting Nov 2017 AddendumDokument16 SeitenAccounting Nov 2017 Addendumkwanele andiswaNoch keine Bewertungen

- 0452 Specimen Paper Answers Paper 2 (For Examination From 2020)Dokument26 Seiten0452 Specimen Paper Answers Paper 2 (For Examination From 2020)Divya SinghNoch keine Bewertungen

- 1210 B C A T A (1071)Dokument6 Seiten1210 B C A T A (1071)rindah100% (2)

- Question No 06 Chapter No 12 - D.K Goal 11 ClassDokument1 SeiteQuestion No 06 Chapter No 12 - D.K Goal 11 ClassNafe MNoch keine Bewertungen

- Cambridge Assessment International Education: Accounting 9706/32 October/November 2017Dokument11 SeitenCambridge Assessment International Education: Accounting 9706/32 October/November 2017Phiri Arah RachelNoch keine Bewertungen

- Accruals Q2 AnswerDokument1 SeiteAccruals Q2 AnswerRiyu RimmyNoch keine Bewertungen

- Cambridge Assessment International Education: Accounting 9706/31 October/November 2017Dokument14 SeitenCambridge Assessment International Education: Accounting 9706/31 October/November 2017Phiri Arah RachelNoch keine Bewertungen

- Bzops9157a 2018 PDFDokument4 SeitenBzops9157a 2018 PDFVikas AhlawatNoch keine Bewertungen

- Paper 2 AccountsDokument20 SeitenPaper 2 AccountsRukudzo Prince MugabeNoch keine Bewertungen

- KDNSK00573390000010660 New PDFDokument2 SeitenKDNSK00573390000010660 New PDFDilip TiwariNoch keine Bewertungen

- Cambridge International Examinations: Accounting 0452/11 May/June 2017Dokument11 SeitenCambridge International Examinations: Accounting 0452/11 May/June 2017Ayman ZarifNoch keine Bewertungen

- BRPAT00098400000056652 NewDokument8 SeitenBRPAT00098400000056652 NewWorld WebNoch keine Bewertungen

- Cambridge International Advanced Subsidiary and Advanced LevelDokument20 SeitenCambridge International Advanced Subsidiary and Advanced LevelRay DoughNoch keine Bewertungen

- Year To 31 Dec Bad Debts Written Off Debtors at 31 Dec % Provision For Doubtful DebtsDokument4 SeitenYear To 31 Dec Bad Debts Written Off Debtors at 31 Dec % Provision For Doubtful DebtsHopeNoch keine Bewertungen

- Mark Scheme: Extra Assessment Material For First Teaching September 2017Dokument13 SeitenMark Scheme: Extra Assessment Material For First Teaching September 2017shamNoch keine Bewertungen

- E4-1 Dixon Company Worksheet For The Month Ended June 30, 2017Dokument7 SeitenE4-1 Dixon Company Worksheet For The Month Ended June 30, 2017Quynh Cao PhuongNoch keine Bewertungen

- 1 - Staff Salaries - 2Dokument1 Seite1 - Staff Salaries - 2Nikhil PatilNoch keine Bewertungen

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDokument2 SeitenLNL Iklcqd /: Employee Share Employer Share Employee Share Employer Shareshubham chutkeNoch keine Bewertungen

- 1563470470430iGymZrii86pAaf8p PDFDokument2 Seiten1563470470430iGymZrii86pAaf8p PDFPreeti SinghNoch keine Bewertungen

- LNL Iklcqd /: Page 1 of 5Dokument5 SeitenLNL Iklcqd /: Page 1 of 5Shakeel RizviNoch keine Bewertungen

- Accounting Test TravelokaDokument8 SeitenAccounting Test TravelokaGabriella CikaNoch keine Bewertungen

- Subsidiary Ledger: Department of Public Works and HighwaysDokument1.881 SeitenSubsidiary Ledger: Department of Public Works and HighwaysKenneth Cyrus OlivarNoch keine Bewertungen

- Exercises 20.4A Bad DebtsDokument1 SeiteExercises 20.4A Bad DebtsCarolnesa Dorie Tan Kar MeanNoch keine Bewertungen

- Irrecoverable Debts & Provision For Doubtful DebtsDokument3 SeitenIrrecoverable Debts & Provision For Doubtful Debtsrichieco.saichi.studentNoch keine Bewertungen

- ALI Intelligence Report 2014Dokument12 SeitenALI Intelligence Report 2014Liyana ShahiminNoch keine Bewertungen

- IGCSE Accounting All Mark Scheme 2002 Summer 2018Dokument1.453 SeitenIGCSE Accounting All Mark Scheme 2002 Summer 2018Muhammad Arif100% (2)

- LNL Iklcqd /: Page 1 of 4Dokument4 SeitenLNL Iklcqd /: Page 1 of 4Sandeep KumarNoch keine Bewertungen

- Laporan Keuangan Konsolidasian PT Garda Tujuh Buana TBK 31 Des 2017Dokument82 SeitenLaporan Keuangan Konsolidasian PT Garda Tujuh Buana TBK 31 Des 2017mahyuniNoch keine Bewertungen

- Ngwata Friends SHGDokument19 SeitenNgwata Friends SHGrobert mogakaNoch keine Bewertungen

- DSNHP15921520000010002 NewDokument6 SeitenDSNHP15921520000010002 NewKundan KumarNoch keine Bewertungen

- HRKNL00191690000010126 NewDokument4 SeitenHRKNL00191690000010126 NewMukul BhallaNoch keine Bewertungen

- LNL Iklcqd /: Page 1 of 4Dokument4 SeitenLNL Iklcqd /: Page 1 of 4Mukul BhallaNoch keine Bewertungen

- WBDGP00390720000018278 NewDokument6 SeitenWBDGP00390720000018278 NewSandipan DasNoch keine Bewertungen

- Cambridge International Advanced Subsidiary and Advanced LevelDokument13 SeitenCambridge International Advanced Subsidiary and Advanced LevelAR RafiNoch keine Bewertungen

- 9706 m17 Ms 32Dokument16 Seiten9706 m17 Ms 32FarrukhsgNoch keine Bewertungen

- 9706 Accounting: MARK SCHEME For The May/June 2014 SeriesDokument5 Seiten9706 Accounting: MARK SCHEME For The May/June 2014 SeriesMateeh-ur -rehmanNoch keine Bewertungen

- LNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareDokument2 SeitenLNL Iklcqd /: Employee Share Employer Share Employee Share Employer ShareMurali MohanNoch keine Bewertungen

- DLCPM00312970000220848 NewDokument5 SeitenDLCPM00312970000220848 NewAnshul KatiyarNoch keine Bewertungen

- Date Account Titles Debit Credit 2017 April 2 4 5 6 7 10: Company Name General Journal April 31, 2017Dokument7 SeitenDate Account Titles Debit Credit 2017 April 2 4 5 6 7 10: Company Name General Journal April 31, 2017kdjasldkajNoch keine Bewertungen

- Aahpw9410b 2018Dokument4 SeitenAahpw9410b 2018Abhijit WaghNoch keine Bewertungen

- Exam 2017 CFSDokument4 SeitenExam 2017 CFSEpic Gaming MomentsNoch keine Bewertungen

- B2 English Test International Students - TemplateDokument5 SeitenB2 English Test International Students - TemplateMabrur devNoch keine Bewertungen

- Exploring The OriginsDokument12 SeitenExploring The OriginsAlexander ZetaNoch keine Bewertungen

- Lesson PlansDokument9 SeitenLesson Plansapi-238729751Noch keine Bewertungen

- Decemeber 2020 Examinations: Suggested Answers ToDokument41 SeitenDecemeber 2020 Examinations: Suggested Answers ToDipen AdhikariNoch keine Bewertungen

- Rhipodon: Huge Legendary Black DragonDokument2 SeitenRhipodon: Huge Legendary Black DragonFigo FigueiraNoch keine Bewertungen

- HDFCDokument60 SeitenHDFCPukhraj GehlotNoch keine Bewertungen

- 7C Environment Test 2004Dokument2 Seiten7C Environment Test 2004api-3698146Noch keine Bewertungen

- Development of International School at Simhachalam, VisakhapatnamDokument4 SeitenDevelopment of International School at Simhachalam, VisakhapatnammathangghiNoch keine Bewertungen

- News Item GamesDokument35 SeitenNews Item GamesUmi KuswariNoch keine Bewertungen

- Created by EDGAR Online, Inc. Dow Chemical Co /de/ Table - of - Contents Form Type: 10-K Period End: Dec 31, 2020 Date Filed: Feb 05, 2021Dokument286 SeitenCreated by EDGAR Online, Inc. Dow Chemical Co /de/ Table - of - Contents Form Type: 10-K Period End: Dec 31, 2020 Date Filed: Feb 05, 2021Udit GuptaNoch keine Bewertungen

- July 2006 Bar Exam Louisiana Code of Civil ProcedureDokument11 SeitenJuly 2006 Bar Exam Louisiana Code of Civil ProcedureDinkle KingNoch keine Bewertungen

- The Library PK - Library of Urdu BooksDokument8 SeitenThe Library PK - Library of Urdu Bookszamin4pakNoch keine Bewertungen

- Case Study - Lucky Cement and OthersDokument16 SeitenCase Study - Lucky Cement and OthersKabeer QureshiNoch keine Bewertungen

- Teaching English in The Elementary Grades (Language Arts)Dokument21 SeitenTeaching English in The Elementary Grades (Language Arts)RENIEL PABONITANoch keine Bewertungen

- Chelsea Bellomy ResumeDokument1 SeiteChelsea Bellomy Resumeapi-301977181Noch keine Bewertungen

- Swati Bajaj ProjDokument88 SeitenSwati Bajaj ProjSwati SoodNoch keine Bewertungen

- The Organization of PericentroDokument33 SeitenThe Organization of PericentroTunggul AmetungNoch keine Bewertungen

- Catibog Approval Sheet EditedDokument10 SeitenCatibog Approval Sheet EditedCarla ZanteNoch keine Bewertungen

- Malware Reverse Engineering HandbookDokument56 SeitenMalware Reverse Engineering HandbookAJGMFAJNoch keine Bewertungen

- Strama-Ayala Land, Inc.Dokument5 SeitenStrama-Ayala Land, Inc.Akako MatsumotoNoch keine Bewertungen

- Philosophies PrinceDokument4 SeitenPhilosophies PrincePrince CuetoNoch keine Bewertungen

- Republic of The Philippines Legal Education BoardDokument25 SeitenRepublic of The Philippines Legal Education BoardPam NolascoNoch keine Bewertungen

- SoapDokument10 SeitenSoapAira RamoresNoch keine Bewertungen

- The Municipality of Santa BarbaraDokument10 SeitenThe Municipality of Santa BarbaraEmel Grace Majaducon TevesNoch keine Bewertungen

- English Holiday TaskDokument2 SeitenEnglish Holiday Taskchandan2159Noch keine Bewertungen

- Radial ReliefDokument4 SeitenRadial Reliefapi-316485458Noch keine Bewertungen

- Cargill VinodDokument98 SeitenCargill Vinodsaurajindal09Noch keine Bewertungen

- Athletic KnitDokument31 SeitenAthletic KnitNish A0% (1)

- The Nervous System 1ae60 62e99ab3Dokument1 SeiteThe Nervous System 1ae60 62e99ab3shamshadNoch keine Bewertungen

- SMA Releases Online Version of Sunny Design For PV System ConfigurationDokument3 SeitenSMA Releases Online Version of Sunny Design For PV System ConfigurationlakliraNoch keine Bewertungen