Beruflich Dokumente

Kultur Dokumente

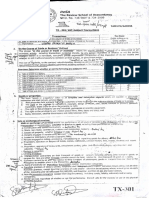

FAR.2916 - Cash and Cash Equivalents.

Hochgeladen von

Eyes SawOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

FAR.2916 - Cash and Cash Equivalents.

Hochgeladen von

Eyes SawCopyright:

Verfügbare Formate

Since 1977

FAR OCAMPO/CABARLES/SOLIMAN/OCAMPO

FAR.2916-Cash and Cash Equivalents OCTOBER 2020

DISCUSSION PROBLEMS

1. A financial instrument is 4. A financial liability is any liability that is:

a. A contract that gives rise to a financial asset of one I. A contractual obligation to deliver cash or another

entity and a financial liability or equity instrument financial asset to another entity

of another entity. II. A contractual obligation to exchange financial

b. A contract under which neither party has assets or financial liabilities with another entity

performed any of its obligations or both parties under conditions that are potentially unfavorable

have partially performed their obligations to an to the entity

equal extent. III. A contract that will or may be settled in the

c. A contract under which one party accepts entity's own equity instruments and is a non-

significant insurance risk from another party by derivative for which the entity is or may be

agreeing to compensate the policyholder if a obliged to deliver a variable number of the

specified uncertain future event adversely affects entity's own equity instruments

the policyholder. IV. A contract that will or may be settled in the

d. A contract that requires the issuer to make entity's own equity instruments and is a

specified payments to reimburse the holder for a derivative that will or may be settled other than

loss it incurs because a specified debtor fails to by the exchange of a fixed amount of cash or

make payment when due in accordance with the another financial asset for a fixed number of the

original or modified terms of a debt instrument. entity's own equity instruments.

a. I, II, III and IV

2. A financial asset is any asset that is:

b. I, II and III only

I. Cash

c. I and II only

II. An equity instrument of another entity

d. III and IV only

III. A contractual right to receive cash or another

financial asset from another entity

5. Using the data given below, compute for the total

IV. A contractual right to exchange financial assets or

amount of items that meet the definition of financial

financial liabilities with another entity under

liability

conditions that are potentially favorable to the

entity Bank overdraft P 100,000

V. A contract that will or may be settled in the Accounts payable 1,200,000

entity's own equity instruments and is a non- Notes payable 500,000

derivative for which the entity is or may be Loans payable 1,800,000

obliged to receive a variable number of the Income tax payable 120,000

entity's own equity instruments Warranty obligations 180,000

VI. A contract that will or may be settled in the Deferred revenue 240,000

entity's own equity instruments and is a Cumulative, redeemable preference

derivative that will or may be settled other than shares at the option of the holder 1,000,000

by the exchange of a fixed amount of cash or Non-cumulative, non-redeemable

another financial asset for a fixed number of the preference shares 2,000,000

entity's own equity instruments.

a. P4,900,000 c. P4,600,000

a. I, II, III, IV, V and VI b. P3,620,000 d. P4,500,000

b. I, II, III, IV and V only

c. I, II, III and IV only 6. Currency (cash) is a financial asset. Why?

d. I, II and III only a. Because it represents the medium of exchange and

is therefore the basis on which all transactions are

3. Using the data given below, compute for the total measured and recognized in financial statements.

amount of items that meet the definition of financial b. Because it represents the contractual right of the

asset depositor to obtain cash from the institution or to

draw a check or similar instrument against the

Cash P 150,000

balance in favor of a creditor in payment of a

Investment in shares – FVTPL 500,000

financial liability.

Investment in associate 2,000,000

c. Because it is an equity instrument of another

Accounts receivable 1,000,000

entity.

Inventories 800,000

d. Because it is a contractual right to exchange

Prepaid rent 50,000

financial assets or financial liabilities with another

Interest rate swap receivable 200,000

entity under conditions that are potentially

Investment in debt securities – FVTOCI 400,000

favorable to the entity.

Investment in debt securities – AC 300,000

Land 2,000,000

7. Cash comprises cash on hand and demand deposits.

Buildings 3,000,000

Which of the following items can be considered as

Machinery and equipment 1,500,000

‘cash’?

Patents 250,000

I. Credit card receipts representing sales

a. P4,550,000 c. P2,550,000 II. Bitcoins

b. P4,600,000 d. P2,600,000 III. US dollar bills

IV. Certificates of deposit

Page 1 of 4 www.facebook.com/excel.prtc FAR.2916

EXCEL PROFESSIONAL SERVICES, INC.

The total amount to be reported as ‘cash’ as of

a. I, II, III and IV c. III only

December 31, 2020 is

b. III and IV only d. None of these

a. P6,300,000 c. P3,300,000

b. P5,300,000 d. P2,300,000

8. Which statement is incorrect regarding cash

equivalents?

12. Compensating balance

a. Cash equivalents are short-term, highly liquid

a. Is a minimum or average balance on deposit with a

investments that are readily convertible to known

bank.

amounts of cash and which are subject to an

b. Constitutes support for existing borrowing

insignificant risk of changes in value.

arrangements.

b. Cash equivalents are held for the purpose of

c. Provides a source of funds to the lender as partial

meeting short-term cash commitments rather than

compensation for the credit extended.

for investment or other purposes.

d. All of these.

c. An investment normally qualifies as a cash

equivalent only when it has a short maturity of,

13. Which statement is correct regarding presentation of

say, three months or less from the end of the

compensating balances?

reporting period.

a. “Legally restricted” deposits held as compensating

d. None, all the statements are correct.

balances should be segregated and reported

separately.

9. Which of the following may qualify as cash equivalents?

b. Deposits held as compensating balances that are

a. Investment in ordinary shares

not “legally restricted” are not shown separately.

b. Investment in share options

However, footnote disclosure is necessary.

c. Investment in preference shares acquired within a

c. Both a and b.

short period of their maturity and with a specified

d. Neither a nor b.

redemption date

d. None of these

14. Tinoc Company borrows P2,000,000 from National

Bank at 12% annual interest. In addition, Tinoc is

10. The following data pertain to Lincoln Corporation on

required to keep a compensatory balance of P200,000

December 31, 2020:

on deposit at National Bank which will earn interest at

Current account at Bangko Dito P1,800,000 4%. The effective interest that Tinoc pays on its

Current account at Bangko Doon (100,000) P2,000,000 loan is

Payroll account at Bangko Dyan 500,000 a. 10.0% c. 12.0%

Foreign bank account b. 11.6% d. 12.9%

(in equivalent pesos) 800,000

Savings account in a closed bank 150,000 15. Ray Company is negotiating a loan with Excel Bank.

Postage stamps 1,000 Ray needs P900,000. As part of the loan agreement,

Employee’s post dated check 4,000 Excel Bank will require Ray to maintain a compensating

IOU from employees 10,000 balance of 15% of the loan amount on deposit in a

Credit memo from a vendor for a checking account at the bank. Ray currently maintains

purchase return 20,000 a balance of P50,000 in the checking account. The

Traveler’s check 50,000 interest rate Ray is required to pay on the loan is 12%.

Money order 30,000 Excel Bank pays 4% interest on checking accounts.

Sinking fund 2,000,000 Determine the effective interest rate on the loan. (Hint:

DAIF check of customer 15,000 Compute the net interest paid on the loan per year and

Customer’s check dated 1/1/21 80,000 the “take home” amount of the loan.)

Time deposit – 30 days 200,000 a. 12.9% c. 13.4%

Money market placement (due 6/30/21) 500,000 b. 12.0% d. 11.4%

Treasury bills, due 3/31/21

(purchased 12/31/20) 200,000 16. The following information pertains to an entity’s cash

Treasury bills, due 1/31/21 account:

(purchased 2/1/20) 300,000

Cash balance, beginning P 880,000

The total amount to be reported as cash and cash Cash receipts from the sale of goods 8,000,000

equivalents as of December 31, 2020 is Cash receipts from dividends and interest 80,000

a. P2,780,000 c. P3,780,000 Cash payments for interest 250,000

b. P3,080,000 d. P3,580,000 Cash payments to suppliers of goods 6,000,000

Cash payments to employees 800,000

11. Baxia Corporation had the following account balances Cash payments to acquire property, plant

at December 31, 2020: and equipment 1,200,000

Cash receipts from sales of property,

Current account at Bank A P2,500,000

plant and equipment 280,000

Savings account at Bank B restricted

Cash payments to acquire equity or debt

for bonds payable due on June 30,

instruments of other entities 520,000

2021 1,000,000

Cash receipts from sales equity or debt

Time deposit at Bank C 3,000,000

instruments of other entities 430,000

Current account at Bank A includes P500,000 of Cash proceeds from issuing shares 1,600,000

compensating balance against short term borrowing Cash payments to owners to redeem the

arrangement at December 31, 2020. The entity’s shares 340,000

compensating balance is legally restricted as to Cash proceeds from borrowings 2,100,000

withdrawal by Baxia. A check of P300,000 dated Cash repayments of amounts borrowed 1,700,000

January 15, 2021 in payment of accounts payable was

The entity’s cash balance at the end of the period is

recorded and mailed on December 31, 2020.

a. P2,480,000 c. P2,650,000

b. P2,560,000 d. P2,840,000

Page 2 of 4 www.facebook.com/excel.prtc FAR.2916

EXCEL PROFESSIONAL SERVICES, INC.

17. An office supplies enterprise, operating on a calendar- 24. Which of the following is true regarding the imprest

year basis, has the following data in its accounting petty cash system?

records: a. Entries are made to the Petty Cash account only to

01/01 12/31 increase or decrease the size of the fund.

Cash P 47,000 b. The Petty Cash account is debited when the fund is

Inventory 101,000 P 93,000 replenished.

Accounts receivable 82,000 116,000 c. The imprest petty cash system in effect adheres to

Accounts payable 68,000 63,000 the rule of disbursement by check.

Sales 1,150,000 d. All of these are not true.

Cost of goods sold 900,000

Operating expenses 200,000

Use the following information for the next three questions.

What is the cash balance at December 31?

a. P50,000 c. P 76,000 The petty cash fund of Guiguinto Company on December

b. P66,000 d. P134,000 31 is composed of the following:

Coins and currencies P14,000

18. Which of the following is not a basic characteristic of a Petty cash vouchers:

system of cash control? Gasoline payments 3,000

a. Use of a voucher system Supplies 1,000

b. Segregated responsibility for handling and Cash advances to employees 2,000

recording cash Employee’s check returned by bank

c. Internal audits at irregular intervals marked NSF 5,000

d. Weekly deposit of all cash received Check drawn by the company payable to

the order of the petty cash custodian,

19. Important elements of an internal control system for representing her salary 20,000

cash disbursements include each of the following A sheet of paper with names of

except: employees together with contribution

a. Only authorized personnel should sign checks. for a birthday gift of a co-employee in

b. All expenditures should be authorized before a the amount of 8,000

check is prepared. P53,000

c. All disbursements, other than very small

The petty cash ledger account has an imprest balance

disbursements, should be made by check.

of P50,000.

d. The same person that prepares the check should

also record it to the proper journal.

25. What is the correct amount of petty cash on December

31?

20. The cash receipts function should be separated from

a. P34,000 c. P39,000

the related record keeping in an organization to

b. P14,000 d. P42,000

a. Physically safeguard the cash receipts.

b. Establish accountability when the cash is first

26. The adjusting entry at December 31 would include a

received.

a. Debit to Cash of P16,000

c. Prevent paying cash disbursements from cash

b. Debit to Expenses of P11,000

receipts.

c. Credit to Cash Short or Over of P5,000

d. Minimize undetected misappropriations of cash

d. Credit to Petty Cash Fund of P16,000

receipts.

27. A cash over or short account

21. It consists of misappropriating a collection from one

a. Is not generally accepted

customer and concealing this defalcation by applying a

b. Is debited when the petty cash fund proves out

subsequent collection made from another customer.

over

a. Window dressing c. Kiting

c. Is debited when the petty cash fund proves out

b. Lapping d. Imprest system

short

d. Is a contra account to cash

22. The payments of accounts payable made subsequent to

the close of the accounting period are recorded as if

they were made at the end of the current period. 28. Which statement is incorrect regarding presentation

a. Window dressing c. Kiting and disclosure of cash and cash equivalents?

b. Lapping d. Imprest system a. Cash and cash equivalents are normally presented

as the first line item under current assets.

23. A petty cash system is designed to b. The entity should disclose the components of cash

a. Cash checks for employees and cash equivalents.

b. Handle cash sales c. The entity should disclose the amount of

c. Account for all cash receipts and disbursements significant cash and cash equivalent balances

d. Pay small miscellaneous expenses held by the entity that are not available for use

by the group.

d. Cash on hand should be included under the

disclosures on credit risk.

- now do the DIY drill -

Page 3 of 4 www.facebook.com/excel.prtc FAR.2916

EXCEL PROFESSIONAL SERVICES, INC.

DO-IT-YOURSELF (DIY) DRILL

1. Which statement is true? Notes receivable in the possession of a

a. Certificates of deposit are usually classified as cash collecting agency 12,500

on the statement of financial position. Undeposited receipts, including postdated

b. Companies include postdated checks and petty check for P5,250 and traveler’s check 89,000

cash funds as cash. for P5,000

c. Cash equivalents are investments with original Bond sinking fund – cash 63,750

maturities of six months or less. IOUs signed by employees 2,475

d. Savings accounts are usually classified as cash on Paid vouchers not yet recorded 3,225

the statement of financial position. Total P341,125

At what amount should “Cash on hand and in bank” be

2. On December 31, 2020, the cash account of Jen reported on Ingersoll’s balance sheet?

Company has a debit balance of P3,500,000. An a. P267,375 c. P331,125

analysis of the cash account shows the following b. P250,925 d. P314,675

details:

Undeposited collections P 60,000

Cash in bank-PCIB checking account 500,000 5. The following items were included as cash in the books

Cash in bank-PNB (overdraft) (50,000) of Gotch Co.:

Undeposited NSF check received from a Checking account at Security Bank (P1,200)

customer, dated December 1, 2020 15,000 Checking account at BPI 5,335

Undeposited check from a customer, Checking account at Citytrust used for

dated January 15, 2021 25,000 payment of salaries 5,500

Cash in bank-PCIB (fund for payroll) 150,000 Postage stamps 107

Cash in bank-PCIB (savings deposit) 100,000 Employee’s post-dated check 2,300

Cash in bank-PCIB (money market I.O.U. from an employee 200

instrument, 90 days) 2,000,000 A check marked “DAIF” 1,250

Cash in foreign bank (restricted) 100,000 Postal money order 500

IOUs from officers 30,000 Petty cash fund (P324 in expense

Sinking fund cash 450,000 receipts) 500

Listed stock held as temporary Certificate of time deposit with BPI 5,000

investment 120,000 A gold ring surrendered as security by a

P3,500,000 customer who lost his wallet (at

Cash and cash equivalents on Jen’s December 31, market value) 1,500

2020 statement of financial position should be The correct amount that should be reported as cash is

a. P2,760,000 c. P2,885,000 a. P11,835 c. P16,511

b. P2,810,000 d. P2,935,000 b. P11,011 d. P11,511

3. Diversity Corporation's checkbook balance on 6. Aguinaldo Corporation had the following transactions in

December 31, 2020, was P800,000. In addition, its first year of operations:

Diversity held the following items in its safe on

Sales (90% collected in the first year) P750,000

December 31:

Disbursements for costs and expenses 600,000

Check payable to Diversity Corporation, Purchases of equipment for cash 200,000

dated January 2, 2021, not included in Proceeds from issuance of ordinary

December 31 checkbook balance P200,000 shares 250,000

Check payable to Diversity Corporation, Payments on short-term borrowings 25,000

deposited December 20, and included in Proceeds from short-term borrowings 50,000

December 31 checkbook balance, but Depreciation on equipment 40,000

returned by bank on December 30, Disbursements for income taxes 45,000

stamped "DAIF." The check was Bad debt write-offs 30,000

redeposited January 2, 2021, and

cleared January 7 40,000 What is the cash balance at December 31 of the first

Check drawn on Diversity Corporation's year?

account, payable to a vendor, dated a. P 75,000 c. P 85,000

and recorded December 31, but not b. P105,000 d. P140,000

mailed until January 15, 2021 100,000

The proper amount to be shown as cash on Diversity's 7. Pops Co. established a P3,000 petty cash fund. You

statement of financial position at December 31, 2020, found the following items in the fund:

is

Cash and currency P1,683.80

a. P760,000 c. P860,000

Expense vouchers 829.80

b. P800,000 d. P975,000

Advance to salesman 200.00

IOU from employee 300.00

4. The Ingersoll Co.’s ledger showed a balance in its cash

In the entry to replenish the fund, what amount should

account at December 31, 2020 of P341,125 which was

be debited to Cash Short and Over?

determined to consist of the following:

a. P500.00 c. P13.60

Petty cash fund P 1,800 b. P300.00 d. P 0

Cash per bank statement with a check for

P3,000 still outstanding 168,375 J - end of FAR.2916 - J

Page 4 of 4 www.facebook.com/excel.prtc FAR.2916

Das könnte Ihnen auch gefallen

- Financial Asset at Fair Value - 1S - SY1819 PDFDokument3 SeitenFinancial Asset at Fair Value - 1S - SY1819 PDFPea Del Monte AñanaNoch keine Bewertungen

- 02 Notes Loans and Bonds Payables and Debt Restructuring PDFDokument6 Seiten02 Notes Loans and Bonds Payables and Debt Restructuring PDFKlomoNoch keine Bewertungen

- 2013 SGV Cup Level Up FinalDokument17 Seiten2013 SGV Cup Level Up FinalAndrei GoNoch keine Bewertungen

- Expenditures On The Project Were As Follows:: Problem 3Dokument3 SeitenExpenditures On The Project Were As Follows:: Problem 3Par Cor100% (2)

- Mindanao State University College of Business Administration and Accountancy Marawi CityDokument7 SeitenMindanao State University College of Business Administration and Accountancy Marawi CityHasmin Saripada AmpatuaNoch keine Bewertungen

- Cash and Cash Equivalent LatestDokument53 SeitenCash and Cash Equivalent LatestxagocipNoch keine Bewertungen

- 8 Audit of LiabilitiesDokument4 Seiten8 Audit of LiabilitiesCarieza CardenasNoch keine Bewertungen

- A9 Audit of LiabilitiesDokument7 SeitenA9 Audit of LiabilitiesKezNoch keine Bewertungen

- AP.2904 - Cash and Cash Equivalents.Dokument7 SeitenAP.2904 - Cash and Cash Equivalents.Eyes Saw0% (1)

- Audit of Intangible AssetsDokument2 SeitenAudit of Intangible AssetsJasmine Marie Ng CheongNoch keine Bewertungen

- Q1 - Philippine Accountancy Act of 2004, Code of EthicsDokument10 SeitenQ1 - Philippine Accountancy Act of 2004, Code of EthicsPrankyJellyNoch keine Bewertungen

- National Federation of Junior Philippine Institute of Accountants Financial AccountingDokument8 SeitenNational Federation of Junior Philippine Institute of Accountants Financial AccountingWeaFernandezNoch keine Bewertungen

- Inventories - TheoriesDokument9 SeitenInventories - TheoriesIrisNoch keine Bewertungen

- Discussion Problems: FAR.2928-Notes Payable OCTOBER 2020Dokument3 SeitenDiscussion Problems: FAR.2928-Notes Payable OCTOBER 2020John Nathan KinglyNoch keine Bewertungen

- FAR Summary Lecture (14 May 2021)Dokument10 SeitenFAR Summary Lecture (14 May 2021)rav danoNoch keine Bewertungen

- Cpale Subjects & TopicsDokument12 SeitenCpale Subjects & Topicsnikol sanchezNoch keine Bewertungen

- LiabilitiesDokument6 SeitenLiabilitiesJi YuNoch keine Bewertungen

- Audit Problems FinalDokument48 SeitenAudit Problems FinalShane TabunggaoNoch keine Bewertungen

- Applied Auditing Audit of Receivables Problem 1: QuestionsDokument9 SeitenApplied Auditing Audit of Receivables Problem 1: QuestionsPau SantosNoch keine Bewertungen

- Audit of Cash and Cash EquivalentsDokument9 SeitenAudit of Cash and Cash Equivalentspatricia100% (1)

- Audit of ReceivablesDokument4 SeitenAudit of ReceivablesClarisse AnnNoch keine Bewertungen

- Pas 32 Pfrs 9 Part 2Dokument8 SeitenPas 32 Pfrs 9 Part 2Carmel Therese100% (1)

- Audit of Investments 1Dokument2 SeitenAudit of Investments 1Raz MahariNoch keine Bewertungen

- Cash With AnsDokument6 SeitenCash With AnsHhhhhNoch keine Bewertungen

- Receivable Financing Notes LoansDokument7 SeitenReceivable Financing Notes Loansemman neriNoch keine Bewertungen

- Specialized IndustriesDokument107 SeitenSpecialized IndustriesCristine Joyce ValdezNoch keine Bewertungen

- 03 Gross Profit AnalysisDokument5 Seiten03 Gross Profit AnalysisJunZon VelascoNoch keine Bewertungen

- Chapter 26Dokument8 SeitenChapter 26Mae Ciarie YangcoNoch keine Bewertungen

- At.1822 Comprehensive DrillDokument11 SeitenAt.1822 Comprehensive DrillJolina ManceraNoch keine Bewertungen

- IA1 Financial Assets at Fair ValueDokument11 SeitenIA1 Financial Assets at Fair ValueSteffanie OlivarNoch keine Bewertungen

- Afar 106 - Home Office and Branch Accounting PDFDokument3 SeitenAfar 106 - Home Office and Branch Accounting PDFReyn Saplad PeralesNoch keine Bewertungen

- PSBA - Property, Plant and EquipmentDokument13 SeitenPSBA - Property, Plant and EquipmentAbdulmajed Unda MimbantasNoch keine Bewertungen

- Quiz - Intangible Assets With QuestionsDokument3 SeitenQuiz - Intangible Assets With Questionsjanus lopezNoch keine Bewertungen

- De La Salle Araneta UniversityDokument7 SeitenDe La Salle Araneta UniversityBryent GawNoch keine Bewertungen

- Correction of ErrorsDokument4 SeitenCorrection of Errorsjustine Kiel Sorrosa100% (1)

- Absorption and Variable Costing Act3Dokument2 SeitenAbsorption and Variable Costing Act3Gill Riguera100% (1)

- Investments in Debt SecuritiesDokument19 SeitenInvestments in Debt SecuritiesdfsdfdsfNoch keine Bewertungen

- REVIEWer Take Home QuizDokument3 SeitenREVIEWer Take Home QuizNeirish fainsan0% (1)

- Lease ProblemsDokument15 SeitenLease ProblemsArvigne DorenNoch keine Bewertungen

- Ppe Depreciation and DepletionDokument21 SeitenPpe Depreciation and DepletionEarl Lalaine EscolNoch keine Bewertungen

- 18 x12 ABC A Traditional Cost Accounting (MAS) BobadillaDokument12 Seiten18 x12 ABC A Traditional Cost Accounting (MAS) BobadillaAnnaNoch keine Bewertungen

- FAR 2733 - Share-Based-Payment PDFDokument4 SeitenFAR 2733 - Share-Based-Payment PDFPHI NGUYEN HOANGNoch keine Bewertungen

- Provisions and Contingencies SlidesDokument28 SeitenProvisions and Contingencies SlidesAinnur Arifah100% (1)

- Ra 9298Dokument10 SeitenRa 9298Abraham Mayo MakakuaNoch keine Bewertungen

- Audit of LiabilitiesDokument9 SeitenAudit of LiabilitiesI Am Not Deterred100% (2)

- Auditing and Assurance: Concepts and Applications 2: Outcomes-Based Learning Modules inDokument4 SeitenAuditing and Assurance: Concepts and Applications 2: Outcomes-Based Learning Modules inAngela AralarNoch keine Bewertungen

- FAR 04 - ReceivablesDokument10 SeitenFAR 04 - ReceivablesSheira Mae Sulit Napoles100% (1)

- Auditing Theory AT.0101 - R.A. 9298/accountancy Law MAY 2020: Lecture Notes Overview of RA 9298 and Its IRRDokument16 SeitenAuditing Theory AT.0101 - R.A. 9298/accountancy Law MAY 2020: Lecture Notes Overview of RA 9298 and Its IRRMae100% (1)

- AP - Loans & ReceivablesDokument11 SeitenAP - Loans & ReceivablesDiane PascualNoch keine Bewertungen

- Far/Ap Ocampo/Ocampo LCC-M Accrev and Refreshers Schedule August To December 2020Dokument2 SeitenFar/Ap Ocampo/Ocampo LCC-M Accrev and Refreshers Schedule August To December 2020Andrei Nicole RiveraNoch keine Bewertungen

- Manila Cavite Laguna Cebu Cagayan de Oro Davao: FAR Ocampo/Ocampo First Pre-Board Examination AUGUST 3, 2021Dokument15 SeitenManila Cavite Laguna Cebu Cagayan de Oro Davao: FAR Ocampo/Ocampo First Pre-Board Examination AUGUST 3, 2021Bella Choi100% (1)

- Assertions Audit Objectives Audit Procedures: Audit of Intangible AssetsDokument12 SeitenAssertions Audit Objectives Audit Procedures: Audit of Intangible AssetsUn knownNoch keine Bewertungen

- Chapter 1: Partnership: Part 1: Theory of AccountsDokument10 SeitenChapter 1: Partnership: Part 1: Theory of AccountsKeay Parado0% (1)

- Q AND A's For Sales and CreditsDokument104 SeitenQ AND A's For Sales and CreditsChristine Nathalie Balmes100% (1)

- AFAR 13 Derivatives and Hedge Accounting Under PFRS 9Dokument10 SeitenAFAR 13 Derivatives and Hedge Accounting Under PFRS 9Louie RobitshekNoch keine Bewertungen

- FAR Test BankDokument34 SeitenFAR Test BankRaamah DadhwalNoch keine Bewertungen

- 08 Audit of InvestmentsDokument10 Seiten08 Audit of InvestmentsAryando Mocali TampubolonNoch keine Bewertungen

- ReportsDokument5 SeitenReportsLeanne FaustinoNoch keine Bewertungen

- FAR.2916 - Cash and Cash EquivalentsDokument4 SeitenFAR.2916 - Cash and Cash EquivalentsCathlyn PatalitaNoch keine Bewertungen

- Rey Ocampo Online! FAR: Cash and Cash EquivalentsDokument3 SeitenRey Ocampo Online! FAR: Cash and Cash EquivalentsMacy SantosNoch keine Bewertungen

- A. Inventory of Required Supplies, Equipments, Materials, and Utilities 1. Office Supplies Item Description Qty. Supplier Unit Price Total PriceDokument17 SeitenA. Inventory of Required Supplies, Equipments, Materials, and Utilities 1. Office Supplies Item Description Qty. Supplier Unit Price Total PriceEyes SawNoch keine Bewertungen

- MAS.2906 - Short-Term BudgetingDokument9 SeitenMAS.2906 - Short-Term BudgetingEyes SawNoch keine Bewertungen

- FAR.2920 - Generating Cash From Receivables.Dokument4 SeitenFAR.2920 - Generating Cash From Receivables.Eyes Saw100% (1)

- FAR.2917 - Bank Reconciliation PDFDokument4 SeitenFAR.2917 - Bank Reconciliation PDFEyes Saw0% (1)

- AP.2904 - Cash and Cash Equivalents.Dokument7 SeitenAP.2904 - Cash and Cash Equivalents.Eyes Saw0% (1)

- Tax32 RESA PDFDokument15 SeitenTax32 RESA PDFEyes SawNoch keine Bewertungen

- 04 HPGD1103 T1Dokument24 Seiten04 HPGD1103 T1aton hudaNoch keine Bewertungen

- Blue Ocean Strategy: Case Study: Quick DeliveryDokument29 SeitenBlue Ocean Strategy: Case Study: Quick DeliveryKathy V. Chua-GrimmeNoch keine Bewertungen

- Lesson 2 Cultural Relativism - Part 1 (Reaction Paper)Dokument2 SeitenLesson 2 Cultural Relativism - Part 1 (Reaction Paper)Bai Zaida Abid100% (1)

- Using Games in English Language Learning Mrs Josephine Rama: Jurong Primary SchoolDokument16 SeitenUsing Games in English Language Learning Mrs Josephine Rama: Jurong Primary SchoolChristine NguyễnNoch keine Bewertungen

- Two Steps From Hell Full Track ListDokument13 SeitenTwo Steps From Hell Full Track ListneijeskiNoch keine Bewertungen

- 332-Article Text-1279-1-10-20170327Dokument24 Seiten332-Article Text-1279-1-10-20170327Krisdayanti MendrofaNoch keine Bewertungen

- Yangkam WordlistDokument19 SeitenYangkam Wordlistxdboy2006Noch keine Bewertungen

- Unit 9Dokument3 SeitenUnit 9LexNoch keine Bewertungen

- Structural Analysis Cheat SheetDokument5 SeitenStructural Analysis Cheat SheetByram Jennings100% (1)

- University of Mumbai: Bachelor of Management Studies (Finance) Semester VIDokument73 SeitenUniversity of Mumbai: Bachelor of Management Studies (Finance) Semester VIPranay ShettyNoch keine Bewertungen

- Montessori Methodology To Teach EnglishDokument7 SeitenMontessori Methodology To Teach EnglishRaul Iriarte AnayaNoch keine Bewertungen

- Concrete Batching and MixingDokument8 SeitenConcrete Batching and MixingIm ChinithNoch keine Bewertungen

- Law 431 Course Outline (Aug 22-23)Dokument3 SeitenLaw 431 Course Outline (Aug 22-23)Precious OmphithetseNoch keine Bewertungen

- Impulse: Operation ManualDokument8 SeitenImpulse: Operation ManualRonggo SukmoNoch keine Bewertungen

- 3 - QMT425-T3 Linear Programming (29-74)Dokument46 Seiten3 - QMT425-T3 Linear Programming (29-74)Ashraf RadzaliNoch keine Bewertungen

- 2nd YearDokument46 Seiten2nd YearRajnish DeoNoch keine Bewertungen

- 19 March 2018 CcmaDokument4 Seiten19 March 2018 Ccmabronnaf80Noch keine Bewertungen

- APQP TrainingDokument22 SeitenAPQP TrainingSandeep Malik100% (1)

- Cambridge International Advanced Subsidiary LevelDokument12 SeitenCambridge International Advanced Subsidiary LevelMayur MandhubNoch keine Bewertungen

- Disseminated Tuberculosis in An AIDS/HIV-Infected Patient: AbstractDokument3 SeitenDisseminated Tuberculosis in An AIDS/HIV-Infected Patient: AbstractAmelia Fitria DewiNoch keine Bewertungen

- Spiderman EvolutionDokument14 SeitenSpiderman EvolutionLuis IvanNoch keine Bewertungen

- Project Report On Reliance TrendsDokument91 SeitenProject Report On Reliance TrendsSubash Tej T50% (4)

- Catherine The Great: Catherine II, Empress of RussiaDokument7 SeitenCatherine The Great: Catherine II, Empress of RussiaLawrence James ParbaNoch keine Bewertungen

- Knee Jerk Libertarianism by Frank Van DunnDokument9 SeitenKnee Jerk Libertarianism by Frank Van DunnLuis Eduardo Mella GomezNoch keine Bewertungen

- Bi Tahun 5 Penjajaran RPT 2020Dokument6 SeitenBi Tahun 5 Penjajaran RPT 2020poppy_90Noch keine Bewertungen

- Mendezona vs. OzamizDokument2 SeitenMendezona vs. OzamizAlexis Von TeNoch keine Bewertungen

- Module 7 Weeks 14 15Dokument9 SeitenModule 7 Weeks 14 15Shīrêllë Êllézè Rīvâs SmïthNoch keine Bewertungen

- The Tamil Nadu Commercial Taxes ServiceDokument9 SeitenThe Tamil Nadu Commercial Taxes ServiceKumar AvelNoch keine Bewertungen

- Music TherapyDokument13 SeitenMusic TherapyXavier KiranNoch keine Bewertungen

- A Skunk, A Weasel and A Rat!Dokument174 SeitenA Skunk, A Weasel and A Rat!WalliveBellair100% (1)