Beruflich Dokumente

Kultur Dokumente

Government Accounting Quiz

Hochgeladen von

Kate Fernandez100%(2)100% fanden dieses Dokument nützlich (2 Abstimmungen)

3K Ansichten2 Seiten1. The document contains multiple choice questions related to government budgeting, accounting, and financial management terms.

2. The questions cover topics like the government budget process, accounting entries for transactions, different agencies' roles and responsibilities, and key terms used for things like funds, allotments, obligations, and disbursements.

3. Many questions ask the examinee to identify the correct term or accounting entry for a given definition or transaction described.

Originalbeschreibung:

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument melden1. The document contains multiple choice questions related to government budgeting, accounting, and financial management terms.

2. The questions cover topics like the government budget process, accounting entries for transactions, different agencies' roles and responsibilities, and key terms used for things like funds, allotments, obligations, and disbursements.

3. Many questions ask the examinee to identify the correct term or accounting entry for a given definition or transaction described.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

100%(2)100% fanden dieses Dokument nützlich (2 Abstimmungen)

3K Ansichten2 SeitenGovernment Accounting Quiz

Hochgeladen von

Kate Fernandez1. The document contains multiple choice questions related to government budgeting, accounting, and financial management terms.

2. The questions cover topics like the government budget process, accounting entries for transactions, different agencies' roles and responsibilities, and key terms used for things like funds, allotments, obligations, and disbursements.

3. Many questions ask the examinee to identify the correct term or accounting entry for a given definition or transaction described.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

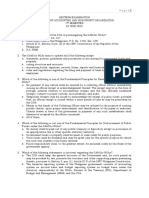

Multiple Choice 6.

It is the legislative authorization to make payments out of

under specified conditions and specific purposes

government funds

1. It is the process of analyzing, recording, classifying, a. Appropriation

summarizing and communicating all transactions involving b. Allotment

the receipt and disposition of government funds and c. Obligation

property and interpreting the results thereof. d. Budgeting

a. Government auditing

b. Government budgeting

7. It is the amount committed to be paid by the government

c. Government accounting

arising from an act of a duly authorized administrative

d. National government

officer and which binds the government to the immediate

and eventual payment of money.

2. The Department of Budget and Management, Department a. Obligation

of Finance, Bureau of Treasury, and Commission on Audit b. Appropriation

are collectively responsible for the Unified Accounts Code c. Allotment

Structure (UACS). Who is responsible for the validation and d. Commitment

assignment of new codes for funding source, organization,

sub-object codes for expenditure items? 8. The journal entry to be made in the books of government

a. Department of Budget and Management agencies/units upon receipt of Notice of Cash Allocation is

b. Department of Finance a. Cash - MDS, Regular Subsidy from National

c. Bureau of Treasury Government

d. Commission on Audit b. Cash in Bank - Local Currency, Current Account

Subsidy from National Government

3. The Department of Budget and Management, Department c. Cash in Bank- Local Currency, Savings Account

of Finance, Bureau of Treasury, and Commission on Audit Subsidy from National Government

are collectively responsible for the Unified Accounts Code d. Cash in Bank - Local Currency, Time Deposit Subsidy

Structure (UACS). Who is responsible for the consistency of from National Government

account classification and coding standards with the

Government Finance Statistics? 9. It is the formal document issued by the Department of

a. Department of Budget and Management Budget and Management to the head of the agency

b. Department of Finance & Bureau of Treasury containing the authorization, conditions and amount of

c. Commission on Audit allocation

d. All of them are responsible a. Special Allotment Release Order

b. Allotment and Obligation Slip

4. This registry shall be maintained by Appropriation Act, by c. Notice of Cash Allocation

Fund Cluster, by Major Fund Output or d. Registry of Allotment and Obligation

Program/Activity/Project for personnel services.

a. Registry of Allotments, Obligations and 10. In government accounting, which of the following is a

Disbursements – Personnel Services Personnel service?

b. Registry of Budget, Utilizations and Disbursements a. Telephone charge

– Personnel Services. b. Rent

c. Registry of Allotment and Notice of Transfer of c. Meal allowance for overtime work

Allocations d. Salaries and wages

d. Registry of Revenue and Other Receipts.

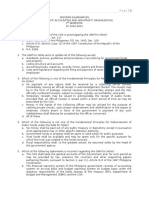

11. In government accounting, which of the following is a capital

5. This form shall be used by the originating offices in the outlay?

utilization of their approved budget allocation for off- a. Salaries and wages

budgetary and custodial funds, such as SAGF, Internally b. Repairs and maintenance

Generated Funds c. Land improvement

a. Budget Utilization Request Status d. Merchandise inventory

b. Obligation Request Status

c. Notice of Budget Utilization Request and Status 12. It is a disbursement authority representing Modified

Adjustments Disbursement Checks issued and direct payments to external

d. Registry of Revenue and Other Receipts – Internally creditors per validated advice to debit account in the list of

Generated Funds/Business related Funds due and demandable accounts payable.

a. Tax Remittance Advice (TRA)

b. Notice of cash Allocation (NCA)

c. Non-cash Availment Authority (NCAA)

d. Cash disbursement Ceiling (CDC)

13. lt is a phase of budget cycle that starts upon the

receipt of the President's budget by the House Speaker

and ends with the President's enactment of the

General Appropriations Act.

a. Budget preparation

b. Budget legislation

c. Budget execution and operation

d. Budget accountability

14. This refers to a government agency, department or

`operating field unit:

a. Entity

b. Corporation

c. Partnership

d. Proprietor

15. Refers to a check issued by government agencies

chargeable against the account of the Treasurer of the

Philippines

a. Modified Disbursement System (MDS) Check

b. Modified Disbursement System

c. Tax Remittance Advice (TRA)

d. Project

Entries:

1. Incurrence of an obligation

Posted to RAOD

2. Collection of a Revenue and its remittance.

Cash – CO xx

AR xx

Cash – Treasury/Agency Deposit, Regular xx

Cash – CO xx

3. Grant of cash advance for payroll

Advances for Payroll xx

Cash-MDS, regular xx

4. Remittance of taxes thru TRA

Due to BIR xx

Cash - TRA xx

Das könnte Ihnen auch gefallen

- Government Accounting NotesDokument24 SeitenGovernment Accounting Noteszee abadilla100% (1)

- Government Accounting Final Examination With Answer and SolutionDokument13 SeitenGovernment Accounting Final Examination With Answer and SolutionRheu Reyes100% (6)

- Midterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsDokument12 SeitenMidterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsLeny Joy Dupo33% (3)

- Midterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsDokument12 SeitenMidterm Exam Government Accounting and Npo Dfcamclp Ay 2020 2021 For Online StudentsNate Dela Cruz100% (1)

- Gov Acc Quiz 1, BeltranDokument2 SeitenGov Acc Quiz 1, BeltranbruuhhhhNoch keine Bewertungen

- This Study Resource Was: Quiz 1: Public Accounting and BudgetingDokument6 SeitenThis Study Resource Was: Quiz 1: Public Accounting and BudgetingReggie AlisNoch keine Bewertungen

- 2020 Dec. MIDTRM EXAM BSA 3A Accounting For Got. NPODokument6 Seiten2020 Dec. MIDTRM EXAM BSA 3A Accounting For Got. NPOVernn100% (1)

- Government-Accounting PH 2021Dokument14 SeitenGovernment-Accounting PH 2021Vince Perolina100% (3)

- Acctg 11 Answer Key Chapter 1 and Chapter 2 Quiz PDFDokument7 SeitenAcctg 11 Answer Key Chapter 1 and Chapter 2 Quiz PDFRandelle James FiestaNoch keine Bewertungen

- Acc OrgDokument9 SeitenAcc OrgDena Heart OrenioNoch keine Bewertungen

- Government Accounting 1st ExamDokument6 SeitenGovernment Accounting 1st ExamRandelle James Fiesta100% (1)

- Chapter 4 Revenues and Other Receipts PDFDokument5 SeitenChapter 4 Revenues and Other Receipts PDFSteffany Roque100% (1)

- Chapter 1 SolmanDokument14 SeitenChapter 1 Solmancalypso greyNoch keine Bewertungen

- Quiz - Chapter 1 - Overview of Government AccountingDokument2 SeitenQuiz - Chapter 1 - Overview of Government AccountingRoselyn Mangaron SagcalNoch keine Bewertungen

- MidTerm-Govt.-accounting-RAMOS, ROSEMARIE CDokument12 SeitenMidTerm-Govt.-accounting-RAMOS, ROSEMARIE Cagentnic100% (1)

- Government Accounting Test BankDokument23 SeitenGovernment Accounting Test BankMyles Ninon LazoNoch keine Bewertungen

- Answers To Multiple Choice Government AccountingDokument10 SeitenAnswers To Multiple Choice Government AccountingJP Taccad Romero63% (8)

- Pamantasan NG Lungsod NG Pasig: Test I - True or FalseDokument4 SeitenPamantasan NG Lungsod NG Pasig: Test I - True or FalseJOHN PAUL DOROIN100% (1)

- Accounting Gov ReviewerDokument19 SeitenAccounting Gov ReviewerAira Jaimee GonzalesNoch keine Bewertungen

- Chapter 2 - The Budget ProcessDokument19 SeitenChapter 2 - The Budget ProcessDexter Neil Solisa67% (3)

- Afar Government AccountingDokument7 SeitenAfar Government AccountingJasmine Lim88% (8)

- Government Accounting Exam PhilippinesDokument3 SeitenGovernment Accounting Exam PhilippinesIrdo Kwan64% (11)

- CHAPTER 3.pptx - ACC9 EditedDokument30 SeitenCHAPTER 3.pptx - ACC9 EditedAngelica CastilloNoch keine Bewertungen

- Chapter 7 InventoriesDokument5 SeitenChapter 7 InventoriesJoyce Mae D. FloresNoch keine Bewertungen

- Module 9 - Government Accounting ProcessDokument10 SeitenModule 9 - Government Accounting ProcessJeeramel TorresNoch keine Bewertungen

- Chapter 1 Overview of Government AccountingDokument4 SeitenChapter 1 Overview of Government AccountingSteffany Roque100% (1)

- PLP Government Accounting Mid-Term ExamDokument4 SeitenPLP Government Accounting Mid-Term ExamApril Manjares100% (2)

- Chapter 5 DisbursementsDokument5 SeitenChapter 5 DisbursementsSteffany Roque100% (2)

- FINALS EXAMINATION - ACCTG 6 Accounting For Government & Non-Profit OrganizationsDokument11 SeitenFINALS EXAMINATION - ACCTG 6 Accounting For Government & Non-Profit OrganizationsAmie Jane Miranda100% (1)

- Overview of Government AccountingDokument11 SeitenOverview of Government Accountingroch100% (1)

- Chapter 2 The Budget ProcessDokument8 SeitenChapter 2 The Budget ProcessChris tine Mae MendozaNoch keine Bewertungen

- Chapter 3 - The Govt Acctg ProcessDokument11 SeitenChapter 3 - The Govt Acctg Processweddiemae villariza0% (2)

- Midterm Summative Assessment 1Dokument7 SeitenMidterm Summative Assessment 1Von Andrei MedinaNoch keine Bewertungen

- AFAR8720 - Government Accounting Manual PDFDokument8 SeitenAFAR8720 - Government Accounting Manual PDFSid Tuazon100% (2)

- Government Accounting Exam PhilippinesDokument3 SeitenGovernment Accounting Exam PhilippinesPrincess Claris Araucto100% (5)

- Quiz - Overview of Government AccountingDokument5 SeitenQuiz - Overview of Government AccountingPaula Bautista80% (5)

- QUIZDokument4 SeitenQUIZBryan Ibarrientos100% (2)

- Government AccountingDokument5 SeitenGovernment AccountingPrincessa Lopez Masangkay100% (1)

- 9024 - Government Accounting ManualDokument8 Seiten9024 - Government Accounting ManualAljur SalamedaNoch keine Bewertungen

- Government Accounting Exam PhilippinesDokument4 SeitenGovernment Accounting Exam PhilippinesPrince Oliver ArauctoNoch keine Bewertungen

- Government Accounting Finals 2021Dokument21 SeitenGovernment Accounting Finals 2021Michael Bongalonta100% (1)

- Chapter 9 - Investment PropertyDokument14 SeitenChapter 9 - Investment Propertyweddiemae villariza100% (1)

- Gov Acctg Solman MillanDokument68 SeitenGov Acctg Solman MillanSymae Jung100% (1)

- Acctg 16 - Midterm Exam PDFDokument4 SeitenAcctg 16 - Midterm Exam PDFjoan miral0% (1)

- Government Accounting PunzalanDokument5 SeitenGovernment Accounting PunzalanN Jo88% (17)

- Acc11 Accounting For Government and Not-For-profit EntitiesDokument5 SeitenAcc11 Accounting For Government and Not-For-profit EntitiesKaren UmaliNoch keine Bewertungen

- Government Accounting Manual For National Government Agencies Volume IDokument27 SeitenGovernment Accounting Manual For National Government Agencies Volume IKath Hidalgo100% (1)

- Chapter 1 Quiz Overview of Government AccountingDokument3 SeitenChapter 1 Quiz Overview of Government Accountingnatalie clyde matesNoch keine Bewertungen

- Govt Acctg - Semi FinalsDokument5 SeitenGovt Acctg - Semi Finalsrustylopez1112Noch keine Bewertungen

- Module 2 Quiz AnswersDokument1 SeiteModule 2 Quiz AnswersVon Andrei MedinaNoch keine Bewertungen

- QUIZ 3 - Government Accounting and Accounting For Non-Profit OrganizationsDokument4 SeitenQUIZ 3 - Government Accounting and Accounting For Non-Profit OrganizationsI am Jacob100% (1)

- After The Budget Call From The DBMDokument6 SeitenAfter The Budget Call From The DBMJahanna MartorillasNoch keine Bewertungen

- Government AccountingDokument33 SeitenGovernment AccountingKristelJaneDonaireBihag80% (5)

- Chapter 4 Revenue and Other ReceiptsDokument46 SeitenChapter 4 Revenue and Other Receiptsroselynm18100% (1)

- SE Gov ActgDokument16 SeitenSE Gov ActgCristel TannaganNoch keine Bewertungen

- Quiz Results: Week 13: GAMS Quizzer 40 12/40 30%Dokument15 SeitenQuiz Results: Week 13: GAMS Quizzer 40 12/40 30%marie aniceteNoch keine Bewertungen

- Government Accounting PHDokument14 SeitenGovernment Accounting PHrylNoch keine Bewertungen

- Government Accounting Exam PhilippinesDokument4 SeitenGovernment Accounting Exam PhilippinesLJ Aggabao100% (1)

- CE Government Accounting PDFDokument9 SeitenCE Government Accounting PDFjtNoch keine Bewertungen

- Government AccountingDokument10 SeitenGovernment AccountingRampotz Ü EchizenNoch keine Bewertungen

- CASE 3 Managers Have FeelingsDokument1 SeiteCASE 3 Managers Have FeelingsKate FernandezNoch keine Bewertungen

- BM 100 Journal Writing - FernandezDokument9 SeitenBM 100 Journal Writing - FernandezKate FernandezNoch keine Bewertungen

- Third Exam QuizzerDokument1 SeiteThird Exam QuizzerKate FernandezNoch keine Bewertungen

- Acc 223 1ST ExamDokument3 SeitenAcc 223 1ST ExamKate FernandezNoch keine Bewertungen

- Acc 211 Activity - Debt RestructuringDokument1 SeiteAcc 211 Activity - Debt RestructuringKate FernandezNoch keine Bewertungen

- Investment PropertyDokument7 SeitenInvestment PropertyKate Fernandez50% (4)

- LIABILITIESDokument5 SeitenLIABILITIESKate FernandezNoch keine Bewertungen

- Multiple Choice Questions On Financial Accounting V2Dokument6 SeitenMultiple Choice Questions On Financial Accounting V2Kate FernandezNoch keine Bewertungen

- ACC 211 - Seventh QuizzerDokument1 SeiteACC 211 - Seventh QuizzerKate FernandezNoch keine Bewertungen

- Resume Of: Name: Kingshuk Saha Address: Mobile: E-MailDokument2 SeitenResume Of: Name: Kingshuk Saha Address: Mobile: E-MailKingshuk Saha PalasNoch keine Bewertungen

- Odt Article - Djo - Virtual Population Analysis Improves Orthopedic Implant Design 1 PDFDokument3 SeitenOdt Article - Djo - Virtual Population Analysis Improves Orthopedic Implant Design 1 PDFDragana RajicNoch keine Bewertungen

- Foundstone Hacme Bank User and Solution Guide v2.0Dokument60 SeitenFoundstone Hacme Bank User and Solution Guide v2.0Yeison MorenoNoch keine Bewertungen

- Sacramento County Compensation Survey Board of SupervisorsDokument13 SeitenSacramento County Compensation Survey Board of SupervisorsCBS13Noch keine Bewertungen

- TA35 & TA40 Articulated Dumptruck Maintenance Manual: Click Here For Table ofDokument488 SeitenTA35 & TA40 Articulated Dumptruck Maintenance Manual: Click Here For Table ofKot878100% (2)

- 34P S4hana1909 BPD en UsDokument18 Seiten34P S4hana1909 BPD en UsBiji RoyNoch keine Bewertungen

- Reconductoring Using HTLS Conductors. Case Study For A 220 KV Double Circuit Transmission LINE in RomaniaDokument7 SeitenReconductoring Using HTLS Conductors. Case Study For A 220 KV Double Circuit Transmission LINE in RomaniaJose ValdiviesoNoch keine Bewertungen

- Assignment ProblemDokument3 SeitenAssignment ProblemPrakash KumarNoch keine Bewertungen

- Would You Like Eddy Current, Video & Strip Chart in One Portable Case?Dokument2 SeitenWould You Like Eddy Current, Video & Strip Chart in One Portable Case?Daniel Jimenez MerayoNoch keine Bewertungen

- ATMPP Diabetes Change and Review Proposal Npa 2012-18Dokument8 SeitenATMPP Diabetes Change and Review Proposal Npa 2012-18Juha TamminenNoch keine Bewertungen

- ToobaKhawar 6733 VPL Lab Sat 12 3 All TasksDokument38 SeitenToobaKhawar 6733 VPL Lab Sat 12 3 All TasksTooba KhawarNoch keine Bewertungen

- Microtech Testing & Research Laboratory: Condition of Sample, When Received: SatisfactoryDokument1 SeiteMicrotech Testing & Research Laboratory: Condition of Sample, When Received: SatisfactoryKumar AbhishekNoch keine Bewertungen

- The Eclectic (OLI) Paradigm of International Production - Past, Present and FutureDokument19 SeitenThe Eclectic (OLI) Paradigm of International Production - Past, Present and FutureJomit C PNoch keine Bewertungen

- MT6580 Android Scatter FRPDokument7 SeitenMT6580 Android Scatter FRPTudor Circo100% (1)

- Legal Aspects of Construction Ethics PaperDokument11 SeitenLegal Aspects of Construction Ethics PaperbikaresNoch keine Bewertungen

- Essay Writing TipsDokument4 SeitenEssay Writing TipsSubhasish MitraNoch keine Bewertungen

- FM Assignment 17-M-518 MMM - Eicher MotorDokument33 SeitenFM Assignment 17-M-518 MMM - Eicher MotorTrilokNoch keine Bewertungen

- Forms of Organizing Activity Games, Methodology of Conducting Activity Games in Physical Education LessonsDokument4 SeitenForms of Organizing Activity Games, Methodology of Conducting Activity Games in Physical Education LessonsAcademic JournalNoch keine Bewertungen

- Focus GroupDokument20 SeitenFocus GroupItzel H. ArmentaNoch keine Bewertungen

- MATLAB PROGRAMMING An Engineering PerspectiveDokument129 SeitenMATLAB PROGRAMMING An Engineering PerspectivelolaNoch keine Bewertungen

- Conformational AnalysisDokument4 SeitenConformational AnalysisJinNoch keine Bewertungen

- Pit Viper 351Dokument6 SeitenPit Viper 351Sebastian Robles100% (2)

- Ricoh Aficio SP C420DN PARTS CATALOGDokument82 SeitenRicoh Aficio SP C420DN PARTS CATALOGYury Kobzar100% (2)

- Ebook Essentials of Kumar Clarks Clinical Medicine PDF Full Chapter PDFDokument67 SeitenEbook Essentials of Kumar Clarks Clinical Medicine PDF Full Chapter PDFjanet.cochran431100% (19)

- Partnership For Sustainable Textiles - FactsheetDokument2 SeitenPartnership For Sustainable Textiles - FactsheetMasum SharifNoch keine Bewertungen

- Zielinski AnArcheology For AnArchivesDokument10 SeitenZielinski AnArcheology For AnArchivesPEDRO JOSENoch keine Bewertungen

- Planting Guide For Rice 1. Planning and BudgetingDokument4 SeitenPlanting Guide For Rice 1. Planning and BudgetingBraiden ZachNoch keine Bewertungen

- 1778 3557 1 SM PDFDokument4 Seiten1778 3557 1 SM PDFjulio simanjuntakNoch keine Bewertungen

- Catalogue of Palaearctic Coleoptera Vol.4 2007Dokument471 SeitenCatalogue of Palaearctic Coleoptera Vol.4 2007asmodeus822Noch keine Bewertungen

- Mucic Acid Test: PrincipleDokument3 SeitenMucic Acid Test: PrincipleKrizzi Dizon GarciaNoch keine Bewertungen