Beruflich Dokumente

Kultur Dokumente

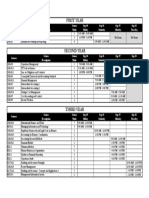

Intacc 2 LCNRV Debt Restructuring

Hochgeladen von

Elaine AntonioOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Intacc 2 LCNRV Debt Restructuring

Hochgeladen von

Elaine AntonioCopyright:

Verfügbare Formate

UNIVERSITY OF SANTO TOMAS

AMV COLLEGE OF ACCOUNTANCY

INTERMEDIATE ACCCOUNTING 2

NAME_____________________

On December 31, 2016, Hestia Company experienced a decline in the value of inventory from

P5,000,000 cost to NRV of P4,650,000. Hestia’s inventory on January 1, 2016 was P3,000,000 and

purchases of P2,600,000 were made during the year 2016. During the year 2017, Hestia made

purchases of P2,500,000 and market conditions had improved. At the end of the year 2017, the

inventory had a cost of P 5,400,000 while the fair value less cost to sell is 5,200,000.

1. How much is the cost of goods sold in 2016 assuming the company is using the

allowance method and treat the loss as part of other expense in the income

statement?

a. 600,000 c.5,6000,000

b. 950,000 d.4,650,000

2. How much should be reported as cost of goods sold in 2017 assuming the company is

using allowance method and includes reversal in the cost of goods sold?

a. 2,300,000 c. 1,950,000

b. 2,100,000 d. 1,750,000

Apple Company owed P 2,000,000 plus P 180,000 of accrued interest to Mac Bank which is due to be paid

on December 31, 2017. During 2017, Apple’s business deteriorated because of faltering regional economy.

On December 31, 2017, Mac Bank agrees to accept an old machine and cancel the entire debt. The

machine has a cost of P 3,900,000, accumulated depreciation of P 2,210,000, and a fair value of

P1,900,000.

3. How much is the total amount to be reported in its profit or loss as a result of the

financial liability’s derecognition?

a. 0 c. 210,000

b. 280,000 d. 490,000

Cherry Company is experiencing financial difficulty and is negotiating a trouble debt restructuring with its

creditors to relieve its financial stress. Cherry has a P 6,000,000 note payable to Mobile Bank. The bank

accepted an equity interest from Cherry Company in a form of 200,000 ordinary shares. The fair value of

ordinary shares is P 24 per share while the par value of the ordinary shares is P 20 per share.

4. What is the amount of gain on debt restructuring to be reported by Cherry in its profit

or loss as a result of the restructuring?

a. 0 c. 1,200,000

b. 800,000 d. 2,000,000

Samsung Company has an overdue 10% note payable to Galaxy Bank of P 8,000,000 and recorded

accrued interest of P 800,000. On December 31, 2017, Galaxy Bank agreed to the following restructuring

agreement:

Reduced the principal obligation to P 6,000,000

Waived the P 800,000 accrued interest

Extended the maturity date to December 31, 2019.

Annual interest of 8% is to be paid on December 31, 2018 and 2019

Present value of P1 at 10% for 2 periods is 0.8264. Present value of an ordinary annuity of P1 at

10% for 2 periods is 1.7355.

The prevailing market interest rate for similar debt instrument is 12%

5. What is Samsung Company’s gain on debt restructuring?

a. 3,008,560 b. 2,208,560 c. 3,205,552 d. 0

6. What is Samsung Company’s interest expense for the year 2018?

a. 579,144 b. 694,973 c. 559,445 d. 671,334

waa

Page 1 of 1

Das könnte Ihnen auch gefallen

- CFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Von EverandCFA Level 1 Calculation Workbook: 300 Calculations to Prepare for the CFA Level 1 Exam (2023 Edition)Bewertung: 4.5 von 5 Sternen4.5/5 (5)

- AFAR TestbankDokument56 SeitenAFAR TestbankDrama SubsNoch keine Bewertungen

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Von EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Bewertung: 5 von 5 Sternen5/5 (1)

- FAR Practical Exercises Liabilities PDFDokument8 SeitenFAR Practical Exercises Liabilities PDFRemy Caperocho80% (5)

- Asian Development Bank Sustainability Report 2020Von EverandAsian Development Bank Sustainability Report 2020Noch keine Bewertungen

- FAR First Pre BoardDokument18 SeitenFAR First Pre BoardKIM RAGANoch keine Bewertungen

- A Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionVon EverandA Comparative Analysis of Tax Administration in Asia and the Pacific: Fifth EditionNoch keine Bewertungen

- Asset To LiabDokument25 SeitenAsset To LiabHavanaNoch keine Bewertungen

- LIABILITIESDokument12 SeitenLIABILITIESAimee NucumNoch keine Bewertungen

- CupDokument7 SeitenCupJerauld BucolNoch keine Bewertungen

- FIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityDokument7 SeitenFIN 2 Financial Analysis and Reporting: Lyceum-Northwestern UniversityAmie Jane MirandaNoch keine Bewertungen

- ApDokument8 SeitenApMonina Cabalag100% (1)

- Finals Answer KeyDokument6 SeitenFinals Answer Keymarx marolinaNoch keine Bewertungen

- Acctg4 Prelim ProbDokument6 SeitenAcctg4 Prelim ProbLalaine BeatrizNoch keine Bewertungen

- Module 13 Notes Payable - Debt ResructuringDokument10 SeitenModule 13 Notes Payable - Debt ResructuringryanNoch keine Bewertungen

- Revised Accounting 16Dokument20 SeitenRevised Accounting 16Jennifer GarnetteNoch keine Bewertungen

- Problems - Docx 1Dokument25 SeitenProblems - Docx 1You Knock On My DoorNoch keine Bewertungen

- PUP Review Handout 5 OfficialDokument2 SeitenPUP Review Handout 5 OfficialDonalyn CalipusNoch keine Bewertungen

- Prelim Lecture 1 Assignment: Multiple ChoiceDokument4 SeitenPrelim Lecture 1 Assignment: Multiple Choicelinkin soyNoch keine Bewertungen

- INTACCTG2 Assignment Statement of Comprehensive Income Financial Position Final Revised PDFDokument2 SeitenINTACCTG2 Assignment Statement of Comprehensive Income Financial Position Final Revised PDFUnnamed homosapienNoch keine Bewertungen

- Problem No. 1Dokument6 SeitenProblem No. 1Jinrikisha TimoteoNoch keine Bewertungen

- AFAR Test BankDokument57 SeitenAFAR Test BankandengNoch keine Bewertungen

- Notes PayableDokument4 SeitenNotes PayableShilla Mae BalanceNoch keine Bewertungen

- Financial Accounting and Reporting - ReviewerDokument12 SeitenFinancial Accounting and Reporting - ReviewerRonald SaludesNoch keine Bewertungen

- Intermediate Accounting 2 Reviewer PDFDokument133 SeitenIntermediate Accounting 2 Reviewer PDFCarl CagampzNoch keine Bewertungen

- FAR REview. DinkieDokument10 SeitenFAR REview. DinkieJollibee JollibeeeNoch keine Bewertungen

- Far FPBDokument16 SeitenFar FPBMae Marcos SaguipedNoch keine Bewertungen

- Abc 6Dokument4 SeitenAbc 6Kath LeynesNoch keine Bewertungen

- FAR Practical Exercises Liabilities PDFDokument8 SeitenFAR Practical Exercises Liabilities PDFNhel AlvaroNoch keine Bewertungen

- Compre23 FARDokument12 SeitenCompre23 FARchristinemariet.ramirezNoch keine Bewertungen

- Instructions: Answer The Following Carefully. Highlight Your Answer With Color Yellow. AfterDokument8 SeitenInstructions: Answer The Following Carefully. Highlight Your Answer With Color Yellow. AfterMIKASANoch keine Bewertungen

- IA2 Quiz 1 QuestionsDokument6 SeitenIA2 Quiz 1 QuestionsJames Daniel SwintonNoch keine Bewertungen

- Quiz On LiabilitiesDokument5 SeitenQuiz On LiabilitiesDewdrop Mae RafananNoch keine Bewertungen

- INTERMEDIATE ACCOUNTING - MIDTERM - 2019-2020 - 2nd SemesterDokument12 SeitenINTERMEDIATE ACCOUNTING - MIDTERM - 2019-2020 - 2nd SemesterRenalyn ParasNoch keine Bewertungen

- Semi-Finals Financial Accounting and ReportingDokument23 SeitenSemi-Finals Financial Accounting and Reportingjoyce KimNoch keine Bewertungen

- Local Media271226407970108268Dokument17 SeitenLocal Media271226407970108268Jana Rose PaladaNoch keine Bewertungen

- CPAR B94 MAS Final PB Exam - QuestionsDokument13 SeitenCPAR B94 MAS Final PB Exam - QuestionsSilver LilyNoch keine Bewertungen

- AfarDokument18 SeitenAfarFleo GardivoNoch keine Bewertungen

- Uts MK Mei 2021 PascaDokument2 SeitenUts MK Mei 2021 PascaDwiayu WidyastutiNoch keine Bewertungen

- Ilovepdf Merged 1Dokument14 SeitenIlovepdf Merged 1BATISATIC, EDCADIO JOSE E.Noch keine Bewertungen

- AE 16 Prelims Problem SolvingDokument6 SeitenAE 16 Prelims Problem SolvingJheally SeirNoch keine Bewertungen

- Instructions: Choose The Letter That Corresponds To Your Answer and Write Them On A Crosswise YellowDokument8 SeitenInstructions: Choose The Letter That Corresponds To Your Answer and Write Them On A Crosswise YellowRoseNoch keine Bewertungen

- IA2 Finals ReviewerDokument6 SeitenIA2 Finals ReviewerJoana MarieNoch keine Bewertungen

- Poem PoemDokument5 SeitenPoem PoemElizabeth Espinosa ManilagNoch keine Bewertungen

- L 1Dokument5 SeitenL 1Elizabeth Espinosa ManilagNoch keine Bewertungen

- Ap-100Q: Quizzer On Accounting Changes, Error Corrections, Cash/Accrual and Single EntryDokument8 SeitenAp-100Q: Quizzer On Accounting Changes, Error Corrections, Cash/Accrual and Single EntryJohn Paulo SamonteNoch keine Bewertungen

- Ba 13 Final Departmental ExamDokument9 SeitenBa 13 Final Departmental ExamKristine Joy Peñaredondo BazarNoch keine Bewertungen

- Quiz 1. Special Revenue RecognitionDokument6 SeitenQuiz 1. Special Revenue RecognitionApolinar Alvarez Jr.Noch keine Bewertungen

- p1 QuizDokument3 Seitenp1 QuizEvita Faith LeongNoch keine Bewertungen

- Identify The Choice That Best Completes The Statement or Answers The QuestionDokument5 SeitenIdentify The Choice That Best Completes The Statement or Answers The QuestionErine ContranoNoch keine Bewertungen

- Accounting ProblemsDokument7 SeitenAccounting ProblemsMarisolNoch keine Bewertungen

- AP Review LiabDokument10 SeitenAP Review LiabTuya DayomNoch keine Bewertungen

- The Professional CPA Review School: Financial Accounting & Reporting (Problems) May 2019 BatchDokument10 SeitenThe Professional CPA Review School: Financial Accounting & Reporting (Problems) May 2019 BatchKriztleKateMontealtoGelogoNoch keine Bewertungen

- 01 Installment SalesDokument5 Seiten01 Installment SalesPatríck Louie0% (1)

- Gen008 P1 ExamDokument11 SeitenGen008 P1 ExamMary Lyn DatuinNoch keine Bewertungen

- Chapter 4: Installment Sales (Ias 18) : Part 1: Theory of AccountsDokument4 SeitenChapter 4: Installment Sales (Ias 18) : Part 1: Theory of AccountsKeay ParadoNoch keine Bewertungen

- Multiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer SheetDokument14 SeitenMultiple Choice: Select The Best Answer From The Given Choices and Write It Down On Your Answer Sheetmimi supasNoch keine Bewertungen

- Acc204 Midterm Exam Set BDokument5 SeitenAcc204 Midterm Exam Set BJudy Ann Imus0% (1)

- IntAcc Reviewer - Module 2 (Problems)Dokument26 SeitenIntAcc Reviewer - Module 2 (Problems)Lizette Janiya SumantingNoch keine Bewertungen

- Verdadero Cjezerei Borrowing CostsDokument11 SeitenVerdadero Cjezerei Borrowing CostsPeter PiperNoch keine Bewertungen

- MODULE 1 Video Lecture NotesDokument3 SeitenMODULE 1 Video Lecture NotesElaine AntonioNoch keine Bewertungen

- Planning SheetDokument1 SeitePlanning SheetElaine AntonioNoch keine Bewertungen

- M1 - Formative Assessment 1Dokument1 SeiteM1 - Formative Assessment 1Elaine AntonioNoch keine Bewertungen

- Reflection Paper GBER - Antonio - 3A8Dokument1 SeiteReflection Paper GBER - Antonio - 3A8Elaine AntonioNoch keine Bewertungen

- Custom Format Codes ReferenceDokument10 SeitenCustom Format Codes ReferenceElaine AntonioNoch keine Bewertungen

- ACCA Seven Quotients PDFDokument13 SeitenACCA Seven Quotients PDFElaine AntonioNoch keine Bewertungen

- Form. Assess. 1Dokument2 SeitenForm. Assess. 1Elaine AntonioNoch keine Bewertungen

- CA51013 - ACTIVITY 1 (Group Work)Dokument2 SeitenCA51013 - ACTIVITY 1 (Group Work)Elaine AntonioNoch keine Bewertungen

- BIR Form 2316Dokument1 SeiteBIR Form 2316edz_ramirez87% (15)

- UPDATED SCHEDULE Departmental Quiz 1Dokument1 SeiteUPDATED SCHEDULE Departmental Quiz 1Elaine AntonioNoch keine Bewertungen

- Exer7 Manager's Performance - AntonioDokument10 SeitenExer7 Manager's Performance - AntonioElaine AntonioNoch keine Bewertungen

- Principles of TaxationDokument13 SeitenPrinciples of TaxationHazel OrtegaNoch keine Bewertungen

- University of Santo Tomas Amv College of Accountancy Intermediate Acccounting 2 NAMEDokument3 SeitenUniversity of Santo Tomas Amv College of Accountancy Intermediate Acccounting 2 NAMEElaine AntonioNoch keine Bewertungen

- Weekly Schedule of Class Activities PRELIMINARY PERIODDokument2 SeitenWeekly Schedule of Class Activities PRELIMINARY PERIODElaine AntonioNoch keine Bewertungen

- IBT MODULE 1 PART 1 and 2Dokument2 SeitenIBT MODULE 1 PART 1 and 2Elaine AntonioNoch keine Bewertungen

- IBT MODULE 1 PART 1 and 2Dokument2 SeitenIBT MODULE 1 PART 1 and 2Elaine AntonioNoch keine Bewertungen

- Cash-And-Cash-Equivalent - Answers On HandoutDokument6 SeitenCash-And-Cash-Equivalent - Answers On HandoutElaine AntonioNoch keine Bewertungen

- Practical Auditing Empleo Sol Man Chapter 3Dokument6 SeitenPractical Auditing Empleo Sol Man Chapter 3Elaine AntonioNoch keine Bewertungen

- Assignment No. 2 PCF and BANK RECONCILIATION1Dokument4 SeitenAssignment No. 2 PCF and BANK RECONCILIATION1Elaine Antonio100% (1)

- Introduction To Global Business: The Rise of GlobalizationDokument20 SeitenIntroduction To Global Business: The Rise of GlobalizationElaine AntonioNoch keine Bewertungen

- Individual Assignment 1 - Acct. ResearchDokument3 SeitenIndividual Assignment 1 - Acct. ResearchElaine AntonioNoch keine Bewertungen

- Antonio, Ysa Elaine - 3A8Dokument2 SeitenAntonio, Ysa Elaine - 3A8Elaine AntonioNoch keine Bewertungen

- Answer Key To Module 2 InventoriesDokument4 SeitenAnswer Key To Module 2 InventoriesElaine AntonioNoch keine Bewertungen

- Chapter 5 PPT (To Students)Dokument48 SeitenChapter 5 PPT (To Students)Heidi ChanNoch keine Bewertungen

- Cash Management Account Application TrustDokument20 SeitenCash Management Account Application TrustVinod BCNoch keine Bewertungen

- HBL RP (Qual)Dokument25 SeitenHBL RP (Qual)Mudabbir Azeez JamalNoch keine Bewertungen

- Campus RecruitmentDokument2 SeitenCampus RecruitmentNihar KavdiaNoch keine Bewertungen

- .Accounts and l2 DDDDDDDDD - 1616743497000Dokument10 Seiten.Accounts and l2 DDDDDDDDD - 1616743497000Guddataa DheekkamaaNoch keine Bewertungen

- Africa Energy Week PresentationDokument13 SeitenAfrica Energy Week PresentationTheophile MegueptchieNoch keine Bewertungen

- Exchange Control - Foreign Exchange Bureaux de Change - OrdeDokument9 SeitenExchange Control - Foreign Exchange Bureaux de Change - OrdeKelvin RugonyeNoch keine Bewertungen

- MBA104 - Almario - Parco - Case Study LGAOP01Dokument15 SeitenMBA104 - Almario - Parco - Case Study LGAOP01Jesse Rielle CarasNoch keine Bewertungen

- Fundamentals of Economics and Financial MarketsDokument4 SeitenFundamentals of Economics and Financial MarketsluluNoch keine Bewertungen

- SBI Life InsuranceDokument17 SeitenSBI Life InsuranceAshish PatelNoch keine Bewertungen

- RtreDokument48 SeitenRtremm sectionNoch keine Bewertungen

- Mortgage Quality Control Specialist in Chicago IL Resume Judith ManganDokument2 SeitenMortgage Quality Control Specialist in Chicago IL Resume Judith ManganJudithManganNoch keine Bewertungen

- Rating Credit Risks - OCC HandbookDokument69 SeitenRating Credit Risks - OCC HandbookKent WhiteNoch keine Bewertungen

- ATUL Project Report On Study On Home Loans of HDFC BankDokument47 SeitenATUL Project Report On Study On Home Loans of HDFC Bankabhijit05580% (45)

- Bank Mandiri 2013 Annual Report - EnglishDokument759 SeitenBank Mandiri 2013 Annual Report - EnglishtiffanyNoch keine Bewertungen

- Nature of Banking IndustryDokument79 SeitenNature of Banking IndustryAbeesh Panikkaveetil100% (1)

- Comprehensive NotesDokument13 SeitenComprehensive NotesBelle Andrea GozonNoch keine Bewertungen

- Suhl Annual Report 2021 - FinalDokument226 SeitenSuhl Annual Report 2021 - FinalDavis ManNoch keine Bewertungen

- Other Percentage TaxDokument3 SeitenOther Percentage TaxBon BonsNoch keine Bewertungen

- CA Final Advanced Auditing Professional Ethics Important QuestionsDokument7 SeitenCA Final Advanced Auditing Professional Ethics Important QuestionsSrinivasan KrishnanNoch keine Bewertungen

- SHCIL DP Stock MarketDokument114 SeitenSHCIL DP Stock MarketArvind Sanu Misra50% (2)

- Commerce Past Questions and AnswersDokument37 SeitenCommerce Past Questions and AnswersBabucarr Nguda Jarju100% (2)

- All About Interest Rates in IndiaDokument27 SeitenAll About Interest Rates in IndiaNitinAggarwalNoch keine Bewertungen

- Casablanca Best Practices in Slum ImprovementDokument37 SeitenCasablanca Best Practices in Slum ImprovementM. Y. HassanNoch keine Bewertungen

- Transaction HeaderDokument3 SeitenTransaction HeaderWaleed AljackNoch keine Bewertungen

- Quatloos - NESARA ScamDokument7 SeitenQuatloos - NESARA Scam05C1LL473Noch keine Bewertungen

- Final Project On IpoDokument58 SeitenFinal Project On IpoFarzana SayyedNoch keine Bewertungen

- Organisational Centered Study On HDFCDokument20 SeitenOrganisational Centered Study On HDFCAkshay Krishnan VNoch keine Bewertungen

- Export Guidelines in Nigeria PDFDokument6 SeitenExport Guidelines in Nigeria PDFetohNoch keine Bewertungen

- India: Amarchand & Mangaldas & Suresh A. Shroff & CoDokument6 SeitenIndia: Amarchand & Mangaldas & Suresh A. Shroff & CofaizlpuNoch keine Bewertungen

- The Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeVon EverandThe Millionaire Fastlane, 10th Anniversary Edition: Crack the Code to Wealth and Live Rich for a LifetimeBewertung: 4.5 von 5 Sternen4.5/5 (90)

- 24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldVon Everand24 Assets: Create a digital, scalable, valuable and fun business that will thrive in a fast changing worldBewertung: 5 von 5 Sternen5/5 (20)

- 12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurVon Everand12 Months to $1 Million: How to Pick a Winning Product, Build a Real Business, and Become a Seven-Figure EntrepreneurBewertung: 4 von 5 Sternen4/5 (2)

- Summary of Zero to One: Notes on Startups, or How to Build the FutureVon EverandSummary of Zero to One: Notes on Startups, or How to Build the FutureBewertung: 4.5 von 5 Sternen4.5/5 (100)

- ChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveVon EverandChatGPT Side Hustles 2024 - Unlock the Digital Goldmine and Get AI Working for You Fast with More Than 85 Side Hustle Ideas to Boost Passive Income, Create New Cash Flow, and Get Ahead of the CurveNoch keine Bewertungen

- Secrets of the Millionaire Mind: Mastering the Inner Game of WealthVon EverandSecrets of the Millionaire Mind: Mastering the Inner Game of WealthBewertung: 4.5 von 5 Sternen4.5/5 (1026)

- To Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryVon EverandTo Pixar and Beyond: My Unlikely Journey with Steve Jobs to Make Entertainment HistoryBewertung: 4 von 5 Sternen4/5 (26)

- The Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeVon EverandThe Millionaire Fastlane: Crack the Code to Wealth and Live Rich for a LifetimeBewertung: 4.5 von 5 Sternen4.5/5 (58)

- Summary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizVon EverandSummary of The Four Agreements: A Practical Guide to Personal Freedom (A Toltec Wisdom Book) by Don Miguel RuizBewertung: 4.5 von 5 Sternen4.5/5 (112)

- The Master Key System: 28 Parts, Questions and AnswersVon EverandThe Master Key System: 28 Parts, Questions and AnswersBewertung: 5 von 5 Sternen5/5 (62)

- Take Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyVon EverandTake Your Shot: How to Grow Your Business, Attract More Clients, and Make More MoneyBewertung: 5 von 5 Sternen5/5 (22)

- Every Tool's a Hammer: Life Is What You Make ItVon EverandEvery Tool's a Hammer: Life Is What You Make ItBewertung: 4.5 von 5 Sternen4.5/5 (249)

- SYSTEMology: Create time, reduce errors and scale your profits with proven business systemsVon EverandSYSTEMology: Create time, reduce errors and scale your profits with proven business systemsBewertung: 5 von 5 Sternen5/5 (48)

- Summary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisVon EverandSummary: Choose Your Enemies Wisely: Business Planning for the Audacious Few: Key Takeaways, Summary and AnalysisBewertung: 4.5 von 5 Sternen4.5/5 (3)

- Your Next Five Moves: Master the Art of Business StrategyVon EverandYour Next Five Moves: Master the Art of Business StrategyBewertung: 5 von 5 Sternen5/5 (801)

- Enough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursVon EverandEnough: The Simple Path to Everything You Want -- A Field Guide for Perpetually Exhausted EntrepreneursBewertung: 5 von 5 Sternen5/5 (24)

- Rich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessVon EverandRich Dad's Before You Quit Your Job: 10 Real-Life Lessons Every Entrepreneur Should Know About Building a Multimillion-Dollar BusinessBewertung: 4.5 von 5 Sternen4.5/5 (407)

- Transformed: Moving to the Product Operating ModelVon EverandTransformed: Moving to the Product Operating ModelBewertung: 4 von 5 Sternen4/5 (1)

- The Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelVon EverandThe Science of Positive Focus: Live Seminar: Master Keys for Reaching Your Next LevelBewertung: 5 von 5 Sternen5/5 (51)

- Summary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedVon EverandSummary of The Subtle Art of Not Giving A F*ck: A Counterintuitive Approach to Living a Good Life by Mark Manson: Key Takeaways, Summary & Analysis IncludedBewertung: 4.5 von 5 Sternen4.5/5 (38)

- Brand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleVon EverandBrand Identity Breakthrough: How to Craft Your Company's Unique Story to Make Your Products IrresistibleBewertung: 4.5 von 5 Sternen4.5/5 (48)

- 7 Secrets to Investing Like Warren BuffettVon Everand7 Secrets to Investing Like Warren BuffettBewertung: 4.5 von 5 Sternen4.5/5 (121)

- Cryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyVon EverandCryptocurrency for Beginners: A Complete Guide to Understanding the Crypto Market from Bitcoin, Ethereum and Altcoins to ICO and Blockchain TechnologyBewertung: 4.5 von 5 Sternen4.5/5 (300)

- The E-Myth Revisited: Why Most Small Businesses Don't Work andVon EverandThe E-Myth Revisited: Why Most Small Businesses Don't Work andBewertung: 4.5 von 5 Sternen4.5/5 (709)

- Summary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Von EverandSummary: Who Not How: The Formula to Achieve Bigger Goals Through Accelerating Teamwork by Dan Sullivan & Dr. Benjamin Hardy:Bewertung: 5 von 5 Sternen5/5 (2)

- Level Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeVon EverandLevel Up: How to Get Focused, Stop Procrastinating, and Upgrade Your LifeBewertung: 5 von 5 Sternen5/5 (22)

- 100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziVon Everand100M Offers Made Easy: Create Your Own Irresistible Offers by Turning ChatGPT into Alex HormoziNoch keine Bewertungen

- Startup: How To Create A Successful, Scalable, High-Growth Business From ScratchVon EverandStartup: How To Create A Successful, Scalable, High-Growth Business From ScratchBewertung: 4 von 5 Sternen4/5 (114)

- Invention: A Life of Learning Through FailureVon EverandInvention: A Life of Learning Through FailureBewertung: 4.5 von 5 Sternen4.5/5 (28)