Beruflich Dokumente

Kultur Dokumente

Petty Cash Test

Hochgeladen von

Ehsan Elahi100%(4)100% fanden dieses Dokument nützlich (4 Abstimmungen)

2K Ansichten6 SeitenOriginaltitel

petty cash test

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

100%(4)100% fanden dieses Dokument nützlich (4 Abstimmungen)

2K Ansichten6 SeitenPetty Cash Test

Hochgeladen von

Ehsan ElahiCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 6

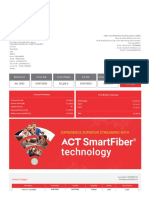

SKANS School of Accountancy, Multan.

MA1 Petty Cash Batch: 51&53

Test 9 Total Time: 1 hour

Teacher: Muhammad Amjad Karim Total Marks: 64

Date:17/07/2020 Time:

MULTIPLE CHOICE QUESTIONS

Question # 01

which of the following is involved in small cash transaction?

A. Payments to service providers

B. Petty cash

C. Purchases of inventory

D. Receipts from sales

Question # 02

The original document used for recording petty cash into the petty cash book is:

A. An invoice

B. A till receipt

C. A petty cash i.o.u

D. .A petty cash voucher

Question # 03

David is a retailer of shoes. When cashing up at the end of a particular day, he finds that his

till roll which records daily sales is different from the amount of cash and cheques in the till of

$329.50 David always starts the day by placing a float of $40 in the till. He puts the remaining

difference down to giving a customer change for a $20 note when only a $10 note was

tendered. What sale did the till roll record for that day?

A. $279.50

B. $299.50

C. $359.50

D. $379.50

Question # 04

On a particular day, the cash register in a shop shows that cash sales were made of$1,073.21

The cash in the till at the end of the day totaled $1318.76 and a cash float of $250 is always

carried in the till. Which of the following is not a valid reason for the difference between the

Cash the till and the cash register records?

A. All of the cash received was not paid into the till.

B. Customer was given too much change.

C. The price for goods entered into the cash register was higher than that charged to the

customer

D. The price for goods entered into the cash register was lower than that charged to the

customer

Question # 05

A petty cash system operates on a $120 imprest system. At the end of a month, there are

$6723 of valid petty cash vouchers in the petty cash till. How much cash should be taken out

of the bank account in order to top up it to the correct amount?

A. $52.77

B. B.$67.23

C. $120.00

D. $187.23

Question # 06

A cash advance of $20 is taken out of the petty cash box by an employee of a company

refreshments for a client and an authorized voucher for $20 put into the petty cash box.

employee only spends $17.65 on refreshments. What is the petty cash procedure required?

A. The employee keeps the change of $2.35.

B. The employee keeps the change of $2.35 and the petty cash voucher is altered to

$17.65

C. The employee returns the $2.35.

D. The employee returns the $2.35 and the petty cash voucher is altered to ready 117.65

Question # 07

Hawk is preparing a bank paying-in slip at the end of the day in his shop. His till roll shows

sales of $193.24. Hawk always maintains a float of $25 in the till and takes $20 each day as

his wages. How much will Hawk pay into the bank today?

A. $213.24

B. $193.24

C. .$173.24

D. $148.24

Question # 08

For which of the following payments would petty cash not be used?

A. $9.50 for cleaning the shop windows

B. $26.00 for coffee and tea for office staff.

C. $85.00 invoice for postage via a courier

D. $37.00 train fare to a business conference

Question # 09

At the beginning of March the petty cash tin contained a float of $65. During the

month petty cash payments totaled $64 and a cheque for $50 was cashed at

the bank to top up the float what was the folat at the beginning of April

A. $1

B. $51

C. $75

D. $80

Question # 10

The petty cash box should be kept:

A. In a drawer

B. On the desk

C. In a safe

D. On a cabinet

Question # 11

What is the function of the petty cash?

A. To act as a cash float.

B. To cover all out of pocket expenses.

C. To pay small and/or irregular amounts.

D. To finance the office parties.

Question # 12

How can you ensure that petty cash payments have been made for valid expenditure ?

A. By recording the vouchers immediately in the petty cash book.

B. By ensuring the petty cash vouchers are signed

C. . By stapling appropriate receipts to the vouchers.

D. Allowing only certain employees to have access to petty cash,

Question # 13

Lassie withdraws .$300 from her business bank account for petty cash. How should this be

recorded in the general ledger?

A. Debit bank, Credit petty cash

B. Debit petty cash, Credit bank

C. Debit petty cash, Credit capital

D. No record is necessary

Question # 14

The petty cash in the sales office of Bram Limited is checked by someone in the accounts

department, who checks the petty cash vouchers and the amount of money in the petty cash

tin.The company uses an imprest system for its petty cash and petty cash is periodically

topped up to $500 the purpose of the check is to:

A. Make sure that the total value of the sales vouchers equals the amount of money in the

petty cash tin

B. Authorize all the petty cash vouchers,

C. Make sure that the total value of the sales vouchers plus the amount of money in the

petty cash tin equals $500

D. Make sure that the total value of the sales vouchers plus the amount of money petty

cash tin equals $500 plus any money transferred into petty cash in the period covered by

the vouchers

Question # 15

Walsh operates an imprest system for petty cash, and the float in the petty cash is topped

up to $250 at the end of each month. During April, employees paying for private use of the

office photocopier paid $25 into petty cash and chque for $20 were cashed for an employee

out of petty cash. During April, Walsh drew cheques for $340 for petty cash. How much

cash expenses?

A. $295

B. $345

C. $355

D. $385

Question # 16

Which of the following records is often maintained on an imprest system?

A. A Cash book

B. Potty cash book

C. Journal

D. Sales day book

Question # 17

Expenses recorded in the petty cash book are posted,

A. A To the credit side of the supplier's personal accounts

B. To the credit of the nominal ledger expense accounts

C. To the debit of the nominal ledger expense accounts

D. To the debit of the main cash book

Question # 18

The petty cash can be checked at any time, even if the petty cash book is not update. Which

of the following formula is used for checking the petty cash?

A. Petty cash vouchers - cash held = imprest

B. Imprest + petty cash vouchers = cash held

C. Imprest + cash held = petty cash vouchers

D. Petty cash vouchers + cash held = imprest

Question # 19

A petty cash system is run with an imprest amount of $200. Each Saturday just before the

cash is topped up to $200, the amount of cash is counted and the vouchers in in the petty

cash box are totaled. On this particular Saturday, the cash in the petty cash box amount to

$97.80 and the petty cash vouchers $102.20. How much will be need to restore it to its

nominal amount of $200?

A $102.20

B. $97.80

C. 4.40

D. $200

Question # 20

The prime document used for recording petty cash into the petty cash books

A. An invoice

B. A till receipt

C. A petty cash io.u

D. A petty cash voucher

Question # 21

Which of the following is the best description of the term 'petty cash?

A. Small payments in cash not dealt with through the business bank account

B. Used to reimburse employees for expenditure undertaken for business purpose

C. Minor expenditure not subject to strict controls

D. Expenditure not subject to limits.

Question # 22

You are banking today's takings. Your till had a $50 float at the start of the day and this is to

be increased to $100. You count the cash as follows: $50 notes - 2; $20 notes - 10: $10 notes

- 37; $5 notes - 23; 10 bags of $20 $1 coins, other coinage $12, cheques $892. How much is

banked?

A. $1.939

B. $1,839

C. $1,889

D. $1,789

Question # 23

Which of the following are valid reasons for controlling the size of petty cash payments? (i)

security of cash, (i) controlling expenditure, (iii) risk of fraud, (iv) monitoring expenditure.

A. (i), (ii), (iii), (iv)

B. (i). (ii), (ii)

C. (ii), (iii), (iv)

D. (i), (iii), (iv)

Question # 24

A business has petty cash imprest of $250, expenditure in the month is $200 and the imprest

is to be increased to $300. How much cash must be drawn to restore and increase the

imprest?

A. S50

B. $300

C. S350

D. $250

Question # 25

which of the following items would be most likely to be paid out of petty cash?

(i) Payment to window cleaner $10

(ii) Hire purchase payment for a delivery van $123

(iii) A payment for postage stamps $11.60

A. All of the above

B. (i), (iii) and (iv)

C. (i) only

D. (i) and (iii)

Question # 26

Which of the following items will not be shown on a petty cash voucher?

A. Name and signature of person authorizing payment

B. Name and signature of recipient

C. Purpose of the expenditure and details.

D. Names and signature of petty cashier

Question # 27

which of the following is an example of a payment, which could be made out of petty cash?

(The petty cash float is $100),

A. Payment of an employee's parking fine whilst on company business - $25

B. Purchase of a concrete mixer - $275

C. The first installment of a lease agreement ($15 per month) for office equipment

D. Purchase of postage stamps - $7.57

Question # 28

A petty cash imprest is $500. A spot check by the auditors of the petty cash discovered cash

in hand of $45. In addition the cashier produced valid vouchers to the value of $395. How

much cash missing?

A. $60

B. $455

C. $395

D. $350

Question # 29

Your business has a petty cash imprest of $750; this is to be increased to $800. At the end of

month the cash in hand was $57 and receipts and vouchers totaled $673. In addition the cash

contained an IOU from a member of staff for $20. How much cash is withdrawn from the bank

restore and increase the imprest?

A. $723

B: $800

C. $743

D. $653

Question # 30

A petty cash purchase is made costing $77.55, Inclusive of VAT at 17,5%. Which of the

following is the correct entry?

A. Dr. Expense $66, Dr. VAT $11.55, Cr. Cash $77.55

B. Dr. Cash $77.55, Cr. VAT $11.55, Cr. Expense $66

C. Dr. Expense $63.98, Dr. VAT 13.57, Cr, Cash $77.5

D. Dr. Cash $77.55, Cr. VAT $13.57, Cr. Expense $63.98

Question # 31

When a petty cash book is kept, there will be:

A. More entries made in the general ledger

B. Fewer entries made in the general ledger

C. The same number of entries made in the general ledger

D .No entries made at all in the general ledger for items paid by the petty cash

Question # 32

A petty cash imprest is in operation with a float of $150 being maintained. There are vouchers

in the box totaling $76 and IOUS totaling $35. There is $29 in the box and $10 travel advance

has been given to one of the directors. How much should be drawn from the bank to top up

the imprest?

A. $110

B. $120

C. $76

D.$121

Das könnte Ihnen auch gefallen

- Management AccountingDokument164 SeitenManagement AccountingEhsan ElahiNoch keine Bewertungen

- ACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesDokument40 SeitenACCA F3 CH#5: Sale Returns, Purchases Returns, Discounts NotesMuhammad AzamNoch keine Bewertungen

- IGCSE & OL Accounting WorksheetsDokument73 SeitenIGCSE & OL Accounting Worksheetssana.ibrahimNoch keine Bewertungen

- Chapter 6 Suspense Practice Q HDokument5 SeitenChapter 6 Suspense Practice Q HSuy YanghearNoch keine Bewertungen

- Netflix VRIODokument1 SeiteNetflix VRIOHardik Jadav100% (1)

- MA1 BPP Kit (2016) CompletedDokument113 SeitenMA1 BPP Kit (2016) CompletedAbdul Wasay AlsyedNoch keine Bewertungen

- FA1Dokument13 SeitenFA1bingbongmylove33% (3)

- Crane Operator Rigger TrainingDokument55 SeitenCrane Operator Rigger TrainingAli Jalil80% (5)

- T2 Mock Exam (Dec'08 Exam)Dokument12 SeitenT2 Mock Exam (Dec'08 Exam)vasanthipuruNoch keine Bewertungen

- Fa2 Mock Test 2Dokument7 SeitenFa2 Mock Test 2Sayed Zain ShahNoch keine Bewertungen

- Fa2 Mock Exam 2Dokument10 SeitenFa2 Mock Exam 2Iqra HafeezNoch keine Bewertungen

- Chapter 6 Bank Recon Practice QHDokument3 SeitenChapter 6 Bank Recon Practice QHSuy Yanghear100% (1)

- MA 1 Mock Exam QuestionDokument4 SeitenMA 1 Mock Exam QuestionAbdul Gaffar100% (1)

- FA1 MOCK EXAM CHAPTER 1 To 5Dokument6 SeitenFA1 MOCK EXAM CHAPTER 1 To 5Haris AhnedNoch keine Bewertungen

- FA1 NotesDokument270 SeitenFA1 Notesdaneq80% (10)

- Chapter 11 - Maintaining Petty Cash RecordsDokument28 SeitenChapter 11 - Maintaining Petty Cash Recordsshemida100% (3)

- Fa1 PilotDokument14 SeitenFa1 PilotMuhammad Yousuf100% (3)

- Ma2 Mock ExamDokument13 SeitenMa2 Mock Examsaad shahidNoch keine Bewertungen

- T4 - Past Paper CombinedDokument53 SeitenT4 - Past Paper CombinedU Abdul Rehman100% (1)

- FA2 Mock 3 ExamDokument12 SeitenFA2 Mock 3 ExamRameen ChNoch keine Bewertungen

- Chapter 03Dokument12 SeitenChapter 03Asim NazirNoch keine Bewertungen

- Introduction To Economics 1Dokument89 SeitenIntroduction To Economics 1Jely Taburnal Bermundo100% (1)

- FIA MA1 Course Exam MOCK 3 QuestionsDokument12 SeitenFIA MA1 Course Exam MOCK 3 QuestionsBharat Kabariya67% (3)

- FIA MA1 Mock Exam - QuestionsDokument20 SeitenFIA MA1 Mock Exam - QuestionsSim LeeWen50% (2)

- Omair Masood: AS Level MCQs MadnessDokument75 SeitenOmair Masood: AS Level MCQs MadnessAli Qazi100% (11)

- Bodie 11e PPT Ch08Dokument26 SeitenBodie 11e PPT Ch08Fatimah AlashourNoch keine Bewertungen

- Sure Repair LectureDokument10 SeitenSure Repair LectureKaye Villaflor80% (5)

- Accounting Source Documents Quiz: QuestionsDokument2 SeitenAccounting Source Documents Quiz: QuestionsGilbert Cal100% (1)

- FIA FA1 Course Exam 2 QuestionsDokument16 SeitenFIA FA1 Course Exam 2 Questionsmarlynrich3652Noch keine Bewertungen

- Book of Original Entry MCQDokument14 SeitenBook of Original Entry MCQTahmina SobhanNoch keine Bewertungen

- Fa1 Exam Report j14 1Dokument3 SeitenFa1 Exam Report j14 1Abdul SamadNoch keine Bewertungen

- Double Entry Bookkeeping: Ledgers Journal Trial Balance Practice Questions Answer BankDokument12 SeitenDouble Entry Bookkeeping: Ledgers Journal Trial Balance Practice Questions Answer BankUmar SageerNoch keine Bewertungen

- Mock 2Dokument13 SeitenMock 2Angie Nguyen0% (1)

- Accacat Paper t3 Maintaining Financial ReDokument32 SeitenAccacat Paper t3 Maintaining Financial ReKian Yen0% (1)

- Chapter 12-Depreciation and Disposal of Non-Current AssetsDokument15 SeitenChapter 12-Depreciation and Disposal of Non-Current AssetsJunaid IslamNoch keine Bewertungen

- Revision Worksheet FundamentalsDokument2 SeitenRevision Worksheet Fundamentalssshyam3100% (1)

- FA Consolidation Test - Questions S20-A21 PDFDokument16 SeitenFA Consolidation Test - Questions S20-A21 PDFAlpha MpofuNoch keine Bewertungen

- Chapter 5 - Book of Prime EntryDokument16 SeitenChapter 5 - Book of Prime EntryHanis NailyNoch keine Bewertungen

- ManufacturingDokument6 SeitenManufacturingapi-3034896990% (1)

- MCQ FA1 TenDokument12 SeitenMCQ FA1 TenZeeshan BakaliNoch keine Bewertungen

- FA1 Bank ReconciliationDokument4 SeitenFA1 Bank Reconciliationamir100% (1)

- Correction of Errors (With Answers) : Step 1 Show CorrectionsDokument34 SeitenCorrection of Errors (With Answers) : Step 1 Show CorrectionsangaNoch keine Bewertungen

- Accounting Revision Notes (0452)Dokument38 SeitenAccounting Revision Notes (0452)MissAditi KNoch keine Bewertungen

- FA1 Basic MCQsDokument8 SeitenFA1 Basic MCQsamir100% (3)

- Ratios AS - Topical A Level Accounting Past PaperDokument27 SeitenRatios AS - Topical A Level Accounting Past PaperVersha 2021Noch keine Bewertungen

- MA1 (Mock 2)Dokument19 SeitenMA1 (Mock 2)Shamas 786Noch keine Bewertungen

- Examiner's Report - FA2 PDFDokument40 SeitenExaminer's Report - FA2 PDFSuy YanghearNoch keine Bewertungen

- MA1 First TestDokument14 SeitenMA1 First TestMishael MAKE-UP100% (1)

- Introduction To AccountingDokument3 SeitenIntroduction To AccountingDamith Piumal Perera100% (1)

- Worksheet 4.1 Introducing Bank ReconciliationDokument4 SeitenWorksheet 4.1 Introducing Bank ReconciliationHan Nwe Oo100% (1)

- Incomplete Records - N4 22 PDFDokument57 SeitenIncomplete Records - N4 22 PDFSay SopheakneathNoch keine Bewertungen

- Incomplete RecordsDokument27 SeitenIncomplete RecordsSteven Raintung0% (1)

- 02 MA1 LRP Questions 2014Dokument34 Seiten02 MA1 LRP Questions 2014Yahya KaimkhaniNoch keine Bewertungen

- AccountingDokument24 SeitenAccountingnour mohammedNoch keine Bewertungen

- Single Entry System and Incomplete Records NotesDokument5 SeitenSingle Entry System and Incomplete Records NotesKristen Shaw100% (5)

- Bank Reconciliation Statement-2 MCQSFFDDokument11 SeitenBank Reconciliation Statement-2 MCQSFFDAbdul Ahad YousafNoch keine Bewertungen

- Accounting II (Written)Dokument20 SeitenAccounting II (Written)drosbeastNoch keine Bewertungen

- Fa1 Batch 86 Test 19 March 24Dokument6 SeitenFa1 Batch 86 Test 19 March 24Paradox ForgeNoch keine Bewertungen

- Fa1 Mock 3Dokument9 SeitenFa1 Mock 3smartlearning1977Noch keine Bewertungen

- Financial Accounting Test One (01) James MejaDokument21 SeitenFinancial Accounting Test One (01) James MejaroydkaswekaNoch keine Bewertungen

- FA1 Mock 1Dokument10 SeitenFA1 Mock 1Abdul MughalNoch keine Bewertungen

- Financial Accounting Final AssessmentDokument17 SeitenFinancial Accounting Final AssessmentroydkaswekaNoch keine Bewertungen

- Fa1 Mock 2Dokument9 SeitenFa1 Mock 2smartlearning1977Noch keine Bewertungen

- Cash Book Homework AnswerDokument8 SeitenCash Book Homework AnswerBonnie ChanNoch keine Bewertungen

- ACCADokument12 SeitenACCAanon-502587Noch keine Bewertungen

- The Voucher System of ControlDokument32 SeitenThe Voucher System of ControlNicole LaiNoch keine Bewertungen

- ACCA F2 Becker Study Material PDF F2Dokument1 SeiteACCA F2 Becker Study Material PDF F2Ehsan ElahiNoch keine Bewertungen

- F3 MTQSDokument2 SeitenF3 MTQSEhsan ElahiNoch keine Bewertungen

- SKANS School of Accountancy, MultanDokument6 SeitenSKANS School of Accountancy, MultanEhsan ElahiNoch keine Bewertungen

- Set 1 QP Business StatisticsDokument2 SeitenSet 1 QP Business StatisticsTitus ClementNoch keine Bewertungen

- DSR Report - Milind BM MiraroadDokument28 SeitenDSR Report - Milind BM MiraroadMilind navalkarNoch keine Bewertungen

- Q-Egr-15-23 Puesta A Cero Fap Spare Parts TC Updated 4-17-2023 ItpDokument26 SeitenQ-Egr-15-23 Puesta A Cero Fap Spare Parts TC Updated 4-17-2023 ItpAsahel BenitezNoch keine Bewertungen

- Jurnal TOCDokument11 SeitenJurnal TOCEndia HergariNoch keine Bewertungen

- Solutions To Selected End-Of-Chapter 4 Problem Solving QuestionsDokument10 SeitenSolutions To Selected End-Of-Chapter 4 Problem Solving QuestionsVân Anh Đỗ LêNoch keine Bewertungen

- Wiley - International Economics, 13th Edition - 978-1-119-55495-0Dokument2 SeitenWiley - International Economics, 13th Edition - 978-1-119-55495-0Kankana BanerjeeNoch keine Bewertungen

- Process Costing: Faculty: Zaira AneesDokument76 SeitenProcess Costing: Faculty: Zaira AneesAnas4253Noch keine Bewertungen

- Additional Review QNSDokument2 SeitenAdditional Review QNSchabeNoch keine Bewertungen

- Management - Nepali BBS 3rd YearDokument63 SeitenManagement - Nepali BBS 3rd YearDhurba Bahadur BkNoch keine Bewertungen

- Capítulo 3 - Análisis Univariante de Series Temporales. Modelos ARIMA, Intervención y Función de TransferenciaDokument12 SeitenCapítulo 3 - Análisis Univariante de Series Temporales. Modelos ARIMA, Intervención y Función de TransferenciaFelix MartinezNoch keine Bewertungen

- CCBE - Rajeev Tripathi - 3crd - POMDokument7 SeitenCCBE - Rajeev Tripathi - 3crd - POMRohit BhangaleNoch keine Bewertungen

- ACTJULY2022Dokument2 SeitenACTJULY2022mohan venkatNoch keine Bewertungen

- CVDokument1 SeiteCVEnno AskrindoNoch keine Bewertungen

- XII - Economics - MOCK PAPERDokument7 SeitenXII - Economics - MOCK PAPERRiyanshi MauryaNoch keine Bewertungen

- Common NFT Form Rev 1Dokument2 SeitenCommon NFT Form Rev 1Sree Siddarameshwara Agro IndustriesNoch keine Bewertungen

- MIDHANIDokument4 SeitenMIDHANIShaik MajaharNoch keine Bewertungen

- Elspec Case Study Cablecaritaly WebDokument3 SeitenElspec Case Study Cablecaritaly WebSid LicoNoch keine Bewertungen

- Business ApplicationDokument1 SeiteBusiness ApplicationBảo Châu VươngNoch keine Bewertungen

- Mathematical Analysis 2019 ASSIGNDokument9 SeitenMathematical Analysis 2019 ASSIGNMario Rioux JnrNoch keine Bewertungen

- Ets InternacionalDokument72 SeitenEts InternacionalRicardo MarquesNoch keine Bewertungen

- Stated Choice MethodsAnalysis and ApplicationsDokument30 SeitenStated Choice MethodsAnalysis and ApplicationsGolam MorshedNoch keine Bewertungen

- Package Scheme of Incentive - 2019Dokument59 SeitenPackage Scheme of Incentive - 2019GOYAL & AGRAWAL GOYAL & AGRAWALNoch keine Bewertungen

- 1.all Drafting System. All Parts of DraftingDokument3 Seiten1.all Drafting System. All Parts of DraftingRatul Hasan0% (1)

- Indemnity BondDokument3 SeitenIndemnity BondNavam JainNoch keine Bewertungen

- Neon PolityDokument1 SeiteNeon PolityNirajThakurNoch keine Bewertungen