Beruflich Dokumente

Kultur Dokumente

Sebi Frame Work

Hochgeladen von

dushyantOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sebi Frame Work

Hochgeladen von

dushyantCopyright:

Verfügbare Formate

ROLE OF SEBI IN CORPORATE GOVERNANCE (LEGAL FRAMEWORK)

Clause 49 of the Listing Agreement

Clause 49 of the listing agreement to be entered into by the listed companies with the Stock Exchanges refers to

certain conditions under the heading “Corporate Governance”.

The said clause 49 mandates various conditions to be complied with by the Companies under the head “Corporate

Governance”.

Thus, it is specific to the Listed Public Companies though the word “Corporate Governance” is used in general and

as a synonymous to “Good Governance”.

The Listing agreement was first introduced by Bombay Stock Exchange and later followed by other stock

exchanges.

SEBI, through its circular dated February 21, 2000, specified principles of corporate governance and introduced a

new clause 49 in the Listing agreement of the Stock Exchanges.

Clause 49 was amended a number of times following the recommendations of subsequent Committees.

Clause 49 was last revised w.e.f. October 1, 2014.

It was revised to:

• bring the Corporate Governance norms in line with Companies Act, 2013

• impose more stringent conditions to the listed companies through listing agreement considering the need to

have better governance practices in the listed companies

• adopt leading industry practices on Corporate Governance

• make framework of CG more effective

• ensure disclosure and transparency on all material matters.

Revised Clause 49 is applicable to all listed companies

Provisions relating to constitution of Risk Management Committee to be applicable to top 100 listed companies by

market capitalisation as at the end of the immediate previous financial year

Other listed entities which are not companies, but body corporate or are subject to regulations under other statutes

(e.g. banks, financial institutions, insurance companies etc.). Clause 49 will apply to the extent that it does not

violate their respective statutes and guidelines or directives issued by the relevant regulatory authorities.

Principles

1) Rights of Shareholders: The company should seek to protect and facilitate the exercise of shareholders’ rights,

viz.,

• Shareholders should have the right to participate in, and to be sufficiently informed on, decisions

concerning fundamental corporate changes.

• Shareholders should have the opportunity to participate effectively and vote in general shareholder

meetings.

• Shareholders should be informed of the rules, including voting procedures that govern general shareholder

meetings.

• Shareholders should have the opportunity to ask questions to the board, to place items on the agenda of

general meetings, and to propose resolutions, subject to reasonable limitations.

• Effective shareholder participation in key Corporate Governance decisions, such as the nomination and

election of

• board members, should be facilitated.

• The exercise of ownership rights by all shareholders, including institutional investors, should be facilitated.

• The Company should have an adequate mechanism to address the grievances of the shareholders.

• Minority shareholders should be protected from abusive actions by, or in the interest of, controlling

shareholders acting

• either directly or indirectly, and should have effective means of redress

2) Information Sharing with Shareholders:

• Shareholders should be furnished with sufficient and timely information concerning the date, location and

agenda of

• general meetings, as well as full and timely information regarding the issues to be discussed at the meeting.

• Capital structures and arrangements that enable certain shareholders to obtain a degree of control

disproportionate to

• their equity ownership should be disclosed.

• All investors should be able to obtain information about the rights attached to all series and classes of

shares before they

• purchase.

3) Equitable Treatment of all Shareholders:

• All shareholders of the same series of a class should be treated equally.

• Effective shareholder participation in key Corporate Governance decisions, such as the nomination and

election of

• board members, should be facilitated.

• Exercise of voting rights by foreign shareholders should be facilitated.

• The company should devise a framework to avoid Insider trading and abusive self-dealing.

• Processes and procedures for general shareholder meetings should allow for equitable treatment of all

shareholders.

• Company procedures should not make it unduly difficult or expensive to cast votes.

4) Role of Stakeholders in Corporate Governance The company should recognise the rights of stakeholders and

encourage co-operation between company and the stakeholders.

• The rights of stakeholders that are established by law or through mutual agreements are to be respected.

• Stakeholders should have the opportunity to obtain effective redress for violation of their rights.

• Company should encourage mechanisms for employee participation.

• Stakeholders should have access to relevant, sufficient and reliable information on a timely and regular

basis to enable them to participate in Corporate Governance process.

• The company should devise an effective whistle blower mechanism enabling stakeholders, including

individual employees and their representative bodies, to freely communicate their concerns about illegal or

unethical practices.

5) Disclosure and Transparency The company should ensure timely and accurate disclosure on all material matters

including the financial situation, performance, ownership, and governance of the company.

• Information should be prepared and disclosed in accordance with the prescribed standards of accounting,

financial and non-financial disclosure.

• Channels for disseminating information should provide for equal, timely and cost efficient access to

relevant information by users.

• The company should maintain minutes of the meeting explicitly recording dissenting opinions, if any.

• The company should implement the prescribed accounting standards in letter and spirit in the preparation of

financial statements taking into consideration the interest of all stakeholders and should also ensure that the

annual audit is conducted by an independent, competent and qualified auditor.

6) Responsibilities of the Board

(i) Disclosure of Information

• Members of the Board and key executives should be required to disclose to the board whether they,

directly, indirectly or on behalf of third parties, have a material interest in any transaction or matter directly

affecting the company.

• The Board and top management should conduct themselves so as to meet the expectations of operational

transparency to stakeholders while at the same time maintaining confidentiality of information in order to

foster a culture for good decision-making.

(ii) Key Functions of the Board

• Reviewing and guiding corporate strategy, major plans of action, risk policy, annual budgets and business

plans; setting performance objectives; monitoring implementation and corporate performance; and

overseeing major capital expenditures, acquisitions and divestments.

• Monitoring the effectiveness of the company’s governance practices and making changes as needed.

• Selecting, compensating, monitoring and, when necessary, replacing key executives and overseeing

succession planning.

• Aligning key executive and board remuneration with the longer term interests of the company and its

shareholders.

• Ensuring a transparent board nomination process with the diversity of thought, experience, knowledge,

perspective and gender in the Board.

• Monitoring and managing potential conflicts of interest of management, board members and shareholders,

including misuse of corporate assets and abuse in related party transactions.

• Ensuring the integrity of the company’s accounting and financial reporting systems , including the

independent audit, and that appropriate systems of control are in place, in particular, systems for risk

management, financial and operational control, and compliance with the law and relevant standards.

• Overseeing the process of disclosure and communications.

• Monitoring and reviewing Board Evaluation framework.

(iii) Other Responsibilities:

• The Board should provide the strategic guidance to the company, ensure effective monitoring of the

management and should be accountable to the company and the shareholders.

• The Board should set a corporate culture and the values by which executives throughout a group will

behave.

• Board members should act on a fully informed basis, in good faith, with due diligence and care, and in the

best interest of the company and the shareholders.

• The Board should encourage continuing directors training to ensure that the Board members are kept up to

date.

• Where Board decisions may affect different shareholder groups differently, the Board should treat all

shareholders fairly.

• The Board should apply high ethical standards while taking into account the interests of stakeholders.

• The Board should be able to exercise objective independent judgement on corporate affairs.

• Boards should consider assigning a sufficient number of non-executive Board members capable of

exercising independent judgement to tasks where there is a potential for conflict of interest.

• The Board should ensure that, while rightly encouraging positive thinking, these do not result in over-

optimism that either leads to significant risks not being recognised or exposes the company to excessive

risk.

• The Board should have ability to ‘step back’ to assist executive management by challenging the

assumptions underlying: strategy, strategic initiatives (such as acquisitions), risk appetite, exposures and the

key areas of the company's focus.

• When committees of the board are established, their mandate, composition and working procedures should

be well defined and disclosed by the board.

• Board members should be able to commit themselves effectively to their responsibilities.

• In order to fulfil their responsibilities, board members should have access to accurate, relevant and timely

information.

• The Board and senior management should facilitate the Independent Directors to perform their role

effectively as a Board member and also a member of a committee.

Das könnte Ihnen auch gefallen

- What Does Governance Mean?: Is Exercised Only by The Government of The Country"Dokument7 SeitenWhat Does Governance Mean?: Is Exercised Only by The Government of The Country"Drayce Ferran100% (1)

- Corporate Governance - Effective Performance Evaluation of the BoardVon EverandCorporate Governance - Effective Performance Evaluation of the BoardNoch keine Bewertungen

- Nature and ScopeDokument16 SeitenNature and ScopedushyantNoch keine Bewertungen

- What Is Corporate Governance?Dokument37 SeitenWhat Is Corporate Governance?Marium ShabbirNoch keine Bewertungen

- Gorporate Government On Malaysia CompanyDokument27 SeitenGorporate Government On Malaysia CompanyJames100% (5)

- Corporate Finance Workbook: A Practical ApproachVon EverandCorporate Finance Workbook: A Practical ApproachNoch keine Bewertungen

- Cadbury ReportDokument16 SeitenCadbury ReportToral Shah100% (1)

- Introduction to Corporate Governance Principles and PillarsDokument11 SeitenIntroduction to Corporate Governance Principles and Pillarsqari saib100% (3)

- Good GovernanceDokument36 SeitenGood GovernanceCheZz Terabithian100% (6)

- Corporate Governance EssentialsDokument55 SeitenCorporate Governance EssentialsVaidehi ShuklaNoch keine Bewertungen

- Corporate GovernanceDokument133 SeitenCorporate GovernanceAman Dheer Kapoor100% (1)

- Top Executives & Leadership TeamsDokument4 SeitenTop Executives & Leadership TeamsPragati SahuNoch keine Bewertungen

- CG Intro Session 1Dokument31 SeitenCG Intro Session 1Dhaval ShahNoch keine Bewertungen

- IFRS9 Financial Instruments 2018 PDFDokument108 SeitenIFRS9 Financial Instruments 2018 PDFYo ThuvanNoch keine Bewertungen

- Corporate Governance and Social ResponsibilityDokument7 SeitenCorporate Governance and Social ResponsibilityMohitNoch keine Bewertungen

- Corporate Governance: Unit Iv Entrepreneurship and Good GovernanceDokument20 SeitenCorporate Governance: Unit Iv Entrepreneurship and Good GovernanceShailajareddy ChintapalliNoch keine Bewertungen

- Corporate Governance Mechanisms (US StyleDokument19 SeitenCorporate Governance Mechanisms (US StyleNadeem GanaiNoch keine Bewertungen

- Unit 2 Corporate GovernanceDokument28 SeitenUnit 2 Corporate GovernanceDeborahNoch keine Bewertungen

- ICAEW Advanced Level Corporate Reporting Study Manual Chapter Wise Interactive Questions With Immediate AnswersDokument191 SeitenICAEW Advanced Level Corporate Reporting Study Manual Chapter Wise Interactive Questions With Immediate AnswersOptimal Management Solution100% (1)

- Internal and External Institutions and Influences of Corporate GovernanceDokument39 SeitenInternal and External Institutions and Influences of Corporate GovernanceLovely PasatiempoNoch keine Bewertungen

- Corporate Governance EssentialsDokument48 SeitenCorporate Governance EssentialsMark IlanoNoch keine Bewertungen

- Maxwell Communication Corporation and Mirror Group NewspapersDokument28 SeitenMaxwell Communication Corporation and Mirror Group NewspapersKajal V100% (1)

- Shailesh Black BookDokument57 SeitenShailesh Black Bookshailesh prajapatiNoch keine Bewertungen

- Know Your CustomerDokument2 SeitenKnow Your CustomerSAMEERNoch keine Bewertungen

- Basel Committee Principles Guide Bank GovernanceDokument8 SeitenBasel Committee Principles Guide Bank Governanceprajwal shresthaNoch keine Bewertungen

- CG 1Dokument28 SeitenCG 1saran muralidaranNoch keine Bewertungen

- Business Ethics and Corporate Governance (Session-1)Dokument15 SeitenBusiness Ethics and Corporate Governance (Session-1)Sharad TapasviNoch keine Bewertungen

- Improving Corporate Governance in NepalDokument4 SeitenImproving Corporate Governance in NepalAzula AzulaNoch keine Bewertungen

- Corporate Governance Principles IIMK Vidhu ShekharDokument26 SeitenCorporate Governance Principles IIMK Vidhu ShekharBalachandra MallyaNoch keine Bewertungen

- Nitin - ProjectDokument19 SeitenNitin - ProjectAnkit SangwanNoch keine Bewertungen

- G20/The Oecd Principles of Corporate GovernanceDokument35 SeitenG20/The Oecd Principles of Corporate GovernanceNino MdinaradzeNoch keine Bewertungen

- G20-OECD Principles of CGDokument3 SeitenG20-OECD Principles of CGSherry LaiNoch keine Bewertungen

- CG AnalysisDokument5 SeitenCG AnalysisCHETHAN KUMAR N 17BBLB012Noch keine Bewertungen

- Module IV Corporate Governance and Social Responsibility 3Dokument13 SeitenModule IV Corporate Governance and Social Responsibility 3Pulak DixitNoch keine Bewertungen

- CF Unit 5Dokument52 SeitenCF Unit 5Saravanan ShanmugamNoch keine Bewertungen

- Prinsip Corporate GovernanceDokument20 SeitenPrinsip Corporate GovernanceMuhammad Vakollad WibowoNoch keine Bewertungen

- Lecture 3Dokument4 SeitenLecture 3ayamaher3323Noch keine Bewertungen

- Assignment in GovernanceDokument10 SeitenAssignment in GovernanceCyrus Joshua SargentoNoch keine Bewertungen

- Kumar Mangalam Report On Corporate GovernanceDokument28 SeitenKumar Mangalam Report On Corporate GovernanceKirti BaviskarNoch keine Bewertungen

- Unit V - Corporate GovernanceDokument28 SeitenUnit V - Corporate Governancepooja_patnaik237Noch keine Bewertungen

- Corporate Goverance in IndiaDokument43 SeitenCorporate Goverance in IndiaParandeep ChawlaNoch keine Bewertungen

- GBRICK NOTEDokument13 SeitenGBRICK NOTEshadowlord468Noch keine Bewertungen

- GBRICK NOTESDokument25 SeitenGBRICK NOTESshadowlord468Noch keine Bewertungen

- CG PracDokument45 SeitenCG PrachitarthsarvaiyaNoch keine Bewertungen

- ICAC Symposium Cornerstone Corporate GovernanceDokument40 SeitenICAC Symposium Cornerstone Corporate GovernanceOwen GarciaNoch keine Bewertungen

- The Oecd Principles of Corporate GovernanceDokument8 SeitenThe Oecd Principles of Corporate GovernanceNazifaNoch keine Bewertungen

- Lecture 25 NovDokument10 SeitenLecture 25 NovamsalaliNoch keine Bewertungen

- CORPORATE GOVERNANCE FUNDAMENTALSDokument22 SeitenCORPORATE GOVERNANCE FUNDAMENTALSDeanne GuintoNoch keine Bewertungen

- Corporate GovernanceDokument29 SeitenCorporate GovernanceCHANDER PARKASHNoch keine Bewertungen

- ICAC Symposium Corporate Governance CornerstoneDokument40 SeitenICAC Symposium Corporate Governance CornerstonevickymellasariNoch keine Bewertungen

- Corporate Governance FundamentalsDokument9 SeitenCorporate Governance FundamentalsjdjdbNoch keine Bewertungen

- Corporate Governance: Presented ByDokument36 SeitenCorporate Governance: Presented ByDeepak GNoch keine Bewertungen

- Ethical Aspects of SFMDokument21 SeitenEthical Aspects of SFMKaneNoch keine Bewertungen

- Corporate Governance: Presented byDokument36 SeitenCorporate Governance: Presented bymala singhNoch keine Bewertungen

- 22mba510a BLCG Module 5Dokument55 Seiten22mba510a BLCG Module 5Shivakami RajanNoch keine Bewertungen

- Corporate Governance: "Satyam Vada Dharmam Chara"Dokument23 SeitenCorporate Governance: "Satyam Vada Dharmam Chara"Akshay MalhotraNoch keine Bewertungen

- BGS Mod-3Dokument29 SeitenBGS Mod-3Shruti GadgoliNoch keine Bewertungen

- Corporate Governance ReportDokument4 SeitenCorporate Governance ReportNikhil PrajapatiNoch keine Bewertungen

- Corporate Governance EssentialsDokument16 SeitenCorporate Governance EssentialsIqbal HanifNoch keine Bewertungen

- Presented by Group 3Dokument23 SeitenPresented by Group 3Aishwarya ShettyNoch keine Bewertungen

- Ethics and Corporate GovernanaceDokument3 SeitenEthics and Corporate GovernanaceAditya MishraNoch keine Bewertungen

- Regulations & Reforms in CG: Prof. Supriti Mishra Session 5Dokument44 SeitenRegulations & Reforms in CG: Prof. Supriti Mishra Session 5SilaroNoch keine Bewertungen

- Lesson 2.2 Responsibilities of The BoardDokument9 SeitenLesson 2.2 Responsibilities of The BoardYessameen Franco R. CastilloNoch keine Bewertungen

- Code On Corporate GovernanceDokument63 SeitenCode On Corporate GovernanceVishwas JorwalNoch keine Bewertungen

- 2960Dokument3 Seiten2960erickson hernanNoch keine Bewertungen

- Corp Gov - TybmsDokument46 SeitenCorp Gov - TybmsNurdayantiNoch keine Bewertungen

- Revised ClauseDokument33 SeitenRevised ClausePalash SarowareNoch keine Bewertungen

- GGSR - ReportDokument49 SeitenGGSR - ReportGabrielle Alonzo100% (1)

- Corporate Governance and Social Responsibility Assignment: Name: Ravneet Rehal 2 Year Section A Roll No. 36Dokument14 SeitenCorporate Governance and Social Responsibility Assignment: Name: Ravneet Rehal 2 Year Section A Roll No. 36ravneetNoch keine Bewertungen

- 564Dokument12 Seiten564dushyantNoch keine Bewertungen

- copy pptDokument9 Seitencopy pptdushyantNoch keine Bewertungen

- Akshaya Trust NgoDokument24 SeitenAkshaya Trust NgodushyantNoch keine Bewertungen

- Corporate Social Responsibility What Is Corporate Social Responsibility (CSR) ?Dokument5 SeitenCorporate Social Responsibility What Is Corporate Social Responsibility (CSR) ?Mansi MalikNoch keine Bewertungen

- Industrial Dispute, Kinds of Industrial DisputesDokument21 SeitenIndustrial Dispute, Kinds of Industrial DisputesdushyantNoch keine Bewertungen

- Eviction Petition Download in Ms Word FormatDokument6 SeitenEviction Petition Download in Ms Word Formatinderpreet100% (1)

- The Role of The Board of Directors in Corporate GovernanceDokument12 SeitenThe Role of The Board of Directors in Corporate GovernancedushyantNoch keine Bewertungen

- Hearing and Deciding ClaimsDokument11 SeitenHearing and Deciding ClaimsdushyantNoch keine Bewertungen

- White Collar CrimeDokument12 SeitenWhite Collar CrimedushyantNoch keine Bewertungen

- Trademark Protection Through International AgreementsDokument29 SeitenTrademark Protection Through International AgreementsdushyantNoch keine Bewertungen

- Concept of Minimum WageDokument24 SeitenConcept of Minimum WageVishal SinghNoch keine Bewertungen

- Fair Wage: Meaning and ConceptDokument11 SeitenFair Wage: Meaning and ConceptdushyantNoch keine Bewertungen

- Social MediaDokument11 SeitenSocial MediadushyantNoch keine Bewertungen

- Introduction of GST in India Simplifies Indirect TaxationDokument12 SeitenIntroduction of GST in India Simplifies Indirect TaxationdushyantNoch keine Bewertungen

- The Employee's State Insurance Act, 1948 (ESI Act)Dokument10 SeitenThe Employee's State Insurance Act, 1948 (ESI Act)dushyant100% (1)

- Auditors' Responsibility For Fraud Detection.: Fraud Accounting and Financial ReportingDokument13 SeitenAuditors' Responsibility For Fraud Detection.: Fraud Accounting and Financial ReportingdushyantNoch keine Bewertungen

- copy pptDokument9 Seitencopy pptdushyantNoch keine Bewertungen

- The Role of The Board of Directors in Corporate GovernanceDokument12 SeitenThe Role of The Board of Directors in Corporate GovernancedushyantNoch keine Bewertungen

- Difference Between Customer and ConsumerDokument12 SeitenDifference Between Customer and ConsumerdushyantNoch keine Bewertungen

- Gulmuhommad TarasahebDokument1 SeiteGulmuhommad TarasahebdushyantNoch keine Bewertungen

- Theories and Enron ScandalDokument6 SeitenTheories and Enron ScandalMansi MalikNoch keine Bewertungen

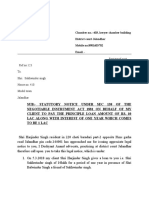

- Advocate Issues Statutory Notice to Repay LoanDokument2 SeitenAdvocate Issues Statutory Notice to Repay LoandushyantNoch keine Bewertungen

- Detecting Financial Fraud: Auditor's Guide to SAS 82Dokument8 SeitenDetecting Financial Fraud: Auditor's Guide to SAS 82dushyantNoch keine Bewertungen

- Resolving An Ethical Dilemma: Know The PrinciplesDokument6 SeitenResolving An Ethical Dilemma: Know The PrinciplesdushyantNoch keine Bewertungen

- Theories and Enron ScandalDokument6 SeitenTheories and Enron ScandalMansi MalikNoch keine Bewertungen

- Difference Between Customer and ConsumerDokument12 SeitenDifference Between Customer and ConsumerdushyantNoch keine Bewertungen

- Advocate Dushyant Anand Chamber No.:-403, Lawyer Chamber Building District Court Jalandhar Mobile No.8901603702 Registered PostDokument2 SeitenAdvocate Dushyant Anand Chamber No.:-403, Lawyer Chamber Building District Court Jalandhar Mobile No.8901603702 Registered PostdushyantNoch keine Bewertungen

- Complainant 138Dokument4 SeitenComplainant 138dushyantNoch keine Bewertungen

- Bni Ar2013 Eng Fin PDFDokument514 SeitenBni Ar2013 Eng Fin PDFBriandLukeNoch keine Bewertungen

- International Financial Reporting Standard 1Dokument26 SeitenInternational Financial Reporting Standard 1Platonic100% (17)

- CIL Annual ReportDokument251 SeitenCIL Annual ReportAnirudh91Noch keine Bewertungen

- Hitt Chapter 10 Corporate GovernanceDokument34 SeitenHitt Chapter 10 Corporate GovernanceHemant ChaudharyNoch keine Bewertungen

- Deloitte IFRS 1 First Time Implementation GuideDokument84 SeitenDeloitte IFRS 1 First Time Implementation GuideRaymond M Reed100% (1)

- Contents of Only This Much For Company Secretary Professional Program All Module BookDokument2 SeitenContents of Only This Much For Company Secretary Professional Program All Module BookOnly This MuchNoch keine Bewertungen

- Deutche Bank Doc 1 - Deutsche Bank at A GlanceDokument14 SeitenDeutche Bank Doc 1 - Deutsche Bank at A GlanceUriGrodNoch keine Bewertungen

- Arohi Badshah 7Dokument21 SeitenArohi Badshah 7Deepanshu JharkhandeNoch keine Bewertungen

- Jaiib Ethics in Banking Part-2Dokument15 SeitenJaiib Ethics in Banking Part-2avinash kumarNoch keine Bewertungen

- Derivatives VolumesDokument13 SeitenDerivatives VolumesCristina ZaineaNoch keine Bewertungen

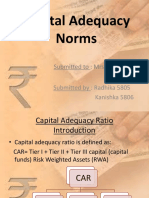

- Capital Adequacy NormsDokument26 SeitenCapital Adequacy Normspuneeta chughNoch keine Bewertungen

- Annual Financial Highlights and Share PerformanceDokument323 SeitenAnnual Financial Highlights and Share PerformanceMaylaniNoch keine Bewertungen

- 06&07 - GE05 - FECGBL - Corporate Governance (10%) - Class No.06 & 07 - by MD - Monowar Hossain FCMA, CPA, FCS, ACADokument17 Seiten06&07 - GE05 - FECGBL - Corporate Governance (10%) - Class No.06 & 07 - by MD - Monowar Hossain FCMA, CPA, FCS, ACAadnan.shajonNoch keine Bewertungen

- CLERP9 SummaryDokument2 SeitenCLERP9 SummaryUjwal_Adhikari_4618Noch keine Bewertungen

- PWC Ifrs Us Gaap Similarities and DifferencesDokument222 SeitenPWC Ifrs Us Gaap Similarities and DifferencesShahwaiz ZahidNoch keine Bewertungen

- Chapter 18Dokument13 SeitenChapter 18Muntazir MehdiNoch keine Bewertungen

- AP Oil International Limited Annual Report 2015: 40 Years of Growing Story/TITLEDokument116 SeitenAP Oil International Limited Annual Report 2015: 40 Years of Growing Story/TITLETony Del PieroNoch keine Bewertungen

- UGC NET - Strategic ManagementDokument101 SeitenUGC NET - Strategic ManagementKasiraman RamanujamNoch keine Bewertungen

- Derivatives Study on India's Growing MarketDokument9 SeitenDerivatives Study on India's Growing MarketManjunath NayakaNoch keine Bewertungen

- GCG and ESG TheoryDokument5 SeitenGCG and ESG Theorypempi mlgNoch keine Bewertungen

- Annual Report 2009 10 EnglishDokument106 SeitenAnnual Report 2009 10 Englishrabi_shah_2Noch keine Bewertungen