Beruflich Dokumente

Kultur Dokumente

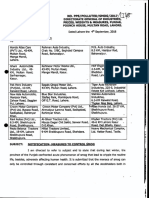

S. # Section of The Law Proposed Change Nature of Impact Recommendation / Remarks

Hochgeladen von

sadullah0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten1 SeiteOriginaltitel

Post Budget

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

13 Ansichten1 SeiteS. # Section of The Law Proposed Change Nature of Impact Recommendation / Remarks

Hochgeladen von

sadullahCopyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

Section

S. # of the Proposed Change Nature of Impact Recommendation / Remarks

Law

1 Income In Income Tax Ordinance Under The advance tax Recommendation:

Tax Section 148: collected under Clarification to this effect would be

Ordinanc section 148 for import helpful and appreciated

e – (A) in sub-section (1),— of capital goods and

Section (a) after the word “Schedule” raw material by an 1. Insert in end of subsection

148 and the expression “in respect of industrial undertaking (7) of section148 of

income tax ordinance,

Twelfth goods classified in Parts I to III of for its own use will

2001:

Schedule the Twelfth Schedule” shall be now be treated as

inserted; and minimum “Provided that this sub

(b) for the full stop at the end, a tax. However, at the section, in case of

colon shall be substituted and time of the import industrial undertakings

thereafter the following proviso the classification of importing raw material,

shall be added, namely:— capital goods and components and sub-

86 “Provided that the Board raw material relates assemblies for own use in

may, by a notification in the to the activity to be manufacturing shall not

official Gazette, add in the undertaken by the apply to Part III of the

Twelfth Schedule any entry taxpayer will not be Twelfth Schedule.

thereto or omit any entry clear. While the intent 2. Proviso to be added in

therefrom or amend any entry of the legislation is Division II of Part V of

therein.”; understood to be to Chapter X after (b):

reduce incidence of

“In case of industrial

(B) in sub-section (7), taxation on the local

undertakings importing

(a) after the words “import of”, industry and make

raw material, components

the expression “goods on which local manufacturing

and sub-assemblies for

tax is required to be collected attractive, the the manufacturing of auto

under this section at the rate of inadvertent omission parts duly verified by the

1% or 2% by an industrial of a mechanism to engineering development

undertaking for its own use.” establish link board for its own

shall be inserted; and between imports and consumption, shall be the

(b) the hyphen and clauses (a), the subsequent use one applicable to the

(c), (d) and (e), occurring has created an category (1% or 2% as

thereafter shall be omitted; anomaly where most the case may).”

of the imports of the

auto vending industry

will now attract a

duty of 5.5% as the

final tax liability. This

high incidence of

taxation is not

sustainable as the

profit margin of this

industry is far below

this threshold.

Das könnte Ihnen auch gefallen

- Test Bank For Supply Chain Management A Logistics Perspective 9th Edition CoyleDokument8 SeitenTest Bank For Supply Chain Management A Logistics Perspective 9th Edition Coylea385904759Noch keine Bewertungen

- Disney Pixar Case AnalysisDokument4 SeitenDisney Pixar Case AnalysiskbassignmentNoch keine Bewertungen

- TR 39 PDFDokument31 SeitenTR 39 PDFSaifullah SherajiNoch keine Bewertungen

- Trade Liberalisation and "Revealed" Comparative Advantage'Dokument26 SeitenTrade Liberalisation and "Revealed" Comparative Advantage'ray orquizaNoch keine Bewertungen

- Competitive Analysis of Stock Brokers ReligareDokument92 SeitenCompetitive Analysis of Stock Brokers ReligareJaved KhanNoch keine Bewertungen

- Mike Anthony D. Sabangan Bsca Iv-1: Joint Administrative Order No. 03 Series of 2000Dokument26 SeitenMike Anthony D. Sabangan Bsca Iv-1: Joint Administrative Order No. 03 Series of 2000Mike Anthony SabanganNoch keine Bewertungen

- The Tax Laws Amendment Act 2020Dokument23 SeitenThe Tax Laws Amendment Act 2020PatrtickNoch keine Bewertungen

- Departmental Interpretation and Practice Notes No. 7 (Revised)Dokument33 SeitenDepartmental Interpretation and Practice Notes No. 7 (Revised)Difanny KooNoch keine Bewertungen

- IRR RA+8800+ (Safeguards)Dokument55 SeitenIRR RA+8800+ (Safeguards)chrisliecomia8Noch keine Bewertungen

- Textile Industry:: Sr. No. Incentives Description Reference Eligibility CriteriaDokument12 SeitenTextile Industry:: Sr. No. Incentives Description Reference Eligibility CriteriaPmu ResNoch keine Bewertungen

- SBD 6.2Dokument6 SeitenSBD 6.2Makhekhe MokoenaNoch keine Bewertungen

- 8143 Companies Income Tax (Amendment) Act, 2007Dokument10 Seiten8143 Companies Income Tax (Amendment) Act, 2007magnetbox8Noch keine Bewertungen

- Finance Bill 2023-24Dokument121 SeitenFinance Bill 2023-24Hussain AfzalNoch keine Bewertungen

- Facilitation Guide: Withholding Tax Regime (Income Tax) Under The Income Tax Ordinance, 2001Dokument39 SeitenFacilitation Guide: Withholding Tax Regime (Income Tax) Under The Income Tax Ordinance, 2001Siraj ul HaqNoch keine Bewertungen

- The Annaul Finance-Bill 2023 of PakistanDokument123 SeitenThe Annaul Finance-Bill 2023 of PakistanJasmin NabeelNoch keine Bewertungen

- Advanced Taxation (Sep 2019)Dokument331 SeitenAdvanced Taxation (Sep 2019)Sourav KarnNoch keine Bewertungen

- A Brief On Tax LAWS (Second Amendment) Ordinance, 2021Dokument15 SeitenA Brief On Tax LAWS (Second Amendment) Ordinance, 2021Aemon KhanNoch keine Bewertungen

- Presentation WTO LAWDokument10 SeitenPresentation WTO LAWAlkis KonstaNoch keine Bewertungen

- All Proposed Amendments Bills 2023Dokument34 SeitenAll Proposed Amendments Bills 2023B-Pharma Traders ugNoch keine Bewertungen

- The Income Tax (Am) Act, 2020Dokument10 SeitenThe Income Tax (Am) Act, 2020TonyNoch keine Bewertungen

- US Internal Revenue Service: F1120idp - 1992Dokument2 SeitenUS Internal Revenue Service: F1120idp - 1992IRSNoch keine Bewertungen

- Changes in Withholding Tax Provisions Through Finance BILL, 2009Dokument3 SeitenChanges in Withholding Tax Provisions Through Finance BILL, 2009mshauibNoch keine Bewertungen

- Petitioner Vs Vs Respondents: en BancDokument21 SeitenPetitioner Vs Vs Respondents: en BancDaryl YuNoch keine Bewertungen

- IV. Job Work Notifications General Exemption No. 23Dokument6 SeitenIV. Job Work Notifications General Exemption No. 23Samy JainNoch keine Bewertungen

- BudgetDokument10 SeitenBudgetNagaraj ThakkannavarNoch keine Bewertungen

- CREBA V Executive SecretaryDokument10 SeitenCREBA V Executive SecretaryseentherellaaaNoch keine Bewertungen

- Exemptions To Private Companies 05062015Dokument2 SeitenExemptions To Private Companies 05062015Murali Mohana Rao PNoch keine Bewertungen

- Circulars/Notifications: Legal UpdateDokument8 SeitenCirculars/Notifications: Legal UpdateAnupam BaliNoch keine Bewertungen

- 18 Chamber of Real Estate and Builders Association vs. Alberto RomuloDokument23 Seiten18 Chamber of Real Estate and Builders Association vs. Alberto RomuloAriel Conrad MalimasNoch keine Bewertungen

- 164706-2010-Chamber of Real Estate and Builders20210505-11-1blgqsoDokument20 Seiten164706-2010-Chamber of Real Estate and Builders20210505-11-1blgqsoGina RothNoch keine Bewertungen

- Comments by ICPAU On The Tax and Revenue Bills, 2024Dokument14 SeitenComments by ICPAU On The Tax and Revenue Bills, 2024walterhillarykaijamaheNoch keine Bewertungen

- Project-Import Scheme NovDokument2 SeitenProject-Import Scheme NovGaurang BhattNoch keine Bewertungen

- Act No 28dt 24-9-08Dokument7 SeitenAct No 28dt 24-9-08Balu Mahendra SusarlaNoch keine Bewertungen

- Presenration TAX LAW (AMENDMENT) ORDINANCE, 2020Dokument49 SeitenPresenration TAX LAW (AMENDMENT) ORDINANCE, 2020Asad Abbas MalikNoch keine Bewertungen

- Commentary On Impact of Finance Bill 2022 On IT SectorDokument10 SeitenCommentary On Impact of Finance Bill 2022 On IT SectorurcapkNoch keine Bewertungen

- 2022 Finance Bill HorDokument4 Seiten2022 Finance Bill HorSam Jnr AnthonyNoch keine Bewertungen

- Income Tax Amendment Act 1996 Act No 10 of 1996Dokument14 SeitenIncome Tax Amendment Act 1996 Act No 10 of 1996kasongo.mwensoNoch keine Bewertungen

- Aatmanirbhar Bharat Releif To Contractors dtd.18.05.2020Dokument2 SeitenAatmanirbhar Bharat Releif To Contractors dtd.18.05.2020DIGVIJAY PATILNoch keine Bewertungen

- Custom Notification cs79-2017 - IGST ExemptionDokument6 SeitenCustom Notification cs79-2017 - IGST ExemptionSumit ChhuganiNoch keine Bewertungen

- 02 Cp01 GBB 4 Annex ADokument7 Seiten02 Cp01 GBB 4 Annex AnothingmoreNoch keine Bewertungen

- Sec. 1146. Medicare Improvement Fund.: F:/P11/NHI/TRICOMM/AAHCA09 - 001.XMLDokument8 SeitenSec. 1146. Medicare Improvement Fund.: F:/P11/NHI/TRICOMM/AAHCA09 - 001.XMLVino DNoch keine Bewertungen

- Tax Assigned CasesDokument21 SeitenTax Assigned CasesPawi ProductionsNoch keine Bewertungen

- IRC Section 469Dokument11 SeitenIRC Section 469John GrundNoch keine Bewertungen

- Unclassified Customs Duty ExemptionsDokument5 SeitenUnclassified Customs Duty ExemptionsANDRE AURELLIONoch keine Bewertungen

- SR No 24 Rent of Agrculture Land For AgricultureDokument32 SeitenSR No 24 Rent of Agrculture Land For AgriculturerajanbardiaNoch keine Bewertungen

- Telecom Reforms 2021 VOL 2Dokument172 SeitenTelecom Reforms 2021 VOL 2testtrial forcloudNoch keine Bewertungen

- Notification No. 1/2018-Central Tax (Rate)Dokument7 SeitenNotification No. 1/2018-Central Tax (Rate)Yash JainNoch keine Bewertungen

- Tax Assigned CasesDokument21 SeitenTax Assigned CasesDominic EmbodoNoch keine Bewertungen

- Chapter 99Dokument291 SeitenChapter 99simongrayNoch keine Bewertungen

- Answer 8 (Iii)Dokument26 SeitenAnswer 8 (Iii)Murugesh Kasivel EnjoyNoch keine Bewertungen

- Sales Tax SRODokument3 SeitenSales Tax SROMuhammadIjazAslamNoch keine Bewertungen

- 11-Salient Feature - FY 2020-21 11.18AMDokument26 Seiten11-Salient Feature - FY 2020-21 11.18AMSahar BaigNoch keine Bewertungen

- Finance Bill 2018Dokument36 SeitenFinance Bill 2018Iddi KassiNoch keine Bewertungen

- Republic Act No. 7918 - Amendment To E.O. No. 226 (Omnibus InvestmentsDokument3 SeitenRepublic Act No. 7918 - Amendment To E.O. No. 226 (Omnibus InvestmentsMaria Celiña PerezNoch keine Bewertungen

- Income Tax & VAT Amendment 2080-81Dokument25 SeitenIncome Tax & VAT Amendment 2080-81pokhrelsuman165Noch keine Bewertungen

- Key Highlights of The Proposed GST Changes in Union Budget 2023 24 For Easy DigestDokument23 SeitenKey Highlights of The Proposed GST Changes in Union Budget 2023 24 For Easy DigestshwetaNoch keine Bewertungen

- Aanzfta Co Form GuidelinesDokument3 SeitenAanzfta Co Form GuidelinesSani AnggrainiNoch keine Bewertungen

- IAS Prelims - 2020: EconomyDokument42 SeitenIAS Prelims - 2020: EconomyJenny BNoch keine Bewertungen

- Screenshot 2023-08-17 at 12.32.07 AMDokument1 SeiteScreenshot 2023-08-17 at 12.32.07 AManiketefilingNoch keine Bewertungen

- Republic of The PhilippinesDokument19 SeitenRepublic of The PhilippinesKevin PeterNoch keine Bewertungen

- Finance Act, 2021Dokument31 SeitenFinance Act, 2021NnanyerugoNoch keine Bewertungen

- RMC 66-03 (Taxability of PAL)Dokument4 SeitenRMC 66-03 (Taxability of PAL)Bobby Olavides SebastianNoch keine Bewertungen

- Forest Products: Advanced Technologies and Economic AnalysesVon EverandForest Products: Advanced Technologies and Economic AnalysesNoch keine Bewertungen

- Equity Valuation: Models from Leading Investment BanksVon EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNoch keine Bewertungen

- Supply Chain Vulnerabilities Impacting Commercial AviationVon EverandSupply Chain Vulnerabilities Impacting Commercial AviationNoch keine Bewertungen

- Draft PSQCA Nomination Pre-Conditions 28012016Dokument2 SeitenDraft PSQCA Nomination Pre-Conditions 28012016sadullahNoch keine Bewertungen

- PAMA Meeting On Participation in PAPS Show 2017: AttendeesDokument2 SeitenPAMA Meeting On Participation in PAPS Show 2017: AttendeessadullahNoch keine Bewertungen

- MIDP TextDokument38 SeitenMIDP TextsadullahNoch keine Bewertungen

- PAMA Meeting On Participation in PAPS Show 2017: AttendeesDokument2 SeitenPAMA Meeting On Participation in PAPS Show 2017: AttendeessadullahNoch keine Bewertungen

- (18-05-2016) Minutes - PAMA Meeting With Japan - AmbassadorDokument2 Seiten(18-05-2016) Minutes - PAMA Meeting With Japan - AmbassadorsadullahNoch keine Bewertungen

- PAMA Writeup For Economic Survey 2016Dokument3 SeitenPAMA Writeup For Economic Survey 2016sadullahNoch keine Bewertungen

- 1 Oct 2018 Annex D1 Policy and Action Plan For Control PDFDokument12 Seiten1 Oct 2018 Annex D1 Policy and Action Plan For Control PDFsadullahNoch keine Bewertungen

- 1 Oct 2018 Annex D1 Policy and Action Plan For Control PDFDokument12 Seiten1 Oct 2018 Annex D1 Policy and Action Plan For Control PDFsadullahNoch keine Bewertungen

- EDB-Record Notes of The Meeting Held On 29 May On EV PolicyDokument5 SeitenEDB-Record Notes of The Meeting Held On 29 May On EV PolicysadullahNoch keine Bewertungen

- Template For Feedback On E-Vehicle Policy ConsiderationsDokument7 SeitenTemplate For Feedback On E-Vehicle Policy ConsiderationssadullahNoch keine Bewertungen

- 4 Sept 2018 Meassures To Control Smog (Directorate General of Industries)Dokument2 Seiten4 Sept 2018 Meassures To Control Smog (Directorate General of Industries)sadullahNoch keine Bewertungen

- Tariff For 2-3 Wheelers ProposedDokument4 SeitenTariff For 2-3 Wheelers ProposedsadullahNoch keine Bewertungen

- 12th PAMA PAAPAM Joint Meeting 16 Feb 2012Dokument2 Seiten12th PAMA PAAPAM Joint Meeting 16 Feb 2012sadullahNoch keine Bewertungen

- PPP Versus PrivatizationDokument4 SeitenPPP Versus PrivatizationsadullahNoch keine Bewertungen

- S/no Date Description of Correspondence / Activity AnnexDokument1 SeiteS/no Date Description of Correspondence / Activity AnnexsadullahNoch keine Bewertungen

- Data For Pakistan Institute of Development Economics SurveyDokument2 SeitenData For Pakistan Institute of Development Economics SurveysadullahNoch keine Bewertungen

- PPP Versus PrivatizationDokument4 SeitenPPP Versus PrivatizationsadullahNoch keine Bewertungen

- Motorcycles IranDokument2 SeitenMotorcycles IransadullahNoch keine Bewertungen

- Indians Barred From Investing in PakistanDokument2 SeitenIndians Barred From Investing in PakistansadullahNoch keine Bewertungen

- Analysis of Report According To Terms of Reference (TorsDokument4 SeitenAnalysis of Report According To Terms of Reference (TorssadullahNoch keine Bewertungen

- Yamaha Brand Motorcycle Production Begins Again in Iran Under Technical Assistance Agreement - Parts Supplied by YMC's Indian Joint Venture CompanyDokument2 SeitenYamaha Brand Motorcycle Production Begins Again in Iran Under Technical Assistance Agreement - Parts Supplied by YMC's Indian Joint Venture CompanysadullahNoch keine Bewertungen

- Export Finance Schme2Dokument19 SeitenExport Finance Schme2sadullahNoch keine Bewertungen

- Two Page Summary For Ministry of Water and Power (Head AIP Committee) .Docx. (Final)Dokument3 SeitenTwo Page Summary For Ministry of Water and Power (Head AIP Committee) .Docx. (Final)sadullahNoch keine Bewertungen

- PR Fro Hodna PridorDokument2 SeitenPR Fro Hodna PridorsadullahNoch keine Bewertungen

- Industry Exemption Order - 17 May 2020Dokument4 SeitenIndustry Exemption Order - 17 May 2020sadullahNoch keine Bewertungen

- APTTA Custom Protocol DraftDokument6 SeitenAPTTA Custom Protocol DraftsadullahNoch keine Bewertungen

- SUMP Brochure FinalDokument12 SeitenSUMP Brochure FinalindraandikapNoch keine Bewertungen

- SOSC 2340 Final ExamDokument8 SeitenSOSC 2340 Final Examshak najakNoch keine Bewertungen

- Afisco Insurance Corp. v. CIRDokument6 SeitenAfisco Insurance Corp. v. CIRJB GuevarraNoch keine Bewertungen

- Starting A Business in Germany For International StudentsDokument11 SeitenStarting A Business in Germany For International StudentsJohn AcidNoch keine Bewertungen

- Onkar SeedsDokument1 SeiteOnkar SeedsTejaspreet SinghNoch keine Bewertungen

- Test Item File To Accompany Final With Answers2Dokument247 SeitenTest Item File To Accompany Final With Answers2Chan Vui YongNoch keine Bewertungen

- Sanjay Kanojiya-ElectricalDokument1 SeiteSanjay Kanojiya-ElectricalAMANNoch keine Bewertungen

- Mutual Fund PPT 123Dokument53 SeitenMutual Fund PPT 123Sneha SinghNoch keine Bewertungen

- IATF by MauryaDokument91 SeitenIATF by MauryaManoj MauryaNoch keine Bewertungen

- UCD2F1209Dokument17 SeitenUCD2F1209sharvin05Noch keine Bewertungen

- E-Procurement: MBA 7601 - Managing E-BusinessDokument31 SeitenE-Procurement: MBA 7601 - Managing E-BusinessPrateek Parkash100% (1)

- Job Satisfaction and MoraleDokument21 SeitenJob Satisfaction and MoraleChannpreet ChanniNoch keine Bewertungen

- A Study On Customer Preference Towards Branded Jewellery: Dr. Aarti Deveshwar, Ms. Rajesh KumariDokument9 SeitenA Study On Customer Preference Towards Branded Jewellery: Dr. Aarti Deveshwar, Ms. Rajesh KumariArjun BaniyaNoch keine Bewertungen

- Chapter 6 CostDokument144 SeitenChapter 6 CostMaria LiNoch keine Bewertungen

- Dire-Dawa University Institute of Technology: Construction Technology and Management Chair Course Code: byDokument34 SeitenDire-Dawa University Institute of Technology: Construction Technology and Management Chair Course Code: bySemNoch keine Bewertungen

- Luqmanul Hakim Bin Johari (2020977427) Individual Assignment Case Study 1Dokument7 SeitenLuqmanul Hakim Bin Johari (2020977427) Individual Assignment Case Study 1Luqmanulhakim JohariNoch keine Bewertungen

- Project Cooperative BankDokument33 SeitenProject Cooperative BankPradeepPrinceraj100% (1)

- 1992 ColwellDokument20 Seiten1992 ColwellBhagirath BariaNoch keine Bewertungen

- TQM Research Paper PDFDokument7 SeitenTQM Research Paper PDFAbhijeet MishraNoch keine Bewertungen

- Kertas 2 - Information Transer - Set ADokument3 SeitenKertas 2 - Information Transer - Set AtiyeesanNoch keine Bewertungen

- 10 Axioms of FinManDokument1 Seite10 Axioms of FinManNylan NylanNoch keine Bewertungen

- Corporate Finance MCQDokument35 SeitenCorporate Finance MCQRohan RoyNoch keine Bewertungen

- Inv TG B1 88173907 101003789746 January 2023 - 1 PDFDokument4 SeitenInv TG B1 88173907 101003789746 January 2023 - 1 PDFVara Prasad dasariNoch keine Bewertungen

- Functions of CSODokument25 SeitenFunctions of CSOS Sai KumarNoch keine Bewertungen

- Business English Stock MarketDokument2 SeitenBusiness English Stock MarketMara CaiboNoch keine Bewertungen