Beruflich Dokumente

Kultur Dokumente

Synthetic Forwards

Hochgeladen von

deels99Originalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Synthetic Forwards

Hochgeladen von

deels99Copyright:

Verfügbare Formate

Forward contracts on financial assets

Financial Derivatives

Finance 206/717

Philip Bond

Wharton, University of Pennsylvania

Bond – FNCE 206/717 – p. 1/33

Themes of course

Two big themes:

1. pricing derivatives

2. using derivatives

These notes:

concentrate on pricing forwards, without distractions of particular

institutional trading arrangements in futures markets

Next set of notes:

using forwards/futures

institutional details of trading

Bond – FNCE 206/717 – p. 2/33

Derivative prices and the absence of arbitrage

The key technique for pricing derivatives is the no arbitrage principle

Definition:

A (pure) arbitrage is a set of trades that:

does not require any initial funds

never loses any money

produces strictly positive cash flows with strictly positive probability

The no arbitrage principle is that:

asset prices must be such that no arbitrage exists

Why is this a reasonable principle?

Bond – FNCE 206/717 – p. 3/33

Synthetic securities

Synthetic securities:

Example:

Suppose a 3-month T-Bill trades at $98 today, and pays out $100 in 3

months

This is a (simple) example of a financial security

Now, suppose that I produce a security that pays out $100 in 3 months

The cash flows are exactly the same as the government-issued T-Bill

We can say that my security is a synthetic T-Bill

In general, given any financial security, a synthetic security is one that has

the same cash flows

Bond – FNCE 206/717 – p. 4/33

Synthetic securities and no arbitrage

Absent transaction costs, the no arbitrage principle implies that the price of a

synthetic security must equal the price of the original security

Back to example:

Suppose that my synthetic T-Bill trades at $99. What would you do?

Suppose that my synthetic T-Bill trades at $97. What would you do?

At what price is no arbitrage possible?

Bond – FNCE 206/717 – p. 5/33

The forward price

We begin our examination of derivative prices by looking at the determinants

of the forward price.

Basic case: financial asset, no dividends

Why is this the basic case?

financial assets have no storage costs

financial assets are held only for the cash flows they produce

Forwards vs. futures

forwards and futures are basically the same thing

forward contracts are arranged between pairs of individuals/firms

futures contracts are exchange traded

whereas forward contracts are often said to be “OTC”

i.e. over the counter

Bond – FNCE 206/717 – p. 6/33

The cash flows of a forward contract

We will price a forward contract by no arbitrage.

We start by carefully writing down the cash flows:

Consider a forward contract for a share of Apple stock

enter into at time t

delivery at time T

forward price is Ft,T

the cash flows are:

t T

Forward contract

Bond – FNCE 206/717 – p. 7/33

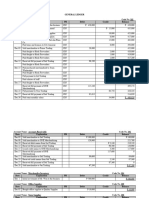

Synthetic forwards

Next, we build a synthetic forward.

Consider the following trading strategy

To match the date T cash flow of ST : buy a share of Apple stock at time

t, sell at time T

What are the cash flows?

To match the date T cash flow of −Ft,T : borrow and incur a date T

obligation of −Ft,T

Cash flows:

t T

Buy stock

Borrow

Total

No arbitrage implies that ...

Bond – FNCE 206/717 – p. 8/33

Synthetic T-Bills

Instead of building a synthetic forward from the stock and risk-free bonds,

we can build a synthetic T-bill (risk-free bond) out of the stock and forward

Suppose we invest $1 in T-bills today:

the date T cash flow is er(T −t)

We can create a synthetic T-Bill by:

buying a share of Apple stock

and hedging the price risk by taking a short position in a forward contract

the combined date T cash flow is:

No arbitrage implies that:

Bond – FNCE 206/717 – p. 9/33

The cash-and-carry arbitrage

Next, let’s check to see if an arbitrage exists if the forward price is different

from predicted.

Suppose the forward price is more than predicted.

What would you do?

What does this do to the forward price?

Note: the cash-and-carry produces a synthetic T-Bill

Bond – FNCE 206/717 – p. 10/33

The reverse cash-and-carry arbitrage

Suppose the forward price is less than predicted.

What would you do?

What does this do to the price?

Note: the reverse cash-and-carry produces a synthetic short position in a

T-Bill

Bond – FNCE 206/717 – p. 11/33

Example

The spot price of a share in XYZ Corp. is $23

The six month T-Bill rate is 3% (APR, twice yearly compounding).

What is the forward price for delivery in 3 months?

The continuously compounded interest rate is

3%

2 × ln(1 + ) = 2.98%

2

The forward price for an XYZ share with delivery in 3 months is:

$23 × e.25×.0298 = $23.172

Bond – FNCE 206/717 – p. 12/33

Using forwards for asset reallocation

Suppose you own Apple stock, but think its performance over the next six

months will be poor.

You could sell the stock now, and invest the proceeds in six-month T-Bills

Alternatively, you could take a short position in a six-month forward contract.

Value of investment today is St

Value of investment after six months is

(Ft,T − ST ) + ST = Ft,T = St er(T −t)

Bond – FNCE 206/717 – p. 13/33

Asset reallocation, continued

You have effectively transferred your investments from Apple stock to T-Bills

You are investing in T-Bills without holding T-Bills!

Why do it this way?

transactions costs

taxes

Converting a position in one asset into a position in another asset using a

forward/futures contracts is called a futures overlay

Here, we have converted a stock position into a bond position

Question to think about at home:

What would would you do to convert a T-Bill investment into a stock

investment?

Bond – FNCE 206/717 – p. 14/33

Selling forwards

You work for a bank

A client wants to take a long position in a forward contract.

If you supply the forward contract, you will have a short position.

What could you do to hedge the risk created?

Bond – FNCE 206/717 – p. 15/33

Forward price = expected spot price?

What is the relationship between the forward price and the expected spot

price?

For example, what would the forward price for 1 share of IBM for delivery in 1

year tell us about the spot price of IBM in 1 year?

One possible guess:

Ft,T = E[ST ]

this says: the forward price is the market’s best guess as to what the

price of IBM will be in one year

Empirically, this is NOT the case.

Bond – FNCE 206/717 – p. 16/33

Forward price = expected spot price?

And economically it doesn’t make any sense:

Consider a long position in the forward, combined with investing

Ft,T e−r(T −t) in T-Bills

What is the expected payoff on this position?

What is the expected gross rate of return if Ft,T = E[ST ]?

Would this ever be the case?

Bond – FNCE 206/717 – p. 17/33

The actual relation

To determine the actual relationship between E[ST ] and Ft,T we use the

CAPM:

First, we need to define some notation. Let

E[rIBM ] = the expected return on IBM over the time period t to T

E[rmkt ] = the expected return on the market over the time period t to T

r = the risk-free rate over the time period t to T

βIBM = the beta of IBM

What is the forward price?

What is the expected spot price?

Bond – FNCE 206/717 – p. 18/33

Observations

If beta is greater than zero, the expected spot exceeds the forward price.

So someone holding a long position in the forward expects to earn a positive

return.

Since forward contracts are zero-sum, the person holding the short position

expects to earn a negative return.

So why is anyone willing to hold a short position?

Bond – FNCE 206/717 – p. 19/33

Pricing with Coupon Payments or Dividends

If the spot commodity is a stock or a bond then the investor will receive a

dividend or coupon payment while carrying the spot commodity.

So far we have ignored this complication.

Recall that when we ignored dividends, no arbitrage implies that a synthetic

T-Bill produced by a cash-and-carry (long stock, short forward)

produces the same return as an actual T-Bill

To see how dividends affect the forward price consider the following modified

cash-and-carry:

date t: take short position in forward, buy the spot

date t′ : receive the coupon or dividend

date T : forward expires and delivery occurs

Bond – FNCE 206/717 – p. 20/33

The cash flows are:

t t′ T

buy spot

short forward

receive dividend

invest dividend

Total

The position resembles a T-Bill.

Bond – FNCE 206/717 – p. 21/33

To avoid arbitrage possibilities, we need the rate of return on the

cash-and-carry to be the same as the rate of return on a T-Bill:

i.e.

St er(T −t) − Der(T −t )

′

Ft,T =

Note that in this case the forward price may or may not be greater than the

spot price.

Bond – FNCE 206/717 – p. 22/33

Continuous dividends

It is often convenient to assume dividends are paid continuously

How would we do the cash-and-carry with continuous dividends?

we need the dividend yield

Aside on dividend yields:

Ford Motor Co. pays a $0.30/share dividend quarterly.

If the current share price is $30, as a percent this is 1% per quarter

this is the dividend yield

i.e. an APR of 4% with quarterly compounding

As a continuous yield, this is

4 × ln (1.01) = 3.98%

We will generally denote the dividend yield in continuous form by δ.

Bond – FNCE 206/717 – p. 23/33

Continuous dividends

In many cases in this class we will be treating dividends as if they are paid

continuously.

This is the standard approach in this area.

It is a “modeling convention” which makes the formulas and intuition easier to

understand and to work with.

If you buy one share of stock which pays dividends continuously,

and you reinvest those dividends when they are paid,

then at the end of the period t to T you will have 1 × eδ(T −t) shares

(δ is the continuously compounded dividend yield.)

Example:

You buy one share Ford stock and hold it for 2 years.

The dividends are paid at continuously compounded rate of 3.98% and

you reinvest all the dividends when they are paid.

How many shares do you have at the end of two years?

Bond – FNCE 206/717 – p. 24/33

Back to the forward price

The cash-and-carry with a continuous dividend yield is done slightly

differently.

At delivery of the forward you need to have one share of stock.

So at time t buy just enough stock so that when you reinvest the dividends

you have accumulated exactly one share by T .

(“tailing the position”)

If you buy 1 × e−δ(T −t) shares at time t, then at time T you will have

1 × e−δ(T −t) × eδ(T −t) = 1 share

The cash flows are:

t T

buy the spot

short the forward

Total

Bond – FNCE 206/717 – p. 25/33

The remaining steps should be familiar by now ...

the cash-and-carry has produced a synthetic T-Bill

For no arbitrage, we need:

i.e.

Ft,T = St er(T −t) e−δ(T −t)

= St e(r−δ)(T −t)

Bond – FNCE 206/717 – p. 26/33

Example

Ford Motor Co.’s current share price is $30/share.

The continuously compounded dividend yield is 3.98%

If you wanted to create a synthetic 3 month T-bill using Ford stock, what

would you do?

And if the forward price is $29.90, what is the yield on the synthetic T-Bill?

Bond – FNCE 206/717 – p. 27/33

Pricing with Transactions Costs

There are a number of transactions costs associated with cash-and-carry

positions.

bid-ask spreads on both the forward and the spot good

brokerage commissions

differential borrowing and lending rates

How do these transactions costs affect forward pricing?

Terminology:

the ask price is the price you buy at

(it is the price the seller is “asking”)

the bid price is the price you sell at

(it is the price the buyer is “bidding”)

in general, the bid price is lower than the ask price

the difference is often called the bid-ask spread

Bond – FNCE 206/717 – p. 28/33

Notation:

StA = the spot ask price

StB = the spot bid price

T F = future value of any transactions fees

rb = borrowing rate

rl = lending rate

As before, forward prices are determined by a no arbitrage condition.

First, we consider a strategy with a short position in the forward

Second, we consider a strategy with a long position in the forward

Bond – FNCE 206/717 – p. 29/33

Short position

Strategy: take a short position in the forward, hedge by buying stock, and

borrow to finance

t T

buy the spot, short forward

borrow the spot price

pay the transactions fee

total

There is an arbitrage opportunity if:

A rb (T −t)

Ft,T − T F − St e >0

i.e. if

b (T −t)

Ft,T > StA er + TF

short position is profitable if forward price high enough

Bond – FNCE 206/717 – p. 30/33

Long position

Strategy: take a long position in the forward, hedge by shorting stock, and

invest short proceeds

t T

buy the forward, short the

spot

invest the short proceeds

pay the transactions fee

total

There is an arbitrage opportunity if:

l (T −t)

−Ft,T − T F + StB er >0

i.e. if

l

(T −t)

Ft,T < StB er − TF

long position is profitable if forward price low enough

Bond – FNCE 206/717 – p. 31/33

No arbitrage bounds

Summary:

b

If Ft,T > StA er (T −t) + T F , then an arbitrage is possible.

So to eliminate arbitrage possibilities, we must have

b (T −t)

Ft,T ≤ StA er + TF

This is an upper bound on the forward price

l

If Ft,T < StB er (T −t) − T F then an arbitrage is possible.

So to eliminate arbitrage possibilities, we must have

B rl (T −t)

Ft,T ≥ St e − TF

This is an lower bound on the forward price

Bond – FNCE 206/717 – p. 32/33

Topics covered

The forward price of a financial asset

without dividends

with dividends

No arbitrage pricing

Synthetic positions

Using derivatives for asset reallocation

What the forward price tells us about future spot prices.

Pricing with transactions costs

Bond – FNCE 206/717 – p. 33/33

Das könnte Ihnen auch gefallen

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Cost of New Investment-OS 3,250k: Undervalued Equipment P100k X 40% Ownership P40k/5 P8kDokument1 SeiteCost of New Investment-OS 3,250k: Undervalued Equipment P100k X 40% Ownership P40k/5 P8kQueenie ValleNoch keine Bewertungen

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5795)

- Brief History of Global Market Integration in 20th CenturyDokument2 SeitenBrief History of Global Market Integration in 20th Centurymae Kuan100% (3)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Standard 21.05.2014Dokument80 SeitenThe Standard 21.05.2014Zachary MonroeNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- 2011 Vol 5 No 2Dokument13 Seiten2011 Vol 5 No 2Nipun SharmaNoch keine Bewertungen

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- Journal EntriesDokument12 SeitenJournal Entriesg81596262Noch keine Bewertungen

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (400)

- Seller'S Full LetterheadDokument4 SeitenSeller'S Full LetterheadRailesUsados83% (6)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- Amplify University TrainingDokument11 SeitenAmplify University Trainingshariz500100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Subject - Corporate Finance & Taxation Prof. - BODA: Financial Scam of 31000 CroresDokument12 SeitenSubject - Corporate Finance & Taxation Prof. - BODA: Financial Scam of 31000 CroresSwati Sontakke60% (5)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- 4 Step Trading Protocol Discretionary FrameworkDokument42 Seiten4 Step Trading Protocol Discretionary Frameworkfake.mNoch keine Bewertungen

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (74)

- CFA Institute Research ChallengeDokument3 SeitenCFA Institute Research ChallengeAritra BhowmikNoch keine Bewertungen

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- 2008.10 The Super Investor Walter Schloss InterviewDokument4 Seiten2008.10 The Super Investor Walter Schloss Interviewadjk97100% (4)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- No. Tipe Akun Kode Perkiraan NamaDokument6 SeitenNo. Tipe Akun Kode Perkiraan Namapkm.sdjNoch keine Bewertungen

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- STCM 04 Ge CVPDokument2 SeitenSTCM 04 Ge CVPdin matanguihanNoch keine Bewertungen

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- 04.20.17 Secretary's Certificate (LEG-028 (04-17) TMP) - RawDokument3 Seiten04.20.17 Secretary's Certificate (LEG-028 (04-17) TMP) - Rawjayar medico100% (1)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (345)

- Lower of Cost and Net Realizable ValueDokument3 SeitenLower of Cost and Net Realizable ValueMae Loto100% (1)

- Chapter 1: The Investment SettingDokument54 SeitenChapter 1: The Investment Settingcharlie tunaNoch keine Bewertungen

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- Inscaping: Exploring The Connection Between Experiential Surfacing and Social InnovationDokument11 SeitenInscaping: Exploring The Connection Between Experiential Surfacing and Social InnovationNesta100% (1)

- Chapter 5-Merchandising OperationsDokument46 SeitenChapter 5-Merchandising OperationsSina RahimiNoch keine Bewertungen

- Case Study On Equity ValuationDokument3 SeitenCase Study On Equity ValuationUbaid DarNoch keine Bewertungen

- Financial StatementDokument6 SeitenFinancial StatementCeddie UnggayNoch keine Bewertungen

- Bank of India Indeminity YelwandeDokument5 SeitenBank of India Indeminity YelwandeRohit PardeshiNoch keine Bewertungen

- The Green Register - Spring 2011Dokument11 SeitenThe Green Register - Spring 2011EcoBudNoch keine Bewertungen

- Insuring The Frontier MarketsDokument35 SeitenInsuring The Frontier MarketsHarry CerqueiraNoch keine Bewertungen

- Fundamentals of Abm 2 Grade 11 Midterm Exam S.Y. 2019 - 2020Dokument2 SeitenFundamentals of Abm 2 Grade 11 Midterm Exam S.Y. 2019 - 2020Sheena RobiniolNoch keine Bewertungen

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- 0002 T en - Ar.enDokument33 Seiten0002 T en - Ar.enriyasudheenmhNoch keine Bewertungen

- General LedgerDokument4 SeitenGeneral Ledger21-53070Noch keine Bewertungen

- Role of Statistics in Business & FinanceDokument20 SeitenRole of Statistics in Business & Financenitinvohra_capricornNoch keine Bewertungen

- Freight Out or Delivery Expenses or TransportationDokument4 SeitenFreight Out or Delivery Expenses or TransportationMichelle GoNoch keine Bewertungen

- Haj Committee of India: Cover No. DLF-1823-1-0Dokument1 SeiteHaj Committee of India: Cover No. DLF-1823-1-0Mohd.Nayab AhmadNoch keine Bewertungen

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Audit Practice Manual - IndexDokument4 SeitenAudit Practice Manual - IndexIftekhar IfteNoch keine Bewertungen

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)