Beruflich Dokumente

Kultur Dokumente

Budeting Quiz 8 PDF

Hochgeladen von

Zara SaeedOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Budeting Quiz 8 PDF

Hochgeladen von

Zara SaeedCopyright:

Verfügbare Formate

A Level

2 Cost and management accounting

44 Budgeting and budgetary

control

Additional questions

Question 1

Selena is to start business on 1 May selling rice cookers. She believes that she will sell

300 cookers in May and that her monthly sales will increase by 20 per cent on the

previous month’s budgeted sales until the end of the year.

Inventory is to be maintained at ten per cent of the following month’s budgeted

sales.

Note

● A 20 per cent increase in sales in July would result in August sales of 518.4

rice cookers. It is impossible to sell 0.4 of a cooker! So sales for August will be

predicted to be 519 rice cookers.

● Likewise, inventory held at 31 July could not be 51.84 cookers – Selena has to

keep whole cookers as inventory! Closing inventory at 31 July is therefore 52 rice

cookers.

Required

Prepare a purchases budget for the three months ending 31 July.

Question 2

The budgeted sales for Cerne Ltd are predicted to be:

February March April May

$ $ $ $

Budgeted sales 60 000 70 000 80 000 90 000

● Twenty per cent of all budgeted sales are expected to be for cash.

● Credit customers are allowed and will take one month’s credit.

Required

Prepare a trade receivables budget for the three months ending 31 May.

Question 3

The following information is available for Zhang Ltd:

May June July August

$ $ $ $

Budgeted purchases 15 000 20 000 25 000 30 000

● Five per cent of all purchases are for cash; the remainder are purchased on credit.

● Suppliers offering credit terms will be paid in the month following the purchase of

goods.

Cambridge International AS and A Level Accounting Student’s CD © Ian Harrison 2015 1

44 Budgeting and budgetary control

Required

Prepare a trade payables budget for the three months ending 31 August.

Question 4

Hovig is to start in business in January with a gift of $8000 from his uncle. He

provides the following forecast information for his first three months of trading:

January February March

$ $ $

Purchases 6 000 7 000 8 000

Sales 8 000 15 000 20 000

Hovig will pay for purchases in the month they are made.

Forty per cent of sales are for cash; the remainder are expected to be paid in the

month following sale.

Hovig will rent his premises for $3000 per payable each 3 months. The first

payment is due on 1 January.

Assistants’ wages will amount to $4000 per calendar month.

Other expenses are expected to be $1500 per calendar month payable in the

month after they are incurred.

Required

a Prepare a cash budget for the three months ending 31 March.

b Comment on the results of your cash budget.

Question 5

The following budgeted information relates to Rajpoot Ltd for the three months

ending 31 October.

The cash balance at 1 August is expected to be $2100.

August September October

$ $ $

Cash sales 90 963 106 125 116 230

Payments to trade payables 29 650 35 050 38 400

Payments for wages 19 100 28 000 21 500

Rent and local taxes 2 800 2 800 2 800

Other expenses 5 700 5 500 5 300

Payment for purchase of machine 84 000

Depreciation on machine 700 700

Required

Prepare a cash budget for each of the three months ending 31 October.

Question 6

The following budgeted information is available for Hsiao Ltd:

January February March April

$ $ $ $

Credit sales 21 000 28 000 30 000 31 000

Cash purchases 8 000 12 000 9 000 10 000

Cash expenses 21 000 20 000 22 000 18 000

Cash purchase of office machinery 24 000

Depreciation of office machinery 200 200 200

2 Cambridge International AS and A Level Accounting Student’s CD © Ian Harrison 2015

Additional questions

It is expected that the cash balance at 1 February will be $3200.

Trade receivables are expected to settle their debts one month after sales have

taken place.

Required

Prepare a cash budget for each of the three months ending 30 April.

Question 7

Tommy Chan supplies the following budgeted information relating to his business:

August September October November December

$ $ $ $ $

Sales 23 000 24 000 29 000 34 000 43 000

Purchases 12 000 13 000 15 000 24 000 35 000

Wages 4 500 4 500 4 500 6 000 6 500

Rent 400 400 450

Other expenses 1 750 1 850 3 400 1 600 980

Depreciation of office equipment 450 450 450 450 450

It is expected that:

● the cash balance at 1 October will be $670

● inventory at 1 October will be $7000

● inventory at 31 December will be $8000

● ten per cent of all sales will be on credit

● ten per cent of purchases will be for cash

● debtors will settle their debts in the month following sale

● creditors will be paid two months after purchase

● rent is payable every two months in advance

● wages and other expenses will be paid as incurred.

Required

Prepare:

a a cash budget for each of the three months ending 31 December.

b a budgeted income statement for the three months ending 31 December.

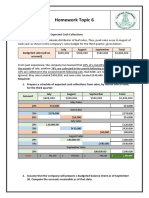

Question 8

The following information is available for Wong plc, for the year ending 31

December:

Budget Actual

Level of production (units) 5000 4900

$ $

Variable costs – direct materials 85 000 90 000

direct labour 120 000 116 000

variable overheads 50 000 52 000

255 000 258 000

Fixed costs 140 000 142 000

Total costs 395 000 400 000

Required

a Prepare a flexed operating statement for the year ending 31 December.

b Calculate any variances revealed by the flexed budget.

Cambridge International AS and A Level Accounting Student’s CD © Ian Harrison 2015 3

Das könnte Ihnen auch gefallen

- Entrepreneur Summit - Aaron SansoniDokument11 SeitenEntrepreneur Summit - Aaron SansoniAnna Murakawa100% (1)

- Master Budget With SolutionsDokument12 SeitenMaster Budget With SolutionsDea Andal100% (4)

- Master Budgeting (Sample Problems With Answers)Dokument11 SeitenMaster Budgeting (Sample Problems With Answers)Jonalyn TaboNoch keine Bewertungen

- United States Medical Licensing Examination® Step 2 CK Scheduling PermitDokument1 SeiteUnited States Medical Licensing Examination® Step 2 CK Scheduling PermitZara SaeedNoch keine Bewertungen

- Master BudgetDokument10 SeitenMaster BudgetFareha Riaz0% (1)

- Internal Medicine Residency ProgramsDokument51 SeitenInternal Medicine Residency ProgramsZara SaeedNoch keine Bewertungen

- CH 09Dokument69 SeitenCH 09Navindra Jaggernauth100% (1)

- Cash Budgeting QuestionsDokument5 SeitenCash Budgeting QuestionsAnissa GeddesNoch keine Bewertungen

- Budgets Exercises StudentDokument5 SeitenBudgets Exercises Studentديـنـا عادل0% (1)

- Exercises Budgeting ACCT2105 3s2010Dokument7 SeitenExercises Budgeting ACCT2105 3s2010Hanh Bui0% (1)

- Taller de Ejercicios de PresupuestosDokument11 SeitenTaller de Ejercicios de PresupuestosalexNoch keine Bewertungen

- Cash BudgetDokument4 SeitenCash BudgetSANDEEP SINGH0% (1)

- Pearson LCCI Level 2 Certifi Cate in Cost Accounting (ASE20094)Dokument60 SeitenPearson LCCI Level 2 Certifi Cate in Cost Accounting (ASE20094)Pinky PinkyNoch keine Bewertungen

- Cost Classification and Profit Reporting - MCQsDokument7 SeitenCost Classification and Profit Reporting - MCQsmajidghauriNoch keine Bewertungen

- Casebook Ross 2019Dokument153 SeitenCasebook Ross 2019Yue RENNoch keine Bewertungen

- 3.1 Netapp The Day To Day of A DM X PDFDokument24 Seiten3.1 Netapp The Day To Day of A DM X PDFRafayNoch keine Bewertungen

- Introducing Dawlance Electronics Internationally and Upgrading to AIDokument32 SeitenIntroducing Dawlance Electronics Internationally and Upgrading to AISyed Huzayfah Faisal100% (1)

- Unit 1 - Step 2 - Comprehend Intellectual Property: Technology Valuation and NegotiationDokument15 SeitenUnit 1 - Step 2 - Comprehend Intellectual Property: Technology Valuation and Negotiationlaura vanessa morales angaritaNoch keine Bewertungen

- Review Questions Volume 1 - Chapter 28Dokument2 SeitenReview Questions Volume 1 - Chapter 28YelenochkaNoch keine Bewertungen

- LCCI Level I & II Accounting EquationDokument4 SeitenLCCI Level I & II Accounting EquationJames MilzerNoch keine Bewertungen

- SCHOOL OF PURE AND APPLIED SCIENCES PROBABILITY & STATISTICS IIDokument8 SeitenSCHOOL OF PURE AND APPLIED SCIENCES PROBABILITY & STATISTICS IIcyrusNoch keine Bewertungen

- Week 8 Practice Test With SolutionsDokument8 SeitenWeek 8 Practice Test With SolutionspartyycrasherNoch keine Bewertungen

- Midterm Ifm Nov2022Dokument7 SeitenMidterm Ifm Nov2022Ya YaNoch keine Bewertungen

- Cash Budget for Calgon Products for September 20x4Dokument11 SeitenCash Budget for Calgon Products for September 20x4신두Noch keine Bewertungen

- Cash Management QuestionsDokument5 SeitenCash Management QuestionsManasi Jamsandekar100% (1)

- Cash Budget Sums Mcom Sem 4Dokument14 SeitenCash Budget Sums Mcom Sem 4Prachi BhosaleNoch keine Bewertungen

- Hillyard CompanyDokument3 SeitenHillyard CompanyJea BalagtasNoch keine Bewertungen

- Mr Kaybee's cash budgetDokument2 SeitenMr Kaybee's cash budgetPrince TshepoNoch keine Bewertungen

- Cost Accounting - Cash BudgetDokument4 SeitenCost Accounting - Cash BudgetRealGenius (Carl)Noch keine Bewertungen

- Completing A Master BudgetDokument2 SeitenCompleting A Master BudgetPines MacapagalNoch keine Bewertungen

- Programmazione e Controllo Esercizi Capitolo 7aDokument14 SeitenProgrammazione e Controllo Esercizi Capitolo 7aMavzky RoqueNoch keine Bewertungen

- Accounts - Full Test 1Dokument6 SeitenAccounts - Full Test 1Shushaanth SanthoshNoch keine Bewertungen

- Budgeting - 1Dokument3 SeitenBudgeting - 1Muhammad MansoorNoch keine Bewertungen

- Question Compilation - 230316 - 072454Dokument9 SeitenQuestion Compilation - 230316 - 072454Ranjan DhakalNoch keine Bewertungen

- Budget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Dokument7 SeitenBudget and Budgetary Control - Mba Ca. Asim K. Biswas: Question # 1Suraj KumarNoch keine Bewertungen

- Profit Planning and BudgetingDokument3 SeitenProfit Planning and BudgetingRoyce Maenard EstanislaoNoch keine Bewertungen

- Cash Sales Credit Sales: ACCT201B Practice Questions Chapter 8Dokument9 SeitenCash Sales Credit Sales: ACCT201B Practice Questions Chapter 8GuinevereNoch keine Bewertungen

- ACCT1003 - Worksheet - 8 - Summer 2016Dokument5 SeitenACCT1003 - Worksheet - 8 - Summer 2016sandrae brownNoch keine Bewertungen

- Financial Accounting 2019Dokument8 SeitenFinancial Accounting 2019Ivy NinjaNoch keine Bewertungen

- Cash budgets and forecasts for Notlimah LtdDokument15 SeitenCash budgets and forecasts for Notlimah Ltdrizwan ul hassanNoch keine Bewertungen

- op-budget-sampleDokument2 Seitenop-budget-sampleAngelica MalpayaNoch keine Bewertungen

- Modul Lab. Akuntansi Manajemen 2 - L22.23Dokument34 SeitenModul Lab. Akuntansi Manajemen 2 - L22.23Aniedhea LissudaNoch keine Bewertungen

- Chap07 Rev. FI5 Ex PRDokument11 SeitenChap07 Rev. FI5 Ex PRKhryzha Hanne Dela CruzNoch keine Bewertungen

- Assignment QuestionsDokument3 SeitenAssignment QuestionsKARTIK CHADHANoch keine Bewertungen

- Review Myron Corporation's seasonal product sales budget and production requirementsDokument8 SeitenReview Myron Corporation's seasonal product sales budget and production requirementsmohammad bilalNoch keine Bewertungen

- RF Ltd Cash BudgetDokument26 SeitenRF Ltd Cash BudgetRiaz Baloch Notezai100% (1)

- THE FOUNDATIONAL 15Dokument8 SeitenTHE FOUNDATIONAL 15Shafa AlyaNoch keine Bewertungen

- FINC 301 Tutorial Set 5Dokument3 SeitenFINC 301 Tutorial Set 5Anita SmithNoch keine Bewertungen

- Chapter 5-Master Budgeting Offline Quiz-1 PDFDokument2 SeitenChapter 5-Master Budgeting Offline Quiz-1 PDFMARY ALODIA BEN YBARZABALNoch keine Bewertungen

- FALL Class 7 - Cash Budgeting - Ch9 - GDBA - Note # 7 - TEACHERDokument7 SeitenFALL Class 7 - Cash Budgeting - Ch9 - GDBA - Note # 7 - TEACHERAkankshaNoch keine Bewertungen

- CA Inter MTP 2 M'19 PDFDokument149 SeitenCA Inter MTP 2 M'19 PDFSunitha SuniNoch keine Bewertungen

- 54940bosmtpsr2 Inter p1 QDokument6 Seiten54940bosmtpsr2 Inter p1 QAryan GurjarNoch keine Bewertungen

- Chap07 Rev. FI5 Ex PR 1Dokument10 SeitenChap07 Rev. FI5 Ex PR 1Beyond ThatNoch keine Bewertungen

- Comprehensive Problem Master BudgetDokument1 SeiteComprehensive Problem Master BudgethdejnNoch keine Bewertungen

- Performance Task No 2 - Group Work - Planning Concepts and Tools P1Dokument8 SeitenPerformance Task No 2 - Group Work - Planning Concepts and Tools P1Corn SaladNoch keine Bewertungen

- Strategic Business Analysis Short-term Budgeting ExercisesDokument2 SeitenStrategic Business Analysis Short-term Budgeting Exercisesahyenn cabelloNoch keine Bewertungen

- Problem 20Dokument4 SeitenProblem 20Kath Chu100% (1)

- Homework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionsDokument3 SeitenHomework Topic 6: EXERCISE 8-1 Schedule of Expected Cash CollectionskhetamNoch keine Bewertungen

- Auditing 2019 P S CH 8Dokument16 SeitenAuditing 2019 P S CH 8barakat801Noch keine Bewertungen

- HW 15-2 Task Budget Prep MCQ StudDokument5 SeitenHW 15-2 Task Budget Prep MCQ StudКсения НиколоваNoch keine Bewertungen

- Master Budget AssignmentDokument1 SeiteMaster Budget AssignmentAbreham AwokeNoch keine Bewertungen

- CVP AnalysisDokument2 SeitenCVP Analysisjhean dabatosNoch keine Bewertungen

- Paper 1Dokument19 SeitenPaper 1GianNoch keine Bewertungen

- MASTER-BUDGETDokument36 SeitenMASTER-BUDGETRafols AnnabelleNoch keine Bewertungen

- HASF Hardware Store 2011 budget schedules and financial forecastsDokument2 SeitenHASF Hardware Store 2011 budget schedules and financial forecastsHaris HasanNoch keine Bewertungen

- SECTION 3 (80 Marks) : Page 8 of 8Dokument1 SeiteSECTION 3 (80 Marks) : Page 8 of 8Muhammad Salim Ullah KhanNoch keine Bewertungen

- Example Cash BudgetDokument1 SeiteExample Cash BudgetPamela GalangNoch keine Bewertungen

- Most Probable Diagnosis & Treatment OptionsDokument1 SeiteMost Probable Diagnosis & Treatment OptionsZara SaeedNoch keine Bewertungen

- Osce 2Dokument1 SeiteOsce 2Zara SaeedNoch keine Bewertungen

- Student Guidance - Minimum Spec v2.0 2 June PDFDokument4 SeitenStudent Guidance - Minimum Spec v2.0 2 June PDFZara SaeedNoch keine Bewertungen

- September color pallets: תינכות - - תויתרבח תותשר תישדוח Premier Dead SeaDokument4 Seiten September color pallets: תינכות - - תויתרבח תותשר תישדוח Premier Dead SeaZara SaeedNoch keine Bewertungen

- UK guideline on diagnosis and management of acute meningitisDokument2 SeitenUK guideline on diagnosis and management of acute meningitisZara SaeedNoch keine Bewertungen

- Cambridge International Advanced LevelDokument4 SeitenCambridge International Advanced LevelmahamNoch keine Bewertungen

- UK guideline on diagnosis and management of acute meningitisDokument2 SeitenUK guideline on diagnosis and management of acute meningitisZara SaeedNoch keine Bewertungen

- Maintaining Financial Records (International StreamDokument10 SeitenMaintaining Financial Records (International StreamZara SaeedNoch keine Bewertungen

- Ma1 BPP Book 16-17 PDFDokument290 SeitenMa1 BPP Book 16-17 PDFZara SaeedNoch keine Bewertungen

- Accacat Paper t3 Maintaining Financial ReDokument32 SeitenAccacat Paper t3 Maintaining Financial ReKian Yen0% (1)

- SubcultureDokument3 SeitenSubcultureZara SaeedNoch keine Bewertungen

- University of Cambridge International Examinations International General Certificate of Secondary EducationDokument20 SeitenUniversity of Cambridge International Examinations International General Certificate of Secondary EducationZara SaeedNoch keine Bewertungen

- AS Business NotesDokument102 SeitenAS Business NotesZara SaeedNoch keine Bewertungen

- DepartmentationDokument9 SeitenDepartmentationArjunsingh HajeriNoch keine Bewertungen

- Usefu L Busin ESS Usefu L Busin ESS Englis H Expr Ession S Englis H Expr Ession SDokument67 SeitenUsefu L Busin ESS Usefu L Busin ESS Englis H Expr Ession S Englis H Expr Ession SMaría del Pilar Mancha BoteNoch keine Bewertungen

- Overall Equipment Effectiveness: GuideDokument13 SeitenOverall Equipment Effectiveness: GuideJunjie ChenNoch keine Bewertungen

- Measuring Digital Marketing Effectiveness: Key Performance Indicators (KPIsDokument4 SeitenMeasuring Digital Marketing Effectiveness: Key Performance Indicators (KPIsTruc TranNoch keine Bewertungen

- Agritech Startups in India Face Challenges Despite SupportDokument33 SeitenAgritech Startups in India Face Challenges Despite SupportVaibhav DafaleNoch keine Bewertungen

- Acc117-Chapter 2Dokument26 SeitenAcc117-Chapter 2Fadilah JefriNoch keine Bewertungen

- Group 5 FabmDokument33 SeitenGroup 5 FabmHanissandra Franz V. DalanNoch keine Bewertungen

- Crafting The Brand Positioning: Marketing Management, 13 EdDokument22 SeitenCrafting The Brand Positioning: Marketing Management, 13 EdYash Roxs100% (1)

- Commerce: Name - Prashant Singh Chauhan Class - Bba 6 SemesterDokument14 SeitenCommerce: Name - Prashant Singh Chauhan Class - Bba 6 Semesterprashant singh chauhanNoch keine Bewertungen

- RC Property TransferDokument2 SeitenRC Property TransferaugustapressNoch keine Bewertungen

- Solved Paper 2016-2017 - Financial ManagementDokument23 SeitenSolved Paper 2016-2017 - Financial ManagementGaurav SharmaNoch keine Bewertungen

- PM - Case Study - Razor MetalDokument2 SeitenPM - Case Study - Razor MetalDatta SaisudhirNoch keine Bewertungen

- Sample Exercises On Drafting A Software Development Agreement and Drafting Terms of Use For A WebsiteDokument4 SeitenSample Exercises On Drafting A Software Development Agreement and Drafting Terms of Use For A WebsitePrachi ThakurNoch keine Bewertungen

- Bestore Omni Channel Digital Marketing Business Mid Platform CaseDokument14 SeitenBestore Omni Channel Digital Marketing Business Mid Platform CaseGabriela LoveraNoch keine Bewertungen

- Audit Control Risk AssessmentDokument15 SeitenAudit Control Risk AssessmentKathleenNoch keine Bewertungen

- Module 4 Quiz (LT2)Dokument2 SeitenModule 4 Quiz (LT2)marriette joy abadNoch keine Bewertungen

- Operations Scheduling: Maximize Resource UtilizationDokument14 SeitenOperations Scheduling: Maximize Resource Utilizationbezawit mamuyeNoch keine Bewertungen

- TechnoFino LTF - List - AU - BankDokument22 SeitenTechnoFino LTF - List - AU - BankbengaltigerNoch keine Bewertungen

- Individual AssignmentDokument3 SeitenIndividual AssignmentLoveness NyakurimwaNoch keine Bewertungen

- Consumers and Producers Surplus05Dokument12 SeitenConsumers and Producers Surplus05SubratKumarNoch keine Bewertungen

- Valutazionestart Up (Def)Dokument32 SeitenValutazionestart Up (Def)Alberto CancliniNoch keine Bewertungen

- 11 BSTDokument4 Seiten11 BSTMayank KumarNoch keine Bewertungen

- A Cantilever Beam Is Subjected To A Concentrated L...Dokument4 SeitenA Cantilever Beam Is Subjected To A Concentrated L...harabassNoch keine Bewertungen

- Canadian Jeweller Magazine September October 2009Dokument116 SeitenCanadian Jeweller Magazine September October 2009rivegaucheNoch keine Bewertungen

- Lecture Topic 1.2 ENVIORNMENT SCANNING TECHNIQUESDokument35 SeitenLecture Topic 1.2 ENVIORNMENT SCANNING TECHNIQUESKertik Singh100% (1)