Beruflich Dokumente

Kultur Dokumente

Table 1: Tax Morale Is Affected by Two Types of Fairness: Mrunal's Economy Pillar#2B: Budget Revenue Part: Page 166

Hochgeladen von

Washim Alam50C0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten3 SeitenThe document discusses strategies to improve tax compliance in India through behavioral economics principles. It notes that tax morale, or intrinsic motivation to pay taxes, is affected by perceptions of fairness. When taxpayers feel taxes are commensurate with benefits received or that similar taxpayers are taxed similarly, morale increases. However, morale decreases when taxpayers feel their money is wasted or others face less tax burden. The document recommends honoring top taxpayers publicly, emphasizing taxes fund public services, and easing the tax filing process to improve morale and compliance.

Originalbeschreibung:

Originaltitel

paper 21

Copyright

© © All Rights Reserved

Verfügbare Formate

PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThe document discusses strategies to improve tax compliance in India through behavioral economics principles. It notes that tax morale, or intrinsic motivation to pay taxes, is affected by perceptions of fairness. When taxpayers feel taxes are commensurate with benefits received or that similar taxpayers are taxed similarly, morale increases. However, morale decreases when taxpayers feel their money is wasted or others face less tax burden. The document recommends honoring top taxpayers publicly, emphasizing taxes fund public services, and easing the tax filing process to improve morale and compliance.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

17 Ansichten3 SeitenTable 1: Tax Morale Is Affected by Two Types of Fairness: Mrunal's Economy Pillar#2B: Budget Revenue Part: Page 166

Hochgeladen von

Washim Alam50CThe document discusses strategies to improve tax compliance in India through behavioral economics principles. It notes that tax morale, or intrinsic motivation to pay taxes, is affected by perceptions of fairness. When taxpayers feel taxes are commensurate with benefits received or that similar taxpayers are taxed similarly, morale increases. However, morale decreases when taxpayers feel their money is wasted or others face less tax burden. The document recommends honoring top taxpayers publicly, emphasizing taxes fund public services, and easing the tax filing process to improve morale and compliance.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 3

https://telegram.me/pdf4exams https://telegram.

me/testseries4exams

2) Presence of informal sector, parallel economy, cash based economy.

3) Low per capita income, high level of poverty. Concentration of income in the hands of

few- who are greedy to engage in tax evasion & avoidance.

4) Election funding as the mother source of corruption, and therefore black money.

Politician-Builders-Mafia nexus.

5) Due to political considerations, state governments and local bodies do not levy all the

taxes authorised by the constitution e.g. tax on agricultural income. So our (direct)

tax base is narrow. [Tax base: कराधार means the total value of all the income,

property, etc. on which tax is charged.]

6) Loopholes in the tax laws which encourage tax avoidance using Domestic and Offshore

channels.

7) Direct taxes like wealth tax, gift tax and estate duty suffered from loopholes, lax

monitoring and evasion. They didn’t yield much revenue. Hence even referred as

‘paper taxes’, and had to be abolished ultimately.

24.7.2 “Use Behavioural Economics to improve Tax Compliance”

Economic Survey 2018-19 observed that:

❖ Plato said, “What is honored in a country, is cultivated there.” Indians join military

because 1) salary 2) because serving in the armed forces is considered ‘honorable’.

❖ So, we should use the principles of Behavioral Economics ( यावहा रक अथ ा ) enhance

tax compliance (कर अनप ु ालन). We’ve to modify the social norm from “evading taxes is

acceptable” to “paying taxes honestly is honorable.”

❖ Tax Morale (कर संबंिी नै तक मनोबल): it is the intrinsic motivation (आंत रक ेरणा) of

taxpayers to pay taxes. When tax morale is down → motivation for tax evasion

increases.

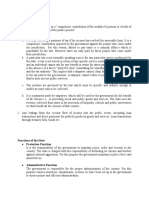

Table 1: Tax Morale is affected by two types of fairness

Fairness _ _ _ _ Fairness _ _ _ _ Fairness

ि प ता (उ ्ाधार ि प ता ै तज) ( ै तज ि प ता)

Tax Payer’s What I pay in taxes is There should not be a great

thought commensurate to the benefits I difference in the taxes paid by the

process → receive as services from the ‘similar’ sections of society.

Government.

His Tax He sees taxpayers' money wasted If a salaried employee and a

morale is in public expenditure (like shopkeeper are earning ₹8 lakhs

lowered Mayawati’s elephant statutes) per annum, still the salaried

when → instead of better quality of water, employee is forced to pay more

road, education or electricity. taxes than this shopkeeper,

because

- TDS on salary whereas

shopkeeper underreports his

sales in cash payment.

- Shopkeeper shows less profit

through fictitious business

expenditures.

Mrunal’s Economy Pillar#2B: Budget → Revenue Part : Page 166

https://telegram.me/pdf4exams https://telegram.me/testseries4exams

Solution(s) ✓ under-constructions projects ✓ SMS, billboards highlighting

should show signboards “Your self-employed individuals who

tax money at work” pay good amount of tax.

✓ Reminding tax payers that ✓ Public shaming of individuals

public goods can only be who don’t pay taxes. It’ll scare

provided in return for tax other tax-evaders that the

compliance. Most people in probability of their detection

your local community pay has increased.

their taxes on time. ✓ Avoid Tax Amnesties. Give

stringent punishment to tax

evaders.

Further, CEA Subramanian K. suggested:

✓ Top 10 highest taxpayers within a district → They should be given VIP-treatment such

as faster boarding privileges at airports, special “diplomatic” type lanes at

immigration counters, fast-lane on roads and toll booths, etc.

✓ Highest taxpayers over a decade → Important places should be named after them e.g.

roads, trains, schools, universities, hospitals and airports.

✓ In Hinduism, Islam and Christianity - unpaid debt is considered a sin. So,

advertisements should highlight how tax evasion is a violation of such

“spiritual/religious norms”.

✓ Ease in Paying Taxes: Pre-populated Income Tax forms with easy to understand terms.

Even if a person’s tax liability is ZERO, he should be required to fill Income Tax form.

✓ Automated TDS as and where possible and timely release of Tax refunds.

Hindi-Medium-Mains candidates should refer ES2018-19 Vol1 Ch.2

page52’s bullet 2.33 upto page 55’s box 5 to get the clean & formal

vocabulary for Answer Writing

24.8 TAXATION: MISC. TERMS

- American economist Arthur Laffer: if (direct) tax rates are increased

above a certain level, then tax revenue collection will fall because

higher tax rates discourage people from working and/or encourage

Laffer Curve them to engage in tax evasion and tax avoidance).

- So, tax-cuts could lead to higher tax revenue collections.

(ल र व ):

- Modi Budgets from 2017 onwards: The lowest Income Tax slab was

cut from 10% to 5%; The corporation tax on small sized companies

was also brought down from 30 % to 25% in a phased manner

- USA Budget-2017: Corporation tax cut down from 35 % to 15%

Tax buoyancy - If GDP grew by x%, then how much % Income tax collection will grow?

- E.g. if income tax collection growth rate is 11% when GDP growth

(कर उ लावकता):

rate is 10%, then Income Tax’s tax buoyancy is 1.1

Tax elasticity If first income tax slab increased from say 5% to 15%, then in absolute

(कर ल चलाता): terms how much more IT-revenue will be generated?

Mrunal’s Economy Pillar#2B: Budget → Revenue Part : Page 167

https://telegram.me/pdf4exams https://telegram.me/testseries4exams

24.8.1 Net Tax Revenue of the Govt (शु ध कर राज ि)

Sr. Budget → Revenue Receipts → Tax Receipts Expected in 2019-20

A Union’s Direct taxes, incl. cess and surcharge ~ _ _ _ _ lakh crores

B Union’s Indirect taxes incl. cess and surcharge. ~ _ _ _ _ lakh crores

- For Union: direct taxes income is >>

indirect taxes.

- But if we summed all the taxes of union,

state and local bodies then indirect taxes

income >> direct taxes.

C Union territories without legislature: their direct ~7000 crores

and indirect taxes: िधानमंडल र हत संघ रा य े

D Gross Tax Revenue (=A+B+C) सकल कर राज ि ~24 lakh crores

E Minus the Tax devolution to States (कर ह तांतरण) (-)~8 lakh crores

as per the Finance Commission

F Minus Contributions to National Disaster Response (-)~2500 crores

Fund in Home ministry*

D-E-F Net Tax Revenue of Union (शु ध कर राज ि) ~ _ _ _ _ lakh crores

*National Disaster Response Fund (रा य आपदा त या को ) is a statutory fund under

Disaster Management Act, 2005. Previously, called National Calamity Contingency Fund

(NCCF).

24.8.2 Revenue Shortfall (राज व म कमी)

Type of Tax Tax in ₹ crores 2018-19’s Advance Estimates 2018-19’s Revised

Made in Feb-2018 Estimates in Feb-2019

Direct-Tax Corporation Tax 621000 671000

Direct-Tax Income Tax 529000 529000

Direct-Tax STT 11000 11000

Indirect Tax Custom Duty 112500 130038

Indirect Tax Excise on Fuel 259600 259612

Indirect Tax GST 743900 643900

Gross Tax Revenue → 22.7 lakh crores 22.4 lakh crores

- 1/2/2018: Budget 2018 is presented for the next financial year starting from 1st April

2018 to 31st March 2019. So, FinMin could have only made projections /estimations

about how much taxes will be collected during 1/4/18 to 31/3/19.

- But throughout the year, based on the advance tax-collection figures & monthly GST

collection figures, FinMin will have to re-adjust the estimates.

- 1/2/2019: (Interim) Budget 2019 is presented, along with that, Govt will present

revised estimates for previous Financial Year (2018-19).

- From the table we can see that Gross Tax collection is less than expected (22.7 MINUS

22.4) = ~30,000 crores is ‘Revenue Shortfall’, mainly because _ _ _ _ _ _ _ _ were less

than expected.

24.8.3 Mock Questions for UPSC Mains (250 words each)

4. (Asked in GSM3-2013) Money laundering poses a serious threat to country’s economic

sovereignty. What steps are required to be taken to control this menace? मनी लॉ ंग दे श

क आ क सं भत

ु ा के लए एक गंभीर खतरा है। इस खतरे को नयं त करने के लए या कदम उठाए

जाने क आि यकता है ?

Mrunal’s Economy Pillar#2B: Budget → Revenue Part : Page 168

Das könnte Ihnen auch gefallen

- 18bco6el U3Dokument11 Seiten18bco6el U3Teguade ChekolNoch keine Bewertungen

- Tax Law NotesDokument86 SeitenTax Law Notesmanika100% (1)

- Unit - I TAX HistoryDokument4 SeitenUnit - I TAX HistoryWelcome 1995Noch keine Bewertungen

- 21.10 M - D T - F T T: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 123Dokument3 Seiten21.10 M - D T - F T T: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 123Washim Alam50CNoch keine Bewertungen

- Bermuda Taxation & Global Compliance: Scott Stallard Photography Headin' Out For de CatchDokument8 SeitenBermuda Taxation & Global Compliance: Scott Stallard Photography Headin' Out For de CatchRG-eviewerNoch keine Bewertungen

- TAXATION. Good NotesDokument33 SeitenTAXATION. Good NotesDavid100% (2)

- Advanced Taxation Chapter-2 MaterialDokument48 SeitenAdvanced Taxation Chapter-2 MaterialTeweldeNoch keine Bewertungen

- Effectiveness of Tax Deduction at Source (TDS) in IndiaDokument4 SeitenEffectiveness of Tax Deduction at Source (TDS) in IndiaIJEMR JournalNoch keine Bewertungen

- Notes - Residential Status Module 1Dokument30 SeitenNotes - Residential Status Module 1Sajan N ThomasNoch keine Bewertungen

- Income TaxDokument16 SeitenIncome TaxVEDSHREE CHAUDHARINoch keine Bewertungen

- Taxation NotesDokument22 SeitenTaxation NotesIniesta DenohNoch keine Bewertungen

- Indirect Taxes 1,2,3Dokument33 SeitenIndirect Taxes 1,2,3Welcome 1995Noch keine Bewertungen

- Lecture 1Dokument10 SeitenLecture 1Masitala PhiriNoch keine Bewertungen

- TAXATIONDokument23 SeitenTAXATIONOluwamurewa FadareNoch keine Bewertungen

- RITESHDokument94 SeitenRITESHrohilla smythNoch keine Bewertungen

- Etaxation Unit 1Dokument50 SeitenEtaxation Unit 1Rohit Tripathi ModicareNoch keine Bewertungen

- Tax Theory and ManagementDokument18 SeitenTax Theory and Managementomoding benjaminNoch keine Bewertungen

- Topic: Page NoDokument21 SeitenTopic: Page NoAcchu BajajNoch keine Bewertungen

- Principles of Economics/TaxationDokument2 SeitenPrinciples of Economics/TaxationCarmi B. ChulipaNoch keine Bewertungen

- Direct Tax CodeDokument6 SeitenDirect Tax Codesanjay494Noch keine Bewertungen

- Business Taxation 8.3.18Dokument27 SeitenBusiness Taxation 8.3.18BALASARAVANANNoch keine Bewertungen

- Public RevenueDokument90 SeitenPublic RevenuekhanjiNoch keine Bewertungen

- Irect Axes Ypes: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 116Dokument3 SeitenIrect Axes Ypes: Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 116Washim Alam50CNoch keine Bewertungen

- Taxation TheoryDokument32 SeitenTaxation TheoryKaycia HyltonNoch keine Bewertungen

- Taxation: Témakör 2 Téma 3 1Dokument2 SeitenTaxation: Témakör 2 Téma 3 1Mark MatyasNoch keine Bewertungen

- TaxationDokument34 SeitenTaxationShyamKumarKCNoch keine Bewertungen

- HRD 104 - Qs II Topic Three (Taxation) Notes-1-1Dokument10 SeitenHRD 104 - Qs II Topic Three (Taxation) Notes-1-1Fidel FlavinNoch keine Bewertungen

- Tax System: BY Arpita Pali Prachi Jaiswal Mansi MahaleDokument30 SeitenTax System: BY Arpita Pali Prachi Jaiswal Mansi MahaleSiddharth SharmaNoch keine Bewertungen

- RITESHDokument94 SeitenRITESHRahul RajNoch keine Bewertungen

- Answers To Chapter 12 QuestionsDokument5 SeitenAnswers To Chapter 12 QuestionsManuel SantanaNoch keine Bewertungen

- 21.6 D D T (DDT: लाभाश वतरण कर) : Mrunal's Economy Pillar#2A: Budget → Revenue Part → Tax-Receipts → Page 119Dokument3 Seiten21.6 D D T (DDT: लाभाश वतरण कर) : Mrunal's Economy Pillar#2A: Budget → Revenue Part → Tax-Receipts → Page 119Washim Alam50CNoch keine Bewertungen

- Buque - Prelim Exam-Income TaxationDokument3 SeitenBuque - Prelim Exam-Income TaxationVillanueva, Jane G.Noch keine Bewertungen

- Interview QuestionsDokument12 SeitenInterview QuestionsnadeemNoch keine Bewertungen

- Mid term TCC Trương Thị Khánh Ly 11205991Dokument3 SeitenMid term TCC Trương Thị Khánh Ly 11205991Hưng TrịnhNoch keine Bewertungen

- 1Dokument5 Seiten1Hafiz Farrukh IshaqNoch keine Bewertungen

- Question 1-Answers. A)Dokument7 SeitenQuestion 1-Answers. A)salongo geofNoch keine Bewertungen

- Direct & Indirect Tax Structure in India-FinalDokument23 SeitenDirect & Indirect Tax Structure in India-FinalJivaansha SinhaNoch keine Bewertungen

- Simply Cleaning: Taxation IssuesDokument10 SeitenSimply Cleaning: Taxation IssuesadeelmuzaffaralamNoch keine Bewertungen

- Taxation System in BangladeshDokument12 SeitenTaxation System in BangladeshkoheliNoch keine Bewertungen

- BBA Program Course Title: Taxation Course Code: A408 Course Outline Introduction of FacultyDokument45 SeitenBBA Program Course Title: Taxation Course Code: A408 Course Outline Introduction of FacultyMunkasir MasudNoch keine Bewertungen

- 5.1 Taxation IssuesDokument21 Seiten5.1 Taxation IssuesFranco FungoNoch keine Bewertungen

- Canons of TaxationDokument5 SeitenCanons of TaxationStudy AllyNoch keine Bewertungen

- Canons of Taxation: Income Tax LawsDokument13 SeitenCanons of Taxation: Income Tax LawsHaris MughalNoch keine Bewertungen

- Institute-University School of Business Department of CommerceDokument21 SeitenInstitute-University School of Business Department of Commercebhavu aryaNoch keine Bewertungen

- Ch-1 IntroductionDokument16 SeitenCh-1 IntroductionMd. Rayhanul IslamNoch keine Bewertungen

- Q1. Define Tax and Explain The Important Characteristics of TaxDokument37 SeitenQ1. Define Tax and Explain The Important Characteristics of TaxSuryanarayana Murthy YamijalaNoch keine Bewertungen

- 18bec62c U3Dokument9 Seiten18bec62c U3Chandru VeluNoch keine Bewertungen

- Chapter 1 Introduction To Income Tax Act PDFDokument66 SeitenChapter 1 Introduction To Income Tax Act PDFRISHI SHAHNoch keine Bewertungen

- St. Mary'S Technical Campus, Kolkata Mba 3 Semester: Q1 Write Short Notes On (Any Five)Dokument22 SeitenSt. Mary'S Technical Campus, Kolkata Mba 3 Semester: Q1 Write Short Notes On (Any Five)Barkha LohaniNoch keine Bewertungen

- DS 432Dokument10 SeitenDS 432chris fwe fweNoch keine Bewertungen

- Null 3Dokument37 SeitenNull 3GeofreyNoch keine Bewertungen

- TAXATION001Dokument31 SeitenTAXATION001Boqorka AmericaNoch keine Bewertungen

- Chapter 1 FDokument8 SeitenChapter 1 Flamees yildizNoch keine Bewertungen

- BabeDokument3 SeitenBabeCYRUS WABUTEYANoch keine Bewertungen

- Taxation I Lesson 1 and 2 Introduction TDokument13 SeitenTaxation I Lesson 1 and 2 Introduction TApex LionheartNoch keine Bewertungen

- Nature of Indian Economy - DirectDokument4 SeitenNature of Indian Economy - DirectGhanshyamDixitNoch keine Bewertungen

- TaxationDokument12 SeitenTaxationHaris MalikNoch keine Bewertungen

- Taxation Assignment BcaDokument12 SeitenTaxation Assignment BcaJeniffer TracyNoch keine Bewertungen

- Direct TaxDokument7 SeitenDirect TaxFarhan Masood ZamanNoch keine Bewertungen

- How America was Tricked on Tax Policy: Secrets and Undisclosed PracticesVon EverandHow America was Tricked on Tax Policy: Secrets and Undisclosed PracticesNoch keine Bewertungen

- Read 6Dokument2 SeitenRead 6Washim Alam50CNoch keine Bewertungen

- Read 5Dokument2 SeitenRead 5Washim Alam50CNoch keine Bewertungen

- Read 2Dokument2 SeitenRead 2Washim Alam50CNoch keine Bewertungen

- .) - ) ' - Ab Cde ) B F G HB - Ib Jik L) Mdik - Inb MF B Dlmfo) B - Im L - PLQDokument4 Seiten.) - ) ' - Ab Cde ) B F G HB - Ib Jik L) Mdik - Inb MF B Dlmfo) B - Im L - PLQWashim Alam50CNoch keine Bewertungen

- Read 4Dokument1 SeiteRead 4Washim Alam50CNoch keine Bewertungen

- WWW - Visionias.in: 6 ©vision IASDokument2 SeitenWWW - Visionias.in: 6 ©vision IASWashim Alam50CNoch keine Bewertungen

- G.S. Paper Ii - : Social JusticeDokument3 SeitenG.S. Paper Ii - : Social JusticeWashim Alam50CNoch keine Bewertungen

- Report 3Dokument4 SeitenReport 3Washim Alam50CNoch keine Bewertungen

- Read 3Dokument2 SeitenRead 3Washim Alam50CNoch keine Bewertungen

- WWW - Visionias.in: 3 ©vision IASDokument2 SeitenWWW - Visionias.in: 3 ©vision IASWashim Alam50CNoch keine Bewertungen

- Report 1Dokument3 SeitenReport 1Washim Alam50CNoch keine Bewertungen

- Report 2Dokument3 SeitenReport 2Washim Alam50CNoch keine Bewertungen

- Report 6Dokument5 SeitenReport 6Washim Alam50CNoch keine Bewertungen

- Report 5Dokument4 SeitenReport 5Washim Alam50CNoch keine Bewertungen

- 45.5 P C N A: S: Position Planning Commission NITI AayogDokument3 Seiten45.5 P C N A: S: Position Planning Commission NITI AayogWashim Alam50CNoch keine Bewertungen

- 45.8 E P PM-EAC?: Mrunal's Economy Pillar#4: Sectors of Economy Page 310Dokument3 Seiten45.8 E P PM-EAC?: Mrunal's Economy Pillar#4: Sectors of Economy Page 310Washim Alam50CNoch keine Bewertungen

- 45.4 P C: L / S: Mrunal's Economy Pillar#4: Sectors of Economy Page 307Dokument3 Seiten45.4 P C: L / S: Mrunal's Economy Pillar#4: Sectors of Economy Page 307Washim Alam50CNoch keine Bewertungen

- 48.6 P #4: I: Cpi, Wpi, Iip &: Mrunal's Economy Pillar#4: Sectors of Economy Page 332Dokument2 Seiten48.6 P #4: I: Cpi, Wpi, Iip &: Mrunal's Economy Pillar#4: Sectors of Economy Page 332Washim Alam50CNoch keine Bewertungen

- 30.4 B C A I G: Figure 1: Oil Barrel Prices in U$D. Source: ES2018-19, Vol2Ch6Dokument3 Seiten30.4 B C A I G: Figure 1: Oil Barrel Prices in U$D. Source: ES2018-19, Vol2Ch6Washim Alam50CNoch keine Bewertungen

- Economic System आ थक णाल →: Mrunal's Economy Pillar#4: Sectors of Economy → Page 305Dokument2 SeitenEconomic System आ थक णाल →: Mrunal's Economy Pillar#4: Sectors of Economy → Page 305Washim Alam50CNoch keine Bewertungen

- Paper 19 PDFDokument3 SeitenPaper 19 PDFWashim Alam50CNoch keine Bewertungen

- 24 T B M & A I: Axation Lack Oney Llied SsuesDokument3 Seiten24 T B M & A I: Axation Lack Oney Llied SsuesWashim Alam50CNoch keine Bewertungen

- Mrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 136Dokument3 SeitenMrunal's Economy Pillar#2A: Budget Revenue Part Tax-Receipts Page 136Washim Alam50CNoch keine Bewertungen

- Mrunal's Economy Pillar#4: Sectors of Economy Page 302Dokument3 SeitenMrunal's Economy Pillar#4: Sectors of Economy Page 302Washim Alam50CNoch keine Bewertungen

- Membership Application FormDokument2 SeitenMembership Application FormVishal WasnikNoch keine Bewertungen

- Cases On Consent Assault, CF N Hurt, GriveousDokument3 SeitenCases On Consent Assault, CF N Hurt, GriveousafiqahNoch keine Bewertungen

- SONG BOK YOONG V HO KIM POUIDokument2 SeitenSONG BOK YOONG V HO KIM POUIAinul Mardiah bt HasnanNoch keine Bewertungen

- 2023-01-26 St. Mary's County TimesDokument32 Seiten2023-01-26 St. Mary's County TimesSouthern Maryland OnlineNoch keine Bewertungen

- RISHI21 - Alpha Bluechip - LUMPSUMDokument4 SeitenRISHI21 - Alpha Bluechip - LUMPSUMPower of Stock MarketNoch keine Bewertungen

- Personal Information: Abdinasir Mohamed AbdullahiDokument3 SeitenPersonal Information: Abdinasir Mohamed AbdullahiAbdinasir MohammedNoch keine Bewertungen

- Cabrera V Isaac 8Dokument3 SeitenCabrera V Isaac 8Michael MartinNoch keine Bewertungen

- Banking Law NotesDokument9 SeitenBanking Law NotesAfiqah Ismail100% (2)

- Francisco vs. HerreraDokument3 SeitenFrancisco vs. Herreragen1Noch keine Bewertungen

- Ai Compliance in ControlDokument16 SeitenAi Compliance in ControlYasir ButtNoch keine Bewertungen

- Newcase MNLdraftDokument2 SeitenNewcase MNLdraftHari DasNoch keine Bewertungen

- There May Be More Students, Did The Same Things. We Will Also Do Rti If Institute Don'T Take Any MeasuresDokument4 SeitenThere May Be More Students, Did The Same Things. We Will Also Do Rti If Institute Don'T Take Any MeasuresSouvik MondalNoch keine Bewertungen

- Imfpa 5MDokument7 SeitenImfpa 5Mxhxbxbxbbx79Noch keine Bewertungen

- Case Law (Paventhan 131902004)Dokument2 SeitenCase Law (Paventhan 131902004)Rajalakshmi TNNoch keine Bewertungen

- Solution Manual For Design and Analysis of Experiments 10th Edition Douglas C MontgomeryDokument35 SeitenSolution Manual For Design and Analysis of Experiments 10th Edition Douglas C Montgomeryverminly.rhaetic96no100% (48)

- De Mesa vs. CA, G.R. Nos. 196467-68, Oct. 19, 1999, 317 SCRA 24Dokument4 SeitenDe Mesa vs. CA, G.R. Nos. 196467-68, Oct. 19, 1999, 317 SCRA 24xpdgyt2ddkNoch keine Bewertungen

- CRIME MAPPING C-WPS OfficeDokument4 SeitenCRIME MAPPING C-WPS OfficeIvylen Gupid Japos CabudbudNoch keine Bewertungen

- Letter of CreditDokument37 SeitenLetter of CreditMohammad A Yousef100% (1)

- 11 Matthews vs. TaylorDokument11 Seiten11 Matthews vs. TaylorRenceNoch keine Bewertungen

- Harambee University COURSE OUTLINEDokument2 SeitenHarambee University COURSE OUTLINEbashaNoch keine Bewertungen

- Primary Sources FinalDokument2 SeitenPrimary Sources Finalapi-203215781Noch keine Bewertungen

- 1 StandardReportDokument12 Seiten1 StandardReportPolo Delehandro YogAjunoNoch keine Bewertungen

- Decisions of AgmDokument1 SeiteDecisions of AgmVarun KhannaNoch keine Bewertungen

- Legal Services Paper 2021Dokument43 SeitenLegal Services Paper 2021Unanimous ClientNoch keine Bewertungen

- Compania Maritima v. Insurance Company of North AmericaDokument2 SeitenCompania Maritima v. Insurance Company of North AmericaYodh Jamin OngNoch keine Bewertungen

- Govt. T.R.S. College Rewa (M.P.) : Papers (Write Papers in Blank) Test 1 Test 2 Test 3 Assignment SeminarDokument2 SeitenGovt. T.R.S. College Rewa (M.P.) : Papers (Write Papers in Blank) Test 1 Test 2 Test 3 Assignment Seminarsauravv7Noch keine Bewertungen

- Information Sheet Motorcycle Helmets Visors and Goggles Aug 10Dokument4 SeitenInformation Sheet Motorcycle Helmets Visors and Goggles Aug 10HANIFNoch keine Bewertungen

- M/S Best Sellers Retail (I) P.Ltdvs M/S Aditya Birla Nuvo Ltd.&Ors (2012) 6 SCC 792Dokument4 SeitenM/S Best Sellers Retail (I) P.Ltdvs M/S Aditya Birla Nuvo Ltd.&Ors (2012) 6 SCC 792sai kiran gudisevaNoch keine Bewertungen

- Affdvt Opposing MFSJDokument3 SeitenAffdvt Opposing MFSJthesolprovider13Noch keine Bewertungen

- Ramesh Raj Bohra Vs DCIT ITAT JodhpurDokument16 SeitenRamesh Raj Bohra Vs DCIT ITAT JodhpurSriram KNoch keine Bewertungen