Beruflich Dokumente

Kultur Dokumente

Joannamarie Uy Problem

Hochgeladen von

Feiya LiuOriginalbeschreibung:

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Joannamarie Uy Problem

Hochgeladen von

Feiya LiuCopyright:

Verfügbare Formate

Joannamarie Uy Problem

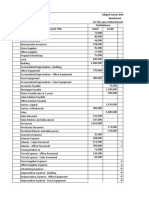

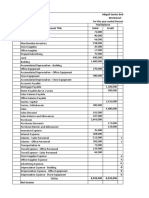

After several years with a large accounting firm, Joannamarie Uy decided to establish her own

accounting practice. The following transactions of Joannamarie Uy, CPA, were completed during May

2019:

May Transferred P92,500 cash from a personal savings account to a checking account,

2 Joannamarie Uy, CPA.

Acquired office equipment on account from Liboro Furniture, P36,800.

3

4 Acquired office supplies on account from Palatino Office Supply, P17,100.

6 Performed accounting services for Gabayan Computers and submitted a bill of

P29,200 for those services.

7 Paid for accounting and tax books for use in the practice, P19,500.

8 Paid Palatino Office Supply, P4,100 on account.

10 Acquired a condominium unit for the accounting practice, P265,000. A down payment

of P38,000 was made, and issued a note payable for the remaining P227,000.

12 Paid salaries, P14,200.

13 Received P9,750 from Gabayan Computers, billed on May 6.

16 Paid telephone expense, P650.

19 Received cash in the amount of P14,600 from Mallari Books for accounting services

rendered for the month.

22 Acquired office supplies on account from Palatino Office Supply, P4,650.

23 Withdrew P8,150 for personal use.

25 Paid salaries, P10,300.

26 Billed Chua Exporters P31,600 for accounting services rendered.

27 Paid PICPA-Palawan P5,500 for professional dues.

28 Paid P3,250 rent on an office-copying machine.

Required:

1. Prepare the journal entries for the May transactions. Record the entries in a General Journal

using the General Journal template available on Canvas.

2. Set up the following ledger accounts (using the General Ledger template available on

Canvas) and post all the journal entries to the ledger, using account numbers (enclosed in

parentheses) for cross-reference and using journal page number 1: Cash (110); Accounts

Receivable (120); Office Supplies (130); Office Condominium (140); Office Equipment (150);

Accounting Library (160); Notes Payable (210); Accounts Payable (220); Uy, Capital (310); Uy,

Withdrawals (320); Accounting Revenues (410); Salaries Expense (510); Rent Expense (520);

Telephone Expense (530); and Professional Dues Expense (540).

3. Prepare a trial balance.

Das könnte Ihnen auch gefallen

- Dior Product Development PresentationDokument59 SeitenDior Product Development PresentationSade WycheNoch keine Bewertungen

- T-Accounts, Evelyn Tria, Systems ConsultantDokument3 SeitenT-Accounts, Evelyn Tria, Systems ConsultantFeiya Liu81% (21)

- T-Accounts, Evelyn Tria, Systems ConsultantDokument3 SeitenT-Accounts, Evelyn Tria, Systems ConsultantFeiya Liu81% (21)

- Orca Share Media1605010109407 6731900321930361605Dokument37 SeitenOrca Share Media1605010109407 6731900321930361605MARY JUSTINE PAQUIBOTNoch keine Bewertungen

- Practice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetDokument11 SeitenPractice Set #1 (3-56) Recording Transactions in A Financial Transaction WorksheetBenedict FajardoNoch keine Bewertungen

- Journalizing Merchandising Transactions, Problem #12Dokument2 SeitenJournalizing Merchandising Transactions, Problem #12Feiya Liu100% (1)

- Santa Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The PhilippinesDokument19 SeitenSanta Rosa Campus City of Santa Rosa, Laguna: Polytechnic University of The PhilippinesareumNoch keine Bewertungen

- Redox ChemistryDokument25 SeitenRedox ChemistrySantosh G PattanadNoch keine Bewertungen

- Learning Task 1 - Special Journals & Subsidiary Ledgers, Problem #5Dokument9 SeitenLearning Task 1 - Special Journals & Subsidiary Ledgers, Problem #5Feiya LiuNoch keine Bewertungen

- Chart of AccountsDokument6 SeitenChart of AccountsDonna Lyn Boncodin100% (1)

- Module 5 - Correcting EntriesDokument2 SeitenModule 5 - Correcting EntriesFeiya LiuNoch keine Bewertungen

- Prepare Journal Entries 2Dokument1 SeitePrepare Journal Entries 2Rie CabigonNoch keine Bewertungen

- FAR Assignment 1Dokument3 SeitenFAR Assignment 1Abegail Marababol50% (12)

- 06 - Wreak Bodily HavokDokument40 Seiten06 - Wreak Bodily HavokJivoNoch keine Bewertungen

- Activity 25 - Journal Entry To Post-ClosingDokument23 SeitenActivity 25 - Journal Entry To Post-ClosingAdam Cuenca100% (1)

- Learning Task 1 - Shareholders Equity TransactionsDokument3 SeitenLearning Task 1 - Shareholders Equity TransactionsFeiya Liu100% (1)

- Journalizing Merchandising Transactions, Problem #13Dokument2 SeitenJournalizing Merchandising Transactions, Problem #13Feiya Liu80% (10)

- Journalizing Merchandising Transactions, Problem #13Dokument2 SeitenJournalizing Merchandising Transactions, Problem #13Feiya Liu80% (10)

- Learning Task 2 - Shareholders Equity Transactions & Statements (Problem #7,11-13)Dokument8 SeitenLearning Task 2 - Shareholders Equity Transactions & Statements (Problem #7,11-13)Feiya Liu50% (2)

- Simple Vocabulary Vs IELTS VocabularyDokument7 SeitenSimple Vocabulary Vs IELTS VocabularyHarsh patelNoch keine Bewertungen

- Stephanie Calamba ACCA101Dokument1 SeiteStephanie Calamba ACCA101Nicole FidelsonNoch keine Bewertungen

- The Impact of Online Selling As Perceived by The Traditional RetailersDokument77 SeitenThe Impact of Online Selling As Perceived by The Traditional RetailersFeiya Liu100% (3)

- Transportation Costs, Problem #11Dokument3 SeitenTransportation Costs, Problem #11Feiya LiuNoch keine Bewertungen

- Accounting Problem 5Dokument8 SeitenAccounting Problem 5Carlo AniNoch keine Bewertungen

- John Bala Company Worksheet: Unadjusted Trial Balance DebitDokument9 SeitenJohn Bala Company Worksheet: Unadjusted Trial Balance DebitJekoeNoch keine Bewertungen

- Noel Hungria, Adjusting EntriesDokument1 SeiteNoel Hungria, Adjusting EntriesFeiya Liu100% (2)

- 9 Problems After Accounting Cycle Book1Dokument7 Seiten9 Problems After Accounting Cycle Book1Efi of the IsleNoch keine Bewertungen

- Sow English Year 4 2023 2024Dokument12 SeitenSow English Year 4 2023 2024Shamien ShaNoch keine Bewertungen

- Value-Added Tax (VAT) Is A Form of Sales TaxDokument6 SeitenValue-Added Tax (VAT) Is A Form of Sales TaxFeiya LiuNoch keine Bewertungen

- Lec2 Bookkeeping QuizDokument3 SeitenLec2 Bookkeeping QuizJasmine Carpio100% (1)

- Elegant Home Decors Worksheet For The Year Ended December 31,20ADokument8 SeitenElegant Home Decors Worksheet For The Year Ended December 31,20AChloe CatalunaNoch keine Bewertungen

- Trade and Cash Discount, Problem #1Dokument1 SeiteTrade and Cash Discount, Problem #1Feiya LiuNoch keine Bewertungen

- Trade and Cash Discount, Problem #1Dokument1 SeiteTrade and Cash Discount, Problem #1Feiya LiuNoch keine Bewertungen

- General Journal, Joannamarie Uy ProblemDokument4 SeitenGeneral Journal, Joannamarie Uy ProblemFeiya Liu100% (6)

- General Journal, Joannamarie Uy ProblemDokument4 SeitenGeneral Journal, Joannamarie Uy ProblemFeiya Liu100% (6)

- Pusing Rhezel - UNIT V - Learning Activity 5 - Exercise 5 - Closing Entries - Post Closing Trial Balance - Opening EntryDokument2 SeitenPusing Rhezel - UNIT V - Learning Activity 5 - Exercise 5 - Closing Entries - Post Closing Trial Balance - Opening EntryRhezel Baroro Pusing100% (2)

- Abigail Santos Boutique, Financial Statement For MerchandisingDokument9 SeitenAbigail Santos Boutique, Financial Statement For MerchandisingFeiya Liu100% (1)

- Sales Transaction, Problem #6Dokument1 SeiteSales Transaction, Problem #6Feiya Liu83% (6)

- This Study Resource Was: Jia T. Rañesis BSFT 3M2Dokument6 SeitenThis Study Resource Was: Jia T. Rañesis BSFT 3M2Anonymous100% (1)

- Noel Hungria, Adjusting EntriesDokument1 SeiteNoel Hungria, Adjusting EntriesFeiya Liu100% (4)

- Acctg Assginment 4 Adjusting EntriesDokument3 SeitenAcctg Assginment 4 Adjusting EntriesDaisy Marie A. RoselNoch keine Bewertungen

- QUIZZES Soln Ap 2015Dokument51 SeitenQUIZZES Soln Ap 2015Din Rose Gonzales100% (1)

- Nelson Daganta CashDokument10 SeitenNelson Daganta CashDan RioNoch keine Bewertungen

- Jose Rizal Heavy Bombers Trial Balance: Totals P 44,793,750 P 44,793,750Dokument16 SeitenJose Rizal Heavy Bombers Trial Balance: Totals P 44,793,750 P 44,793,750Sou TVNoch keine Bewertungen

- Journalizing To Adjusting Entries QuizDokument3 SeitenJournalizing To Adjusting Entries QuizNemar Jay Capitania100% (1)

- Problem Set 2Dokument2 SeitenProblem Set 2Mijo Cruz67% (3)

- Acctgchap 2Dokument15 SeitenAcctgchap 2Anjelika ViescaNoch keine Bewertungen

- Corazon Tabaranza Worksheet For The Month Ended December 31, 20ADokument9 SeitenCorazon Tabaranza Worksheet For The Month Ended December 31, 20AHaries Vi Traboc MicolobNoch keine Bewertungen

- Acc and BMDokument8 SeitenAcc and BMShawn Mendez100% (1)

- AC1Dokument1 SeiteAC1Lyanna Mormont25% (4)

- 3c - Chapter 4Dokument1 Seite3c - Chapter 4Lady Mae Dioquino33% (12)

- Cabutotan Jennifer 2ADokument12 SeitenCabutotan Jennifer 2AJennifer Mamuyac CabutotanNoch keine Bewertungen

- Learning Task 2 Financial Statements of Rosalina Besario SurveyorsDokument6 SeitenLearning Task 2 Financial Statements of Rosalina Besario SurveyorsNeil Matundan100% (1)

- Theories of AccountingDokument4 SeitenTheories of AccountingShanine BaylonNoch keine Bewertungen

- Recording Transactions in A Financial Transaction WorksheetDokument1 SeiteRecording Transactions in A Financial Transaction WorksheetSHENoch keine Bewertungen

- PostingandTrialBalance Kareen LeonDokument7 SeitenPostingandTrialBalance Kareen LeonMerdwindelle AllagonesNoch keine Bewertungen

- FSDokument44 SeitenFSMaria Beatriz Aban Munda100% (2)

- Chapter 4 - 5 ActivitiesDokument3 SeitenChapter 4 - 5 ActivitiesJane Carla BorromeoNoch keine Bewertungen

- Abm Q4Dokument3 SeitenAbm Q4Brandon Choi100% (1)

- Partnership FormationDokument13 SeitenPartnership FormationPhilip Dan Jayson LarozaNoch keine Bewertungen

- Group 6Dokument8 SeitenGroup 6Parkiee JamsNoch keine Bewertungen

- Activity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeDokument3 SeitenActivity 24. in This Activity You Need To Identify The Adjusting Entry That Can BeTriquesha Marriette Romero RabiNoch keine Bewertungen

- Analyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsDokument6 SeitenAnalyzing, Recording, Posting and Trial Balance: Normal Balance of AccountsMich Binayug100% (1)

- AccountingDokument2 SeitenAccountingrizhmeen45% (11)

- Adjusting Entries 11-23Dokument2 SeitenAdjusting Entries 11-23Allen CarlNoch keine Bewertungen

- Laurente Cleaning Services LedgerDokument3 SeitenLaurente Cleaning Services LedgerAriel PalayNoch keine Bewertungen

- Basic AccountingDokument9 SeitenBasic AccountingAllysa Almazan BoholstNoch keine Bewertungen

- Current Asset Current Asset Contra AssetDokument7 SeitenCurrent Asset Current Asset Contra AssetAlexander QuemadaNoch keine Bewertungen

- It FinalsDokument11 SeitenIt FinalsHea Jennifer AyopNoch keine Bewertungen

- ACCOUNTINGDokument2 SeitenACCOUNTINGantibacterialsoapNoch keine Bewertungen

- Accounting 2Dokument4 SeitenAccounting 2Jocelyn Delacruz50% (2)

- Moises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CRDokument5 SeitenMoises Dondoyano Information Systems Company Trial Balance: Accounts Dr. CR버니 모지코Noch keine Bewertungen

- Lucero - Jose - Rizal - Heavy - Bombers - Statement - of - Cash - FlowsDokument1 SeiteLucero - Jose - Rizal - Heavy - Bombers - Statement - of - Cash - FlowsKemerut100% (1)

- ASP Notes Page 16Dokument2 SeitenASP Notes Page 16Jeizel ConcepcionNoch keine Bewertungen

- Accounting 1 ReviewDokument13 SeitenAccounting 1 ReviewAlyssa Lumbao100% (1)

- Problem-5 - AFCAR Chapter 3Dokument9 SeitenProblem-5 - AFCAR Chapter 3kakao100% (1)

- Jose Rizal Heavy BombersDokument10 SeitenJose Rizal Heavy BombersClaud NineNoch keine Bewertungen

- Worksheet PalaganasDokument38 SeitenWorksheet PalaganasMomo HiraiNoch keine Bewertungen

- Accounting CycleDokument2 SeitenAccounting Cyclewonderer mystery60% (5)

- Module 1 JournalizingDokument6 SeitenModule 1 JournalizingDianne CabilloNoch keine Bewertungen

- ABM+2 Learning+Material+No.+4Dokument3 SeitenABM+2 Learning+Material+No.+4Gelesabeth GarciaNoch keine Bewertungen

- Acctg 1 - PrelimDokument1 SeiteAcctg 1 - PrelimRalph Christer Maderazo80% (5)

- MIDTERM EXAMINATION Non LENSDokument1 SeiteMIDTERM EXAMINATION Non LENSRey ViloriaNoch keine Bewertungen

- Financial Transaction Worksheet, Luca ProblemDokument3 SeitenFinancial Transaction Worksheet, Luca ProblemFeiya LiuNoch keine Bewertungen

- Abigail Santos Boutique, Worksheet and Financial Statement For MerchandisingDokument9 SeitenAbigail Santos Boutique, Worksheet and Financial Statement For MerchandisingFeiya LiuNoch keine Bewertungen

- Learning Task 2 Merchandising TransactionsDokument5 SeitenLearning Task 2 Merchandising TransactionsFeiya LiuNoch keine Bewertungen

- Abigail Santos Boutique, FS ProblemDokument3 SeitenAbigail Santos Boutique, FS ProblemFeiya LiuNoch keine Bewertungen

- Perpetual System, Problem #17Dokument2 SeitenPerpetual System, Problem #17Feiya LiuNoch keine Bewertungen

- Preparing The Reversing Entries, Problem #6Dokument1 SeitePreparing The Reversing Entries, Problem #6Feiya LiuNoch keine Bewertungen

- Adjusting Entries A. Short ProblemsDokument3 SeitenAdjusting Entries A. Short ProblemsFeiya LiuNoch keine Bewertungen

- Financial Transaction Worksheet, Luca ProblemDokument3 SeitenFinancial Transaction Worksheet, Luca ProblemFeiya LiuNoch keine Bewertungen

- Adjusting Entries - Solution Manual LynzelDokument7 SeitenAdjusting Entries - Solution Manual LynzelFeiya LiuNoch keine Bewertungen

- General Journal, GeveraDokument2 SeitenGeneral Journal, GeveraFeiya LiuNoch keine Bewertungen

- Narrative ReportDokument13 SeitenNarrative ReportfranceNoch keine Bewertungen

- Studi Penanganan Hasil Tangkapan Purse Seine Di KM Bina Maju Kota Sibolga Study of Purse Seine Catches Handling in KM Bina Maju Sibolga CityDokument8 SeitenStudi Penanganan Hasil Tangkapan Purse Seine Di KM Bina Maju Kota Sibolga Study of Purse Seine Catches Handling in KM Bina Maju Sibolga CitySavira Tapi-TapiNoch keine Bewertungen

- Term Coalition Has Been Derived From The Latin Word 'Coalitio' Which Means To Grow Up TogetherDokument2 SeitenTerm Coalition Has Been Derived From The Latin Word 'Coalitio' Which Means To Grow Up TogetherShree MishraNoch keine Bewertungen

- s4c Project - Hollie MccorkellDokument7 Seitens4c Project - Hollie Mccorkellapi-662823090Noch keine Bewertungen

- Napoleon Lacroze Von Sanden - Crony Capitalism in ArgentinaDokument1 SeiteNapoleon Lacroze Von Sanden - Crony Capitalism in ArgentinaBoney LacrozeNoch keine Bewertungen

- 2014 Price ListDokument17 Seiten2014 Price ListMartin J.Noch keine Bewertungen

- Signaling Pathways of EndocDokument1 SeiteSignaling Pathways of Endocashleighlong2014Noch keine Bewertungen

- BY DR Muhammad Akram M.C.H.JeddahDokument32 SeitenBY DR Muhammad Akram M.C.H.JeddahMuhammad Akram Qaim KhaniNoch keine Bewertungen

- The Daily Jinx 0 - ENG-3 (1) - 1Dokument3 SeitenThe Daily Jinx 0 - ENG-3 (1) - 1NoxNoch keine Bewertungen

- Thesis For Driving AgeDokument6 SeitenThesis For Driving Agestefanieyangmanchester100% (2)

- RPL201201H251301 EN Brochure 3Dokument11 SeitenRPL201201H251301 EN Brochure 3vitor rodriguesNoch keine Bewertungen

- Tesla, Inc.: Jump To Navigation Jump To Search Tesla Induction Motor AC MotorDokument90 SeitenTesla, Inc.: Jump To Navigation Jump To Search Tesla Induction Motor AC MotorEdi RaduNoch keine Bewertungen

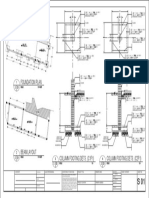

- Foundation Plan: Scale 1:100 MTSDokument1 SeiteFoundation Plan: Scale 1:100 MTSJayson Ayon MendozaNoch keine Bewertungen

- Micro Fibra Sintetica at 06-MapeiDokument2 SeitenMicro Fibra Sintetica at 06-MapeiSergio GonzalezNoch keine Bewertungen

- @PAKET A - TPM BAHASA INGGRIS KuDokument37 Seiten@PAKET A - TPM BAHASA INGGRIS KuRamona DessiatriNoch keine Bewertungen

- Kristen Tillett: ContactDokument2 SeitenKristen Tillett: ContactYtibNoch keine Bewertungen

- Vince - Michael - Intermediate - Language Assive 1Dokument5 SeitenVince - Michael - Intermediate - Language Assive 1Николай КолевNoch keine Bewertungen

- 1040 A Day in The Life of A Veterinary Technician PDFDokument7 Seiten1040 A Day in The Life of A Veterinary Technician PDFSedat KorkmazNoch keine Bewertungen

- Research ProposalDokument14 SeitenResearch ProposalMhal Dane DinglasaNoch keine Bewertungen

- Cambridge Assessment International Education: Information Technology 9626/13 May/June 2019Dokument10 SeitenCambridge Assessment International Education: Information Technology 9626/13 May/June 2019katiaNoch keine Bewertungen

- Chapter 2: Related Theoretical Design Inputs 2.1 Sihwa Lake Tidal Power StationDokument9 SeitenChapter 2: Related Theoretical Design Inputs 2.1 Sihwa Lake Tidal Power Stationaldrin leeNoch keine Bewertungen

- Goa Excise Duty Amendment Rules 2020Dokument5 SeitenGoa Excise Duty Amendment Rules 2020saritadsouzaNoch keine Bewertungen

- Unit 4 Classical and Keynesian Systems: 4.0 ObjectivesDokument28 SeitenUnit 4 Classical and Keynesian Systems: 4.0 ObjectivesHemant KumarNoch keine Bewertungen

- Model Control System in Triforma: Mcs GuideDokument183 SeitenModel Control System in Triforma: Mcs GuideFabio SchiaffinoNoch keine Bewertungen

- Grammar Summary Unit 8Dokument2 SeitenGrammar Summary Unit 8Luana Suarez AcostaNoch keine Bewertungen