Beruflich Dokumente

Kultur Dokumente

Preliminary Assessment Notice

Hochgeladen von

Hanabishi RekkaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Preliminary Assessment Notice

Hochgeladen von

Hanabishi RekkaCopyright:

Verfügbare Formate

REPUBLIC OF THE PHILIPPINES

DEPARTMENT OF FINANCE

BUREAU OF INTERNAL REVENUE

REVENUE REGION NO. 008 - MAKATI

RDO No. 049 - NORTH MAKATI

PRELIMINARY ASSESSMENT NOTICE

November 27, 2017

PRESIDENT

BOTTLEZONE CORPORATION

#3029, MAYON STREET, OLYMPIA, CITY OF

MAKATI 1207

TIN: 006-814-922-00000

Sir/Madam:

Please be informed that after investigation there has been found due from you deficiency

Improperly Accumulated Earnings Tax, Documentary Stamp Tax, Value Added Tax for taxable period from

January 01, 2016 to December 31, 2016 as shown hereunder:

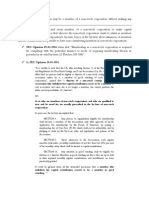

I. IMPROPERLY ACCUMULATED EARNINGS TAX

Assessment No. P-LA012144-IAET-049-2016-11-17-0000051083

Taxable Income P 4,108,763.00

Add: a) Income subjected to final tax P 0.00

b) NOLCO 0.00

c) Income exempt from tax 0.00

d) Income excluded from gross

income 0.00 0.00

Total P 4,108,763.00

Less: Income Tax Paid P 24,999.90

Dividends Declared / Paid 0.00 24,999.90

Net Amount P 4,083,763.10

Add: Retained earnings from prior years 9,778,463.00

Total Accumulated Earnings as of taxable

period ending (12/31/2016) P 13,862,226.10

(Less): Amount that may be retained

8,062,500.00

Improperly Accumulated Taxable Income

(IATI) P 5,799,726.10

Tax Rate (Section 29 of NIRC) 10%

Improperly Accumulated Earnings Tax

(IAET) P 579,972.61

Add: Surcharge P 144,993.15

*20% Interest per annum from 01/11/2017

to 11/15/2017 97,880.31

Compromise Penalty 0.00 242,873.46

*Total Deficiency Improperly Accumulated

Earnings Tax Due P 822,846.07

II. DEFICIENCY DOCUMENTARY STAMP

PRELIMINARY ASSESSMENT NOTICE Page 1 of 3

AUDM35/012144/2017

Assessment No. P-LA012144-DS-049-2016-11-17-0000051084

Tax Due (Per Audit) P 40,000.00

Add / (Less) : Discrepancies / Adjustments

0.00

Tax Due (Per Audit) P 40,000.00

Less: Allowable tax credits /payments

Tax Paid Per Return P 0.00

Add/(Less): Tax Payment Adjustment 0.00 0.00

Deficiency Documentary Stamp Tax Due /

(Overpayment) 40,000.00

Add: Surcharge P 10,000.00

*20% Interest per annum from

01/05/2017 to 11/15/2017 6,882.19

Compromise Penalty 0.00 16,882.19

*TOTAL Documentary Stamp Tax Due 56,882.19

III. DEFICIENCY VALUE-ADDED TAX

Assessment No. P-LA012144-VT-049-2016-11-17-0000051085

Taxable Sales / Receipts(Per Return) P 130,869,470.24

Add / (Less) : Adjustments

2,812,751.76

Taxable Sales / Receipts (Per Audit) P 133,682,222.00

Output Tax 16,041,866.64

Less: Input Tax 15,597,641.67

VAT Due(Overpayment/Tax Credit Refund) 444,224.97

Less: VAT Withheld / Paid (Per Audit) 82,309.76

Deficiency Value-Added Tax Due /

(Overpayment) P 361,915.21

Add: Surcharge P 0.00

*20% Interest per annum from 01/26/2017

to 11/15/2017 58,104.74

Compromise Penalty 0.00 58,104.74

*TOTAL VAT Due 420,019.95

TOTAL AMOUNT DUE AND PAYABLE P 1,299,748.21

* Please note that the interest and the total amount due will have to be adjusted if paid beyond November

15, 2017.

PRELIMINARY ASSESSMENT NOTICE Page 2 of 3

AUDM35/012144/2017

The complete details of the factual and legal basis covering the aforementioned discrepancies

established during the investigation of this case and details of Administrative Penalties/Other Taxes, if

applicable, are shown in the accompanying ANNEX "A" of this letter.

The surcharge, if applicable, has been imposed pursuant to the provisions of section 248 of the

Tax Code of 1997, as amended.

The 20% interest per annum has been imposed pursuant to the provisions of Section 249(B) of the

Tax Code of 1997.

The compromise penalty, if applicable, has been imposed pursuant to RMO No. 7-2015.

Pursuant to the provisions of Section 228 of the National Internal Revenue Code of 1997 and its

implementing Revenue Regulations, you are hereby given fifteen (15) days from receipt hereof to pay the

aforesaid deficiency Improperly Accumulated Earnings Tax, Documentary Stamp Tax, Value Added Tax. If

we fail to hear from you within the said period, a formal letter of demand and assessment notice shall be

issued by this Office calling for payment of your aforesaid deficiency tax/es, inclusive of the

aforementioned civil penalty and interest.

We hope that you will give this matter your preferential attention.

Very truly yours,

CAESAR R. DULAY

COMMISSIONER OF INTERNAL REVENUE

BY:

GLEN A. GERALDINO

REGIONAL DIRECTOR

PRELIMINARY ASSESSMENT NOTICE Page 3 of 3

AUDM35/012144/2017

Das könnte Ihnen auch gefallen

- Chapter 3 Fringe & de Minimis BenefitsDokument6 SeitenChapter 3 Fringe & de Minimis BenefitsNovelyn Hiso-anNoch keine Bewertungen

- Flowchart of Remedies (NIRC)Dokument3 SeitenFlowchart of Remedies (NIRC)Lorelyn FNoch keine Bewertungen

- Sales Q ADokument109 SeitenSales Q APatatas SayoteNoch keine Bewertungen

- Articles of Incorporation-Stock CorpDokument5 SeitenArticles of Incorporation-Stock CorpJavier EspinolaNoch keine Bewertungen

- Cta 3D CV 08694 A 2018jun28 AssDokument25 SeitenCta 3D CV 08694 A 2018jun28 AssLady Paul SyNoch keine Bewertungen

- Plaintiff,: Municipal Trial CourtDokument5 SeitenPlaintiff,: Municipal Trial CourtDominic EmbodoNoch keine Bewertungen

- Preliminary Assessment Notice and Final Assessment NoticeDokument5 SeitenPreliminary Assessment Notice and Final Assessment NoticeGuiltyCrown0% (1)

- Q: What Is The Difference Between These Administrative and Judicial Remedies?Dokument11 SeitenQ: What Is The Difference Between These Administrative and Judicial Remedies?Kharen ValdezNoch keine Bewertungen

- Javier BookDokument594 SeitenJavier BookNoreen T� ClaroNoch keine Bewertungen

- Board Resolution-Commonwealth Rural Bank (Gangan)Dokument6 SeitenBoard Resolution-Commonwealth Rural Bank (Gangan)Gaspar ascoNoch keine Bewertungen

- 2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Dokument2 Seiten2004 BIR - Ruling - DA 320 04 - 20180419 1159 Ho7dm4Yya Ladignon100% (2)

- Prulink Withdrawal Form: Individual PolicyownerDokument3 SeitenPrulink Withdrawal Form: Individual PolicyownerMichelle NavaNoch keine Bewertungen

- Revised BP Form 202 - InstructionsDokument5 SeitenRevised BP Form 202 - InstructionsEmelyn Ventura SantosNoch keine Bewertungen

- AuthorizationDokument74 SeitenAuthorizationGeneva50% (2)

- Affidavit of Loss - JASPER JOHN A. VELOSODokument1 SeiteAffidavit of Loss - JASPER JOHN A. VELOSOAnjo AlbaNoch keine Bewertungen

- Labor Arbiter: Interplay of The Labor Agencies in Cases of Strikes & LockoutsDokument31 SeitenLabor Arbiter: Interplay of The Labor Agencies in Cases of Strikes & LockoutsLe Obm Sizzling100% (1)

- Dlsu v. Dlsu Empl Assoc., G.R. No. 109002. April 12, 2000Dokument8 SeitenDlsu v. Dlsu Empl Assoc., G.R. No. 109002. April 12, 2000EuniceD.PiladorNoch keine Bewertungen

- Cases and Case Digest in Remedial Law Review 2Dokument259 SeitenCases and Case Digest in Remedial Law Review 2Arnnie Gayle Santos100% (1)

- Recommendation Letter 3Dokument1 SeiteRecommendation Letter 3Rnm ZltaNoch keine Bewertungen

- Lecture-Npos in The PhilippinesDokument14 SeitenLecture-Npos in The PhilippinesAngela PaduaNoch keine Bewertungen

- Part 2 Political Law Reviewer by Atty SandovalDokument67 SeitenPart 2 Political Law Reviewer by Atty SandovalHazel Toledo MartinezNoch keine Bewertungen

- CONFLICTSDokument7 SeitenCONFLICTSIrish PrecionNoch keine Bewertungen

- How Insurance Law Developed in the PhilippinesDokument41 SeitenHow Insurance Law Developed in the PhilippinesAndrea NaquimenNoch keine Bewertungen

- AM No 00-8-10-SC - Rehab RulesDokument20 SeitenAM No 00-8-10-SC - Rehab RulesJacinto Jr JameroNoch keine Bewertungen

- To Tax Church PropertyDokument2 SeitenTo Tax Church PropertyKino MarinayNoch keine Bewertungen

- FINAL PPT FPIC PROCESS Orientation On Processing of CP Applic For Govt ProjectsDokument23 SeitenFINAL PPT FPIC PROCESS Orientation On Processing of CP Applic For Govt Projectsangelita dapigNoch keine Bewertungen

- Galindo Vs COA PDFDokument26 SeitenGalindo Vs COA PDFAnjNoch keine Bewertungen

- Certification Under OathDokument1 SeiteCertification Under OathAdrian AribatoNoch keine Bewertungen

- 2023 Bar Com SyllabusDokument11 Seiten2023 Bar Com SyllabusElieann Mae QuinajonNoch keine Bewertungen

- Formal Invitation LetterDokument1 SeiteFormal Invitation LetterTriyono SoepardiNoch keine Bewertungen

- Fremier Resto Partnership AgreementDokument5 SeitenFremier Resto Partnership AgreementHannah Mae BernardoNoch keine Bewertungen

- Deed of Absolute Sal2Dokument3 SeitenDeed of Absolute Sal2Joseph Rosales Dela CruzNoch keine Bewertungen

- Psa Form For MarriageDokument2 SeitenPsa Form For MarriageJay Mark Albis SantosNoch keine Bewertungen

- Chapter 6.0 Taxation Under Local GovtDokument7 SeitenChapter 6.0 Taxation Under Local GovtDerick Ocampo FulgencioNoch keine Bewertungen

- Requirements For Cpa AccreditationDokument1 SeiteRequirements For Cpa AccreditationJ'ca EdulanNoch keine Bewertungen

- SPECIAL POWER OF ATTORNEY - RACHEL SALOME DOMINGO and EDDIE VER PDFDokument2 SeitenSPECIAL POWER OF ATTORNEY - RACHEL SALOME DOMINGO and EDDIE VER PDFPaulo BrionesNoch keine Bewertungen

- Preliminary Report: Making AI Systems Accountable Through A Transparent, Grassroots-Based Consultation ProcessDokument49 SeitenPreliminary Report: Making AI Systems Accountable Through A Transparent, Grassroots-Based Consultation ProcessRapplerNoch keine Bewertungen

- 2017 Bar Exams Taxation LawDokument15 Seiten2017 Bar Exams Taxation Lawrobertpeter_aNoch keine Bewertungen

- Administrative Law Case DoctrinesDokument25 SeitenAdministrative Law Case DoctrinesJhon NiloNoch keine Bewertungen

- Audited FS NVC 2017Dokument23 SeitenAudited FS NVC 2017NVC Foundation100% (1)

- Academic Freedom of Universities to Admit or Reject StudentsDokument13 SeitenAcademic Freedom of Universities to Admit or Reject StudentsNichole LusticaNoch keine Bewertungen

- HRep SALN Form SummaryDokument3 SeitenHRep SALN Form SummaryImelda BenosaNoch keine Bewertungen

- Iloilo City Regulation Ordinance 2013-319Dokument3 SeitenIloilo City Regulation Ordinance 2013-319Iloilo City CouncilNoch keine Bewertungen

- Petition For Notarial CommissionDokument5 SeitenPetition For Notarial CommissiontetdilleraNoch keine Bewertungen

- Legal Forms OutlineDokument4 SeitenLegal Forms OutlineRonic TreptorNoch keine Bewertungen

- Revenue Regulations No 3-98Dokument9 SeitenRevenue Regulations No 3-98Anonymous MikI28PkJcNoch keine Bewertungen

- Affidavit of Supplemental ReportDokument1 SeiteAffidavit of Supplemental ReportBikoy EstoqueNoch keine Bewertungen

- Assocation of Water Districts Bylaws-AmendedDokument15 SeitenAssocation of Water Districts Bylaws-AmendedLeyCodes LeyCodesNoch keine Bewertungen

- Notice of Appearance of CounselDokument2 SeitenNotice of Appearance of CounselBayani AtupNoch keine Bewertungen

- Minutes of The Special Meeting of The Board of Directors - Election of Statutory Executive OfficersDokument2 SeitenMinutes of The Special Meeting of The Board of Directors - Election of Statutory Executive OfficersKlabin_RINoch keine Bewertungen

- 2019 Amendments To The Rules of CourtDokument70 Seiten2019 Amendments To The Rules of CourtDesiree Tejano-OquiñoNoch keine Bewertungen

- Whether members need contribute to join a non-stock corporationDokument2 SeitenWhether members need contribute to join a non-stock corporationVenus AmbronaNoch keine Bewertungen

- Jacob vs. CA - 224 S 189Dokument2 SeitenJacob vs. CA - 224 S 189Zesyl Avigail FranciscoNoch keine Bewertungen

- CPDD-ACC-01-A Application Form As Local CPD Provider 2020Dokument2 SeitenCPDD-ACC-01-A Application Form As Local CPD Provider 2020Elie DGNoch keine Bewertungen

- Partnership Rescission CaseDokument17 SeitenPartnership Rescission CaseluckyNoch keine Bewertungen

- 1702 NewDokument11 Seiten1702 NewDIVINE WAGTINGANNoch keine Bewertungen

- Ra 9337Dokument23 SeitenRa 9337cheska_abigail950Noch keine Bewertungen

- Preliminary Assessment NoticeDokument3 SeitenPreliminary Assessment NoticeHanabishi RekkaNoch keine Bewertungen

- Dizon Lands Realty and Development Corporation - 2.17.2022Dokument6 SeitenDizon Lands Realty and Development Corporation - 2.17.2022Kervin GalangNoch keine Bewertungen

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDokument3 SeitenFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNoch keine Bewertungen

- Cityland Late FillingDokument29 SeitenCityland Late FillingHanabishi RekkaNoch keine Bewertungen

- Additional Reading List For Agrarian Reform LawDokument7 SeitenAdditional Reading List For Agrarian Reform LawLynne AgapitoNoch keine Bewertungen

- General Contractor Offers Completion of Gymnasium ProjectDokument1 SeiteGeneral Contractor Offers Completion of Gymnasium ProjectHanabishi RekkaNoch keine Bewertungen

- Destruction FormDokument2 SeitenDestruction FormHanabishi RekkaNoch keine Bewertungen

- REMINDER LETTER Late Filing of Vat ReturnDokument2 SeitenREMINDER LETTER Late Filing of Vat ReturnHanabishi Rekka100% (1)

- 209 - Suggested Answers in Civil Law Bar Exams (1990-2006)Dokument124 Seiten209 - Suggested Answers in Civil Law Bar Exams (1990-2006)ben_ten_1389% (19)

- R 2 B 2Dokument1 SeiteR 2 B 2Hanabishi RekkaNoch keine Bewertungen

- 49 PAID 2016Dokument12 Seiten49 PAID 2016Hanabishi RekkaNoch keine Bewertungen

- Labor Law IntroductionDokument152 SeitenLabor Law IntroductionCharnette Cao-wat LemmaoNoch keine Bewertungen

- Bottle Cap Labels by ElaineDokument1 SeiteBottle Cap Labels by ElaineHanabishi RekkaNoch keine Bewertungen

- Cta 2D Ac 00159 M 2017feb23 OthDokument5 SeitenCta 2D Ac 00159 M 2017feb23 OthHanabishi RekkaNoch keine Bewertungen

- Sub Contract Agreement TabukDokument7 SeitenSub Contract Agreement TabukHanabishi RekkaNoch keine Bewertungen

- Revised Construction Safety Guidelines During COVID-19Dokument12 SeitenRevised Construction Safety Guidelines During COVID-19Katherine EvangelistaNoch keine Bewertungen

- PDF Possession Case DigestsDokument20 SeitenPDF Possession Case DigestsHanabishi RekkaNoch keine Bewertungen

- Bid Disqualification LetterDokument1 SeiteBid Disqualification LetterHanabishi RekkaNoch keine Bewertungen

- Law On Sales Final Exam First Sem 2020Dokument2 SeitenLaw On Sales Final Exam First Sem 2020Hanabishi RekkaNoch keine Bewertungen

- RBR Builders & Ready Mix Concrete: Cell # 09228390603 / TELEFAX (044) 940-4005Dokument1 SeiteRBR Builders & Ready Mix Concrete: Cell # 09228390603 / TELEFAX (044) 940-4005Hanabishi RekkaNoch keine Bewertungen

- Land reform laws in the PhilippinesDokument1 SeiteLand reform laws in the PhilippinesHanabishi RekkaNoch keine Bewertungen

- Income Payee'S Sworn Declaration of Gross Receipts/SalesDokument2 SeitenIncome Payee'S Sworn Declaration of Gross Receipts/SalesHanabishi RekkaNoch keine Bewertungen

- Payment Assessment FormDokument1 SeitePayment Assessment FormHanabishi RekkaNoch keine Bewertungen

- Undertaking Eyiv966810748308 PDFDokument5 SeitenUndertaking Eyiv966810748308 PDFMmrahc EetlevsNoch keine Bewertungen

- RDO_C TP PSIC ReportDokument13 SeitenRDO_C TP PSIC ReportHanabishi RekkaNoch keine Bewertungen

- EDITABLE Sample Bid Forms (BCDA)Dokument12 SeitenEDITABLE Sample Bid Forms (BCDA)CECANoch keine Bewertungen

- Labor Code AssignmentDokument1 SeiteLabor Code AssignmentHanabishi RekkaNoch keine Bewertungen

- Constitutional Law 1 - Assignment For September 12, 2020 (John Wesley School of Law & Governance, 1St Semester, Ay 2020-2021Dokument3 SeitenConstitutional Law 1 - Assignment For September 12, 2020 (John Wesley School of Law & Governance, 1St Semester, Ay 2020-2021Hanabishi RekkaNoch keine Bewertungen

- Week 3Dokument1 SeiteWeek 3Hanabishi RekkaNoch keine Bewertungen

- John Louie Esguerra Constitutional Law I Midterm (October 31, 2020)Dokument2 SeitenJohn Louie Esguerra Constitutional Law I Midterm (October 31, 2020)Hanabishi RekkaNoch keine Bewertungen

- LAW ON SALES MIDTERM EXAMDokument2 SeitenLAW ON SALES MIDTERM EXAMHanabishi Rekka100% (1)

- LAW ON SALES MIDTERM EXAMDokument2 SeitenLAW ON SALES MIDTERM EXAMHanabishi Rekka100% (1)

- RLF-Profile-Estate-Planning-Talk SalesDokument1 SeiteRLF-Profile-Estate-Planning-Talk SalesHanabishi RekkaNoch keine Bewertungen

- Recorte Apis 1Dokument35 SeitenRecorte Apis 1ENZO SEBASTIAN GARCIA ANDRADENoch keine Bewertungen

- In Re Sycip, 92 SCRA 1 (1979)Dokument3 SeitenIn Re Sycip, 92 SCRA 1 (1979)Edgar Joshua Timbang100% (4)

- For Session DTD 5th Sep by CA Alok Garg PDFDokument46 SeitenFor Session DTD 5th Sep by CA Alok Garg PDFLakshmi Narayana Murthy KapavarapuNoch keine Bewertungen

- IC33 - 8 Practice TestsDokument128 SeitenIC33 - 8 Practice TestskujtyNoch keine Bewertungen

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokument4 SeitenStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceSiraj PNoch keine Bewertungen

- Pathalgadi Movement and Adivasi RightsDokument5 SeitenPathalgadi Movement and Adivasi RightsDiXit JainNoch keine Bewertungen

- Columbia Aaltius: Columbia Developers Private LimitedDokument4 SeitenColumbia Aaltius: Columbia Developers Private LimitedRishav GoyalNoch keine Bewertungen

- Compassion and Choices Fall 2015Dokument27 SeitenCompassion and Choices Fall 2015Kathleen JaneschekNoch keine Bewertungen

- UntitledDokument3 SeitenUntitledSarah Jane UsopNoch keine Bewertungen

- Dizon vs. CA - GR No. 101929 - Case DigestDokument2 SeitenDizon vs. CA - GR No. 101929 - Case DigestAbigail Tolabing100% (1)

- Cma End Game NotesDokument75 SeitenCma End Game NotesManish BabuNoch keine Bewertungen

- Petron vs Calesa and OthersDokument9 SeitenPetron vs Calesa and Othersedawrd aroncianoNoch keine Bewertungen

- Spec Pro Case DoctrinesDokument4 SeitenSpec Pro Case DoctrinesRalph Christian UsonNoch keine Bewertungen

- Guide To Plan Management PDFDokument20 SeitenGuide To Plan Management PDFArrigo Lupori100% (1)

- Supreme Court Power to Order Change of VenueDokument1 SeiteSupreme Court Power to Order Change of VenueKathleneGabrielAzasHaoNoch keine Bewertungen

- B.E., B.S., B.Ed. (H), DPT, BA/LL.B (Test Based) B.E., B.S., B.Ed. (H), DPT, BA/LL.B (Test Based) B.E., B.S., B.Ed. (H), DPT, BA/LL.B (Test Based)Dokument1 SeiteB.E., B.S., B.Ed. (H), DPT, BA/LL.B (Test Based) B.E., B.S., B.Ed. (H), DPT, BA/LL.B (Test Based) B.E., B.S., B.Ed. (H), DPT, BA/LL.B (Test Based)Anas ArifNoch keine Bewertungen

- Case StudyDokument15 SeitenCase Studysonam shrivasNoch keine Bewertungen

- HSG University of St. Gallen MBA Program Employment ReportDokument6 SeitenHSG University of St. Gallen MBA Program Employment ReportSam SinhatalNoch keine Bewertungen

- NdpsDokument22 SeitenNdpsRaviKumar VeluriNoch keine Bewertungen

- Deed of Donation for Farm to Market Road ROWDokument2 SeitenDeed of Donation for Farm to Market Road ROWAntonio Del Rosario100% (1)

- Management of Financial Services (MB 924)Dokument14 SeitenManagement of Financial Services (MB 924)anilkanwar111Noch keine Bewertungen

- Procedure For Registration (Copyright) - 0Dokument10 SeitenProcedure For Registration (Copyright) - 0Meekal ANoch keine Bewertungen

- Hindu Law Alienation of Coparcenary PropertyDokument6 SeitenHindu Law Alienation of Coparcenary PropertyUdhithaa S K KotaNoch keine Bewertungen

- 10th Henry Dunant Regional Moot Memorial RulesDokument13 Seiten10th Henry Dunant Regional Moot Memorial RulesRajat DuttaNoch keine Bewertungen

- Chemicals CheckpointDokument9 SeitenChemicals Checkpointali tayyibNoch keine Bewertungen

- Mindanao Mission Academy: Business FinanceDokument3 SeitenMindanao Mission Academy: Business FinanceHLeigh Nietes-GabutanNoch keine Bewertungen

- Grievance Machinery ReportDokument16 SeitenGrievance Machinery ReportRoseMantuparNoch keine Bewertungen

- Legal Profession Cases CompilationDokument13 SeitenLegal Profession Cases CompilationManuelMarasiganMismanosNoch keine Bewertungen

- Supreme Court of India Yearly Digest 2015 (692 Judgments) - Indian Law DatabaseDokument15 SeitenSupreme Court of India Yearly Digest 2015 (692 Judgments) - Indian Law DatabaseAnushree KapadiaNoch keine Bewertungen