Beruflich Dokumente

Kultur Dokumente

Canque V CA, 305 SCRA

Hochgeladen von

gongsilogOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Canque V CA, 305 SCRA

Hochgeladen von

gongsilogCopyright:

Verfügbare Formate

LAGUTAN, KENKEN Q.

2017-0060

CANQUE v CA

305 SCRA

FACTS:

Rosella D. Canque is a contractor doing business under the name and style RDC Construction. She

had contracts with the government. Canque entered into two contracts with Socor Construction

Corporation. Socor sent a bill representing the balance of Canque for materials delivered and

services rendered by Socor under the two contracts. But, Canque refused to pay, claiming that

private respondent failed to submit the delivery receipts showing the actual weight of the items

delivered and the acceptance by the government.

Because of this, Socor brought a suit in the RTC to recover from the Canque. During the trial, Socor

presented Dolores Aday, its bookkeeper to testify on the entries of their Book of Collectible

Accounts. RTC rendered a decision in favor of Socor. Canque however, argues that the entries in

Socor's Book of Collectible Accounts cannot take the place of the delivery receipts and that such

entries are mere hearsay and, thus, inadmissible.

ISSUE:

Whether the entries in the Book of Collectible Accounts constitute competent evidence?

HELD:

No. The admission in evidence of entries in corporate books requires the satisfaction of the

following conditions:

1. The person who made the entry must be dead, outside the country or unable to testify;

2. The entries were made at or near the time of the transactions to which they refer;

3. The entrant was in a position to know the facts stated in the entries;

4. The entries were made in his professional capacity or in the performance of a duty, whether legal,

contractual, moral or religious; and

5. The entries were made in the ordinary or regular course of business or duty.

First, Dolores Aday, who made the entries, was presented by private respondent to testify on the

account. There was, therefore, neither justification nor necessity for the presentation of the entries

as the person who made them was available to testify in court. Moreover, Aday admitted that she

had no personal knowledge of the facts constituting the entry. She said she made the entries based

on the bills given to her. But she has no knowledge of the truth or falsity of the facts stated in the

bills.

Second, under the provision (Rule 132, 10), the memorandum used to refresh the memory of the

witness does not constitute evidence, and may not be admitted as such, for the simple reason that

the witness has just the same to testify on the basis of refreshed memory. In other words, where the

witness has testified independently of or after his testimony has been refreshed by a memorandum

of the events in dispute, such memorandum is not admissible as corroborative evidence. It is self-

evident that a witness may not be corroborated by any written statement prepared wholly by him.

However, the entries recorded under the exhibit were supported by Socor's Billings under the

account of RDC Construction. These billings were presented and duly received by the authorized

representatives. The circumstances obtaining in the case at bar clearly show that for a long period

of time after receipt thereof, RDC never manifested its dissatisfaction or objection to the aforestated

billings submitted by plaintiff. Neither did defendant immediately protest to plaintiff’s alleged

incomplete or irregular performance.

Das könnte Ihnen auch gefallen

- Legal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemVon EverandLegal Words You Should Know: Over 1,000 Essential Terms to Understand Contracts, Wills, and the Legal SystemBewertung: 4 von 5 Sternen4/5 (16)

- MORTEL - Canque V CADokument2 SeitenMORTEL - Canque V CAJefferson MortelNoch keine Bewertungen

- 294 - Canque v. CADokument4 Seiten294 - Canque v. CAIhna Alyssa Marie SantosNoch keine Bewertungen

- Canque Vs CADokument3 SeitenCanque Vs CANap GonzalesNoch keine Bewertungen

- CANQUE v. CA and SOCOR CONSTRUCTIONDokument4 SeitenCANQUE v. CA and SOCOR CONSTRUCTIONChimney sweepNoch keine Bewertungen

- 2016-0463 - Canque V CADokument3 Seiten2016-0463 - Canque V CAIshmael AbrahamNoch keine Bewertungen

- Canque VDokument1 SeiteCanque VMayr TeruelNoch keine Bewertungen

- E4 - 2 Canque v. CADokument4 SeitenE4 - 2 Canque v. CAAaron AristonNoch keine Bewertungen

- E4 - 2 Canque v. CADokument4 SeitenE4 - 2 Canque v. CAAaron AristonNoch keine Bewertungen

- 461 Metrobank v. Ley Construction and Development Corp. - DIGESTDokument4 Seiten461 Metrobank v. Ley Construction and Development Corp. - DIGESTCarlo FernandezNoch keine Bewertungen

- C5 Victoria B. Collado vs. Dr. Eduardo M. Dela VegaDokument4 SeitenC5 Victoria B. Collado vs. Dr. Eduardo M. Dela VegaJANE MARIE DOROMALNoch keine Bewertungen

- Kalilid Wood Industries Corp Vs IACDokument2 SeitenKalilid Wood Industries Corp Vs IACana ortizNoch keine Bewertungen

- Collado Vs Dela VegaDokument6 SeitenCollado Vs Dela VegaEden RachoNoch keine Bewertungen

- Philamgen v. Sweet Lines shipping disputeDokument3 SeitenPhilamgen v. Sweet Lines shipping disputejudith_marie1012Noch keine Bewertungen

- Sets 4 and 5Dokument141 SeitenSets 4 and 5Ken ArnozaNoch keine Bewertungen

- Colinares & Veloso vs. CA (Edited)Dokument3 SeitenColinares & Veloso vs. CA (Edited)Ton RiveraNoch keine Bewertungen

- Evidence Digests Part 5Dokument59 SeitenEvidence Digests Part 5Ahmad Arip50% (2)

- Permanent Savings Vs VelardeDokument5 SeitenPermanent Savings Vs VelardeUE LawNoch keine Bewertungen

- Canque V CADokument10 SeitenCanque V CAJovita Andelescia MagasoNoch keine Bewertungen

- Rafael Arsenio Dizon vs. CTA & CIR (Digest)Dokument2 SeitenRafael Arsenio Dizon vs. CTA & CIR (Digest)madzarellaNoch keine Bewertungen

- Barnachea v. QuiochoDokument2 SeitenBarnachea v. QuiochoAce DiamondNoch keine Bewertungen

- Civpro Case Digest PrefiDokument17 SeitenCivpro Case Digest PrefiNic NalpenNoch keine Bewertungen

- 04 Reyes v. Century Canning Corporation. G.R. No. 165377. February 16, 2010.Dokument9 Seiten04 Reyes v. Century Canning Corporation. G.R. No. 165377. February 16, 2010.Sonia PortugaleteNoch keine Bewertungen

- May 8 Digests (#13 (I-Iii) )Dokument3 SeitenMay 8 Digests (#13 (I-Iii) )SMMNoch keine Bewertungen

- United States v. Worack, 10th Cir. (2011)Dokument7 SeitenUnited States v. Worack, 10th Cir. (2011)Scribd Government DocsNoch keine Bewertungen

- Nego Case DigestDokument16 SeitenNego Case DigestFatimaNoch keine Bewertungen

- Calderon Vs IACDokument2 SeitenCalderon Vs IACArnold Villena De CastroNoch keine Bewertungen

- Iris Rodriguez v. Your Own Home Development Corporation (YohdcDokument3 SeitenIris Rodriguez v. Your Own Home Development Corporation (YohdcJahzeel GallentesNoch keine Bewertungen

- Negotiable Instrument (Discharge of Instrument)Dokument15 SeitenNegotiable Instrument (Discharge of Instrument)Sara Andrea Santiago100% (1)

- Remedial Law CasesDokument13 SeitenRemedial Law CasesIrish LlarenasNoch keine Bewertungen

- DBP vs Prudential Bank: Ruling on Validity of Trust Receipts and MortgagesDokument3 SeitenDBP vs Prudential Bank: Ruling on Validity of Trust Receipts and MortgagesylessinNoch keine Bewertungen

- REPUBLIC vs. CAGUIOAG.R. No. 187488 January 9, 2017Dokument4 SeitenREPUBLIC vs. CAGUIOAG.R. No. 187488 January 9, 2017Gabriel Antonio ZuluetaNoch keine Bewertungen

- 2019 Ko - v. - Uy LampasaDokument9 Seiten2019 Ko - v. - Uy LampasalexscribisNoch keine Bewertungen

- SALES Cases (Digest)Dokument48 SeitenSALES Cases (Digest)Vittorio Ignatius RaagasNoch keine Bewertungen

- CA Erred in Ruling Indigent Litigants Exempt from Fee PaymentDokument46 SeitenCA Erred in Ruling Indigent Litigants Exempt from Fee Paymentjacq17Noch keine Bewertungen

- Dizon Vs CTA DigestDokument4 SeitenDizon Vs CTA DigestSanjay FigueroaNoch keine Bewertungen

- Star Two vs Howard KoDokument2 SeitenStar Two vs Howard KoAirisa MolaerNoch keine Bewertungen

- In Re Reeve 396 SC 230 721 SE2d 775 SC 2011Dokument4 SeitenIn Re Reeve 396 SC 230 721 SE2d 775 SC 2011JonahNoch keine Bewertungen

- 114759-2001-Lagon v. Hooven Comalco Industries Inc.Dokument17 Seiten114759-2001-Lagon v. Hooven Comalco Industries Inc.Pia SottoNoch keine Bewertungen

- NIL Complitation of Case DigestsDokument50 SeitenNIL Complitation of Case DigestsGalilee Paraiso Patdu100% (1)

- Star Two V KoDokument2 SeitenStar Two V KoAngelo TiglaoNoch keine Bewertungen

- Security Bank and Trust Co V Gan, G.R. No. 150464, June 27, 2006Dokument8 SeitenSecurity Bank and Trust Co V Gan, G.R. No. 150464, June 27, 2006KinitDelfinCelestialNoch keine Bewertungen

- Mitra V PP and Tarcelo FactsDokument4 SeitenMitra V PP and Tarcelo FactsBenn DegusmanNoch keine Bewertungen

- Karen - Case Digest EvidenceDokument11 SeitenKaren - Case Digest EvidenceAljeane TorresNoch keine Bewertungen

- Landbank VS PerezDokument1 SeiteLandbank VS PerezReggie LlantoNoch keine Bewertungen

- Demurrer To EvidenceDokument17 SeitenDemurrer To EvidenceEgg EggNoch keine Bewertungen

- Case DigestDokument27 SeitenCase DigestJulhan GubatNoch keine Bewertungen

- Trust Receipts 1-14Dokument29 SeitenTrust Receipts 1-14Angelo LopezNoch keine Bewertungen

- Rolando T. Ko, Complainant, vs. Atty. Alma Uy-Lampasa, RespondentDokument8 SeitenRolando T. Ko, Complainant, vs. Atty. Alma Uy-Lampasa, RespondentJarvin David ResusNoch keine Bewertungen

- Constitutional Law Case Digests on Estafa and Land UseDokument11 SeitenConstitutional Law Case Digests on Estafa and Land UseSultan Kudarat State UniversityNoch keine Bewertungen

- Bersamin Case DigestsDokument25 SeitenBersamin Case Digestsjstin_jstinNoch keine Bewertungen

- Coca Cola Bottlers vs. Sps. SorianoDokument1 SeiteCoca Cola Bottlers vs. Sps. SorianoLeca FontelarNoch keine Bewertungen

- Sabay v. People G.R. No. 192150. October 1, 2014Dokument1 SeiteSabay v. People G.R. No. 192150. October 1, 2014Dana Denisse RicaplazaNoch keine Bewertungen

- Far Eastern V PeopleDokument7 SeitenFar Eastern V PeopleCarla Carmela Villanueva-CruzNoch keine Bewertungen

- Sorreda Digest and FullDokument3 SeitenSorreda Digest and FullRomnick JesalvaNoch keine Bewertungen

- Not PrecedentialDokument10 SeitenNot PrecedentialScribd Government DocsNoch keine Bewertungen

- Coca-Cola Bottlers Phils. Inc. v. SpousesDokument9 SeitenCoca-Cola Bottlers Phils. Inc. v. SpousesChristian Edward CoronadoNoch keine Bewertungen

- SECTION 20 of Rule 132Dokument4 SeitenSECTION 20 of Rule 132Tootsie GuzmaNoch keine Bewertungen

- Article On Criteria For Electing OfficialsDokument2 SeitenArticle On Criteria For Electing OfficialsgongsilogNoch keine Bewertungen

- CommRev Apr 3Dokument11 SeitenCommRev Apr 3gongsilogNoch keine Bewertungen

- Add On: RankwatchDokument20 SeitenAdd On: RankwatchgongsilogNoch keine Bewertungen

- How to create a word cloud presentation in MentimeterDokument5 SeitenHow to create a word cloud presentation in MentimetergongsilogNoch keine Bewertungen

- Comm Rev - Syllabus 2021-2022Dokument2 SeitenComm Rev - Syllabus 2021-2022gongsilogNoch keine Bewertungen

- CIV II For Torts N AGENCY (Ktrl+'s More Than) Q&ADokument29 SeitenCIV II For Torts N AGENCY (Ktrl+'s More Than) Q&AgongsilogNoch keine Bewertungen

- Isabel Portugal V Leonila Portugal-BeltranDokument2 SeitenIsabel Portugal V Leonila Portugal-BeltrangongsilogNoch keine Bewertungen

- Tuna TunaDokument3 SeitenTuna TunagongsilogNoch keine Bewertungen

- Sept 24 Notes Settlement of Estate ReportDokument19 SeitenSept 24 Notes Settlement of Estate ReportgongsilogNoch keine Bewertungen

- Credit Transaction Notes From YTDokument41 SeitenCredit Transaction Notes From YTgongsilogNoch keine Bewertungen

- 5-Romero V CADokument3 Seiten5-Romero V CAgongsilogNoch keine Bewertungen

- Commrev 3 Exams, Prelims, MT, F Final Grade: Average of AmfDokument1 SeiteCommrev 3 Exams, Prelims, MT, F Final Grade: Average of AmfgongsilogNoch keine Bewertungen

- MT Notes Rem2Dokument3 SeitenMT Notes Rem2gongsilogNoch keine Bewertungen

- Civ2 Torts QuizDokument4 SeitenCiv2 Torts QuizgongsilogNoch keine Bewertungen

- Word File of Syllabus Civ Law IIDokument3 SeitenWord File of Syllabus Civ Law IIgongsilogNoch keine Bewertungen

- TRANSPORTATION LAW GUIDEDokument12 SeitenTRANSPORTATION LAW GUIDEgongsilogNoch keine Bewertungen

- Razon Vs TagtiisDokument39 SeitenRazon Vs TagtiisgongsilogNoch keine Bewertungen

- So, in Case of Claim For Insurance, The Insurer Can Ask For Indemnity From ReinsurerDokument8 SeitenSo, in Case of Claim For Insurance, The Insurer Can Ask For Indemnity From ReinsurergongsilogNoch keine Bewertungen

- Philippine Supreme Court Circulars on Guardianship of MinorsDokument6 SeitenPhilippine Supreme Court Circulars on Guardianship of MinorsgongsilogNoch keine Bewertungen

- CivRev 2 NotesDokument14 SeitenCivRev 2 NotesgongsilogNoch keine Bewertungen

- Canlas Vs Napico HomeownersDokument5 SeitenCanlas Vs Napico HomeownersgongsilogNoch keine Bewertungen

- Castillo Vs CruzDokument12 SeitenCastillo Vs CruzgongsilogNoch keine Bewertungen

- Roxas Vs Macapagal-ArroyoDokument37 SeitenRoxas Vs Macapagal-ArroyogongsilogNoch keine Bewertungen

- A.M. No. 03-04-04-SC Custody of Minors & WHC in Relation To ItDokument4 SeitenA.M. No. 03-04-04-SC Custody of Minors & WHC in Relation To ItgongsilogNoch keine Bewertungen

- Notes Oct 4, 11 TortsDokument2 SeitenNotes Oct 4, 11 TortsgongsilogNoch keine Bewertungen

- A. M. No. 08-1-16-SCDokument5 SeitenA. M. No. 08-1-16-SCRenNoch keine Bewertungen

- National Irrigation Adm v. FontanillaDokument2 SeitenNational Irrigation Adm v. FontanillagongsilogNoch keine Bewertungen

- Deed of Sale of Unregistered LandDokument3 SeitenDeed of Sale of Unregistered Landgongsilog100% (1)

- Complaint of Forcible EntryDokument1 SeiteComplaint of Forcible EntrygongsilogNoch keine Bewertungen

- Rex Contact 09271219018 Babes PenaDokument3 SeitenRex Contact 09271219018 Babes PenagongsilogNoch keine Bewertungen

- Activity 5Dokument8 SeitenActivity 5Marielle UyNoch keine Bewertungen

- Evaluasi Pengolahan Dan Mutu Bahan Olah Karet Rakyat (Bokar) Di Tingkat Petani Karet Di Sumatera SelatanDokument10 SeitenEvaluasi Pengolahan Dan Mutu Bahan Olah Karet Rakyat (Bokar) Di Tingkat Petani Karet Di Sumatera SelatanFerly OktriyediNoch keine Bewertungen

- Diamond Water Paradox 180620013018 PDFDokument17 SeitenDiamond Water Paradox 180620013018 PDFNoor KhanNoch keine Bewertungen

- Debit Cards User Guide PDFDokument24 SeitenDebit Cards User Guide PDFMuhammad UmaisNoch keine Bewertungen

- MBA105 - Almario - Parco - Assignment 3Dokument10 SeitenMBA105 - Almario - Parco - Assignment 3nicolaus copernicusNoch keine Bewertungen

- STL Acquires Wendelin Consulting Group, Inc., An Illinois-Based Technology Consulting CompanyDokument3 SeitenSTL Acquires Wendelin Consulting Group, Inc., An Illinois-Based Technology Consulting CompanyPR.comNoch keine Bewertungen

- Appendix F Preparation of Interim Payment Certificates: GeneralDokument4 SeitenAppendix F Preparation of Interim Payment Certificates: GeneralOrebic ViganjNoch keine Bewertungen

- Income From Business & ProfessionDokument32 SeitenIncome From Business & ProfessionauditNoch keine Bewertungen

- THEME 6 Caribbean EconomydocxDokument15 SeitenTHEME 6 Caribbean EconomydocxJacob seraphineNoch keine Bewertungen

- How Corporate Strategy Impacts SalesDokument2 SeitenHow Corporate Strategy Impacts SalesRommel RoxasNoch keine Bewertungen

- Corporate Culture: Getting StartedDokument4 SeitenCorporate Culture: Getting StartedNassima MarchoudNoch keine Bewertungen

- Bank Confirmation FormatDokument4 SeitenBank Confirmation FormatTasdik MahmudNoch keine Bewertungen

- High Flow Technology: Liquid Filtration SolutionsDokument8 SeitenHigh Flow Technology: Liquid Filtration SolutionsHmidaNoch keine Bewertungen

- Trade Shows and ExhibitionsDokument21 SeitenTrade Shows and ExhibitionssangeetaangelNoch keine Bewertungen

- Capstone ProjectDokument62 SeitenCapstone ProjectPoorva GharatNoch keine Bewertungen

- Semir E-Commerce Business Case AnalysisDokument15 SeitenSemir E-Commerce Business Case AnalysisnydiaNoch keine Bewertungen

- Computer Stationary PDFDokument1 SeiteComputer Stationary PDFPrem KumarNoch keine Bewertungen

- BARCELOC - Logistics Services Concepts and DefinitionsDokument19 SeitenBARCELOC - Logistics Services Concepts and DefinitionsHéctor Federico MuñozNoch keine Bewertungen

- Artikel 3 PDFDokument24 SeitenArtikel 3 PDFanrassNoch keine Bewertungen

- Assignment 2Dokument12 SeitenAssignment 2Waqar Ali MustafaiNoch keine Bewertungen

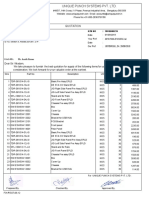

- Unique Punch Systems Pvt. LTD.: QuotationDokument2 SeitenUnique Punch Systems Pvt. LTD.: QuotationMechanical DesignNoch keine Bewertungen

- Negev Company ProfileDokument7 SeitenNegev Company ProfilenegevtatsionNoch keine Bewertungen

- Motion by Design - Complete Motion Graphic GuideDokument27 SeitenMotion by Design - Complete Motion Graphic GuidefalahanajaNoch keine Bewertungen

- CSG PProcgsDokument1 SeiteCSG PProcgsS Sivarao JonnalagaddaNoch keine Bewertungen

- Supreme Court upholds VAT rate hike authorityDokument2 SeitenSupreme Court upholds VAT rate hike authorityKrish CasilanaNoch keine Bewertungen

- Chapter 4 PDFDokument10 SeitenChapter 4 PDFMinh TúNoch keine Bewertungen

- WEEK 2 Reading Materials - SMP - PDFDokument24 SeitenWEEK 2 Reading Materials - SMP - PDFMd Abdullah Al ArmanNoch keine Bewertungen

- Oxford Public School, RanchiDokument7 SeitenOxford Public School, RanchiRishav Singh RajputNoch keine Bewertungen

- B36LNDokument2 SeitenB36LNfarukh azeemNoch keine Bewertungen

- Polytron 5000 Series Ifu 9033902 ItnlDokument190 SeitenPolytron 5000 Series Ifu 9033902 ItnlМаркус ФеликсNoch keine Bewertungen

- Legal Writing in Plain English, Third Edition: A Text with ExercisesVon EverandLegal Writing in Plain English, Third Edition: A Text with ExercisesNoch keine Bewertungen

- Legal Guide for Starting & Running a Small BusinessVon EverandLegal Guide for Starting & Running a Small BusinessBewertung: 4.5 von 5 Sternen4.5/5 (9)

- Dictionary of Legal Terms: Definitions and Explanations for Non-LawyersVon EverandDictionary of Legal Terms: Definitions and Explanations for Non-LawyersBewertung: 5 von 5 Sternen5/5 (2)

- Everybody's Guide to the Law: All The Legal Information You Need in One Comprehensive VolumeVon EverandEverybody's Guide to the Law: All The Legal Information You Need in One Comprehensive VolumeNoch keine Bewertungen

- Essential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsVon EverandEssential Guide to Workplace Investigations, The: A Step-By-Step Guide to Handling Employee Complaints & ProblemsBewertung: 3 von 5 Sternen3/5 (2)

- LLC or Corporation?: Choose the Right Form for Your BusinessVon EverandLLC or Corporation?: Choose the Right Form for Your BusinessBewertung: 3.5 von 5 Sternen3.5/5 (4)

- The Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyVon EverandThe Power of Our Supreme Court: How Supreme Court Cases Shape DemocracyBewertung: 5 von 5 Sternen5/5 (2)

- Legal Research: a QuickStudy Laminated Law ReferenceVon EverandLegal Research: a QuickStudy Laminated Law ReferenceNoch keine Bewertungen

- Torts: QuickStudy Laminated Reference GuideVon EverandTorts: QuickStudy Laminated Reference GuideBewertung: 5 von 5 Sternen5/5 (1)

- Nolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionVon EverandNolo's Deposition Handbook: The Essential Guide for Anyone Facing or Conducting a DepositionBewertung: 5 von 5 Sternen5/5 (1)

- Nolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsVon EverandNolo's Encyclopedia of Everyday Law: Answers to Your Most Frequently Asked Legal QuestionsBewertung: 4 von 5 Sternen4/5 (18)

- Legal Writing in Plain English: A Text with ExercisesVon EverandLegal Writing in Plain English: A Text with ExercisesBewertung: 3 von 5 Sternen3/5 (2)

- Federal Income Tax: a QuickStudy Digital Law ReferenceVon EverandFederal Income Tax: a QuickStudy Digital Law ReferenceNoch keine Bewertungen

- Employment Law: a Quickstudy Digital Law ReferenceVon EverandEmployment Law: a Quickstudy Digital Law ReferenceBewertung: 1 von 5 Sternen1/5 (1)

- So You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolVon EverandSo You Want to be a Lawyer: The Ultimate Guide to Getting into and Succeeding in Law SchoolNoch keine Bewertungen

- Legal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersVon EverandLegal Forms for Starting & Running a Small Business: 65 Essential Agreements, Contracts, Leases & LettersNoch keine Bewertungen

- Nolo's Essential Guide to Buying Your First HomeVon EverandNolo's Essential Guide to Buying Your First HomeBewertung: 4 von 5 Sternen4/5 (43)

- A Student's Guide to Law School: What Counts, What Helps, and What MattersVon EverandA Student's Guide to Law School: What Counts, What Helps, and What MattersBewertung: 5 von 5 Sternen5/5 (4)

- Comprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedVon EverandComprehensive Glossary of Legal Terms, Law Essentials: Essential Legal Terms Defined and AnnotatedNoch keine Bewertungen

- Form Your Own Limited Liability Company: Create An LLC in Any StateVon EverandForm Your Own Limited Liability Company: Create An LLC in Any StateNoch keine Bewertungen

- Stanford Law Review: Vol. 63, Iss. 4 - Apr. 2011Von EverandStanford Law Review: Vol. 63, Iss. 4 - Apr. 2011Noch keine Bewertungen