Beruflich Dokumente

Kultur Dokumente

Notes To Partnership Liquidation Final

Hochgeladen von

Kristel Sumabat0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

41 Ansichten2 SeitenOriginaltitel

Notes to Partnership Liquidation Final

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

41 Ansichten2 SeitenNotes To Partnership Liquidation Final

Hochgeladen von

Kristel SumabatCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 2

Notes to Partnership Liquidation

Partnership Liquidation

1. Conversion of non-cash assets to cash (Sale of NCA)

2. Pay liquidation expenses

3. Pay outside creditors

4. Pay INTEREST of partners

*Before a partner receives his payment, he must absorb Total Gain/Loss:

a. G/L on sale of Realization of Non-cash Assets (Inc: Actual Liquidation Expenses)

b. Maximum Possible Loss (MPL) for installment liquidation

i. Book value of Unrealized Non-cash Assets

ii. Cash withheld for future liquidation expenses & possible

unrecorded liabilities

c. Deficiency

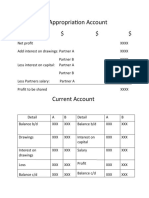

SAFE PAYMENT SCHEDULE

A B C TOTAL

Capital Balances before Liquidation xxx xxx xxx xxx

Add/Less: Loan to/(from) partnership x(x) x(x) x(x) x(x)

Total Interest before Realization xxx xxx xxx xxx

Share in G/L on Realization x(x) x(x) x(x) x(x)

Total

Gain/Loss Share in the MPL(if, installment) (xx) (xx) (xx) (xx)

Total Balance after Realization xxx xxx xxx xxx

Contribution of Partner to cover xx xxx xxx xxx

deficiency(If Solvent)

Absorption of Deficiency(1ST, 2ND, and so on) (xx) (xx) (xx) (xx)

Amount received by each partner xxx xxx xxx xxx

*Total Cash available for the partners

Cash beginning balance xxx

Proceed of realization xxx

Payment of Liquidation Expenses (xx) EQUAL

Payment outside creditors (xx)

Total cash withheld for:

Future liquidation/future expenses (xx)

Unpaid balance of liability (xx)

Total amount available for the Partners xxx

Proceeds from realization of N-cash assets xxx *For Installment liquidation:

Less: Actual Liquidation Expenses (xx) Book value of Unrealized Non-cash Assets xxx

Book value of the asset sold (xx) Cash withheld for future liquidation expenses &

GAIN/(LOSS) ON REALIZATION XX(XX possible unrecorded liabilities xxx

MAXIMUM POSSIBLE LOSS (MPL) XXX

ILLUSTRATION:

The statement of financial position of ABC Co. before the liquidation is as follows:

Cash 40,000 Accounts Payable 60,000

Account Receivable 120,000 Payable B 40,000

Inventory 240,000 A, Capital (20%) 200,000

Equipment 800,000 B, Capital (30%) 300,000

Acc. Depreciation (200,000) C, Capital (50%) 400,000

Total Assets 1,000,000 Total Liabilities & Equity 1,000,000

Case 1: Lump-sum liquidation

Assuming the non-cash assets were realized as follows:

a. Of the total accounts receivable, only 100,000 were collected.

b. The entire inventory was sold for 140,000.

c. The equipment was sold for 500,000.

d. 4,000 liquidation expenses were paid.

Compute for the cash distributions to the partners.

Proceeds from realization of N-cash assets:

Collection on accounts receivable 100,000

Sale of inventory 140,000

Sale of equipment 500,000

Proceeds from Realization 740,000

Actual Liquidation Expenses (4,000)

Carrying amount of non-cash assets sold

(120K + 240K + 600K) (960,000)

Gain/Loss on Realization (224,000)

The final settlement to partners is computed as follows:

A B C TOTAL

Capital Balances before Liquidation 200,000 300,000 400,000 900,000

Add/Less: Loan to/(from) partnership 40,000

Total Interest before Realization 200,000 340,000 400,000 940,000

Share in G/L on Realization (44,800) (67,200) (112,000) (224,000)

Share in the MPL(if, installment) - - - -

Total Balance after Realization 155,200 272,800 288,000 716,000

Contribution of Partner to cover Deficiency(If Solvent) - - - -

Absorption of Deficiency(1ST, 2ND, and so on) - - - -

Amount received by each partner 155,200 272,800 288,000 716,000

Total Cash available for the partners

Cash beginning balance 40,000

Proceed of realization 740,000

Payment of Liquidation Expenses (4,000)

Payment outside creditors (60,000)

Total cash withheld for:

Future liquidation/future expenses -

Unpaid balance of liability -

Total amount available for the Partners 716,000

Das könnte Ihnen auch gefallen

- Notes To Partnership Liquidation Final PDFDokument6 SeitenNotes To Partnership Liquidation Final PDFKristel SumabatNoch keine Bewertungen

- Cash Flow - Format & Problems - 2020Dokument3 SeitenCash Flow - Format & Problems - 2020aaryaNoch keine Bewertungen

- P2 NotesDokument13 SeitenP2 NotesJayrick James AriscoNoch keine Bewertungen

- P2 NotesDokument13 SeitenP2 NotesJayrick James AriscoNoch keine Bewertungen

- Cash Flow StatementDokument5 SeitenCash Flow StatementDebaditya SenguptaNoch keine Bewertungen

- Accounting For Special Transactions - Module 4Dokument9 SeitenAccounting For Special Transactions - Module 4Jcel JcelNoch keine Bewertungen

- FA2 Chapter 4-Partnership-LiquidationDokument20 SeitenFA2 Chapter 4-Partnership-LiquidationAyren Dela CruzNoch keine Bewertungen

- Accounting-Formats For Cambridge IGCSEDokument11 SeitenAccounting-Formats For Cambridge IGCSEmuhtasim kabir100% (9)

- Cash Flow Statement Ias 7Dokument5 SeitenCash Flow Statement Ias 7JOSEPH LUBEMBANoch keine Bewertungen

- Partnership LiquidationDokument4 SeitenPartnership LiquidationMelanie RuizNoch keine Bewertungen

- Format of FS-1Dokument4 SeitenFormat of FS-1Happy PillsNoch keine Bewertungen

- Advacc1 Accounting For Special Transactions (Advanced Accounting 1)Dokument18 SeitenAdvacc1 Accounting For Special Transactions (Advanced Accounting 1)Stella SabaoanNoch keine Bewertungen

- Financial - Statement Reporting-IIDokument29 SeitenFinancial - Statement Reporting-IIAshwini KhareNoch keine Bewertungen

- CompanyDokument4 SeitenCompanyparwez_0505Noch keine Bewertungen

- Accounts Full ConceptsDokument91 SeitenAccounts Full ConceptsAnmol BehalNoch keine Bewertungen

- CFS - Accountancy - Grade 12 - Session 10Dokument62 SeitenCFS - Accountancy - Grade 12 - Session 10Nirav Sheth100% (1)

- Vertical Format: Format of Income Statement ParticularsDokument4 SeitenVertical Format: Format of Income Statement ParticularsAnjali Betala Kothari100% (1)

- Cash Flow - Format 2021Dokument3 SeitenCash Flow - Format 2021Roy YadavNoch keine Bewertungen

- 5.consolidated SOCI - AAFRDokument11 Seiten5.consolidated SOCI - AAFRAli OptimisticNoch keine Bewertungen

- Partnership Lecture Handout With IllustrationDokument23 SeitenPartnership Lecture Handout With IllustrationMichael Asiedu100% (3)

- Cash Flows StatementsDokument4 SeitenCash Flows StatementsMae-shane SagayoNoch keine Bewertungen

- Fund Flow - RevisedDokument11 SeitenFund Flow - RevisedModhish NothumanNoch keine Bewertungen

- Amount (RS) Amount (RS) Cash Flow From Operating Activities Add: Non-Operating ItemsDokument8 SeitenAmount (RS) Amount (RS) Cash Flow From Operating Activities Add: Non-Operating ItemsSanjana MouliNoch keine Bewertungen

- Cash Flow Statement Mcqs With AnswerDokument25 SeitenCash Flow Statement Mcqs With Answermahesh patilNoch keine Bewertungen

- Topic 7 MFRS 107 Statement of Cash FlowsDokument21 SeitenTopic 7 MFRS 107 Statement of Cash Flowsaisyahinafaryanis14Noch keine Bewertungen

- Fund Flow:: Working CapitalDokument19 SeitenFund Flow:: Working CapitalAlex JayachandranNoch keine Bewertungen

- Accountancy All FormulaDokument23 SeitenAccountancy All FormulaThe Unknown vlogger100% (1)

- Statement of Cash FlowDokument6 SeitenStatement of Cash FlowNhel AlvaroNoch keine Bewertungen

- Notes - COMPUTATION OF INCOME FROM BUSINESS OR PROFESSIONDokument8 SeitenNotes - COMPUTATION OF INCOME FROM BUSINESS OR PROFESSIONSajan N ThomasNoch keine Bewertungen

- Corporate Unit 3Dokument497 SeitenCorporate Unit 3bhavu aryaNoch keine Bewertungen

- Lesson 5 Partnrship LiquidationDokument14 SeitenLesson 5 Partnrship LiquidationheyheyNoch keine Bewertungen

- Cash Flow StatementDokument13 SeitenCash Flow Statementshrestha.aryxnNoch keine Bewertungen

- Partnership - Part 4: Problem 4-1: True or FalseDokument7 SeitenPartnership - Part 4: Problem 4-1: True or FalseMichelle PalacayNoch keine Bewertungen

- Chapter 4 Teachers Manual Afar Part 1Dokument13 SeitenChapter 4 Teachers Manual Afar Part 1cezyyyyyyNoch keine Bewertungen

- Ias 7 Cash Flow Statement ContinuedDokument8 SeitenIas 7 Cash Flow Statement ContinuedMichael Bwire100% (1)

- Accounting & Financial Systems (Lecture 7)Dokument20 SeitenAccounting & Financial Systems (Lecture 7)Right Karl-Maccoy HattohNoch keine Bewertungen

- Chapter 2-The Accounting EquationDokument132 SeitenChapter 2-The Accounting EquationAmr HassanNoch keine Bewertungen

- Drawing Financial Statements and ProjectionsDokument36 SeitenDrawing Financial Statements and ProjectionsAaron MushunjeNoch keine Bewertungen

- Income Statement & Operating Expenses Statement & CAPEX StatementDokument7 SeitenIncome Statement & Operating Expenses Statement & CAPEX StatementAbraham LinkonNoch keine Bewertungen

- Trading and Profit and Loss Account Format: DR CRDokument12 SeitenTrading and Profit and Loss Account Format: DR CRHarshini AkilandanNoch keine Bewertungen

- Quizzes Chapter 14 Partnership LiquidationDokument7 SeitenQuizzes Chapter 14 Partnership LiquidationAmie Jane Miranda83% (6)

- HANDOUT 2 Cash Flow AnalysisDokument2 SeitenHANDOUT 2 Cash Flow AnalysisJayson Bautista RicoNoch keine Bewertungen

- Funds Flow StatementDokument5 SeitenFunds Flow StatementAshfaq ZameerNoch keine Bewertungen

- Trading and Profit and Loss Account Format: DR CRDokument14 SeitenTrading and Profit and Loss Account Format: DR CRHarshini AkilandanNoch keine Bewertungen

- General Purpose Financial StatementDokument10 SeitenGeneral Purpose Financial Statementfaith olaNoch keine Bewertungen

- Valuation of SharesDokument12 SeitenValuation of SharesnabhayNoch keine Bewertungen

- NCERT Solutions For Class 11 Accountancy Chapter 10 Financial Statements - 2Dokument90 SeitenNCERT Solutions For Class 11 Accountancy Chapter 10 Financial Statements - 2Badal singh ThakurNoch keine Bewertungen

- Format of Income StatementDokument2 SeitenFormat of Income StatementForam VasaniNoch keine Bewertungen

- Partnership LiquidationDokument2 SeitenPartnership LiquidationRomel Paul Taguinod GeronimoNoch keine Bewertungen

- Direct MethodDokument2 SeitenDirect MethodZazaBasriNoch keine Bewertungen

- Limited Liability Partnership (LLP)Dokument10 SeitenLimited Liability Partnership (LLP)sejal ambetkarNoch keine Bewertungen

- Profe03 - Chapter 5 Consolidated FS Intercompany TopicsDokument8 SeitenProfe03 - Chapter 5 Consolidated FS Intercompany TopicsSteffany RoqueNoch keine Bewertungen

- 2 Assignment For Midterm - Merchandising Business: (Periodic System)Dokument4 Seiten2 Assignment For Midterm - Merchandising Business: (Periodic System)Lisa PalermoNoch keine Bewertungen

- Exam 3Dokument22 SeitenExam 3Darynn F. Linggon100% (2)

- IAS 7 - Cashflow StatementsDokument64 SeitenIAS 7 - Cashflow StatementsDawar Hussain (WT)Noch keine Bewertungen

- Financial Statements of A PartnershipDokument12 SeitenFinancial Statements of A PartnershipCharlesNoch keine Bewertungen

- 1stLecture-Partnership LiquidationDokument25 Seiten1stLecture-Partnership LiquidationRechelle Dalusung100% (1)

- Equity Valuation: Models from Leading Investment BanksVon EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNoch keine Bewertungen

- Capital Asset Investment: Strategy, Tactics and ToolsVon EverandCapital Asset Investment: Strategy, Tactics and ToolsBewertung: 1 von 5 Sternen1/5 (1)

- Arts Cpa Review: BatchDokument8 SeitenArts Cpa Review: BatchKristel Sumabat0% (1)

- Auditing and Assurance - Principles - Prelim ExamDokument7 SeitenAuditing and Assurance - Principles - Prelim ExamMaricar San AntonioNoch keine Bewertungen

- Amendments CorporationDokument6 SeitenAmendments CorporationKristel SumabatNoch keine Bewertungen

- Auditing and Assurance - Concepts and Applications - Preim ExamDokument8 SeitenAuditing and Assurance - Concepts and Applications - Preim ExamMaricar San AntonioNoch keine Bewertungen

- Arts Cpa Review: BatchDokument5 SeitenArts Cpa Review: BatchKristel Sumabat0% (1)

- Arts Cpa Review: BatchDokument5 SeitenArts Cpa Review: BatchKristel Sumabat0% (1)

- Module 1 312Dokument6 SeitenModule 1 312Kristel SumabatNoch keine Bewertungen

- FCL 1 FOR COLLEGE MIDTERM CONTENT Edited Sep 5 2018Dokument17 SeitenFCL 1 FOR COLLEGE MIDTERM CONTENT Edited Sep 5 2018Kristel SumabatNoch keine Bewertungen

- Seatwork Allocation Support CostsDokument1 SeiteSeatwork Allocation Support CostsDIANE EDRANoch keine Bewertungen

- Partnership Liquidation Problem For DiscussionDokument1 SeitePartnership Liquidation Problem For DiscussionKristel SumabatNoch keine Bewertungen

- Exercise Joint CostsDokument1 SeiteExercise Joint CostsDIANE EDRANoch keine Bewertungen

- Abc Practice SetDokument5 SeitenAbc Practice SetDIANE EDRANoch keine Bewertungen

- Costing Accounting Practice SetDokument2 SeitenCosting Accounting Practice SetKristel SumabatNoch keine Bewertungen

- Prelim Exam Answers and SolutionsDokument2 SeitenPrelim Exam Answers and SolutionsKristel SumabatNoch keine Bewertungen

- Corporation Liquidation Notes .1Dokument2 SeitenCorporation Liquidation Notes .1Kristel SumabatNoch keine Bewertungen

- Partnership OperationsDokument2 SeitenPartnership OperationsKristel SumabatNoch keine Bewertungen

- Prelim Exam Business CombinationDokument2 SeitenPrelim Exam Business CombinationKristel Sumabat0% (2)

- Drill 2 - Formation To Dissolution PDFDokument2 SeitenDrill 2 - Formation To Dissolution PDFMelvin MendozaNoch keine Bewertungen

- TBCH01Dokument6 SeitenTBCH01Arnyl ReyesNoch keine Bewertungen

- Prelim Exam Answers and SolutionsDokument2 SeitenPrelim Exam Answers and SolutionsKristel SumabatNoch keine Bewertungen

- Corporation Liquidation Notes .1Dokument2 SeitenCorporation Liquidation Notes .1Kristel SumabatNoch keine Bewertungen

- Partnership ExercisesDokument36 SeitenPartnership ExercisesKristel SumabatNoch keine Bewertungen

- Drill 2 - Formation To Dissolution PDFDokument2 SeitenDrill 2 - Formation To Dissolution PDFMelvin MendozaNoch keine Bewertungen

- Partnership Exercise SolutionsDokument14 SeitenPartnership Exercise SolutionsKristel SumabatNoch keine Bewertungen

- Cash Flow Estimation and Risk Analysis: Multiple Choice: ConceptualDokument2 SeitenCash Flow Estimation and Risk Analysis: Multiple Choice: ConceptualKristel Sumabat100% (1)

- Other Topics in Capital Budgeting: Multiple Choice: ConceptualDokument2 SeitenOther Topics in Capital Budgeting: Multiple Choice: ConceptualKristel SumabatNoch keine Bewertungen

- Distributions To Shareholders: Dividends and Share RepurchasesDokument2 SeitenDistributions To Shareholders: Dividends and Share RepurchasesKristel SumabatNoch keine Bewertungen

- Business Combination: Expense ImmediatelyDokument7 SeitenBusiness Combination: Expense ImmediatelyKristel SumabatNoch keine Bewertungen

- Capital Structure and Leverage: Multiple Choice: ConceptualDokument2 SeitenCapital Structure and Leverage: Multiple Choice: ConceptualKristel SumabatNoch keine Bewertungen

- Business Plan of Shubham Restaurant: Presented By: Bhavesh PipaliyaDokument14 SeitenBusiness Plan of Shubham Restaurant: Presented By: Bhavesh PipaliyaAnkit SrivastavaNoch keine Bewertungen

- Basic Accounting Concepts and Case StudiesDokument114 SeitenBasic Accounting Concepts and Case Studiesgajiniece429Noch keine Bewertungen

- Introduction TABDokument2 SeitenIntroduction TABShreshtha ShahNoch keine Bewertungen

- State of Retirement Benefits in IndiaDokument12 SeitenState of Retirement Benefits in IndiaSpeakupNoch keine Bewertungen

- Wall Street Courier Services, Inc. PayslipDokument1 SeiteWall Street Courier Services, Inc. PayslipAimee TorresNoch keine Bewertungen

- Pacifico Renewables Yield AG 2021H1 enDokument50 SeitenPacifico Renewables Yield AG 2021H1 enLegonNoch keine Bewertungen

- A222 BWBB3193 Topic 04 Management of Risk in BankingDokument38 SeitenA222 BWBB3193 Topic 04 Management of Risk in BankingNurFazalina AkbarNoch keine Bewertungen

- Registration of Corporations Stock Corporation Basic RequirementsDokument27 SeitenRegistration of Corporations Stock Corporation Basic RequirementsRhyz Taruc-ConsorteNoch keine Bewertungen

- A R RoqueDokument73 SeitenA R RoqueTwish BarriosNoch keine Bewertungen

- May 2019 Professional Examinations Public Sector Accounting & Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeDokument24 SeitenMay 2019 Professional Examinations Public Sector Accounting & Finance (Paper 2.5) Chief Examiner'S Report, Questions and Marking SchemeMahama JinaporNoch keine Bewertungen

- Joint Venture Agreement TemplateDokument3 SeitenJoint Venture Agreement Templategwynette12Noch keine Bewertungen

- CIR Vs Procter and Gamble 1Dokument1 SeiteCIR Vs Procter and Gamble 1JVLNoch keine Bewertungen

- Composition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxDokument6 SeitenComposition of Gross Estate: Inter-Vivos (During The Lifetime) Transfer TaxKatie PxNoch keine Bewertungen

- Important : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadDokument1 SeiteImportant : Allama Iqbal Open University Islamabad Allama Iqbal Open University IslamabadMuhammad Sohail0% (1)

- Project Report On NurseryDokument6 SeitenProject Report On NurseryManju Mysore100% (1)

- MiFID II - Product GovernanceDokument8 SeitenMiFID II - Product GovernanceHoàng Minh ChiếnNoch keine Bewertungen

- Bank Challan FormDokument1 SeiteBank Challan Formakangsha dekaNoch keine Bewertungen

- FIN4284 ALTERNATIVE ASSESSMENT-FinalDokument11 SeitenFIN4284 ALTERNATIVE ASSESSMENT-FinalAtif QureshiNoch keine Bewertungen

- Cambridge IGCSE™: Accounting 0452/21 May/June 2020Dokument18 SeitenCambridge IGCSE™: Accounting 0452/21 May/June 2020Israa MostafaNoch keine Bewertungen

- CashTOa JPDokument11 SeitenCashTOa JPDarwin LopezNoch keine Bewertungen

- Seminar QuestionsDokument2 SeitenSeminar QuestionsjekaterinaNoch keine Bewertungen

- Annual Report 2019Dokument416 SeitenAnnual Report 2019Saima Binte IkramNoch keine Bewertungen

- Crisis: Clouded at The Core: ForewordDokument22 SeitenCrisis: Clouded at The Core: ForewordMildred Wilkins100% (1)

- Tally Accounting Book by Ca MD ImranDokument6 SeitenTally Accounting Book by Ca MD ImranMd ImranNoch keine Bewertungen

- Ast TX 901 Fringe Benefits Tax (Batch 22)Dokument6 SeitenAst TX 901 Fringe Benefits Tax (Batch 22)Shining LightNoch keine Bewertungen

- CH2 ... Introduction To Financial Statement AnalysisDokument96 SeitenCH2 ... Introduction To Financial Statement AnalysisMariam AlraeesiNoch keine Bewertungen

- Cost Cia 3RD SemDokument30 SeitenCost Cia 3RD SemSaloni Jain 1820343Noch keine Bewertungen

- Partners Healthcare (Tables and Exhibits)Dokument9 SeitenPartners Healthcare (Tables and Exhibits)sahilkuNoch keine Bewertungen

- BFM Sem - Vi Corporate RestructuringDokument48 SeitenBFM Sem - Vi Corporate RestructuringJeffNoch keine Bewertungen

- Purchase Order: 3015 Lulu HM # Al Messila, Doha 4740707390Dokument1 SeitePurchase Order: 3015 Lulu HM # Al Messila, Doha 4740707390IzzathNoch keine Bewertungen