Beruflich Dokumente

Kultur Dokumente

At.3008 Understanding The Entity and Its Environment

Hochgeladen von

SadAccountantOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

At.3008 Understanding The Entity and Its Environment

Hochgeladen von

SadAccountantCopyright:

Verfügbare Formate

Excel Professional Services, Inc.

Management Firm of Professional Review and Training Center (PRTC)

(LUZON) Manila 87339344 * Calamba City, Laguna * Dasmariñas City, Cavite * Lipa City,

Batangas (0917) 8852769 * (VISAYAS) Bacolod City (034) 4346214 * Cebu City (032)

2537900 loc. 218 (MINDANAO) Cagayan De Oro (0917) 7081465 * Davao City (082) 2250049

AUDITING THEORY

AT.3008 – Understanding the Entity R.C.P. SOLIMAN/ K.J. UY and its Environment MAY

2021

Reference:

a. PSA 315 (Redrafted), Identifying and Assessing the Risks of Material Misstatement through Understanding the

Entity and its Environment

DISCUSSION QUESTIONS

d. The shareholders.

Introduction—Importance of Understanding the Required Understanding

Entity, Its Environment, and Its Internal Control

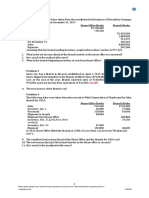

5. The auditor’s understanding of the

1. The reasons why an auditor should obtain an client encompasses

understanding of the entity and its environment,

including internal control, include a. b. c. d.

External factors (e.g.,

a. b. c. d. industry and regulatory Yes Yes Yes Yes

To determine materiality. Yes Yes Yes Yes issues)

To consider appropriateness of accounting policies Nature of the entity Yes Yes Yes No

and disclosures. Yes Yes Yes No Accounting policies Yes Yes Yes Yes

To identify areas of audit emphasis. Yes Yes Yes Yes Entity objectives, strategies, Yes No No Yes and

To set expectations for results of analytical business risks

procedures. Yes No No Yes Financial performance Yes Yes No No measurement and

To design further audit procedures. Yes Yes No No review

To evaluate audit evidence. Yes Yes Yes Yes Internal control Yes No No No

To appropriately apply

professional judgment and 6. Business risks refer to

a. The entity’s operations, its ownership and

skepticism. Yes Yes Yes Yes governance, the types of investments that it is

making and plans to make, the way that the entity

2. An auditor who accepts an audit engagement and does is structured and how it is financed.

not possess the industry expertise of the business b. The overall plans for the entity.

entity should: c. The operational approaches by which management

a. engage financial experts familiar with the nature of intends to achieve its objectives.

the business entity. d. The result of significant conditions, events and

b. obtain a knowledge of matters that relate to the circumstances, actions or inactions that could

nature of the entity’s business. adversely affects the entity’s ability to achieve its

c. refer a substantial portion of the audit to another objectives and execute the strategies or the setting

CPA who will act as the principal auditor. of inappropriate objectives and strategies.

d. first inform management that an unqualified

opinion cannot be issued. 7. Select the incorrect statement:

a. Business risk is broader than the risk of material

3. An understanding of a client’s business and industry misstatement.

and knowledge about operations are essential for b. Most business risks do not have financial

performing an adequate audit. For a new client, most consequences, though they may have an effect on

of this information is obtained: the financial statements of an entity.

a. from the predecessor auditor. c. Usually, management identifies business risks and

b. from the Securities and Exchange Commission. develops approaches to address them.

c. from the prior year working papers and permanent d. Smaller entities often do not set their objectives

file for the client. and strategies or manage the related business risks

d. at the client’s premises. through formal plans or processes.

4. Who is the most knowledgeable about the entity’s Procedures to Obtain Understanding

operations and financial reporting? a. The auditor.

b. The regulatory bodies. 8. What are the auditor’s procedures and sources of

c. The management and those charged with information to obtain understanding of the entity and

governance. its environment, including internal control? a. Risk

assessment procedures (RAP).

Page 1 of 6 www.teamprtc.com.ph AT.3008

EXCEL PROFESSIONAL SERVICES, INC.

b. Information obtained in prior period audits. Examples include

c. Discussions among the audit team.

d. All of the above. a. b. c. d.

Business activities and

Risk Assessment Procedures operations Yes Yes Yes Yes

Documents and records Yes Yes Yes No

9. The main purpose of risk assessment procedures is to Business report and minutes of

a. Obtain an understanding of the entity and its meetings Yes Yes Yes Yes

environment, including its internal control, to Tours of facilities Yes No No Yes

assess the risks of material misstatement at the Walkthrough Yes Yes No No

financial statement and assertion levels.

b. Test the operating effectiveness of controls in

preventing, or detecting and correcting, material 15. Evaluations of financial information made by a study of

misstatement at the assertion level. plausible relationships among both financial and non-

financial data. It also encompasses the investigation of

c. Detect material misstatements at the assertion

identified fluctuations and relationships that are

level.

inconsistent with other relevant information or that

d. All of the above

differ from expected values by a significant amount.

a. Audit planning c. Analytical procedures

10. Which of the following is least likely to be considered a

b. Audit evidence d. Inspection

risk assessment procedure? a. Analytical procedures.

b. Confirmation of ending accounts receivable.

16. Analytical procedures are used in an audit because it is

c. Inspection of documents.

assumed of financial statements that (i.e., the basic

d. Observation of the performance of certain

premise of analytical procedures)

accounting procedures.

a. management fraud can be discovered using such

procedures.

11. Which of the following is least likely to be considered a b. it is plausible that no relationship among data

risk assessment procedure? exists.

a. Inquiries of management and others within the c. analytical procedures are used as tests of controls.

entity.

d. plausible relationships among data may reasonably

b. Test of operation of bank reconciliation. be expected to exist and continue in the absence of

c. Inquiries of external legal counsel. known conditions to the contrary.

d. Review of external financial publications.

17. Analytical procedures enable the auditor to predict the

12. In obtaining an understanding of the entity and its balance or quantity of an item under audit.

environment, the auditor performs inquiries within the Information to develop this estimate can be obtained

entity that may be directed to different levels of from all of the following, except

authority who may have information about risks of a. Comparison of financial data with data for

material misstatement such as comparable prior periods, anticipated results (e.g.,

budgets and forecasts), and similar data for the

a. b. c. d. industry in which the entity operates.

Management and those b. Study of the relationships of elements of financial

responsible for financial data that would be expected to conform to a

reporting Yes Yes Yes Yes predictable pattern based upon the entity’s

Those charged with Yes Yes Yes No experience.

governance c. Study of the relationships of financial data with

Internal auditors Yes Yes Yes Yes relevant nonfinancial data.

Legal counsel Yes No No Yes d. Tracing transactions through the system to

Marketing and sales personnel Yes Yes No No determine whether procedures are being applied as

Production personnel Yes Yes Yes Yes prescribed.

13. Inquiries directed towards internal audit personnel may

18. In performing analytical procedures, the auditor

most likely

develops expectations or predictions of recorded

a. Relate to their activities concerning the design and balances or ratios. Examples of analytical procedures

effectiveness of the entity’s internal control and include

whether management has satisfactorily responded

to any findings from those activities

a. b. c. d.

b. Help the auditor in understanding the environment

Predicting current year sales

in which the financial statements are prepared

based on prior year trend. Yes Yes Yes Yes

c. Relate to changes in the entity’s marketing The use of standard costs and

strategies, sales trends or contractual

variance analysis. Yes Yes Yes No

arrangements with its customers Expecting increase in accounts

d. Help the auditor in evaluating the appropriateness receivable due to

of the selection and application

corresponding increase in

of accounting policies sales. Yes Yes Yes Yes

Expecting the same level of

14. When an auditor obtains an understanding of the entity industry average inventory

and its environment, observation and inspection turnover. Yes Yes No Yes

provide support for inquiries and direct evidence about Expecting increase in labor costs

the entity and its environment. due to increase in number of

Page 2 of 6 www.teamprtc.com.ph AT.3008

EXCEL PROFESSIONAL SERVICES, INC.

hours worked. Yes Yes No No b. No Yes No

Recalculating depreciation based c. No Yes Yes

on company policies. Yes No No No d. Yes No No

19. The auditors use analytical procedures during the 25. Analytical procedures used in planning an audit should

course of an audit. The most important phase of focus on

performing these procedures is the: a. Reducing the scope of tests of controls and

a. Vouching of all data supporting various ratios. substantive tests.

b. Investigation of significant variations and unusual b. Providing assurance that potential material

relationships. misstatements will be identified.

c. Comparison of client-computed statistics with c. Enhancing the auditor’s understanding of the client’

industry data on a quarterly and full-year basis. s business required to identify areas of heightened

d. Recalculation of industry date. risk.

d. Assessing the adequacy of the available evidence.

20. In performing analytical procedures, significant

differences between expectations and recorded

amounts should be investigated and evaluated.

Significance is largely a function of ________ and the 26. Which of the following nonfinancial information would

desired degree of assurance to be provided. an auditor most likely consider in performing analytical

a. Materiality procedures during the planning phase of an audit?

b. Auditor’s preference a. Turnover of personnel in the accounting

c. Inherent risk department.

d. Control risk b. Objectivity of audit committee members.

c. Square footage of selling space.

21. In performing analytical procedures, significant d. Management's plans to repurchase stock.

differences do not necessarily result in

a. Evaluation of how expectations were developed. 27. In which of the following stages of audit analytical

b. Inquiries of management. procedures tend to use detailed and disaggregated

c. Corroboration of management responses with other data

audit evidence. a. Planning.

d. Performance of other procedures and consideration b. Substantive procedures.

of risks of material misstatement due to fraud. c. Overall review.

d. All of the above.

22. As a form of analytical procedure, test of

reasonableness 28. Two analytical procedures available to the auditor are:

a. is based on the assumption that performance will • Compare current year’s balances with the

continue in line with previous performance or preceding year.

industry trends unless something unusual is • Compare details of a particular account’s balance

happening in the company. with the preceding year.

b. is similar to financial statement analysis, and is

highly effective technique to highlight account Shortcomings of these two procedures are that:

balances that are out of line and may signal the a. the first ignores effects of tests of controls and the

potential for fraud. second fails to consider possible changes in client

c. tests whether a recorded amount is reasonable personnel.

with regards to the auditor’s expectation. b. the first fails to consider growth or decline in

d. involves time-series analysis by examining trends business activity and the second ignores

in relationship with previous results. relationships of data to other data.

c. both fail to consider growth or decline in business

23. The following statements are true regarding analytical activity and ignore relationships of data.

procedures except d. it is difficult, time consuming, and, therefore,

a. Should be applied in planning all financial costly to perform these procedures.

statements audit to determine the nature, timing,

and extent of other audit procedures. 29. An auditor compares 2019 revenues and expenses with

b. Used as substantive tests may sometimes be more those of the prior year and investigates all changes

effective or efficient than tests of details. exceeding 10%. By this procedure the auditor would be

c. Should be applied in the final stage of the audit as most likely to learn that

an overall review. a. An increase in property tax rates has not been

d. Used to obtain understanding and test the recognized in the client's accrual.

operating effectiveness of internal control. b. The 2019 provision for uncollectible accounts is

inadequate, because of worsening economic

24. For all audits of financial statements made in conditions.

accordance with PSAs, the use of analytical procedures c. Fourth quarter payroll taxes were not paid.

is required to some extent d. The client changed its capitalization policy for small

tools in 2019.

In the As a As an overall

assessment of substantive review at the 30. Auditors try to identify predictable relationships when

risks of material audit completion using analytical procedures. Which of the following

misstatement procedure stage accounts would most likely yield the highest level of

a. Yes No Yes

Page 3 of 6 www.teamprtc.com.ph AT.3008

EXCEL PROFESSIONAL SERVICES, INC.

evidence regarding relationships that involve PSA 315 regarding the discussion among engagement

transactions? team as part of understanding the entity and assessing

a. Accounts payable risks of material misstatement. Which is incorrect?

b. Accounts receivable a. The discussion shall focus on the susceptibility of

c. Payroll expense the entity’s financial statements to material

d. Advertising expense misstatement, and the application of the applicable

financial reporting framework to the entity’s facts

Use of Information Obtain in Prior Period Audits and circumstances.

b. The discussion allows the engagement team

31. Statement 1: In performing an audit for the current members to exchange information about the

year, the auditor may use prior period information only business risks to which the entity is subject.

after procedures have been performed to evaluate its

current relevance. c. The discussion assists the engagement team

members to gain a better understanding of the

Statement 2: The auditor may consider pertinent potential for material misstatement of the financial

information obtained from client acceptance statements.

procedures, previous engagements for the client, and d. The discussion shall, in all cases, include all of the

other sources. members of the engagement team to attend and

be

DO-IT-YOURSELF (DIY) DRILL

a. True, true c. False, true informed of all of the decisions reached.

b. True, false d. False, false

Documentation

32. To obtain an understanding of a continuing client's

business, an auditor most likely would 35. The following statements relate to documentation

a. Perform tests of details of transactions and requirements about the auditor’s understanding of the

balances. client. Which is incorrect?

b. Review prior year working papers and the a. The auditor shall document the risk assessment

permanent file for the client. procedures performed.

c. Read current issues of specialized industry journals. b. The discussion among the engagement team, and

d. Reevaluate the client's internal the significant decisions reached may be

control documented in a memorandum or minutes of

environment. meeting

c. The documentation shall include key elements of

Brainstorming Among Engagement Team the understanding obtained regarding each of the

aspects of the entity and its environment including

33. Who among the following should lead and preside the the sources of information from which the

sharing of insights and discussion about the understanding was obtained

susceptibility of financial statements to material d. For recurring audits, certain documentation may be

misstatement? carried forward without the need to consider to any

a. Partner c. Senior update to reflect changes in the entity’s business or

b. Manager d. Assistant processes.

34. The following matters relate to the requirements of - now do the DIY drill –

b. an understanding of how economic events and

1. The purpose of risk assessment procedures is to transactions have an effect on the company's

a. Obtain an understanding of the entity and its financial statements.

environment c. information about engagement risk.

b. Reduce detection risk d. information regarding whether the company is

c. Evaluate management ability engaging in financial statement fraud.

d. Determine the operating effectiveness of controls

4. Which of the following are the most common

2. The primary objective of procedures performed to techniques used in obtaining knowledge of a client in

obtain an understanding of the entity and its the planning phase of an audit engagement?

environment is to provide an auditor with: a. Confirmation, enquiry, analysis, reperformance

a. Knowledge necessary for risk assessment and audit b. Enquiry, analysis, observation, inspection

planning. c. Enquiry, analysis, observation, reperformance

b. Audit evidence to use in assessing inherent risk. d. Vouching, tracing, discussion, analysis

c. A basis for issuing an opinion on the financial

statements. 5. The auditors are planning an audit engagement for a

d. An evaluation of the consistency of application of new client in a business that is unfamiliar to the

management's policies. auditors. Which of the following would be the most

useful source of information for the auditors during the

preliminary planning stage when they are trying to

3. The audit team gathers information about a new

obtain a general understanding of audit problems that

client's business and industry in order to obtain:

might be encountered?

a. an understanding of the clients internal control

a. Client manuals of accounts and charts of accounts.

system for financial reporting.

b. Established Industry Audit Guides.

Page 4 of 6 www.teamprtc.com.ph AT.3008

EXCEL PROFESSIONAL SERVICES, INC.

c. Prior-year working papers of the predecessor c. Examined monthly performance reports and

auditors. investigated significant variations from budgeted

d. Latest annual and interim financial statements amounts.

issued by the client. d. Examined invoices for plant asset additions to

determine whether the client had erroneously

6. Which of the following is least likely to be included in recorded ordinary repairs as plant assets.

an auditor's inquiry of management while obtaining

information to identify the risks of material 12. What type of analytical procedure would an auditor

misstatement due to fraud? most likely use in developing relationships among

a. Are all financial reporting operations at one balance sheet accounts when reviewing the financial

location? statements of a nonpublic entity?

b. Does it have knowledge of fraud or suspect fraud? a. Trend analysis. c.

c. Does it have programs to mitigate fraud risks? Ratio analysis.

d. Has it reported to the audit committee the nature b. Regression analysis. d. Risk analysis.

of the company's internal control?

13. An auditor compares year-to-year account balances in

7. Inquiries directed towards those charged with order to perform analytical procedures. This is an

governance may most likely example of:

a. Relate to their activities concerning the design and a. Vertical analysis c.

effectiveness of the entity’s internal control and Trend

whether management has satisfactorily responded analysis

to any findings from those activities b. Internal control analysis d. Ratio analysis

b. Help the auditor in understanding the environment

in which the financial statements are prepared 14. Analytical procedures used in planning an audit should

c. Relate to changes in the entity’s marketing focus on identifying

strategies, sales trends or contractual a. material weaknesses in internal control.

arrangements with its customers b. the predictability of financial data from individual

d. Help the auditor in evaluating the appropriateness transactions.

of the selection and application c. the various assertions that are embodied in the

of certain accounting policies financial statements.

d. areas that may represent specific risks relevant to

8. Which one of the following is a valid source of the audit.

information about the client's processes? a.

Management inquiry 15. In performing an audit, which one of the following

b. Review of the client's budget procedures would be considered an analytical

c. Tour of client’s plant and operations procedure?

d. All are valid sources. a. Comparing last year’s interest expense with this

year’s interest expense.

9. Which of the following is not an information source for b. Comparing signatures on checks with the

developing analytical procedures used in the audit? signatures of authorized check signers.

a. Relationships among financial statement c. Reviewing initials on received documents

elements d. Reviewing procedures followed in receiving,

b. Relationships between financial and relevant depositing, and disbursing cash.

nonfinancial data

c. Comparison of financial data with anticipated 16. Which of the following is least likely to be comparable

results (e.g., budgets and forecasts) between similar corporations in the same industry line

d. Comparison of current year financial data with of business?

projections for next year's financial results a. Accounts receivable turnover

b. Earnings per share

10. Which of the following is not a typical analytical review c. Gross profit percent

procedure? d. Return on assets before interest and taxes

a. Study of relationships of the financial information

with relevant non-financial information. 17. An example of an analytical procedure is the

b. Comparison of the financial information with similar comparison of

information regarding the industry in which the a. Financial information with similar information

entity operates. regarding the industry in which the entity operates

c. Comparisons of recorded amounts of major b. Recorded amounts of major disbursements with

disbursements with appropriate invoices. appropriate invoices

d. Comparisons of the financial information with c. Results of a statistical sample with the expected

budgeted amounts. characteristics of the actual population

d. EDP generated data with similar data generated

11. Which of the following is not an example of analytical by a manual accounting system

evidence?

a. Compared inventory turnover by major class with 18. Analytical procedures are

the prior year on a monthly and quarterly basis. a. Never required

b. Compared gross profit percentages by major b. Required for planning, substantive testing, and

product classes with the prior year. overall review of the financial statements

c. Required for planning and overall review of the

financial statements

Page 5 of 6 www.teamprtc.com.ph AT.3008

EXCEL PROFESSIONAL SERVICES, INC.

d. Required during planning only

19. Which of the following statements is not correct?

a. Analytical procedures are used to isolate accounts

or transactions that should be investigated more

extensively.

b. For certain immaterial accounts, analytical

procedures may be the only evidence needed.

c. In some instances, other types of evidence may be

reduced when analytical procedures indicate that

an account balance appears reasonable.

d. Analytical procedures use supporting

documentation to determine which account

balances need additional detailed procedures.

20. Which of the following parties would normally attend a

planning meeting held before the beginning of an audit

engagement to discuss relevant client information and

the audit approach to be taken in performing the

engagement?

a. Engagement partner and the client’s chief financial

officer

b. Engagement partner and audit manager

c. Engagement partner, audit manager, and senior

auditor

d. Engagement partner, audit manager, senior

auditor, and junior audit staff members

- end of AT.3008 -

Page 6 of 6 www.teamprtc.com.ph AT.3008

Das könnte Ihnen auch gefallen

- 1ROF07100.024 INV-2611994RevDokument1 Seite1ROF07100.024 INV-2611994RevSiddiq Khan100% (1)

- Auditing Theory Cpa Review Auditing in A Cis (It) EnvironmentDokument11 SeitenAuditing Theory Cpa Review Auditing in A Cis (It) EnvironmentJohn RosalesNoch keine Bewertungen

- Quiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2Dokument31 SeitenQuiz Results: Week 12: Conceptual Framework: Expenses Quizzer 2marie aniceteNoch keine Bewertungen

- Sushilog Ac503Dokument251 SeitenSushilog Ac503SadAccountant100% (1)

- Pizza Bomb Feasib CompiledDokument235 SeitenPizza Bomb Feasib CompiledSadAccountant100% (3)

- Business Plan Flight Training AviationDokument28 SeitenBusiness Plan Flight Training AviationTa Man100% (1)

- At.3009-Internal Control ConsiderationsDokument9 SeitenAt.3009-Internal Control ConsiderationsSadAccountant100% (1)

- AP 08 Substantive Audit Tests of EquityDokument2 SeitenAP 08 Substantive Audit Tests of EquityJobby JaranillaNoch keine Bewertungen

- Chapter 13 AnsDokument4 SeitenChapter 13 AnsDave ManaloNoch keine Bewertungen

- Chapter 10 Identifying and Assessing The Risks of Material MisstatementsDokument7 SeitenChapter 10 Identifying and Assessing The Risks of Material MisstatementsRichard de LeonNoch keine Bewertungen

- Form of A List of Risks Exercise People With An Extensive Knowledge of The Program or Process That Will Be Analyzed To Use A Prepared ListDokument4 SeitenForm of A List of Risks Exercise People With An Extensive Knowledge of The Program or Process That Will Be Analyzed To Use A Prepared ListKeanne ArmstrongNoch keine Bewertungen

- OpAudCh10-CBET-01-501E-Toralde, Ma - Kristine E.Dokument6 SeitenOpAudCh10-CBET-01-501E-Toralde, Ma - Kristine E.Kristine Esplana ToraldeNoch keine Bewertungen

- Pre Week NewDokument30 SeitenPre Week NewAnonymous wDganZNoch keine Bewertungen

- Audprob Final Exam 1Dokument26 SeitenAudprob Final Exam 1Joody CatacutanNoch keine Bewertungen

- Auditing Theory 100 Questions 2015Dokument22 SeitenAuditing Theory 100 Questions 2015Louie de la TorreNoch keine Bewertungen

- AC 3101 Discussion ProblemDokument1 SeiteAC 3101 Discussion ProblemYohann Leonard HuanNoch keine Bewertungen

- Accounting 14 - Applied Auditing OkDokument12 SeitenAccounting 14 - Applied Auditing OkNico evansNoch keine Bewertungen

- AT.2822 - Code of Ethics For Professional Accountants PDFDokument11 SeitenAT.2822 - Code of Ethics For Professional Accountants PDFMaeNoch keine Bewertungen

- 92-FIRST PB-AUD ExamDokument11 Seiten92-FIRST PB-AUD ExamReynaldo corpuzNoch keine Bewertungen

- Auditing Theory - Risk AssessmentDokument10 SeitenAuditing Theory - Risk AssessmentYenelyn Apistar CambarijanNoch keine Bewertungen

- Auditing Theory - AssuranceDokument5 SeitenAuditing Theory - AssuranceDavidCruzNoch keine Bewertungen

- Multiple-Choice QuestionsDokument75 SeitenMultiple-Choice QuestionsJasmine LimNoch keine Bewertungen

- Other PSAs and PAPSsDokument7 SeitenOther PSAs and PAPSsnikNoch keine Bewertungen

- Auditing Theory: Audit SamplingDokument11 SeitenAuditing Theory: Audit SamplingFayehAmantilloBingcangNoch keine Bewertungen

- Auditing Problems ReviewerDokument9 SeitenAuditing Problems Revieweralexis prada0% (1)

- Interactive Model of An EconomyDokument142 SeitenInteractive Model of An Economyrajraj999Noch keine Bewertungen

- Dahlia DahliaDokument21 SeitenDahlia Dahliaambrosia96Noch keine Bewertungen

- Auditing Theory - MockDokument10 SeitenAuditing Theory - MockCarlo CristobalNoch keine Bewertungen

- Topic 1Dokument65 SeitenTopic 1Carl Dhaniel Garcia SalenNoch keine Bewertungen

- Auditing Theory Summary Auditing Theory SummaryDokument42 SeitenAuditing Theory Summary Auditing Theory SummaryCJ TinNoch keine Bewertungen

- AssignmentDokument6 SeitenAssignmentIryne Kim PalatanNoch keine Bewertungen

- Bus. Combi Probs and SolnDokument3 SeitenBus. Combi Probs and SolnRyan Prado AndayaNoch keine Bewertungen

- Ch07 Audit Planning Assessment of Control Risk1Dokument26 SeitenCh07 Audit Planning Assessment of Control Risk1Mary GarciaNoch keine Bewertungen

- Chapter 5 Audit PlanningDokument6 SeitenChapter 5 Audit Planning威陈Noch keine Bewertungen

- Audit On CIS EnvironmentDokument30 SeitenAudit On CIS EnvironmentMiles SantosNoch keine Bewertungen

- Specialized BusinessDokument16 SeitenSpecialized BusinessMaritess LobrigoNoch keine Bewertungen

- Lecture Notes: Auditing Theory AT.0106-Understanding The Entity and Its Environment MAY 2020Dokument7 SeitenLecture Notes: Auditing Theory AT.0106-Understanding The Entity and Its Environment MAY 2020MaeNoch keine Bewertungen

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Dokument20 SeitenPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Pdf FilesNoch keine Bewertungen

- Chapter 16 AnsDokument7 SeitenChapter 16 AnsDave Manalo100% (5)

- Psa 620Dokument9 SeitenPsa 620Jae Hwa LeeNoch keine Bewertungen

- Finals Reviewer AudtheoDokument36 SeitenFinals Reviewer AudtheoMae VillarNoch keine Bewertungen

- Auditing Theory ReviewerDokument6 SeitenAuditing Theory ReviewerHans Even Dela CruzNoch keine Bewertungen

- MA Cabrera 2010 - SolManDokument4 SeitenMA Cabrera 2010 - SolManCarla Francisco Domingo40% (5)

- 03 Gross Profit AnalysisDokument5 Seiten03 Gross Profit AnalysisJunZon VelascoNoch keine Bewertungen

- Summary Psa 560Dokument1 SeiteSummary Psa 560Danielle Potter RadcliffeNoch keine Bewertungen

- ch11 Doc PDF - 2 PDFDokument39 Seitench11 Doc PDF - 2 PDFRenzo RamosNoch keine Bewertungen

- Answer Key: Audit Planning, Understanding The Client, Assessing Risks, and RespondingDokument15 SeitenAnswer Key: Audit Planning, Understanding The Client, Assessing Risks, and RespondingRizza OmalinNoch keine Bewertungen

- Instruction: Encircle The Letter of The Correct Answer in Each of The Given QuestionDokument6 SeitenInstruction: Encircle The Letter of The Correct Answer in Each of The Given QuestionMarjorie PalmaNoch keine Bewertungen

- Psa 401Dokument5 SeitenPsa 401novyNoch keine Bewertungen

- AUD 1206 Case Analysis Number 2Dokument2 SeitenAUD 1206 Case Analysis Number 2RNoch keine Bewertungen

- 4 Probability AnalysisDokument11 Seiten4 Probability AnalysisLyca TudtudNoch keine Bewertungen

- Chapter 04 AnsDokument4 SeitenChapter 04 AnsDave Manalo100% (1)

- Which Situation Most Likely Violates The IIA's Code of Ethics and The Standards?Dokument5 SeitenWhich Situation Most Likely Violates The IIA's Code of Ethics and The Standards?ruslaurittaNoch keine Bewertungen

- Absorption and Variable Costing Act3Dokument2 SeitenAbsorption and Variable Costing Act3Gill Riguera100% (1)

- Risk Assessment and Response To Assessed RiskDokument8 SeitenRisk Assessment and Response To Assessed RiskJanella PatriziaNoch keine Bewertungen

- Final 2 2Dokument3 SeitenFinal 2 2RonieOlarteNoch keine Bewertungen

- The Risk-Based Audit ProcessDokument16 SeitenThe Risk-Based Audit ProcessCarlo manejaNoch keine Bewertungen

- Expert Q&A SolutionsDokument3 SeitenExpert Q&A SolutionsSitiNadyaSefrilyNoch keine Bewertungen

- Which of The Following Is An Example of Fraudulent Financial Reporting?Dokument2 SeitenWhich of The Following Is An Example of Fraudulent Financial Reporting?accounts 3 lifeNoch keine Bewertungen

- AC13.1.1 Module 1 - Provisions, Contingencies, and Other LiabilitiesDokument15 SeitenAC13.1.1 Module 1 - Provisions, Contingencies, and Other LiabilitiesRenelle HabacNoch keine Bewertungen

- Lyceum of The Philippines University Manila College of Business AdministrationDokument166 SeitenLyceum of The Philippines University Manila College of Business AdministrationVanessa SisonNoch keine Bewertungen

- Excel Professional Services, Inc.: Discussion QuestionsDokument5 SeitenExcel Professional Services, Inc.: Discussion QuestionskæsiiiNoch keine Bewertungen

- At.3006-Planning An Audit of Financial StatementsDokument5 SeitenAt.3006-Planning An Audit of Financial StatementsSadAccountantNoch keine Bewertungen

- AT - CDrill9 - Simulated Examination DIY PDFDokument10 SeitenAT - CDrill9 - Simulated Examination DIY PDFMae100% (1)

- Prof. Ryan C. Roque, CPA, MBADokument109 SeitenProf. Ryan C. Roque, CPA, MBASadAccountantNoch keine Bewertungen

- Final Paper November22Dokument123 SeitenFinal Paper November22SadAccountantNoch keine Bewertungen

- Group 2 Sec 1 Taco LabDokument159 SeitenGroup 2 Sec 1 Taco LabSadAccountant100% (1)

- At.3004-Nature and Type of Audit EvidenceDokument6 SeitenAt.3004-Nature and Type of Audit EvidenceSadAccountantNoch keine Bewertungen

- Excel Professional Services, Inc.: Discussion QuestionsDokument4 SeitenExcel Professional Services, Inc.: Discussion QuestionsSadAccountantNoch keine Bewertungen

- At.3006-Planning An Audit of Financial StatementsDokument5 SeitenAt.3006-Planning An Audit of Financial StatementsSadAccountantNoch keine Bewertungen

- Excel Professional Services, Inc.: Discussion QuestionsDokument5 SeitenExcel Professional Services, Inc.: Discussion QuestionsSadAccountantNoch keine Bewertungen

- Excel Professional Services, Inc.: Discussion QuestionsDokument4 SeitenExcel Professional Services, Inc.: Discussion QuestionsSadAccountantNoch keine Bewertungen

- At.3001 Assurance Engagements Other Services of A PractitionerDokument4 SeitenAt.3001 Assurance Engagements Other Services of A PractitionerSadAccountantNoch keine Bewertungen

- CH 1 Nature of StramanDokument17 SeitenCH 1 Nature of StramanSadAccountantNoch keine Bewertungen

- Contact List 2020Dokument14 SeitenContact List 2020Crawford BoydNoch keine Bewertungen

- Firma Solok Indah: DECEMBER, 2016 Debit Credit Vat-In Freight in Invoice NO Merchandise Inventory Account PayableDokument45 SeitenFirma Solok Indah: DECEMBER, 2016 Debit Credit Vat-In Freight in Invoice NO Merchandise Inventory Account PayableBento HartonoNoch keine Bewertungen

- CFAS Quiz Questions AddedDokument2 SeitenCFAS Quiz Questions AddedSaeym SegoviaNoch keine Bewertungen

- UAE ConfDokument20 SeitenUAE ConfAkshata kaleNoch keine Bewertungen

- Nova Chemical CorporationDokument28 SeitenNova Chemical Corporationrzannat94100% (2)

- Total 1 473 900.00 1 473 900.00Dokument4 SeitenTotal 1 473 900.00 1 473 900.00Angela GarciaNoch keine Bewertungen

- FundamentalsOfFinancialManagement Chapter8Dokument17 SeitenFundamentalsOfFinancialManagement Chapter8Adoree RamosNoch keine Bewertungen

- Parker Economic Regulation Preliminary Literature ReviewDokument37 SeitenParker Economic Regulation Preliminary Literature ReviewTudor GlodeanuNoch keine Bewertungen

- Pontoon PLC A Case StudyDokument6 SeitenPontoon PLC A Case Studyparthasarathi_inNoch keine Bewertungen

- A K Rubber Vetting ReportDokument2 SeitenA K Rubber Vetting ReportSJDKSSDWNoch keine Bewertungen

- Meredith WhitneyDokument13 SeitenMeredith WhitneyFortuneNoch keine Bewertungen

- Appendix I Specimen of Advice of Maturity Date To Term Deposit Account HoldersDokument11 SeitenAppendix I Specimen of Advice of Maturity Date To Term Deposit Account HoldersRuchi SharmaNoch keine Bewertungen

- Tata Group - M&ADokument24 SeitenTata Group - M&Aankur_khushu66100% (1)

- Excel Drill - CAPM & WACCDokument8 SeitenExcel Drill - CAPM & WACCgjlastimozaNoch keine Bewertungen

- Mergers, EtcDokument4 SeitenMergers, EtcflorynmarianNoch keine Bewertungen

- LESSONSDokument151 SeitenLESSONSsmile.wonder12Noch keine Bewertungen

- The Essential Guide To Systems Trading (For Non-Programmers)Dokument29 SeitenThe Essential Guide To Systems Trading (For Non-Programmers)Constantino L. Ramirez III100% (4)

- Account Statement From 1 Jan 2019 To 31 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokument11 SeitenAccount Statement From 1 Jan 2019 To 31 Dec 2019: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceKrishna YadavNoch keine Bewertungen

- Birla Sun Life InsuranceDokument17 SeitenBirla Sun Life InsuranceKenen BhandhaviNoch keine Bewertungen

- Revenue Memorandum Circular No. 09-06: January 25, 2006Dokument5 SeitenRevenue Memorandum Circular No. 09-06: January 25, 2006dom0202Noch keine Bewertungen

- Philippine National Construction Corporation Executive Summary 2019Dokument5 SeitenPhilippine National Construction Corporation Executive Summary 2019reslazaroNoch keine Bewertungen

- Comp Acct G 1 PrelimDokument2 SeitenComp Acct G 1 PrelimTiffanyNoch keine Bewertungen

- Application Form For Clean LoansDokument2 SeitenApplication Form For Clean LoansmaheshNoch keine Bewertungen

- Summer Internship Report On Indian Stock MarketsDokument18 SeitenSummer Internship Report On Indian Stock Marketssujayphatak070% (1)

- Banco CompartamosDokument4 SeitenBanco Compartamosarnulfo.perez.pNoch keine Bewertungen

- Chapter 13Dokument67 SeitenChapter 13HugooNoch keine Bewertungen

- Accpd9629e 2023Dokument5 SeitenAccpd9629e 2023wordsinditeNoch keine Bewertungen

- Accounting STDDokument168 SeitenAccounting STDChandra ShekharNoch keine Bewertungen