Beruflich Dokumente

Kultur Dokumente

PDF Credit Transactions Case Digest Compilation PDF

Hochgeladen von

Marlon SevillaOriginaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

PDF Credit Transactions Case Digest Compilation PDF

Hochgeladen von

Marlon SevillaCopyright:

Verfügbare Formate

lOMoARcPSD|5911403

[PDF] Credit Transactions Case digest compilation

ECE Laws, Contracts, and Ethics (Xavier University-Ateneo de Cagayan)

StuDocu is not sponsored or endorsed by any college or university

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

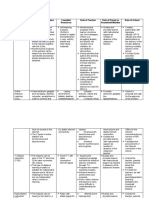

GR 118342, January 5, 1998 DBP VS. CA dispose the property. DBP then thereafter, executed a Deed of

Conditional Sale in favor of Agripina Caperal.

RTC ruled in favor of Cuba declaring that DBP’s

FACTS: takingpossessionandownershipofpropertywithoutforeclosurewas

plainly violative of Article 2088 of the Civil Code or the provision on

Cuba is a grantee of a Fishpond Lease Agreement from the pactum commissorium. RTC also ruled that

Government.SheobtainedloansfromDBPintheamountsof P109, conditionno.12oftheAssignmentofLeaseholdRightswasa clear case

000 and P98, 700 under the terms stated in the of pactum commissorium expressly prohibited and declared null and

promissorynotesandassecurityforsaidloans;sheexecuted two void by Article 2088, Civil Code and concluded that since DBP never

deeds of assignment of her leasehold right. Cuba acquired lawful ownership ofCuba’s leasehold rights, all acts of

however, failed to pay her loan on scheduled dates ownership and possession by bank is void and that the deed

and without foreclosure proceedings, DBP of Conditional Sale in favor

appropriated the Leasehold Rights of Cuba over the fishpond. ofCaperalwasaswellvoidandineffective.

After DBP’sappropriation over the fishpond, DBP in turn Cuba and DBP interposed appeals to CA. CA ruled that RTC

executed a deed of Conditional Sale of the Leasehold Rights erred in declaring the deed of assignment as null and void and

in favor of Cuba over the same fishpond in question. In the that Caperal can validly acquire the leasehold rights and that

negotiation for condition no. 12 of deed of assignment was an express

repurchase,Cubaaddressed2letterstotheManagerofDBP which authority from Cuba for DBP to sell whatever right she had

wasaccepted. over the fishpond.

After the Deed of Conditional Sale was executed in favor of Hence, this petition. ISSUE/

Cuba, a new fishpond lease agreement was issued by the

Ministry of Agriculture and Food in favor of Cuba only S:

excluding her husband. Cuba again failed to pay the 1.WoN the assignment of leasehold rights was a mortgage

amortization as stated in Deed of Conditional Sale and contract (as contended byCuba)

because of this she entered with DBP a temporary

arrangement whereby in consideration for deferment of YES. In all of the promissory notes, there is a provision that

Notarial Rescission of Deed of Conditional Sale, Cuba “inthe event of foreclosure of the mortgage securing this

promised to make certain payments. note, I/Wefurtherbindmyself/ourselves,jointlyandseverally,topaythedeficiency,if

any.” Moreover, in Condition No. 22 of the deed, it was provided

DBP thereafter sent a Notice of Rescission thru Notarial Act that “failure to comply with the terms andcondition of any of the

and was received by Cuba. After the Notice of Rescission, loans shall cause all other loans to become due and

DBPtookpossessionoftheLeaseholdRightsoffishpondand demandable and all mortgages shall

after,advertisedinSUNDAYPUNCHthepublicbiddingto beforeclosed.”Inthef acts stip u la te d, itsta te st ha t“A s secu rit y

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

for loans, plaintiff Lydia P. Cuba executed two Deeds of proceeds to the payment of the loan. This provision is a

Assignment of her leasehold rights.” standard condition in mortgage contracts and is in conformity

with Article 2087 of the Civil Code, which authorizes the

We find no merit in DBP’s contention that the assignmentnovated mortgagee to foreclose the mortgage and alienate the

the promissory notes in that the obligation to pay a sum of mortgaged property for the payment of the principal obligation.

money the loans (under the promissory notes) was

substituted by the assignment of the rights over the fishpond

(under the deed of assignment). The said assignment merely G.R. No. 126800. November 29, 1999. Bustamante vs. Rosel

complemented or supplemented the notes; both could stand

together. Significantly, both the deeds of assignment and the

promissorynoteswereexecutedonthesamedatestheloans were Facts:

granted. Also, the last paragraph of the

assignment stated: “The assignor further reiterates and states all Petitioner borrowed money from respondents for a period of

terms,covenants,andconditionsstipulatedinthepromissorynoteor two years and with interest. The former set up as collateral a

notes covering the proceeds of this loan, making said promissory note parcel of land with apartment thereon to guaranty payment.

or notes, to all intent and purposes, anintegral parthereof.” They also agreed that in the event that she fails to pay,

respondents can buy the collateral for a cheap consideration,

2.WoN condition no. 12 of the deed of assignment constituted inclusive of the principal and interest. When the loan was

pactumcommissorium about to mature, respondents proposed to buy the collateral.

NO.Theelementsofpactumcommissoriumareasfollows:(1) there should Petitioner, however, refused to sell and requested for

be a property mortgaged by way of security for extension of time to pay the loan. She, instead, offered to sell

thepaymentoftheprincipalobligation,and(2)thereshouldbe a stipulation another residential lot. Respondents refused to extend the

for automatic appropriation by the creditor of the thing mortgaged in payment of the loan and to accept the second lot offered. On

case of non-payment of the principal obligation within the maturity date, petitioner tendered payment of the loan to

stipulatedperiod. respondents which the latter refused to accept. They insisted

that a deed of absolute sale of the collateral be executed.

Condition no. 12 did not provide that the ownership over the Respondents then instituted an action for specific performance

leasehold rights would automatically pass to DBP and consignation against petitioner. After demand, petitioner

uponCUBA’s failure to pay the loan on time. It merely provided consigned the amount of the loan plus interest.

forthe appointment of DBP as attorney-in-fact with authority,

among other things, to sell or otherwise dispose of the said The trial court ruled in favor of the petitioner. On the other

realrights,incaseofdefaultbyCUBA,andtoapplythe hand, the Court of Appeals reversed this decision, which the

Supreme Court affirmed. However, petitioner filed a motion for

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

reconsideration. She alleged that she did not fail to pay the thing mortgaged in case of non-payment of the principal

loansothereisnoreasonforrespondenttobuythecollateral; that the obligation within the stipulated period. These elements are

real intention of the parties in putting up the collateral is to guarantee present in this case. Therefore, the stipulation is void. All

the payment of the loan. Respondent, on one hand, contends that persons in need of money are liable to enter into contractual

petitioner failed to pay the loan; that it is their right to purchase the relationships whatever the condition if only to alleviate their

collateral based on the contact which is not contrary to law, morals, financial burden albeit temporarily. Hence, courts are duty

good customs, public order and publicpolicy. bound to exercise caution in the interpretation and resolution

of contracts lest the lenders devour the borrowers like vultures

Issues: do with their prey.

(1)Whetherornotpetitionerfailedtopaytheloanatits

maturitydate.

(2)Whether or not the stipulation in the loan contract was GR 171592

valid andenforceable. ONG. V. ROBAN LENDING CORPORATION, (2008)

Held: Pactum Commissorium, Art. 2087, Art. 2088: Effects

onPledge or Mortgage

Petitionerdidnotfailtopaytheloan.Onthematuritydate,she “

T he SECOND PARTY hereby signed another promissory

tendered the payment which respondents refused. After note with a promise to pay the FIRST PARTY in full within

refusal, she consigned the payment. The sale of the collateral oneyear from the date of the consolidation and restructuring,

is an obligation with a suspensive condition. Since the event otherwise the SECOND PARTY agree to have their “DACION

did not occur, respondents do not have the right to IN PAYMENT” agreement, which they have executed and

demandfulfillment of petitioner’s obligation, especially where the signed today in favor of the FIRST PARTY be enforced”

samewould be disadvantageous to petitioner.

Issue:Whether the contract

The stipulation in the loan contract was not valid and constitutes pactumcommissorium ordacion en

unenforceable. A scrutiny of the stipulation of the parties pago.

revealsasubtleintentionofthecreditortoacquiretheproperty given as

security for the loan. This is embraced in the concept of pactum Held:Pactum Commissorium.

commissorium, which the law prohibits. The elements of pactum

commissorium are as follows: (1) there should be a property mortgaged In the case at bar, the MOA and the Dacion in Payment

by way of security for the payment of the principal obligation, and (2) contain no provisions for foreclosure proceedings nor

there should be a redemption. Under the MOA, the failure by the petitioners to

stipulationforautomaticappropriationbythecreditorofthe pay their debt within the one-year period gives respondent the

right to enforce the Dacion in Payment transferring to it

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

ownership of the properties covered by the TCT. Respondent,

in effect, automatically acquires ownership of the properties It was established from the facts that in the deed of real estate

upon petitioners’ failure to pay their debt within the $mortgage executed between Galas and Villar, the former

stipulatedperiod. appoints the latter to sell the subject &property in case Galas

fails to &ay the loan, and with such, &proceeds shall be

Ø Respondent argues that the law recognizes dacion en a&&lied to her outstanding loan.

pago as a special form of payment whereby the debtor

alienates property to the creditor in satisfaction of a monetary A year later, the same subject &property was subsequently

obligation. mortgaged in favor of Pablo Garcia to secure a loan

amounting to P 1, 800,000.00. afterwards, Galas decided to

This does not persuade. In a truedacion en pago, the sell the subject &property to Villar. deed of sale was executed

assignment of the property extinguishes the monetary debt. between them, and a T-T was issued in favor of Villar.

Aggrieved, Garcia filed a Petition for mandamus with

In the case at bar, the alienation of the properties was by way damages, arguing his main &point that the authority given to

of security, and not by way of satisfying the debt. The Dacion Villaras stipulated in the deed of the real estate $mortgage is

in Payment did not extinguish petitioners’ obligation violative of the prohibition of Pactum -ommissorium.

torespondent. On the contrary, under the MOA executed on

the same day as the Dacion in Payment, petitioners had to It ruled in favor of Garcia. CA appeal, reversed the decision

execute a promissory note which they were to pay within one and ruled in favor of Villar.

year.

issue

That the questioned contracts were freely and 1 whether the authority given to Villar in the deed of real estate

voluntarilyexecuted by petitioners and respondent is of mortgage is violative of the prohibition on pactum

no moment, pactum commissorium being void for being commissorium

prohibited by law.

Held:

Villar’s purchase of the subject property did not violate the

GR158891, June 27, 2012

prohibition on pactum commissorium. The following are the

Garcia vs Villar

elements of pactum commissorium.

1.thereshouldbeapropertymortgagedbywayofsecurityfor

Thecasestemmedfromamortgagetransactioninvolvingalo t owned thepaymentoftheprincipalobligation

by Lourdes Galas in favor of Yolanda Villar. The lot 2.there should be a stipulation for automatic appropriation by

was mortgaged to secure a loan obtained by Galas the creditor ofthe

from Villar in the amount ofP2,200,000.00.

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

thing mortgaged in case of nonpayment of the principal While we agree with Garcia that since the second mortgage, of

obligation within the stipulated period. which he is the mortgagee, has not yet been discharged, we

find that said mortgage subsists and is still

in the case at bar, the owner of attorney provision above did enforceable. However,Villar,in buying the subject property

not provide that ownership over the subject property would with notice that it was mortgaged, only undertook to pay such

automatically pass to Villar upon Galas failure to pay the loan mortgage or allow the subject property to be sold upon failure

on time. hat it granted was the mere appointment of of the mortgage creditor to obtain payment from the principal

Villaras Attorney in fact with authority to sell, or otherwise debtor once the debt matures. Villar did not obligateherselfto

disposed of the subject property, and to apply the proceeds to replace the debtor in the principal obligation, and could not

the payment of the loan. doso in law without the creditor’s consent. Therefore,

theobligation to pay the mortgage indebtedness remains with

Real nature of a mortgage: the original debtors Galas andPingol.

( Article 2126 of the Civil Code)

Art. 2126.The mortgage directlyandimmediately subjects

Effects of a transfer of a mortgaged property to a third person

thepropertyuponwhichitisimposed,whoeverthepossessor According toArt.1879 ofthis Code, the creditor may demand of

maybe,tothefulfillmentoftheobligationforwhosesecurityit the third person in possession of the property mortgaged

wasconstituted. paymentofsuchpartofthedebt,asissecuredbytheproperty in his

possession, in the manner and form established by the

A mortgage is a real right, which follows the property, even law. The Mortgage Lawprovidedthat the debtor should not

after subsequent transfers by the mortgagor.“A paythedebtuponitsmaturityafterjudicialornotarialdemand, for payment

registeredmortgage lien is considered inseparable from the has been made by thecreditorupon him.(Art.

property inasmuch as it is a right inrem.” The sale or transfer of 135 of the Mortgage Law of the Philippines of

themortgaged property cannot affect or release the mortgage; 1889.) According to this, the obligation of the newpossessorto

thus the purchaser or transferee is necessarily bound to pay the debt originated only from the right of the creditor to

acknowledge and respect the encumbrance. In fact, under Art. demandpaymentofhim,itbeingnecessarythatademandfor payment

2129 of the Civil Code, the mortgage on the property may still should have previously been made upon the debtor and the latter

be foreclosed despite the transfer,viz: should have failed topay.And even if these requirements were

Art. 2129.The creditormayclaim from a third person in complied with, still the third possessor might abandon the

possessionofthemortgagedproperty,thepaymentofthepart of the property mortgaged, and in that case it is considered to be in

credit secured by the property which said third person thepossessionof the debtor. (Art. 136 of the same law.) This

possesses, in terms and with the formalities which the clearly shows that the spirit of the Civil

law establishes. Codeistolettheobligationofthedebtortopaythedebtstand although the

property mortgaged to secure the payment of said debt may have

beentransferredto a third person. While

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

the Mortgage Law of 1893 eliminated these provisions, it THE MANILA BANKING CORPORATION vs. ANASTACIO TEODORO, JR. and GRACE ANNA TEODO

containednothingindicatinganychangeinthespiritofthelaw in this G.R. No. L-53955 January 13, 1989

respect. Article 129 of this law, which provides the substitution of the

debtor by the third person in possession of the property, for the

purposes of the giving of notice, does not show this change and has

reference to a case where the action is directed only against the Bidin, J.

property burdened with the mortgage. (Art. 168 oftheRegulation.)

The mere fact that the purchaser of an immovable has notice 1.April 1966, SpousesTeodorotogether with

that the acquired realty is encumbered with a mortgage does TeodoroSrexecutedaPNinfavourofManilaBankingCorp(MBC);

not render him liable for the payment of the debt guaranteed - Payablewithin120 days(untilAug), with

bythemortgage,intheabsenceofstipulationorconditionthat 12%interestperannum;

heistoassumepaymentofthemortgagedebt. - They failed to pay and left balance of 15k as of

September1969;

Reason:the mortgage is merely an encumbrance on the 2.May and June 1966, executedtwoPNs;

property, entitling the mortgagee to have the property - 8k and1krespectivelypayablewithin120daysand 12%

foreclosed,i.e.,sold,incasetheprincipalobligordoesnotpay the perannum;

mortgage debt, and apply the proceeds of the sale to the satisfaction of - Theymadepartial payment butstillleft 8.9kbalanceas of

his credit.Mortgage is merely an accessory undertaking for the September1969;

convenience and security of the mortgage creditor, and exists 3.Ita p p e a r s t h a n i n 1964,T e o d o r o J r executeda D e e d o f

independently of the obligation to pay the debt secured by it. Assignment of Receivables in favour of MBC from

The mortgagee, if he is so minded, can waive the mortgage Emergency Employment Administration;

security and proceed to collect the principal debt by personal - Amounted to44k;

action against the original mortgagor - The deed provided it was forconsiderationof certain

credits, loans, overdrafts and other credit

accommodations extended to the spouses and

Teodoro Sr as security for the payment of said sum

and interest thereon; and that they release and

quitclaim all its rights, title and interest in the

receivables;

4.Inthestipulationsoffact,itwasadmittedbytheparties:

- ThatMBCextended loans to thespousesand Teodoro Jr

because of certain contracts entered into by latter

withE E A f o r f a b r i c a t i o n o f f i s h i n g b o a t s a n d t h a t t

he

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

llee bank and correspondingly Philippine Fisheries

the assignment Commission

shall succeeded

also extend to EEA after

all the accounts receivable; appellants shall also obtain in the future, until the consideration on the loans secured by

its abolition;

- Thatnon-paymentof

w of the following provisions the PNs was due to failure of the

of the deed of assignment:

Commission

pplied by appellants, first par., to payspouses;

Deed of Assignment).

- That the Bank tookstepsto collect

hatever the fromtheCommissionbutnocollectionwaseffected;

5.For failure of thespousesand Teodor Sr topay,MBC instituted

againstthem;

- Teodoro Sr subsequently died so suit only

againstthespouses;

gnment of the receivables did not result from a sale transaction. It cannot be said to have been constituted by virtue of a dation in payment for appellants' loans with the bank evidence

6.TCfavouredMBC;MFRdenied;

- Spouses appealedto CAbut since issue pure question

oflaw,CAforwardedtoSC;

Issues:

W/N the assignment of receivables has the effect of payment

of all the loans contracted by the spouses; NO.

W/N MBC must exhaust all legal remedies against PFC before

it can proceed against the spouses. NO.

Ratio:

The assignment of receivables executed by appellants did not transfer the ownership of the receivables to appellee bank and release appellants from their loans w

The Deed of Assignment provided that it was for and in consideration of certain credits, loans, overdrafts, and their credit accommodations extended to appellant

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

as she

nts, as a continuing guaranty for whatever sums would be owing by defendants to plaintiff, as stated claims to have

in stipulation No. 9 substantial

of the deed. deposits and money market

placements with the petitioners and other investment

companies, the proceeds of which were supposedly deposited

automatically and directly to her account with Citibank.

Sabeniano alleged that Citibank et al refused to return her

deposits

ithout the need of the consent of the debtor, transfers his credit and its accessory rights to another, known and

as the

the proceeds of her

assignee, who money

acquires themarket

powerplacements

to enforce it to the same extent as

despite her repeated demands, thus, the civil case

for"Accounting, Sum of Money and Damages.”

In their reply, Citibank et al admitted that Sabeniano had

deposits and money market placements with them, including

dollar accounts in other Citibank branches. However, they also

alleged that respondent later obtained several loans from

Citibank, executed through Promissory Notes and secured by

a pledge on her dollar accounts, and a deed of assignment

against her MMPS with FNCB Finance. When Sabeniano

CITIBANK, N.A. & INVESTOR FINANCE CORPORATION V. defaulted, Citibank exercised its right to off-set or compensate

SABENIANO respondent's outstanding loans with her deposits and money

market placements, pursuant to securities she executed.

Facts: Citibank supposedly informed Sabeniano of the foregoing

compensation through letters, thus, Citibank et al were

This is a case involving Citibank, N.A., a banking corporation surprised when six years later, Sabeniano and her counsel

duly registered under US Laws and is licensed to do made repeated requests for the withdrawal of respondent's

commercial banking and trust functions in the Philippines and deposits and MMPs with Citibank, including her dollar

Investor's Finance Corporation (aka FNCB Finance), and accounts with Citibank-Geneva and her money market

affiliate company of Citibank, mainly handling money market placements with petitioner FNCB Finance. Thus, petitioners

placements(MMPs are short term debt instruments that give prayed for the dismissal of the Complaint and for the award of

the owner an unconditional right to receive a stated, fixed sum actual, moral, and exemplary damages, and attorney's fees.

of money on a specified date). The case was eventually decided after 10 years with the

Judge declaring the offsetting done as illegal and the return of

ModestaR.SabenianowasaclientofbothpetitionersCitibank and FNCB theamountwithlegalinterest,whileSabenianowasorderedto pay her

Finance.Unfortunately, the business relations among the parties loans to Citibank. The ruling was then appealed. TheCA modified the

subsequently went awry. Subsequently, decision but only to the extent of Sabeniano’s loans

SabenianofiledacomplaintwiththeRTCagainstpetitioners

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

whichitruledthatCitibankfailedtoestablishtheindebtedness and is

also without legal and factual basis. The case was thus appealed to By June 1979, all of respondent's PNs in the second

theSC. set had matured and became demandable, while respondent's

savings account was demandable anytime. Neither was there

Issue: any retention or controversy over the PNs and the deposit

Whether or not there was a valid off setting/compensation of account commenced by a third person and communicated in

loan vis a vis the a.)Deposits and b.) MMPs. due time to the debtor concerned. Compensation takes place

by operation of law.

Held:

2.Yes, but technically speaking Citibank did not effect a legal

General Requirement of Compensation: compensation or off-set under Article 1278 of the Civil Code,

Art. 1278. Compensation shall take place when two persons, but rather, it partly extinguished respondent's obligations

in their own right, are creditors and debtors of each other. throughtheapplicationofthesecuritygivenbytherespondent for her

Art. 1279. In order that compensation may be proper, it is loans. Respondent's money market placements were

necessary; withpetitionerFNCBFinance,andafterseveralroll-overs,they were

(1)That each one of the obligors be bound principally, ultimately covered by PNs No. 20138 and 20139, which, by 3

and that he be at the same time a principal creditor of the September 1979, the date the check for the proceeds of the said PNs

other; were issued, amounted to P1,022,916.66, inclusive of the principal

(2)Thatbothdebtsconsistinasumofmoney,orifthe things amountsandinterests.

due areconsumable,they be of the same kind, and As to thesemoneymarketplacements, respondentwas

alsoofthesamequalityifthelatterhasbeenstated; the creditor and petitioner FNCB Finance the debtor (thereby

(3)That the two debts bedue; implying that money market placement is a simple

(4)That they be liquidated anddemandable; loanormutuum);while,astotheoutstandingloans,petitioner

(5)That over neither of them there be any retention or Citibankwasthecreditorandrespondentthedebtor.

controversy,commencedby third persons andcommunicatedin Consequently, legal compensation, under Article 1278

due time to thedebtor. of the Civil Code, would not apply since the first requirement

for a valid compensation, that each one of the obligors be

1.Yes.AsalreadyfoundbythisCourt,petitionerCitibankwas the creditor bound principally, and that he be at the same time a principal

of respondent for her outstanding loans. At the creditor of the other, was not met. What petitioner Citibank

sametime,respondentwasthecreditorofpetitionerCitibank, as far as her actually did was to exercise its rights to the proceeds of

deposit account was concerned, since bank deposits, whether fixed, respondent's money market placements with petitioner FNCB

savings, or current, should be considered as simple loan or mutuum Finance by virtue of the Deeds of Assignment executed by

by the depositor to the respondent in its favor. Petitioner Citibank was only acting

bankinginstitution.Bothdebtsconsistinsumsofmoney. upon the authority granted to it under the foregoing Deeds

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

when it finally used the proceeds of PNs No. 20138 and They executed a deed of real estate mortgage of the said

20139, paid by petitioner FNCB Finance, to partly pay for property in favor of petitioner Prudential Bank to secure the

respondent's outstanding loans. Strictly speaking, it did not payment of a loan worth P250,000.00. (PN BD#75/C-252) was

effect a legal compensation or off-set under Article 1278 of the then issued covering the said loan, which provides that the

Civil Code, but rather, it partly extinguished respondent's loan matured on 4 August 1976 at an interest rate of 12% per

obligations through the application of the security given by the annum with a 2% service charge, and that the note is secured

respondent for her loans. Although the pertinent documents by a real estate mortgage as aforementioned with a“blanket

were entitled Deeds of Assignment, they were, in reality, more mortgage clause” or the “dragnet clause”.

of a pledge by respondent to petitioner Citibank of her credit

due from petitioner FNCB Finance by virtue of her money The spouses thereafter issued other promissory notes (PN):

market placements with the latter. According to Article 2118 of PN BD#76/C-345 for P2,640,000.00, secured by D/A

the Civil Code

SFDX#129, signifying that the loan was secured by a “hold -out”

–

on the mortgagor’s foreign currency savings account with the

ART. 2118. If a credit has been pledged becomes due before

bank under Account No. 129 in the name of Donalco

it is redeemed, the pledgee may collect and receive the

Trading, Inc., PN BD#76/C-430 covering P545,000.000 to

amount due. He shall apply the same to the payment of his

besecured by “Clean-Phase out TOD CA 3923. Bank also

claim, and deliver the surplus, should there be any, to the

mentioned in their approval letter that additional securities for

pledgor.

the loan were the deed of assignment on two PNs executed

by Bancom Realty and the chattel mortgage on various

heavy andtransportationequipment.

GR150197, July 28, 2005 PRUDENTIAL BANK VS ALVIAR

Spoused Alviar paid petitioner P2,000,000.00, to be applied to

the obligations of G.B. Alviar Realty and Development, Inc.

Doctrine:

and for the release of the real estate mortgage for

the P450,000.00 loan covering the two (2) lots in San Juan,

The “dragnet clause” in the first security instrument constituted a

Metro Manila. The payment was acknowledged by petitioner

continuing offer by the borrower to secure further loans under

who accordingly released the mortgage over the two

the security of the first security instrument, and that

properties Prudential Bank moved for the extrajudicial

whenthelenderacceptedadifferentsecurityhedidnotaccept the foreclosureofthemortgageonthepropertysincerespondents had the

firstoffer. total obligation of P1,608,256.68, covering the three (3) promissorynotes.

Facts:

Respondents then filed a complaint for damages with a prayer

Spouses Alviar are the registered owners of a parcel of land in for the issuance of a writ of preliminary injunction with

San Juan, Metro Manila

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

the RTC of Pasig,[11] claiming that they have paid their mortgage contract. This ambiguity shall be interpreted strictly

principalloansecuredbythemortgagedproperty,andthusthe mortgage against petitioner for having drafted the same.

should not beforeclosed

RTC, on its final decision, favored respondents saying that the Petitioner, however, is not without recourse. Both the lower

extrajudicial foreclosure was improper for the mortgage only courts found that respondents have not yet paid

covers the first loan of P250,000 the P250,000.00. Thus, the mortgaged property could still be

CA affirmed the decision of the RTC properly subjected to foreclosure proceedings for the

unpaid P250,000.00 loan, and as mentioned earlier, for any

Issue: WON real estate mortgage secures only the first loan of deficiency after D/A SFDX#129, security for PN BD#76/C-345,

P250,000. has been exhausted, subject of course to defenses which are

available to respondents.

Held: Yes. While the existence and validity of the “dragnet

clause” cannot bedenied, there is a need to respect the Petition is DENIED. CA affirmed.

existence of the other securities given for the two other

promissorynotes.The foreclosure of themortgagedproperty

should only then be for theP250,000.00 loan covered by PN

BD#75/C-252,andforanyamountnotcoveredbythesecurity for the G.R. No. L-17500

second promissorynote. People's Bank and Trust Co. v. Dahican Lumber Co.,

Petitioner and respondents intended the real estate mortgage

to secure not only the P250,000.00 loan from the petitioner, Facts:

but also future credit facilities and advancements that may be Dahican Lumber Co. (DALCO) obtained a loan from People's

obtained by the respondents. However, the subsequent loans Bank and Trust Co. (Bank) secured by a deed of mortgage

obtained by respondents were secured by other securities. covering 5 parcels of land together with all the buildings and

other improvements existing thereon and all the personal

When the mortgagor takes another loan for which another properties of DALCO located in its place of business.

security was given it could not be inferred that such loan was

made in reliance solely on the original security with After the day of the execution of the mortgage, DALCO

the“dragnet clause,” but rather, on the new security given.This purchased various machinery, equipment, spare parts and

isthe “reliance on the securityt e s t . ” supplies.

If the parties intended that the “blanket mortgage clause” Pursuant to the provision of the mortgage deeds regarding

shallcover subsequent advancement secured by separate "after acquired properties", the Bank requested DALCO to

securities, then the same should have been indicated in the submit complete list of the said properties but DALCO refused

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

to do so.

Issue:

nk to petitioners.- The bank responded and said that petitioners were notified of the auction sale by the posting of notices and the publication of notice in the Metropolitan Newsweek, a n

Whether or not the "after acquired properties" were subject to

hat the foreclosure was the violative

deed of mortgage.

of the provisions of the mortgage contract, specifically paragraph (k) thereof which provides:

Held:

ct of sending any correspondence by mail or by personal delivery to the said address shall be valid and effective notice to the Mortgagor for all legal purposes, and the fact that any communication is not a

Yes, they are subject to the deeds of mortgage.

act and that

Article 415 of the Civil Code does not define real property but

enumerates what are considered as such, among them being

machinery, receptacles, instruments or replacements intended

by owner of the tenement for an industry or works which may

be carried on in a building or on a piece of land, and shall tend

directly to meet the needs of the said industry or works.

The chattels or the "after acquired properties" were placed in

the real properties mortgaged to the Bank. They came within

the operation of Article 145.

Hence, the "after acquired properties" were subject to the deed

of mortgage.

ebruary 7, 1991

Court of Valenzuela, Metro Manila for annulment and/or declaration of nullity of the extrajudicial foreclosure proceedings over their mortgaged properties, with damages,

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

the mortgagee was appointed atty-in-fact with full powers upon any breach of the obligations in the contract.- The RTC issued an order denying petitioners' motion for summ

Issue:

Whether or not summary judgment was proper

HELD:

YES. The Rules of Court authorize the renditi on of a summary judgmenti f the pleadings, depositions and admissions on file, together with the affidavit

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

matter of law that there is no defense to the action or that the claim is clearly meritorious.

Reasoning

Private respondent tacitly admitted in its answer to petitioners' request for admission that it did not send any formal notice of foreclosure to petitioners. Stated otherwise, and a

illusory Art. 1306. And as the record is bereft of any evidence which even impliedly indicatethat the

required notice of the extrajudicial foreclosure was ev

er sent to the debtor mortgag or, the extrajudicial foreclosure proceedings on the property in question are fatally defective and are not binding on the debtor-mo

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

MANUEL D. MEDIDA, Deputy Sheriff of the Province of

Cebu, CITY SAVINGS BANK (formerly Cebu City Savings and Loan Association, Inc.) and TEOTIMO ABELLANA, petitioners, vs. COURT OF APPEALS and SPS. ANDRES DOLINO and

Facts:

Private respondents, Spouses Dolino, alarmed of losing their right of redemption over thesubject parcel of land from Juan Gandiocho, purchaser of the aforesaid l

Association, Inc.), to obtain a loan of P30, 000. Prior thereto, their son Teofredo filed a similar loan application and the subject lot was offered as security. Subseq

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

CSB. Sps. Dolino then filed a case to annul the sale at public auction and for the cancel

Issue:

Whether or not a mortgage, whose property has been extrajudicially foreclosed and s

Held:

It is undisputed that the real estate mortgage in favor of petitioner bank was executed

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

Article. 2085 of the Civil Code for the constitution of another of all the subject properties to its name. The petitioners

thereafterwherein

mortgage on the property. To hold otherwise would create an inequitable situation filed a the

Complaint

mortgagor against

wouldthe PNB before

be deprived theopportunity,

of the RTC of which may be h

Mandaue City for Declaration of Nullity of Extrajudicial

Foreclosure of Mortgage.

RTC rendered its Decision for declaration of nullity of the

extrajudicial foreclosure of mortgage, the certificate of sale and

certificate of finality of sale owing to the failure of PNB as the

winning bidder to GR deliver to the petitioners the amount of its

170215

bidor even just the amount

SUICO v. in excess of petitioners’ obligation.

PNB

When the PNB appealed its case to CA, it reversed and set

FACTS: aside the questioned decision of the RTC declaring that the

SpousesSuico,obtainedloanfromPNBsecuredbyareal extra judicial foreclosure of mortgage, including the certificate

estatemortgageonfiveoftheirproperties.Thepetitioners were of sale and final deed of sale executed appurtenant thereto are

unable to pay theirobligation. hereby declared to be valid and binding.

PNB filed a petition for extrajudicial foreclosure of Petitioners filed a Motion for Reconsideration but the Court of

mortgageconstituted on the petitioners’ properties. Appeals maintained the validity of the foreclosure sale and, in

PNB,as lonebidder, offered a bid in the amount of P8, its Amended Decision, merely directing PNB to pay the

511,000.00. A Certificate of Sale of the subject properties deficiency in the filing fees

was issued in favor of PNB. However, PNB did not pay to the

Sheriff who conducted the ISSUES:

auctionsaletheamountofitsbidwhichwasP8,511,000.00or give an

accounting of how said amount was applied againstpetitioners’ 1. WoN the discrepancy between the amount of

outstanding loan, which according to thepetitioners, as of 10 petitioners’obligationasreflectedintheNoticeofSaleandtheamoun

March 1992, amounted only to t actuallydueandcollectedfromthepetitionersatthetimeof the

P1,991,770.38.Sincetheamountofthebidgrosslyexceededthe auction sale constitute fraud which renders the

amount of petitioners’ outstanding obligation as stated in the extrajudicialforeclosuresalenullandvoid.

extrajudicial foreclosure of mortgage, it was the legal duty of 2. WoNthefailureofPNBtopayandtenderthepriceofitsbid or the

the winning bidder, PNB, to deliver to the Sheriff the bid price surplus thereof to the sheriff nullifies the extrajudicial foreclosure.

or what was left thereof after deducting the amount

ofpetitioners’ outstandingobligation. HELD:

PNBfailedtodelivertheamountoftheirbidtotheSheriffor,atthe very 1.No.

least, the amount of such bid in excess of petitioners’ outstanding

obligation. One year after issuanceofthe Certificate of Sale,

PNB secured a Certificate of Final Sale

fromtheSheriffand,asaresult,PNBtransferredregistration

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

Notices are given for the purpose of securing bidders and to such encumbrancers or there be a balance or residue after

prevent a sacrifice of the property. If these objects are payment to them, then to the mortgagor or his duly authorized

attained, immaterial errors and mistakes will not affect the agent, or to the person entitled to it.

sufficiency of the notice; but if mistakes or omissions occur in

the notices of sale, which are calculated to deter or mislead Under the above rule, the disposition of the proceeds of the

bidders, to depreciate the value of the property, or to prevent it sale in foreclosure shall be as follows:

from bringing a fair price, such mistakes or omissions will be (a)first,paythecosts(b)secondly,payoffthemortgagedebt

fatal to the validity of the notice, and also to the sale made (c)thirdly,paythejuniorencumbrancers,ifanyintheorderof priority (d)

pursuant thereto. fourthly, give the balance to the mortgagor, his agent or the person

The purpose of the publication of the Notice of Sheriff’s Sale is to entitled toit.

inform all interested parties of the date, time and place of

theforeclosuresaleoftherealpropertysubjectthereof. The application of the proceeds from the sale of the

Logically, this not only requires that the correct date, time and mortgaged property to the mortgagor's obligation is an act of

place of the foreclosure sale appear in the notice, but also that payment, not payment by dacion; hence, it is the mortgagee's

any and all interested parties be able to determine that what is dutytoreturnanysurplusinthesellingpricetothemortgagor. Perforce, a

about to be sold at the foreclosure sale is the real property in mortgagee who exercises the power of sale contained in a mortgage

which they have an interest. is considered a custodian of the fund and, being bound to apply it

All these considered, the Court held that the Notice of Sale in properly, is liable to the persons

this case is valid. There is no showing that the difference entitledtheretoifhefailstodoso.Eventhoughthemortgagee is not

between the amount stated in the Notice of Sale and strictly considered a trustee in a purely equitable sense, but as far as

theamount of PNB’s bid resulted in discouraging or concerns the unconsumed balance, the mortgagee is deemed a

misleadingbidders, depreciated the value of the property or trustee for the mortgagor or owner of the equity ofredemption.

prevented it from commanding a fair price. Thus it has been held that if the mortgagee is retaining more of

the proceeds of the sale than he is entitled to, this fact alone

2.No. will not affect the validity of the sale but simply give the

mortgagor a cause of action to recover such surplus.

Rule 68, Section 4 of the Rules of Court provides:

SEC. 4. Disposition of proceeds of sale.- The amount realized

fromtheforeclosuresaleofthemortgagedpropertyshall,after deducting GR 176019

the costs of the sale, be paid to the person foreclosing the mortgage, BPI FAMILY SAVINGS BANK v. GOLDEN POWER DIESEL SALES

and when there shall be any

balanceorresidue,afterpayingoffthemortgagedebtdue,the same shall

be paid to junior encumbrancers in the order of FACTS:

theirpriority,tobeascertainedbythecourt,oriftherebeno

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

CEDECTransport,Inc.mortgaged2parcelsoflandsituatedin implementation saying that it should not affect 3rd persons

Malibay,PasayCity,includingalltheimprovementsthereon,in favor of BPI holdingadverserightstothejudgmentthatthefirstwritfailedto

Family to secure a loan of P6, 570, 000. On the same day, mortgage consider respondent’s claim of ownership in another

was duly annotated on titles. CEDEC obtained from BPI Family courtandthatrespondentsareinactualpossession.

additional loans of P2, 160, 000 and P1, 140, 000, respectively, and BPI moved to reconsider but was denied which was then

again mortgaged same affirmed by CA. Hence, present petition.

properties.Theselattermortgagesweredulyannotatedonthe ISSUE:

titlesrespectively,onthesamedaytheloanswereobtained. 1.Whetherornot GPD is a3rd partyin possession who

Despite demand, CEDEC defaulted in its mortgage

hasadverseinterestagainstdebtorormortgagor

obligations. BPI Family filed a verified petition for extrajudicial

foreclosure of real estate mortgage over the properties. After HELD:

due notice and publication, Sheriff sold the properties at public No.

auction. BPI Family, as highest bidder, acquired properties In extrajudicial foreclosures of real estate mortgages, the

forP13, 793, 705.31. Certificate of Sheriff’s sale was then issuance of a writ of possession is governed by Section 7 of

dulyannotated on titles covering properties. Act No. 3135. This procedure may also be availed of by the

Despite several demand letters, CEDEC refused to vacate purchaser seeking possession of the foreclosed property

properties and to surrender possession to BPI Family. BPI bought at the public auction sale after the redemption period

Family filed an ex-parte petition for writ of possession over the has expired without redemption having been made.

properties which were granted by the trial court. Then, Golden

Power Diesel (GPD) and Renato Tan motioned to hold the The general rule is that a purchaser in a public auction sale of

implementation of writ alleging that they are in possession of a foreclosed property is entitled to a writ of possession and,

the properties as allegedly acquired from CEDEC pursuant to upon an ex parte petition of the purchaser, it is ministerial

a deed of absolute sale. upon the trial court to issue the writ of possession in favor of

GPD argued that they are 3rd persons claiming rights adverse the purchaser. There is, however, an exception. In an

to CEDEC and cannot be deprived of possession over extrajudicial foreclosure of real property, when the foreclosed

properties. Also, they filed a complaint in RTC for property is in the possession of a third party holding the

cancellationof Sheriff’s certificate sale and an order to direct BPI same adversely to the judgment obligor, the issuance by the

to honor and accept the deed of sale between CEDEC and trial court of a writ of possession in favor of the purchaser of

respondents. RTC however, denied the motion. An alias writ saidrealpropertyceasestobeministerialandmaynolonger

wasthenissuedwhichexpiredwithoutbeingimplementedand another bedoneexparte.Theprocedureisforthetrialcourttoorder

one was later issued but before it could be ahearingtodeterminethenatureoftheadversepossession. For the

implemented,RenatoTanfiledanaffidavitof3rd partyclaimon exception to apply, however, the property need not only be possessed

properties.Insteadofimplementingthewrit,Sherifftransferred by a third party, but also held by the third

themattertoRTCforresolution.RTCsuspendedthe partyadverselytojudgmentobligor.Unfortunately,forthe

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

Bank of Sta. Barbara (Iloilo), Inc. as security for a P1,753.65

loan. Sps. Centeno, however, defaulted on the loan, prompting

petitioner to cause the extrajudicial foreclosure of the said

mortgage. Consequently, the subject lots were sold to

favor of the BPI FAMILY.”

petitioner being the highest bidder at the auction sale. On

instruments and does hereby further agree to be bound by the precise terms and conditions therein contained.”

October 10, 1969, it obtained a Certificate of Sale at Public

Auction[4]which was later registered with the Register of Deeds

CEDEC, they merely stepped into CEDEC’s shoes and are bound to acknowledge and respect the mortgage CEDEC

of Iloilo City on had executed

December in 1971.

13, favor of

[5] BPI Family. Respondents are thesuccessors-in-

Sps. Centeno failed to redeem the subject lots within the one

(1) year redemption period pursuant to Section 6[6] of Act No.

3135.[7]Nonetheless, they still continued with the possession

and cultivation of the aforesaid properties. Sometime in 1983,

respondent Gerry Centeno, son of Sps. Centeno, took over the

cultivation of the same. On March 14, 1988, he purchased the

said lots from his parents. Accordingly, Rosario Centeno paid

the capital gains taxes on the sale transaction and tax

declarations were eventually issued in the name of

respondent.[8] While the latter was in possession of the subject

lots, petitioner secured on November 25, 1997 a Final Deed of

Sale thereof and in 1998, was able to obtain the corresponding

tax declarations in its name.[9]

On March 19, 1998, petitioner filed a petition for the issuance

of a writ of possession before the RTC, claiming entitlement to

the said writ by virtue of the Final Deed of Sale covering the

G.R. No. 200667 subject lots.[10] Respondent opposed the petition, asserting

Rural Bank of Sta. Barbara v. Centeno that he purchased and has, in fact, been in actual, open and

exclusive possession of the same properties for at least fifteen

Facts: (15) years.[11] He further averred that the foreclosure sale was

null and void owing to the forged signatures in the real estate

SpousesGregorioandRosarioCenteno(Sps.Centeno)were the mortgage. Moreover, he claims that petitioner's rights over the

previous owners of the subject lots. During that time, they subject lots had already prescribed.[12]

mortgagedtheforegoingpropertiesinfavorofpetitionerRural

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

title, to a purchaser in an extrajudicial foreclosure sale

becomes merely a ministerial function,[17] unless it appears

Ruling of the RTC that the property is in possession of a third party claiming a

On October 8, 2002, the RTC rendered its Decision[13] in right adverse to that of the mortgagor. [18] The foregoing rule is

Cadastral Case No. 98-069, finding petitioner to be the lawful contained in Section 33, Rule 39 of the Rules of Court which

ownerofthesubjectlotswhoserightsbecameabsolutedueto partly provides:

respondent's failure to redeem the same. Consequently, it found the

issuance of a writ of possession ministerial on its part.

[14]

Dissatisfied,respondentappealedtotheCA. Sec.33.Deedandpossessiontobegivenatexpirationofredemption

period; by whom executed orgiven.

Ruling of the CA xxxx

The CA, through its January 31, 2012 Decision,[15] reversed

the RTC and ruled against the issuance of a writ of Upontheexpirationoftherightofredemption,thepurchaserorredemptionershallb

possession. It considered respondent as a third party who is esubstitutedtoandacquirealltherights,title,interestandclaimofthejudgmento

actually holding the property adverse to the judgment obligor bligortothepropertyasofthetimeofthelevy.Thepossessionofthe

and as such, has the right to ventilate his claims in a proper property shall be given to the purchaser or last redemptioner by

judicial proceeding i.e., an ejectment suit or reinvindicatory the same officer unless a third party is actually holding the

action.[16]Aggrieved, petitioner filed the instant petition. property adversely to the judgment

obligor. (Emphasisandunderscoringsupplied)

Issue Before The Court InChina Banking Corporation v. Lozada,[19] the Court held that

The sole issue in this case is whether or not petitioner is thephrase"athirdpartywhoisactuallyholdingtheproperty

entitled to a writ of possession over the subject lots. adverselytothejudgmentobligor"contemplatesasituationin

whichathirdpartyholdsthepropertybyadversetitleorright, such as that of a co-

owner, tenant or usufructuary. The co- owner, agricultural tenant, and

The Court's Ruling usufructuary possess the property in their own right, and they arenot

merely the successor or transferee of the right of

The petition is meritorious. possession of anotherco-ownerortheowneroftheproperty.

[20]

It is well-established that after consolidation of title in the Notably,thepropertyshouldnotonlybepossessedbyathirdparty,butalsoheld

purchaser's name for failure of the mortgagor to redeem the bythethirdpartyadversely to the judgmentobligor.[21]

property, the purchaser's right to possession ripens into the

absoluterightofaconfirmedowner.Atthatpoint,theissuance

ofawritofpossession,uponproperapplicationandproofof

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

Barotac Viejo, Iloilo City, Branch 66 in Cadastral Case No. 98-

In this case, respondent acquired the subject lots from his 069 is herebyREINSTATED. SO ORDERED.

parents,Sps.Centeno,onMarch14,1988aftertheywere

purchasedbypetitioneranditsCertificateofSaleatPublic March 13, 2013

Auction was registered with the Register of Deeds of Iloilo City GOLDENWAY MERCHANDISING CORPORATION VS EQUITABLE PCI BANK

in 1971. It cannot therefore be disputed that respondent is a

mere successor-in-interest of Sps. Centeno. Consequently, he

cannot be deemed as a "third party who is actually holding the DOCTRINE: Section 47 did not divest juridical persons of

property adversely to the judgment obligor" under legal the right to redeem their foreclosed properties but only

contemplation. Hence, the RTC had the ministerial duty to modified the time for the exercise of such right by

issue as it did issue the said writ in petitioner's favor. reducing the one-year period srcinally provided in Act No.

3135. The new redemption period commences from the

On the issue regarding the identity of the lots as raised by date of foreclosure sale, and expires upon registration of

respondentinhisComment,[22] recordsshowthattheRTChad already the certificate of sale or three months after foreclosure,

passed upon petitioner's title over the subject lots during the course of whichever is earlier. There is likewise no retroactive

the proceedings. Accordingly, the identity of the said lots had already applicationofthenewredemptionperiodbecauseSection

been established for the purpose of issuing a writ of possession. It is 47exemptsfromitsoperationthosepropertiesforeclosed prior to its

hornbook principle that absent any clear showing of abuse, effectivity and whose owners shall retain their redemption rights

arbitrariness or capriciousnesscommittedby the lower court, its under Act No.3135.

findings of facts are binding and conclusive upon theCourt,

[23]

asin thiscase. FACTS:

On November 29, 1985, petitioner Goldenway Merchandising

Finally, anent the issue of laches, it must be maintained that Corporation executed a Real Estate Mortgage in favour of

the instant case only revolves around the issuance of a writ of Equitable PCI Bank over three parcels of land as security for a

possession which is merely ministerial on the RTC's part as Php2,000,000 loan granted to the petitioner. Petitioner

above-explained. As such, all defenses which respondent may eventually failed to settles its loan obligation, leading

raise including that of laches should be ventilated through a respondent to extrajudicially foreclose the mortgage on

proper proceeding. December 13, 2000. Subsequently, a Certificate of Sale was

issued to respondent on January 26, 2001. In a letter dated

WHEREFORE, the petition isGRANTED. The January 31, March 7, 2001, petitioner offered to redeem the foreclosed

2012DecisionoftheCebuCityCourtofAppealsinCA-G.R. properties by tendering a check. Petitioner and respondent

CVNo.78398isREVERSED andSETASIDE. Accordingly, met on March 12, 2001. However, petitioner was told that

theOctober8,2002DecisionoftheRegionalTrialCourtof redemption was no longer

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

possible since the certificate of sale had already been But under Sec 47 of RA 8791, an exception is thus made in

registered; the title to the foreclosed properties were the case of juridical persons which are allowed to exercise the

consolidated in favor of the respondent on March 9, 2001. right of redemption only "until, but not after, the registration of

Petitioner filed a complaint for specific performance and the certificate of foreclosure sale" and in no case more than

damages contending that the 1-year period of redemption three (3) months after foreclosure, whichever comes first.

under Act 3135 should apply, and not the shorter redemption

periodunderRA8791asapplyingRA8791wouldresultinthe Section 47 did not divest juridical persons of the right to

impairment of obligations of contracts and would violate the equal redeem their foreclosed properties but only modified the time

protection clause underthe for the exercise of such right by reducing the one-year period

constitution. The RTC dismissed the action of the petitioner srcinally provided in Act No. 3135. The new redemption period

ruling that redemption was made belatedly and that there was commences from the date of foreclosure sale, and expires

no redemption made at all. upon registration of the certificate of sale or three months after

The Court of Appeals affirmed the RTC. foreclosure, whichever is earlier. There is likewise no

retroactive application of the new redemption period because

Section 47 exempts from its operation those properties

ISSUE: foreclosed prior to its effectivity and whose owners shall retain

their redemption rights under Act No. 3135.

Whether or not the redemption period should be the 1-year

period provided under Act 3135, and not the shorter period We agree with the CA that the legislature clearly intended to

under RA 8791 as the parties expressly agreed that shorten the period of redemption for juridical persons whose

foreclosure would be in accordance with Act 3135 properties were foreclosed and sold in accordance with the

provisions of Act No. 3135.

RULING:

The difference in the treatment of juridical persons and natural

The shorter period under RA 8791 should apply. persons was based on the nature of the properties foreclosed

The one-year period of redemption is counted from the date of – whether these are used as residence, for which the more

the registration of the certificate of sale. In this case, the liberal one-year redemption period is retained, or used for

parties provided in their real estate mortgage contract industrial or commercial purposes, in which case a shorter

thatupon petitioner’s default and the latter’s entire loan term is deemed necessary to reduce the period of uncertainty

obligationbecoming due, respondent may immediately in the ownership of property and enable mortgagee-banks to

foreclose the mortgage judicially in accordance with the Rules dispose sooner of these acquired assets. It must be

of Court, or extrajudicially in accordance with Act No. 3135, as underscored that the General Banking Law of 2000, crafted in

amended. the aftermath of the 1997 Southeast Asian financial crisis,

sought to reform the General Banking Act of 1949 by

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

fashioning a legal framework for maintaining a safe and sound Court has time and again emphasized, is undeniably imbued

banking system. In this context, the amendment introduced by with public interest.

Section 47 embodied one of such safe and sound practices

aimed at ensuring the solvency and liquidity of our banks. It Having ruled that the assailed Section 47 of R.A. No. 8791 is

cannot therefore be disputed that the said provision amending constitutional, we find no reversible error committed by the CA

the redemption period in Act 3135 was based on a reasonable in holding that petitioner can no longer exercise the right of

classification and germane to the purpose of the law. redemption over its foreclosed properties after the certificate of

sale in favor of respondent had been registered.

Therightofredemptionbeingstatutory,itmustbeexercisedin the

manner prescribed by the statute, and within the

prescribedtimelimit,tomakeiteffective.Furthermore,aswith other

individual rights to contract has to give way to police power exercised

for public welfare and to property, if the concept of police power is

well-established in this jurisdiction. It has been defined as the "state G.R. No. L-15128

authority to enact legislation that may interfere with personal liberty or Diego v Fernando

property in order to promote the general welfare." Its scope, ever-

expanding to meet the exigencies of the times, even to anticipate the DOCTRINE:

future where it could be done, provides enough room for an efficient If a contract of loan with security does not stipulate the

and flexible response to conditions andcircumstancesthus payment of interest but provides for the delivery to the creditor

assuming the greatestbenefits. by the debtor of the property given as security, in order that

the latter may gather its fruits, without stating that said fruits

The freedom to contract is not absolute; all contracts and all are to be applied to the payment of interest, if any, and

rights are subject to the police power of the State and not only afterwards that of the principal, the contract is a mortgage and

mayregulationswhichaffectthembeestablishedbytheState, not antichresis.

butallsuchregulationsmustbesubjecttochangefromtimeto time, as

the general well-being of the community may require, or as the FACTS:

circumstances may change, or as experience may demonstrate the The defendant Segundo Fernando executed a deed of

necessity. Settled is the rule that the non- impairment clause of the mortgage in favor of plaintiff Cecilio Diego over 2 parcels of

Constitution must yield to the loftier purposes targeted by the land registered in his name, to secure a loan P2,000, without

Government. The right granted by this provision must submit to the interest, payable within 4 years. After the execution,

demands and necessities ofthe State’s power of regulation. Such possession of the mortgaged properties were turned over to

authority to regulate the mortagagee.

businessesextendstothebankingindustrywhich,asthis

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

Fernando failed to pay after four years, with Diego having Diego is a mortgagee in possession, one who has lawfully

made several demands. Hence this action for foreclosure of acquired possession of the premises mortgaged to him,

mortgage. standing upon his rights as mortgagee and not claiming under

another title, for the purpose of enforcing his security upon

Fernando claims that the transaction was one of antichresis such property or making its income help to pay his debt.

andnotofmortgage.AlsoDiegohadallegedlyreceivedatotal of 120 A mortgagee in possession and a creditor in an antichresis

cavans of palay from the properties given as security, which, at the have the following similar or identical rights and obligations:

rate of P10 a cavan, represented a value of if the mortgagee acquires possession in any lawful manner, he

P5,200.Hencehisdebthadalreadybeenpaid,withDiegostill owing him is entitled to retain such possession until the indebtedness is

a refund of someP2,720. satisfied and the property redeemed;

the non-payment of the debt within the term agreed does not

The CFI found that it was really a mortgage and that the fact vest the ownership of the property in the creditor;

that possession of the mortgaged properties were turned over the general duty of the mortgagee in possession towards the

to the mortgagee did not alter the transaction. The parties premises is that of the ordinary prudent owner;

musthaveintendedthatthemortgageewouldcollectthefruits of the the mortgagee must account for the rents and profits of the

mortgaged properties as interest on his loan, which land, or its value for purposes of use and occupation, any

agreementisnotuncommon.AlsoDiegohasalreadyreceived 55 amount thus realized going towards the discharge on the

cavans of palay during his possession. Hence the CFI ordered mortgage debt;

Fernando to pay Diego 2K with interest and upon ifthemortgageremainsinpossessionafterthemortgagedebt

default,fortheforeclosure.Hencethisappeal. hasbeensatisfied,hebecomesatrusteeforthemortgagoras

totheexcessoftherentsandprofitsoversuchdebt;

ISSUE: W/ the contract between Diego and Fernando is the mortgagor can only enforce his rights to the land by an

mortgage or antichresis considering that the loan was without equitable action for an account and to redeem.

interest, coupled with the transfer of the possession of the

properties mortgaged to the mortgagee. SinceFernandodidnotexpresslywaivehisrighttothefruitsofthe

properties mortgaged during the time they were in

HELD: considered as a mortgage contract between the Diego’spossession, the latter, like an antichretic creditor, must

parties. account for the value of the fruits received by him, and deduct

To be antichresis, it must be expressly agreed between itfromtheloanobtainedbyappellant.

creditor and debtor that the former, having been given

possession of the properties given as security, is to apply their In this case, Diego had received a net share of 55 cavans of

fruits to the payment of the interest, if owing, and thereafter to palay; at the rate of P9.00 per cavan, the total value of the

the principal of his credit.[READ DOCTRINE]. fruits received by Diego is P495. Deducting this amount from

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

the loan of P2,000.00 received by Fernando from Diego, the sum of P430, which I have received from him in current coin,

former has only P1,505.00 left to pay the latter. and as the same was not received in our presence, we waive

the exception of money not paid in cash; therefore, henceforth

WHEREFORE, the CFI judgement is MODIFIED in that and during the period above stipulated, I grant and convey my

Fernando is ordered to pay P1,505 and that Diego has the ownership and possession in the said two parcels of land to

obligation to render an accounting of all the fruits received by the said D. Tomas Ballilos in order that he may manage and

him from the properties in question from the time of the filing of enjoy the same in consideration of the sum for which they are

this action until full payment, or in case of appellant's failure to mortgaged.

pay, until foreclosure of the mortgage thereon, the value of There being present D.TomasBallilos..........., he stated thathe

which fruits shall be deducted from the total amount of his had received in mortgage, to his entire satisfaction, the two

recovery. parcels of tillable land above mentioned, under the conditions

and for the time stipulated, for the sum of P430, which he has

already delivered to the said D. Fidel de a Vega, who in turn

states that the said lands are free of all charges and

encumbrances and binds himself to warrant this mortgage

G.R. No. L-9957 August 8, 1916 incase of legal proceedings.” (These provisions will be material

PERFECTO DE LA VEGA, ET AL., plaintiffs-appellees, in the rendition ofjudgment)

vs. TOMAS BALLILOS (or BALIELOS), defendant- appellant. In essence, it alleges that the agreement was one of

antichresis constituted until the borrowed sum is paid in full.

In the following year, 1905, the plaintiffs (save for Policarpio

dele Vega) borrowed in succession P40, P18, and P60 from

Facts: the respondent under the same contract of antichresis. They

Petitioners are co-owners (pro-indiviso share) of eight parcels gave three more properties as security from which he is to

of land in Batangas. One of them, Fidel dela Vega, mortgaged collect the interest.

three of the properties to defendant Ballilos for P430. The The plaintiffs then attempted to pay off their loans (in the total

relevant provisions of their contract as follows: amount of P548) in order to reacquire the said parcels of land.

“ and whereas on this day I have mortgaged the two The defendant refused to receive the sums and appropriated

parcels of land above-mentioned to the said D. Tomas Ballilos to himself the parcels of land.

for the sum of P430 and for the term of eight years, counting During the trial in the lower court, defendant alleged, among

from this day, at the expiration of which I may redeem them; other things, that:

thatshouldInotthendoso,thesaidlandsshallcontinuetobe The parcels of land in question as these were validly sold to

mortgaged until I have the money available wherewith him by the co-owners dela Vega;

the redeem them; therefore, I hereby mortgage the two There was no period specified for the right of repurchase

parcels of land hereinabove mentioned to D. Tomas agreed upon;

Ballilos for thes a i d

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

When the co-owners failed to repurchase within the legal lands in order that he might manage and enjoy them in

period,ownershipofthepropertieswasconsolidatedinhimby consideration of the sum for which they were mortgaged.

operation oflaw; Second Topic: Instrument is a Contract of Antichresis

(Main Point of the Case)

ISSUE: As it is not shown that the said document is a contract of

Whether or not there was a contract of Antichresis. (Yes) mortgage executed as security for a loan, still less does it

appear to be a contract of pacto de retro, in view of the terms

HELD: of the agreement Exhibit O, as stipulated between the

First topic: Instrument neither a Real Mortgage nor a Sale contracting parties, of the allegations of both parties, and of

Pacto de Retro(Academic) the findings of the court in regard to the allegations, made and

The said contract apparently records a loan of P430, secured proven at the trial by the contending parties, we find the

by a mortgage of the aforementioned two parcels of land and classification of the said contract as one of antichresis to be

payable within the period of eight years, or within such time as correct and proper, taking into account the intention of the

the debtor Fidel de la Vega might be able to pay his debt and contracting parties as revealed by the words and terms

redeem the said land. However, notwithstanding the terms of employed by them and recorded in the said document.

the document, legally there is no mortgage inasmuch as the Several articles of the Civil Code relating to the contract of

said instrument is not of the nature of a public instrument. And antichresis. (The court cited Old Civil Code provisions, A1881,

even though it were, it was not recorded in the property -83, -84, and -85 – Now NCC A2132, -36, -37, and -38; These

registry as it ought to have been. Furthermore, the instrument are the elements of a contract of Antichresis)

recites that the debtor thenceforth ceded and conveyed his

ownership and possession in the said two parcels of land to 1.By antichresis a creditoracquiresa right to receive the

the creditor Ballilos in order that Ballilos might manage and fruits of real property of his debtor, with the obligation

enjoy the same in consideration of the sum for which the to apply them to the payment of interest, if due, and

lands, free of all burden and encumbrance according to the afterwards to the principal ofhiscredit.

debtor, were mortgaged. 2.The debtor cannotrecovertheenjoymentof the real

If the instrument above mentioned cannot be construed as a property without previously paying in full what he owes

mortgage of the said two parcels of land in security for P430, to his creditor. But the latter, in order to free himself

the amount loaned, and for the payment of the debt within from the obligations imposed on him by the preceding

eight years or some other period, neither can it be held to be a article, may always compel the debtor to reenter upon

sale under pacto de retro inasmuch as the said document the enjoyment of the estate, unless there be an

contains no mention whatever of any sale with right of agreement to thecontrary.

redemption, although it does say that the debtor ceded and 3.The creditordoesnot acquire the ownership of the real

conveyed to the creditor the ownership and possession of the property by nonpayment of the debt within the term

agreedu p o n . A n y s t i p u l a t i o n t o t h e c o n t r a r y s h a l l

be

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

lOMoARcPSD|5911403

void. But in this case the creditor may demand, in the recovery of the enjoyment of immovables given in antichresis,

manner prescribed in the law of civil procedure, the provided that the debtor previously pay what he owes to this

payment of the debtor or the sale of the reality. creditor, the plaintiffs have an unquestionable right to recover

4.The contractingpartiesmay stipulate that the interest of parcels Nos. 1, 5, and 7 of the land designated in the map or

the debt be set off against the fruits of the estate given planadmittedbyagreementoftheparties,afterfirstpayingthe debt of

inantichresis. P430 to thedefendant-creditor.

This contract is somewhat similar to those of pledge and

mortgage and for this reason article 1886 (now 2139)

prescribed that certain articles relative to these latter contracts

are applicable to contracts of antichresis, for both the former

andthelattercontractsarecomprisedintitle15,book4,ofthe Civil Code.

(Still applicable. Specific article numbers just changed)

The contract entered into by the contracting parties which has

produced between them rights and obligations is in fact one of

antichresis,forarticle1281oftheCivilCodeprescribesamong other

things that if the words should appear to conflict with the

evidentintentofthecontractingparties,theintentshallprevail.

Article 1283 provides that however general the terms of the

contract may be, they should not be understood to include

things and cases different from those with regard to which the

interested parties intended to contract; and, further, article

1284ofthesamecodesaysthatifanystipulationofacontract should

admit of several different meanings, that most suitable to give it effect

should beapplied.

In this case, it was stipulated that even after eight years the

debtor, the owner of the property, might redeem it whenever

he should have the means to pay his debt and recover the

landsgiveninantichresistohiscreditorwhomighttoldthemin usufruct in

consideration for the money he had loaned; and as

thef o r e g o i n g a r t i c l e s o f t h e C i v i l C o d e f i x e s n o t e r m f o r t

he

Downloaded by Marlon Sevilla (bascawauditormas@gmail.com)

Das könnte Ihnen auch gefallen

- Law School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesVon EverandLaw School Survival Guide (Volume I of II) - Outlines and Case Summaries for Torts, Civil Procedure, Property, Contracts & Sales: Law School Survival GuidesNoch keine Bewertungen

- Credit Transactions Case Digest CompilationDokument26 SeitenCredit Transactions Case Digest CompilationMoireeG100% (1)

- March 4 Credit DigestDokument18 SeitenMarch 4 Credit DigestJosiah BalgosNoch keine Bewertungen