Beruflich Dokumente

Kultur Dokumente

Barcelona, Joyce Ann A. - FMA-3A - Quiz#2 PDF

Hochgeladen von

Joyce Ann Agdippa Barcelona0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

40 Ansichten1 SeiteOriginaltitel

Barcelona, Joyce Ann A._FMA-3A_Quiz#2.pdf.docx

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

40 Ansichten1 SeiteBarcelona, Joyce Ann A. - FMA-3A - Quiz#2 PDF

Hochgeladen von

Joyce Ann Agdippa BarcelonaCopyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

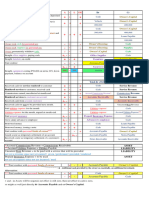

Barcelona, Joyce Ann A.

FMA-3A

QUIZ #2

Indicate the effects of the transactions listed in the following table on total current assets, current

ratio, and net income. Use (+) to indicate an increase, (−) to indicate a decrease, and (0) to

indicate either no effect or an indeterminate effect. Be prepared to state any necessary

assumptions and assume an initial current ratio of more than 1.0.

Total current Current ratio Effect on net

assets income

1. Cash is acquired through issuance of additional + + 0

common stock.

2. Merchandise is sold for cash. + + +

3. Federal income tax due for the previous year is paid. _ + 0

4. A fixed asset is sold for less than book value. + + _

5. A fixed asset is sold for more than book value. + + +

6. Merchandise is sold on credit. + + +

7. Payment is made to trade creditors for previous _ + 0

purchases.

8. A cash dividend is declared and paid. _ _ 0

9. Cash is obtained through short-term bank loans. + _ 0

10. Short-term notes receivable are sold at a discount. _ _ _

11. Marketable securities are sold below cost. _ _ _

12. Advances are made to employees. 0 0 0

13. Current operating expenses are paid. _ _ _

14. Short-term promissory notes are issued to trade 0 0 0

creditors in exchange for past due accounts payable.

15. 10-year notes are issued to pay off accounts payable. 0 + 0

16. A fully depreciated asset is retired. 0 0 0

17. Accounts receivable are collected. 0 0 0

18. Equipment is purchased with short-term notes. 0 _ 0

19. Merchandise is purchased on credit. + _ 0

20. The estimated taxes payable are increased. 0 _ _

JOYCE ANN A. BARCELONA

Das könnte Ihnen auch gefallen

- Barcelona, Joyce Ann A - Quiz#2 PDFDokument1 SeiteBarcelona, Joyce Ann A - Quiz#2 PDFJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Answers and Solution To Chapter 4 Seat WorkDokument4 SeitenAnswers and Solution To Chapter 4 Seat WorkGlyza Celeste RonquilloNoch keine Bewertungen

- Chapter4 Lao Bsacc 2yb 1Dokument4 SeitenChapter4 Lao Bsacc 2yb 1Jessa LaoNoch keine Bewertungen

- Chapter 7 Current Liabilities: 7.1 Trade and Other PayableDokument11 SeitenChapter 7 Current Liabilities: 7.1 Trade and Other PayableMaryrose SumulongNoch keine Bewertungen

- NamaDokument4 SeitenNamaputri ekaNoch keine Bewertungen

- HULA MEDokument4 SeitenHULA MEEnrique BongaisNoch keine Bewertungen

- Accounting for Investments ClassificationDokument19 SeitenAccounting for Investments ClassificationJhon Vincent BuragaNoch keine Bewertungen

- Cash Flow Statement Details for Operating, Investing and Financing ActivitiesDokument2 SeitenCash Flow Statement Details for Operating, Investing and Financing ActivitiesJagriti SukhijaNoch keine Bewertungen

- Worksheet One With SolutionsDokument17 SeitenWorksheet One With SolutionsTanmay SharmaNoch keine Bewertungen

- Business Combination - ExercisesDokument36 SeitenBusiness Combination - ExercisesJessalyn CilotNoch keine Bewertungen

- CORPORATE LIQUIDATION STATEMENTDokument73 SeitenCORPORATE LIQUIDATION STATEMENTCasper John Nanas MuñozNoch keine Bewertungen

- Statement of Comprehensive Income (SOCI) and Statement of Financial Position (SOFP)Dokument37 SeitenStatement of Comprehensive Income (SOCI) and Statement of Financial Position (SOFP)Iris NguNoch keine Bewertungen

- EZ 1 Financial AccountingDokument5 SeitenEZ 1 Financial AccountingMohona SenguptaNoch keine Bewertungen

- In-Class Quiz #1 - SolutionsDokument1 SeiteIn-Class Quiz #1 - SolutionsMustafa Kemal KaraağaçNoch keine Bewertungen

- Chapter - 2 Accounting Equation: ContentsDokument3 SeitenChapter - 2 Accounting Equation: ContentsKenneth BegumisaNoch keine Bewertungen

- AST Discussion 5 - CORPORATE LIQUIDATIONDokument5 SeitenAST Discussion 5 - CORPORATE LIQUIDATIONCHRISTINE TABULOGNoch keine Bewertungen

- FABM Q3 M4 (Output No. 4 - Five Major Accounts)Dokument4 SeitenFABM Q3 M4 (Output No. 4 - Five Major Accounts)Sophia MagdaraogNoch keine Bewertungen

- Global Econ - Balance of Payments - LectureDokument16 SeitenGlobal Econ - Balance of Payments - LectureKatherine SauerNoch keine Bewertungen

- ACCO Module 2Dokument5 SeitenACCO Module 2Lala BoraNoch keine Bewertungen

- Analysis of Financial Statements: Answers To End-Of-Chapter QuestionsDokument20 SeitenAnalysis of Financial Statements: Answers To End-Of-Chapter QuestionsChoi TeumeNoch keine Bewertungen

- Grade 10 Learner Marking GuidelineDokument19 SeitenGrade 10 Learner Marking GuidelineyandisaNoch keine Bewertungen

- Use The Following Information For Questions 1 and 2Dokument5 SeitenUse The Following Information For Questions 1 and 2Jane Michelle Eman0% (2)

- Ch10 ProblemDokument2 SeitenCh10 ProblempalashndcNoch keine Bewertungen

- CashFlowZadani28 3 2022Dokument10 SeitenCashFlowZadani28 3 2022Nguyen GiangNoch keine Bewertungen

- Cashflow StatementDokument40 SeitenCashflow StatementJUAN ANTONIO CERON CRUZNoch keine Bewertungen

- AfM 0 - Introduction, Transaction Recognition, AccountsDokument30 SeitenAfM 0 - Introduction, Transaction Recognition, AccountsjaymursalieNoch keine Bewertungen

- Module4 AccountsReceivablePartIDokument6 SeitenModule4 AccountsReceivablePartIGab OdonioNoch keine Bewertungen

- Business Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedDokument5 SeitenBusiness Combinations: Fees of Finders and Registration Fees Consultants For Equity Securities IssuedHanna Mendoza De Ocampo0% (3)

- Acc 1Dokument7 SeitenAcc 1Taskeen AliNoch keine Bewertungen

- BKP 9 Accounting EquationDokument13 SeitenBKP 9 Accounting EquationPhilpNil8000Noch keine Bewertungen

- Understanding Financial Statements: Income, Cash Flow and Balance SheetDokument6 SeitenUnderstanding Financial Statements: Income, Cash Flow and Balance SheetGorakhpuria MNoch keine Bewertungen

- Key Words: Multiple Choice QuestionsDokument7 SeitenKey Words: Multiple Choice QuestionsMOHAMMED AMIN SHAIKHNoch keine Bewertungen

- EZ 1 Financial AccountingDokument4 SeitenEZ 1 Financial AccountingMohona SenguptaNoch keine Bewertungen

- Accounts ReceivableDokument43 SeitenAccounts ReceivableZee 24Noch keine Bewertungen

- Capital budgeting and financial management true or false quizDokument4 SeitenCapital budgeting and financial management true or false quizAbrham TamiruNoch keine Bewertungen

- 2 Accounting Equestion and Double EntryDokument10 Seiten2 Accounting Equestion and Double EntryAlex MaugoNoch keine Bewertungen

- Computing Development Strategies Pro Forma Balance Sheet - 12/31/00Dokument12 SeitenComputing Development Strategies Pro Forma Balance Sheet - 12/31/00shahboozoNoch keine Bewertungen

- Calculate Goodwill in Acquisition of WestmontDokument33 SeitenCalculate Goodwill in Acquisition of WestmontSu Ed100% (1)

- Ias 7 Cash Flow Statement ContinuedDokument8 SeitenIas 7 Cash Flow Statement ContinuedMichael Bwire100% (1)

- Statement of Financial Position (SFPDokument22 SeitenStatement of Financial Position (SFPZyriece Camille CentenoNoch keine Bewertungen

- Financial Stament ReviewDokument8 SeitenFinancial Stament Reviewロザリーロザレス ロザリー・マキルNoch keine Bewertungen

- Accounts Receivable Module ExplainedDokument2 SeitenAccounts Receivable Module ExplainedChristine Joy Rapi MarsoNoch keine Bewertungen

- Ia Reviewer QuizzesandexamsDokument22 SeitenIa Reviewer QuizzesandexamsReady PlayerNoch keine Bewertungen

- BKP 9 Accounting EquationDokument16 SeitenBKP 9 Accounting EquationPhilpNil8000Noch keine Bewertungen

- Balance SheetDokument1 SeiteBalance Sheethillaryonyango044Noch keine Bewertungen

- Chapter 11 Lecture 2018Dokument62 SeitenChapter 11 Lecture 2018Johnny Sins100% (1)

- Learning Module - Accounts ReceivableDokument2 SeitenLearning Module - Accounts ReceivableAngelica SamonteNoch keine Bewertungen

- FDNACCT Unit 4 - Part 1 - Analyzing Business Transactions - Class Ex - Answer KeyDokument1 SeiteFDNACCT Unit 4 - Part 1 - Analyzing Business Transactions - Class Ex - Answer Keyrabinoadrian24Noch keine Bewertungen

- Corporate Liquidation Statement of AffairsDokument7 SeitenCorporate Liquidation Statement of Affairsiptrcrml100% (1)

- Corporate Liquidation AssessmentsDokument11 SeitenCorporate Liquidation AssessmentsVon Andrei Medina100% (1)

- Financial Accounting Week 2Dokument5 SeitenFinancial Accounting Week 2Siva PraveenNoch keine Bewertungen

- Accounting Equation and Double-Entry SystemDokument2 SeitenAccounting Equation and Double-Entry SystemMARLON JHAN PHAULL P. KHONoch keine Bewertungen

- Chapter-02-Cash Flow SatementDokument21 SeitenChapter-02-Cash Flow SatementSafeen LabibNoch keine Bewertungen

- Analyzing Business TransactionsDokument21 SeitenAnalyzing Business TransactionsDan Gideon Cariaga100% (1)

- Exam Revision - Chapter 17Dokument6 SeitenExam Revision - Chapter 17Vũ Thị NgoanNoch keine Bewertungen

- ACC113 - Chapter 16Dokument20 SeitenACC113 - Chapter 16Zeba LubabaNoch keine Bewertungen

- Assignment On Financial Accounting & AnalysisDokument7 SeitenAssignment On Financial Accounting & AnalysisArko RoyNoch keine Bewertungen

- Assignment 3Dokument3 SeitenAssignment 3AnishNoch keine Bewertungen

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideVon EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideNoch keine Bewertungen

- Gates Company Balance Sheet and NotesDokument19 SeitenGates Company Balance Sheet and NotesJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- IFRS Comprehensive Income Statement RequirementsDokument13 SeitenIFRS Comprehensive Income Statement RequirementsJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- The Balance Sheet and NotesDokument47 SeitenThe Balance Sheet and NotesJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- PAS 14 Segment Reporting GuideDokument15 SeitenPAS 14 Segment Reporting GuideJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Seatwork Income MaDokument3 SeitenSeatwork Income MaJoyce Ann Agdippa Barcelona0% (1)

- Installment Sales-: Loss On Repossession XXX Gain On Repossession XXXDokument5 SeitenInstallment Sales-: Loss On Repossession XXX Gain On Repossession XXXJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Other Comprehensive IncomeDokument11 SeitenOther Comprehensive IncomeJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- BASIC EARNINGS PER SHARE StudentswithanswersDokument9 SeitenBASIC EARNINGS PER SHARE StudentswithanswersJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Sample Problem IncomeDokument4 SeitenSample Problem IncomeJoyce Ann Agdippa Barcelona100% (1)

- Barcelona, Joyce Ann A. - FMA-3A - Activity 2 PDFDokument3 SeitenBarcelona, Joyce Ann A. - FMA-3A - Activity 2 PDFJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Interim Financial ReportingDokument10 SeitenInterim Financial ReportingJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Statement of Cash FlowDokument9 SeitenStatement of Cash FlowJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Activity 3 Statana Letter BDokument5 SeitenActivity 3 Statana Letter BJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Barcelona Statana Actvity 4 PDFDokument3 SeitenBarcelona Statana Actvity 4 PDFJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Barcelona, Joyce Ann A. - FMA-3A - Balance Sheet PDFDokument7 SeitenBarcelona, Joyce Ann A. - FMA-3A - Balance Sheet PDFJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Total Deposits of U.S Federal Deposit Insurance CorporationDokument4 SeitenTotal Deposits of U.S Federal Deposit Insurance CorporationJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- AEV Balance Sheet: Total Current AssetsDokument5 SeitenAEV Balance Sheet: Total Current AssetsJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Activity 3 Financial Planning and Forecastingg PDFDokument2 SeitenActivity 3 Financial Planning and Forecastingg PDFJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Barcelona, Joyce Ann A. - FMA-3A - Balance SheetDokument7 SeitenBarcelona, Joyce Ann A. - FMA-3A - Balance SheetJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Barcelona Statana Actvity 4Dokument3 SeitenBarcelona Statana Actvity 4Joyce Ann Agdippa BarcelonaNoch keine Bewertungen

- ACTIVITY 3 FINANCIAL PLANNING AND FORECASTINGgDokument2 SeitenACTIVITY 3 FINANCIAL PLANNING AND FORECASTINGgJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Sample Problem IncomeDokument4 SeitenSample Problem IncomeJoyce Ann Agdippa Barcelona100% (1)

- Other Comprehensive IncomeDokument11 SeitenOther Comprehensive IncomeJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Activity 3 Financial Planning and Forecasting - Barcelona PDFDokument2 SeitenActivity 3 Financial Planning and Forecasting - Barcelona PDFJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Financial Statement Analysis - UpdatedDokument58 SeitenFinancial Statement Analysis - UpdatedJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Conceptual Framework For Financial Reporting: March 2018Dokument20 SeitenConceptual Framework For Financial Reporting: March 2018Priss PrissNoch keine Bewertungen

- SCI Handout 1 PDFDokument4 SeitenSCI Handout 1 PDFhairu keyansamNoch keine Bewertungen

- CFAS - Depreciation Methods - Barcelona, JoyceAnnDokument9 SeitenCFAS - Depreciation Methods - Barcelona, JoyceAnnJoyce Ann Agdippa BarcelonaNoch keine Bewertungen

- Journal of The Japanese and International Economies: Tetsuya Kawamura, Tomoharu Mori, Taizo Motonishi, Kazuhito OgawaDokument19 SeitenJournal of The Japanese and International Economies: Tetsuya Kawamura, Tomoharu Mori, Taizo Motonishi, Kazuhito OgawaNguyễn Việt TùngNoch keine Bewertungen

- Key Fact StatementDokument4 SeitenKey Fact Statementsanjeev guptaNoch keine Bewertungen

- Loan Agreement - Swiftbanq CreditDokument5 SeitenLoan Agreement - Swiftbanq CreditcyrilNoch keine Bewertungen

- Chapter 9 Bond ValuationDokument7 SeitenChapter 9 Bond ValuationArjun kumar ShresthaNoch keine Bewertungen

- Basel Committee On Banking Supervision: CRE Calculation of RWA For Credit RiskDokument19 SeitenBasel Committee On Banking Supervision: CRE Calculation of RWA For Credit RiskAnghel StefanNoch keine Bewertungen

- Fund Based Financial Services GuideDokument16 SeitenFund Based Financial Services GuidePriyanka PanigrahiNoch keine Bewertungen

- G.R. No. 201892. July 22, 2015. Norlinda S. Marilag, Petitioner, vs. Marcelino B. MARTINEZ, RespondentDokument22 SeitenG.R. No. 201892. July 22, 2015. Norlinda S. Marilag, Petitioner, vs. Marcelino B. MARTINEZ, RespondentKristine MagbojosNoch keine Bewertungen

- Equity Analysis With Reference To Automobile IndustryDokument79 SeitenEquity Analysis With Reference To Automobile Industrysmartway projectsNoch keine Bewertungen

- New Civ Digest 2017 2018Dokument294 SeitenNew Civ Digest 2017 2018Allen SopocoNoch keine Bewertungen

- Legal Ram Chand Etc. Burj Manshia Location Rampura PhulDokument4 SeitenLegal Ram Chand Etc. Burj Manshia Location Rampura Phulabhijeetgoyal16Noch keine Bewertungen

- Audit of Cash and Cash EquivalentsDokument9 SeitenAudit of Cash and Cash Equivalentspatricia100% (1)

- DOLES v. ANGELES G.R. No. 149353. June 26, 2006Dokument2 SeitenDOLES v. ANGELES G.R. No. 149353. June 26, 2006SSNoch keine Bewertungen

- CONTRACTSDokument11 SeitenCONTRACTSJoshua dela CruzNoch keine Bewertungen

- Maria Zarah - Villanueva - Castro: Banking LawsDokument15 SeitenMaria Zarah - Villanueva - Castro: Banking LawsNiel Edar BallezaNoch keine Bewertungen

- FINANCIAL INTELLIGENCE - PPSXDokument14 SeitenFINANCIAL INTELLIGENCE - PPSXBryson MwasebaNoch keine Bewertungen

- Taxation Reviewer PDFDokument32 SeitenTaxation Reviewer PDFIsobel CoNoch keine Bewertungen

- Provincial Assessors Office Citizens CharterDokument6 SeitenProvincial Assessors Office Citizens CharterMeryl Cayla C. GuintuNoch keine Bewertungen

- Answer Paper 5Dokument17 SeitenAnswer Paper 5SomeoneNoch keine Bewertungen

- Guide Note 12: Analyzing Market TrendsDokument6 SeitenGuide Note 12: Analyzing Market TrendsAlex PalcovNoch keine Bewertungen

- On LiabilitiesDokument20 SeitenOn LiabilitiescheesekuhNoch keine Bewertungen

- Gs 51 General 6 PageDokument6 SeitenGs 51 General 6 PageOneNationNoch keine Bewertungen

- PNB V PHIL. VEGETABLE OILDokument2 SeitenPNB V PHIL. VEGETABLE OILRizzaNoch keine Bewertungen

- Case No 12. The United States v. Chua: G.R NO. L-13708 DATE: January 29, 1919 TOPIC: Usury LawDokument2 SeitenCase No 12. The United States v. Chua: G.R NO. L-13708 DATE: January 29, 1919 TOPIC: Usury LawLance Lagman100% (1)

- Expert in Risk Management and Financial ServicesDokument1 SeiteExpert in Risk Management and Financial ServicesEko RatriantoNoch keine Bewertungen

- Finman Module 8Dokument42 SeitenFinman Module 8Jennyveive RiveraNoch keine Bewertungen

- Form 1099 InstructionsDokument6 SeitenForm 1099 InstructionsCarlos BatisteNoch keine Bewertungen

- University of Caloocan City Bachelor of Science in AccountancyDokument5 SeitenUniversity of Caloocan City Bachelor of Science in AccountancyLumingNoch keine Bewertungen

- Part 4 YanguasDokument33 SeitenPart 4 YanguasDANICA FLORESNoch keine Bewertungen

- Chapter 1 None CompressDokument9 SeitenChapter 1 None CompressiadcNoch keine Bewertungen

- Principles of Corporate Finance 12th Edition Brealey Test BankDokument19 SeitenPrinciples of Corporate Finance 12th Edition Brealey Test BankGloria Nicol100% (30)