Beruflich Dokumente

Kultur Dokumente

Prop15 Title Summ Analysis

Hochgeladen von

Anthony WrightCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Prop15 Title Summ Analysis

Hochgeladen von

Anthony WrightCopyright:

Verfügbare Formate

PROPOSITION INCREASES FUNDING SOURCES FOR PUBLIC SCHOOLS, COMMUNITY COLLEGES, AND

15 LOCAL GOVERNMENT SERVICES BY CHANGING TAX ASSESSMENT OF COMMERCIAL

AND INDUSTRIAL PROPERTY. INITIATIVE CONSTITUTIONAL AMENDMENT.

OFFICIAL TITLE AND SUMMARY PREPARED BY THE ATTORNEY GENERAL

15 The text of this measure can be found on the Secretary of State’s website at

voterguide.sos.ca.gov.

• Increases funding sources for K–12 public • Exempts small businesses from personal

schools, community colleges, and local property tax; for other businesses, provides

governments by requiring commercial and $500,000 exemption.

industrial real property be taxed based on

current market value, instead of purchase SUMMARY OF LEGISLATIVE ANALYST’S ESTIMATE

price. OF NET STATE AND LOCAL GOVERNMENT

• Exempts from taxation changes: residential FISCAL IMPACT:

properties; agricultural land; and owners of

commercial and industrial properties with • Increased property taxes on commercial

combined value of $3 million or less. properties worth more than $3 million

providing $6.5 billion to $11.5 billion in new

• Any additional education funding will funding to local governments and schools.

supplement existing school funding

guarantees.

ANALYSIS BY THE LEGISLATIVE ANALYST

BACKGROUND land or a building is purchased, its taxable value

typically is its purchase price. Each year after

Local Governments Tax Property. California cities, that, the property’s taxable value is adjusted for

counties, schools, and special districts (such as inflation by up to 2 percent. When a property

a fire protection district) collect property taxes is sold again, its taxable value is reset to its

from property owners based on the value of their new purchase price. The taxable value of most

property. Property taxes raise around $65 billion land and buildings is less than what they could

each year for these local governments. Overall, be sold for. This is because the price most

about 60 percent of property taxes go to cities, properties could be sold for grows faster than

counties, and special districts. The other 2 percent per year.

40 percent goes to schools and community

colleges. These shares are different in different Taxable Value of Business Equipment Is Based on

counties. How Much It Could Be Sold for. Unlike land and

buildings, business equipment is taxed based on

Property Includes Land, Buildings, Machinery,

how much it could be sold for today.

and Equipment. Property taxes apply to many

kinds of property. Land and buildings are taxed. Counties Manage the Property Tax. County

Businesses also pay property taxes on most assessors determine the taxable value of

other things they own. This includes equipment, property. County tax collectors bill property

machinery, computers, and furniture. We call owners. County auditors distribute tax revenue

these things “business equipment.” to local governments. Statewide, counties spend

How Is a Property Tax Bill Calculated? Each about $800 million each year on these activities.

property owner’s annual property tax bill is equal

to the taxable value of their property multiplied PROPOSAL

by their property tax rate. The typical property Tax Commercial and Industrial Land and Buildings

owner’s property tax rate is 1.1 percent. Based on How Much They Could Be Sold for. The

Taxable Value of Land and Buildings Is Based on measure requires commercial and industrial

Original Purchase Price. In the year a piece of (after this referred to simply as “commercial”)

22 | Title and Summary / Analysis

INCREASES FUNDING SOURCES FOR PUBLIC SCHOOLS, COMMUNITY COLLEGES, AND PROPOSITION

LOCAL GOVERNMENT SERVICES BY CHANGING TAX ASSESSMENT OF COMMERCIAL

AND INDUSTRIAL PROPERTY. INITIATIVE CONSTITUTIONAL AMENDMENT. 15

ANALYSIS BY THE LEGISLATIVE ANALYST CONTINUED

land and buildings to be taxed based on how costs created by the measure. This includes 15

much they could be sold for instead of their giving several hundred million dollars per year to

original purchase price. This change is put in counties to pay for their costs of carrying out

place over time starting in 2022. The change the measure. The measure would increase the

does not start before 2025 for properties used amount of work county assessors do and could

by California businesses that meet certain rules require changes in how they do their work.

and have 50 or fewer employees. Housing and Counties could have costs from the measure

agricultural land continues to be taxed based on before new money is available to cover these

its original purchase price. costs. The state would loan money to counties

Some Lower Value Properties Not Included. to cover these initial costs until new property tax

This change does not apply if the owner has revenue is available.

$3 million or less worth of commercial land and New Funding for Local Governments and Schools.

buildings in California (adjusted for inflation Overall, $6.5 billion to $11.5 billion per

every two years). These properties continue to be year in new property taxes would go to local

taxed based on original purchase price. governments. 60 percent would go to cities,

Reduce Taxes on Business Equipment. The counties, and special districts. Each city,

measure reduces the taxable value of each county, or special district’s share of the money

business’s equipment by $500,000 starting depends on several things including the amount

in 2024. Businesses with less than $500,000 of new taxes paid by commercial properties in

of equipment pay no taxes on those items. that community. Not all governments would be

All property taxes on business equipment are guaranteed new money. Some in rural areas may

eliminated for California businesses that meet end up losing money because of lower taxes on

certain rules and have 50 or fewer employees. business equipment. The other 40 percent would

increase funding for schools and community

colleges. Each school or community college’s

FISCAL EFFECTS share of the money is mostly based on how many

Increased Taxes on Commercial Land and Buildings. students they have.

Most owners of commercial land and buildings

worth more than $3 million would pay higher Visit http://cal-access.sos.ca.gov/campaign/

property taxes. Only some of these property measures/ for a list of committees primarily

owners would start to pay higher taxes in formed to support or oppose this measure.

2022. By 2025, most of these property owners

would pay higher taxes. Beginning in 2025, Visit http://www.fppc.ca.gov/

total property taxes from commercial land transparency/top-contributors.html

and buildings probably would be $8 billion to to access the committee’s top 10 contributors.

$12.5 billion higher in most years. The value of

commercial property can change a lot from year If you desire a copy of the full text of this state

to year. This means the amount of increased measure, please call the Secretary of State

property taxes also could change a lot from year

to year. at (800) 345-VOTE (8683) or you can email

vigfeedback@sos.ca.gov and a copy will

Decreased Taxes on Business Equipment. Property

taxes on business equipment probably would be be mailed at no cost to you.

several hundred million dollars lower each year.

Money Set Aside to Pay Costs of the Measure.

The measure sets aside money for various

Analysis | 23

Das könnte Ihnen auch gefallen

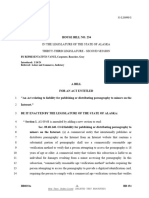

- House Bill 254Dokument3 SeitenHouse Bill 254Anthony WrightNoch keine Bewertungen

- Final Investigative Report Concerning Ombudsman ComplaintsDokument26 SeitenFinal Investigative Report Concerning Ombudsman ComplaintsAlaska's News SourceNoch keine Bewertungen

- Indiana 2024 SB0205 Comm SubDokument9 SeitenIndiana 2024 SB0205 Comm SubAnthony WrightNoch keine Bewertungen

- BRO - Video Release and WaiverDokument1 SeiteBRO - Video Release and WaiverWCCO - CBS Minnesota100% (3)

- FY2024 ATP Approved Selections RevDokument16 SeitenFY2024 ATP Approved Selections RevAnthony WrightNoch keine Bewertungen

- Mini Lesson Lithium Ion Battery SafetyDokument2 SeitenMini Lesson Lithium Ion Battery SafetyPRG ARMYNoch keine Bewertungen

- Alaska House Bill 399Dokument6 SeitenAlaska House Bill 399Anthony WrightNoch keine Bewertungen

- Order - Grant WritDokument1 SeiteOrder - Grant WritAnthony WrightNoch keine Bewertungen

- 2023 Shop Small SaturdayDokument2 Seiten2023 Shop Small SaturdayAnthony WrightNoch keine Bewertungen

- KHSD Fentanyl StatementIIDokument1 SeiteKHSD Fentanyl StatementIIBakersfieldNowNoch keine Bewertungen

- Public Call For Solidarity With Palestine at Purdue UniversityDokument6 SeitenPublic Call For Solidarity With Palestine at Purdue UniversityAnthony WrightNoch keine Bewertungen

- Teacher of The Year BiosDokument2 SeitenTeacher of The Year BiosAnthony WrightNoch keine Bewertungen

- National Blue Ribbon Schools MapDokument1 SeiteNational Blue Ribbon Schools MapinforumdocsNoch keine Bewertungen

- Troubleshooting OTT Stream IssuesDokument1 SeiteTroubleshooting OTT Stream IssuesAnthony WrightNoch keine Bewertungen

- Violation Report Heart of IndiaDokument3 SeitenViolation Report Heart of IndiaAnthony WrightNoch keine Bewertungen

- KHSD Fentanyl InformationDokument3 SeitenKHSD Fentanyl InformationAnthony WrightNoch keine Bewertungen

- Stipulated Surrender of License AgreementDokument16 SeitenStipulated Surrender of License AgreementAnthony WrightNoch keine Bewertungen

- Proclamation of A State of EmergencyDokument4 SeitenProclamation of A State of EmergencyAnthony WrightNoch keine Bewertungen

- Kern County Community Priorities SurveyDokument10 SeitenKern County Community Priorities SurveyAnthony WrightNoch keine Bewertungen

- Rotating Power Outages Fact SheetDokument2 SeitenRotating Power Outages Fact SheetAnthony WrightNoch keine Bewertungen

- State Water Resources Control Board ReportDokument66 SeitenState Water Resources Control Board ReportAnthony WrightNoch keine Bewertungen

- A Citizens Guide To Soil Vapor Extraction and Air SpargingDokument2 SeitenA Citizens Guide To Soil Vapor Extraction and Air SpargingAnthony WrightNoch keine Bewertungen

- Bakersfield City Council Homelessness Ad Hoc CommitteeDokument12 SeitenBakersfield City Council Homelessness Ad Hoc CommitteeAnthony WrightNoch keine Bewertungen

- Community Engagement PreseentationDokument47 SeitenCommunity Engagement PreseentationAnthony WrightNoch keine Bewertungen

- Traffic Safety Facts: Sobriety CheckpoinsDokument2 SeitenTraffic Safety Facts: Sobriety CheckpoinsAnthony WrightNoch keine Bewertungen

- AB-2571 Firearms: Advertising To MinorsDokument7 SeitenAB-2571 Firearms: Advertising To MinorsAnthony WrightNoch keine Bewertungen

- 6.13.22 Letter To DOI For The Concurrence 1Dokument3 Seiten6.13.22 Letter To DOI For The Concurrence 1Anthony WrightNoch keine Bewertungen

- The Future of The State: Kern County's Young, Growing, Diverse Population and Dynamic EconomyDokument14 SeitenThe Future of The State: Kern County's Young, Growing, Diverse Population and Dynamic EconomyAnthony WrightNoch keine Bewertungen

- Kern County Grand Jury Report: City of California CityDokument8 SeitenKern County Grand Jury Report: City of California CityAnthony WrightNoch keine Bewertungen

- SB-1327 Firearms: Private Rights of ActionDokument20 SeitenSB-1327 Firearms: Private Rights of ActionAnthony WrightNoch keine Bewertungen

- The Yellow House: A Memoir (2019 National Book Award Winner)Von EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Bewertung: 4 von 5 Sternen4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceVon EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceBewertung: 4 von 5 Sternen4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeVon EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeBewertung: 4 von 5 Sternen4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingVon EverandThe Little Book of Hygge: Danish Secrets to Happy LivingBewertung: 3.5 von 5 Sternen3.5/5 (399)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaVon EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaBewertung: 4.5 von 5 Sternen4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeVon EverandShoe Dog: A Memoir by the Creator of NikeBewertung: 4.5 von 5 Sternen4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureVon EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureBewertung: 4.5 von 5 Sternen4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItVon EverandNever Split the Difference: Negotiating As If Your Life Depended On ItBewertung: 4.5 von 5 Sternen4.5/5 (838)

- Grit: The Power of Passion and PerseveranceVon EverandGrit: The Power of Passion and PerseveranceBewertung: 4 von 5 Sternen4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryVon EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryBewertung: 3.5 von 5 Sternen3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerVon EverandThe Emperor of All Maladies: A Biography of CancerBewertung: 4.5 von 5 Sternen4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyVon EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyBewertung: 3.5 von 5 Sternen3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealVon EverandOn Fire: The (Burning) Case for a Green New DealBewertung: 4 von 5 Sternen4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersVon EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersBewertung: 4.5 von 5 Sternen4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnVon EverandTeam of Rivals: The Political Genius of Abraham LincolnBewertung: 4.5 von 5 Sternen4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaVon EverandThe Unwinding: An Inner History of the New AmericaBewertung: 4 von 5 Sternen4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreVon EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreBewertung: 4 von 5 Sternen4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Von EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Bewertung: 4.5 von 5 Sternen4.5/5 (121)

- Her Body and Other Parties: StoriesVon EverandHer Body and Other Parties: StoriesBewertung: 4 von 5 Sternen4/5 (821)

- Chavez Vs PCGGDokument34 SeitenChavez Vs PCGGJerome C obusan100% (1)

- Role of SEBI in Capital MarketDokument6 SeitenRole of SEBI in Capital MarketShashank HatleNoch keine Bewertungen

- Comm Cir 224 MERC-SoP-Regulation-2014 3Dokument1 SeiteComm Cir 224 MERC-SoP-Regulation-2014 3RohitNoch keine Bewertungen

- Seller Registration Pre Requisites v1.2Dokument2 SeitenSeller Registration Pre Requisites v1.2sumitshyamalNoch keine Bewertungen

- Brosura LiberandDokument47 SeitenBrosura LiberandClaudiuNoch keine Bewertungen

- Logolog Farmers Multi-Purpose Cooperative: Contractor'S Accomplishment Report (Car)Dokument2 SeitenLogolog Farmers Multi-Purpose Cooperative: Contractor'S Accomplishment Report (Car)CarloCabanayanNoch keine Bewertungen

- LAW 160A Alternative Dispute Resolution Prof. Arthur Autea: Class PoliciesDokument76 SeitenLAW 160A Alternative Dispute Resolution Prof. Arthur Autea: Class Policiesxalmah100% (6)

- Jose F. Aguirre For Zoila Co Lim. Ismael T. Almeda For Continental Development Corporation. Joaquin G. Chung, Jr. For Benito Gervasio TanDokument4 SeitenJose F. Aguirre For Zoila Co Lim. Ismael T. Almeda For Continental Development Corporation. Joaquin G. Chung, Jr. For Benito Gervasio TanNoreen T� ClaroNoch keine Bewertungen

- Assignment On PSC 212Dokument10 SeitenAssignment On PSC 212Kalu UchennaNoch keine Bewertungen

- Annex 1 (Judicial Affidavit - Tyke Philip Lomibao)Dokument6 SeitenAnnex 1 (Judicial Affidavit - Tyke Philip Lomibao)kim dahyunNoch keine Bewertungen

- P.G Altbach 2007 - Student Politics, Activism and Culture PDFDokument17 SeitenP.G Altbach 2007 - Student Politics, Activism and Culture PDFWannor AdilahNoch keine Bewertungen

- Guidelines in The Audit of GAD Fund and Activities in Government Agencies (COA Circular 2014-01)Dokument55 SeitenGuidelines in The Audit of GAD Fund and Activities in Government Agencies (COA Circular 2014-01)PSU PCOONoch keine Bewertungen

- The Legal Status of E-ContractsDokument1 SeiteThe Legal Status of E-ContractsHarsh KumarNoch keine Bewertungen

- Aldine WestfieldDokument250 SeitenAldine WestfieldJafarNoch keine Bewertungen

- Prelim ModuleDokument31 SeitenPrelim ModuleJerome AmbrocioNoch keine Bewertungen

- Ruiz - 1998 - Personal Agency in Feminist Theory Evicting The Illusive DwellerDokument14 SeitenRuiz - 1998 - Personal Agency in Feminist Theory Evicting The Illusive DwellerAna Alice Reis PierettiNoch keine Bewertungen

- Monaim D. Guro: Nimfa Tiu, Building 1, J. Rosales Avenue Butuan City, Agusan Del Norte 8600Dokument2 SeitenMonaim D. Guro: Nimfa Tiu, Building 1, J. Rosales Avenue Butuan City, Agusan Del Norte 8600Faidah PangandamanNoch keine Bewertungen

- Volo's Waterdeep EnchiridionDokument26 SeitenVolo's Waterdeep EnchiridionFuria100% (2)

- Fair TrialDokument5 SeitenFair Trialanon_396821368Noch keine Bewertungen

- Chapter 5 - Introduction To EthicsDokument10 SeitenChapter 5 - Introduction To EthicsAimae Inot Malinao100% (1)

- China Unveils Its Vision of A Global Security Order - The EconomistDokument9 SeitenChina Unveils Its Vision of A Global Security Order - The EconomistFrancisco OliveiraNoch keine Bewertungen

- Sample DVDokument1 SeiteSample DVchatNoch keine Bewertungen

- Monthly VAT Return SampleDokument35 SeitenMonthly VAT Return SampleJohnHKyeyuneNoch keine Bewertungen

- Arise Elites - Taiwo Oluyomi AdejumoDokument78 SeitenArise Elites - Taiwo Oluyomi AdejumoTaiwo O. AdejumoNoch keine Bewertungen

- 1st ReadingDokument18 Seiten1st ReadingVirgil AstilloNoch keine Bewertungen

- NYCHA Management Manual Chapter II - APPENDIX ADokument15 SeitenNYCHA Management Manual Chapter II - APPENDIX AEmanuel obenNoch keine Bewertungen

- 65 RR - LPC Forwarding LetterDokument46 Seiten65 RR - LPC Forwarding LetterAbhijeet Singh KadianNoch keine Bewertungen

- Unit 1 Soto Pino Gianfranco Samuel: Sitcom: Introduce Me! Scene 1Dokument2 SeitenUnit 1 Soto Pino Gianfranco Samuel: Sitcom: Introduce Me! Scene 1Gianfranco Samuel100% (2)

- Tax Differentiated From Other TermsDokument2 SeitenTax Differentiated From Other TermsMiguel Satuito100% (1)

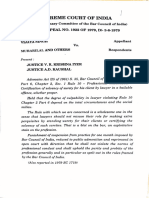

- Vijaya Singh v. Murarilal and OthersDokument4 SeitenVijaya Singh v. Murarilal and Otherscbaarun6162Noch keine Bewertungen