Beruflich Dokumente

Kultur Dokumente

Sole Proprietorship ("SP") General Partnership ("GP") Limited Partnership ("LP") Limited Liability Company ("LLC") Corporation ("Corp.")

Hochgeladen von

new smirdOriginalbeschreibung:

Originaltitel

Copyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Sole Proprietorship ("SP") General Partnership ("GP") Limited Partnership ("LP") Limited Liability Company ("LLC") Corporation ("Corp.")

Hochgeladen von

new smirdCopyright:

Verfügbare Formate

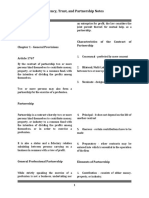

Limited Limited Liability Corporation

Sole Proprietorship General Partnership (“Corp.”)

Partnership Company

(“SP”) (“GP”)

(“LP”) (“LLC”)

C-Corp. B-Corp. S-Corp.

Full liability. Joint and individual. General partner:

Owner is 100% Each partner is 100% liable

(personal and Limited liability.

responsible for debt responsible for 100%

business assets). Liability limited to Limited Liability.

Liability obligations. of debt obligations.

the investment in Liability limited to the investment in the corporation.

Business and Business and LP: liable to the the LLC.

personal assets are at personal assets are at extent invested in

risk. risk. the business.

Pass through. Double taxation. Treated as a

Pass through. Pass through. Profits pass Profits taxed at the pass-through

Profits pass through Profits pass through through to the May choose either corporate level Can choose to be entity.*

Tax to the owner to be to the members to be members to be double taxation or and distributions treated as a C-

reported in personal reported in personal reported in pass-through status. to shareholder are Corp. or S-Corp. *U.S. Tax Law

outlines

tax return. tax returns. personal tax taxed as personal eligibility for S-

returns. income. corp. status.

1) Execute

1) File Articles of

Partnership

1) Begin Operating 1) Execute Organization

Agreement 1) File a Certificate of Incorporation

Partnership

How to 2) File Certificate Agreement 2) Publication

2) File Certificate 2) Elect Board of Directors

Form of Assumed

of Limited

Name 2) File Certificate of 3) Write

Partnership 3) Create Bylaws

(if applicable) Assumed Name Operating

Agreement

3) Publication

Strong liability

Strong liability protection

protection

Easy to form Easy to form

Limited Ability to offer different types of stock interests

Simple to

Pros liability for

Inexpensive to Inexpensive to manage

some partners Investor friendly, easier to raise capital

form form

Transparent tax

Easier to transfer ownership

treatment

Complicated

Full liability at Full liability at formation

stake stake

Not investor

Cons General Strict corporate formalities

friendly

Hard to manage Agency partner still

with employees relationship faces full

liability

Das könnte Ihnen auch gefallen

- Finance (Introduction)Dokument6 SeitenFinance (Introduction)nericuevas1030Noch keine Bewertungen

- Stockholders' Equity:: Paid-In CapitalDokument34 SeitenStockholders' Equity:: Paid-In Capitaldecipher7Noch keine Bewertungen

- BA OutlineDokument17 SeitenBA OutlineCarrie AndersonNoch keine Bewertungen

- TTM 9 Akuntansi PartnershipDokument47 SeitenTTM 9 Akuntansi PartnershipAsti RahmadaniaNoch keine Bewertungen

- Level Up-CMPC 131 ReviewerDokument6 SeitenLevel Up-CMPC 131 ReviewerazithethirdNoch keine Bewertungen

- UNIT 3. Company LawDokument41 SeitenUNIT 3. Company LawдашаNoch keine Bewertungen

- Non-Tax Factors for Business Legal Forms SummaryDokument3 SeitenNon-Tax Factors for Business Legal Forms SummaryMark WatneyNoch keine Bewertungen

- 003 Eh 403 WWW PDFDokument5 Seiten003 Eh 403 WWW PDFChezka Bianca TorresNoch keine Bewertungen

- Fabm ReviewerDokument18 SeitenFabm ReviewerDrahneel MarasiganNoch keine Bewertungen

- Chapter 1 - Partnership Formation PDFDokument33 SeitenChapter 1 - Partnership Formation PDFAldrin ZolinaNoch keine Bewertungen

- ACC 113 - CH 12Dokument33 SeitenACC 113 - CH 12ahmed.alaradi88Noch keine Bewertungen

- PAT notesDokument40 SeitenPAT notesEd sorianoNoch keine Bewertungen

- Agency, Trust, and Partnership Comparison ChartDokument97 SeitenAgency, Trust, and Partnership Comparison ChartRoberto AguilaNoch keine Bewertungen

- Quiz 1 ReviewDokument4 SeitenQuiz 1 ReviewHibbah OwaisNoch keine Bewertungen

- Ch.1 Accounting For PartnershipDokument16 SeitenCh.1 Accounting For PartnershipSapphire Au MartinNoch keine Bewertungen

- Forms of Business Ownership Lesson 1Dokument9 SeitenForms of Business Ownership Lesson 1Aghaanaa JaiganeshNoch keine Bewertungen

- Conceptual Framework and Accounting Standards for CorporationsDokument23 SeitenConceptual Framework and Accounting Standards for CorporationsVanessaNoch keine Bewertungen

- Classification of Business - Legal Structure: InstructionsDokument3 SeitenClassification of Business - Legal Structure: InstructionsLachie HarmerNoch keine Bewertungen

- Sole Proprietor Vs LLP Vs General Partnership Vs CompanyDokument7 SeitenSole Proprietor Vs LLP Vs General Partnership Vs CompanyElizabeth NelsonNoch keine Bewertungen

- FIN4717 FIN4717 Entrepreneurial Entrepreneurial Finance FinanceDokument69 SeitenFIN4717 FIN4717 Entrepreneurial Entrepreneurial Finance Financedaniel_foo_16Noch keine Bewertungen

- Accounting For Share CapitalDokument86 SeitenAccounting For Share CapitalJPS JNoch keine Bewertungen

- Partnership NotesDokument8 SeitenPartnership NotesKingNoch keine Bewertungen

- Career Certificate In Business & HR ModulesDokument81 SeitenCareer Certificate In Business & HR ModulesMuhamad Fadli HarunNoch keine Bewertungen

- PARTNERSHIPDokument5 SeitenPARTNERSHIPAcabar AgosajesNoch keine Bewertungen

- Business Structure TableDokument1 SeiteBusiness Structure TableLuke AlbertsonNoch keine Bewertungen

- Paul Hype Page & CoDokument39 SeitenPaul Hype Page & CoArunKumarNoch keine Bewertungen

- Partnership Liability and AuthorityDokument31 SeitenPartnership Liability and AuthorityJassey Jane Orapa50% (2)

- Financial Management: Handout #01 - Basic Concept of Financial Management & Financial MarketsDokument5 SeitenFinancial Management: Handout #01 - Basic Concept of Financial Management & Financial MarketsMaryrose SumulongNoch keine Bewertungen

- Partnership vs Company ComparisonDokument8 SeitenPartnership vs Company ComparisonMuhammad Faizan GhafoorNoch keine Bewertungen

- Week1 - Assignment A - AccountingDokument3 SeitenWeek1 - Assignment A - AccountingJulan Calo CredoNoch keine Bewertungen

- Preparation For Credit ManagerDokument3 SeitenPreparation For Credit ManagerRohitNoch keine Bewertungen

- 1109 BusStrucChart PDFDokument3 Seiten1109 BusStrucChart PDFBiniam TufaNoch keine Bewertungen

- Actreg1 Notes 1Dokument33 SeitenActreg1 Notes 1nuggsNoch keine Bewertungen

- Comparison of The Features of Different Types of Business OrganizationsDokument2 SeitenComparison of The Features of Different Types of Business Organizationsgavin adrianNoch keine Bewertungen

- Ch3Accounting For PartnershipDokument39 SeitenCh3Accounting For Partnershipz62m2h2x6hNoch keine Bewertungen

- Forms of Business AssociationsDokument4 SeitenForms of Business Associationsnamratha minupuri100% (1)

- Business OrganizationDokument31 SeitenBusiness OrganizationcapunoaimieNoch keine Bewertungen

- BA I Outline - Spring 2014, Prof. SautterDokument151 SeitenBA I Outline - Spring 2014, Prof. Sautterlogan doopNoch keine Bewertungen

- Partnership AccountingDokument4 SeitenPartnership AccountingbelliissiimmaaNoch keine Bewertungen

- 3237 - Sole, Parnership and CorporationDokument5 Seiten3237 - Sole, Parnership and CorporationRAY NICOLE MALINGINoch keine Bewertungen

- PartnershipDokument2 SeitenPartnershipFraulien Legacy MaidapNoch keine Bewertungen

- Company - Basic ConceptsDokument2 SeitenCompany - Basic ConceptsAnu AcharNoch keine Bewertungen

- LEB. Session 1Dokument17 SeitenLEB. Session 1ashay sinhaNoch keine Bewertungen

- Types of Businesses Chart WorksheetDokument1 SeiteTypes of Businesses Chart WorksheetYousif Jamal Al Naqbi 12BENoch keine Bewertungen

- PARTNERSHIP Notes (Prelim)Dokument13 SeitenPARTNERSHIP Notes (Prelim)Bedynz Mark PimentelNoch keine Bewertungen

- Accounting For PartnershipsDokument37 SeitenAccounting For PartnershipsTsigereda MulugetaNoch keine Bewertungen

- Weeks 10 Chapter 5. General Provisions (Republic Act No. 11232)Dokument6 SeitenWeeks 10 Chapter 5. General Provisions (Republic Act No. 11232)Jean Paula SequiñoNoch keine Bewertungen

- Form company with LLC, partnership or corporationDokument4 SeitenForm company with LLC, partnership or corporationGloria TaiNoch keine Bewertungen

- Entity ComparisonDokument3 SeitenEntity Comparisoncthunder_1Noch keine Bewertungen

- AFAR - Sir BradDokument36 SeitenAFAR - Sir BradOliveros JaymarkNoch keine Bewertungen

- Accounting For PartnershipsDokument38 SeitenAccounting For PartnershipsLeticia AvelynNoch keine Bewertungen

- Types of Business EntitiesDokument4 SeitenTypes of Business EntitiesAini SyafiqahNoch keine Bewertungen

- Partnership-Chapter 3Dokument5 SeitenPartnership-Chapter 3Erfan KhanNoch keine Bewertungen

- Documents To Be SubmittedDokument10 SeitenDocuments To Be SubmittedPaulita GomezNoch keine Bewertungen

- Types of Business Structures in the PhilippinesDokument7 SeitenTypes of Business Structures in the PhilippinesBusiness100% (1)

- Overview of Financial ManagementDokument30 SeitenOverview of Financial ManagementDeza Mae PabataoNoch keine Bewertungen

- ML 292 Topic 1 - Lecture 1 - SlidesDokument16 SeitenML 292 Topic 1 - Lecture 1 - Slidestpotera8Noch keine Bewertungen

- Company Law: 1. Companies V PartnershipsDokument2 SeitenCompany Law: 1. Companies V PartnershipsPragash MaheswaranNoch keine Bewertungen

- Atty. Gaviola's Corporation Law Notes from University of San CarlosDokument50 SeitenAtty. Gaviola's Corporation Law Notes from University of San CarlosLourleth Caraballa LluzNoch keine Bewertungen

- LLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessVon EverandLLC Beginner's Guide & S-Corp 2024: The Ultimate Handbook for Establishing, Operating, and Maximizing Tax Savings for Your LLC and S-Corp as an Entrepreneur Launching a BusinessNoch keine Bewertungen

- Pale Digests Part 1Dokument24 SeitenPale Digests Part 1dingNoch keine Bewertungen

- Week 18 ImperialismDokument5 SeitenWeek 18 Imperialismapi-301032464Noch keine Bewertungen

- Company Deck - SKVDokument35 SeitenCompany Deck - SKVGurpreet SinghNoch keine Bewertungen

- Sapexercisegbi FiDokument18 SeitenSapexercisegbi FiWaqar Haider AshrafNoch keine Bewertungen

- LL.M in Mergers and Acquisitions Statement of PurposeDokument3 SeitenLL.M in Mergers and Acquisitions Statement of PurposeojasNoch keine Bewertungen

- The Aircraft EncyclopediaDokument196 SeitenThe Aircraft Encyclopediaa h100% (11)

- Read and Answer The QuestionsDokument4 SeitenRead and Answer The Questionsjhonatan c.Noch keine Bewertungen

- A. Express TermsDokument27 SeitenA. Express TermscwangheichanNoch keine Bewertungen

- Norton Leslie - Léonide Massine and The 20th Century BalletDokument381 SeitenNorton Leslie - Léonide Massine and The 20th Century BalletManuel CoitoNoch keine Bewertungen

- Residential Status Problems - 3Dokument15 SeitenResidential Status Problems - 3ysrbalajiNoch keine Bewertungen

- UK Health Forum Interaction 18Dokument150 SeitenUK Health Forum Interaction 18paralelepipicoipiNoch keine Bewertungen

- G.R. No. L-26549 July 31, 1970 EUGENIO LOPEZ, Publisher and Owner of The "MANILA, CHRONICLE and JUAN T. GATBONTONDokument6 SeitenG.R. No. L-26549 July 31, 1970 EUGENIO LOPEZ, Publisher and Owner of The "MANILA, CHRONICLE and JUAN T. GATBONTONnic mNoch keine Bewertungen

- Cervo Neue Font - FontlotcomDokument10 SeitenCervo Neue Font - FontlotcomontaarabNoch keine Bewertungen

- Environmental Impact Assessment (Eia) System in The PhilippinesDokument11 SeitenEnvironmental Impact Assessment (Eia) System in The PhilippinesthekeypadNoch keine Bewertungen

- Common University Entrance Test - WikipediaDokument17 SeitenCommon University Entrance Test - WikipediaAmitesh Tejaswi (B.A. LLB 16)Noch keine Bewertungen

- Realizing Your True Nature and Controlling CircumstancesDokument43 SeitenRealizing Your True Nature and Controlling Circumstancesmaggie144100% (17)

- Opinion About The Drug WarDokument1 SeiteOpinion About The Drug WarAnonymous JusFNTNoch keine Bewertungen

- David Mamet - The RakeDokument5 SeitenDavid Mamet - The Rakesuperslyspy100% (1)

- Answers: Unit 5 A Place To Call HomeDokument1 SeiteAnswers: Unit 5 A Place To Call HomeMr Ling Tuition CentreNoch keine Bewertungen

- Culture Plays Vital Role in Shaping An IdentityDokument5 SeitenCulture Plays Vital Role in Shaping An IdentityBahuNoch keine Bewertungen

- Paint Industry: Industry Origin and GrowthDokument50 SeitenPaint Industry: Industry Origin and GrowthKarishma Saxena100% (1)

- The Classical PeriodDokument49 SeitenThe Classical PeriodNallini NarayananNoch keine Bewertungen

- Introduction - Sanskrit Varnamala: - ह्रस्व (short vowels) - अ इ उ ऋ लृ and दीर्ण (long vowels) - आ ई ऊ ॠ ए ऐ ओ औDokument3 SeitenIntroduction - Sanskrit Varnamala: - ह्रस्व (short vowels) - अ इ उ ऋ लृ and दीर्ण (long vowels) - आ ई ऊ ॠ ए ऐ ओ औVijaykumar KunnathNoch keine Bewertungen

- WFBS Admin GuideDokument506 SeitenWFBS Admin GuideShivkumar505Noch keine Bewertungen

- Structure of Banking in IndiaDokument22 SeitenStructure of Banking in IndiaTushar Kumar 1140Noch keine Bewertungen

- Mecip GayahanDokument101 SeitenMecip GayahanPuerto CiasNoch keine Bewertungen

- Codex Alimentarius Commission: Procedural ManualDokument258 SeitenCodex Alimentarius Commission: Procedural ManualRoxanaNoch keine Bewertungen

- Unit 1, Herbal Drug Technology, B Pharmacy 6th Sem, Carewell PharmaDokument37 SeitenUnit 1, Herbal Drug Technology, B Pharmacy 6th Sem, Carewell Pharmawritters2023Noch keine Bewertungen

- Exam Call Letter Clerk RecruitmentDokument2 SeitenExam Call Letter Clerk RecruitmentBala SubramanianNoch keine Bewertungen

- HITEC Institute of Medical Sciences, Taxila Cantt (MBBS) Admission ListDokument168 SeitenHITEC Institute of Medical Sciences, Taxila Cantt (MBBS) Admission ListHaroon KhanNoch keine Bewertungen