Beruflich Dokumente

Kultur Dokumente

6: Corporate-Level Strategy 152: Strategic Focus

Hochgeladen von

Kavya Gopakumar0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

31 Ansichten1 SeiteThis document discusses different levels and types of corporate diversification strategies including related, unrelated, and value-creating, neutral, or reducing diversification. It explains reasons companies diversify such as pursuing related business opportunities to leverage core competencies, increasing market power, or accessing resources. The document also reviews acquisition strategies for horizontal and vertical integration to expand market power, overcome barriers, speed new products, and reshape competitive scope.

Originalbeschreibung:

Originaltitel

1

Copyright

© © All Rights Reserved

Verfügbare Formate

DOCX, PDF, TXT oder online auf Scribd lesen

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenThis document discusses different levels and types of corporate diversification strategies including related, unrelated, and value-creating, neutral, or reducing diversification. It explains reasons companies diversify such as pursuing related business opportunities to leverage core competencies, increasing market power, or accessing resources. The document also reviews acquisition strategies for horizontal and vertical integration to expand market power, overcome barriers, speed new products, and reshape competitive scope.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

0 Bewertungen0% fanden dieses Dokument nützlich (0 Abstimmungen)

31 Ansichten1 Seite6: Corporate-Level Strategy 152: Strategic Focus

Hochgeladen von

Kavya GopakumarThis document discusses different levels and types of corporate diversification strategies including related, unrelated, and value-creating, neutral, or reducing diversification. It explains reasons companies diversify such as pursuing related business opportunities to leverage core competencies, increasing market power, or accessing resources. The document also reviews acquisition strategies for horizontal and vertical integration to expand market power, overcome barriers, speed new products, and reshape competitive scope.

Copyright:

© All Rights Reserved

Verfügbare Formate

Als DOCX, PDF, TXT herunterladen oder online auf Scribd lesen

Sie sind auf Seite 1von 1

6: Corporate-Level Strategy 152

Opening Case: Procter and Gamble’s Diversification Strategy 153

Levels of Diversification 155

Low Levels of Diversification 155

Moderate and High Levels of Diversification 156

Reasons for Diversification 157

Value-Creating Diversification: Related Constrained and Related

Linked Diversification 158

Operational Relatedness: Sharing Activities 159

Corporate Relatedness: Transferring of Core Competencies 160

Market Power 161

Simultaneous Operational Relatedness and Corporate Relatedness 163

Unrelated Diversification 163

Strategic Focus: Operational and Corporate Relatedness: Smith & Wesson

and Luxottica 164

Efficient Internal Capital Market Allocation 165

Restructuring of Assets 166

Value-Neutral Diversification: Incentives and Resources 166

Strategic Focus: Revival of the Unrelated Strategy (Conglomerate): Small Firms Acquire

Castoffs from Large Firms and Seek to Improve Their Value 167

Incentives to Diversify 168

Resources and Diversification 171

Value-Reducing Diversification: Managerial Motives to Diversify 172

Summary 174 • Review Questions 174 • Experiential Exercises 175 • Notes 175

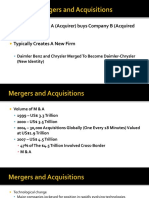

7: Acquisition and Restructuring Strategies 180

Opening Case: The Increased Trend Toward Cross-Border

Acquisitions 181

The Popularity of Merger and Acquisition Strategies 183

Mergers, Acquisitions, and Takeovers: What Are the Differences? 184

Reasons for Acquisitions 184

Increased Market Power 184

Strategic Focus: Oracle Makes a Series of Horizontal Acquisitions While

CVS Makes a Vertical Acquisition 185

Overcoming Entry Barriers 187

Cost of New Product Development and Increased Speed to Market 188

Lower Risk Compared to Developing New Products 189

Increased Diversification 189

Reshaping the Firm’s Competitive Scope 190

Das könnte Ihnen auch gefallen

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Von EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Bewertung: 4.5 von 5 Sternen4.5/5 (25)

- Crafting and Executing StrategyDokument13 SeitenCrafting and Executing StrategyRafiqul Islam7% (15)

- TSD Staffing - Scenario 1Dokument4 SeitenTSD Staffing - Scenario 1Kavya GopakumarNoch keine Bewertungen

- Creating Value From Mergers and Acquisitions - ToCDokument7 SeitenCreating Value From Mergers and Acquisitions - ToCredaek0% (1)

- PenmanDokument8 SeitenPenmanvinaymathewNoch keine Bewertungen

- ISMS Policy StatementDokument21 SeitenISMS Policy StatementKavya Gopakumar100% (2)

- Strategy Formulation: Situation Analysis and Business StrategyDokument22 SeitenStrategy Formulation: Situation Analysis and Business Strategyreimarie120% (1)

- Chapter 8Dokument4 SeitenChapter 8rakibulislammbstu01Noch keine Bewertungen

- Valuation For M and ADokument57 SeitenValuation For M and AAayushi AroraNoch keine Bewertungen

- SM Ch-6 Corporate Level StrategiesDokument116 SeitenSM Ch-6 Corporate Level Strategiesnisar241989Noch keine Bewertungen

- Creating Corporate StrategyDokument18 SeitenCreating Corporate StrategyAnoop SrivastavaNoch keine Bewertungen

- Corporate StrategyDokument60 SeitenCorporate StrategyAkarshNoch keine Bewertungen

- Stability StrategyDokument19 SeitenStability Strategyzakirno19248Noch keine Bewertungen

- Shareholder ValueDokument27 SeitenShareholder ValueDr Rushen SinghNoch keine Bewertungen

- Strategie: Villanova School Ofbusiness Villanova UniversityDokument6 SeitenStrategie: Villanova School Ofbusiness Villanova UniversitygauravNoch keine Bewertungen

- DiversificationDokument56 SeitenDiversificationvarsha27k4586Noch keine Bewertungen

- Key TakeawaysDokument32 SeitenKey TakeawaysKumar AbhishekNoch keine Bewertungen

- S MGT Ki - Maa Ki AankhDokument25 SeitenS MGT Ki - Maa Ki AankhPrannoy Karekar KalghatkarNoch keine Bewertungen

- Deloitte Conference WarsawDokument28 SeitenDeloitte Conference WarsawgoniolimNoch keine Bewertungen

- Ch8 Corporate Strategy: Diversification and The Multibusiness CompanyDokument39 SeitenCh8 Corporate Strategy: Diversification and The Multibusiness CompanyNour LyNoch keine Bewertungen

- Corporate-Level Strategy: S A S FDokument25 SeitenCorporate-Level Strategy: S A S FSneha DaswaniNoch keine Bewertungen

- Corporate Level StrategyDokument23 SeitenCorporate Level StrategyNagarjun VsNoch keine Bewertungen

- Strategic Management CH 6Dokument26 SeitenStrategic Management CH 6Rushabh VoraNoch keine Bewertungen

- Turnaround ManagementDokument29 SeitenTurnaround ManagementNeha KalloliNoch keine Bewertungen

- Merger Strategies and MotivesDokument18 SeitenMerger Strategies and MotivesGaurav RathaurNoch keine Bewertungen

- DiversificationDokument18 SeitenDiversificationVinod PandeyNoch keine Bewertungen

- Strategy and Capital AllocationDokument32 SeitenStrategy and Capital AllocationsonalNoch keine Bewertungen

- Book PenmanDokument8 SeitenBook PenmanL67Noch keine Bewertungen

- DiversificationDokument34 SeitenDiversificationPratikJoshiNoch keine Bewertungen

- Fundamental Analysis: Company Analysis: C S Mishra VGSOM, IIT KharagpurDokument48 SeitenFundamental Analysis: Company Analysis: C S Mishra VGSOM, IIT Kharagpurdivyagoel3010Noch keine Bewertungen

- Pride and Prospers IncDokument4 SeitenPride and Prospers Incjomari samonte100% (3)

- Corporate RestructuringDokument20 SeitenCorporate Restructuringshakti1212Noch keine Bewertungen

- Business Creation and Growth (GNS 302 - 2021) Important SummariesDokument148 SeitenBusiness Creation and Growth (GNS 302 - 2021) Important SummariesAminu AbdullahiNoch keine Bewertungen

- A Strategy Where The Organization Maintains Its Current Size and Current Level of Business OperationsDokument22 SeitenA Strategy Where The Organization Maintains Its Current Size and Current Level of Business Operationsgameplay84Noch keine Bewertungen

- Corporate Strategy: Mod Iii Topic 4Dokument27 SeitenCorporate Strategy: Mod Iii Topic 4Meghna SinghNoch keine Bewertungen

- Strategic in ActionDokument47 SeitenStrategic in ActionIzzy CalangianNoch keine Bewertungen

- July - Aug 2010 - Gaining Good Grades in ProcurementDokument8 SeitenJuly - Aug 2010 - Gaining Good Grades in ProcurementlithonNoch keine Bewertungen

- Harvard Business Review: Roll No: Tps - Major Finance Total Number of Slides - 28Dokument28 SeitenHarvard Business Review: Roll No: Tps - Major Finance Total Number of Slides - 28Udaya ChoudaryNoch keine Bewertungen

- Reasons For Corporate RestructuringDokument5 SeitenReasons For Corporate RestructuringRikardasNoch keine Bewertungen

- Crafting StrategiesDokument22 SeitenCrafting StrategiesIsaa Ruth FernandezNoch keine Bewertungen

- AISE Ch06Dokument31 SeitenAISE Ch06Vinay SinghNoch keine Bewertungen

- Types of Strategies SalimDokument62 SeitenTypes of Strategies SalimAshLee0% (1)

- Lecture 8 Growth StrategiesDokument16 SeitenLecture 8 Growth StrategiesGautam GokhaleNoch keine Bewertungen

- U-2 - Corporate Level Strategy - Creating Value Through DiversificationDokument18 SeitenU-2 - Corporate Level Strategy - Creating Value Through DiversificationGenieNoch keine Bewertungen

- Strategies For Multi-Business Corporations Strategic ReviewDokument31 SeitenStrategies For Multi-Business Corporations Strategic ReviewwordssmithNoch keine Bewertungen

- Investment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownDokument78 SeitenInvestment Analysis and Portfolio Management: Frank K. Reilly & Keith C. BrownNoreenakhtar100% (1)

- Chipotle Analyst's Report - 15 March 2017Dokument19 SeitenChipotle Analyst's Report - 15 March 2017Nhan NguyenNoch keine Bewertungen

- Title Page: Valuation of Mergers and AcquisitionsDokument58 SeitenTitle Page: Valuation of Mergers and Acquisitionsgirish8911Noch keine Bewertungen

- Research Paper Corporate RestructuringDokument20 SeitenResearch Paper Corporate RestructuringsamNoch keine Bewertungen

- Multi Business FirmDokument20 SeitenMulti Business Firmneha aggarwal100% (1)

- M & A: Company A (Acquirer) Buys Company B (Acquired or Target Firm) Typically Creates A New FirmDokument12 SeitenM & A: Company A (Acquirer) Buys Company B (Acquired or Target Firm) Typically Creates A New FirmGaneshRathodNoch keine Bewertungen

- MDLZ - Mondelez Barclays Consumer Conference 2016Dokument59 SeitenMDLZ - Mondelez Barclays Consumer Conference 2016Ala BasterNoch keine Bewertungen

- Merger Management Article CompendiumDokument52 SeitenMerger Management Article CompendiumAkshay Rawat100% (2)

- Ch05 Investment Analysis and Portfolio MGT MDokument77 SeitenCh05 Investment Analysis and Portfolio MGT MJenilyn VergaraNoch keine Bewertungen

- Assignment #2Dokument14 SeitenAssignment #2rowland50% (2)

- Ch06 SMDokument36 SeitenCh06 SMYber LexNoch keine Bewertungen

- Corporate-Level Strategy (Acquisitions and Restructuring)Dokument58 SeitenCorporate-Level Strategy (Acquisitions and Restructuring)Ranjan KishoreNoch keine Bewertungen

- Corporate-Level Strategy:: Creating Value Through DiversificationDokument36 SeitenCorporate-Level Strategy:: Creating Value Through DiversificationshuvoertizaNoch keine Bewertungen

- The Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)Von EverandThe Balanced Scorecard (Review and Analysis of Kaplan and Norton's Book)Bewertung: 4.5 von 5 Sternen4.5/5 (3)

- Business Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldVon EverandBusiness Process Mapping: How to improve customer experience and increase profitability in a post-COVID worldNoch keine Bewertungen

- Stock Valuation: An Essential Guide to Wall Street's Most Popular Valuation ModelsVon EverandStock Valuation: An Essential Guide to Wall Street's Most Popular Valuation ModelsNoch keine Bewertungen

- Pricing: Evaluation of Pricing PolicyDokument2 SeitenPricing: Evaluation of Pricing PolicyKavya GopakumarNoch keine Bewertungen

- Data Quality PolicyDokument4 SeitenData Quality PolicyKavya GopakumarNoch keine Bewertungen

- Your Logo: It Policy TemplateDokument8 SeitenYour Logo: It Policy TemplateKavya GopakumarNoch keine Bewertungen

- According To Exhibit 10: Adapting The PriceDokument2 SeitenAccording To Exhibit 10: Adapting The PriceKavya GopakumarNoch keine Bewertungen

- Policy: General EnvironmentalDokument4 SeitenPolicy: General EnvironmentalKavya GopakumarNoch keine Bewertungen

- Airtle Doc-Pages-2,12-13Dokument3 SeitenAirtle Doc-Pages-2,12-13Kavya GopakumarNoch keine Bewertungen

- CH 4.1 - Strategic IS PlanningDokument15 SeitenCH 4.1 - Strategic IS PlanningKavya GopakumarNoch keine Bewertungen

- What Is A Privacy Policy?Dokument3 SeitenWhat Is A Privacy Policy?Kavya GopakumarNoch keine Bewertungen

- What Should I Include in A Boilerplate Privacy Policy?: What Information You CollectDokument4 SeitenWhat Should I Include in A Boilerplate Privacy Policy?: What Information You CollectKavya GopakumarNoch keine Bewertungen

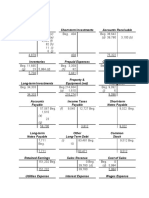

- (B) 3,100 9,545 (F) 82 (H) 11 (I) 6 (J) (D) 39,780Dokument3 Seiten(B) 3,100 9,545 (F) 82 (H) 11 (I) 6 (J) (D) 39,780Kavya GopakumarNoch keine Bewertungen

- SBCP Information Security and Governance OverviewDokument8 SeitenSBCP Information Security and Governance OverviewKavya GopakumarNoch keine Bewertungen

- Information Security Policy Statement: Jim HassellDokument1 SeiteInformation Security Policy Statement: Jim HassellKavya GopakumarNoch keine Bewertungen

- Information Security and Privacy at AirtelDokument2 SeitenInformation Security and Privacy at AirtelKavya GopakumarNoch keine Bewertungen

- Continuing ProblemDokument7 SeitenContinuing ProblemKavya GopakumarNoch keine Bewertungen

- Sharda Crop - Annual Report 2017-18 PDFDokument196 SeitenSharda Crop - Annual Report 2017-18 PDFKavya GopakumarNoch keine Bewertungen

- T Tut Sec 2015 PDF e PDFDokument206 SeitenT Tut Sec 2015 PDF e PDFKavya GopakumarNoch keine Bewertungen

- Sharda Crop - Annual-Report 2018-19 PDFDokument216 SeitenSharda Crop - Annual-Report 2018-19 PDFKavya GopakumarNoch keine Bewertungen

- Differential Calculus - QDokument19 SeitenDifferential Calculus - QKavya GopakumarNoch keine Bewertungen

- LP - Marketing Case StudyDokument3 SeitenLP - Marketing Case StudyKavya GopakumarNoch keine Bewertungen

- Comp4 1Dokument3 SeitenComp4 1Kavya GopakumarNoch keine Bewertungen

- SSRN Id224274Dokument39 SeitenSSRN Id224274Kavya GopakumarNoch keine Bewertungen