Beruflich Dokumente

Kultur Dokumente

Chapter 3 Advanced Accounting

Hochgeladen von

Marife De Leon VillalonCopyright

Verfügbare Formate

Dieses Dokument teilen

Dokument teilen oder einbetten

Stufen Sie dieses Dokument als nützlich ein?

Sind diese Inhalte unangemessen?

Dieses Dokument meldenCopyright:

Verfügbare Formate

Chapter 3 Advanced Accounting

Hochgeladen von

Marife De Leon VillalonCopyright:

Verfügbare Formate

Chapter 3

AN INTRODUCTION TO CONSOLIDATED FINANCIAL STATEMENTS

Answers to Questions

1 A corporation becomes a subsidiary when another corporation either directly or indirectly acquires a

controlling financial interest (generally over 50 percent) of its outstanding voting stock.

2 Amounts assigned to identifiable assets and liabilities in excess of recorded amounts on the books of the

subsidiary are not recorded separately by the parent. Instead, the parent records the fair value/purchase

price of the interest acquired in an investment account. The assignment to identifiable asset and liability

accounts is made through working paper entries when the parent and subsidiary financial statements are

consolidated.

3 The land would be shown in the consolidated balance sheet at $100,000, its fair value, assuming that the

purchase price of the subsidiary is greater than the book value of the subsidiary’s net assets. If the parent

had acquired an 80 percent interest and the implied fair value of the subsidiary was greater than the book

value of the subsidiary’s net assets, the land would still appear in the consolidated balance sheet at

$100,000. Under GAAP, the noncontrolling interest is also reported based on fair values at the acquisition

date.

4 Parent company—a corporation that owns a controlling interest in the outstanding voting stock of another

corporation (its subsidiary).

Subsidiary company—a corporation that is controlled by a parent that owns a controlling interest in its

outstanding voting stock, either directly or indirectly.

Affiliates—companies that are controlled by a single management team through parent-subsidiary

relationships. (Although the term affiliate is a synonym for subsidiary, the parent is included in the total

affiliation structure.) In many annual reports, the term includes all investments accounted for by the

equity method.

Associates—companies that are controlled through parent-subsidiary relationships or whose operations

can be significantly influenced through equity investments of 20 percent to 50 percent.

5 A noncontrolling interest is the equity interest in a subsidiary that is owned by stockholders outside of the

affiliation structure. In other words, it is the equity interest in a subsidiary (recorded at fair value) that is

not held by the parent or subsidiaries of the parent.

6 Under GAAP, a subsidiary will not be consolidated if control does not rest with the majority owner, such

as in the case of a subsidiary in reorganization or bankruptcy, or when the subsidiary operates under

severe foreign exchange restrictions or other governmentally imposed uncertainties.

7 Consolidated financial statements are intended primarily for the stockholders and creditors of the parent,

according to GAAP.

8 The amount of capital stock that appears in a consolidated balance sheet is the total par or stated value of

the outstanding capital stock of the parent.

9 Goodwill from consolidation may appear in the general ledger of the surviving entity in a merger or a

consolidation accounted for as an acquisition. But goodwill from consolidation would not appear in the

general ledger of a parent or its subsidiary. Goodwill is entered in consolidation working papers when the

reciprocal investment and equity amounts are eliminated. Working paper entries affect consolidated

financial statements, but they are not entered in any general ledger.

Copyright © 2018 Pearson Education, Inc.

3-1

3-2 An Introduction to Consolidated Financial Statements

10 The parent’s investment in subsidiary does not appear in a consolidated balance sheet if the subsidiary is

consolidated. It would appear in the parent’s separate balance sheet under the heading “investments” or

“other assets.” Investments in unconsolidated subsidiaries are shown in consolidated balance sheets as

investments or other assets. They are accounted for under the equity method if the parent can exercise

significant influence over the subsidiary; otherwise, they are accounted for by the fair value / cost

method.

11 Parent’s books: Reciprocal accounts on subsidiary’s books:

Investment in subsidiary Capital stock and retained earnings

Sales Purchases

Accounts receivable Accounts payable

Interest income Interest expense

Dividends receivable Dividends payable

Advance to subsidiary Advance from parent

12 Reciprocal accounts are eliminated in the process of preparing consolidated financial statements in order

to show the financial position and results of operations of the total economic entity that is under the

control of a single management team. Sales by a parent to a subsidiary are internal transactions from the

viewpoint of the economic entity and the same is true of interest income and interest expense and rent

income and rent expense arising from intercompany transactions. Similarly, receivables from and

payables to affiliates do not represent assets and liabilities of the economic entity for which consolidated

financial statements are prepared.

13 The stockholders’ equity of a parent under the equity method is the same as the consolidated

stockholders’ equity of a parent except for noncontrolling interest. Consolidated balance sheets disclose

noncontrolling interest for subsidiaries that are not wholly owned.

14 No. The amounts that appear in the parent’s statement of retained earnings under the equity method and

the amounts that appear in the consolidated statement of retained earnings are identical, assuming that the

noncontrolling interest is included as a separate component of stockholders’ equity.

15 Income attributable to noncontrolling interest is not an expense, but rather it is an allocation of the total

income to the consolidated entity between controlling and noncontrolling stockholders. From the

viewpoint of the controlling interest (the stockholders of the parent), income attributable to

noncontrolling interest has the same effect on consolidated net income as an expense. This is because

consolidated net income is income to all stockholders. Alternatively, you can view total consolidated net

income as being allocated to the controlling and noncontrolling interests.

16 The computation of noncontrolling interest is comparable to the computation of retained earnings. It is

computed:

Noncontrolling interest beginning of the period

Add: Income attributable to noncontrolling

interest

Deduct: Noncontrolling interest dividends

Deduct: Noncontrolling interest of amortization of

excess of fair value over book value

Add: Noncontrolling interest of amortization of

excess of book value over fair value

Noncontrolling interest end of the period

17 It is acceptable to consolidate the annual financial statements of a parent and a subsidiary with different

fiscal periods, provided that the dates of closing are not more than three months apart. Any significant

developments that occur in the intervening three-month period should be disclosed in notes to the

financial statements. In the situation described, it is acceptable to consolidate the financial statements of

Copyright © 2018 Pearson Education, Inc.

Chapter 3 3-3

the subsidiary with an October 31 closing date with the financial statements of the parent with a

December 31 closing date.

18 The acquisition of shares from noncontrolling stockholders is not a business combination. It is not

possible, by definition, to acquire a controlling interest from noncontrolling stockholders. Increasing a

controlling interest is the same as making an additional investment. Acquisition of additional subsidiary

stock is recorded by increasing the investment account and reducing the noncontrolling interest account.

SOLUTIONS TO EXERCISES

Solution E3-1 Solution E3-2

1 b 1 d

2 c 2 b

3 d 3 d

4 d 4 d

5 a 5 a

6 b

7 c

Solution E3-3 [AICPA adapted]

1 c Advance to Hill $75,000 + receivable from Ward $200,000 = $275,000

2 a Zero, goodwill has an indeterminate life and is not amortized.

3 a Pop accounts for Sap using the equity method, therefore,

consolidated retained earnings is equal to Pop’s retained earnings, or

$2,480,000.

Solution E3-4 (in thousands)

1 Implied fair value of Son ($3,600 / 90%) $4,000

Less: Book value of Son (3,600)

Excess fair value over book value $ 400

Equipment undervalued 120

Goodwill at January 1, 2016 $ 280

Goodwill at December 31, 2016 = Goodwill from consolidation $ 280

Since goodwill is not amortized

2 Consolidated net income

Pop’s reported net income $1,960

Less: Correction to income from Son for

depreciation on excess allocated

to equipment [($120,000/3 years)x 90%] (36)

Controlling share of consolidated net income $1,924

Noncontrolling share of consolidated net income

[$400,000 - $40,000 depreciation] x 10% $ 36

Controlling share of consolidated net income 1,924

Copyright © 2018 Pearson Education, Inc.

3-4 An Introduction to Consolidated Financial Statements

Consolidated net income $1,960

Copyright © 2018 Pearson Education, Inc.

Chapter 3 3-5

Solution E3-5 (in thousands)

1 $2,400, the dividends of Pam

2 $1,320, equal to $1,200 dividends payable of Pam plus $120 (30% of $400)

dividends payable to noncontrolling interests of Sun.

Solution E3-6 (in thousands)

Preliminary computation

Cost of Son stock (Fair value) $10,000

Fair value of Son’s identifiable net assets 8,000

Goodwill $ 2,000

1 Journal entry to record push down values

Inventories 160

Land 400

Buildings — net 1,200

Equipment — net 640

Goodwill 2,000

Retained earnings 1,680

Note payable 80

Push-down capital 6,000

2 Son Corporation

Balance Sheet

January 1, 2016

(in thousands)

Assets

Cash $ 560

Accounts receivable 640

Inventories 800

Land 1,600

Buildings — net 4,000

Equipment — net 2,400

Goodwill 2,000

Total assets $12,000

Liabilities

Accounts payable $ 800

Note payable 1,200

Total liabilities 2,000

Stockholders’ equity

Capital stock $ 4,000

Push-down capital 6,000

Total stockholders’ equity 10,000

Total liabilities and stockholders’ equity $12,000

Copyright © 2018 Pearson Education, Inc.

3-6 An Introduction to Consolidated Financial Statements

Solution E3-7

1 Pam Corporation and Subsidiary

Consolidated Income Statement

for the year 2017

(in thousands)

Sales ($4,000 + $1,600) $5,600

Less: Cost of sales ($2,400 + $800) (3,200)

Gross profit 2,400

Less: Depreciation expense ($200 + $160) (360)

Other expenses ($796 + $360) (1,156)

Consolidated net income 884

Less: Noncontrolling interest share ($280 ´ 30%) (84)

Controlling interest share of cnsolidated net income $ 800

2 Pam Corporation and Subsidiary

Consolidated Income Statement

for the year 2017

(in thousands)

Sales ($4,000 + $1,600) $5,600

Less: Cost of sales ($2,400 + $800) (3,200)

Gross profit 2,400

Less: Depreciation expense ($200 + $160 - $24) (336)

Other expenses ($796 + $360) (1,156)

Consolidated net income 908

Less: Noncontrolling interest share

[($280 ´ 30%)+ ($24 depreciation x 30%)] (91.2)

Controlling interest share of consolidated net income $ 816.8

Supporting computations

Depreciation of excess allocated to overvalued equipment:

$120/5 years = $24

Copyright © 2018 Pearson Education, Inc.

Chapter 3 3-7

Solution E3-8 (in thousands)

1 Capital stock

The capital stock appearing in the consolidated balance sheet at

December 31, 2016 is $3,600, the capital stock of Pop,the parent

company.

2 Goodwill at December 31, 2016

Investment cost at January 2, 2016 (80% interest) $1,400

Implied total fair value of Son ($1,400 / 80%) $1,750

Book value of Son(100%) (1,200)

Excess is considered goodwill since no other fair value

information is given. $ 550

3 Consolidated retained earnings at December 31, 2016

Pop’s retained earnings January 2 (equal to

beginning consolidated retained earnings $1,600

Add: Net income of Pop (equal to controlling share of

consolidated net income) 600

Less: Dividends declared by Pop (360)

Consolidated retained earnings December 31 $1,840

4 Noncontrolling interest at December 31, 2016

Capital stock and retained earnings of Son on

January 2 $1,200

Add: Son’s net income 180

Less: Dividends declared by Son (100)

Son’s stockholders’ equity December 31 1,280

Noncontrolling interest percentage 20%

Noncontrolling interest at book value $ 256

Add: 20% Goodwill 110

Noncontrolling interest December 31 $ 366

5 Dividends payable at December 31, 2016

Dividends payable to stockholders of Pop $ 180

Dividends payable to noncontrolling stockholders ($50 ´ 20%) 10

Dividends payable to stockholders outside the

Consolidated entity $ 190

Copyright © 2018 Pearson Education, Inc.

3-8 An Introduction to Consolidated Financial Statements

Solution E3-9 (in thousands)

Pam Corporation and Subsidiary

Partial Balance Sheet

at December 31, 2016

Stockholders’ equity:

Capital stock, $10 par $1,200

Additional paid-in capital 200

Retained earnings 260

Equity of controlling stockholders 1,660

Noncontrolling interest 164

Total stockholders’ equity $1,824

Supporting computations

Computation of consolidated retained earnings:

Pam’s December 31, 2015 retained earnings $ 140

Add: Pam’s reported income for 2016 220

Less: Pam’s dividends (100)

Consolidated retained earnings December 31, 2016 $ 260

Computation of noncontrolling interest at December 31, 2016

Sun’s December 31, 2015 stockholders’ equity $800

Income less dividends for 2016 ($80 - $60) 20

Sun’s December 31, 2016 stockholders’ equity 820

Noncontrolling interest percentage 20%

Noncontrolling interest December 31, 2016 $164

Copyright © 2018 Pearson Education, Inc.

Chapter 3 3-9

Solution E3-10

Pop Corporation and Subsidiary

Consolidated Income Statement

for the year ended December 31, 2018

(in thousands)

Sales $4,200

Cost of goods sold 2,200

Gross profit 2,000

Deduct: Operating expenses 1,110

Consolidated net income 890

Deduct: Noncontrolling interest share 29

Controlling interest share $ 861

Supporting computations

Investment cost January 1, 2016 (90% interest) $ 1,620

Implied total fair value of Son ($1,620 / 90%) $ 1,800

Son’s Book value acquired (100%) (1,400)

Excess of fair value over book value $ 400

Excess allocated to:

Inventories (sold in 2016) $ 60

Equipment (4 years remaining useful life) 40

Goodwill 300

Excess of fair value over book value $ 400

Operating expenses:

Combined operating expenses of Pop and Son $1,100

Add: Depreciation on excess allocated to equipment

($40/4 years) 10

Consolidated operating expenses $1,110

Copyright © 2018 Pearson Education, Inc.

3-10 An Introduction to Consolidated Financial Statements

SOLUTIONS TO PROBLEMS

Solution P3-1

1 Pam Corporation and Subsidiary

Consolidated Balance Sheet

at December 31, 2016

(in thousands)

Assets

Cash ($128 + $72) $ 200

Accounts receivable ($180 + $136 - $20) 296

Inventories ($572 + $224) 796

Equipment — net ($1,520 + $700) 2,220

Total assets $3,512

Liabilities and Stockholders’ Equity

Liabilities:

Accounts payable ($160 + $132 - $20) $ 272

Stockholders’ equity:

Common stock, $10 par 1,840

Retained earnings 1,200

Noncontrolling interest ($600 + $400) ´ 20% 200

Total liabilities and stockholders’ equity $3,512

2 Consolidated net income for 2017

Pam’s separate income $ 680

Add: Income from Sun 360

Consolidated net income $1,040

Noncontrolling interest share (20% x $360,000) $ 72

Controlling interest share (80%) $ 968

Copyright © 2018 Pearson Education, Inc.

Chapter 3 3-11

Solution P3-2 (in thousands)

1 Schedule to allocate fair value/book value differential

Cost of investment in Son $ 350

Implied fair value of Son ($350 / 70%) $ 500

Book value of Son (220)

Excess fair value over book value $ 280

Excess allocated:

Fair Value Book Value Allocation

Inventories ($100 - $60) $ 40

Land ($120 - $100) 20

Buildings — net ($180 - $140) 40

Equipment — net ($60 - $80) (20)

Other liabilities ($80 - $100) 20

Allocated to identifiable net assets 100

Goodwill for the remainder 180

Excess fair value over book value $280

2 Pop Corporation and Subsidiary

Consolidated Balance Sheet

at January 1, 2016

Assets

Current assets:

Cash ($70 + $40) $110

Receivables — net ($160 + $60) 220

Inventories ($140 + $60 + $40) 240 $ 570

Property, plant and equipment:

Land ($200 + $100 + $20) $320

Buildings — net ($220 + $140 + $40) 400

Equipment — net ($160 + $80 - $20) 220 940

Goodwill (from consolidation) 180

Total assets $1,690

Liabilities and Stockholders’ Equity

Liabilities:

Accounts payable ($180 + $160) $ 340

Other liabilities ($20 + $100 - $20) 100 $ 440

Stockholders’ equity:

Capital stock $1,000

Retained earnings 100

Equity of controlling stockholders 1,100

Noncontrolling interest * 150 1,250

Total liabilities and stockholders’ equity $1,690

* 30% of implied fair value of $500 = $150.

Copyright © 2018 Pearson Education, Inc.

3-12 An Introduction to Consolidated Financial Statements

Solution P3-3 (in thousands)

Cost of investment in Sun January 1, 2016 $10,800

Implied fair value of Sun ($10,800 / 80%) $13,500

Book value of Sun 10,000

Excess of fair value over book value $ 3,500

Schedule to Allocate Fair Value — Book Value Differential

Fair Value

- Book Allocation

Value

Current assets $2,000 $2,000

Equipment 4,000 4,000

Bargain purchase

gain* (2,500)

Excess fair value over book value $3,500

*After recognizing acquired assets and liabilities at fair values, we are left

with a negative excess of $2,500. Under GAAP, this difference is recorded as a

gain in the consolidated income statement in the year of acquisition. The gain

is attributable entirely to the controlling interest, and is recorded on the

parent’s books by a debit to the Investment account and a credit to a Gain

from bargain Purchase account. An alternative calculation of this amount takes

the difference between the fair values of the net assets ($16,000) and their

fair value implied by the acquisition price ($13,500), which equals $2,500.

Solution P3-4 (in thousands)

Noncontrolling interest of $260 (fair value) plus $1,040 (fair value of Pam’s

investment) equals total fair value of $1,300. Therefore, Pam’s interest is

80% ($1,040 / $1,300), and noncontrolling interest is 20% ($260 / $1,300).

Total fair value $1,300

Book value of Sun (1,040)

Excess fair value over book value $ 260

Excess allocated to

Fair Value - Book Value

Plant assets — net $840 - $800 $ 40

Goodwill 220

Total $ 260

Copyright © 2018 Pearson Education, Inc.

Chapter 3 3-13

Solution P3-5

Pop Corporation and Subsidiary

Consolidated Balance Sheet

at December 31, 2016

(in thousands)

Assets

Current assets $ 2,720

Plant assets 6,640

Goodwill 1,600

$10,960

Equities

Liabilities $ 5,280

Capital stock 2,400

Retained earnings 3,280

$10,960

Supporting computations

Son’s net income ($3,200 - $2,400 - $400) $ 400

Less: Excess allocated to inventories that were sold in 2016 (160)

Less: Depreciation on excess allocated to plant

assets ($320 /4 years) (80)

Income from Son $ 160

Plant assets ($4,000 + $2,400 + $320 - $80) $6,640

Pop’s retained earnings:

Beginning retained earnings $2,720

Add: Operating income 800

Add: Income from Son 160

Deduct: Dividends (400)

Retained earnings December 31, 2016 $3,280

Copyright © 2018 Pearson Education, Inc.

3-14 An Introduction to Consolidated Financial Statements

Solution P3-6

Pam Corporation and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2016

(in thousands)

Pam Sun Adjustments and Consolidated

per books per books Eliminations Balance Sheet

Cash $ 168 $ 80 $ 248

Receivables — net 200 520 b 36 684

Inventories 1,400 200 1,600

Land 600 800 1,400

Equipment — net 2,400 400 2,800

Investment in Sun 1,836 a 1,836

Goodwill ______ ______ a 400 400

Total assets $6,604 $2,000 $7,132

Accounts payable $1,640 $ 320 $1,960

Dividends payable 240 40 b 36 244

Capital stock 4,000 1,200 a 1,200 4,000

Retained earnings 724 440 a 440 724

Noncontrolling interest ______ ______ a 204 204

Total equities $6,604 $2,000 $7,132

a To eliminate reciprocal investment and equity accounts, record goodwill ($400),

and enter noncontrolling interest [($1,640 equity + $400 goodwill) ´ 10%)].

b To eliminate reciprocal dividends receivable (included in receivables — net) and

dividends payable amounts ($40 dividends ´ 90%).

Copyright © 2018 Pearson Education, Inc.

Chapter 3 3-15

Solution P3-7 (in thousands)

Preliminary computations

Cost of 80% investment January 3, 2016 $1,120

Implied total fair value of Son ($1,120 / 80%) $1,400

Book value of Son (1,000)

Excess fair value over book value on January 3 = Goodwill $ 400

1 Noncontrolling interest share of income:

Son’s net income $200 ´ 20% noncontrolling interest $ 40

2 Current assets:

Combined current assets ($816 + $300) $1,116

Less: Dividends receivable ($40 ´ 80%) (32)

Current assets $1,084

3 Income from Son: None Investment income is eliminated in consolidation.

4 Capital stock: $2,000 Capital stock of the parent, Pop Corporation.

5 Investment in Son: None The investment account is eliminated.

6 Excess of fair value over book value $400

7 Controlling share of consolidated net income: Equals Pop’s

net income, or:

Consolidated sales $ 2,400

Less: Consolidated cost of goods sold (1,480)

Less: Consolidated expenses (320)

Consolidated net income $ 600

Less: Noncontrolling interest share (40)

Controlling share $ 560

8 Consolidated retained earnings December 31, 2016: $808 Equals Pop’s

beginning retained earnings.

9 Consolidated retained earnings December 31, 2017

Equal to Pop’s ending retained earnings:

Beginning retained earnings $ 808

Add: Controlling share of consolidated net income 560

Less: Pop’s dividends for 2017 (240)

Ending retained earnings $1,128

10 Noncontrolling interest December 31, 2017

Son’s capital stock and retained earnings $1,200

Add: Net income 200

Less: Dividends (100)

Son’s equity December 31, 2017 at fair value 1,300

Noncontrolling interest percentage 20%

Noncontrolling interest December 31, 2017 using book value $ 260

Add: Noncontrolling interest share of Goodwill 80

Noncontrolling interest December 31, 2017 at fair value $ 340

Copyright © 2018 Pearson Education, Inc.

3-16 An Introduction to Consolidated Financial Statements

Solution P3-8 [AICPA adapted]

Preliminary computations Son Sam

Investment cost:

Son (2,000 shares ´ 80%) ´ $280 448,000

Sam (6,000 shares ´ 70%) ´ $160 672,000

Implied total fair values:

Son ($448,000 / 80%) 560,000

Sam ($672,000 / 70%) 960,000

Book value

Son 280,000

Sam 480,000

Excess fair value over book value at acquisition

Goodwill $280,000 $480,000

1 a. Journal entries to account for investments

January 1, 2016 — Acquisition of investments

Investment in Son (80%) 448,000

Cash 448,000

To record acquisition of 1,600 shares of

Son common stock at $280 per share.

Investment in Sam (70%) 672,000

Cash 672,000

To record acquisition of 4,200 shares of

Sam common stock at $160 per share.

b. During 2016 — Dividends from subsidiaries

Cash 51,200

Investment in Son (80%) 51,200

To record dividends received from Son ($64,000 ´ 80%).

Cash 25,200

Investment in Sam (70%) 25,200

To record dividends received from Sam ($36,000 ´ 70%).

c. December 31, 2016 — Share of income or loss

Investment in Son (80%) 115,200

Income from Son 115,200

To record investment income from Son ($144,000 ´ 80%).

Loss from Sam 33,600

Investment in Sam (70%) 33,600

To record investment loss from Sam ($48,000 ´ 70%).

Copyright © 2018 Pearson Education, Inc.

Chapter 3 3-17

Solution P3-8 (continued)

2 Noncontrolling interest December 31, 2016

Son Sam

Common stock $200,000 $240,000

Capital in excess of par 80,000

Retained earnings 160,000 76,000

Equity December 31 360,000 396,000

Noncontrolling interest percentage 20% 30%

Noncontrolling interest December 31 $ 72,000 $118,800

Plus: Goodwill $280,000 x 20% 56,000

$480,000 x 30% 144,000

Noncontrolling interest December 31 $128,000 $262,800

3 Consolidated retained earnings December 31, 2016

Consolidated retained earnings is reported at $1,218,400, equal to the

retained earnings of Pop Corporation, the parent, at December 31, 2016.

4 Investment balance December 31, 2016:

Son Sam

Investment cost January 1 $448,000 $672,000

Add (deduct): Income (loss) 115,200 (33,600)

Deduct: Dividends received (51,200) (25,200)

Investment balances December 31 $512,000 $613,200

Check: Investment balances should be equal to the underlying book value

plus share of goodwill

Son ($360,000 ´ 80%) = $288,000 + ($280,000 x 80%) = $512,000

Sam ($396,000 ´ 70%) = $277,200 + ($480,000 x 70%) = $613,200

After consolidation, the Investment balances are $0.

Copyright © 2018 Pearson Education, Inc.

3-18 An Introduction to Consolidated Financial Statements

Solution P3-9

Preliminary computations (in thousands)

Cost of 90% investment January 1, 2016 $14,400

Implied total fair value of Sun ($14,400 / 90%) $16,000

Book value of Sun (10,800)

Excess fair value over book value on January 1 $ 5,200

Allocation to equipment $ 3,200

Remainder is Goodwill $ 2,000

Additional annual depreciation on equipment ($3,200 / 8 years) $ 400

Pam Corporation and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2016

(in thousands)

90% Adjustments and Consolidated

Pan Son Eliminations Balance Sheet

Cash $ 1,200 $ 800 $ 2,000

Receivables — net 2,400 1,600 4,000

Dividends receivable 360 b 360

Inventory 2,800 2,400 5,200

Land 2,400 2,800 5,200

Buildings — net 8,000 4,000 12,000

Equipment — net 6,000 3,200 a 2,800 12,000

Investment in Sun 15,120 a 15,120

Goodwill _______ ________ a 2,000 2,000

Total assets $38,280 $ 14,800 $42,400

Accounts payable $ 1,200 $ 2,400 $ 3,600

Dividends payable 2,000 400 b 360 2,040

Capital stock 28,000 8,000 a 8,000 28,000

Retained earnings 7,080 4,000 a 4,000 7,080

Noncontrolling interest _______ ________ a 1,680 1,680

Total equities $38,280 $ 14,800 $42,400

a To eliminate reciprocal investment and equity accounts, enter unamortized excess

allocated to equipment, record goodwill, and enter noncontrolling interest (at

fair value).

b To eliminate reciprocal dividends receivable and dividends payable amounts.

Copyright © 2018 Pearson Education, Inc.

Chapter 3 3-19

Solution P3-10

1 Purchase price of investment in Sun (in thousands)

Underlying book value of investment in Sun:

Equity of Sun January 1, 2016 $1,760

Add: Excess investment fair value over book value:

Goodwill at December 31, 2020 480

Fair value of Sun January 1, 2016 $2,240

Purchase price of 80% investment at fair value($2,240 x 80%) $1,792

2 Sun’s stockholders’ equity on December 31, 2020 (in thousands)

20% noncontrolling interest at fair value $496

20% goodwill (96)

20% noncontrolling interest’s equity at book value $400

Total equity = Noncontrolling interest’s equity $400/20% = $2,000

3 Pam’s investment in Sun account balance at December 31, 2020

(in thousands)

Underlying book value in Sun December 31, 2020

($2,000 ´ 80%) $1,600

Add: 80% of Goodwill December 31, 2020

(20% is attributable to the noncontrolling interest) 384

Investment in Sun December 31, 2020 $1,984

Alternative solution:

Investment cost January 1, 2016 $1,792

Add: 80% of Sun’s increase since acquisition

($2,000 - $1,760) ´ 80% 192

Investment in Sun December 31, 2020 $1,984

4 Pam’s capital stock and retained earnings December 31, 2020

(in thousands)

Capital stock $3,200

Retained earnings $ 240

Amounts are equal to capital stock and retained earnings shown in the

consolidated balance sheet.

Copyright © 2018 Pearson Education, Inc.

3-20 An Introduction to Consolidated Financial Statements

Solution P3-11

Preliminary computations (in thousands)

Cost of 70% investment in Son $2,800

Implied fair of Son($2,800 / 70%) $4,000

Book value of Son (100%) 3,200

Excess $ 800

Excess allocated:

Inventories $ 80

Plant assets 320

Goodwill 400

Excess $ 800

Investment balance at January 1, 2016 $2,800

Share of Son’s retained earnings increase ($240 ´ 70%) 168

Less: Amortization

70% of excess allocated to inventories (sold in 2016) (56)

70% of excess allocated to plant assets ($320 /8 years) (28)

Investment balance at December 31, 2016 $2,884

Noncontrolling interest at December 31

30% of Son’s book value at December 31 ($3,440 x 30%) $1,032

30% of Goodwill 120

30% Unamortized excess for plant assets

30% x ($320 - $40 amortization) 84

Noncontrolling at December 31 (fair value) $1,236

Pop Corporation and Subsidiary

Consolidated Balance Sheet Working Papers

at December 31, 2016

(in thousands)

70% Adjustments and Consolidated

Pop Son Eliminations Balance Sheet

Cash $ 240 $ 80 $ 320

Accounts receivable — net 1,760 800 2,560

Accounts receivable — Pop 40 b 40

Dividends receivable 28 c 28

Inventories 2,000 1,280 3,280

Land 400 600 1,000

Plant assets — net 2,800 1,400 a 280 4,480

Investment in Son 2,884 a 2,884

Goodwill _______ _______ a 400 400

Assets $10,112 $ 4,200 $12,040

Accounts payable $ 1,200 $ 320 $ 1,520

Account payable to Son 40 b 40

Dividends payable 160 40 c 28 172

Long-term debt 2,400 400 2,800

Capital stock 4,000 2,000 a 2,000 4,000

Retained earnings 2,312 1,440 a 1,440 2,312

Noncontrolling interest

($4,120,000 ´ 30%) _______ _______ a 1,236 1,236

Copyright © 2018 Pearson Education, Inc.

Chapter 3 3-21

Equities $10,112 $ 4,200 $12,040

Copyright © 2018 Pearson Education, Inc.

3-22 An Introduction to Consolidated Financial Statements

Solution P3-12

Preliminary computations (in thousands)

80% Investment in Sun at cost January 1, 2016 $ 6,080

Implied total fair value of Sun ($6,080 / 80%) $ 7,600

Sun book value 7,200

Excess fair value over book value recorded as goodwill $ 400

Sun Sun 80% of

Dividends Net Income Net Income

2016 $ 320 $ 640 $ 512

2017 400 800 640

2018 480 960 768

$1,200 $2,400 $1,920

1 Sun’s dividends for 2017 ($320 / 80%) $ 400

2 Sun’s net income for 2017 ($640 / 80%) $ 800

3 Goodwill — December 31, 2017 $ 400

4 Noncontrolling interest share of income — 2018

Sun’s income for 2018

($384 dividends received/80%) ´ 2 $ 960

Noncontrolling interest percentage 20%

Noncontrolling interest share $ 192

5 Noncontrolling interest December 31, 2018

Equity of Sun January 1, 2016 $7,200

Add: Income for 2016, 2017 and 2018 2,400

Deduct: Dividends for 2016, 2017 and 2018 (1,200)

Equity book value of Sun December 31, 2018 8,400

Goodwill 400

Equity fair value of Sun December 31, 2018 $8,800

Noncontrolling interest percentage 20%

Noncontrolling interest December 31, 2018 $1,760

6 Controlling share of consolidated net income for 2018

Pam’s separate income $2,240

Add: Income from Sun 768

Controlling share of consolidated net income $3,008

Pam’s net income $2,240

Sun’s net income 960

Consolidated net income $3,200

Less: Noncontrolling interest share ($960 x 20%) 192

Controlling interest share $3,008

Copyright © 2018 Pearson Education, Inc.

Chapter 3 3-23

PR 3-1

ASC 805-10-20 Glossary: “Acquisition Date - The date on which

the acquirer obtains control of the acquiree.”

PR 3-2

ASC 810-10-50-1A:

A parent with one or more less-than-wholly-owned subsidiaries shall disclose

all of the following for each reporting period:

a. Separately, on the face of the consolidated financial statements, both

of the following:

1. The amounts of consolidated net income and consolidated

comprehensive income

2. The related amounts of each attributable to the parent and

the noncontrolling interest.

b. Either in the notes or on the face of the consolidated income

statement, amounts attributable to the parent for any of the following, if

reported in the consolidated financial statements:

1. Income from continuing operations

2. Discontinued operations

c. Either in the consolidated statement of changes in equity, if presented,

or in the notes to consolidated financial statements, a reconciliation at the

beginning and the end of the period of the carrying amount of total equity

(net assets), equity (net assets) attributable to the parent, and equity (net

assets) attributable to the noncontrolling interest. That reconciliation shall

separately disclose all of the following:

1. Net income

2. Transactions with owners acting in their capacity as owners,

showing separately contributions from and distributions to owners

3. Each component of other comprehensive income.

d. In notes to the consolidated financial statements, a separate schedule

that shows the effects of any changes in a parent’s ownership interest in a

subsidiary on the equity attributable to the parent.

Copyright © 2018 Pearson Education, Inc.

Das könnte Ihnen auch gefallen

- 2-1 Maynard Company (A)Dokument1 Seite2-1 Maynard Company (A)Tarry Berry75% (4)

- Chapter 4 Advanced AccountingDokument48 SeitenChapter 4 Advanced AccountingMarife De Leon Villalon100% (3)

- Chapter 4 Advanced AccountingDokument48 SeitenChapter 4 Advanced AccountingMarife De Leon Villalon100% (3)

- Kunci Jawaban Advance Accounting Chapter 3Dokument25 SeitenKunci Jawaban Advance Accounting Chapter 3jiajia67% (6)

- Beams AdvAcc11 ChapterDokument21 SeitenBeams AdvAcc11 Chaptermd salehinNoch keine Bewertungen

- Chp3 Advanced Acc Beams 11eDokument21 SeitenChp3 Advanced Acc Beams 11eFelixNovendraNoch keine Bewertungen

- Chapter 3 - 12thEDITIONDokument21 SeitenChapter 3 - 12thEDITIONHyewon43% (7)

- FAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsDokument32 SeitenFAC2602 - Generally Accepted Accounting Stds Valuation of Financial InstrumentsAhmed Raza MirNoch keine Bewertungen

- Summary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownVon EverandSummary of William H. Pike & Patrick C. Gregory's Why Stocks Go Up and DownNoch keine Bewertungen

- Profit or Loss From Business: Schedule C (Form 1040) 09Dokument2 SeitenProfit or Loss From Business: Schedule C (Form 1040) 09JIMOH100% (1)

- Advanced Accounting 9th Edition Hoyle Solutions ManualDokument33 SeitenAdvanced Accounting 9th Edition Hoyle Solutions Manualcemeteryliana.9afku100% (23)

- Corporate Governance in Ford Motor CompanyDokument14 SeitenCorporate Governance in Ford Motor CompanyLarisa Samciuc100% (3)

- An Introduction To Consolidated Financial StatementsDokument22 SeitenAn Introduction To Consolidated Financial Statementsratih meliniaNoch keine Bewertungen

- Ch03 Beams12ge SMDokument22 SeitenCh03 Beams12ge SMWira Moki50% (2)

- ch03, AccountingDokument27 Seitench03, AccountingEkta Saraswat Vig50% (2)

- Solution Manual Advanced Accounting 11E by Beams 03 Solution Manual Advanced Accounting 11E by Beams 03Dokument22 SeitenSolution Manual Advanced Accounting 11E by Beams 03 Solution Manual Advanced Accounting 11E by Beams 03vvNoch keine Bewertungen

- Solution Manual Advanced Accounting 11e by Beams 03 ChapterDokument22 SeitenSolution Manual Advanced Accounting 11e by Beams 03 ChapterPacific Hunter Johnny0% (1)

- Beams Aa13e SM 08Dokument36 SeitenBeams Aa13e SM 08Akila Kirana RatriNoch keine Bewertungen

- Beams - AdvAcc11 - Chapter 8Dokument32 SeitenBeams - AdvAcc11 - Chapter 8DiditNoch keine Bewertungen

- Full Download Advanced Accounting 13th Edition Beams Solutions ManualDokument36 SeitenFull Download Advanced Accounting 13th Edition Beams Solutions Manualjacksongubmor100% (34)

- Dwnload Full Advanced Accounting 13th Edition Beams Solutions Manual PDFDokument36 SeitenDwnload Full Advanced Accounting 13th Edition Beams Solutions Manual PDFunrudesquirtjghzl100% (15)

- Dwnload Full Advanced Accounting 12th Edition Beams Solutions Manual PDFDokument13 SeitenDwnload Full Advanced Accounting 12th Edition Beams Solutions Manual PDFunrudesquirtjghzl100% (11)

- Full Download Advanced Accounting 12th Edition Beams Solutions ManualDokument36 SeitenFull Download Advanced Accounting 12th Edition Beams Solutions Manualrojeroissy2232s100% (39)

- Chapter 5 Consolidation of Less Than Wholly Owned SubsidiariesDokument95 SeitenChapter 5 Consolidation of Less Than Wholly Owned Subsidiariesnottingham03290100% (3)

- 7 - Consolidated Financial Statements P3 PDFDokument7 Seiten7 - Consolidated Financial Statements P3 PDFDarlene Faye Cabral RosalesNoch keine Bewertungen

- Dwnload Full Advanced Accounting 11th Edition Beams Solutions Manual PDFDokument35 SeitenDwnload Full Advanced Accounting 11th Edition Beams Solutions Manual PDFwilliambrowntdoypjmnrc100% (14)

- Full Download Advanced Accounting 11th Edition Beams Solutions ManualDokument35 SeitenFull Download Advanced Accounting 11th Edition Beams Solutions Manualrojeroissy2232s100% (19)

- Group Account Week 1Dokument8 SeitenGroup Account Week 1Omolaja IbukunNoch keine Bewertungen

- Investments in Associates and Investments in Jointly Controlled EntitiesDokument47 SeitenInvestments in Associates and Investments in Jointly Controlled EntitiesPhilip Dan Jayson LarozaNoch keine Bewertungen

- Consolidations: Chapter-6Dokument54 SeitenConsolidations: Chapter-6Ram KumarNoch keine Bewertungen

- Chapter 05 Consolidation of Less Than WHDokument93 SeitenChapter 05 Consolidation of Less Than WH05 - Trần Mai AnhNoch keine Bewertungen

- Advanced Financial Accounting 11th Edition Christensen Solutions ManualDokument43 SeitenAdvanced Financial Accounting 11th Edition Christensen Solutions Manualtiffanywilliamsenyqjfskcx100% (20)

- Advanced Financial Accounting 11th Edition Christensen Solutions Manual Full Chapter PDFDokument64 SeitenAdvanced Financial Accounting 11th Edition Christensen Solutions Manual Full Chapter PDFSandraMurraykean100% (13)

- SMCH 11 BeamsDokument25 SeitenSMCH 11 BeamsAtika DaretyNoch keine Bewertungen

- Chap005 131230190800 Phpapp01Dokument95 SeitenChap005 131230190800 Phpapp01AlmoosawiNoch keine Bewertungen

- ACC 113 Mid Term Examination Sept 30 2021Dokument11 SeitenACC 113 Mid Term Examination Sept 30 2021yhygyug0% (1)

- MCOM Sem 1 FA Project On Consolidated Financial StatementDokument27 SeitenMCOM Sem 1 FA Project On Consolidated Financial StatementAnand Singh100% (5)

- When A Parent Increases Its Investment in A Subsidiary From 60 To 75%, Should TheDokument5 SeitenWhen A Parent Increases Its Investment in A Subsidiary From 60 To 75%, Should TheLisa ZhangNoch keine Bewertungen

- Ch02 Beams12ge SMDokument27 SeitenCh02 Beams12ge SMWira Moki100% (3)

- Consolidated Financial Statements (Part 3)Dokument96 SeitenConsolidated Financial Statements (Part 3)Justine Kate Ferrer BascoNoch keine Bewertungen

- Consolidation TheoryDokument22 SeitenConsolidation TheorySmruti RanjanNoch keine Bewertungen

- Consolidation TheoryDokument22 SeitenConsolidation TheorySmruti RanjanNoch keine Bewertungen

- Vdocuments - MX - Chapter 5 578590693cc3a PDFDokument43 SeitenVdocuments - MX - Chapter 5 578590693cc3a PDFAmrita TamangNoch keine Bewertungen

- Advance Financial Accounting CH 5 Consolidation of Less Than Wholly Owned SubsidiariesDokument125 SeitenAdvance Financial Accounting CH 5 Consolidation of Less Than Wholly Owned SubsidiariesynnaNoch keine Bewertungen

- 8216 Cpar Consolidated FSDokument8 Seiten8216 Cpar Consolidated FSDaniela Ramos67% (3)

- Questions 1Dokument4 SeitenQuestions 1calvin sijabatNoch keine Bewertungen

- Jeter CHP 3Dokument54 SeitenJeter CHP 3Kim StevNoch keine Bewertungen

- CH 03Dokument56 SeitenCH 03Dr-Bahaaeddin AlareeniNoch keine Bewertungen

- Advanced Accounting Part 2 Business Combinations (Ifrs 3)Dokument10 SeitenAdvanced Accounting Part 2 Business Combinations (Ifrs 3)ClarkNoch keine Bewertungen

- Chapter 5Dokument48 SeitenChapter 5HelloWorldNowNoch keine Bewertungen

- Consolidated Statement of Financial Position AdjustmentsDokument35 SeitenConsolidated Statement of Financial Position AdjustmentsPeter Kibelesi KukuboNoch keine Bewertungen

- Accounting: Lecture 4.2 Associates & JVDokument14 SeitenAccounting: Lecture 4.2 Associates & JVcynthiama7777Noch keine Bewertungen

- Chapter Learning ObjectivesDokument10 SeitenChapter Learning ObjectivesChathura DalugodaNoch keine Bewertungen

- Consolidated Statement ORGDokument8 SeitenConsolidated Statement ORGPak_4everNoch keine Bewertungen

- Tugas Chap 5Dokument3 SeitenTugas Chap 5Elva RosNoch keine Bewertungen

- Accounting For Groups of CompaniesDokument9 SeitenAccounting For Groups of CompaniesEmmanuel MwapeNoch keine Bewertungen

- Chapter 3 An Introduction To Consolidated Financial Statements - STDDokument54 SeitenChapter 3 An Introduction To Consolidated Financial Statements - STDdhfbbbbbbbbbbbbbbbbbh100% (1)

- Consolidated Financial Statements-Date of AcquisitionDokument56 SeitenConsolidated Financial Statements-Date of AcquisitionAhmed GemyNoch keine Bewertungen

- W1 Partnership AccountingDokument11 SeitenW1 Partnership AccountingChristine Joy MondaNoch keine Bewertungen

- Summary of Richard A. Lambert's Financial Literacy for ManagersVon EverandSummary of Richard A. Lambert's Financial Literacy for ManagersNoch keine Bewertungen

- Textbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingVon EverandTextbook of Urgent Care Management: Chapter 46, Urgent Care Center FinancingNoch keine Bewertungen

- CLA Work-Life Balance Guidelines: Encourage Everyone ToDokument1 SeiteCLA Work-Life Balance Guidelines: Encourage Everyone ToMarife De Leon VillalonNoch keine Bewertungen

- Chapter 5 Advanced AccountingDokument19 SeitenChapter 5 Advanced AccountingMarife De Leon VillalonNoch keine Bewertungen

- As of May 10, 2020Dokument5 SeitenAs of May 10, 2020Marife De Leon VillalonNoch keine Bewertungen

- Red Roof Inn Case StudyDokument2 SeitenRed Roof Inn Case StudyMarife De Leon VillalonNoch keine Bewertungen

- Product Life Cycle Diagram: For UniqloDokument3 SeitenProduct Life Cycle Diagram: For UniqloMarife De Leon VillalonNoch keine Bewertungen

- Asynchronous 3Dokument35 SeitenAsynchronous 3Mark Anthony CondaNoch keine Bewertungen

- 12 Lyp Economics Set1Dokument26 Seiten12 Lyp Economics Set1Suhail BilalNoch keine Bewertungen

- Adrenaline Rush Business Plan PresentationDokument19 SeitenAdrenaline Rush Business Plan Presentationapi-491083678Noch keine Bewertungen

- Session 1 - Gross Income - Inclusions and ExclusionsDokument13 SeitenSession 1 - Gross Income - Inclusions and ExclusionsABBIE GRACE DELA CRUZNoch keine Bewertungen

- Services, Training, Delivery Equipment Right To Trade NameDokument6 SeitenServices, Training, Delivery Equipment Right To Trade Namecram colasitoNoch keine Bewertungen

- Lecture NotesDokument25 SeitenLecture NotesPrecious Diarez Pureza67% (3)

- Activity Based Costing PDFDokument59 SeitenActivity Based Costing PDFSiddharthNoch keine Bewertungen

- Case Presentation Guidelines 2Dokument14 SeitenCase Presentation Guidelines 2ephremogNoch keine Bewertungen

- MCQ of Environment of Business FinanceDokument5 SeitenMCQ of Environment of Business FinanceRahul GhosaleNoch keine Bewertungen

- Depreciation R.L GuptaDokument15 SeitenDepreciation R.L GuptaaNoch keine Bewertungen

- Capital Raising Underwriting and The Certification HypothesisDokument21 SeitenCapital Raising Underwriting and The Certification HypothesisZhang PeilinNoch keine Bewertungen

- ACCA - Chapter 5-6Dokument7 SeitenACCA - Chapter 5-6Bianca Alexa SacabonNoch keine Bewertungen

- AutozoneDokument19 SeitenAutozoneSakshi GargNoch keine Bewertungen

- Testbanks PrelimsDokument32 SeitenTestbanks PrelimsSharmaine LiasosNoch keine Bewertungen

- Cranium Filament Reductions: Executive SummaryDokument15 SeitenCranium Filament Reductions: Executive SummaryRegine IgnacioNoch keine Bewertungen

- Ch-2 Accounting SolutionsDokument22 SeitenCh-2 Accounting SolutionsDarienDBKearneyNoch keine Bewertungen

- Activity For SMEDokument7 SeitenActivity For SMERaymond S. Pacaldo0% (1)

- Cumulus Investments With Recurring Payments - Technical Information - Summary June 2017Dokument7 SeitenCumulus Investments With Recurring Payments - Technical Information - Summary June 2017marko joosteNoch keine Bewertungen

- Section:C-1/B-1 Subject: CAF-06 Teacher: Mr. Sir Adnan Rauf Total Marks: 33 Time Allowed: 55 Mints. Assessment-1 Date: 28oct, 2019Dokument5 SeitenSection:C-1/B-1 Subject: CAF-06 Teacher: Mr. Sir Adnan Rauf Total Marks: 33 Time Allowed: 55 Mints. Assessment-1 Date: 28oct, 2019Shaheer MalikNoch keine Bewertungen

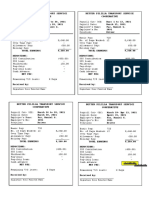

- Reconciliation of AccountsDokument4 SeitenReconciliation of AccountsLittle ButterflyNoch keine Bewertungen

- Book Value Per ShareDokument1 SeiteBook Value Per SharejoooNoch keine Bewertungen

- Midterm 1 Review Selected From Lecture Slides and Assignments - 001 MarkupsDokument14 SeitenMidterm 1 Review Selected From Lecture Slides and Assignments - 001 MarkupsXIAODANNoch keine Bewertungen

- Cabcharge Research Report CAB ASXDokument4 SeitenCabcharge Research Report CAB ASXzengooiNoch keine Bewertungen

- The Control ProcessDokument40 SeitenThe Control ProcessRoy CabarlesNoch keine Bewertungen

- Better Pililla Transport Service Cooperative Better Pililla Transport Service CooperativeDokument1 SeiteBetter Pililla Transport Service Cooperative Better Pililla Transport Service CooperativeHellen DeaNoch keine Bewertungen

- Income Tax Planning in IndiaDokument61 SeitenIncome Tax Planning in IndiaPRIYANKA LANDGENoch keine Bewertungen